|

시장보고서

상품코드

1636203

아시아태평양의 폐기물 관리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Asia-Pacific Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

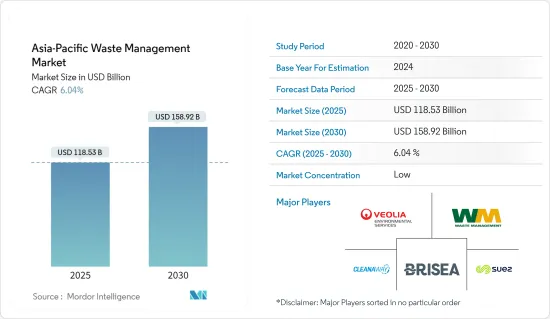

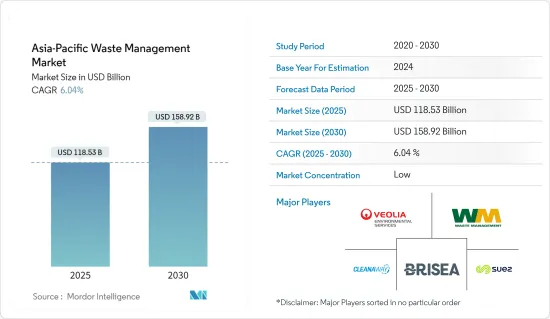

아시아태평양의 폐기물 관리 시장 규모는 2025년에 1,185억 3,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 6.04%의 CAGR로 2030년에는 1,589억 2,000만 달러에 달할 것으로 예상됩니다.

지난 50년 동안 모든 나라에서 폐기물 발생량이 증가하고 있습니다. 그러나 일본과 한국은 최근 감소세를 보이고 있습니다. 예를 들어, 한국에서 진행 중인 생산자책임재활용제도(EPR)는 제품 제조업체에게 제품에서 나오는 폐기물의 회수 및 재활용을 의무화하고 있습니다. 이러한 정부의 노력과 규제는 폐기물 처리 업체들이 국내에서 효과적으로 사업을 전개하는 데 도움이 되고 있습니다.

2023년 9월, 인도 메갈리아 주에서는 AI를 활용한 폐기물 관리 방법을 도입하여 AI 지원 로봇 보트가 호수에 버려진 대량의 쓰레기를 수거하는 AI 지원 로봇 보트를 도입하여 수작업에 비해 효과적이고 시간도 절약할 수 있게 되었습니다. 이 과정은 수작업에 비해 효과적이고 시간도 덜 걸립니다.

아시아태평양에서는 재활용 재료에 대한 수요가 증가하고 있습니다. 각국은 폐기물을 재사용 가능한 재료로 가공하기 위한 첨단 재활용 기술에 투자하고 있으며, 이는 재활용 사업자에게 새로운 시장 기회를 창출하고 있습니다.

예를 들어, 2024년 5월 울산대학교(UC)와 울산국제개발협력센터(UIDCC)는 UNEP 국제환경기술센터와 공동으로 울산에서 5일간의 역량 개발 프로그램을 개최하였습니다. 이 행사에서는 플라스틱 재활용 기술의 발전이 발표되었고, 환경 이니셔티브에 대한 지역사회의 참여가 강조되었습니다.

아시아태평양의 폐기물 관리 시장 동향

아시아태평양의 폐기물 관리를 주도하는 플라스틱 폐기물

- 아시아태평양은 방대한 양의 플라스틱 폐기물을 관리하지 못하고 있으며, 전 세계적으로 보다 효과적인 폐기물 관리 솔루션에 대한 요구가 높아지고 있습니다. 이러한 시급성은 첨단 폐기물 관리 기술 및 인프라 강화에 대한 수요를 증가시키고 있습니다. 이에 힘입어 민간단체와 정부는 최첨단 폐기물 처리 및 재활용 기술 개발 및 도입에 대한 투자를 늘리고 있습니다.

- 예를 들어, 2024년 중국은 아시아태평양 국가들의 플라스틱 폐기물 오처리량에서 1위를 차지했으며, 그 양은 약 5,500만 톤에 달할 것으로 추정됩니다. 같은 해 뉴질랜드는 8,410톤의 플라스틱 폐기물을 잘못 처리한 것으로 나타났습니다.

- 2024년 6월, 호주 연방위원회는 국내 수역의 플라스틱 오염을 퇴치하기 위해 22개 권고안을 발표했고, 2022년 11월, 호주는 플라스틱 오염 근절을 위한 '플라스틱 오염 근절을 위한 높은 뜻 연합'에 가입하여 플라스틱 오염 억제에 대한 약속을 더욱 강조하였습니다. 이 연합은 새로운 조약에 따라 2030년까지 전 세계 플라스틱 오염을 근절하는 것을 목표로 하고 있습니다.

- 이러한 행동은 아시아태평양의 폐기물 관리 상황을 형성하고, 첨단 재활용 기술, 폐기물 수거 시스템 강화, 혁신적인 폐기물 감소 전략의 시급한 필요성을 강조하고 있습니다.

중국의 폐기물 관리 이니셔티브는 시장 성장과 혁신을 촉진합니다.

- 중국 국가통계국 데이터에 따르면 2022년 현재 중국에는 약 444개의 위생 매립지가 있는 것으로 나타났습니다. 지난 10년간 중국의 폐기물 배출량은 꾸준히 증가하여 2022년에는 약 2억 4,450만 톤에 달할 것으로 예상됩니다.

- 또한, 중국에서 발생하는 일반 고형 산업 폐기물의 양은 2022년에 410억 톤에 달할 것으로 예상됩니다. 이러한 폐기물 배출량의 급격한 증가는 중국 내 첨단 폐기물 관리 기술과 서비스에 대한 긴급한 수요를 강조하고 있으며, 이러한 추세는 아시아태평양 폐기물 관리 시장의 성장과 기술 혁신을 촉진할 것으로 예상됩니다.

- 중국은 이러한 폐기물 문제를 해결하기 위해 2017년 전국적인 폐기물 분리수거 캠페인을 시작했으며, 2020년까지 80개 이상의 도시가 음식물 쓰레기, 재활용 가능 쓰레기, 유해 폐기물, 잔류물 등의 카테고리로 도시 쓰레기를 분류하는 것을 의무화했거나 시범적으로 시행하고 있습니다. 2025-2030년까지 이 분리배출 시스템을 전 도시로 확대할 계획입니다. 이러한 노력은 폐기물 관리 부문의 성장과 혁신을 촉진하고, 아시아태평양 전체의 투자와 기술 발전을 촉진할 것으로 기대됩니다.

아시아태평양의 폐기물 관리 산업 개요

아시아태평양의 폐기물 관리 시장은 폐기물 수거, 재활용, 유해 폐기물 처리 등의 서비스를 제공하는 현지 및 세계 기업이 대부분을 차지하고 있으며, Suez Environment SA, Veolia Environmental Services, Waste Management, Inc. 와 같은 업계 선두 기업들이 풍부한 전문 지식과 첨단 기술을 바탕으로 지역 전체에 종합적인 폐기물 관리 솔루션을 제공하고 있습니다.

한편, 호주의 Cleanaway Waste Management와 일본의 Daiseki와 같은 지역 기업들도 지역 수요와 규제 프레임워크에 맞는 서비스를 제공하며 주목할 만한 시장 점유율을 차지하고 있습니다. BRISEA Group Inc. AG & Co.Kg와 같은 주목할 만한 기업들이 첨단 재활용 및 폐기물 처리 기술을 지지하고 있습니다. 이 기업들은 함께 힘을 합쳐 이 부문을 재구성하고, 세계 모범 사례를 도입하고, 지속가능성을 지지하며, 아시아태평양의 효과적인 폐기물 관리 솔루션에 대한 급증하는 수요에 대응하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 인사이트

- 현재 시장 시나리오

- 기술 동향

- 공급망/밸류체인 분석에 관한 인사이트

- 산업 규제에 관한 인사이트

- 산업의 기술적 진보에 관한 인사이트

제5장 시장 역학

- 시장 성장 촉진요인

- 급속한 도시화와 인구 증가

- 정부 규제와 대처

- 시장 성장 억제요인

- 문화적·행동적 장벽

- 농촌 인프라 부족

- 시장 기회

- 성장하는 재활용 시장

- 폐기물 에너지화 기술

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제6장 시장 세분화

- 폐기물 유형별

- 산업 폐기물

- 도시 고형 폐기물

- 전자폐기물

- 플라스틱 폐기물

- 의료 폐기물과 기타 폐기물(건설 폐기물을 포함)

- 처분 방법별

- 매립 처분

- 소각

- 재활용

- 기타 처분 방법

- 국가별

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

제7장 경쟁 구도

- 시장 집중도 개요

- 기업 개요

- Suez Environment SA

- Waste Management Inc.

- Cleanaway Waste Management

- Veolia Environmental Services

- BRISEA Group Inc.

- Attero

- Remondis AG & Co. Kg

- Daiseki Co. Ltd

- Averda

- Clean Harbors Inc.*

- 기타 기업

제8장 시장 기회와 향후 동향

제9장 부록

ksm 25.02.05The Asia-Pacific Waste Management Market size is estimated at USD 118.53 billion in 2025, and is expected to reach USD 158.92 billion by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

Over the past 50 years, waste generation has risen across all nations. However, Japan and Korea have recently shown a decline. For example, Korea's ongoing Extended Producer Responsibility (EPR) scheme mandates that product manufacturers collect and recycle the waste from their products. These governmental initiatives and regulations have helped waste management companies to operate effectively within the country.

Adopting cutting-edge technologies such as IoT, AI, and robotics in waste management processes is revolutionizing the industry. In September 2023, the Indian state of Meghalaya introduced an AI-enabled waste management method. The AI-enabled robotic boat collects vast quantities of garbage dumped in a lake. Compared to manual labor, this process is effective and less time-consuming.

The APAC region is seeing an increase in the demand for recycled materials. Countries are investing in advanced recycling technologies to process waste into reusable materials, creating new market opportunities for recycling businesses.

For instance, in May 2024, Ulsan College (UC) and the Ulsan International Development Cooperation Center (UIDCC) hosted a five-day capacity-building program in Ulsan, Republic of Korea, in partnership with the UNEP's International Environmental Technology Center. This event showcased advancements in plastic recycling technologies and emphasized community involvement in environmental initiatives.

Asia-Pacific Waste Management Market Trends

Plastic Waste Driving Waste Management in Asia-Pacific

- The Asia-Pacific region grapples with a staggering volume of mismanaged plastic waste, propelling a global call for more effective waste management solutions. This urgency accentuates the demand for advanced waste management technologies and infrastructure enhancements. Driven by this, private entities and governments increasingly invest in developing and deploying cutting-edge waste processing and recycling technologies.

- For instance, in 2024, China led the Asia-Pacific nations in mismanaged plastic waste, with an estimated 55 million metric tons. New Zealand stood out in the same year, accounting for 8.41 thousand metric tons of mismanaged plastic waste.

- In June 2024, an Australian federal committee made 22 recommendations to combat plastic pollution in the nation's water bodies. In November 2022, Australia's commitment to curbing plastic pollution was further underscored as it joined the High Ambition Coalition to End Plastic Pollution. This coalition aims to eradicate global plastic pollution by 2040 through a new treaty.

- These actions shape the waste management landscape in the Asia-Pacific and emphasize the pressing need for advanced recycling technologies, enhanced waste collection systems, and innovative waste reduction strategies.

China's Waste Management Initiatives Propel Market Growth and Innovation

- Data from the National Bureau of Statistics of China revealed that the nation had around 444 sanitary landfill sites as of 2022. Over the past decade, China has steadily increased its waste output, reaching approximately 244.5 million tons by 2022.

- Furthermore, the volume of regular solid industrial waste produced in China amounted to 41 billion metric tons in 2022. This surge in waste generation underscores the urgent need for advanced waste management technologies and services in China, a trend expected to drive growth and innovation in the APAC waste management market.

- China launched a nationwide waste sorting campaign in 2017 to address this waste challenge. By 2020, over 80 cities had fully implemented or were piloting mandatory sorting of municipal waste into categories such as food waste, recyclables, hazardous waste, and residuals. The plan is to extend this sorting system to all cities between 2025 and 2030. This initiative is expected to spur growth and innovation in the waste management sector, encouraging investments and technological advancements throughout the APAC region.

Asia-Pacific Waste Management Industry Overview

Local and global entities dominate the waste management market in Asia-Pacific, offering services spanning waste collection, recycling, and hazardous waste treatment. Industry behemoths like Suez Environment SA, Veolia Environmental Services, and Waste Management Inc. stand at the forefront, harnessing their vast expertise and cutting-edge technologies to deliver holistic waste management solutions across the region.

Meanwhile, regional players like Australia's Cleanaway Waste Management and Japan's Daiseki Co. Ltd also command notable market shares, tailoring their services to local demands and regulatory frameworks. Noteworthy entities such as BRISEA Group Inc., Attero, and Remondis AG & Co. Kg are championing advanced recycling and waste processing technologies. Collectively, these firms are reshaping the sector, infusing global best practices, championing sustainability, and meeting the surging need for effective waste management solutions in Asia-Pacific.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights into Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Urbanization and Population Growth

- 5.1.2 Government Regulations and Initiatives

- 5.2 Market Restraints

- 5.2.1 Cultural and Behavioral Barriers

- 5.2.2 Lack of Infrastructure in Rural Areas

- 5.3 Market Opportunities

- 5.3.1 Growing Recycling Market

- 5.3.2 Waste-to-Energy Technologies

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Waste Type

- 6.1.1 Industrial Waste

- 6.1.2 Municipal Solid Waste

- 6.1.3 E-waste

- 6.1.4 Plastic Waste

- 6.1.5 Biomedical and Other Waste Types (Including Construction Waste)

- 6.2 By Disposal Methods

- 6.2.1 Landfill

- 6.2.2 Incineration

- 6.2.3 Recycling

- 6.2.4 Other Disposal Methods

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

- 6.3.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Suez Environment SA

- 7.2.2 Waste Management Inc.

- 7.2.3 Cleanaway Waste Management

- 7.2.4 Veolia Environmental Services

- 7.2.5 BRISEA Group Inc.

- 7.2.6 Attero

- 7.2.7 Remondis AG & Co. Kg

- 7.2.8 Daiseki Co. Ltd

- 7.2.9 Averda

- 7.2.10 Clean Harbors Inc.*

- 7.3 Other Companies