|

시장보고서

상품코드

1690789

동남아시아의 POS 단말기 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Southeast Asia POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

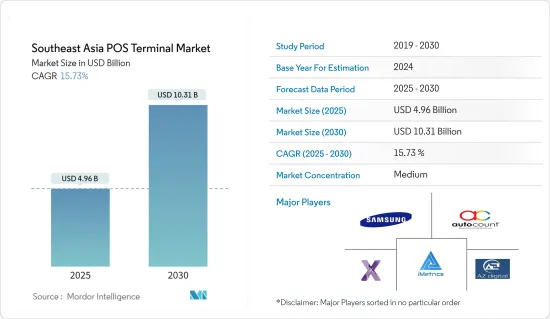

동남아시아의 POS 단말기 시장 규모는 2025년 49억 6,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 15.73%로 확대되어, 2030년에는 103억 1,000만 달러에 달할 것으로 예측되고 있습니다.

POS 단말기는 투자 수익률 향상과 접근성 향상을 실현할 수 있기 때문에 최근 몇 년간 급속히 도입이 진행되고 있습니다. 최근 몇 년동안 중소기업과 대기업에서 POS 시스템의 중요성이 높아지고 있으며, 소매, 접객, 운송, 은행 등의 분야에서 기업의 중심부에서 거래가 촉진되고 있습니다.

주요 하이라이트

- POS 터미널은 트랜잭션 지향 터미널에서 기업 CRM 및 기타 금융 솔루션과 통합된 시스템으로 진화하고 있습니다. 결과적으로 비즈니스 인텔리전스를 갖춘 최종 사용자는 수익원 및 재고 관리를 더욱 적절하게 수행할 수 있습니다. 엔터프라이즈는 고급 POS 시스템의 기능적 이점으로 기존 과금 소프트웨어를 POS 시스템으로 대체하여 POS 시스템의 성장을 보장합니다.

- 최근 몇 년동안 동남아시아에서 금융 범죄 사례가 증가하고 있기 때문에 정부 규제 기관은 결제 거래의 보안을 향상시키기 위해 노력하고 있습니다. 디지털 거래의 안전성과 신뢰성에 대한 소비자의 요구에 부응하기 위해 안전한 결제 절차의 필요성이 점점 커지고 있습니다. 이러한 규제 당국은 POS 단말기의 도입에 긍정적인 영향을 미치고 있습니다. 모바일 POS 시스템은 세계의 이동성 동향이 증가함에 따라 빠르게 확산되고 있습니다. 이 지역에서는 현금없는 거래 기술의 도입으로 POS 도입률이 상승하고 있습니다.

- 단말기와 대면 점포의 성장은 전자상거래와 온라인 쇼핑 동향 증가와 실제 매장형 소매 관행에 의해 방해될 것으로 예상됩니다. 주요 전자상거래 플랫폼이 제공하는 대금 상환 가능성으로 인해 모바일 POS 단말기의 채택이 급격히 증가하고 있습니다.

- 신속하고 간편한 지불을 요구하는 고객의 요구가 증가함에 따라 카드 사기는 점점 더 영리 해지고 있습니다. 해커는 POS 시스템의 펌웨어를 대상으로 신용 및 기타 결제 데이터를 훔치는 것으로 확인되었습니다. POS 사기의 주요 원인은 가맹점이 POS 데이터를 보호하기 위한 P2PE(Point-to-Point Encryption) 솔루션을 사용하지 않는 것입니다.

동남아시아 POS 단말 시장 동향

소매 부문이 크게 성장할 전망

- 소비자 선호도의 급속한 변화에 따라 동남아 시장은 점점 역동적이 되고 있습니다. 소비자가 선호하는 소매점에서의 매끄러운 경험과 관련하여 기술에 익숙한 고객도 그렇지 않은 고객도 같은 것을 요구하고 있습니다.

- 또한 POS 단말기가 제공하는 다양한 재고, 판매 보고서, 재무 관리 및 고객 분석 기능 덕분에 소매점은 고객 유지의 어려움을 극복하는 데 도움이 됩니다. 따라서 POS 단말기의 개발은 고객 충성도를 유지하고 이 분야에서의 경쟁을 강화하는 요구사항에 의해 뒷받침됩니다.

- 상당한 할인 및 기타 서비스로 인해 지역에 상관없이 많은 상점이 고객을 유치하고 있지만 그 유지는 시장 지속에 중요한 문제가되었습니다. 새로운 기술에 대한 투자와 수익의 균형을 맞추면서 가격 경쟁을 피하기 위해 경쟁 환경에서 비즈니스 모델을 검토하는 것이 더 중요합니다.

- 또한 동남아시아에서는 디지털 이코노미가 급속히 확대되고 있습니다. 구글과 테마섹에 따르면 상위 6개국의 온라인 소비자 지출은 향후 1년간 약 2,500억 달러에 달할 것으로 예상되며, POS 단말 수요 증가가 시장을 견인하고 있습니다.

- ASEAN의 주요 기업인 인도네시아, 태국, 말레이시아, 싱가포르, 필리핀, 베트남은 더 큰 시장 점유율을 얻기 위해 소매점 통합을 추진하고 있습니다. POS 단말 시장의 현지 기업은 네트워크를 확대하고 고객 획득을 늘리기 위해 파트너십을 채택하여 수요 증가를 활용하고 있습니다.

급성장이 예상되는 싱가포르 시장

- 싱가포르는 잠시 동안 결제 혁신의 최전선에 위치하고 있습니다. 정부가 내걸는 스마트 국가구상의 중요한 목표 중 하나가 디지털 결제의 가속입니다. 이와 관련하여 싱가포르는 무현금 결제를 위한 장기적인 인프라 구축에 엄청난 투자를 해왔습니다. 싱가포르 금융관리국에 따르면 POS 단말기는 국내 여러 산업분야에서 이용가능하며 카드결제거래는 증가의 길을 따라가고 있습니다.

- 디지털 지갑의 사용은 증가하는 경향이 있습니다. 휴대전화 이용률의 높이가 보급으로 연결되어 현재 거래의 18%에 달하고 있습니다. 2023년까지 디지털 지갑 시장 점유율은 약 26%에 이를 것으로 예상됩니다. PayPal은 디지털 지갑 브랜드로 가장 잘 알려져 있으며 시장 점유율은 5%에서 10%입니다. 또한 Apple Pay, Samsung Pay, Visa Checkout, Masterpass 이용도 인기가 있습니다.

- 게다가 유행이 계기가 된 전자상거래 붐을 생각하면 내년에는 디지털 지갑이 신용카드를 빼고 싱가포르에서 인기있는 온라인 결제 수단이 될 것으로 보입니다. 또한 디지털 월렛은 소비자가 매장 단말기의 현금 결제에서 전환함에 따라 매장에서 구매에 대한 소비자의 로열티를 높입니다. Worldpay사에 따르면 내년에는 POS 시장의 20%를 차지할 것으로 예측되고 있습니다.

- 비즈니스 집중이 진행됨에 따라 고객 간의 디지털 결제와 모바일 결제의 빈도가 증가함에 따라 동남아시아 정부는 대체 결제 수단을 촉진하기 위해 다양한 노력을 하고 있습니다.

동남아시아 POS 단말기 산업 개요

동남아시아의 POS 단말기 시장은 국내외 기업의 존재로 반고정화되고 있습니다. 시장 기업은 고객의 매력과 유지를 위해 새로운 전략을 개척하고 있습니다. 소프트웨어에서 구독 기반 가격 모델은 고객에게 유연성을 제공하면서 시장 경쟁 압력을 높입니다.

2022년 9월, Shopify Inc.는 바코드 스캐너, 카드 리더, 재고 트래커가 내장된 핸드헬드 도구인 POS Go를 출시했습니다. 이전에는 가맹점이 Shopify의 POS 시스템을 사용하기 위해 데스크톱, 노트북 또는 모바일 애플리케이션을 다운로드할 수 있었습니다. POS Go는 휴대가 가능하며 체크 포인트, 매장, 연석으로 휴대폰 나 컴퓨터에 연결할 필요가 없습니다. 이 회사의 새로운 도구는 더 많은 고객이 온라인이 아니라 실제로 상점에서 쇼핑하는 습관을 되찾는 동안 등장했습니다.

2022년 8월 Samsung Electronics와 Master Card는 지문센서를 내장한 결제카드를 공동으로 출시한다고 발표했습니다. 양사는 결제 단말기에 대한 물리적 접촉을 줄이면서 보다 안전한 결제 서비스를 제공하는 것을 목표로 하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- POS에 대한 투자 확대가 시장 성장을 가속할 전망

- 결제 업계에서 디지털화의 진전

- 시장 성장 억제요인

- 사이버 공격 및 데이터 유출에 대한 보안 우려

제6장 시장 세분화

- 컴포넌트별

- 하드웨어

- 소프트웨어 및 서비스

- 유형별

- 고정 POS 단말

- 모바일/휴대용 POS 단말

- 최종 사용자 산업별

- 엔터테인먼트

- 접객

- 헬스케어

- 소매

- 기타 최종 사용자 산업

- 국가별

- 싱가포르

- 인도네시아

- 베트남

- 말레이시아

제7장 경쟁 구도

- 기업 프로파일

- Xilnex

- Auto Count Sdn Bhd

- iMetrics Pte. Ltd

- AZ Digital Pte. Ltd

- Samsung Electronics Co. Ltd

- NCR Corporation

- Toshiba Tec Corp.

- HP Development Company LP

- Bindo Labs Inc.

- Shopify Inc.

- Qashier Pte Ltd

- StoreHub Sdn Bhd

제8장 말레이시아의 POS 소프트웨어 벤더 일람

제9장 말레이시아 주요 벤더프로파일-비교 분석

제10장 시장의 미래

JHS 25.04.09The Southeast Asia POS Terminal Market size is estimated at USD 4.96 billion in 2025, and is expected to reach USD 10.31 billion by 2030, at a CAGR of 15.73% during the forecast period (2025-2030).

As a result of its ability to deliver an improved return on investment and accessibility, POS terminals have been rapidly adopted over the last few years. Over the years, the importance of point-of-sale systems in small and large enterprises has increased, facilitating transactions from the central part of the enterprise in sectors such as retail, hospitality, transport, and banking.

Key Highlights

- POS terminals have evolved from transaction-oriented terminals to systems integrated with the company's CRM and other financial solutions. As a result, end users with business intelligence have better managed their revenue streams and inventory. Companies have replaced their traditional billing software with point-of-sale systems due to the functional benefits of advanced point-of-sale systems to ensure the growth of point-of-sale systems.

- Over the past few years, rising cases of financial crime in Southeast Asia have influenced government regulatory bodies to improve security for payment transactions. The need to use secure payment procedures is becoming increasingly essential to meet consumers' demands for safety and reliability with their digital transactions. These Regulatory Authorities have positively affected the adoption of POS terminals. Mobile POS systems have taken off as a result of rising mobility trends around the world. In the region, POS adoption rates have increased due to the introduction of cashless transaction technologies.

- The growth in terminals and face-to-face outlets is expected to be hampered by the growing e-commerce and online shopping trends and brick-and-mortar retail practices. With the possibility of cash on delivery offered by significant e-commerce platforms, a sudden surge in the adoption of mobile POS terminals was noticed.

- Due to growing customer demand for quick and easy payments, card fraud has become increasingly sophisticated. Hackers may be identified targeting the POS system's firmware to steal credit and other payment data. Point-of-sale fraud is largely caused by merchants' failure to leverage point-to-point encryption (P2PE) solutions to safeguard POS data.

Southeast Asia POS Terminal Market Trends

The Retail Segment is Expected to Grow Significantly

- With the rapid pace of changing consumer preferences, the Southeast Asian market is increasingly dynamic. Regarding the seamless experience they desire in their favored retailers, TechSavvy and Nontech Savvy customers also demand the same.

- In addition, retailers are assisted in overcoming the difficulty of retaining customers thanks to a wide range of inventory, sales reports, finance management, and customer analysis features offered by point-of-sale terminals. Therefore, the development of POS terminals is supported by a requirement to maintain customer loyalty and reinforce competition within this sector.

- With large discounts and other services, many outlets across regions attract customers, but their retention becomes an important problem for them to continue on the market. To avoid competition for prices while balancing investments in new technology and revenues, the competitive environment makes it all the more important that their business models are rethought.

- In addition, Southeast Asia is in for a rapid expansion of the Digital Economy. According to Google and Temasek, online consumer spending in the top six economies in the coming year is expected to reach approximately USD 250 billion, driving the market because of the growing demand for POS terminals.

- Top players in the ASEAN big six, Indonesia, Thailand, Malaysia, Singapore, Philippines, and Vietnam, are consolidating their retail outlets to take up a greater market share. Local players in the POS terminals market are taking advantage of rising demand by adopting partnerships to grow their networks and increase customer acquisition.

Singapore Anticipated to be the Fastest-growing Market

- Singapore has been at the forefront of payment innovation for some time. One critical goal of the government's vision for a smart nation is accelerating digital payments. In this connection, Singapore has significantly invested in building a long-term infrastructure for cashless payments. According to the Monetary Authority of Singapore, which suggests that POS terminals can be used in several industry sectors within this country, card payment transactions are growing at an increased rate.

- The use of digital wallets is on the rise. High use of mobile phones leads to uptake, which currently amounts to 18% of transactions. By 2023, digital wallets will have a market share of around 26%. PayPal is the most recognized brand for DigitalWallets, having a market share of between 5% and 10%. It is also popular to use Apple Pay, Samsung Pay, Visa Checkout, and Masterpass.

- In addition, given the e-commerce boom triggered by the epidemic, Digital Wallets will pass credit cards as Singapore's favorite online payment method next year. Digital wallets also capture more consumer loyalty to in-store purchases as consumers shift away from cash at point-of-sales terminals. They are projected to represent 20% of the POS market by next year, according to Worldpay, Inc.

- The increasing concentration of businesses and an increase in the frequency of Digital or Mobile Payments between customers are creating a variety of efforts by governments across Southeast Asia to promote alternative payment methods.

Southeast Asia POS Terminal Industry Overview

The Southeast Asian point-of-sale terminal market is semiconsolidated due to the presence of local and international players. Players in the market are developing new strategies to attract and retain customers. In software, the subscription-based pricing model provides customers flexibility while increasing competitive pressures on the market.

In September 2022, Shopify Inc. launched POS Go, a handheld tool with a built-in barcode scanner, card reader, and inventory tracker. Previously, merchants could download desktop, laptop, or mobile application applications to use Shopify's POS system. The POS Go is portable and does not require a mobile phone or computer connection at the checkpoint, shop floor, or curb. The company's new tool comes as more customers return to the habit of shopping in person rather than online.

In August 2022, Samsung Electronics and master card have announced that the collaboration will launch payment cards with built-in fingerprint sensors. Both companies aim to provide more secure payment services while reducing physical contact with payment terminal

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments in POS is Expected to Boost the Market Growth

- 5.1.2 Increasing Digitalization in the Payment Industry

- 5.2 Market Restraints

- 5.2.1 Security Concerns Related to Cyber Attacks and Data Breaches

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 By Type

- 6.2.1 Fixed Point-of-Sale Terminals

- 6.2.2 Mobile/Portable Point-of-Sale Terminals

- 6.3 By End-user Industries

- 6.3.1 Entertainment

- 6.3.2 Hospitality

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Other End-user Industries

- 6.4 By Country

- 6.4.1 Singapore

- 6.4.2 Indonesia

- 6.4.3 Vietnam

- 6.4.4 Malaysia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Xilnex

- 7.1.2 Auto Count Sdn Bhd

- 7.1.3 iMetrics Pte. Ltd

- 7.1.4 AZ Digital Pte. Ltd

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 NCR Corporation

- 7.1.7 Toshiba Tec Corp.

- 7.1.8 HP Development Company LP

- 7.1.9 Bindo Labs Inc.

- 7.1.10 Shopify Inc.

- 7.1.11 Qashier Pte Ltd

- 7.1.12 StoreHub Sdn Bhd