|

시장보고서

상품코드

1636213

건설 폐기물 관리 시장 전망 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Construction Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

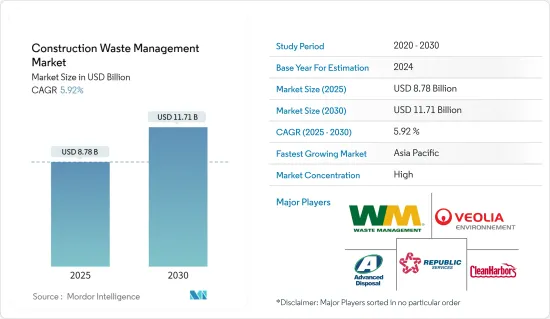

건설 폐기물 관리 시장 규모는 2025년에 87억 8,000만 달러로 추정되며, 예측기간(2025-2030년)의 연평균 성장율(CAGR)은 5.92%로, 2030년에는 117억 1,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 급속한 도시화와 지속 가능성에 대한 강조는 건설 폐기물 관리 시장의 주요 성장 요인입니다. 현재 건설 자재 폐기물의 75% 이상이 고유한 가치에도 불구하고 재활용되지 않고 남아 있습니다. 2018년 미국 환경보호청(EPA)은 건설 폐기물이 가정과 기업에서 발생하는 생활 폐기물의 두 배에 달한다고 강조했습니다. 미국은 가정용 폐기물 발생량에서 전 세계를 선도하고 있습니다.

- 건설 및 철거(C&D) 폐기물 범주에는 콘크리트, 아스팔트, 목재, 벽돌, 점토 타일, 석고 건식 벽체, 아스팔트 지붕 널, 금속 등의 재료가 포함됩니다. 콘크리트와 금속은 쉽게 재활용할 수 있지만, 벽돌, 점토 타일, 석고 건식 벽체 등 다른 재료는 재사용이 어려워 매립지로 가는 경우가 많습니다.

- 인도에서는 급속한 도시화로 인해 건설 부문이 대기 오염의 주요 원인이며 상당한 자원 소비처로 인식되고 있습니다. 특히 인도의 자원 채취량은 에이커당 1,580톤으로 전 세계 평균인 에이커당 450톤을 훨씬 초과합니다.

- 국가 청정 대기 프로그램은 인도의 131개 미달성 도시에 대해 2026년까지 미립자 오염을 40% 감축한다는 엄격한 목표를 설정했습니다. 따라서 건설 및 철거(C&D) 폐기물을 효과적으로 관리하는 것이 오염 수준을 억제하는 데 가장 중요해졌습니다.

- 그러나 최근 CSE의 검토에 따르면 많은 도시에서 체계적이고 과학적인 C&D 폐기물 관리를 위한 제도적 준비가 부족하다는 우려스러운 추세가 드러났습니다. 또한, 2016년 C&D 폐기물 관리 규칙의 채택이 부진하여 실행에 있어 눈에 띄는 격차가 발생하고 있습니다. 이는 시스템 설계에 대한 이해와 효과적인 이행 전략을 향상시키기 위한 포괄적인 지침이 시급히 필요하다는 것을 강조합니다.

- 어려움에도 불구하고 건설 부문은 폐기물의 75% 이상을 재활용하는 등 지속가능성 측면에서 진전을 보이고 있습니다. 특히 재활용 활동은 폐기물 관리 업무의 85% 이상을 차지하며, 미국이 전체 폐기물 배출량의 3분의 1만 재활용한다는 점을 고려할 때 그 중요성이 더욱 강조됩니다.

- 규제 기관과 건설 회사들이 폐기물을 줄이기 위한 노력을 강화함에 따라 건설 폐기물 관리 시장은 더욱 확대될 전망입니다. 린 건설 및 가치 엔지니어링과 같은 접근 방식은 프로젝트 시작 단계부터 폐기물 감소에 초점을 맞추고 있으며, 사후 계획 서비스는 효율적인 폐기물 제거 및 처리 솔루션을 제공하고 있습니다.

건설 폐기물 관리 시장 동향

주택 건설 폐기물이 시장에서 큰 점유율을 차지

주택 건설 폐기물은 세계 건설 폐기물 문제의 주요 원인이 되었으며 효과적인 폐기물 관리의 긴급성이 강조되고 있습니다. 예측은 2025년까지 세계 건설 폐기물이 연간 22억 톤으로 증가하는 것으로 알려져 있으며, 이는 주로 주택 프로젝트와 개축으로 인한 것입니다.

건설 및 철거(C&D) 쓰레기는 미국 전체 폐기물 배출량의 25%에 달합니다. 이 통계는 주택에서 배출되는 폐기물의 많음을 돋보이게 할 뿐만 아니라 상업시설과 공공시설의 폐기물 많음을 보여줍니다.

주택 건설 폐기물에 포함되는 일반적인 재료는 목재, 건식 벽, 콘크리트, 포장재 등입니다. 놀랍게도 건설 현장으로 배송되는 자재의 약 30%가 폐기물로 처리되고 있어 이 분야의 자재 비효율성이 강조되고 있습니다.

관리되지 않은 건설 폐기물은 환경 오염과 자원 고갈로 이어지는 심각한 결과를 초래합니다. 생태계 교란과 그에 따른 오염은 야생동물과 공중 보건 모두에 영향을 미치는 광범위한 결과를 초래할 수 있습니다.

자재 재활용 및 재사용과 같은 지속 가능한 기술을 도입하는 것은 주택 건설 폐기물의 급증을 억제할 수 있는 실행 가능한 해결책이 될 수 있습니다. 낭비없는 건설과 견고한 폐기물 관리 계획과 같은 전략은 주택 건설의 폐기물 배출량을 크게 줄이는 유망한 수단입니다.

아시아태평양이 시장에서 큰 점유율을 차지

아시아의 건설 폐기물 관리 관행은 국가별로 상당한 격차를 보이고 있습니다. 일본, 홍콩, 싱가포르와 같은 국가는 재활용과 적절한 처리를 강조하는 선진적인 시스템으로 두각을 나타내고 있습니다. 한국은 97%가 넘는 인상적인 재활용률을 자랑하며, 대만도 재활용률 50%를 돌파하는 등 진전을 이루었습니다. 반면, 많은 개발도상국에서는 낮은 재활용률로 어려움을 겪고 있으며, 종종 문제가 많은 공개 투기에 의존하고 있습니다.

아시아의 건설 폐기물 관리에 대한 규제 환경은 다양하지만, 공통점은 지방 당국의 책임에 초점을 맞추고 있다는 점입니다. 특히 인도와 같은 국가에서는 폐기물 관리 관행에 대한 감독을 강화하는 규정을 제정하고 있습니다. 이러한 규정은 포괄적인 법률의 일부로, 건설 폐기물 처리의 규정 준수와 효율성 향상을 목표로 합니다.

이러한 진전에도 불구하고 아시아는 건설 폐기물 관리 분야에서 지속적인 도전에 직면해 있습니다. 자금 부족과 표준화된 관행의 부족부터 불법 투기, 부적절한 폐기물 처리 인프라에 이르기까지 다양한 문제가 있습니다. 또한 비공식 폐기물 산업과 복잡한 정부 책임은 특히 개발도상국의 효과적인 폐기물 관리를 더욱 방해하고 있습니다.

앞으로 아시아의 건설 폐기물 관리 시장은 성장할 것으로 예상됩니다. 이러한 성장세는 도시화의 증가와 지속 가능성에 대한 관심의 증폭에 힘입어 더욱 가속화될 것입니다. 예상되는 재활용 기술의 혁신과 더 엄격한 규제는 재활용률을 크게 높일 것으로 보입니다. 또한 건설 회사와 폐기물 관리 기관 간의 협력이 증가함에 따라 폐기물 관리 표준 준수가 강화되고 순환 경제가 촉진될 것으로 예상됩니다.

건설 폐기물 관리 업계 개요

건설 폐기물 관리 시장은 세분화되어 있습니다. 여러 주요 기업들이 건설 프로젝트에 효율적이고 지속 가능한 폐기물 관리 솔루션을 제공하려고 경쟁하고 있습니다. 이 분야에서 주목할만한 기업으로는 Waste Management, Veolia Environment, Clean Harbors, Republic Services, Advanced Disposal Services 등이 있습니다. 이 회사들은 폐기물 수집, 재활용, 매립지 관리, 환경 컨설팅 등 광범위한 서비스를 제공하고 건설 회사가 규제 요건 및 환경 기준을 준수하면서 폐기물을 효과적으로 관리할 수 있도록 지원합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학과 인사이트

- 현재의 시장 시나리오

- 시장 역학

- 성장 촉진요인

- 시장을 견인하는 도시화와 인구 증가

- 시장을 견인하는 경제 성장

- 억제요인

- 시장에 영향을 미치는 규제 프레임워크

- 재활용, 프로세스에 따른 고비용이 시장에 영향

- 기회

- 시장을 주도하는 기술의 진보

- 성장 촉진요인

- 밸류체인, 서플라이체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 폐기물 재활용 서비스 시장에서의 기술 개척

- 시장에 대한 COVID-19의 영향

제5장 시장 세분화

- 폐기물 유형별

- 유해

- 비유해

- 발생원별

- 주택

- 비주택

- 재료별

- 콘크리트 벽돌

- 목재

- 금속

- 플라스틱

- 유리

- 기타 재료(토양, 건식 벽, 석고 등)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 영국

- 독일

- 프랑스

- 러시아

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- Waste Management

- Veolia Environment

- Clean Harbors

- Republic Services

- Advanced Disposal Services

- Biffa

- Covanta Holding

- Daiseki

- Hitachi Zosen

- 기타 기업

제7장 시장의 미래

제8장 부록

- 거시경제지표

- 자본 흐름의 통찰(건설 부문에 대한 투자)

- 대외무역 통계

The Construction Waste Management Market size is estimated at USD 8.78 billion in 2025, and is expected to reach USD 11.71 billion by 2030, at a CAGR of 5.92% during the forecast period (2025-2030).

Key Highlights

- Rapid urbanization and a growing emphasis on sustainability are the primary drivers of the construction waste management market. Currently, over 75% of construction material waste remains unrecycled despite its inherent value. In 2018, the Environmental Protection Agency (EPA) highlighted that construction waste doubled that of municipal waste from both households and businesses. The United States leads globally in household waste generation.

- The construction and demolition (C&D) waste category spans materials like concrete, asphalt, wood, brick, clay tiles, gypsum drywall, asphalt shingles, and metal. While concrete and metal are readily recyclable, others, especially brick, clay tiles, and gypsum drywall, face reusability challenges, often ending up in landfills.

- In India, amid rapid urbanization, the construction sector is increasingly recognized as a key source of air pollution and a substantial consumer of resources. Notably, India's resource extraction rate, at 1,580 tonnes per acre, far exceeds the global average of 450 tonnes per acre.

- The National Clean Air Programme has set a stringent target for the 131 non-attainment cities in India: a 40% reduction in particulate pollution by 2026. Consequently, effective management of construction and demolition (C&D) waste has become paramount in curbing pollution levels.

- However, a recent CSE review highlights a concerning trend: many cities lack the institutional readiness for systematic and scientific C&D waste management. Moreover, the adoption of the C&D Waste Management Rules of 2016 has been sluggish, with noticeable gaps in their execution. This underscores the urgent need for comprehensive guidance to enhance both the understanding of the system's design and the strategies for its effective implementation.

- Despite hurdles, the construction sector has shown progress in sustainability, managing to repurpose more than 75% of its waste. Notably, recycling activities account for over 85% of waste management jobs, underscoring their significance, especially when considering that the United States recycles only a third of its total waste output.

- With regulatory bodies and construction companies intensifying their efforts to curb waste, the construction waste management market is set for expansion. Approaches like lean construction and value engineering are honing in on waste reduction from the project's inception, while post-planning services are offering efficient waste removal and disposal solutions.

Construction Waste Management Market Trends

Residential Construction Waste Holds a Significant Share of the Market

Residential construction waste is a significant contributor to the global construction debris challenge, emphasizing the urgency of effective waste management. Projections suggest that annual construction waste worldwide will escalate to 2.2 billion tons by 2025, largely driven by residential projects and renovations.

Within the United States, construction and demolition (C&D) debris, including residential waste, constitute a striking 25% of the nation's total waste output. This statistic not only underscores the substantial waste from residential endeavors but also highlights the significant contributions from commercial and institutional construction.

Common materials in residential construction waste encompass wood, drywall, concrete, and packaging materials. Alarmingly, around 30% of materials delivered to construction sites end up as waste, accentuating the sector's material inefficiency.

The ramifications of unmanaged construction waste are dire, leading to environmental pollution and resource depletion. Ecosystem disruptions and subsequent pollution can have far-reaching consequences, affecting both wildlife and public health.

Embracing sustainable practices, like material recycling and reusing, presents a viable solution to curbing the surge in residential construction waste. Strategies such as lean construction and robust waste management plans hold promise in significantly reducing waste output during residential endeavors.

Asia-Pacific Holds a Significant Share of the Market

Construction waste management practices in Asia exhibit significant disparities across nations. Countries like Japan, Hong Kong, and Singapore stand out for their advanced systems, emphasizing recycling and proper disposal. South Korea boasts an impressive recycling rate exceeding 97%, while Taiwan has also made strides, surpassing a 50% recycling rate. In contrast, many developing nations grapple with low recycling rates, often resorting to open dumping, a practice laden with challenges.

Asia's regulatory landscape for construction waste management is diverse, with a common thread: a focus on local authorities' responsibilities. Notably, countries like India are enacting regulations to bolster oversight of waste management practices. These regulations, part of comprehensive acts, aim to enhance compliance and efficiency in handling construction waste.

Despite progress, Asia faces persistent challenges in construction waste management. Issues range from funding shortages and a lack of standardized practices to illegal dumping and inadequate waste processing infrastructure. Moreover, informal waste industries and complex governmental responsibilities further hinder effective waste management, particularly in developing nations.

Looking forward, Asia's construction waste management market is set for growth. This trajectory is fueled by rising urbanization and an amplified focus on sustainability. Anticipated innovations in recycling technologies, coupled with stricter regulations, are poised to significantly boost recycling rates. Moreover, increased collaboration between construction firms and waste management entities is expected to bolster compliance with waste management standards and foster a circular economy.

Construction Waste Management Industry Overview

The construction waste management market is fragmented in nature. Several key players are competing to provide efficient and sustainable waste management solutions for construction projects. Some notable companies in this space include Waste Management, Veolia Environment, Clean Harbors, Republic Services, and Advanced Disposal Services. These companies offer a range of services such as waste collection, recycling, landfill management, and environmental consulting to help construction firms effectively manage their waste while adhering to regulatory requirements and environmental standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Urbanization and Population Growth Driving the Market

- 4.2.1.2 Economic Growth Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Frameworks Affecting the Market

- 4.2.2.2 High Costs Associated with the Recycling Process Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving the Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Developments in the Waste Recycling Services Market

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Waste Type

- 5.1.1 Hazardous

- 5.1.2 Non-hazardous

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Non-residential

- 5.3 By Material

- 5.3.1 Concrete & Bricks

- 5.3.2 Wood

- 5.3.3 Metal

- 5.3.4 Plastics

- 5.3.5 Glass

- 5.3.6 Other Materials (Soil, Drywall, Plaster, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Waste Management

- 6.2.2 Veolia Environment

- 6.2.3 Clean Harbors

- 6.2.4 Republic Services

- 6.2.5 Advanced Disposal Services

- 6.2.6 Biffa

- 6.2.7 Covanta Holding

- 6.2.8 Daiseki

- 6.2.9 Hitachi Zosen

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Insights into Capital Flows (Investments in Construction Sector)

- 8.3 External Trade Statistics