|

시장보고서

상품코드

1636469

ASEAN 국가의 전기자동차 배터리 제조 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)ASEAN Countries Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

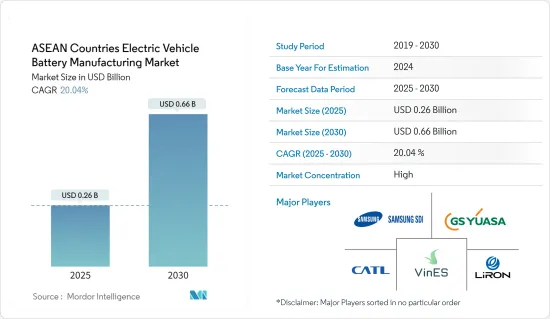

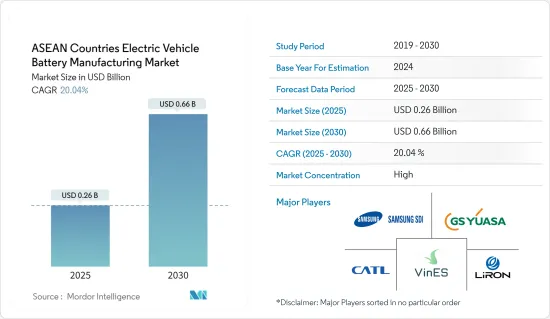

ASEAN 국가의 전기자동차 배터리 제조 시장 규모는 2025년 2억 6,000만 달러, 2030년 6억 6,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 20.04%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전기자동차(EV)의 보급이 진행되고 있으며, 배터리 생산 강화를 위한 정부의 지원책과 투자가 예측기간 중 ASEAN 국가의 전기자동차 배터리 제조 시장 수요를 견인할 것으로 예상됩니다.

- 한편, 원재료의 수급 불균형이 예측기간 동안 시장 성장을 방해할 것으로 예상됩니다.

- 그럼에도 불구하고 배터리 기술의 기술적 진보와 자동차 및 배터리 제조업체의 협력 관계는 미래에 각국의 전기자동차 배터리 제조 시장에 큰 기회를 가져올 것으로 예상됩니다.

- 이 지역의 모든 국가 중 태국은 전기자동차 배터리 제조에 참여하는 기업 수가 증가함에 따라 큰 성장이 예상됩니다.

ASEAN 국가의 전기자동차 배터리 제조 시장 동향

승용차 부문이 큰 성장을 이룰 것

- ASEAN(동남아 국가 연합)의 전기자동차(EV)용 배터리 제조 시장은 특히 승용차 부문에서 상당한 성장을 이루려고 합니다. 이 급성장의 배경에는 EV의 보급 확대, 청정 에너지를 지지하는 정부의 이니셔티브, 환경 문제에 대한 소비자의 의식이 높아집니다. 최근에는 인도네시아, 말레이시아, 태국, 베트남, 필리핀을 비롯한 ASEAN 국가가 EV를 둘러싼 상황에서 중요한 국가로 대두되고 있습니다.

- ASEAN 자동차 연맹(AAF)의 보고에 따르면 ASEAN 지역의 2023년 승용차 생산 대수는 274만 8,000대로 2022년 266만 5,000대에서 3.11% 증가합니다. 2023년 이 지역의 생산 대수는 약 228만 3,000대로 전년의 221만 2,000대에서 3.21% 증가했습니다. 특필해야할 것은 인도네시아, 말레이시아, 태국이 합계로 이 지역의 승용차 생산 대수의 83% 이상을 차지하고 있다는 것입니다.

- 앞으로 ASEAN 지역의 승용차 성장은 전기차 도입을 촉진하는 정부의 지원책에 의해 강화될 것으로 예상됩니다. 그 결과, EV용 배터리 수요가 증가하게 됩니다. 태국, 인도네시아, 싱가포르, 말레이시아, 필리핀과 같은 국가들은 정부의 적극적인 조치로 급속한 EV 보급 궤도를 타고 있습니다. 예를 들어 필리핀은 2030년까지 EV가 자동차 전체의 21%를 차지하고 2040년까지 50%를 차지하는 것을 목표로 하고 있습니다. 기타 특전으로 필리핀 전기자동차협회(EVAP)는 2030년 EV 보급 목표를 30만대에서 100만대로 대담하게 끌어올려 예상되는 섹터 인센티브, 규제의 명확화, EV의 혜택에 대한 의식의 고조에 기대하고 있습니다.

- 인도네시아의 야망도 마찬가지로 현저하고, 2025년까지 자동차 판매에 차지하는 EV의 비율을 20%로, 2030년까지 EV의 국내 생산 목표를 60만대로 하고 있습니다. 이러한 야심은 판매, 생산, 충전 인프라를 포함한 EV 공급망 전체의 구체적인 이정표에 반영되어 전기자동차 배터리 제조 업계를 뒷받침하고 있습니다.

- 이 기세를 뒷받침하기 위해 인도네시아는 2024년 7월 서 자바 주에 최초의 전기자동차 배터리 공장을 가동시켰습니다. 이 공장은 Hyundai Motor Group, LG Energy Solution, Indonesia Battery Corporation의 컨소시엄이 10억 달러를 투자해 공동으로 건설한 것으로 연간 생산능력은 10기가와트(GWh)를 자랑하며 EV 15만대분에 해당합니다. 이 시설은 Hyundai의 자동차 공장과 원활하게 통합되어 있으며, Kona 전기자동차를 연간 5만대 생산할 예정입니다. 또한 컨소시엄은 20억 달러의 추가 투자로 공장의 능력을 20GWh로 두배로 증가시키려는 야심찬 계획을 가지고 있습니다.

- 2023년, 필리핀의 에너지부(DOE)는 2040년까지 630만대의 전기자동차(EV)를 보급시켜 도로를 달리는 모든 차량의 50%를 EV가 차지하도록 하는 야심찬 목표를 설정했습니다. 이 구상은 동시기에 약 14만 7,000곳의 EV 충전 포인트를 설치함으로써 지원됩니다. 단기적으로 DOE는 2028년까지 약 245만대의 전기차, 오토바이, 버스를 보급할 계획입니다. 이러한 대규모 계획은 승용차 부문에서 배터리 시장의 급성장을 뒷받침하는 것이며, EV 배터리 시장의 성장을 더욱 뒷받침하는 것입니다.

- 이러한 역학을 고려하면, 승용차 부문은 향후 수년에 크게 확대될 것입니다.

태국이 현저한 성장을 이루다.

- 태국은 자동차 분야에 대한 주요 투자 대상으로. 지난 50년 동안 태국은 단순히 자동차 부품을 조립하는 나라에서 동남아시아에서 자동차 생산 및 수출의 주요 기지로 변모했습니다. 자동차 제조업체로부터의 투자가 증가하는 가운데, 태국의 배터리 산업은 특히 급성장하는 전기자동차(EV)의 생산을 지원하기 위해, 꾸준한 성장을 이루려고 하고 있습니다.

- 태국 전기자동차협회(EVAT)의 보고에 따르면 태국에서는 2023년 약 10만 219대의 배터리 전기자동차(BEV)가 등록되어 전년 대비 380%라는 경이적인 급증을 기록했습니다. 이 기세는 계속되고, 2024년 2월 말까지 태국에서는 약 2만 2,278대의 BEV 신규 등록이 기록되어, 이 나라의 배터리 수요가 더욱 높아지고 있습니다.

- EV 도입의 급증은 구매자에 대한 정부의 인센티브와 제조업체에 대한 지원책에 기인합니다. 예를 들어, 태국이 국산 EV의 구매 보조금 제도를 소개로 도입한 것은 동남아시아의 EV 생산 허브가 된다는 야심을 강조하고 있습니다. 2024년부터 2027년까지 실시되는 EV3.5 계획에서는 1대당 5만바트(1397.02달러)에서 10만바트(2794.04달러)의 보조금이 지급됩니다.

- 태국의 전략적 움직임은 2030년까지 지역의 EV 생산 거점이 된다는 비전에 따른 것으로, EV가 전체 자동차 판매 대수의 30%를 차지하는 것을 목표로 하고 있습니다. 이러한 노력으로 태국은 향후 EV용 전지, 특히 리튬 이온 전지의 거점이 되어 전지 제조업체에게 큰 기회가 될 것입니다.

- 이 비전에 따라 많은 배터리 제조업체가 태국에서 생산 능력을 강화하고 있습니다. 주목할 만한 예는 BMW Group으로, 2024년 3월에 「Gen-5」고전압 배터리 제조 시설의 기공식을 실시했습니다. 태국 동해안 라용에 위치한 4,000m2의 배터리 조립 공장은 BMW의 기존 자동차 공장에 통합되어 있습니다. 2025년 후반에 EV 가동을 시작할 예정인 이 새로운 조립 라인은 BMW의 세계 전동화 전략에서 매우 중요한 역할을 하며, 수입된 배터리 셀을 고전압 배터리용 모듈로 변환합니다. BMW는 이 야심찬 프로젝트에 4,200만 유로 이상을 투입하고 있습니다.

- 이러한 개발 상황을 감안하면 예측 기간 동안 태국은 ASEAN 지역의 전기자동차 배터리 제조 전망을 선도하게 될 것으로 보입니다.

ASEAN 국가의 전기자동차 배터리 제조 업계 개요

ASEAN 국가의 전기자동차 배터리 제조 시장은 적당히 통합되어 있습니다. 이 시장의 주요 기업(순부동)으로는 Samsung SDI, VinES Energy Solutions Joint Stock Company, Contemporary Amperex Technology(CATL), LiRON LIB Power Pte Ltd, GS Yuasa Corporation 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 전기자동차의 보급 확대

- 배터리 생산 강화를 위한 정부의 지원책과 투자

- 억제요인

- 원재료의 수급 불균형

- 성장 촉진요인

- 공급망 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

- 투자 분석

제5장 시장 세분화

- 배터리 유형별

- 리튬 이온

- 납축전지

- 니켈 수소 전지

- 기타 배터리 유형

- 차량 유형별

- 승용차

- 상용차

- 기타 차량 유형

- 추진별

- 배터리 전기자동차

- 하이브리드 전기자동차

- 플러그인 하이브리드 전기자동차

- 지역별

- 태국

- 인도네시아

- 필리핀

- 말레이시아

- 베트남

- 기타 ASEAN 국가

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- Contemporary Amperex Technology Co. Ltd(CATL)

- LG Energy Solution Ltd.

- LiRON LIB Power Pte Ltd

- GS Yuasa Corporation

- VinES Energy Solutions Joint Stock Company

- SVOLT Energy Technology Co., Ltd.

- Energy Absolute Public Company Limited.

- Exide Industries

- 기타 유명 기업 일람

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 자동차 제조업체와 전지 제조업체의 제휴

- 배터리 기술의 기술적 진보

The ASEAN Countries Electric Vehicle Battery Manufacturing Market size is estimated at USD 0.26 billion in 2025, and is expected to reach USD 0.66 billion by 2030, at a CAGR of 20.04% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing adoption of electric vehicles (EV) and supportive government initiatives and investments to enhance battery production are expected to drive the demand for the ASEAN countries electric vehicle battery manufacturing market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, technological advancements in battery technologies and automaker-battery manufacturer collaborations are expected to create vast opportunities for countries' electric vehicle battery manufacturing markets in the future.

- Among all the countries in the region, Thailand is expected to witness significant growth due to the increase in the number of players participating in EV battery manufacturing.

ASEAN Countries Electric Vehicle Battery Manufacturing Market Trends

Passenger Vehicle Segment to Witness Significant Growth

- The battery manufacturing market for electric vehicles (EVs) in ASEAN (Association of Southeast Asian Nations) countries is poised for substantial growth, especially in the passenger vehicle segment. This surge is driven by the increasing adoption of EVs, government initiatives championing clean energy, and heightened consumer awareness of environmental concerns. In recent years, ASEAN nations, notably Indonesia, Malaysia, Thailand, Vietnam, and the Philippines, have emerged as pivotal players in the EV landscape.

- As reported by the ASEAN Automotive Federation (AAF), the ASEAN region produced a total of 2.748 million passenger vehicles in 2023, marking a 3.11% rise from the 2.665 million units produced in 2022. In 2023, the region's production stood at approximately 2.283 million units, up 3.21% from 2.212 million units in the previous year. Notably, Indonesia, Malaysia, and Thailand collectively accounted for over 83% of the region's passenger vehicle output.

- Looking ahead, the growth of passenger vehicles in the ASEAN region is anticipated to be bolstered by supportive government initiatives promoting electric vehicle adoption. This, in turn, is set to drive demand for EV batteries. Countries like Thailand, Indonesia, Singapore, Malaysia, and the Philippines are on track for rapid EV adoption, thanks to proactive government measures. For instance, the Philippines aims for EVs to constitute 21% of its total vehicles by 2030 and 50% by 2040. Additionally, the Electric Vehicle Association of the Philippines (EVAP) has upped its e-vehicle adoption target from 300,000 units in 2030 to a bold 1.0 million units, banking on anticipated sector incentives, clearer regulations, and growing EV benefits awareness.

- Indonesia's ambitions are equally pronounced, targeting 20% EV representation in car sales by 2025 and a domestic production goal of 600,000 EVs by 2030. These aspirations translate into concrete milestones across the EV supply chain, encompassing sales, production, and charging infrastructure, thereby propelling the EV battery manufacturing industry.

- In a testament to this momentum, Indonesia inaugurated its first electric vehicle battery plant in West Java in July 2024. This plant, a collaborative effort with a USD 1 billion investment from a consortium of Hyundai Motor Group, LG Energy Solution, and the Indonesia Battery Corporation, boasts an annual capacity of 10 gigawatt hours (GWh), sufficient for 150,000 EVs. The facility is seamlessly integrated with Hyundai's auto factory, which is set to produce 50,000 units annually of the Kona Electric vehicle. Furthermore, the consortium has ambitious plans to double the plant's capacity to 20 GWh, backed by an additional USD 2 billion investment.

- In 2023, the Department of Energy (DOE) of the Philippines set an ambitious target to deploy 6.3 million electric vehicles (EVs) by 2040, aiming for them to represent 50% of all vehicles on the road. This initiative will be supported by the installation of approximately 147,000 EV charging points over the same timeframe. In the short term, the DOE plans to roll out around 2.45 million electric cars, motorcycles, and buses by 2028. Such expansive plans underscore the burgeoning market for batteries in the passenger vehicle segment, further fueling the growth of the EV battery market.

- Given these dynamics, the passenger vehicle segment is set for significant expansion in the coming years.

Thailand to Witness a Significant Growth

- Thailand stands out as a prime destination for investments in the automobile sector. Over the past five decades, Thailand has transformed from merely assembling auto components to becoming a dominant hub for automotive production and exports in Southeast Asia. With rising investments from automakers, Thailand's battery industry is poised for steady growth, especially to support the burgeoning production of electric vehicles (EVs).

- As reported by the Electric Vehicle Association of Thailand (EVAT), Thailand registered approximately 100,219 battery electric vehicles (BEVs) in 2023, marking a staggering 380% surge from the previous year. Continuing this momentum, by the end of February 2024, Thailand recorded around 22,278 new BEV registrations, further amplifying the country's battery demand.

- The surge in EV adoption can be attributed to government incentives for buyers and supportive measures for manufacturers. For instance, Thailand's introduction of a purchase subsidy scheme for domestically produced EVs underscores its ambition to be a Southeast Asian EV production hub. The EV3.5 scheme, running from 2024 to 2027, offers subsidies between THB 50,000 (USD 1,397.02) and THB 100,000 (USD 2,794.04) per vehicle, highlighting the government's dedication to nurturing the EV sector and drawing in foreign investments.

- Thailand's strategic moves align with its vision of becoming a regional EV production center by 2030, aiming for EVs to make up 30% of all vehicle sales. Such endeavors position Thailand as a future hub for EV batteries, especially lithium-ion variants, presenting vast opportunities for battery manufacturers.

- In line with this vision, numerous battery manufacturers are ramping up their production capabilities in Thailand. A notable example is BMW Group, which in March 2024, broke ground on its 'Gen-5' high-voltage battery manufacturing facility. Situated in Rayong, on Thailand's east coast, the 4,000 square meter battery assembly is integrated into BMW's existing car plant. With plans to start rolling out EVs in the latter half of 2025, this new assembly line will play a pivotal role in BMW's global electrification strategy, converting imported battery cells into modules for high-voltage batteries. BMW has committed over EUR 42 million to this ambitious project.

- Given these developments, Thailand is poised to lead the electric vehicle battery manufacturing landscape in the ASEAN region during the forecast period.

ASEAN Countries Electric Vehicle Battery Manufacturing Industry Overview

The ASEAN Countries Electric Vehicle Battery Manufacturing market is moderately consolidated. Some of the key players in the market (not in any particular order) include Samsung SDI Co. Ltd., VinES Energy Solutions Joint Stock Company, Contemporary Amperex Technology Co. Ltd (CATL), LiRON LIB Power Pte Ltd and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives and Investments to Enhance the Battery Production

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Other Battery Type

- 5.2 Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.2.3 Other Vehicle Type

- 5.3 Propulsion

- 5.3.1 Battery Electric Vehicle

- 5.3.2 Hybrid Electric Vehicle

- 5.3.3 Plug-in Hybrid Electric Vehicle

- 5.4 Geography

- 5.4.1 Thailand

- 5.4.2 Indonesia

- 5.4.3 Philippines

- 5.4.4 Malaysia

- 5.4.5 Vietnam

- 5.4.6 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Samsung SDI Co., Ltd.

- 6.3.3 Contemporary Amperex Technology Co. Ltd (CATL)

- 6.3.4 LG Energy Solution Ltd.

- 6.3.5 LiRON LIB Power Pte Ltd

- 6.3.6 GS Yuasa Corporation

- 6.3.7 VinES Energy Solutions Joint Stock Company

- 6.3.8 SVOLT Energy Technology Co., Ltd.

- 6.3.9 Energy Absolute Public Company Limited.

- 6.3.10 Exide Industries

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Automaker-Battery Manufacturer Collaborations

- 7.2 Technological Advancements in Battery Technologies