|

시장보고서

상품코드

1635419

미국의 벽면 마감재 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)United States Wall Coverings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

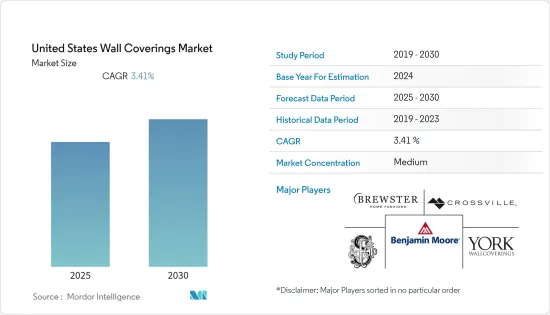

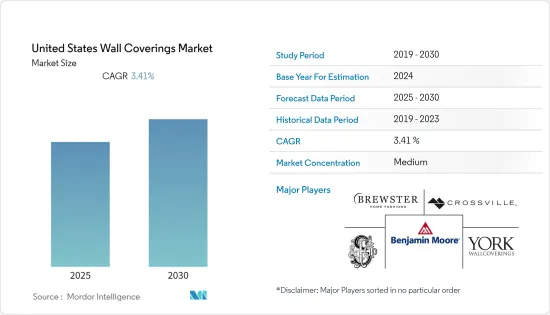

미국의 벽면 마감재 시장은 예측 기간 동안 CAGR 3.41%를 기록할 것으로 예상됩니다.

주요 하이라이트

- 벽지 시장의 확대는 생활수준의 향상, 사치스러운 생활에 대한 열망, 가처분 소득의 증가로 인한 가정의 맞춤화가 원동력이 되고 있습니다. 또한, 기술 혁신의 발전과 잉크젯 인쇄 기술로 인쇄된 맞춤형 3D 벽 등 보다 높은 품질의 아이템이 고소득층 소비자의 벽면 마감재재 구매를 유도하고 있습니다.

- 대부분의 벽면 마감재 제품은 유지보수가 쉽고 수명이 길기 때문에 고객 수요가 증가할 것으로 예상됩니다. 인구 증가와 도시화의 결과로 인프라 활동에 대한 투자가 예측 기간 동안 벽면 마감재 시장의 성장을 촉진할 것으로 보입니다.

- 페인트는 특정 용도에서는 벽지보다 더 나은 대안으로 간주됩니다. 또한 기존 벽지를 벗겨내는 것은 번거로운 작업이며, 효율적인 작업을 위해서는 적절한 도구가 필요합니다. 벽지를 벗기는 것은 화학제품이나 박리 도구를 사용하여 할 수 있지만, 주의를 기울이지 않으면 벽이 손상될 수 있습니다.

- Dodge Construction Network에 따르면, 미국 상위 20개 도시 지역의 상업용 및 다세대 주택 착공은 2020년부터 2021년까지 18% 증가할 것으로 예상됩니다. 미국 전역에서 2021년 상업 및 다세대 주택 착공은 16% 증가했으며, 2021년 상업 및 다세대 주택 착공 건수는 상위 절반(상위 10개 도시 지역)에서 18% 증가했고, 워싱턴 DC와 캘리포니아 주 로스엔젤레스의 2개 도시 지역에서는 감소했습니다.

- 워싱턴 DC와 캘리포니아 주 로스엔젤레스의 두 도시 지역에서는 착공 건수가 감소하고 있습니다. 예를 들어, BEA에 따르면 미국의 건설 부문은 세계 최대 규모이며, 민간 지출은 해마다 증가하고 있으며, 약 800만 명이 고용되어 2023년까지 신규 건설은 1조 4,490억 달러에 달할 것으로 추산됩니다.

- COVID-19 기간 동안 신축 주택 개발은 허가를 제공하는 정부 기관의 폐쇄와 건축자재 공급망의 혼란으로 인해 더욱 어려움을 겪었고, 이는 미국 벽면 마감재 시장에도 영향을 미쳤습니다.

- 팬데믹에도 불구하고 2021년 임대주택에 대한 좋은 소식도 있다: RentCafe의 최근 조사에 따르면, 임대주택 건설은 지난 4년간 아파트 건설이 활발했던 지난 4년간과 거의 같은 속도로 진행되고 있으며, 5년 연속으로 2021년에는 미국 전역에 33만 가구 이상의 신규 임대주택이 오픈할 예정입니다.

미국의 벽면 마감재 시장 동향

미국 주택 건설 활동의 회복으로 시장 활성화

- 주택 건설은 벽면 마감재 시장의 대부분을 차지하고 있으며, 앞으로도 큰 폭의 증가가 예상됩니다. 미국의 지속적인 인구 증가로 인해 아파트를 포함한 모든 유형의 주택에 대한 수요가 증가하고 있으며, 고용 기회와 인구 증가가 신규 주택 수요 증가의 큰 원동력이 되고 있습니다.

- 미국 인구조사국과 미국 주택도시개발부는 공동으로 2022년 4월 신규 주택 건축 통계를 발표했다: 건축 허가 건수는 181만 9,000건, 주택 착공 건수는 172만 4,000건, 주택 완공 건수는 129만 5,000건입니다.

- 미국 인구조사국에 따르면, 2008년 대불황으로 크게 감소한 미국의 신규 상업용 건물 착공액은 불황 이전 수준으로 회복되어 2021년에는 910억 3,000만 달러에 달할 것이며, 2022년에는 1,350억 달러에 달할 것으로 예상됩니다. 또한 미국에서 가장 많이 착공된 상업용 건축물은 개인 사무실로 나타났습니다. 개인 사무실, 창고, 쇼핑 및 소매 시설은 향후 몇 년 동안 그 매력을 유지할 것으로 보입니다.

벽지 제품의 기술 혁신이 시장 성장을 주도

- 벽지 시장에서는 오스너버그를 부직포 백킹으로 대체하고 무게를 줄이는 등 끊임없는 기술 혁신이 이루어지고 있습니다. 또한, 곰팡이 제한을 제거하는 통기성 직물과 같은 다른 특성의 통합은 상업 및 주거 분야 모두에서 벽지 시장의 성장을 상당히 촉진하고 있습니다.

- 또한, 벽지 기술의 발전은 이러한 재료를 쉽게 붙이고 떼어낼 수 있게함으로써 판매 기회를 향상시킬 것으로 보입니다. 따라서 2022년까지 주거 및 비주거 시장에서의 건축 공사 및 주택 개조 가능성이 더욱 매력적으로 변하면서 벽지에 대한 수요가 증가할 것으로 예상됩니다.

- 생활수준의 향상, 가처분 소득의 증가는 생활공간과 업무공간에 대한 더 나은 전망에 대한 욕구로 이어지며, 그 성취의 일부는 뇌가 더 긍정적으로 생각하도록 조정하는 것입니다.

- 미국의 많은 기업들이 친환경적이고 매력적인 벽지 생산에 투자하고 있습니다. 또한 많은 기업들이 시장 점유율을 유지하고 확대하기 위해 인수합병(M&A) 등 새로운 방법을 활용하고 있습니다. 예를 들어, 2021년 5월, F. Backdrop 페인트 회사는 Schumacher & Company에 인수되었습니다. 이 인수를 통해 슈마허 & 컴퍼니는 제품 라인에 프리미엄 벽지 제품을 추가하여 시장 점유율을 확대할 수 있게 되었습니다.

미국의 벽지 산업 개요

미국의 벽면 마감재 시장은 중간 정도의 경쟁관계에 있으며, 여러 대기업으로 구성되어 있습니다. 시장 점유율 측면에서 현재 몇 개의 대기업이 시장을 독점하고 있습니다. 시장에서 압도적인 점유율을 가진 이들 대기업은 다양한 국가에서 고객 기반을 확대하는 데 주력하고 있습니다. 이들 기업은 시장 점유율을 확대하고 수익성을 높이기 위해 전략적 공동 이니셔티브를 활용하고 있습니다. 또한, 이 시장에서 사업을 전개하는 기업들은 제품력을 강화하기 위해 벽면 마감재 기술 관련 스타트업들을 인수하고 있습니다.

- 2022년 6월 - 크로스빌은 표면이 소용돌이치는 듯한 광택과 부드럽고 세련된 광택이 특징인 클래식 그루브 도자기 타일 컬렉션을 출시했습니다. 궁극의 제품은 다양한 장식적 요소로 강조된 미학적으로 개선된 따뜻한 색과 차가운 색의 중성 타일 컬렉션으로, 다양한 장식 요소로 강조된 컬렉션입니다.

- 2021년 8월 - 사우스다코타주 수폴스에 위치한 Furniture Mart USA가 30만 평방피트 규모의 본사 및 물류센터 확장 공사에 착수, 65만 평방피트 규모의 공장이 완공되면 1,200명의 직원이 근무하게 되며, 노스다코타, 사우스다코타, 미네소타, 위스콘신, 일리노이, 아이오와, 애슐리 홈스토어, 애틀랜타, 위스콘신, 노스다코타, 미네소타, 위스콘신, 일리노이 일리노이, 아이오와, 일리노이, 아이오와 주에 있는 가구 마트, 애슐리 홈스토어, 언클레임 프레이트 가구 매장에 제품을 공급할 예정입니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인과 시장 성장 억제요인 소개

- 시장 성장 촉진요인

- 주택 건설 활동 회복

- 인지도 향상에 의한 벽 패널 판매 회복

- 디지털 인쇄 솔루션 수요 증가

- 부직포·종이 기반 벽지 성장

- 시장 성장 억제요인

- 페인트 부문과의 치열한 경쟁

- 최근 거시적 환경의 변화가 고객 소비에 영향을 미치는 전망

- 업계 밸류체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 벽면 마감재과 벽지 수출입 분석

- 미국의 벽면 마감재와 기타 주요 대체품에 대한 고객 소비 동향

- COVID-19의 벽면 마감재 업계에 대한 영향

- 주요 제품 혁신

- 친환경 벽면 마감재

- 플랭크 프린트

- 디지털 인쇄의 진보

- 광흡수 벽면 마감재

제5장 시장 세분화

- 유형별

- 벽 패널

- 타일

- 금속 벽

- 벽지

- 비닐

- 부직포 벽지

- 종이 벽지

- 패브릭 벽지

- 기타 벽지

- 용도별

- 주택

- 상업

- 최종사용자별

- 전문점

- 홈 센터

- 가구점

- 양판점

- E-Commerce

- 기타 최종사용자

제6장 경쟁 구도

- 기업 개요

- Brewster Home Fashion

- Benjamin Moore & Co.

- York Wall Coverings

- F. Schumacher

- Crossville Inc.

- Georgia-Pacific

- Mohawk Industries Inc.

- Ahlstrom-Munksjo Oyj

- Johns Manville Corporation

- Rust-Oleum Coproration

- Sherwin-Williams Company

- The Valspar Company

- Koroseal Wall Protection

- Len-Tex Corporation

- Wallquest Inc.

제7장 투자 분석

제8장 시장 기회와 향후 동향

ksm 25.02.07The United States Wall Coverings Market is expected to register a CAGR of 3.41% during the forecast period.

Key Highlights

- The expansion of the wall coverings market is driven by rising standards of living, the desire for a luxurious existence, and household customization due to increased disposable income. Furthermore, advancements in innovation and better-quality items, such as bespoke 3D walls printed with ink-jet printing technology, have enticed high-income consumers to purchase wall coverings.

- Most wall covering products are simple to maintain and long-lasting, projected to increase customer demand. As a result of the expanding population and urbanization, investments in infrastructure activities are likely to promote the growth of the wall coverings market throughout the forecast period.

- Paint is considered a better alternative, as compared to wall coverings in specific uses. Furthermore, removing existing wallpaper can be a tiresome task that needs the right tools to be efficient. Stripping wallpaper can be achieved with chemicals or stripping tools, but care must be taken, or the wall can be damage.

- According to Dodge Construction Network, the value of commercial and multifamily construction starts in the top 20 metropolitan regions of the United States climbed 18% from 2020 to 2021. Nationally, commercial and multifamily construction in the United States rose by 16% in 2021. Commercial and multifamily starts increased 18% in the top half (the top ten metro areas) in 2021, with two metro areas, Washington, DC, and Los Angeles, CA, reporting declines.

- The New constructions in this region increase an opportunity for the Wall coverings market suppliers. For instance, According to BEA, The construction sector in the United States is one of the world's largest, with private spending continuing to rise year after year and around 8 million people employed. By 2023, new construction is estimated to be worth USD 1,449 billion.

- During the Pandemic, new home development was further hampered by the closure of government agencies that provided permits and disruptions in the supply chain for construction supplies. which also affected the Wall Coverings Market in the United States.

- Despite the Pandemic, there is some good news for renters in 2021: According to a recent survey from RentCafe, rental property construction has stayed at almost the same rate as in the preceding four active years of apartment construction. For the fifth year in a row, over 330,000 new rental units are scheduled to open across the United States in 2021.

US Wall Coverings Market Trends

Rebounding Residential Construction Activity in the United States is Boosting the Market

- Residential constructions account for a significant portion of the wallcovering market and are expected to increase considerably. Employment opportunities and population expansion are substantial drivers of the rising demand for new housing since sustained population growth in the United States has raised the demand for all types of housing, including apartments.

- The United States Census Bureau and the United States Department of Housing and Urban Development jointly released the following new residential building statistics for April 2022: 1,819,000 building permits issued, 1,724,000 housing starts, and 1,295,000 housing completions.

- According to US Census Bureau, after a considerable decline during the 2008 Great recession, the value of the new commercial building in the United States has recovered to pre-recession levels, hitting 91.03 billion USD in 2021. In 2022, the value of construction starts in the United States reached USD 135 billion. Moreover, the most popular forms of commercial construction started in the United States were private offices. Private offices, warehouses, and shopping/retail facilities will maintain their attractiveness in the coming years.

Incremental Innovation in Wallpaper Products Drives Market Growth

- The wallpaper segment of the market is seeing a constant innovation, such as the replacement of Osnaburg with non-woven backing and lightweight. Besides, the incorporation of other characteristics, like breathable fabrics that eliminates the limitations of molds, is considerably promoting the growth of the wall-coverings market in both commercial and residential sectors.

- Furthermore, advancements in wallpaper technology will improve sales opportunities by making these materials easier to apply and remove. Therefore, through 2022, the more attractive possibilities for building construction in residential & non-residential markets and home improvements will enhance wallpaper demand.

- Rising standard of living, Increased disposable income lead to a desire for a better outlook on living and working spaces, and part of achieving that is conditioning one's brain to think more positively, which they may do the surrounding themselves with the wallpapers that make them happy.

- Many companies in the United States are investing in producing environmentally friendly and attractive wallpapers. In addition, numerous corporations are using additional techniques to retain or expand market shares, such as mergers and acquisitions. In May 2021, for instance, F. The Backdrop paint company was purchased by Schumacher & Co. This acquisition allows the company to increase its market share by adding Premium wall coverings to its product line.

US Wall Coverings Industry Overview

The United States Wall Covering Market is moderately competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players, with a prominent share in the market, are focusing on expanding their customer base across different countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. The companies operating in the market are also acquiring start-ups working on Wall Covering technologies to strengthen their product capabilities.

- June 2022 - Crossville launches the classic grooves porcelain tile collection with swirling surface glints and glows with a soft, sophisticated sheen. The ultimate product is a collection of aesthetically improved warm and cool neutral tiles accented by various decorative elements.

- August 2021 - The Furniture Mart USA from Sioux Falls, South Dakota, broke ground on a 300,000-square-foot expansion of its headquarters and distribution hub. The 650,000-square-foot plant will serve as a hub for the company's 1,200 employees and offer the product for its Furniture Mart, Ashley HomeStore, and Unclaimed Freight Furniture stores in North Dakota, South Dakota, Minnesota, Wisconsin, Illinois, and Iowa after it is done.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rebounding Residential Construction Activity

- 4.3.2 Recovery in Wall Panel Sales Aided by Higher Awareness

- 4.3.3 Increasing Demand for Digitally Printed Solutions

- 4.3.4 Growth in Non-woven and Paper-based Wallpapers

- 4.4 Market Restraints

- 4.4.1 Strong Competition from the Paints Segment

- 4.4.2 Recent Changes in Macro-environment Expected to Impact Customer Spending

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Import-Export Analysis for Wallcoverings and Wallpapers

- 4.8 Customer Spending Trends on Wallcoverings and Other Key Alternatives in the United States

- 4.9 Impact of COVID-19 on the Wallcoverings Industry

- 4.10 Key Product Innovations

- 4.10.1 Eco-Friendly Wallcoverings

- 4.10.2 Plank Prints

- 4.10.3 Digital Printing advancements

- 4.10.4 Light Absorbing Wallcoverings

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wall Panel

- 5.1.2 Tiles

- 5.1.3 Metal Wall

- 5.1.4 Wallpaper

- 5.1.4.1 Vinyl

- 5.1.4.2 Non-woven Wallpaper

- 5.1.4.3 Paper-based Wallpaper

- 5.1.4.4 Fabric Wallpapers

- 5.1.4.5 Other Wallpaper Types

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By End User

- 5.3.1 Specialty Store

- 5.3.2 Home Center

- 5.3.3 Furniture Store

- 5.3.4 Mass Merchandizer

- 5.3.5 E-commerce

- 5.3.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Brewster Home Fashion

- 6.1.2 Benjamin Moore & Co.

- 6.1.3 York Wall Coverings

- 6.1.4 F. Schumacher

- 6.1.5 Crossville Inc.

- 6.1.6 Georgia-Pacific

- 6.1.7 Mohawk Industries Inc.

- 6.1.8 Ahlstrom-Munksjo Oyj

- 6.1.9 Johns Manville Corporation

- 6.1.10 Rust-Oleum Coproration

- 6.1.11 Sherwin-Williams Company

- 6.1.12 The Valspar Company

- 6.1.13 Koroseal Wall Protection

- 6.1.14 Len-Tex Corporation

- 6.1.15 Wallquest Inc.