|

시장보고서

상품코드

1690841

라틴아메리카의 항공화물 산업 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Latin America Air Freight Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

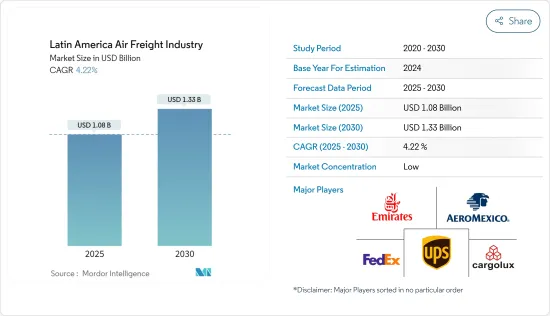

라틴아메리카의 항공화물 산업은 2025년 10억 8,000만 달러로 추정되고, 2030년에는 13억 3,000만 달러로 성장할 전망이며, 예측 기간 2025년부터 2030년까지 CAGR 4.22%로 성장할 전망입니다.

라틴아메리카의 항공 무역은 운송 능력 향상과 신선한 라틴아메리카 생산품의 세계 수요에 따라 성장하고 있습니다. 그러나 구태의연한 규제 및 인프라 성장 고민이 라틴아메리카가 그 잠재 능력을 완전히 발휘하는 데 방해가 되고 있습니다.

업계 전문가에 따르면 2022년 8월 이 지역 항공사의 화물량은 2021년 8월에 비해 9.0% 증가했습니다. 다른 지역 중에서도 라틴아메리카는 현저한 성장률을 보였습니다. 이 성장의 주요 요인은 새로운 노선과 용량을 제공하는 것입니다. 또한 이 지역에서는 향후 몇 개월 동안 항공화물용 항공기에 대한 투자가 늘어날 것으로 예상됩니다. 수송 능력은 24.3% 증가했습니다.

전년 대비 가장 견조했던 것은 라틴아메리카 항공사로, 2022년부터 2023년까지 국제선 수요는 1.9% 증가에 비해 2.0% 증가했습니다. 용량도 13.2% 증가(국제선은 16.9% 증가)로 대폭 증가했습니다.

항공화물 부문은 항공기 누락, 노선 감소, 수요 감소 등 여러 어려움을 겪고 있습니다. 일부 세계 항공화물 회사는 팬데믹(세계 대유행)에 비해 수요가 부진한 것으로 나타났습니다.

지난 2년간 특성화된 소비자 수요의 활황과는 달리 항공화물 부문은 현재 시기에 관계없이 고객 수요 감소에 직면하고 있습니다. 일부 사정으로 인해 항공화물 회사는 2022년 4분기 부진할 것으로 예상하고 있습니다. 공급망의 단절, 전쟁의 장기화, 세계 경제의 감속, 세계 동시 불황의 가능성 등입니다.

라틴아메리카의 항공화물 산업 시장 동향

전자상거래 성장으로 운송 서비스 증가

업계 전문가에 따르면 국경을 넘어선 전자상거래는 물류업체에게 큰 비즈니스 기회 중 하나입니다. 이 업계에서는 최신 기술을 활용하고 부정 방지 솔루션과 인증 기술을 개발하기 위한 기술 혁신이 지속적으로 이루어지고 있으며, 중요한 기업, 가맹점, 은행은 본인 인증을 위한 생체 인증 데이터 등의 솔루션을 활용하여 온라인 쇼핑 이용자를 식별할 수 있게 되었습니다. 이 성장의 배경에는 몇 가지 요인이 있지만, 가장 중요한 것은 구매를 할 많은 밀레니얼 세대 및 스마트폰의 대량 보급입니다.

라틴아메리카에서는 소셜 커머스가 전자상거래를 추월하기 시작했습니다. 브라질, 콜롬비아, 멕시코에서 실시된 여론조사에서는 라틴아메리카 쇼핑객의 절반 이상이 소셜커머스를 이용하고 있었습니다. 소셜 커머스를 기업의 공식 사이트나 아마존, 랩피, 메르카드리브레와 같은 마켓플레이스 사이트와 같은 기존의 전자상거래와 비교하면 라틴아메리카에서는 후자가 대두하고 있습니다.

전문가에 따르면 브라질, 콜롬비아 및 멕시코 고객의 40% 이상이 소셜 커머스의 중요한 이점으로 결제 방법 선택이 증가했다고 밝혔습니다. 아르헨티나, 콜롬비아, 멕시코의 소셜 커머스의 3분의 1 근처는 편의점의 통화 쿠폰을 이용합니다. 이는 은행 송금, 카드 및 PayPal에 의존하는 것 외에도 기술에 익숙한 소셜 미디어 사용자조차도 선호 지불 옵션으로 현금을 선호한다는 것을 보여줍니다. 2023년, 2022년 9월에 비해 남미 항공사의 화물량은 2.3% 증가했습니다. 전월과 비교하면 6.2%의 대폭적인 감소였습니다. 2023년 9월 운송 능력은 2022년 동월 대비 14.4% 증가했습니다.

항공화물 산업의 성장에 중요한 시장으로 발전하는 브라질

브라질의 세관 및 국경 규제에 의한 항공화물에 대한 지원은 2022년 E-freight Friendliness Index(EFFI)에서 세계 52위에 올랐습니다. 브라질 항공화물 운송 시장은 국내외로 제품을 이동하는 경이적인 속도와 안전성을 포함한 다양한 장점으로 인해 상당한 성장을 이루고 있습니다.

미국은 견고한 상업 관계와 공동 번영에 대한 헌신으로 브라질의 두 번째 무역 상대국입니다. 미국 브랜드와 제품에 대한 현지 수요가 높음에도 불구하고 국내 법률과 세제가 복잡하기 때문에 수출업체에게는 종종 어려움이 따릅니다. 따라서 브라질에서 성공적인 수출을 위해서는 현지 시장 동향과 규제에 대한 깊은 지식을 갖는 것이 필수적입니다. 브라질은 2023년 미국에서 391억 2,200만 달러 상당의 상품을 수출하고, 448억 800만 달러 상당의 상품을 수입하고 있습니다.

항공화물의 중요한 장점 중 하나는 신뢰성입니다. 날씨가 항공편 일정에 영향을 미칠 수 있지만 매일 항공편이 있으므로 다음 항공편에 쉽게 탑승할 수 있습니다. 화물의 혼합은 지식이 풍부한 항공화물 포워딩 비즈니스에 의해 지원될 수 있습니다. 공항 터미널에서 수하물, 통관, 화물 배송 및 저렴한 항공사 요금을 결합하여 물류 관리를 간소화할 수 있습니다. 벤더는 이러한 방식으로 보다 신속한 운송에 집중할 수 있습니다.

라틴아메리카 항공화물 산업 개요

라틴아메리카 항공화물 산업은 적당히 단편화되었습니다. 그러나 이 업계는 FedEx, UPS, Emirates 등 대기업에 의해 지배되고 있습니다. 항공화물 운송 서비스에 대한 수요가 증가함에 따라 항공화물 서비스 제공업체에게 새로운 과제가 있었습니다. 전자상거래는 또한 항공화물을 공급망 전체의 가시성과 투명성을 높이기 위해 추진하고 있으며, 브라질이 가장 중요한 시장이 되었습니다. Azul과 같은 기업은 Amazon과 같은 전자 소매업체와의 제휴와 협력을 통해 이 나라에서의 현재의 확대에 주력하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학 및 인사이트

- 현재 시장 시나리오

- 시장 개요

- 시장 역학

- 성장 촉진요인

- 신규 항공 노선 확대 및 수송 능력 증강

- 온도 변화에 민감한 제품의 항상적인 수송 요구

- 성장 억제요인

- 시장 불확실성

- 기회

- 여러 소프트웨어 솔루션 도입

- 성장 촉진요인

- 밸류체인 및 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자 및 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 정부의 규제와 대처

- 공급망 및 밸류체인 분석

- 기술 스냅샷 및 디지털 동향

- 항공 수송되는 주요 상품의 스포트라이트

- 항공화물 운임의 상세

- 공항의 주요 지상 처리 설비에 관한 인사이트

- 위험물의 안전 수송에 관한 기준 및 규제의 리뷰와 해설

- 항공화물 부문의 콜드체인 물류 개요

- COVID-19가 시장에 미치는 영향

제5장 시장 세분화

- 서비스별

- 수송

- 포워딩

- 기타 서비스

- 목적지별

- 국내

- 국제

- 캐리어 유형별

- 베리 카고

- 화물선

- 국가별

- 브라질

- 멕시코

- 아르헨티나

- 콜롬비아

- 기타 라틴아메리카

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- FedEx(Federal Express)

- United Parcel Service

- Emirates Skycargo

- Aeromexico

- Cargolux

- LATAM Cargo

- Qatar Airways

- Azul Cargo Express

- Kuehne Nagel

- IAG Cargo

- Avianca Cargo

- DHL

- United Airlines

- American Airlines

- Delta Airlines

- Copa Airlines*

- 기타 기업

제7장 시장 기회 및 향후 동향

제8장 부록

AJY 25.04.04The Latin America Air Freight Industry is expected to grow from USD 1.08 billion in 2025 to USD 1.33 billion by 2030, at a CAGR of 4.22% during the forecast period (2025-2030).

The air trade in Latin America is growing with increased capacity addition and demand for fresh Latin American perishable goods across the globe. However, the archaic regulations and slow growth in infrastructure are hindering the continent from realizing its full potential.

As per the industry experts, in August 2022, the region had a 9.0% increase in freight volumes for airlines compared to August 2021. Among other areas, Latin America witnessed a significant growth rate. The growth is mainly attributed to the offering of new routes and capacity. The region is also expected to invest more in aircraft for air cargo in the upcoming months. The capacity increased by 24.3%.

The most robust year-on-year performance was achieved by Latin American carriers, with a 2.0% increase in demand for international operations between 2022 and 2023 compared to +1.9%. Capacity also significantly increased by 13.2% (+16.9% for international operations).

The air freight sector is experiencing several difficulties, including planes being grounded, routes being cut, and a drop in demand. Certain global air freight corporations indicate a slackened demand compared to the pandemic.

In contrast to the booming consumer demand that characterized the preceding two years, the air freight sector is currently facing a decline in customer demand, notwithstanding the time of year. Due to several circumstances, air freight companies anticipate a subdued fourth quarter in 2022. These included the broken supply chain, the protracted war, the slowdown of the world economy, and the possibility of a worldwide recession.

Latin America Air Freight Industry Market Trends

Growth of E-commerce Increases The Transport Service

As per industry experts, cross-border e-commerce is one of the significant opportunities for logistics providers due to the lower density of physical retail space, limited product availability, high penetration of smartphones, and purchase savings throughout the region. The industry continuously innovates to leverage the latest technologies and develop fraud protection solutions and authentication technologies that allow vital players, merchants, and banks to identify online shoppers by leveraging solutions such as biometric data for identity authentication. Several factors are behind this growth, the most important being the large numbers of millennials making purchases and the massive proliferation of smartphones.

In Latin America, social commerce is starting to overtake e-commerce. More than half of the Latin American shoppers polled in Brazil, Colombia, and Mexico engaged in social commerce. Comparing social commerce to traditional e-commerce, such as official corporate websites or marketplace websites like Amazon, Rappi, or MercadoLibre, the latter is gaining ground in Latin America.

More than 40% of customers from Brazil, Colombia, and Mexico cited the increased selection of payment options as a critical advantage of social commerce, as per experts. Nearly one-third of social commerce transactions in Argentina, Colombia, and Mexico involved currency coupons from convenience stores. It demonstrates that, besides relying on bank transfers, cards, and PayPal, even tech-savvy social media users favor cash as their preferred payment option. In 2023, compared to September 2022, the cargo volume increased by 2.3% for South American carriers. Compared to the previous month, this was a significant decrease in performance by 6.2%. In September 2023, capacity increased by 14.4% compared with the corresponding month in 2022.

Brazil Evolving As An Important Market For The Growth In The Air Freight Industry

Brazil's assistance of air cargo through its customs and border regulations ranked 52nd in the E-freight Friendliness Index (EFFI) globally in 2022. The air cargo transportation market has grown considerably in the country due to its various benefits, such as incredible speed and safety in the movement of products inside and outside the country.

The United States is Brazil's second-largest trading partner due to a solid commercial relationship and a commitment to joint prosperity. The complexity of domestic legislation and tax rules frequently makes it difficult for exporters despite the high local demand for U.S. brands and products. To achieve export success in Brazil, it is therefore essential to have an in-depth knowledge of local market trends and regulations. Brazil exported goods worth USD 39,122 million and imported goods worth USD 44,808 million in 2023 from the US.

One of the critical advantages of air freight is its dependability. Even though weather conditions can affect flight schedules, the availability of daily flights makes it simple to board the following trip. Consolidating shipments might be assisted by a knowledgeable air freight forwarding business. Combining airport terminal pickup, customs brokerage, cargo delivery, and affordable air carrier rates can help simplify logistics administration. Vendors can then concentrate more on expedited shipping in this fashion.

Latin America Air Freight Industry Industry Overview

The Latin American air freight industry is moderately fragmented. However, the industry is dominated by major players like FedEx, UPS, Emirates, and many more. The growing demand for air freight transportation services has opened new challenges for air cargo service providers. E-commerce also pushes air cargo toward greater visibility and transparency throughout the supply chain, with Brazil being the most significant market. Companies like Azul focus on expanding their presence in the country via collaborations and partnerships with e-retailers like Amazon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.1.1 Extension of new air routes and capacity

- 4.3.1.2 Constant Need to Transport Temperature-Sensitive Products

- 4.3.2 Restraints

- 4.3.2.1 Market Uncertainty

- 4.3.3 Opportunities

- 4.3.3.1 Implementation of Several Software Solutions

- 4.3.1 Drivers

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Government Regulations and Initiatives

- 4.7 Supply Chain/Value Chain Analysis

- 4.8 Technology Snapshot and Digital Trends

- 4.9 Spotlight on Key Commodities Transported by Air

- 4.10 Elaboration on Air Freight Rates

- 4.11 Insights into Key Ground Handling Equipment in Airports

- 4.12 Review and Commentary on Standards and Regulations on the Safe Transport of Dangerous Goods

- 4.13 Brief on Cold Chain Logistics in the Air Cargo Sector

- 4.14 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Transport

- 5.1.2 Forwarding

- 5.1.3 Other Services

- 5.2 By Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 By Carrier Type

- 5.3.1 Belly Cargo

- 5.3.2 Freighter

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Colombia

- 5.4.5 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 FedEx (Federal Express)

- 6.2.2 United Parcel Service

- 6.2.3 Emirates Skycargo

- 6.2.4 Aeromexico

- 6.2.5 Cargolux

- 6.2.6 LATAM Cargo

- 6.2.7 Qatar Airways

- 6.2.8 Azul Cargo Express

- 6.2.9 Kuehne + Nagel

- 6.2.10 IAG Cargo

- 6.2.11 Avianca Cargo

- 6.2.12 DHL

- 6.2.13 United Airlines

- 6.2.14 American Airlines

- 6.2.15 Delta Airlines

- 6.2.16 Copa Airlines*

- 6.3 Other Companies