|

시장보고서

상품코드

1636439

ASEAN 국가의 전기자동차용 배터리 제조 장치 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)ASEAN Countries Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

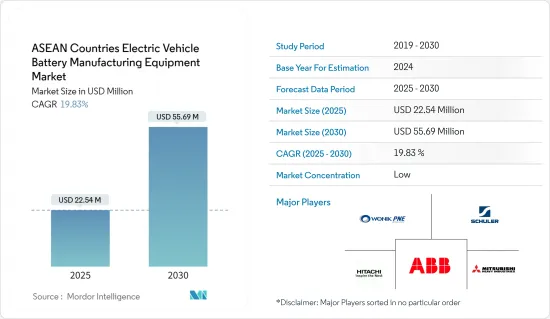

ASEAN 국가의 전기자동차용 배터리 제조장치 시장 규모는 2025년 2,254만 달러, 2030년 5,569만 달러로 추정되며, 예측기간(2025-2030년)중 CAGR은 19.83%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 배터리 제조를 위한 정부의 정책과 투자, 배터리 원료(특히 리튬 이온)의 비용 저하가 예측 기간 시장을 견인할 것으로 보입니다.

- 한편, 고액의 초기 투자비용이 향후 시장의 발판이 될 것으로 예상됩니다.

- 그럼에도 불구하고, 이들 국가들은 전기자동차의 장기적인 야심적 목표를 세우고 있으며 예측 기간 동안 큰 비즈니스 기회가 생길 것으로 예상됩니다.

- 태국은 이 나라에서 전기자동차용 배터리 제조에 대한 투자 증가로 크게 성장할 것으로 예상됩니다.

ASEAN 국가의 전기자동차용 배터리 제조장치 시장 동향

리튬 이온 배터리 부문이 크게 성장할 전망

- 리튬 이온 배터리 제조 장치에는 리튬 이온 배터리 제조에 특화된 전용 기계 및 공구가 포함됩니다. 최근 ASEAN 국가에서는 전기자동차(EV)용 리튬 이온 배터리의 생산이 급증하고 있습니다. 이것은 EV 수요 증가, 정부의 지원 정책, 세계 공급 체인에 있어서 이 지역의 극히 중요한 역할이 박차를 가하고 있습니다. 이러한 제조 증가에 따라 리튬 이온 배터리 제조 장치에 대한 요구도 커지고 있습니다.

- 또한, 국내 제조 설비의 발전은 이들 국가에서 리튬 이온 배터리의 가격을 낮추는 데 중요한 역할을 합니다. EV 수요가 확대됨에 따라 규모의 경제가 생산 비용 절감으로 이어졌습니다. 그 결과, 리튬 이온 배터리 가격이 하락함에 따라 기업은 전기자동차용 배터리 생산에 대한 투자를 확대하고 있으며, 이 지역에서 관련 제조 장치 수요를 더욱 촉진하고 있습니다.

- 2023년 리튬이온 배터리 팩 가격은 전년 대비 14% 하락해 139달러/kWh에 침착했습니다. 이 가격 하락에 그치지 않고 태국, 인도네시아, 베트남, 말레이시아와 같은 국가에서는 개인용 및 상용 EV의 도입이 급증하고 있습니다. 이 기세는 수입에 대한 의존을 줄이고 국내 EV 부문을 강화하는 것을 목적으로 리튬 이온 배터리의 국내 생산에 박차를 가하고 배터리 제조 장치 수요를 증폭시키고 있습니다.

- 예를 들어 중국의 유명한 세계 리튬 배터리 제조업체인 EVE Energy는 2023년 8월 말레이시아 케다 주 크림에 4억 2,200만 달러를 초기 투자하여 새 공장을 착공했습니다. 이러한 전략적 투자로 전기자동차용 리튬이온 배터리의 생산이 확대되고 제조장치에 대한 수요도 높아지고 있습니다.

- 가격 하락과 전기자동차용 리튬 이온 배터리 생산에 대한 투자의 급증을 감안하면, 이 분야는 향후 수년간 상당한 점유율을 차지하게 될 것으로 보입니다.

현저한 성장이 기대되는 태국

- 태국의 전기자동차(EV)용 리튬이온 배터리 제조장치 시장은 전기자동차용 리튬이온 배터리의 생산에 유리한 환경을 배경으로 대폭적인 성장이 전망되고 있습니다. 정부의 뒷받침도 있으며, 태국은 EV 생산의 지역 허브로 부상하고 있습니다. 정부는 세제우대조치나 보조금으로 EV 제조업체나 배터리 제조업체를 유치해, 2030년까지 자동차 생산 대수의 30%를 EV로 한다는 야심적인 목표를 내걸고 있습니다.

- 게다가, 특히 중국의 배터리 제조업체가 태국에서 전기자동차용 배터리의 새로운 공장에 열심히 투자하고 있습니다. 이러한 투자의 급증은 이 나라에서 전기자동차용 배터리의 생산에 필수적인 설비 수요를 끌어올리게 됩니다.

- 예를 들어, 중국의 유명 배터리 제조업체인 SVOLT Energy는 2024년 3월 태국의 촌부리 현에 위치한 시라차의 최첨단 시설에서 전기자동차용 배터리 팩의 양산을 시작했습니다. 이 시설은 연간 약 60,000개의 모듈과 팩 생산 능력을 갖추고 있습니다.

- 태국에서는 전기자동차의 보급이 가속화되고 있으며, 기업은 현지 제조 거점에 대한 투자를 확대하고 있습니다. 태국 자동차 연구소의 데이터는 이 동향을 돋보이게 합니다. 2023년 태국의 전기자동차 등록 대수는 17만 2,540대로 급증했으며, 전년 8만 4,570대에서 현저하게 증가하였습니다. 이러한 EV 보급의 대폭적인 증가는 EV 제조 장비의 요구 확대를 뒷받침합니다.

- 태국에서는 태국 4.0과 동부 경제 회랑(EEC)과 같은 정부의 이니셔티브에 의해 전기자동차용 배터리 제조 장치의 전망은 낙관적인 채로 있습니다. 이러한 이니셔티브는 감세와 규제의 간소화 등 매력적인 인센티브를 제공함으로써 태국을 EV와 배터리를 포함한 하이테크 분야에서 지역의 프런트 러너로서의 지위로 밀어 올리는 것을 목적으로 하고 있습니다.

- 정부의 흔들림없는 지원과 EV의 가속적인 보급을 감안할 때 태국은 앞으로 몇년만에 현저한 성장을 이룰 것으로 보입니다.

ASEAN 국가의 전기자동차용 배터리 제조장치 산업 개요

ASEAN 국가의 전기자동차용 배터리 제조 장비 시장은 반 파편화되었습니다. 이 시장의 주요 기업(순부동)에는 WONIK PNE, Schuler AG, Hitachi Ltd, ABB Ltd., Mitsubishi Heavy Industries, Ltd 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 배터리 제조를 위한 정부의 정책과 투자

- 배터리 원재료 비용의 저하

- 억제요인

- 초기 투자비용 높이

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자 분석

제5장 시장 세분화

- 프로세스별

- 혼합

- 코팅

- 캘린더

- 슬릿 및 전극 가공

- 기타 프로세스

- 배터리별

- 리튬 이온

- 납축배터리

- 니켈 수소 배터리

- 기타 배터리

- 지역별

- ASEAN 국가

- 인도네시아

- 말레이시아

- 필리핀

- 싱가포르

- 태국

- 베트남

- 기타 ASEAN 국가

- ASEAN 국가

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- WONIK PNE CO., LTD.

- Schuler AG

- Hitachi Ltd

- ABB Ltd.

- Mitsubishi Heavy Industries, Ltd

- Sovema Group

- Daiichi Jitsugyo Thailand Co Ltd

- Yokogawa India Ltd.

- 기타 유명 기업 일람

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 전기차의 장기적인 야심적 목표

The ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 22.54 million in 2025, and is expected to reach USD 55.69 million by 2030, at a CAGR of 19.83% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, government policies and investments towards battery manufacturing, and a decline in the cost of battery raw materials, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, high initial investment costs are expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in these countries are expected to create a significant opportunity in the forecast period.

- Thailand is expected to grow significantly owing to the increasing investment in EV battery manufacturing in the country.

ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery Segment is Expected to Grow Significantly

- Lithium-ion battery manufacturing equipment includes specialized machines and tools tailored for producing lithium-ion batteries. In recent years, ASEAN countries have seen a surge in lithium-ion battery production for electric vehicles (EVs), spurred by rising EV demand, supportive government policies, and the region's pivotal role in global supply chains. With this uptick in manufacturing, the need for lithium-ion battery production equipment is set to rise.

- Moreover, advancements in domestic manufacturing equipment have played a crucial role in driving down lithium-ion battery prices across these nations. As EV demand escalates, achieving economies of scale has led to reduced production costs. Consequently, with falling lithium-ion battery prices, companies are ramping up investments in EV battery production, further fueling the demand for associated manufacturing equipment in the region.

- In 2023, lithium-ion battery pack prices plummeted by 14% from the prior year, settling at USD139/kWh. Beyond this price dip, countries like Thailand, Indonesia, Vietnam, and Malaysia are experiencing a surge in both personal and commercial EV adoption. This momentum has spurred local lithium-ion battery production, aiming to lessen import reliance and bolster domestic EV sectors, thereby amplifying the demand for battery manufacturing equipment.

- For example, in August 2023, EVE Energy Co. Ltd., a prominent global lithium battery manufacturer from China, broke ground on a new facility in Kulim, Kedah, Malaysia, with an initial investment of USD 422 million. Such strategic investments are poised to elevate lithium-ion battery production for EVs, subsequently driving up the demand for manufacturing equipment.

- Given the declining prices and surging investments in EV lithium-ion battery production, this segment is poised to command a substantial share in the coming years.

Thailand is Expected to Grow Significantly

- Thailand's electric vehicle (EV) battery manufacturing equipment market is poised for substantial growth, bolstered by a favorable environment for EV battery production. With government backing, Thailand has emerged as a regional hub for EV production. The government is luring EV manufacturers and battery producers with tax incentives and subsidies, setting an ambitious goal to have 30% of its automotive output as EVs by 2030.

- Furthermore, a growing number of battery manufacturers, especially from China, are keenly investing in new facilities for EV batteries in Thailand. This surge in investments is set to boost the demand for equipment essential for EV battery production in the country.

- For example, in March 2024, SVOLT Energy, a prominent Chinese battery manufacturer, kicked off mass production of EV battery packs at its state-of-the-art facility in Si Racha, located in Chonburi province, Thailand. This facility is equipped with an impressive annual production capacity of around 60,000 modules and packs.

- As the adoption of electric vehicles continues to surge in Thailand, companies are amplifying their investments in local manufacturing hubs, consequently spurring demand for manufacturing equipment. Data from the Thailand Automotive Institute highlights this trend: in 2023, registered electric vehicles in Thailand surged to 172,540 units, a notable increase from the previous year's 84,570. Such a significant uptick in EV adoption underscores the expanding need for EV manufacturing equipment.

- Looking ahead, the outlook for EV battery manufacturing equipment in Thailand remains optimistic, due to government initiatives like Thailand 4.0 and the Eastern Economic Corridor (EEC). These initiatives are designed to elevate Thailand's status as a regional frontrunner in high-tech sectors, including EVs and batteries, by providing attractive incentives such as tax breaks and simplified regulations.

- Given the government's unwavering support and the accelerating adoption of EVs, Thailand is set for notable growth in the coming years.

ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Industry Overview

The ASEAN country's electric vehicle battery manufacturing equipment market is semi-fragmented. Some of the major players in the market (in no particular order) include WONIK PNE CO., LTD., Schuler AG, Hitachi Ltd, ABB Ltd., and Mitsubishi Heavy Industries, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 High initial investment costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

- 5.3 Geography

- 5.3.1 ASEAN Countries

- 5.3.1.1 Indonesia

- 5.3.1.2 Malaysia

- 5.3.1.3 Philippines

- 5.3.1.4 Singapore

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Rest of ASEAN Counties

- 5.3.1 ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 WONIK PNE CO., LTD.

- 6.3.2 Schuler AG

- 6.3.3 Hitachi Ltd

- 6.3.4 ABB Ltd.

- 6.3.5 Mitsubishi Heavy Industries, Ltd

- 6.3.6 Sovema Group

- 6.3.7 Daiichi Jitsugyo Thailand Co Ltd

- 6.3.8 Yokogawa India Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles