|

시장보고서

상품코드

1636498

드릴링 리그 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Drilling Rig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

드릴링 리그 시장 규모는 2025년 996억 6,000만 달러, 2030년 1,062억 달러로 추정되며, 예측 기간(2025-2030년)중 CAGR은 1.28%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 천연가스 수요 증가와 가스 인프라의 확장에 따른 드릴링 활동 증가는 조사 기간 동안 시장을 촉진합니다.

- 반면, 신재생에너지 기술로의 세계 변화는 시장에 도전을 가져올 것으로 예상됩니다.

- 한편, 수압 파쇄 기술의 진보는 향후 몇 년동안 시장에 유망한 성장 기회를 가져올 것입니다.

- 지역적으로는 북미가 주도권을 쥐게 됩니다. 특히 미국에서 업스트림 활동의 활성화는 조사 기간 동안 북미의 지배적 지위를 강화합니다.

드릴링 리그 시장 동향

오프쇼어 부문이 현저한 성장을 이루

- 고급 도구와 기계를 갖춘 드릴링 리그는 해저에서 석유 및 가스 매장량을 추출하는 데 매우 중요합니다. 주로 오프쇼어에 설치되는 이러한 장비는 엔지니어와 작업자가 해저 깊은 곳에 매장된 매장 자원에 접근할 수 있는 안정적인 플랫폼 역할을 하며 때로는 수심 수 킬로미터에 이르기도 합니다.

- 석유 및 가스 수요의 세계적 급증과 육상 매장량의 고갈에 견인되어 해양 드릴링 리그 시장은 일관된 성장을 이루어 왔습니다. 이 매장량의 고갈에 의해 보다 깊게 떨어진 해역에서의 탐사가 필요하게 되었습니다. 브라질, 멕시코 만, 서 아프리카와 같은 광범위한 미개발 매장량을 자랑하는 지역은 해양 프로젝트에 대한 대규모 투자의 주요 목표가되었습니다.

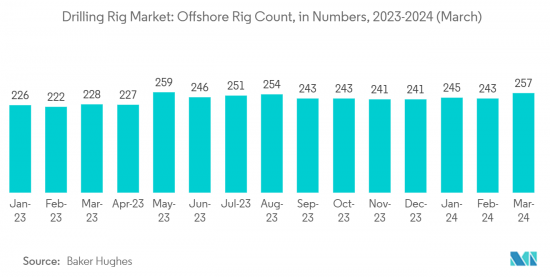

- 2024년 3월 현재 세계 해양 드릴링 리그 수는 2023년 3월 228기에서 257기로 증가했습니다. 오프쇼어 부문에 대한 투자가 증가함에 따라 리그 수는 앞으로도 증가 기조를 유지할 것으로 예상됩니다.

- 2023년 3월, 브라질의 광산 및 에너지부는 「Potencializa」탐광 및 생산 프로그램을 개시했습니다. 이것은 브라질을 세계 4위의 석유 생산국으로 끌어올리는 것을 목적으로 한 것으로, 석유 개발 투자의 확대를 목표로 합니다. 2029년 예측에서는 브라질 생산량은 2021년 대비 80% 증가한 일량 540만 배럴이 되어 그 약 80%를 프레솔트층이 차지합니다. 이 프로그램은 주요 탐광광구를 중시하고 성숙광구와 한계광구 모두에 대한 투자를 제창함으로써 드릴링 리그 수요를 증폭시킵니다.

- 2023년 8월, SFL Corporation Ltd.는 캐나다에서 Equinor ASA의 자회사와 반잠수식 장비 Hercules의 시추 계약(추정 1억 달러)을 체결했습니다. 이 계약은 1차 갱정 1개와 2차 갱정 옵션으로 2024년 2분기에 시작될 예정입니다.

- 2024년 3월 해양 드릴링 계약자인 Dolphin Drilling은 Oil India Limited와 반 다이빙 리그의 장기 계약을 체결했습니다. 인도 앞바다를 무대로, 14개월에 걸쳐 3갱의 우물을 굴착하는 것으로, 비용은 약 1억 4,500만 달러를 전망하고 있습니다.

- 이러한 투자 상황과 육상 매장량 감소로 인한 정부의 오프쇼어 활동에 대한 관심을 감안할 때, 이 분야는 조사 기간 동안 성장할 것으로 보입니다.

시장을 독점하는 북미

- 북미는 세계의 석유 및 가스 시장에서 지배적인 지위를 차지하고 있지만, 그 주된 이유는 미국이 최근 세계 유수의 원유 생산국으로서 대두해 왔기 때문입니다.

- 게다가 미국은 석유 및 가스산업에 있어서 자본지출로 항상 상위에 랭크되고 있으며, 이 경향은 앞으로도 계속될 것으로 예상됩니다.

- 미국은 주로 멕시코만과 알래스카 해안을 중심으로 한 견조한 해양석유 및 가스산업을 자랑하고 있습니다. 드릴링 깊이가 진행됨에 따라 기술적으로 회수 가능한 매장량이 급증하고 이 지역에 많은 투자가 모아지고 있습니다.

- 2023년 3월, 바이든 정부는 환경 문제가 논의되는 가운데 알래스카에서 대규모 석유 시추 사업을 승인했습니다. ConocoPhillips가 알래스카의 국가 석유 보호구에서 드릴링을 시작할 수 있도록 허용했으며 윌로우 프로젝트의 수정 버전을 승인했습니다. ConocoPhillips 는 이 사업으로부터 하루 18만 배럴의 생산량을 전망하고 있습니다.

- 대기업 석유 및 가스 기업은 2023년 이후를 향한 설비 투자액의 평균을 상회하는 증액을 발표했습니다. 예를 들어, Chevron Corporation은 2022년 12월, 2023년 유기 설비 투자 예산을 연결 자회사에서 140억 달러, 지분법 적용 계열사에서 30억 달러로 추가로 설정했습니다.

- 2023년 12월, ConocoPhillips는 석유 생산을 위한 건설을 시작하여 드릴링 리그 서비스에 대한 수요를 높일 것으로 예상되는 큰 단계를 내딛었습니다.

- 2024년 6월, 미국 에너지 개발 공사(미국 에너지)는 퍼미언 베이스에 대한 야심찬 계획을 발표하고, 퍼미언 프로젝트에 중점을 두고 내년에 7억 5,000만 달러 이상을 기록했습니다.

- 이러한 전략적 투자로 북미는 당분간 석유 및 가스 시장에서 우위를 유지할 자세입니다.

드릴링 장비 산업 개요

드릴링 장비 시장은 단편화되었습니다. 이 시장에서 사업을 전개하는 주요 기업(순부동)에는 Nabors Industries Ltd., Transocean Ltd., Saipem SpA, Seadrill Ltd., Schlumberger NV 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 원유 생산량(백만 배럴/일) : -2023년

- 천연 가스 생산량(억 입방 피트) : -2023년

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 천연가스 수요 증가와 가스 인프라 개발

- 드릴링 활동 증가

- 억제요인

- 보다 깨끗한 대체 연료의 채용

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자 분석

제5장 시장 세분화

- 전개 장소별

- 온쇼어

- 오프쇼어

- 유형별

- 잭업

- 세미 서브 머시블

- 드릴십

- 기타 유형

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 영국

- 러시아

- 노르웨이

- 스페인

- 북유럽 국가

- 터키

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 호주

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 이집트

- 나이지리아

- 카타르

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Nabors Industries Ltd.

- Transocean Ltd.

- Noble Corporation PLC

- Saipem SpA

- Arabian Drilling Company

- ADES International Holding PLC

- Shelf Drilling Holdings, Ltd.

- Seadrill Ltd

- Saudi Arabian Oil Company(Saudi Aramco)

- Schlumberger NV

- 기타 주요 기업 목록

- 시장 랭킹/공유(%) 분석

제7장 시장 기회와 앞으로의 동향

- 수압 파쇄 공정에 있어서의 기술의 진보

The Drilling Rig Market size is estimated at USD 99.66 billion in 2025, and is expected to reach USD 106.20 billion by 2030, at a CAGR of 1.28% during the forecast period (2025-2030).

Key Highlights

- In the medium term, rising drilling activities, coupled with an increasing demand for natural gas and the expansion of gas infrastructure, are poised to propel the market during the study period.

- On the flip side, the global shift towards renewable energy technologies is anticipated to pose challenges to the market.

- Meanwhile, advancements in hydraulic fracturing technology present promising growth opportunities for the market in the coming years.

- Regionally, North America is set to take the lead. Specifically, the uptick in upstream activities in the United States bolsters North America's dominant position during the study period.

Drilling Rig Market Trends

Offshore Segment to Witness Significant Growth

- Drilling rigs, equipped with advanced tools and machinery, are pivotal in extracting oil and gas reserves from the ocean floor. Primarily stationed in offshore locales, these rigs serve as stable platforms, enabling engineers and workers to access reserves buried deep beneath the seabed, sometimes reaching depths of several kilometers.

- Driven by a global surge in oil and gas demand and the depletion of onshore reserves, the offshore drilling rig market has witnessed consistent growth. This depletion has necessitated exploration in deeper, more remote waters. Regions like Brazil, the Gulf of Mexico, and West Africa, boasting vast untapped reserves, have become prime targets for heavy investments in offshore projects.

- As of March 2024, the global offshore drilling rig count rose to 257, up from 228 in March 2023. With increasing investments in the offshore sector, the rig count is expected to continue its upward trajectory in the coming years.

- In March 2023, Brazil's Minister of Mines and Energy launched the "Potencializa" exploration and production program. This initiative, aimed at amplifying oil exploration investments, seeks to elevate Brazil to the status of the world's fourth-largest oil producer. Projections for 2029 forecast Brazil's production at 5.4 million barrels daily, an 80% increase from 2021, with pre-salt areas accounting for roughly 80% of this output. The program will emphasize key exploration zones and advocate for investments in both mature and marginal fields, thereby amplifying the demand for drilling rigs.

- In August 2023, SFL Corporation Ltd. secured a drilling contract in Canada, valued at an estimated USD 100 million, with Equinor ASA's subsidiary for the semi-submersible rig Hercules. The contract encompasses one primary well, with an option for a second, and is slated to commence in Q2 2024.

- In March 2024, Dolphin Drilling, an offshore drilling contractor, clinched a long-term contract with Oil India Limited for its semi-submersible rig. Set off the coast of India, the operations involve drilling three wells over 14 months, with a projected cost of around USD 145 million.

- Given this investment landscape and the government's pivot to offshore activities due to dwindling onshore reserves, the segment is poised for growth during the study period.

North America to Dominate the Market

- North America stands as a dominant player in the global oil and gas market, largely because the United States has emerged as one of the world's leading crude oil producers in recent years.

- Moreover, the United States consistently ranks among the top in capital expenditures within the oil and gas industry, a trend that's expected to persist in the coming years.

- The United States boasts a robust offshore oil and gas industry, primarily centered around the Gulf of Mexico and offshore Alaska. As drilling depths have progressed, the surge in technically recoverable reserves has drawn significant investments to the region.

- In March 2023, the Biden administration, amidst environmental debates, sanctioned a significant oil drilling venture in Alaska. They approved a modified version of the Willow project, permitting ConocoPhillips to initiate drilling in Alaska's National Petroleum Reserve. ConocoPhillips projects a daily output of 180,000 barrels from this venture.

- Major oil and gas corporations have unveiled above-average hikes in their capital expenditures for 2023 and the years to follow. For example, Chevron Corporation, in December 2022, set its 2023 organic capital expenditure budgets at USD 14 billion for its consolidated subsidiaries and an additional USD 3 billion for its equity affiliates.

- In December 2023, ConocoPhillips took a significant step by commencing construction for oil production, a move expected to elevate the demand for drilling rig services.

- In June 2024, US Energy Development Corporation (US Energy) unveiled its ambitious plans in the Permian basin, earmarking over USD 750 million for the upcoming year, with a primary emphasis on Permian projects.

- Given these strategic investments, North America is poised to maintain its dominance in the oil and gas market in the foreseeable future.

Drilling Rig Industry Overview

The drilling rig market is fragmented. Some of the major players operating in the market (in no particular order) include Nabors Industries Ltd., Transocean Ltd., Saipem SpA, Seadrill Ltd, and Schlumberger NV, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Crude Oil Production in Million Barrels Per Day, till 2023

- 4.4 Natural Gas Production in Billion Cubic Feet, till 2023

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Growing Demand for Natural Gas And Developing Gas Infrastructure

- 4.7.1.2 Increase in Drilling Activities

- 4.7.2 Restraints

- 4.7.2.1 Adoption of Cleaner Alternatives

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Type

- 5.2.1 Jack-ups

- 5.2.2 Semisubmersible

- 5.2.3 Drill Ships

- 5.2.4 Other Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Russia

- 5.3.2.3 Norway

- 5.3.2.4 Spain

- 5.3.2.5 NORDIC Countries

- 5.3.2.6 Turkey

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Malaysia

- 5.3.3.5 Thailand

- 5.3.3.6 Indonesia

- 5.3.3.7 Vietnam

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nabors Industries Ltd.

- 6.3.2 Transocean Ltd.

- 6.3.3 Noble Corporation PLC

- 6.3.4 Saipem SpA

- 6.3.5 Arabian Drilling Company

- 6.3.6 ADES International Holding PLC

- 6.3.7 Shelf Drilling Holdings, Ltd.

- 6.3.8 Seadrill Ltd

- 6.3.9 Saudi Arabian Oil Company (Saudi Aramco)

- 6.3.10 Schlumberger NV

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Hydraulic Fracturing Process

샘플 요청 목록