|

시장보고서

상품코드

1639367

중국의 플라스틱 뚜껑 및 마개 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)China Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

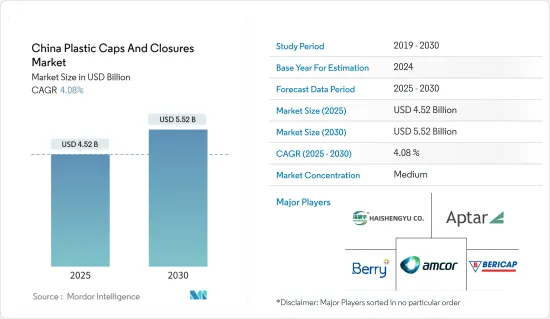

중국의 플라스틱 뚜껑 및 마개 시장 규모는 2025년 45억 2,000만 달러, 2030년 55억 2,000만 달러로 추정 및 예측되고, 예측 기간(2025-2030년)의 CAGR은 4.08%에 이를 것으로 예측됩니다.

생산량에서는 2025년 1,013억 7,000만개에서 2030년에는 1,256억 1,000만개로 성장하며, 예측기간(2025-2030년)의 CAGR은 4.38%로 예측됩니다.

2023년 중국의 GDP는 전년 대비 5.2% 증가했으며, 이는 인구의 꾸준한 증가, 급속한 도시화, 기술 진보에 견인된 것입니다. 게다가 국민 음료에 대한 의욕이 높아지면서 포장업계의 성장을 뒷받침하고 있습니다.

주요 하이라이트

- 중국은 세계의 플라스틱 소비에서 압도적인 존재감을 보여줍니다. 풍부한 원재료의 매장량과 비용효율을 특징으로 하는 생산환경으로 중국은 플라스틱 생산의 대폭적인 급증을 목격하고 있습니다.

- 중국에서는 식음료 산업이 급성장하고 있으며 플라스틱 뚜껑과 마개 수요가 급증하고 있습니다. 소비자가 조리한 밀 팩에 점점 기울어지는 가운데 USDA가 보고한 중국 식품가공산업은 2023년 안정적인 성장을 보였을 뿐만 아니라 식품수입량 증가에 힘입어 더욱 확대될 것으로 전망되고 있습니다.

- USDA는 또한 소비자 수요가 진화하고 보다 건강한 식사와 가정에서의 식사에 초점을 맞춘 라이프스타일 중심이 됨에 따라 반조리식, 식물 유래 제품, 간식 등의 새로운 식품 분야가 지지를 모으고, 중국의 플라스틱 뚜껑과 마개 시장을 크게 강화하고 있다고 강조하고 있습니다.

- 중국에서 플라스틱 뚜껑과 마개 시장은 제품의 혁신으로 번창하여 다양한 최종 이용 산업을 지원합니다. 플라스틱 포장의 기술적 진보는 업계 혁신의 파도를 초래했습니다. 많은 중국 기업들이 독자적인 비용 효율적인 솔루션의 연구 개발에 많은 투자를 하고 있으며, 혁신의 속도가 가속화되고 있습니다. 예를 들어 미국에 본사를 둔 Aptar Group Inc.는 2024년 4월 소주에 "Aptar China Intelligent Production and Research &Development Base(Aptar 중국 지능형 생산·연구개발기지)"를 개설하여 아시아태평양의 매우 중요한 제조 거점으로 삼았습니다.

- 그러나 시장은 플라스틱 폐기물을 둘러싼 환경 문제 심각화라는 큰 장애물에 직면하고 있습니다. 중국 인구가 증가하고 음식과 음식에 대한 수요가 급증함에 따라 이 과제는 점점 더 커지고 있습니다. ACS 출판에 따르면 중국에서 연간 2,600만 톤의 플라스틱 폐기물이 발생하고 있지만, 재활용되고 있는 것은 극히 일부에 불과하다고 합니다.

중국 플라스틱 뚜껑 및 마개 시장 동향

음료 부문이 시장 성장을 견인

- 2023년 미국 농무부(USDA)는 중국에서 급증하는 중간소득층이 점점 건강을 우선시하고 있으며, 약 57%가 식품 및 음료를 구입하기 전에 지방, 당분, 칼로리 등 영양의 세부 사항을 음미하고 있다고 보고했습니다. 이러한 의식이 높아짐에 따라 수입품, 특히 식품 보충제 및 고급 유제품의 매출이 급증하고 시장의 대폭적인 성장을 견인하고 있습니다.

- 중국의 음료 사정이 진화함에 따라 제조업체는 현지 생산을 강화하고 있습니다. 2023년 9월 Coca-Cola의 주요 보틀러인 Swire Coca-Cola Ltd는 20억 위안(약 2억 8,000만 달러)을 투자하여 중국 동부에 최신예 공장을 개설했습니다.

- 중국의 소매 장면에서 설탕을 사용하지 않는 옵션, 특히 차 기반의 믹스 주스에 대한 의지가 높아지고 있습니다. 젊은 층을 대상으로 건강 음료에 다양한 맛을 도입하는 것이이 시장 확대에 박차를 가하고 있습니다. Coca-Cola는 2023년 9월 AI를 활용한 'Coca-Cola Y3000 무설탕' 음료를 발표했습니다.

- 중국에서는 비알코올 음료산업이 급성장하고 있어 향후 몇 년간은 플라스틱 용기 수요가 높아질 것으로 보입니다. 중국 국가 통계국의 데이터에 따르면 생산량은 2024년 3월 1,787만 톤에서 2024년 6월에는 1,954만 톤으로 급증합니다.

폴리에틸렌(PE) 부문이 가장 높은 시장 점유율을 기록

- 내구성이 뛰어난 플라스틱인 폴리에틸렌(PE)은 내화학성과 비용 성능이 우수합니다. 석유 폴리머에서 유래하는 폴리에틸렌은 환경의 위험을 견딜 수 있습니다. 주로 고밀도 폴리에틸렌(HDPE)과 저밀도 폴리에틸렌(LDPE)으로 분류됩니다.

- 일반적으로 HDPE와 LDPE는 뚜껑과 마개의 주요 소재입니다. 특히 HDPE 뚜껑은 무알코올 음료 병 산업을 지배합니다. 뛰어난 특성으로 폴리에틸렌은 물통의 뚜껑에 최적 소재가 되고 있습니다. 석유 유래의 열가소성 고분자인 HDPE는 그 적응성과 견고성 때문에 중국의 다양한 산업을 위한 최선의 선택으로 눈에 띕니다.

- 세계 2위의 미용 시장인 중국에서는 화장품 및 퍼스널케어 산업에서 PE 뚜껑과 마개 동향이 높아지고 있습니다. 이러한 급성장의 배경은 스킨케어에 대한 소비 지출 증가, 셀프케어의 중시, 천연 성분과 유기농 성분에 대한 선호도가 높아집니다. 또한 중국의 화장품 전자상거래 판매 붐이 시장 확대에 박차를 가하고 있습니다.

- 플라스틱 뚜껑과 마개는 제품을 먼지와 유출, 오염으로부터 보호하는 포장에 중요한 역할을 합니다. 내구성, 재활용성, 비용 효과가 뛰어나기 때문에 제조업체의 사이에서 좋아해 선택되고 있습니다. 중국에서는 PE가 뚜껑과 마개의 소재로 톱에 군림하고 있습니다. 중국 국가 통계국의 데이터에 따르면 2024년 6월까지 중국 플라스틱 제품의 생산량은 약 659만 톤에 이릅니다. 중국은 세계에서 가장 큰 플라스틱 생산국이며 세계 플라스틱 생산량의 1/3 가까이를 차지합니다.

중국 플라스틱 뚜껑 및 마개 산업 개요

중국의 뚜껑과 마개 시장은 음료 수요의 급증과 수많은 국내외 벤더들이 시장에 진출하고 있기 때문에 적당히 통합되어 있습니다. 이러한 경쟁 구도를 극복하고 시장에서의 존재감을 높이기 위해 이러한 공급업체는 수평 통합과 수직 통합 모두에 대한 경사를 강화하고 있습니다. 이 시장의 주요 기업은 Bericap Holding GmbH, Aptar Group, Berry Global Inc., Shangdong Haishengyu Plastic Industry 등입니다.

- 2024년 4월, 독일에 본사를 두고 있는 Bericap Holding GmbH는 중국 곤산에 새로운 제조 공장을 설립했습니다. 중국 고객에서의 수요 급증에 대응하기 위해 생산 능력을 50% 증강합니다. 상하이 인근의 전략적 위치인 쿤산은 베리컵에 현지 발판을 제공하여 신속한 고객 지원과 효율적인 제품 물류를 촉진합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 역학

- 시장 성장 촉진요인

- 국내에서의 식품 및 식품 소비 확대

- 시장에서의 제품 혁신 증가

- 시장의 과제

- 플라스틱 포장에 대한 환경 문제가 증가

제6장 업계의 규제와 정책, 규격

제7장 시장 세분화

- 수지별

- 폴리에틸렌(PE)

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리프로필렌(PP)

- 기타 수지(폴리스티렌, PVC, 폴리카보네이트 등)

- 제품 유형별

- 나사식 - 스크류 뚜껑, 진공 등

- 디스펜서

- 나사 없음 - 오버뚜껑, 리드, 에어로졸 베이스 마개

- 어린이 보호

- 최종 이용 산업별

- 식품

- 음료

- 병이 들어간 식수

- 탄산음료

- 알코올 음료

- 주스와 에너지 음료

- 기타 음료

- 퍼스널케어 및 화장품

- 가정용 화학제품

- 기타 최종 이용 산업

제8장 경쟁 구도

- 기업 프로파일

- Shangdong Haishengyu Plastic Industry Co. Ltd

- Bericap Holding GmbH

- Berry Global Inc.

- Silgan Holdings Inc.

- Taizhou Huangyan Baitong Plastic Co. Ltd

- Ningbo Kinpack Commodity Co. Ltd

- Amcor GmbH

- Aptar Group Inc.

- Heat Map Analysis

- Competitor Analysis-Emerging vs. Established Players

제9장 재활용과 지속가능성의 전망

제10장 미래의 전망

JHS 25.02.14The China Plastic Caps And Closures Market size is estimated at USD 4.52 billion in 2025, and is expected to reach USD 5.52 billion by 2030, at a CAGR of 4.08% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 101.37 billion units in 2025 to 125.61 billion units by 2030, at a CAGR of 4.38% during the forecast period (2025-2030).

In 2023, China's GDP grew by 5.2% Y-o-Y, driven by a steadily growing population, swift urbanization, and technological progress. Additionally, the nation's rising appetite for beverages fuels growth in the packaging industry.

Key Highlights

- China stands out as a dominant player in global plastic consumption. With its rich reserves of raw materials and a production landscape characterized by cost efficiency, the nation has witnessed a significant surge in plastic production.

- The burgeoning food and beverage industries in China are driving swift demand for plastic caps and closures. As consumers increasingly lean toward pre-cooked meal packs, the food processing industry in China, as reported by USDA, not only showcased steady growth in 2023 but is also poised for further expansion, buoyed by rising food product import volumes.

- USDA further highlights that as consumer demands evolve and become more lifestyle-centric with a focus on healthier eating and at-home dining, new food segments such as semi-prepared meals, plant-based products, and light snacks are gaining traction, significantly bolstering the market for plastic caps and closures in China.

- In China, the plastic caps and closures market thrives on product innovation, catering to diverse end-use industries. Technological strides in plastic packaging have ushered in a wave of industry innovations. With many Chinese firms channeling substantial investments into research and development for unique, cost-effective solutions, the pace of innovation is accelerating. For instance, in April 2024, US-based Aptar Group Inc. inaugurated its 'Aptar China Intelligent Production and Research & Development Base' in Suzhou, marking it as a pivotal manufacturing hub for Asia-Pacific.

- Yet, the market grapples with a significant hurdle: mounting environmental concerns surrounding plastic waste. As China's population grows and the demand for food and beverage takeaways surges, the challenge intensifies. ACS Publications reports a staggering 26 million tons of plastic waste generated annually in China, with only a mere fraction undergoing recycling.

China Plastic Caps And Closures Market Trends

The Beverages Segment to Drive the Growth of the Market

- In 2023, the USDA reported that a burgeoning middle-income group in China is increasingly prioritizing health, with around 57% scrutinizing nutritional details such as fat, sugar, and calorie content before purchasing food or beverages. This heightened awareness has led to a surge in sales of imported items, particularly food supplements and premium dairy products, driving significant market growth.

- As China's beverage landscape evolves, manufacturers are ramping up local production. In September 2023, Swire Coca-Cola Ltd, a key bottler for Coca-Cola, invested CNY 2 billion (approximately USD 280 million) to inaugurate a state-of-the-art factory in eastern China.

- China's retail scene has long showcased a rising appetite for sugar-free options, especially tea-based mixes. Catering to the younger demographic, introducing varied flavors in healthy beverages is fuelling this market expansion. Highlighting this trend, Coca-Cola unveiled its AI-assisted 'Coca-Cola Y3000 Zero Sugar' drink in September 2023.

- China's burgeoning non-alcoholic beverages industry is set to bolster demand for plastic containers over the coming years. Data from the National Bureau of Statistics of China revealed a production leap from 17.87 million tons in March 2024 to 19.54 million tons by June 2024.

The Polyethylene (PE) Segment to Register the Highest Market Share

- Polyethylene (PE), a durable plastic, offers chemical resistance and cost-effectiveness. Derived from petroleum polymers, PE can endure environmental hazards. It is primarily categorized into high-density polyethylene (HDPE) and low-density polyethylene (LDPE).

- Commonly, HDPE and LDPE are the go-to materials for caps and closures. Specifically, HDPE caps dominate the non-alcoholic beverage bottle industry. Due to its superior properties, polyethylene has been the top choice for water bottle closures. Given its adaptability and robustness, HDPE, a thermoplastic polymer from petroleum, stands out as a prime choice for diverse industries in China.

- China, the world's second-largest beauty market, sees a rising trend in PE caps and closures within its cosmetics and personal care industries. This surge is driven by heightened consumer spending on skincare, a growing emphasis on self-care, and a growing preference for natural and organic ingredients. Additionally, the boom in e-commerce sales of cosmetics in China is fueling this market expansion.

- Plastic caps and closures play a crucial role in packaging, shielding products from dust, spills, and contamination. Their durability, recyclability, and cost-effectiveness make them a favored choice among manufacturers. In China, PE reigns as the top material for crafting caps and closures. Data from the National Bureau of Statistics of China revealed that by June 2024, the nation produced approximately 6.59 million tons of plastic products. Dominating the global scene, China is the largest plastic producer, responsible for nearly a third of the global plastic output, propelling the growth of the plastic caps and closures market.

China Plastic Caps And Closures Industry Overview

The Chinese caps and closures market is moderately consolidated due to a surge in demand for beverages and a multitude of domestic and international vendors operating in the market. To navigate this competitive landscape and bolster their market presence, these vendors are increasingly leaning toward both horizontal and vertical integration. Key players in the market encompass Bericap Holding GmbH, Aptar Group, Berry Global Inc., and Shangdong Haishengyu Plastic Industry Co. Ltd.

- April 2024: Bericap Holding GmbH, a Germany-based company, established a new manufacturing plant in Kunshan, China. This move aims to boost its production capacity by 50% in response to the surging demand from Chinese customers. Strategically located near Shanghai, Kunshan offers Bericap a local foothold, facilitating prompt customer support and efficient product logistics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Consumption of Food and Beverages in the Country

- 5.1.2 Increasing Product Innovation in the Market

- 5.2 Market Challenge

- 5.2.1 Growing Environmental Concerns Over Plastic Packaging

6 INDUSTRY REGULATION, POLICY, AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Resin

- 7.1.1 Polyethylene (PE)

- 7.1.2 Polyethylene Terephthalate (PET)

- 7.1.3 Polypropylene (PP)

- 7.1.4 Other Resins (Polystyrene, PVC, Polycarbonate, etc.)

- 7.2 By Product Type

- 7.2.1 Threaded - Screw Caps, Vacuum, etc.

- 7.2.2 Dispensing

- 7.2.3 Unthreaded - Overcaps, Lids, Aerosol-based Closures

- 7.2.4 Child-resistant

- 7.3 By End-use Industry

- 7.3.1 Food

- 7.3.2 Beverage**

- 7.3.2.1 Bottled Water

- 7.3.2.2 Carbonated Soft Drinks

- 7.3.2.3 Alcoholic Beverages

- 7.3.2.4 Juices and Energy Drinks

- 7.3.2.5 Other Beverages

- 7.3.3 Personal Care and Cosmetics

- 7.3.4 Household Chemicals

- 7.3.5 Other End-use Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Shangdong Haishengyu Plastic Industry Co. Ltd

- 8.1.2 Bericap Holding GmbH

- 8.1.3 Berry Global Inc.

- 8.1.4 Silgan Holdings Inc.

- 8.1.5 Taizhou Huangyan Baitong Plastic Co. Ltd

- 8.1.6 Ningbo Kinpack Commodity Co. Ltd

- 8.1.7 Amcor GmbH

- 8.1.8 Aptar Group Inc.

- 8.2 Heat Map Analysis

- 8.3 Competitor Analysis - Emerging vs. Established Players