|

시장보고서

상품코드

1636141

미국의 항공화물 운송 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)US Air Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

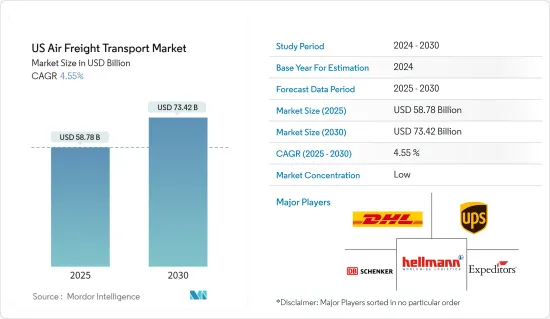

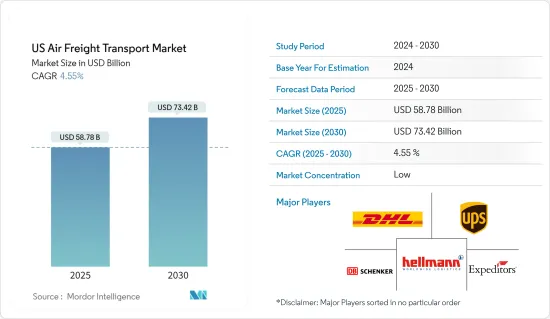

미국의 항공화물 운송 시장 규모는 2025년 587억 8,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 4.55%의 CAGR로 2030년에는 734억 2,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 미국 항공화물 운송 시장은 주로 E-Commerce 활동의 급증과 FMCG 수요의 급증에 의해 주도되고 있습니다.

- E-Commerce의 폭발적인 성장은 항공화물 수요를 지속적으로 견인하고 있습니다. 이러한 급격한 성장으로 인해 빠른 배송에 대한 요구가 높아지면서 물류 제공업체는 빠른 배송에 대한 소비자의 기대에 부응하기 위해 역량을 강화하고 운영을 간소화해야 할 필요성이 대두되고 있습니다.

- 2024년 6월, 미국과 세계 각지를 연결하는 항공화물은 2023년 대비 5% 증가하여 총 103만 6,907톤을 기록했습니다. 미국 항공사는 이 국제화물의 47%를 수송했으며, 전세기가 전체의 21%를 차지했습니다.

- 2024년 6월까지 1년간 미국 화물의 주요 국제 관문은 중국, 한국, 일본, 홍콩, 독일이었습니다. 상위 25개 시장 중 14개국에서 화물 운송량이 증가했고, 11개국에서 감소했습니다. 특히 감소한 시장 중에서는 벨기에가 2023년 대비 12% 급감했습니다. 미국 국적기의 점유율 변동은 다양하여 14개 시장에서 감소, 4개 시장에서 보합, 나머지 7개 시장에서 증가하였습니다.

- 2024년 7월, 지멘스 디지털 인더스트리즈 소프트웨어는 미국 항공우주 기업 나틸러스(Natilus)가 지멘스 엑셀레이터(Siemens Xcelerator) 제품군을 업무에 통합했다고 밝혔습니다. 통합했다고 밝혔습니다. 혁신적인 블렌디드 윙바디 항공기로 전 세계 공급망에 혁명을 일으키겠다는 비전을 가진 나틸러스는 지멘스 소프트웨어를 활용하여 첫 번째 프로토타입 개발 기간을 절반으로 단축했습니다.

미국의 항공화물 운송 시장 동향

국제 무역 수요 증가에 따라 미국 항공화물 시장 성장

2024년 미국 항공화물 운송 시장은 경기 회복, E-Commerce 확대, 지정학적 역학 변화 등의 요인으로 인해 국제 무역 수요가 크게 증가할 것으로 예상됩니다.

최근 몇 년 동안 미국의 E-Commerce 부문은 전례 없는 성장세를 보이고 있으며, 2023년까지 매출은 1조 달러를 돌파할 것으로 예상되며, 아마존과 월마트와 같은 업계 대기업뿐만 아니라 Etsy와 eBay와 같은 소규모 플랫폼에 힘입어 성장세를 보이고 있습니다.

2023년 미국의 캐나다와 멕시코와의 화물 무역액은 1조 5,700억 달러에 달했습니다. 이 무역은 총 24억 8,470만 톤의 중량을 차지합니다. 화물 중량은 2022년보다 8.8% 증가했지만, 북미 화물의 달러화 환산액은 2023년에도 안정적이었습니다.

미국은 25년 이상 '오픈 스카이' 정책을 통해 국제 항공 시장의 확대를 지지해 왔습니다. 이러한 양자 및 다자간 협정은 각국 정부의 국가 간 항공사의 운항 제한을 철폐하는 것입니다. 이 협정들은 허용되는 항공사의 수, 취항할 수 있는 노선, 채택할 수 있는 가격 전략, 사용해야 하는 항공기 등을 규정합니다. 또한, 이 협정은 미국과 외국 항공사 간의 협력을 촉진하여 미국의 화물 및 특송 운송업체가 화물과 소포를 원활하게 운송할 수 있도록 합니다. 오픈스카이의 범위는 여객 항공과 화물 항공에 걸쳐 정기 항공편과 전세 항공편을 모두 포함합니다. 지금까지 미국은 모든 대륙과 개발 단계에 걸쳐 125개 이상의 파트너와 오픈스카이 협정을 체결했습니다.

미국 전기기계 및 전자제품 무역 : 무역 적자 속 성장의 해

2024년 8월 미국은 198억 달러 상당의 전기기계 및 전자제품을 수출했지만 수입은 409억 달러에 달해 210억 달러의 무역적자를 기록했습니다. 2023년 8월부터 2024년 8월까지 미국의 이 부문 수출은 23억 2,000만 달러(13.3%)가 증가하여 175억 달러에서 198억 달러로 증가했습니다. 반면 수입은 376억 달러에서 409억 달러로 32억 6,000만 달러(8.68%) 증가했습니다.

2024년 8월 미국은 주로 멕시코(50억 달러), 캐나다(24억 4,000만 달러), 중국(16억 7,000만 달러), 말레이시아(16억 5,000만 달러), 홍콩(7억 2,000만 달러)에 전기기계 및 전자기기를 수출했습니다. 반대로 수입은 중국(104억 달러), 멕시코(78억 5,000만 달러), 베트남(33억 7,000만 달러), 중국 타이페이(30억 3,000만 달러), 말레이시아(23억 8,000만 달러)에서 많이 수입했습니다.

2024년 8월 미국의 전기기계-전자기기 수출의 전년 동월 대비 증가는 멕시코(3억 8,300만 달러, 9.62%), 캐나다(3억 5,000만 달러, 17.9%), 폴란드(1억 6,500만 달러, 122%)로의 출하 증가에 기인한 것으로 분석됩니다. 수입 측면에서는 멕시코(8억 1,600만 달러, 14.3%), 태국(6억 8,700만 달러, 67.8%), 인도(5억 2,100만 달러, 150%)에서의 구매가 증가했습니다.

미국의 항공화물 운송 산업 개요

미국의 항공화물 운송 시장은 세분화되어 있으며, 지역적 진입업체와 국제적인 진입업체가 혼재되어 있습니다. 이 시장의 주요 기업으로는 DHL, United Parcel Services Inc., Expeditors International, Hellmann Worldwide Logistics, DB Schenker 등이 있습니다.

각 기업이 기술 주도형 솔루션을 도입하고 효율적인 유통 채널을 모색함에 따라, 업계에서 새로운 기회를 포착할 수 있는 전략적 입지를 구축하고 있음을 알 수 있습니다.

2024년 10월 현재, DHL Express와 DHL Global Forwarding은 International Airlines Group(IAG)의 화물 운송 부문인 IAG Cargo와 계약을 갱신하여 지속가능성 약속을 이행하고 있습니다. 2024년과 2025년까지 지속가능한 항공 연료(SAF) 6,000만 리터를 추가로 사용하게 되며, 2024년과 2025년에 걸친 계약 갱신으로 약 165,000톤의 CO2e를 감축할 수 있을 것으로 예상됩니다. 절감할 수 있을 것으로 예상됩니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 시장 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트와 역학

- 시장 개요

- 시장 역학

- 성장 촉진요인

- 국경간 무역 관계 급증이 시장을 견인

- 시장은 경제 성장에 의해 크게 좌우된다

- 성장 억제요인

- 시장을 저해하는 지정학적 요인

- 시장에 영향을 미치는 소비자 행동

- 기회

- 시장을 견인하는 기술의 진보

- 성장 촉진요인

- 정부 이니셔티브와 규제

- 공급망/밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 정도

- 기술 현황과 디지털 동향

- 항공 운송의 주요 품목에 대해

- 항공운임 상세

- 항공화물 산업의 중량 화물/프로젝트 물류 스포트라이트

- 공항의 주요 지상 조업 기기에 관한 인사이트

- 위험물 안전 운송에 관한 기준과 규제 리뷰와 해설

- 항공화물 부문의 콜드체인 물류 개요

- 지정학과 팬데믹이 시장에 미치는 영향

제5장 시장 세분화

- 서비스별

- 화물 운송(화물과 우편)

- 화물 포워딩

- 기타 부가가치 서비스

- 서비스별

- 배송

- 항공사

- 우편

- 기타

- 목적지별

- 국내

- 국제선

- 캐리어 유형별

- 베리 카고

- 화물선

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 개요

- DHL

- United Parcel Services Inc.

- Expeditors International

- Hellmann Worldwide Logistics

- DB Schenker

- Kuehne+Nagel

- DSV

- Nippon Express

- Kerry Logistics

- Ceva Logistics*

- 기타 기업

제7장 시장 전망

제8장 부록

- 거시경제 지표(GDP 분포, 활동별, 운송·창고업의 경제에 대한 기여도)

- 대외무역 통계 - 수출과 수입(제품별)

- 주요 수출지와 수입 원산국에 관한 인사이트

The US Air Freight Transport Market size is estimated at USD 58.78 billion in 2025, and is expected to reach USD 73.42 billion by 2030, at a CAGR of 4.55% during the forecast period (2025-2030).

Key Highlights

- The US air freight transport market is mainly driven by the surge in e-commerce activities and surge in demand for FMCG.

- E-commerce's explosive growth continues to drive air freight demand. This surge has led to an increased need for prompt deliveries, pushing logistics providers to bolster their capabilities and streamline operations to align with consumer expectations for swift shipments.

- In June 2024, air freight between the US and global destinations rose by 5% from 2023, totaling 1,036,907 tons. US airlines were responsible for transporting 47% of this international freight, with charter services making up 21% of the total traffic.

- For the year ending June 2024, the leading international gateways for US freight were China, South Korea, Japan, Hong Kong, and Germany. Among the top 25 country markets, 14 saw an increase in freight traffic, while 11 experienced a decline. Notably, Belgium, among the declining markets, recorded the steepest drop at 12% compared to 2023. The US flag share dynamics varied: it decreased in 14 markets, remained steady in four, and saw an uptick in seven others.

- Technological advancements are significantly transforming air freight operations, improving efficiency and reliability. In July 2024, Siemens Digital Industries Software revealed that Natilus, a US-based aerospace firm, has integrated the Siemens Xcelerator suite into its operations. With a vision to revolutionize global supply chains via its innovative blended-wing-body aircraft, Natilus has leveraged Siemens software to slash its inaugural prototype's development time by half.

US Air Freight Transport Market Trends

US Air Freight Market Set for Growth Amid Rising International Trade Demand

In 2024, the US air freight transport market is poised for significant growth in international trade demand, driven by factors such as economic recovery, the expansion of e-commerce, and shifting geopolitical dynamics.

In recent years, the US e-commerce sector has witnessed unprecedented growth. By 2023, sales surpassed the USD 1 trillion mark, propelled by industry giants like Amazon and Walmart, alongside smaller platforms such as Etsy and eBay.

In 2023, US freight trade with Canada and Mexico reached a value of USD 1.57 trillion. This trade accounted for a total weight of 2,484.7 million tons. Although the weight of the freight saw an 8.8% increase from 2022, the dollar value of North American freight held steady in 2023.

For over 25 years, the United States has championed the expansion of international aviation markets through its "Open Skies" policy. These bilateral and multilateral agreements eliminate government-imposed limitations on airline operations between countries. They dictate the number of airlines permitted, the routes they can take, the pricing strategies they can adopt, and the aircraft they must utilize. Furthermore, these agreements foster collaboration between US and foreign airlines, enabling US cargo and express delivery carriers to transport freight and parcels seamlessly. The scope of Open Skies spans passenger and cargo aviation, covering both scheduled and charter flights. Thus far, the US has forged Open Skies agreements with over 125 partners, spanning every continent and developmental stage.

US Electrical Machinery and Electronics Trade: A Year of Growth Amidst a Trade Deficit

In August 2024, the US exported USD 19.8 Billion worth of electrical machinery and electronics, while imports reached USD 40.9 Billion, leading to a trade deficit of USD 21 Billion. From August 2023 to August 2024, US exports in this sector rose by USD 2.32 Billion (13.3%), climbing from USD 17.5 Billion to USD 19.8 Billion. In contrast, imports saw a USD 3.26 Billion (8.68%) uptick, moving from USD 37.6 Billion to USD 40.9 Billion.

In August 2024, the US primarily exported electrical machinery and electronics to Mexico (USD 5 Billion), Canada (USD 2.44 Billion), China (USD 1.67 Billion), Malaysia (USD 1.65 Billion), and Hong Kong (USD 702 Million). Conversely, imports were predominantly sourced from China (USD 10.4 Billion), Mexico (USD 7.85 Billion), Vietnam (USD 3.37 Billion), Chinese Taipei (USD 3.03 Billion), and Malaysia (USD 2.38 Billion).

The year-on-year rise in US exports of electrical machinery and electronics in August 2024 was largely driven by boosts in shipments to Mexico (USD 383 million or 9.62%), Canada (USD 350 million or 17.9%), and Poland (USD 165 million or 122%). On the import side, the uptick was mainly due to increased purchases from Mexico (USD 816 million or 14.3%), Thailand (USD 687 million or 67.8%), and India (USD 521 million or 150%).

US Air Freight Transport Industry Overview

The US air freight transport market landscape is fragmented, with a mix of regional and international players. Key players in the market include DHL, United Parcel Services Inc., Expeditors International, Hellmann Worldwide Logistics, DB Schenker, etc.

As companies embrace technology-driven solutions and seek efficient distribution channels, they find themselves strategically positioned to seize emerging opportunities in the industry.

As of October 2024, DHL Express and DHL Global Forwarding are advancing their sustainability initiatives by renewing a contract with IAG Cargo, the cargo handling arm of International Airlines Group (IAG). This partnership will see the use of an extra 60 million liters of Sustainable Aviation Fuel (SAF) for DHL's operations. Spanning the years 2024 and 2025, the renewed contract is projected to cut down greenhouse gas emissions by roughly 165,000 metric tons of CO2e.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Surge in cross border trade relations driving the market

- 4.2.1.2 The market is significantly driven by economic growth

- 4.2.2 Restraints

- 4.2.2.1 Geopolitical factors hindering the market

- 4.2.2.2 Consumer Behaviour affecting the market

- 4.2.3 Opportunities

- 4.2.3.1 Technological advancements driving the market

- 4.2.1 Drivers

- 4.3 Government Initiatives and Regulations

- 4.4 Supply Chain/Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Degree Of Competition

- 4.6 Technology Snapshot and Digital Trends

- 4.7 Spotlight on Key Commodities Transported by Air

- 4.8 Elaboration on Air Freight Rates

- 4.9 Spotlight on Heavy Cargo/Project Logistics in the Air Cargo Industry

- 4.10 Insights into Key Ground Handling Equipment in Airports

- 4.11 Review and Commentary on Standards and Regulations on the Safe Transport of Dangerous Goods

- 4.12 Brief on Cold Chain Logistics in the Air Cargo Sector

- 4.13 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Freight Transport (Cargo and Mail)

- 5.1.2 Freight Forwarding

- 5.1.3 Other Value-added Services

- 5.2 By Service

- 5.2.1 Forwarding

- 5.2.2 Airlines

- 5.2.3 Mail

- 5.2.4 Other Services

- 5.3 By Destination

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 By Carrier Type

- 5.4.1 Belly Cargo

- 5.4.2 Freighter

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 United Parcel Services Inc.

- 6.2.3 Expeditors International

- 6.2.4 Hellmann Worldwide Logistics

- 6.2.5 DB Schenker

- 6.2.6 Kuehne + Nagel

- 6.2.7 DSV

- 6.2.8 Nippon Express

- 6.2.9 Kerry Logistics

- 6.2.10 Ceva Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of the Transport and Storage Sector to Economy)

- 8.2 External Trade Statistics - Exports and Imports, by Product

- 8.3 Insights into the Key Export Destinations and Import Origin Countries