|

시장보고서

상품코드

1636237

미국의 SLI 배터리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)United States SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

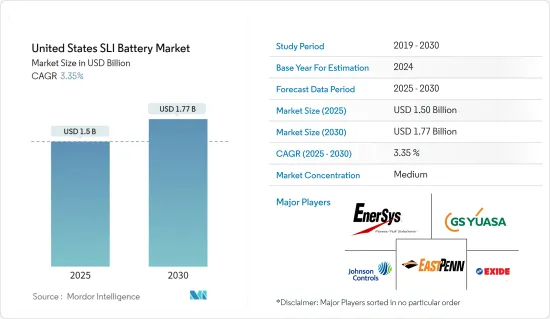

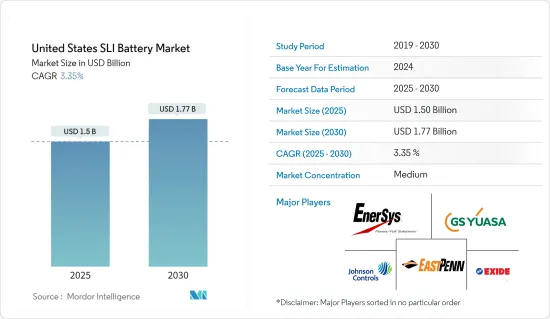

미국의 SLI 배터리 시장 규모는 2025년에 15억 달러로 추정되며, 예측 기간(2025-2030년) 동안 3.35%의 CAGR로 2030년에는 17억 7,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 중기적으로는 이 지역의 전기자동차 산업 성장, 산업 응용 분야에서 SLI 배터리 채택 증가 등의 요인이 예측 기간 동안 미국 SLI 배터리 시장의 가장 큰 촉진요인 중 하나가 될 것으로 예상됩니다.

- 한편, 대체 배터리 화학제품과의 경쟁이 증가하면서 예측 기간 동안 시장 성장에 위협이 되고 있습니다.

- SLI 배터리에 대한 지속적인 연구개발을 통해 향후 여러 시장 기회를 창출할 수 있을 것으로 기대됩니다.

미국의 SLI 배터리 시장 동향

자동차 최종사용자 부문이 큰 성장을 이룰 것으로 예상됩니다.

- 미국 SLI 배터리 시장의 대부분을 차지하는 것은 자동차 최종사용자 부문입니다. 이 부문에는 주로 승용차, 상용차, 오프로드 차량이 포함되며, 모두 핵심 기능에서 SLI 배터리에 크게 의존하고 있습니다. 이 부문의 SLI 배터리 수요는 신차 판매, 기존 차량 보유량, 구형 차량의 배터리 교체 주기 등 여러 요인에 의해 좌우됩니다.

- 최근 미국 자동차 산업은 경제 상황, 소비자 선호도, COVID-19 팬데믹과 같은 세계 이벤트의 영향을 받아 신차 판매량이 변동하고 있습니다. 이러한 변동에도 불구하고 전반적인 추세는 미국 도로를 달리는 자동차의 총 수가 점차 증가하고 있으며, 이는 SLI 배터리의 수요에 직접적인 영향을 미치고 있습니다.

- 국제자동차산업협회에 따르면 최근 몇 년 동안 자동차 생산량이 크게 증가하여 2020-2023년 자동차 생산량 CAGR이 5%를 초과할 것으로 예상됩니다. 한편, 2022-2023년의 성장률은 5.5%를 초과하여 자동차 수요가 확대되고 있음을 보여줍니다.

- 이 부문의 기술 발전은 더욱 정교한 차량 전기 시스템의 개발로 이어져 SLI 배터리 기술의 혁신을 촉진하고 있습니다. 최근 자동차는 첨단 시동 및 정지 시스템, 회생 브레이크, 전기 부품의 증가가 특징이며, 이는 자동차 배터리에 큰 부담을 주고 있습니다.

- 이에 대응하기 위해 배터리 제조사들은 기존 납축배터리에 비해 성능과 수명이 향상된 강화형 전해액형 납축배터리(EFB)와 흡수유리매트(AGM) 배터리를 출시하고 있습니다. 이러한 첨단 배터리는 신차, 특히 스타트/스톱 시스템 탑재 차량에 탑재가 증가하고 있으며, 교체 시장에서도 점차 점유율을 확대해 나가고 있습니다.

- 예를 들어, 2024년 4월, 세계 저전압 차량용 배터리 시장의 3분의 1을 점유하고 있는 클라리오스(Clarios)는 주요 거래처 상표 제품 제조업체와 중요한 공급 계약을 체결했습니다. 이 제휴는 클라리오스의 최신 혁신 제품인 고성능 12볼트 충전식 흡수성 유리 매트(AGM) 배터리를 중심으로 이루어졌습니다. 이 최첨단 배터리는 연료 소비를 줄일 뿐만 아니라 CO2 배출량 감소에도 중요한 역할을 하는 향상된 충전 수용 성능을 자랑합니다. 초기에는 이 혁신적인 AGM 배터리를 소형, 중형, 대형 차량용으로 설계하고, 앞서 언급한 거래처 상표 제품 제조사와의 계약을 통해 미국에 독점적으로 도입하는 데 중점을 둘 예정입니다.

- 또한, 하이브리드 및 순수 전기자동차의 부상과 같이 이 부문에서 진행 중인 전동화 추세는 장기적으로 기존 SLI 배터리에 대한 수요를 감소시킬 수 있습니다. 그러나 이러한 전환은 완만할 것으로 예상되며, 내연기관 자동차는 수년 동안 미국 자동차 보유량의 대부분을 차지할 것으로 예상됩니다.

- 따라서, 위에서 언급한 바와 같이, 자동차 최종사용자 부문은 예측 기간 동안 큰 성장을 보일 것으로 예상됩니다.

산업용 배터리 채택 확대가 시장을 주도하고 있습니다.

- 산업용 애플리케이션에서 배터리의 채택 확대는 시장의 중요한 성장 촉진요인입니다. 이러한 추세는 산업용 전력 솔루션의 전망을 재구성하고 있으며, SLI 배터리는 전통적인 자동차 용도를 넘어 새로운 역할을 찾아 확장하고 있습니다.

- 제조, 물류, 농업, 건설과 같은 산업 분야에서 SLI 배터리의 범용성과 신뢰성이 점점 더 인정받고 있으며, 다양한 응용 분야에서 수요가 급증하고 있습니다. 이러한 변화는 SLI 배터리 시장을 확대할 뿐만 아니라 산업 사용자의 특정 요구를 충족시키는 배터리 기술 혁신에도 박차를 가하고 있습니다.

- 2023년 4분기 미국 경제분석국은 제조업 총생산이 2021년 5조 9,504억 달러에서 7조 2,611억 달러로 급증했다고 보고했습니다. 이러한 제조업의 견조한 성장에 따라 SLI 배터리의 수요도 다양한 산업 응용 분야에서 동시에 증가할 것으로 전망됩니다.

- 제조 부문에서는 지게차, 팔레트 잭, 무인운반차(AGV)와 같은 자재 취급 장비에서 SLI 배터리의 사용이 증가하고 있습니다. 이러한 응용 분야에서는 높은 시동 전력을 공급하고 잦은 충방전 사이클을 견딜 수 있는 배터리가 필요하며, SLI 배터리는 즉각적인 에너지 공급이 가능하기 때문에 간헐적이지만 견고한 작동이 필요한 장비에 특히 적합합니다.

- 제조 시설의 공정 자동화 및 최적화가 진행됨에 따라 SLI 배터리와 같은 신뢰할 수 있고 비용 효율적인 전력 솔루션에 대한 수요가 증가할 것으로 예상됩니다. 이러한 추세는 환경 문제에 대한 관심과 업무 효율성 추구를 배경으로 한 산업 현장의 전기화 추진으로 더욱 가속화될 것입니다.

- 예를 들어, 2024년 2월, 산업 자동화 분야에서 유명한 OMRON Automation Americas는 생산 현장의 작업 효율을 향상시키고 부품 및 자재 이송에 대한 요구를 보다 폭넓게 충족시키는 것을 목표로 하는 MD 시리즈 자율 이동 로봇(AMR)을 출시했습니다. 보다 폭넓게 대응하기 위해 Omron의 포트폴리오를 확장하였습니다. 특히 SLI 배터리를 사용하는 산업에서는 MD 시리즈를 도입함으로써 중요 부품의 이송 및 취급을 효율화하여 보다 원활한 생산 워크플로우를 실현할 수 있습니다.

- 물류 및 창고 부문은 SLI 배터리의 또 다른 중요한 성장 분야로, E-Commerce의 폭발적인 성장과 이에 따른 미국 전역의 물류센터 확장에 따라 전동식 자재 취급 장비의 사용도 증가하고 있습니다. 대형 창고용 지게차까지 다양한 물류 차량에 적용되고 있습니다.

- 따라서, 위에서 언급한 바와 같이, 산업 및 제조 현장에서 이러한 배터리의 채택이 증가함에 따라 예측 기간 동안 시장을 견인할 것으로 예상됩니다.

미국의 SLI 배터리 산업 개요

미국의 SLI 배터리 시장은 반분할되어 있습니다. 이 시장의 주요 기업으로는 GS Yuasa International Ltd, Exide Technologies, Johnson Controls, EnerSys, East Penn Manufacturing Company 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부 정책 및 규정

- 시장 역학

- 성장 촉진요인

- 전기자동차 판매 성장

- 산업 용도의 전지 채용 확대

- 성장 억제요인

- 대체 배터리 화학과의 경쟁

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자 분석

제5장 시장 세분화

- 유형

- 침수형 배터리

- VRLA 배터리

- EBF 배터리

- 최종사용자

- 자동차용

- 기타

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략과 SWOT 분석

- 기업 개요

- GS Yuasa International Ltd

- Exide Technologies

- Johnson Controls

- EnerSys

- Leoch International Technology Limited Inc.

- East Penn Manufacturing Company

- C&D Technologies Inc.

- Clarios International Inc.

- Trojan Battery Company

- Crown Battery Manufacturing Company

- 기타 저명한 기업 리스트

- 시장 순위/점유율(%) 분석

제7장 시장 기회와 향후 동향

- 연구개발에 대한 투자

The United States SLI Battery Market size is estimated at USD 1.50 billion in 2025, and is expected to reach USD 1.77 billion by 2030, at a CAGR of 3.35% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing electric vehicles industry in the region and the increasing adoption of SLI batteries in industrial applications are expected to be among the most significant drivers for the US SLI battery market during the forecast period.

- On the other hand, there is increasing competition from alternate battery chemistries that pose a threat to the market's growth during the forecast period.

- Nevertheless, continued efforts to conduct research and development regarding SLI batteries are expected to create several future market opportunities.

United States SLI Battery Market Trends

The Automotive End-user Segment is Expected to Witness Significant Growth

- The automotive end-user segment represents a significant portion of the US SLI battery market. This segment primarily encompasses passenger vehicles, commercial vehicles, and off-road vehicles, all of which rely heavily on SLI batteries for their core functionalities. The segment's demand for SLI batteries is driven by several factors, including new vehicle sales, the existing vehicle fleet size, and replacement cycles for batteries in older vehicles.

- In recent years, the US automotive industry has experienced fluctuations in new vehicle sales, influenced by economic conditions, consumer preferences, and global events such as the COVID-19 pandemic. Despite these fluctuations, the overall trend showed a gradual increase in the total number of vehicles on US roads, directly impacting the demand for SLI batteries.

- According to the International Organization of Motor Vehicle Manufacturers, the production of vehicles has increased significantly in recent years. The annual average growth rate for vehicle production between 2020 and 2023 was over 5%. In contrast, the growth rate between 2022 and 2023 was over 5.5%, signifying the growing demand for vehicles.

- Technological advancements in the segment have led to the development of more sophisticated vehicle electrical systems, which has driven innovations in SLI battery technology. Modern vehicles feature advanced start-stop systems, regenerative braking, and a growing number of electrical components, placing higher pressure on the vehicle's battery.

- In response, battery manufacturers have introduced enhanced flooded batteries (EFB) and absorbent glass mat (AGM) batteries, which offer improved performance and longevity compared to traditional lead-acid batteries. These advanced batteries are becoming increasingly common in new vehicles, particularly in those with start-stop systems, and are gradually gaining shares in the replacement market as well.

- For instance, in April 2024, Clarios, a leading producer accounting for a third of the global low-voltage car battery market, inked a significant supplier deal with a major original equipment manufacturer. This partnership is centered around Clarios' latest innovation: a high-performance 12-volt rechargeable absorbent glass mat (AGM) battery. This cutting-edge battery boasts enhanced charge acceptance, a feature that not only aids in curbing fuel consumption but also plays a pivotal role in reducing CO2 emissions. Initially, the focus is expected to be on introducing this innovative AGM battery, designed for light, medium, and heavy-duty vehicles, exclusively in the United States, through the aforementioned original equipment manufacturer contract.

- Additionally, the ongoing electrification trend in the segment, including the rise of hybrid and fully electric vehicles, may reduce the demand for traditional SLI batteries in the long term. However, this transition is gradual, and internal combustion engine vehicles are expected to remain a significant part of the US vehicle fleet for many years.

- Therefore, as per the points mentioned above, the automotive end-user segment is expected to witness significant growth during the forecast period.

Growing Adoption of Batteries in Industrial Applications to Drive the Market

- The growing adoption of batteries in industrial applications is a significant growth driver for the market. This trend is reshaping the landscape of industrial power solutions, with SLI batteries finding new and expanded roles beyond their traditional automotive applications.

- Industrial sectors such as manufacturing, logistics, agriculture, and construction are increasingly recognizing the versatility and reliability of SLI batteries, leading to a surge in demand across various applications. This shift is not only expanding the market for SLI batteries but also spurring innovation in battery technology to meet the specific needs of industrial users.

- In the fourth quarter of 2023, the US Bureau of Economic Analysis reported a significant surge in the manufacturing sector's gross output, which soared to USD 7,261.1 billion, up from USD 5,950.4 billion in 2021, marking a remarkable growth rate of over 22% in just two years. Given this robust expansion in manufacturing, the demand for SLI batteries is poised for a parallel uptick across diverse industrial applications.

- In the manufacturing sector, SLI batteries are being increasingly utilized in material handling equipment such as forklifts, pallet jacks, and automated guided vehicles (AGVs). These applications require batteries that can provide high starting power and withstand frequent charge-discharge cycles. The ability of SLI batteries to deliver quick bursts of energy makes them particularly suitable for equipment that requires intermittent but robust operation.

- As manufacturing facilities continue to automate and optimize their processes, the demand for reliable and cost-effective power solutions like SLI batteries is expected to grow. This trend is further accelerated by the push toward electrification in industrial settings, which is driven by environmental concerns and the pursuit of operational efficiencies.

- For instance, in February 2024, OMRON Automation Americas, a prominent player in industrial automation, unveiled its MD Series of autonomous mobile robots (AMRs). The MD Series aims to enhance operational efficiency at production facilities, broadening OMRON's portfolio to address a more diverse range of part and material transport needs. This launch was particularly significant for industries relying on SLI batteries, as the MD Series can streamline the transport and handling of these critical components, ensuring smoother production workflows.

- The logistics and warehousing sector represents another significant growth area for SLI batteries. With the explosive growth of e-commerce and the consequent expansion of distribution centers across the United States, there has been a corresponding increase in the use of electric material handling equipment. SLI batteries are finding applications in a wide range of logistics vehicles, from small electric pallet trucks to large warehouse forklifts.

- Therefore, as mentioned above, the increasing adoption of these batteries in industrial and manufacturing settings is expected to drive the market during the forecast period.

United States SLI Battery Industry Overview

The US SLI battery market is semi-fragmented. Some of the key players in this market (in no particular order) include GS Yuasa International Ltd, Exide Technologies, Johnson Controls, EnerSys, and East Penn Manufacturing Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Growing Adoption of Batteries in the Industrial Applications

- 4.5.2 Restraints

- 4.5.2.1 Competition From Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd

- 6.3.2 Exide Technologies

- 6.3.3 Johnson Controls

- 6.3.4 EnerSys

- 6.3.5 Leoch International Technology Limited Inc.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 C&D Technologies Inc.

- 6.3.8 Clarios International Inc.

- 6.3.9 Trojan Battery Company

- 6.3.10 Crown Battery Manufacturing Company

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Investment in Research and Development Activities

샘플 요청 목록