|

시장보고서

상품코드

1636085

완성차 물류 시장 - 점유율 분석, 산업 동향·통계, 성장 예측(2025-2030년)Finished Vehicles Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

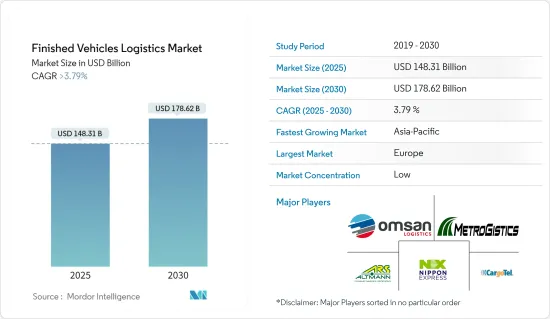

완성차 물류 시장 규모는 2025년 1,483억 1,000만 달러로 추정되며, 2030년 1,786억 2,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 3.79%를 초과할 것으로 예측됩니다.

완성차 물류 시장은 세계 자동차 공급망의 중요한 구성 요소이며, 제조 기지에서 최종 소비자까지 자동차의 원활한 운송을 담당하고 있습니다. 고객의 기대 변화에 의해 큰 진화를 이루고 이해 관계자에게 기회와 과제를 가져오고 있습니다.

시장을 형성하는 두드러진 동향 중 하나는 전기 트럭과 대체 연료 트럭의 채용이 증가하고 있다는 것입니다. CEVA Logistics는 2024년 9월에 BYD의 파트너십을 발표하고 2025년 1월에 4대의 BYD ETH8 전기 트럭을 유럽 사업에 통합하기로 결정했습니다. 첨단 기술로 설계된 이러한 차량은 항속 거리 250km를 지원하고 급속 충전 기능을 갖추고 있으며 2050년까지 인터넷 제로 방출을 달성하는 CEVA의 광범위한 목표에 부합하고 있습니다.

또한 물류의 효율성과 지속가능성을 최적화하기 위해 복합 운송이 중요 해지고 있습니다. 채택하고 배출량을 줄이기 위한 도로와 철도 시스템의 통합을 입증하고 있습니다. 한계를 유지하기 위해 기업이 복합 운송 전략을 도입하는 방법을 부각하고 있습니다. 2024년 IAA 운송 이벤트에서는 이러한 혁신이 현대의 복잡한 물류 네트워크를 탐색하기 위한 중요한 도구로 발표되었습니다.

완성차 물류 시장 동향

북미 완성차 판매 붐이 물류투자 촉진

2024년 자동차 판매의 급증이 북미 완성차 물류 시장을 견인하고 있습니다. 대응하기 위해 제조업체와 서비스 제공 업체는 이 지역 전반에 걸쳐 적시 배송을 보장하기 위해 네트워크를 미세 조정합니다.

United Road는 2024년 5월에 사업을 확장하여 광대한 북미 네트워크를 활용하여 서비스 속도와 효율성을 높입니다. 이와 병행하여 물류의 주요 기업인 Jack Cooper는 2024년에 5개의 신거점을 시작하여 12개 신규 고객을 맞이하여 멕시코의 발자취를 확대했습니다. 물류 프레임 워크에서 매우 중요하다는 것을 강조합니다.

예를 들어 General Motors는 2024년 북미 물류 공급업체와 제휴하여 공급망 경로를 합리화하여 비용 절감과 납기 단축을 실현했습니다. 최첨단 기술에 의해 강화되고 있으며, 이들은 현대의 물류의 정평이 되고 있습니다.

전 세계의 창고 및 제조 물류 성장

세계에서 완성차의 물류 시장은 큰 변모를 이루고 있습니다. 차량 보관, 재고 관리 강화, 환경 영향을 최소화하기 위한 협조적인 노력에 대한 수요 증가로 이어지고 있습니다.

BMW는 이 동향을 강조하고, 자동화와 지속가능성을 세계의 물류의 틀에 통합하는 것을 목적으로 한 2024년 구상을 전개했습니다. 효율성 향상뿐만 아니라 탄소 중립 목표를 향해 앞으로 나아갔습니다. 이러한 업그레이드 된 창고는 세계 물류 업무를 혁신하는 BMW의 종합적인 전략에서 매우 중요한 역할을합니다.

게다가 물류기업은 창고관리 업무를 강화하기 위해 점점 그린솔루션에 눈을 돌리게 되어 왔습니다. 이 움직임은 배출량을 억제할 뿐만 아니라, 제조 거점에 있어서의 지속가능성에의 대처를 강화해, 환경 친화적인 창고 업무에의 산업의 광범위한 대처라고 호응하고 있습니다.

이 추세를 더욱 강조하기 위해 CEVA 물류와 같은 세계 선도 기업들은 도로, 철도 및 해상 운송 허브를 원활하게 통합하는 멀티모달 창고 전략을 지지하고 있습니다. 창고 관리 시스템에 통합하기 위해 일반적으로 중시하고 보관 기간을 단축하고 면밀한 재고 추적을 실현하는 데 도움이 됩니다.

완성차 물류 산업 개요

시장은 매우 경쟁이 격렬하게 세분화되어 있기 때문에 완성차 물류 시장의 진출기업은 큰 시장 점유율을 가지고 있지 않습니다. 예를 들어, 2022년 10 월, DFDS와 터키의 주요 물류 회사 Ekol Logistics는 Ekol Logistics의 국제 도로 운송 사업 인수에 대해 협의를 시작했습니다. 지중해 네트워크의 페리와 물류 서비스의 조합은 북유럽에서 성공한 DFDS의 경제 모델을 모방합니다.

주요 진출기업으로는 MetroGistics LLC, Nippon Express Holdings Inc., Omsan Logistics, ARS Altmann, CargoTel Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학과 인사이트

- 시장 개요

- 시장 역학

- 시장 성장 촉진요인

- 신흥 시장에서의 자동차 판매의 성장

- 물류 업무의 기술적 진보

- 시장 성장 억제요인

- 운전자 부족과 높은 노동 비용

- 연료비 상승과 규제상의 과제

- 시장 기회

- 복합 일관 물류 솔루션 확대

- 시장 성장 촉진요인

- 밸류체인/서플라이체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 정부의 규제와 대처

- 공급체인/가치체인 분석

- 이벤트·물류 부문에 있어서의 기술 혁신에 통찰

- 지정학과 팬데믹이 시장에 미치는 영향

제5장 시장 세분화

- 활동별

- 수송(철도, 도로, 항공, 해상)

- 창고

- 부가가치 서비스

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 방글라데시

- 터키

- 한국

- 호주

- 인도네시아

- 기타 아시아태평양

- 중동 및 아프리카

- 이집트

- 남아프리카

- 사우디아라비아

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- Market Concentration Analysis

- 기업 프로파일

- MetroGistics LLC

- Nippon Express Holdings Inc

- Omsan Logistics

- CargoTel Inc.

- ARS Altmann

- CMA CGM SA

- Pound Gates Vehicle Management Services Ltd.

- CEVA Logistics

- Penske Corporation

- XPO Logistics*

- 기타 기업

제7장 시장 전망

제8장 부록

- 거시경제지표(GDP분포, 활동별)

- 경제 통계-운수·창고업의 경제에의 공헌

- 대외무역 통계-수출입(품목별)

The Finished Vehicles Logistics Market size is estimated at USD 148.31 billion in 2025, and is expected to reach USD 178.62 billion by 2030, at a CAGR of greater than 3.79% during the forecast period (2025-2030).

The finished vehicles logistics market is a critical component of the global automotive supply chain, responsible for the seamless transportation of vehicles from manufacturing hubs to end consumers. In 2024, the market is witnessing significant evolution driven by advancements in technology, stricter environmental regulations, and changing customer expectations, creating opportunities and challenges for stakeholders.

One prominent trend shaping the market is the increasing adoption of electric and alternative fuel-powered trucks. For instance, CEVA Logistics announced a partnership with BYD in September 2024 to incorporate four BYD ETH8 electric trucks into its European operations by January 2025. These vehicles, designed with advanced technology, support a range of 250 km and feature fast-charging capabilities, aligning with CEVA's broader goal to achieve net zero emissions by 2050. Such initiatives underscore the push toward decarbonizing logistics operations while maintaining efficiency.

Additionally, there is a growing emphasis on multimodal transportation to optimize logistics efficiency and sustainability. BMW has adopted electric trucks for its Leipzig facility as part of its "Green Transport Logistics Project," demonstrating the integration of road and rail systems to reduce emissions. These trucks cover approximately 100 km daily, highlighting how companies are embracing multimodal strategies to meet regulatory demands and minimize environmental impact. Furthermore, logistics companies are leveraging technology like digital twins and telematics to enhance vehicle tracking and operational efficiency. At the 2024 IAA Transportation event, such innovations were showcased as vital tools to navigate the complexities of modern logistics networks.

Finished Vehicles Logistics Market Trends

North America Finished Vehicle Sales Boom Driving Logistics Investments

In 2024, a surge in vehicle sales is propelling the North American finished vehicle logistics market. This upswing is prompting substantial investments in transport infrastructure and logistics solutions, especially in the U.S., Mexico, and Canada. In response to this demand, manufacturers and service providers are fine-tuning their networks to guarantee timely deliveries throughout the region.

Highlighting this trend, United Road expanded its operations in May 2024, capitalizing on its vast North American network to boost service speed and efficiency. This move underscores the growing demand for robust transport systems. In a parallel development, Jack Cooper, a key player in logistics, broadened its footprint in Mexico by launching five new locations and welcoming 12 new customers in 2024. This expansion underscores the pivotal significance of Mexico's burgeoning automotive sector in the broader regional logistics framework.

Furthermore, regional OEMs are gravitating towards collaborative logistics models.For instance, General Motors teamed up with North American logistics providers in 2024, streamlining its supply chain routes, which led to cost reductions and enhanced delivery timelines. Such initiatives are bolstered by cutting-edge technologies like AI-driven route optimization and digital twins, which are swiftly becoming staples in contemporary logistics. These trends highlight North America's evolving logistics landscape, marked by a keen emphasis on both scalability and technological integration.

Growth in Warehousing and Manufacturing Logistics Across the Globe

Across the globe, the logistics market for finished vehicles is witnessing a significant transformation. Manufacturers and logistics providers are channeling substantial investments into advanced warehousing and manufacturing support systems. This shift is primarily driven by a rising demand for efficient vehicle storage, enhanced inventory management, and a concerted effort to minimize environmental impact.

Highlighting this trend, BMW has rolled out a 2024 initiative aimed at weaving automation and sustainability into its global logistics framework. By deploying automated storage and retrieval systems across multiple facilities, BMW has not only boosted efficiency but also made strides towards its carbon neutrality objectives. These upgraded warehouses play a pivotal role in BMW's overarching strategy to revamp its global logistics operations.

Moreover, logistics companies are increasingly turning to green solutions to bolster their warehousing activities. A case in point is Vascor, which, in mid-2024, unveiled electric shuttle systems for landside logistics. This move not only curtails emissions but also bolsters sustainability efforts at manufacturing hubs, echoing the industry's broader commitment to eco-friendly warehouse practices.

Further underscoring this trend, global giants like CEVA Logistics are championing multimodal warehousing strategies, seamlessly integrating road, rail, and maritime transport hubs. CEVA's strategic emphasis on embedding AI and IoT technologies into its warehouse management systems has been instrumental in slashing storage durations and achieving meticulous inventory tracking. Such initiatives underscore the growing significance of warehousing and manufacturing logistics as pivotal drivers of operational efficiency in the finished vehicle supply chain.

Finished Vehicles Logistics Industry Overview

Because the market is extremely competitive and fragmented, players in the Finished Vehicles Logistics Market do not have a significant market share. Several firms are merging and acquiring to extend their geographical footprint and proprietary information. For instance, in October 2022, DFDS and Ekol Logistics, a major Turkish logistics firm, began discussions about acquiring Ekol Logistics' international road haulage operations. A combination of ferry and logistics services in the Mediterranean network would mimic DFDS' successful economic model in Northern Europe.

Some of the major players are MetroGistics LLC, Nippon Express Holdings Inc., Omsan Logistics, ARS Altmann, and CargoTel Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Growing Vehicle Sales in Emerging Markets

- 4.2.1.2 Technological Advancements in Logistics Operations

- 4.2.2 Market Restraints

- 4.2.2.1 Driver Shortages and High Labour Costs

- 4.2.2.2 Rising Fuel Costs and Regulatory Challenges

- 4.2.3 Market Opportunities

- 4.2.3.1 Expansion of Multimodal Logistics Solutions

- 4.2.1 Market Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Government Regulations and Initiatives

- 4.6 Supply Chain/Value Chain Analysis

- 4.7 Insights into Technological Innovation in the Events Logistics Sector

- 4.8 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Activity

- 5.1.1 Transport (Rail, Road, Air, Sea)

- 5.1.2 Warehouse

- 5.1.3 Value-added Services

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Bangladesh

- 5.2.3.5 Turkey

- 5.2.3.6 South Korea

- 5.2.3.7 Australia

- 5.2.3.8 Indonesia

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 Middle East & Africa

- 5.2.4.1 Egypt

- 5.2.4.2 South Africa

- 5.2.4.3 Saudi Arabia

- 5.2.4.4 Rest of Middle East & Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Company Profiles

- 6.2.1 MetroGistics LLC

- 6.2.2 Nippon Express Holdings Inc

- 6.2.3 Omsan Logistics

- 6.2.4 CargoTel Inc.

- 6.2.5 ARS Altmann

- 6.2.6 CMA CGM S.A

- 6.2.7 Pound Gates Vehicle Management Services Ltd.

- 6.2.8 CEVA Logistics

- 6.2.9 Penske Corporation

- 6.2.10 XPO Logistics*

- 6.3 Other Companies

7 FUTURE OUTLOOK OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to the Economy

- 8.3 External Trade Statistics - Export and Import, by Product