|

시장보고서

상품코드

1636177

유럽의 SLI 전지 시장 전망 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

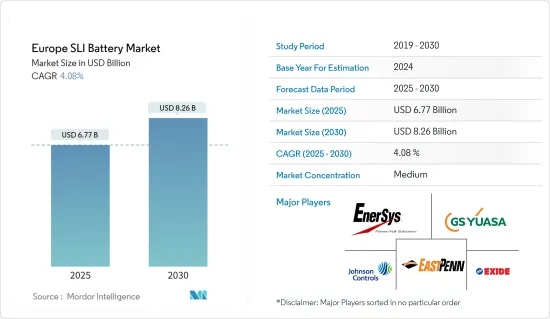

유럽의 SLI(시동, 조명 및 점화) 배터리 시장 규모는 2025년에 67억 7,000만 달러로 추정되며, 예측 기간(2025-2030년)의 연평균 성장율(CAGR)은 4.08%로, 2030년에는 82억 6,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 이 지역에서의 자동차 보급률의 상승이나 산업 및 농업 분야에서의 전지 수요 증가 등의 요인이, 예측 기간중의 유럽의 SLI 전지 시장의 가장 큰 촉진요인의 하나가 될 것으로 예상됩니다.

- 한편, 대체 배터리 화학물질과의 경쟁이 치열해지면 예측 기간 동안 유럽의 SLI 배터리 시장에 위협이 됩니다.

- 그럼에도 불구하고, 신차 및 애프터마켓 교환용으로 신흥 시장에서 확대하기 위한 지속적인 노력은 향후 시장에 몇 가지 기회를 창출할 것으로 예상됩니다.

- 독일은 상당한 성장을 보일 것으로 예상되며 예측 기간 동안 가장 높은 연평균 성장율(CAGR)을 기록 할 것으로 예상됩니다. 이는 이 지역의 중요한 제조 산업 때문입니다.

유럽의 SLI 배터리 시장 동향

자동차 최종 사용자 산업이 현저한 성장을 이룰 것

- 자동차 최종 사용자 산업은 유럽 SLI(시동, 조명 및 점화) 배터리 시장의 초석 역할을 합니다. 이 분야에는 승용차, 경상용차, 대형 트럭 등 다양한 차량이 포함되며, 이들 차량은 모두 중요한 기능을 위해 SLI 배터리에 의존합니다.

- 국제 자동차 제조업체 협회(International Organization of Motor Vehicle Manufacturers)에 따르면 유럽의 자동차 생산량은 2020년 이후 지속적인 성장세를 보이고 있습니다. 2022년부터 2023년까지 생산량은 13% 이상 증가한 반면, 지난 5년간의 연평균 성장률은 2%를 넘었습니다. 이는 이 지역의 자동차 생산량이 증가하고 있으며, 이는 곧 SLI 배터리 시장을 견인하고 있음을 의미합니다.

- 혁신과 품질에 대한 노력으로 유명한 유럽의 자동차 환경은 SLI 배터리 시장을 형성하는 데 중요한 역할을 했습니다. 제조업체들은 현대 자동차의 진화하는 요구 사항과 엄격한 규제 요건을 충족하기 위해 성능, 내구성, 환경 지속 가능성을 개선하기 위해 끊임없이 배터리 기술의 한계를 뛰어넘고 있습니다.

- 예를 들어, 2023년 5월 포르투갈의 스타트업 C2C-NewCap은 에너지 저장 환경에 혁신을 가져올 친환경 슈퍼커패시터 모듈인 GO-START를 개발했습니다. 이 회사는 EU가 자금을 지원하는 HYCAP 프로젝트의 지원을 받아 파일럿 생산 라인을 구축했을 뿐만 아니라 첫 번째 상업용 제품의 시장 데뷔를 위해 공급망을 다듬었습니다. 이 포괄적인 패키지는 차량의 전기 액세서리에 전력을 공급하도록 맞춤화된 딥 사이클 배터리로, 기존 SLI 배터리에 비해 훨씬 긴 수명을 자랑합니다.

- 예를 들어 스타트, 스톱 시스템과 마일드 하이브리드 차량의 채택이 증가함에 따라 잦은 충전,방전 주기를 견디고 더 높은 출력을 제공할 수 있는 고급 SLI 배터리의 개발이 필요해졌습니다. 이러한 변화는 배터리 설계의 혁신을 주도했을 뿐만 아니라 유럽 SLI 배터리 시장의 경쟁 구도를 재편했습니다.

- 유럽의 자동차 제조 부문은 최근 몇 년간 배기가스 규제 강화, 전동화로의 전환 가속화, 소비자 선호도 변화 등 여러 요인이 복합적으로 작용하여 큰 변화를 겪었습니다. 이러한 변화는 주로 파워트레인 시스템에 영향을 미쳤지만, SLI 배터리와 같은 보조 부품에도 연쇄적으로 영향을 미쳤습니다.

- 따라서 앞서 언급한 바와 같이 자동차 최종 사용자 산업은 예측 기간 동안 큰 성장을 이룰 것으로 예상됩니다.

시장을 독점하는 독일

- 유럽 자동차 산업의 강국인 독일은 유럽 시동, 조명 및 점화(SLI) 배터리 시장에서 중추적인 역할을 하고 있습니다. 독일은 풍부한 산업 전문성과 기술 혁신의 역사를 바탕으로 이 분야에서 막강한 제조 역량을 보유하고 있습니다. 독일의 SLI 배터리 제조업체는 생산 효율성, 품질 관리 및 기술 발전의 선두주자로 자리매김했습니다.

- 제조업은 2020년 이후 팬데믹 이전 수준에 도달한 독일 경제의 주요 기여자 중 하나입니다. 2023년 제조업의 독일 GDP 기여도는 18.96%로, 2022년에 비해 2.81% 증가했습니다. 이는 독일에서 제조 부문이 성장하고 있으며, 이는 SLI 배터리에 대한 수요를 견인하고 있음을 의미합니다.

- 독일 내 기업들은 일관된 품질과 높은 생산량을 보장하기 위해 높은 수준의 자동화 및 로봇 공학을 통합하여 최첨단 생산 시설에 막대한 투자를 해왔습니다. 독일의 제조 환경은 대량 생산이 가능한 대규모 생산업체와 틈새 시장 또는 고성능 애플리케이션에 주력하는 소규모 전문 제조업체가 혼합되어 있는 것이 특징입니다.

- 독일 SLI 배터리 시장의 최근 동향은 자동차 산업에서 전기화 및 차량 전동화로의 광범위한 변화를 반영합니다. 전기자동차로의 전환은 기존 SLI 배터리 시장에 영향을 미쳤지만 새로운 기회도 창출했습니다. 독일 제조업체들은 발 빠르게 적응하여 스타트-스톱 시스템과 회생 제동 장치가 장착된 최신 차량의 증가된 전력 수요를 충족할 수 있는 고급 SLI 배터리를 개발했습니다.

- 기존 납 배터리에 비해 성능과 수명이 향상된 강화 침수 배터리(EFB)와 흡수성 유리 매트(AGM) 배터리의 생산이 증가하는 추세입니다. 이러한 첨단 배터리는 특히 정교한 전기 시스템과 전력을 많이 소모하는 수많은 액세서리가 장착된 최신 차량의 요구 사항에 적합합니다.

- 이러한 추세는 배터리 제조업체에서 출시하는 신제품에서 두드러집니다. 예를 들어, 2024년 3월 트로잔 배터리 컴퍼니는 트로잔 AES 제품군에 DIN 규격 배터리 2종을 추가하여 글로벌 배터리 시장 제품을 강화했습니다. 새롭게 추가된 TE35-AES와 5SHP-AES는 트로잔 AES AGM 배터리의 특징적인 기능을 그대로 계승합니다. 이는 최종 사용자의 장비 다운타임 감소라는 추가적인 이점과 함께 원래 장비 제조업체 및 렌탈 회사의 가치와 투자 수익률 향상으로 이어집니다.

- 따라서 위의 언급 한 점에 따라 예측 기간 동안 독일이 시장을 독점할 것으로 예상됩니다.

유럽의 SLI 배터리 산업 개요

유럽의 SLI 배터리 시장은 절반으로 단절되었습니다. 이 시장의 주요 기업(특별한 순서 없음)은 GS Yuasa International Ltd, Exide Technologies, Johnson Controls, EnerSys, East Penn Manufacturing Company 등입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 자동차의 보급 확대

- 산업 및 농업 용도에서의 SLI 전지 수요 증가

- 억제요인

- 대체 전지의 보급 확대

- 성장 촉진요인

- 공급망 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

- 투자분석

제5장 시장 세분화

- 유형별

- 침수형 전지

- VRLA 배터리

- EBF 배터리

- 최종 사용자별

- 자동차용

- 기타

- 지역별

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 노르딕

- 러시아

- 터키

- 기타 유럽

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- Strategies Adopted & SWOT Analysis for Leading Players

- 기업 프로파일

- GS Yuasa International Ltd.

- Exide Technologies

- Johnson Controls

- EnerSys

- Leoch International Technology Limited Inc.

- East Penn Manufacturing Company

- C&D Technologies Inc.

- Clarios International Inc.

- Trojan Battery Company

- Crown Battery Manufacturing Company

- List of Other Prominent Companies

- Market Ranking/Share(%) Analysis

제7장 시장 기회와 앞으로의 동향

- 신흥 시장에서의 신차와 애프터마켓에서의 교체의 확대

The Europe SLI Battery Market size is estimated at USD 6.77 billion in 2025, and is expected to reach USD 8.26 billion by 2030, at a CAGR of 4.08% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in the adoption of motor vehicles in the region coupled with growing demand for batteries from industrial and agricultural industries are expected to be among the most significant drivers for the Europe SLI battery market during the forecast period.

- On the other hand, increasing competition from alternate battery chemistries poses a threat to the European SLI battery market during the forecast period.

- Nevertheless, continued efforts to expand in emerging markets for new vehicles and after-market replacements are expected to create several opportunities for the market in the future.

- Germany is expected to witness significant growth and is expected to register the highest CAGR during the forecast period. This is due to the region's significant manufacturing industry.

Europe SLI Battery Market Trends

Automotive End User Industry to Witness Significant Growth

- The automotive end-user industry stands as a cornerstone of the Europe SLI (Starting, Lighting, and Ignition) battery market. This sector encompasses a diverse array of vehicles, including passenger cars, light commercial vehicles, and heavy-duty trucks, all of which depend on SLI batteries for critical functions.

- According to the International Organization of Motor Vehicle Manufacturers, automobile production in Europe has been witnessing consistent growth since 2020. Between 2022 and 2023, production increased by more than 13%, whereas the annual average growth rate in the past five years was over 2%. This signifies the growing production of automobiles in the region, which in turn drives the SLI batteries market.

- The European automotive landscape, renowned for its commitment to innovation and quality, has been instrumental in molding the SLI battery market. Manufacturers continually push the boundaries of battery technology, striving for enhancements in performance, durability, and environmental sustainability to meet the evolving needs of modern vehicles and stringent regulatory requirements.

- For instance, in May 2023, Portuguese start-up C2C-NewCap pioneered GO-START, an eco-friendly supercapacitor module poised to revolutionize the energy storage landscape. Backed by the EU-funded HYCAP project, the company has not only set up pilot production lines but also honed its supply chain for the market debut of the inaugural commercial iteration. The comprehensive package features a deep-cycle battery, boasting a significantly longer lifespan compared to conventional SLI batteries, tailored to power a vehicle's electrical accessories.

- The growing adoption of start-stop systems and mild hybrid vehicles, for instance, has necessitated the development of more advanced SLI batteries capable of withstanding frequent charge-discharge cycles and delivering higher power output. This shift has not only driven innovation in battery design but has also reshaped the competitive landscape of the SLI battery market in Europe.

- The automotive manufacturing sector in Europe has undergone significant transformations in recent years, propelled by a confluence of factors, including stricter emissions regulations, the accelerating transition toward electrification, and shifting consumer preferences. While these changes have predominantly affected powertrain systems, they have also had cascading effects on auxiliary components like SLI batteries.

- Therefore, as mentioned above, the automotive end-user industry is expected to witness significant growth during the forecast period.

Germany to Dominate the Market

- Germany, as a powerhouse of the European automotive industry, plays a pivotal role in the European Starting, Lighting, and Ignition (SLI) battery market. The country's manufacturing capabilities in this sector are formidable, leveraging a rich history of industrial expertise and technological innovation. German SLI battery manufacturers have established themselves as leaders in production efficiency, quality control, and technological advancement.

- The manufacturing industry is one of the leading contributors to the German economy, which has reached pre-pandemic levels since 2020. In 2023, the manufacturing sector contributed 18.96% to the German GDP, an increase of 2.81% compared to 2022. This signifies the growing manufacturing sector in the country, which drives the demand for SLI batteries.

- Companies in the country have invested heavily in state-of-the-art production facilities, incorporating high levels of automation and robotics to ensure consistent quality and high output volumes. The manufacturing landscape in Germany is characterized by a mix of large-scale producers capable of mass production and smaller, specialized manufacturers focusing on niche markets or high-performance applications.

- Recent trends in the German SLI battery market reflect broader shifts in the automotive industry towards electrification and increased vehicle electrification. While the transition to electric vehicles has impacted the traditional SLI battery market, it has also created new opportunities. German manufacturers have been quick to adapt, developing advanced SLI batteries capable of meeting the increased power demands of modern vehicles equipped with start-stop systems and regenerative braking.

- There's a growing trend toward the production of Enhanced Flooded Batteries (EFB) and Absorbent Glass Mat (AGM) batteries, which offer improved performance and longevity compared to conventional lead-acid batteries. These advanced batteries are particularly well-suited to the demands of modern vehicles with sophisticated electrical systems and numerous power-hungry accessories.

- This trend is pronounced in the new products launched by the battery manufacturers. For instance, in March 2024, Trojan Battery Company bolsters its global battery market offerings by introducing two DIN-size batteries to its Trojan AES family. These new additions, the TE35-AES and 5SHP-AES, inherit the hallmark features of Trojan AES AGM batteries. This translates to enhanced value and return on investments for original equipment manufacturers and rental firms, with the added benefit of reduced equipment downtime for end users.

- Therefore, as per the abovementioned points, Germany is expected to dominate the market during the forecast period.

Europe SLI Battery Industry Overview

The Europe SLI battery market is sem-fragmented. Some of the key players in this market (in no particular order) are GS Yuasa International Ltd, Exide Technologies, Johnson Controls, EnerSys, and East Penn Manufacturing Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Others

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 NORDIC

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd.

- 6.3.2 Exide Technologies

- 6.3.3 Johnson Controls

- 6.3.4 EnerSys

- 6.3.5 Leoch International Technology Limited Inc.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 C&D Technologies Inc.

- 6.3.8 Clarios International Inc.

- 6.3.9 Trojan Battery Company

- 6.3.10 Crown Battery Manufacturing Company

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Emerging Markets for Both New Vehicles and After-Market Replacements

샘플 요청 목록