|

시장보고서

상품코드

1635402

라틴아메리카의 POS 단말기 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Latin America POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

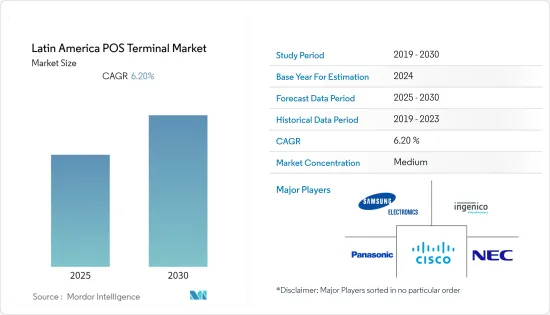

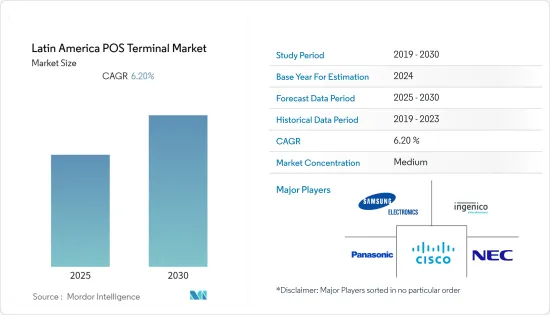

라틴아메리카 POS 단말기 시장은 예측 기간 동안 CAGR 6.2%를 기록할 것으로 예상됩니다.

주요 하이라이트

- POS 단말기 시장은 투자 수익률의 향상과 접근의 용이성으로 인해 지난 몇 년 동안 크게 성장하고 있습니다. 소매업, 접객업, 운송업, 은행업 등 다양한 업종의 비즈니스의 핵심 요소에서 거래를 촉진하는 POS 시스템은 수년 동안 크고 작은 규모의 기업에서 그 중요성이 커지고 있습니다.

- 2020년 10월, 유명 결제 기술 기업인 에포스 나우(Epos Now)는 멕시코에서 클라우드 POS 시스템 출시를 발표하며 멕시코에서 디지털 결제를 지원하기 위한 신제품 출시에 주력하고 있습니다. 이 POS 솔루션은 멕시코 중소기업(SMB)에 새로운 디지털 수익 흐름을 열어주고, 전 세계 고객 기반에 연결하며, 현재 상황에서 빠르게 변화하는 소비자 습관에 대응할 수 있는 능력을 제공합니다.

- POS 단말기 시스템은 거래 중심의 단말기/기기에서 기업의 CRM 및 기타 금융 솔루션과 통합할 수 있는 시스템으로 진화하고 있습니다. 이러한 진화를 통해 최종사용자는 비즈니스 인텔리전스를 얻고 수익원과 재고를 더 잘 관리할 수 있게 되었습니다. 유지보수 비용 절감, 정확한 거래, 실시간 재고 관리는 POS 시스템의 주요 장점입니다. 첨단 POS 시스템이 제공하는 기능적 이점으로 인해 기업은 전통적인 결제 소프트웨어를 POS 시스템으로 대체하여 POS 시스템 시장의 성장을 보장하고 있습니다.

- 시장의 주요 촉진요인 중 하나는 다른 결제 채널에 비해 낮은 소유 비용입니다. 강화된 POS 시스템은 더 높은 내구성과 신뢰성을 제공하고 소유 비용을 낮추기 때문에 기존 시스템에 비해 중소기업의 POS 솔루션에 대한 수요가 증가하고 있습니다.

- 시장 성장에 대한 도전 과제 중 하나는 중요한 정보의 사용으로 인한 보안 문제인데, POS 단말기는 네트워크와 인터넷에 연결되어 있기 때문에 다른 안전하지 않은 기계와 마찬가지로 접근 및 조작 공격에 취약합니다. 단말기가 네트워크의 다른 부분과 통신하는 방식은 공격자가 Track2 및 PIN 정보를 포함한 암호화되지 않은 카드 데이터에 액세스 할 수 있다는 것을 의미하며, 이는 결제 카드 도용 및 복제에 필요한 모든 정보를 제공합니다.

라틴아메리카 POS 단말기 시장 동향

모바일/휴대용 POS 단말기가 큰 시장 점유율을 차지할 것으로 예상

- mPOS는 블루투스를 통해 스마트폰과 연결되는 기존 POS를 대체하는 스마트한 POS입니다. 모바일 POS 시스템을 통해 사용자는 태블릿, 스마트폰, 기타 핸드헬드 디바이스를 통해 결제할 수 있으며, 한 곳의 POS 계산대에 묶이지 않고도 결제를 할 수 있습니다. 거래에는 신용 카드 마그네틱 스트라이프 리더기를 통한 결제 및 무선 거래가 포함됩니다. 휴대폰의 데이터 연결을 이용하여 거래를 처리합니다.

- 모바일 POS 시스템은 판매업과 서비스업이 고객이 있는 곳에서 거래를 할 수 있게 해주고, 전체 프로세스에 유연성을 더해 고객 경험을 향상시켜주기 때문에 많은 사랑을 받고 있습니다.

- 이커머스의 성장과 오프라인 매장과 온라인 소매업의 결합도 모바일 POS 단말기의 성장에 영향을 미칠 것으로 예상됩니다. 실제로 주요 이커머스 플랫폼이 제공하는 대금 상환 옵션으로 인해 모바일 POS 단말기의 채택이 급증하고 있습니다.

- mPOS 단말기는 특히 애플이나 안드로이드 스마트폰이나 태블릿과 같은 상용(COTS) 단말기를 사용하는 경우, POS 단말기만큼 강력한 보안 프로토콜을 갖추고 있지 않을 수 있기 때문에 데이터 보호가 가장 중요합니다.

- 예측 기간이 끝날 무렵, 이 부문은 비접촉식 간편 결제 방식에 대한 수요가 증가함에 따라 판매점들이 관련 서비스를 늘리면서 시장에서의 입지가 확대될 것으로 예상됩니다. 설계되었기 때문에 더 작고 휴대 가능한 디바이스의 추세는 시장 성장을 증가시킬 것으로 예상됩니다.

브라질이 큰 시장 점유율을 차지할 것으로 예상

- 디지털 결제의 확대가 브라질 시장의 성장을 견인하고 있습니다. 다양한 금융 서비스 기관들이 지역 기업들과 제휴하여 POS 단말기를 통한 디지털 결제를 가속화하고 있습니다.

- 또한, 2021년 8월에는 세계적인 금융 서비스 기술 솔루션 제공업체인 Fiserv가 Caixa Economia Federal의 자회사인 Caixa Cartoes와 독점 계약을 체결하여 브라질 전역의 기업들이 Caixa 브랜드 POS단말기를 통해 액퀴어링 서비스를 이용할 수 있게 되었다고 밝혔습니다.

- 이번 제휴의 목적은 라틴아메리카 지역에서 디지털 결제를 촉진하는 것입니다. Caixa 브랜드 POS 단말기는 직불카드, 신용카드, 바우처 결제, 카드 및 QR코드를 통한 근접 결제(Caixa Tem 앱을 통한 결제 등)를 허용하며, 2021년 7월 Caixa 단말기를 이용한 첫 번째 거래가 완료된 후, 이 단말기는 브라질 전역의 174개 Caixa 지점에서 시범적으로 사용할 수 있게 되었습니다.

- 또한, 피서브의 2021년 조사에 따르면, 브라질 국민들이 가장 선호하는 결제 수단은 신용카드와 직불카드(28%), PIX(22%), 디지털 지갑(11%), 바코드 결제(9%), 현금(6%) 순으로 나타났습니다. 브라질에서는 신용카드와 직불카드 결제에 대한 의존도가 높기 때문에 시장에 새로운 기회가 창출되고 있습니다.

- 그러나 POS 단말기를 대체하기 위한 노력도 진행되고 있으며, 이는 이 지역의 하드웨어 기반 POS 단말기의 성장에 영향을 미칠 것으로 예상되며, 2021년 3월, 소프트웨어 정의 트러스트(SDT)의 선두주자인 Magiccube는 브라질의 결제 단말기를 완전히 소프트웨어 기반으로 대체하는 i-Accept를 제공한다고 발표했습니다.

라틴아메리카 POS 단말기 산업 개요

라틴아메리카의 POS 단말기 시장 경쟁은 중간 정도이며, 상당한 수의 지역 및 세계 플레이어가 존재합니다. 주요 기업으로는 삼성전자, Ingenico Group, Cisco Systems Inc. 등이 있습니다.

- 2021년 10월 - 결제 인프라 전문 핀테크 기업 해시(Hash)가 QED Investors와 Kaszek이 공동으로 운영하는 시리즈 C 펀딩 라운드에서 4,000만 달러의 투자를 유치했습니다. 해시는 은행 서비스 제공을 원하는 비금융 B2B 기업을 대상으로 POS(판매시점정보관리) 소프트웨어와 모바일 애플리케이션에서 대시보드와 결제에 이르기까지 엔드투엔드 결제 인프라를 제공합니다.

- 2021년 8월 - Caixa Economia Federal의 자회사 Caixa Cartes와 결제 및 금융 서비스 기술 제공 업체인 Fiserv, Inc. 4,300개의 Caixa 지점 모두에 Caixa 브랜드 단말기가 설치되어 있습니다. 기업들은 이 단말기를 통해 직불카드, 신용카드, 기프트 카드, 기프트 카드 결제, Caixa Tem 앱 결제 등 카드 및 QR코드를 통한 근접 결제 서비스를 이용할 수 있습니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 경쟁 기업 간의 경쟁 관계

- 대체품의 위협

- 밸류체인 분석

- COVID-19의 시장 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 기타 결제 채널과 비교한 총소유비용 낮음

- 비접촉 POS 단말기와 모바일 POS 단말기 수요의 상당한 증가

- 시장 억제요인

- 중요 정보 이용에 의한 보안상 우려

- 시장 기회

- 캐시리스 거래 증가

- POS 단말기에 관한 주요 규제와 불평 기준

- 비접촉 결제 이용 증가와 업계에 대한 영향에 관한 해설

- 주요 사례 분석

제6장 시장 세분화

- 유형별

- 고정 POS 시스템

- 모바일/휴대용 POS 시스템

- 국가별

- 멕시코

- 브라질

- 아르헨티나

제7장 경쟁 구도

- 기업 개요

- PAX Technology

- BBPOS

- VeriFone System Inc.

- DSpread

- Castles

- YourTransactor

- Ingenico SA

- SZZT

- Spectra

- WizarPOS

제8장 투자 분석

제9장 시장 향후 전망

ksm 25.02.07The Latin America POS Terminal Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- The POS terminal market has grown significantly over the past few years, owing to its ability to offer an increased return on investment and ease of access. POS systems that facilitate transactions from the central component of businesses across industries, like retail, hospitality, transportation, and banking, have gained importance in companies of small and big sizes, over the years.

- Companies operating in the market are also focusing on supporting the digital payments in Mexico with the launch of new products. In October 2020, Epos Now, a prominent payment technology company, announced the launch of its cloud POS system in Mexico. The POS solution offers Mexican small and medium-sized businesses (SMBs) the ability to open new digital revenue streams, connect to a global customer base, and cater to rapidly shifting consumer habits in the current climate.

- POS terminal systems have evolved from being transaction-oriented terminals/devices to systems that can integrate with the company's CRM and other financial solutions. This evolution has empowered the end-users with business intelligence to better manage their revenue streams and inventory. Lower maintenance costs, accurate transactions, and real-time inventory are key advantages of the POS systems. With the functional benefits that the advanced POS systems offer, companies have replaced their traditional billing software with POS systems, thus, securing the growth of the POS system market.

- One of the major drivers of the market is the low cost of ownership compared to other payments channels. The enhanced POS systems provide higher durability and reliability, which leads to a lower cost of ownership, thus raising the demand for POS solutions in both medium and small-sized businesses compared to the traditional system.

- One of the challenge to the market's growth is the security concerns due to the usage of critical information. POS terminals are connected to the network and the internet, making them vulnerable to attacks to gain access to and manipulate it like any other insecure machine. The way the terminal communicates with the rest of the network means attackers could access unencrypted card data, including Track2 and PIN information, providing all the necessary information required to steal and clone payment cards.

Latin America POS Terminal Market Trends

Mobile/Portable Point-of-Sale Terminals Expected to Witness Significant Market Share

- An mPOS is a smarter alternative to the traditional POS which connects to smartphones via Bluetooth. A mobile point of sale system allows users to accept payments via tablets, smartphones, and other handheld devices without being tied to a POS register in a single location. The transactions can include credit card magstripe reader payments and wireless transactions. It utilizes a mobile phone's data connection to process transactions.

- Mobile POS systems are gaining traction as they allow sales and service industries to conduct the transaction at the customer's location, adding flexibility to the whole process and improving customer experience.

- The growth in e-commerce and the entangling of the brick-and-mortar and online retail practices are also expected to affect the future growth of the terminals. In fact, with the option of cash on delivery, provided by major e-commerce platforms, a sudden surge in the adoption of mobile POS terminal has been recognized.

- Data protection is paramount as mPOS devices may not have security protocols as robust as their POS counterparts, especially if you're using commercial-off-the-shelf (COTS) devices such as Apple or Android smartphones and tablets.

- Towards the end of the forecast period, the segment is expected to multiply in market presence as vends increase their relevant offerings in response to the increased demand for contactless ease-of-use payment methods. As mPOS solutions are specially designed for tablets instead of desktop computers, the trend of smaller and more portable devices will augment the growth of the market.

Brazil Expected to Witness Significant Market Share

- The growth of digital payments is fueling the growth of the market in Brazil. Various financial services organizations are partnering with regional companies to accelerate digital payments using POS terminals.

- Further, in August 2021, Fiserv, a prominent global provider of financial services technology solutions, announced that it has entered into an exclusive agreement with Caixa Cartoes a subsidiary of Caixa Economia Federal, which enables businesses throughout Brazil to have access to acquiring services through Caixa-branded point-of-sale (POS) terminals.

- The aim of the partnership is to push digital payments in the Latin America region. The Caixa-branded terminals allow businesses to accept payments via debit or credit card or voucher and proximity payments via card or QR code, such as those made using the Caixa Tem app. Following the first transaction completed using a Caixa terminal in July 2021, the terminals were made available through a pilot at 174 Caixa branches throughout Brazil.

- Furthermore, according to a 2021 study by Fiserv, Credit cards and Debit cards are preferred payment methods by the Brazilians (28%), followed by PIX (22%), digital wallets (11%), payments by barcode (9%), and cash (6%). The strong dependence on credit and debit cards for payments creates new opportunities for the market in Brazil.

- However, there have been efforts to replace the POS terminals which is expected to affect the growth of the hardware-based POS terminals in the region. In March 2021, Magiccube, a prominent player in Software Defined Trust (SDT) announced the availability of i-Accept, a complete software-based replacement for acceptance terminals in Brazil.

Latin America POS Terminal Industry Overview

The Latin America POS Terminal Market is moderately competitive, with a considerable number of regional and global players. Key players include Samsung Electronics Co. Ltd, Ingenico Group, Cisco Systems Inc. among others

- October 2021 - Hash, a fintech company focused on payment infrastructure raised USD 40 million in a Series C fundraising round that was jointly managed by QED Investors and Kaszek. Hash provides end-to-end payment infrastructure, ranging from point-of-sale (POS) software and mobile applications to dashboards and payments, for non-financial B2B enterprises wishing to offer banking services.

- August 2021 - As a result of an exclusive agreement between Caixa Cartes, a division of Caixa Economia Federal, and Fiserv, Inc, a provider in payments and financial services technology, businesses across Brazil now have access to purchasing services through Caixa-branded point-of-sale (POS) terminals. All 4,300 Caixa branches have Caixa-branded terminals. Businesses can use the terminals to take payments made with debit, credit, or gift cards and proximity payments made with a card or QR code, such as those made with the Caixa Tem app.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain Analysis

- 4.4 Assesment of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Low Total Cost of Ownership Compared to Other Channels of Payments

- 5.1.2 Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 5.2 Market Restrains

- 5.2.1 Security Concerns due to the Usage of Critical Information

- 5.3 Market Opportunities

- 5.3.1 Increase in Number of Cashlesss Transactions

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Commentary on the rising use of contactless payment and its impact on the industry

- 5.6 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed Point-of-sale Systems

- 6.1.2 Mobile/Portable Point-of-sale Systems

- 6.2 By Country

- 6.2.1 Mexico

- 6.2.2 Brazil

- 6.2.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PAX Technology

- 7.1.2 BBPOS

- 7.1.3 VeriFone System Inc.

- 7.1.4 DSpread

- 7.1.5 Castles

- 7.1.6 YourTransactor

- 7.1.7 Ingenico SA

- 7.1.8 SZZT

- 7.1.9 Spectra

- 7.1.10 WizarPOS

8 INVESTMNET ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

샘플 요청 목록