|

시장보고서

상품코드

1636615

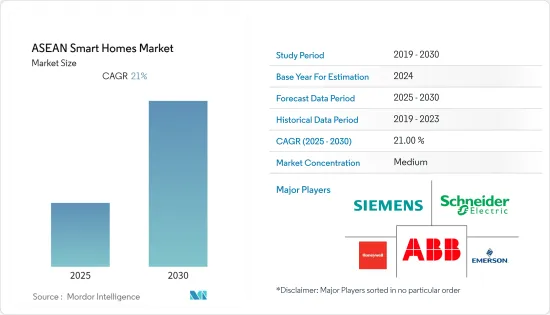

ASEAN 국가의 스마트 홈 시장 전망 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)ASEAN Smart Homes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

동남아시아국가연합(ASEAN) 국가 스마트홈 시장은 예측기간 동안 연평균 성장율(CAGR) 21%를 기록할 전망됩니다.

주요 하이라이트

- COVID-19는 원격 근무와 재택근무가 증가하면서 홈 오토메이션에 대한 수요가 더욱 높아졌습니다. 동남아시아의 여러 도시에서 전국적인 경제 구호 패키지의 효과적인 실행 채널을 목격했습니다. 대규모 사회 지원 프로그램은 설계와 전달에 시간이 걸리기 때문에 더 나은 디지털 인프라를 갖춘 도시가 의도한 수혜자에게 구호금을 전달하는 데 상대적으로 효율적인 것으로 나타났습니다.

- 또한, 몇몇 솔루션 제공업체는 팬데믹으로 촉발된 스마트홈 제품에 대한 수요 증가로 인해 수익이 증가할 것으로 예상했습니다. 2020년 5월, 현지 주방 가전 브랜드인 MMX Malaysia는 코로나19 기간 동안 매출이 4배 증가했다고 보고했습니다. 주요 수요는 조리기구와 쿡탑 제품에서 발생했습니다.

- 또한 여러 시장 기존 업체들의 확장 활동도 스마트 홈 시장의 성장을 이끄는 또 다른 주요 요인입니다. 스마트폰 에코시스템은 Amazon이 인터넷에 연결된 도어벨과 카메라 제조업체인 링사를 예상 10억 달러에 인수한 것으로 대표되는 것처럼 급속한 확대를 경험하고 있습니다.

- 스마트 홈의 등장으로 지난 몇 년 동안 주거 부문에서 비디오 감시 시스템의 중요성이 더욱 커졌습니다. 이 부문에서 구현된 감시 시스템은 모니터링 및 액세스 제어와 같은 다양한 용도로 사용됩니다. 이러한 시스템에는 동작 감지 및 야간 투시경과 같은 기능도 탑재되어 있습니다.

ASEAN 국가의 스마트 홈 시장 동향

소비자의 디지털 교육 강화

- 동남아시아 지역의 인터넷 사용자 증가에 따라 디지털 인식이 빠르게 발전하고 있습니다. 지속적으로 개선되고 있는 인터넷 연결 네트워크와 유행하는 디지털 시장의 존재는 이 지역 인터넷 사용자의 성장에 영향을 미칩니다.

- 이 지역의 소비자들은 스마트홈에 익숙하지 않고, 스마트홈이 완전히 새로운 패러다임이기 때문에 스마트홈에 어떻게 접목할 수 있는지에 대한 지식이 거의 없습니다. 스마트홈 서비스 구현의 장애물 중 하나는 스마트홈 기술에 대한 친숙도가 부족한 것으로 나타났습니다.

- 에너지 정책 보고서에서 싱가포르와 같은 국가의 스마트 홈을 통한 에너지 절약에 대한 연구에 따르면 스마트 기술에 대한 사람들의 투자는 주로 에너지 절약과 편안함에 대한 동기가 가장 컸으며, 그다음으로 보안에 대한 우려가 뒤를 이었습니다. 램프나 스피커와 같은 일반 상품에 센서를 통합하는 것이 점차 일반화되고 있으며, 대신 가전제품의 작동에 대한 상호 작용 손실을 예상하고 소비자의 사용 사례를 단순화하기 위해 노력하는 경향이 증가하고 있습니다.

- 인도네시아 사물 인터넷 포럼의 데이터에 따르면 약 4억 개의 센서 장치가 내장되어 있으며, 이 중 16%는 소매업, 15%는 의료, 11%는 보험, 10%는 은행 및 증권, 그리고 약 8%는 소매업, 미용 및 컴퓨터 유지보수 산업에서 사용되고 있습니다. 또한 7%는 정부, 6%는 운송, 5%는 공공 유틸리티, 4%는 부동산, 상업 및 농업 서비스, 나머지 3%는 주택에 사용됩니다. 디지털 업무 공간의 증가는 소비자들의 가정도 이와 유사하게 디지털화하도록 장려할 것으로 예상됩니다.

인터넷 보급률 증가, 스마트 기술 통합에 대한 정부의 관심 증가

- 스마트 홈 기술 채택에 따른 정부의 지원은 예측 기간 동안 시장 성장을 이끄는 주요 핵심 추제 중 하나입니다. ASEAN 국가들은 포레스트 시티 조호바루, 뉴 클락 시티, 뉴 마닐라 베이 시티 오브 펄, 태국의 동부 경제 회랑 등 스마트 시티 요소를 갖춘 대규모 인프라 프로젝트를 통해 중국 자본의 유입이 급증하고 있습니다. 중국은 또한 인도네시아의 동부 칼리만탄 신도시와 뉴 양곤 시티 등 이 지역에서 새롭게 계획 중인 타운십 프로젝트에도 큰 관심을 보이고 있습니다.

- 말레이시아 투자개발청(MIDA)에 따르면 말레이시아 정부는 스마트 홈 기술 채택을 장려하기 위한 첫 단계로 2020년까지 산업화 빌딩 시스템(IBS) 사용을 의무화하기 시작했습니다. 투자자들은 투자 세금 감면, 전기 및 전자 제품 및 부품에 대한 인센티브와 같은 스마트 홈 기술 관련 인센티브를 활용할 것을 권장합니다.

- 이와 비슷한 맥락에서 2021년 7월 싱가포르 정부는 디지털 혁명의 잠재력을 최대한 발휘할 수 있는 프로젝트와 이니셔티브에 지속적으로 투자하겠다는 의지를 재차 강조하며, 싱가포르의 기술 역량을 지원하기 위해 R&D에 약 7천만 달러를 투입했습니다.

- 정부의 스마트시티 구상은 스마트홈 시장의 성장도 뒷받침하고 있습니다. 호치민시는 2025년까지 스마트시티를 실현하기 위해 신기술에 주력하고 있습니다. 하노이, 호치민, 다낭 등 베트남의 대도시에서는 스마트 아파트가 신기술을 환영하는 현대 주민의 새로운 추세가 되고 있습니다. Schneider Electric은 인도네시아 바탐에서 전력 및 IA 제품을 제조하는 스마트 공장을 운영하고 있으며, 2017년에는 스마트홈 전자 제품과 배선을 제조하는 4,500만 달러의 제조 공장을 베트남에 개설했습니다.

- 마찬가지로 태국은 동남아시아국가연합(ASEAN) 10개 회원국 중 최초로 2020년 말에 5세대 광대역 인터넷(5G)을 전면 상용화하는 국가가 될 예정입니다. 5G의 도래는 IoT의 도입을 더욱 가속화할 것입니다.

- 또한 일본 정부는 2020년 12월 동남아시아 지역에서 스마트시티 프로젝트를 개발하는 일본 기업에 2,500억엔의 자금을 제공할 계획을 발표했습니다. 대상 도시에는 하노이, 호치민, 자카르타, 방콕, 싱가포르, 쿠알라룸푸르가 포함됩니다.

ASEAN 국가의 스마트 홈 산업 개요

ASEAN 국가의 스마트 홈 시장은 현재 세분화되어 있지만 경쟁이 치열하며, 전 세계의 기존 글로벌 및 국내 업체들이 이 지역에서 사업 기회를 잡기 위해 경쟁하고 있습니다. 주요 공급업체로는 Siemens, Schneider, Eaton, LG, Sony, Samsung, Google 등이 있습니다.

이 시장은 주로 최종 사용자를 유치하기 위한 최신 기술 및 사용자 정의의 추가에 의해 주도되고 있습니다. 공급업체들은 주로 에너지 소비를 최적화하고 건물에서 높은 수준의 자동화를 제공할 수 있는 혁신적인 제품과 솔루션을 제공하는 데 집중하고 있습니다. 시장에서는 일반적으로 제품을 향상시키기 위해 파트너십과 협업이 일반적입니다.

- 2020년 12월 - Tuya Smart와 Near는 싱가포르 IoT 시장의 자본 강화를 위해 파트너십을 강화했습니다. Near는 2018년 후반부터 Tuya Smart와 협업하고 있으며, Tuya가 Powered by하는 싱가포르 최초의 공식 스마트 조명 브랜드이며, Tuya는 PCB 설계에서 UI의 커스터마이즈까지 Near의 제품 개발 사이클의 모든 측면에 관여 있어, 필수적인 구성 요소가 되고 있습니다.

- 2020년 11월 - Daikin Singapore는 L3 비즈니스 그룹과 모든 주택 프로젝트 개발에 다이킨 스마트 솔루션을 제공하는 MOU를 체결했습니다. 이 파트너십을 통해 Daikin Singapore는 싱가포르 HDB 최초의 스마트하고 지속 가능한 마을, 녹색 기능 및 스마트 기술을 갖춘 Tengah Township과 같은 민간 콘도와 유명한 공공 주택 개발 모두 지역 주택 프로젝트에 대한 홈 오토메이션 솔루션 를 도입할 수 있습니다. 이 파트너십은 Daikin의 프로젝트에 FIbaro 솔루션을 채택하는 데에도 도움이 됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- COVID-19가 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 가정에서의 에너지 효율의 중시

- 보안 및 조명 부문에서 높은 수요

- 통합형 스마트홈 개념의 출현

- 시장 성장 억제요인

- 시장의 특성상 스마트 홈 기반 제품은 요구 주도형이 아니라 편리성 주도형으로 인식

- 대규모의 교체 사이클과 경쟁의 격화가 제조업체의 과제가 된다

- 비교 분석 : ASEAN 및 기타

- 주요 이해관계자 분석

제6장 말레이시아 스마트홈 시장

- 현재의 시장 시나리오

- 주요 시장 인플루언서

- 시장 세분화

- 제품 유형별

- 조명 제품

- 에너지 관리

- 보안

- 접속성

- 에너지 관리 시스템

- 홈 엔터테인먼트, 스마트 기기

- 제품 유형별

- 주요 베이스 지표

- 말레이시아에서 사업을 전개하는 주요 제품 벤더와 시스템 통합자의 분석

제7장 태국 스마트홈 시장

- 현재의 시장 시나리오

- 주요 시장 인플루언서

- 시장 세분화

- 제품 유형별

- 조명 제품

- 에너지 관리

- 보안

- 접속성

- 에너지 관리 시스템

- 홈 엔터테인먼트, 스마트 기기

- 제품 유형별

- 주요 지표

- 태국에서 사업을 전개하는 주요 제품 벤더와 시스템 통합자의 분석

제8장 싱가포르 스마트홈 시장

- 현재의 시장 시나리오

- 주요 시장 인플루언서

- 시장 세분화

- 제품 유형별

- 조명 제품

- 에너지 관리

- 보안

- 접속성

- 에너지 관리 시스템

- 홈 엔터테인먼트, 스마트 기기

- 제품 유형별

- 주요 베이스 지표

- 싱가포르에서 사업을 전개하는 주요 제품 벤더와 시스템 통합자의 분석

제9장 인도네시아 스마트홈 시장

- 현재의 시장 시나리오

- 주요 시장 인플루언서

- 시장 세분화

- 제품 유형별

- 조명 제품

- 에너지 관리

- 보안

- 접속성

- 에너지 관리 시스템

- 홈 엔터테인먼트, 스마트 기기

- 제품 유형별

- 주요 지표

- 인도네시아에서 사업을 전개하는 주요 제품 벤더와 시스템 통합자의 분석

제10장 베트남 스마트홈 시장

- 현재의 시장 시나리오

- 주요 시장 인플루언서

- 시장 세분화

- 제품 유형별

- 조명 제품

- 에너지 관리

- 보안

- 접속성

- 에너지 관리 시스템

- 홈 엔터테인먼트, 스마트 기기

- 제품 유형별

- 주요 베이스 지표

- 베트남에서 사업을 전개하는 주요 벤더와 시스템 통합자의 분석

제11장 경쟁 구도

- 기업 프로파일

- Cisco Systems Inc.

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- Google Inc.

- Samsung Electronics Co. Ltd

- LG Electronics Inc.

- Sony Corporation

- Xiaomi Corporation

- Smart home Indonesia

- Karsyte

- Koble

- Fibaro

- Doorbird

- IBM Corporation

제12장 시장 전망

- 투자분석

- 시장 기회와 향후의 동향

The ASEAN Smart Homes Market is expected to register a CAGR of 21% during the forecast period.

Key Highlights

- Covid-19 has further enhanced the demand for home automation due to the growing remote working and work from home scenarios. Several cities in South East Asia witnessed effective implementation channels of nationwide economic relief packages. As large-scale social assistance programs take time to design and deliver, cities equipped with better digital infrastructure were found to be relatively efficient in the targeted delivery of relief to intended beneficiaries.

- Further, several solution providers viewed an increase in revenues owing to the growing demand for smart home products triggered by the pandemic. In May 2020, MMX Malaysia, a local kitchen appliance brand, reported that its sales quadrupled during the COVID-19. The major demand was coming from Cookware and Cooktops products.

- Also, expansion activities of several market incumbents is another major factor driving the growth of the smart homes market. The smart home ecosystem is experiencing rapid expansion, represented by Amazon's acquisition of Ring, a maker of internet-connected doorbells and cameras, for an estimated USD 1 billion.

- The emergence of smart homes has increased the prominence of video surveillance systems in the residential segment in the past few years. The surveillance systems implemented in this sector have varied applications, such as monitoring and access control. These systems are also equipped with features, such as motion detection and night vision.

ASEAN Smart Homes Market Trends

Increasing Digital Education of Consumers in the Region

- Digital awareness is currently developing rapidly in line with the increase of internet users in the Southeast Asian region. The internet connectivity network that continues to improve and the existence of trending digital markets affect internet users' growth in the region.

- Consumers in the region are unfamiliar with smart homes and have little knowledge about how to incorporate them in the smart home sense seeing as smart homes were a totally novel paradigm. One of the possible obstacles to smart home service implementation has been discovered to be insufficient familiarity with smart home technology.

- Research on energy conservation through smart homes in countries like Singapore in an Energy Policy report reflected that people's investments in smart technology were primarily motivated by energy savings and comfort, followed by security concerns. The integration of sensors into common goods such as lamps and speakers has been slowly becoming the norm, in lieu of an increasing tendency for appliances that anticipate a loss of interaction with their operations and work towards simplifying use cases for their consumers.

- According to data from the Indonesian Internet of Things Forum, approximately 400 million sensor devices are embedded, of which 16% are employed in retail, 15% in healthcare, and 11% in insurance, 10% in banking and securities, as well as someof the retail, beauty and computer maintenance industries which around 8%. Also, about 7% in government, 6% in transportation, 5% in public utilities, 4% in real estate and commercial and agricultural services, and the remaining 3% is used for housing. Increasingly digital workspaces are expected to encourage consumers to similarly digitize their homes.

Increasing Internet Penetration Rates, Encouraging Government Interest in the integration of Smart Technology

- The initiatives taken by the government in line with the adoption of smart home technologies are one of the major key trends driving the growth of the market over the forecast period. ASEAN countries have seen a surge in Chinese capital flows through massive infrastructure projects that have significant smart city elements, including Forest City Johor Bahru, New Clark City, New Manila Bay City of Pearl, and Thailand's Eastern Economic Corridor. China has also shown a great interest in the region's newly planned township projects, including Indonesia's new capital city in East Kalimantan and New Yangon City.

- According to the Malaysian Investment Development Authority (MIDA), the Malaysian government initiated mandatory compliance to use Industrialised Building Systems (IBS) by 2020 as the first step to encourage the adoption of smart homes technologies. Investors are encouraged to leverage the incentives related to smart homes technology, such as investment tax allowance, incentives for electrical and electronic products and components.

- On similar lines, in July 2021, the Singapore government reiterated its commitment to continuously invest on projects and initiatives that will unlock the full potential of the digital revolution, injecting about USD 70 million into R&D to support the city's technological capabilities.

- The smart city initiatives by the government is also augmenting the growth of the smart home market. Ho Chi Minh, City is focusing on new technologies to become a smart city by 2025. In big cities of Vietnam as Hanoi, Ho Chi Minh City, and Da Nang, smart apartments are becoming a new trend of modern residents who have welcomed the new technologies. Companies have also invested in developing the studied market in the region, Schneider Electric runs a smart factory in Batam, Indonesia for manufacturing power and IA products and opened a USD 45 million manufacturing plant in Viet Nam for the production of electronic products and wiring for smart homes in 2017.

- Similarly, Thailand is poised to be the first country among the Association of Southeast Asia Nations (ASEAN) ten members states, to roll out the fifth generation of broadband internet (5G) for full commercial use in late 2020. The arrival of 5G will further accelerate the adoption of IoT.

- Furthermore, In December 2020, The Japanese government announced plans to provide JPY 250 billion in funding to Japanese companies to develop smart city projects in the Southeast Asian region. The cities include Hanoi, Ho Chi Minh, Jakarta, Bangkok, Singapore and Kuala Lumpur.

ASEAN Smart Homes Industry Overview

The ASEAN smart homes market is currently fragmented but highly competitive, with the presence of established global and domestic players across the globe vying for a piece of the business in the region. Some major vendors include Siemens, Schneider, Eaton, LG, Sony, Samsung, and Google, among others.

The market is mainly driven by the addition of modern technologies and customizations to attract end-users. Vendors are concentrating primarily on offering innovative products and solutions that can optimize energy consumption and serve a high degree of automation in buildings. Partnerships and collaborations are common in the marketplace, generally to enhance offerings. A few include;

- December 2020 - Tuya Smart and Near strengthened their partnership to enhance the capitalization of the Singapore IoT Market. Near has been working with Tuya Smart since late 2018 and is the first official Singaporean smart lighting brand to be Powered by Tuya, Tuya has been involved in all aspects of Near's product creation cycle from PCB design to UI customization making it an integral component.

- November 2020 - Daikin Singapore signed an MOU with the L3 Business Group in November 2020 to provide Daikin Smart Solution for all residential project developments. The partnership will allow Daikin Singapore to implement Home Automation Solutions for Local Residential Projects in both Private Condominium and Prominent Public Housing Development such as the Singapore's HDB first Smart and Sustainable town, with green features and smart technologies, Tengah Township. The collaboration also ensues the use of FIbaro solutions in Daikin projects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Emphasis on Energy Efficiency Among Households

- 5.1.2 High demand in the Security and Lighting Sector

- 5.1.3 Emergence of the Concept of Integrated Smart Homes

- 5.2 Market Restraints

- 5.2.1 Due to the Nature of The Market, Smart Home-based Products Being Perceived to be Convenience-driven as Opposed to Need Driven

- 5.2.2 Large Replacement Cycles and Growing Competition Pose a Challenge for Manufacturers

- 5.3 Comparative Analysis - ASEAN vs Rest of the World

- 5.4 Key Stakeholder Analysis

6 Malaysia Smart Home Market

- 6.1 Current Market Scenario

- 6.2 Key Market Influencers

- 6.3 MARKET SEGMENTATION

- 6.3.1 By Product Type

- 6.3.1.1 Lighting Products

- 6.3.1.2 Energy Management

- 6.3.1.3 Security

- 6.3.1.4 Connectivity

- 6.3.1.5 Energy Management systems

- 6.3.1.6 Home Entertainment & Smart Appliances

- 6.3.1 By Product Type

- 6.4 Key Base Indicators

- 6.5 Analysis of the Key Product Vendors and System Integrators Operating in Malaysia

7 Thailand Smart Home Market

- 7.1 Current Market Scenario

- 7.2 Key Market Influencers

- 7.3 MARKET SEGMENTATION

- 7.3.1 By Product Type

- 7.3.1.1 Lighting Products

- 7.3.1.2 Energy Management

- 7.3.1.3 Security

- 7.3.1.4 Connectivity

- 7.3.1.5 Energy Management systems

- 7.3.1.6 Home Entertainment & Smart Appliances

- 7.3.1 By Product Type

- 7.4 Key Base Indicators

- 7.5 Analysis of the Key Product Vendors and System Integrators Operating in Thailand

8 Singapore Smart Home Market

- 8.1 Current Market Scenario

- 8.2 Key Market Influencers

- 8.3 MARKET SEGMENTATION

- 8.3.1 By Product Type

- 8.3.1.1 Lighting Products

- 8.3.1.2 Energy Management

- 8.3.1.3 Security

- 8.3.1.4 Connectivity

- 8.3.1.5 Energy Management systems

- 8.3.1.6 Home Entertainment & Smart Appliances

- 8.3.1 By Product Type

- 8.4 Key Base Indicators

- 8.5 Analysis of the Key Product Vendors and System Integrators Operating in Singapore

9 Indonesia Smart Home Market

- 9.1 Current Market Scenario

- 9.2 Key Market Influencers

- 9.3 MARKET SEGMENTATION

- 9.3.1 By Product Type

- 9.3.1.1 Lighting Products

- 9.3.1.2 Energy Management

- 9.3.1.3 Security

- 9.3.1.4 Connectivity

- 9.3.1.5 Energy Management systems

- 9.3.1.6 Home Entertainment & Smart Appliances

- 9.3.1 By Product Type

- 9.4 Key Base Indicators

- 9.5 Analysis of the Key Product Vendors and System Integrators Operating in Indonesia

10 Vietnam Smart Home Market

- 10.1 Current Market Scenario

- 10.2 Key Market Influencers

- 10.3 MARKET SEGMENTATION

- 10.3.1 By Product Type

- 10.3.1.1 Lighting Products

- 10.3.1.2 Energy Management

- 10.3.1.3 Security

- 10.3.1.4 Connectivity

- 10.3.1.5 Energy Management systems

- 10.3.1.6 Home Entertainment & Smart Appliances

- 10.3.1 By Product Type

- 10.4 Key Base Indicators

- 10.5 Analysis of the Key Product Vendors and System Integrators Operating in Vietnam

11 COMPETITIVE LANDSCAPE

- 11.1 Company Profiles

- 11.1.1 Cisco Systems Inc.

- 11.1.2 Siemens AG

- 11.1.3 Emerson Electric Co.

- 11.1.4 Honeywell International Inc.

- 11.1.5 Schneider Electric SE

- 11.1.6 Google Inc.

- 11.1.7 Samsung Electronics Co. Ltd

- 11.1.8 LG Electronics Inc.

- 11.1.9 Sony Corporation

- 11.1.10 Xiaomi Corporation

- 11.1.11 Smart home Indonesia

- 11.1.12 Karsyte

- 11.1.13 Koble

- 11.1.14 Fibaro

- 11.1.15 Doorbird

- 11.1.16 IBM Corporation

12 MARKET OUTLOOK

- 12.1 INVESTMENT ANALYSIS

- 12.2 MARKET OPPORTUNITIES AND FUTURE TRENDS