|

시장보고서

상품코드

1906984

유럽의 플라스틱 캡 및 마개 : 시장 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Europe Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

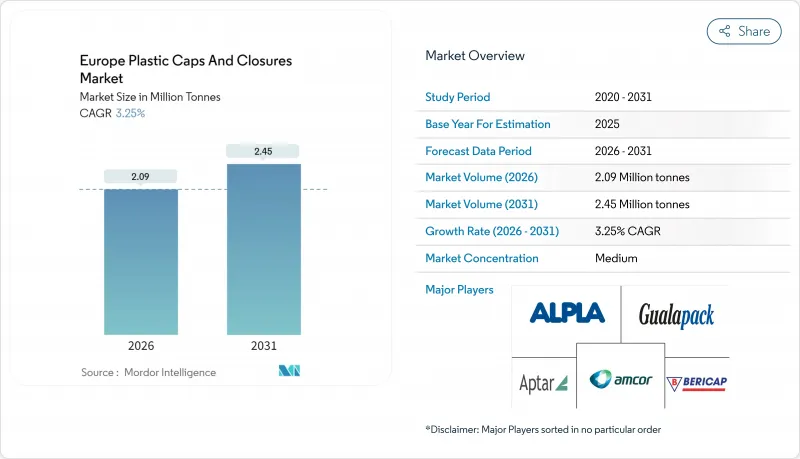

유럽의 플라스틱 캡 및 마개 시장은 2025년 202만 톤으로 평가되었고, 2026년 209만 톤에서 2031년까지 245만 톤에 이를 것으로 예측됩니다.

예측기간(2026-2031년)의 CAGR은 3.25%를 나타낼 것으로 예상됩니다. 포장 및 포장 폐기물 규제(PPWR)에 따른 규제 기세는 재활용 함량의 의무화가 강화됨에 따라 꾸준한 수량 확대를 추진하고 있습니다.

경량화 프로그램으로 캡당 수지 사용량을 15-20% 절감하고, 브랜드 소유자의 공급망 탄소 발자국에 대한 감시가 강화되며, 주류 및 화장품 포장재의 고급화가 수요 탄력성을 유지하고 있습니다. 지역 전체에서 약 3억 유로로 추정되는 테더드 캡 개조 관련 자본 지출은 기술 갱신 주기를 가속화하며, 첨단 사출 성형 역량을 보유한 제조업체에 유리하게 작용합니다. 한편, 재생수지 부족과 보증금 반환 제도(DRS) 도입으로 음료 용량이 알루미늄 대체재로 전환되면서 상승세는 다소 주춤하지만 전체 성장 추세는 꺾이지 않을 전망입니다. 경쟁 강도는 여전히 중간 수준이며, 소재 혁신과 스마트 캡 기능이 주요 차별화 요인으로 작용하고 있습니다.

유럽의 플라스틱 캡 및 마개 시장 동향 및 분석

경량화 요구가 재료 혁신을 추진

PPWR(플라스틱 포장재 경량화 규정)은 성능을 유지하면서 수지 중량을 줄일 것을 변환 업체에 요구하여, 폴리머 혼합 실험과 정밀 금형 설계 업데이트를 촉발하고, 이를 통해 성능 저하 없이 평균 캡 중량을 0.8g까지 줄였습니다. 수지 가격 변동성으로 이미 압박받고 있던 변환업체의 총마진은 8% 미만으로 축소되어, 1차 업체들이 공급 안정화를 위해 수직 통합 및 자체 재활용 루프 구축으로 나아가게 합니다. PET 중심 경량화 성과는 해당 폴리머 등급의 4.39% CAGR과 부합하며, 0.8mm 두께의 측면벽을 가능케 하는 오리엔테이션 기술이 이를 뒷받침합니다. ISO 11469 및 EN 13427 준수 요건 강화로 R&D 진입 장벽이 높아지며, 소재 전문성을 보유한 기존 업체들의 시장 점유율이 공고해질 전망입니다. 중기적으로 경량화 추세는 예상 연평균 성장률에 약 0.8%포인트를 추가할 것으로 예상됩니다.

테더형 캡 규정, 생산 경제성 재편

2024년 7월부터 3L 이하 모든 음료 용기는 테더드 캡을 장착해야 하며, 이로 인해 유럽 내 약 1,350개 병입 라인이 개조될 예정입니다. 개조 비용은 라인당 15만-30만 유로입니다. 테트라팩은 3억 유로를 투자해 2024년 중반까지 120억 개 이상의 규격 준수 캡을 생산했습니다. 통합 표준 EN 17665 : 2022+A1 : 2023은 사출 성형 힌지 솔루션을 선호하고 규제 모호성을 완화하는 명확한 준수 경로를 제시합니다. 소비자 조사에 따르면 환경적 이점을 근거로 73%의 수용률을 보여 브랜드 소유자의 전환 위험을 완화합니다. 단기적 시행은 수요를 1.2% 포인트 끌어올리지만 소규모 경쟁사에게는 자본 장벽을 높입니다.

스탠드업 파우치가 가정용 화학제품 포장을 혁신

세제 및 세정제 시장에서 유연 포장재가 경질 HDPE 병으로부터 연간 15-20% 점유율을 차지하고 있습니다. 이는 60%의 소재 절감 효과와 강력한 진열 매력을 바탕으로 합니다. 독일과 프랑스에서 진행된 브랜드 소유자 시험 결과, 저가 및 중가 SKU에서 파우치에 대한 소비자 수용도가 68%로 확인되었다. 가정용 화학제품의 캡 수요는 2030년까지 8-12% 감소할 수 있으며, 변환업체들이 주입구 부착 파우치로 전환함에 따라 전체 연평균 성장률(CAGR)을 0.7% 포인트 낮출 전망입니다.

부문 분석

폴리프로필렌은 다용도 내화학성과 매력적인 비용 대비 성능 비율로 2025년 유럽 플라스틱 캡 및 클로저 시장에서 44.38% 점유율로 선두를 달리고 있습니다. 이 부문은 확립된 공급 물류 및 성숙한 사출 성형 인프라를 활용하여 음료, 식품 및 가정용 화학 제품을 대규모로 공급합니다. 단위당 PP 사용량을 10-15% 절감하는 경량화 노력은 수지 가격 변동 속에서도 비용 우위를 확보합니다.

폴리에틸렌테레프탈레이트(PET)는 2031년까지 연평균 4.28% 성장률로 가장 빠르게 성장할 전망이며, 이는 테더 캡 및 무균 유제품 응용 분야에 부합하는 경량 프로파일과 강력한 차단 특성 덕분입니다. 유럽 플라스틱 캡 및 마개 시장의 PET 부문 규모는 재활용 함량 인증과 함께 성장할 전망이며, 특히 화학적 재활용이 규제 승인을 획득함에 따라 가속화될 것입니다. LDPE와 HDPE는 유연한 디스펜싱 및 내화학성 틈새 시장에서 여전히 중요성을 유지하는 반면, PVC는 지속가능성 압박 속에서 점유율을 계속 잃고 있습니다.

표준 스크류 캡은 보편적 호환성과 고속 라인 효율성으로 단위당 경제성을 유지하며 2025년 물량의 47.10%로 최대 점유율을 차지할 것입니다. 그러나 유럽 플라스틱 캡 및 마개 시장의 스크류 캡 점유율은 특수 형식의 확산으로 점차 감소할 전망입니다.

어린이 안전 마개는 제약 산업의 생산 능력 확대와 영양제·대마초 제품에 대한 안전 규정 강화로 2031년까지 연평균 4.32% 성장률을 기록할 것으로 예상됩니다. 정밀 계량 메커니즘을 활용한 디스펜싱 마개는 퍼스널케어 및 전자상거래 리필 생태계에서 새로운 성장 동력을 얻고 있습니다. 스냅온 및 특수 스포츠 캡은 이동 중 음료 수요를 충족시키며, 위조 방지 씰은 프리미엄 주류의 위조 방지를 위해 인증 칩을 내장합니다.

유럽의 플라스틱 캡 및 마개 시장 보고서는 소재 유형(폴리에틸렌테레프탈레이트(PET), 폴리프로필렌(PP) 등), 제품 유형(스크류 캡, 스냅온 캡 등), 제조 유형(사출 성형, 압축 성형, 블로우 성형), 최종 사용자 산업(음료, 식품, 의약품 및 헬스케어 등), 지역별로 분석하여 시장 예측은 수량(톤) 단위로 제공됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- EU 포장 및 포장 폐기물 규정(EU Packaging and Packaging-Waste Regulation)의 경량화 의무화

- 2024년 EU 지령 기한을 앞둔 테더 부착 캡의 높은 채택률

- 유제품 RTD(즉석 음용) 라인에서 고차단성, 무균 처리 가능(aseptic-ready) 캡에 대한 수요 증가

- 브랜드 소유자에 의한 재생 소재 캡으로 전환

- 프리미엄·변조 방지용 마개를 주도하는 수제 증류주 붐

- 누출 방지 마개가 필요한 전자상거래 리필 포맷의 급속한 성장

- 시장 성장 억제요인

- 가정용 화학 제품 SKU를 잠식하는 스탠드업 파우치

- 음료 업체를 알루미늄 캔으로 유도하는 보증금 반환 제도

- 대륙 전체에 걸친 rPET/rHDPE 식품 등급 공급 부족

- 기존 PET 라인에서 테더 캡 개조의 고자본 집약성

- 업계 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 경쟁 기업간 경쟁 관계

- 대체품의 위협

제5장 시장 규모와 성장 예측

- 소재 유형별

- 폴리에틸렌테레프탈레이트(PET)

- 폴리프로필렌(PP)

- 저밀도 폴리에틸렌(LDPE)

- 고밀도 폴리에틸렌(HDPE)

- 폴리염화비닐(PVC)

- 기타 소재

- 제품 유형별

- 스크류 캡

- 스냅온 캡

- 디스펜싱 마개

- 어린이 안전 마개

- 변조 방지 캡

- 기타 제품 유형

- 제조방법별

- 사출 성형

- 압축 성형

- 블로우 성형

- 최종 사용자 산업별

- 음료

- 식품

- 의약품 및 헬스케어

- 화장품, 화장실

- 가정용 화학제품

- 기타 산업

- 국가별

- 독일

- 영국

- 스페인

- 프랑스

- 이탈리아

- 슬로베니아

- 오스트리아

- 스위스

- 헝가리

- 크로아티아

- 루마니아

- 그리스

- 러시아

- 기타 유럽

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- BERICAP GmbH and Co. KG

- Guala Closures Group

- Pelliconi and CSpA

- UNITED CAPS Luxembourg SA

- Closure Systems International Europe GmbH

- AptarGroup Inc.

- Amcor plc

- ALPLA Werke Alwin Lehner GmbH and Co KG

- Georg Menshen GmbH and Co. KG

- Weener Plastics Group

- Tetra Pak International SA

- Coral Products PLC

- Greiner Packaging International GmbH

- Logoplaste

- Pano Cap Europe Ltd.

제7장 시장 기회와 장래의 전망

HBR 26.02.04The Europe plastic caps and closures market was valued at 2.02 million tonnes in 2025 and estimated to grow from 2.09 million tonnes in 2026 to reach 2.45 million tonnes by 2031, at a CAGR of 3.25% during the forecast period (2026-2031).Regulatory momentum under the Packaging and Packaging Waste Regulation (PPWR) drives steady volume expansion as recycled-content mandates tighten.

Lightweighting programs that trim 15-20% resin per cap, heightened brand-owner scrutiny of supply-chain carbon footprints, and premiumization of spirits and cosmetics packaging collectively sustain demand resilience. Capital expenditure on tethered-cap retrofits, estimated at EUR 300 million across the region, accelerates technology refresh cycles and favors manufacturers with advanced injection-molding capabilities. Meanwhile, recycled-resin shortages and deposit-return-scheme (DRS) roll-outs channel beverage volumes into aluminum alternatives, tempering upside but not derailing the overall growth trajectory. Competitive intensity remains moderate, with material innovation and smart-closure functionality serving as primary differentiation levers.

Europe Plastic Caps And Closures Market Trends and Insights

Lightweighting mandates drive material innovation

The PPWR compels converters to shave resin weight while safeguarding performance, prompting polymer-blend experimentation and precision-mold design updates that collectively cut average cap weight to 0.8 g without performance loss. Converter gross margins, already under pressure from resin volatility, narrow below 8%, pushing tier-one players toward vertical integration and captive recycling loops for supply security. PET-oriented lightweighting gains align with a 4.39% CAGR for that polymer class, aided by orientation technologies that permit 0.8 mm sidewalls. ISO 11469 and EN 13427 compliance hurdles elevate R&D thresholds and consolidate share in favor of incumbents with deep materials expertise. Over the medium term, lightweighting is expected to add roughly 0.8 percentage points to the forecast CAGR.

Tethered cap compliance reshapes production economics

From July 2024, every beverage container up to 3 L must feature a tethered closure, triggering retrofits on roughly 1,350 European bottling lines priced at EUR 150,000-300,000 each.Tetra Pak's EUR 300 million investment delivered more than 12 billion compliant caps by mid-2024. Harmonized standard EN 17665:2022+A1:2023 offers a clear compliance pathway that favors injection-molded hinge solutions and mitigates regulatory ambiguity. Consumer research shows 73% acceptance based on environmental benefits, easing brand-owner transition risks. Short-term implementation lifts demand by 1.2 percentage points but also raises capital barriers for smaller competitors.

Stand-up pouches disrupt household chemical packaging

Flexible packaging captures 15-20% annual share from rigid HDPE bottles in detergents and cleaners, courtesy of 60% material savings and strong shelf appeal.Brand-owner trials in Germany and France verify 68% consumer acceptance for pouches in budget and mid-tier SKUs. Closure demand in household chemicals could decline 8-12% through 2030, trimming the overall CAGR by 0.7 percentage points as converters pivot toward spouted pouch fitments.

Other drivers and restraints analyzed in the detailed report include:

- Aseptic packaging evolution in dairy RTD segment

- Brand-owner shift toward recycled-content caps

- Deposit-return schemes favor alternative packaging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polypropylene leads the Europe plastic caps and closures market with 44.38% share in 2025 due to versatile chemical resistance and attractive cost-to-performance ratios. The segment serves beverages, food, and household chemicals at scale, capitalizing on established supply logistics and mature injection-molding infrastructure. Lightweighting initiatives that cut PP usage by 10-15% per unit lock in cost advantages even as resin prices fluctuate.

Polyethylene terephthalate follows as the fastest mover at a 4.28% CAGR through 2031, propelled by lightweight profiles and robust barrier characteristics that align with tethered-cap and aseptic dairy applications. The Europe plastic caps and closures market size for PET is projected to climb in tandem with its recycled-content credentials, especially as chemical recycling gains regulatory approvals. LDPE and HDPE retain relevance in flexible dispensing and chemical-resistant niches, while PVC continues to lose ground under sustainability pressure.

Standard screw caps maintain the largest footprint at 47.10% of 2025 volumes as universal compatibility and high-speed line efficiency keep per-unit economics compelling. The Europe plastic caps and closures market share for screw caps, however, is likely to edge lower as specialized formats proliferate.

Child-resistant closures enjoy a 4.32% CAGR through 2031, buoyed by expanding pharmaceutical capacity and tightening safety codes across nutraceuticals and cannabis products. Dispensing closures experience renewed momentum in personal-care and e-commerce refill ecosystems, leveraging precision dosing mechanisms. Snap-on and specialty sports caps address on-the-go beverage needs, while tamper-evident seals embed authentication chips to curb counterfeits in premium spirits.

The Europe Plastic Caps and Closures Market Report is Segmented by Material Type (Polyethylene Terephthalate (PET), Polypropylene (PP), and More), Product Type (Screw Caps, Snap-On Caps, and More), Manufacturing Type (Injection Molding, Compression Molding, Blow Molding), End-User Industry (Beverage, Food, Pharmaceutical and Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Volume (Tonnes).

List of Companies Covered in this Report:

- BERICAP GmbH and Co. KG

- Guala Closures Group

- Pelliconi and C. S.p.A.

- UNITED CAPS Luxembourg S.A.

- Closure Systems International Europe GmbH

- AptarGroup Inc.

- Amcor plc

- ALPLA Werke Alwin Lehner GmbH and Co KG

- Georg Menshen GmbH and Co. KG

- Weener Plastics Group

- Tetra Pak International S.A.

- Coral Products PLC

- Greiner Packaging International GmbH

- Logoplaste

- Pano Cap Europe Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lightweighting mandates from EU Packaging and Packaging-Waste Regulation

- 4.2.2 High adoption of tethered caps ahead of 2024 EU directive deadline

- 4.2.3 Growing demand for high-barrier, aseptic-ready closures in dairy RTD lines

- 4.2.4 Brand-owner shift toward recycled-content caps

- 4.2.5 Craft spirits boom driving premium, tamper-evident closures

- 4.2.6 Rapid growth of e-commerce refill formats requiring leak-proof closures

- 4.3 Market Restraints

- 4.3.1 Stand-up pouches encroaching on household-chemical SKUs

- 4.3.2 Deposit-return schemes steering beverage players to aluminum cans

- 4.3.3 Lack of continent-wide rPET/rHDPE food-grade supply

- 4.3.4 High capital intensity for tethered-cap retrofits in legacy PET lines

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VOLUME)

- 5.1 By Material Type

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Low-Density Polyethylene (LDPE)

- 5.1.4 High-Density Polyethylene (HDPE)

- 5.1.5 Polyvinyl Chloride (PVC)

- 5.1.6 Other Materials

- 5.2 By Product Type

- 5.2.1 Screw Caps

- 5.2.2 Snap-On Caps

- 5.2.3 Dispensing Closures

- 5.2.4 Child-Resistant Closures

- 5.2.5 Tamper-Evident Closures

- 5.2.6 Other Product Types

- 5.3 By Manufacturing Type

- 5.3.1 Injection Molding

- 5.3.2 Compression Molding

- 5.3.3 Blow Molding

- 5.4 By End-User Industry

- 5.4.1 Beverage

- 5.4.2 Food

- 5.4.3 Pharmaceutical and Healthcare

- 5.4.4 Cosmetics and Toiletries

- 5.4.5 Household Chemicals

- 5.4.6 Other Industries

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Spain

- 5.5.4 France

- 5.5.5 Italy

- 5.5.6 Slovenia

- 5.5.7 Austria

- 5.5.8 Switzerland

- 5.5.9 Hungary

- 5.5.10 Croatia

- 5.5.11 Romania

- 5.5.12 Greece

- 5.5.13 Russia

- 5.5.14 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BERICAP GmbH and Co. KG

- 6.4.2 Guala Closures Group

- 6.4.3 Pelliconi and C. S.p.A.

- 6.4.4 UNITED CAPS Luxembourg S.A.

- 6.4.5 Closure Systems International Europe GmbH

- 6.4.6 AptarGroup Inc.

- 6.4.7 Amcor plc

- 6.4.8 ALPLA Werke Alwin Lehner GmbH and Co KG

- 6.4.9 Georg Menshen GmbH and Co. KG

- 6.4.10 Weener Plastics Group

- 6.4.11 Tetra Pak International S.A.

- 6.4.12 Coral Products PLC

- 6.4.13 Greiner Packaging International GmbH

- 6.4.14 Logoplaste

- 6.4.15 Pano Cap Europe Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment