|

시장보고서

상품코드

1636616

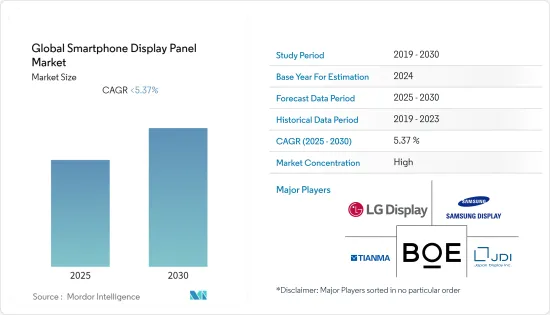

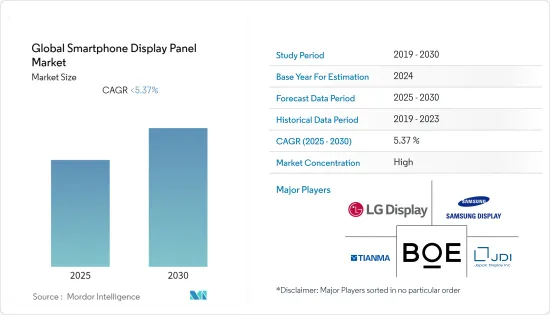

스마트폰 디스플레이 패널 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global Smartphone Display Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

세계의 스마트폰 디스플레이 패널 시장의 예측 기간 중 CAGR은 5.37% 미만으로 예측됩니다.

주요 하이라이트

- UHD 컨텐츠 보급으로 4K 및 8K 디스플레이 수요 증가, 스마트폰에서 OLED 디스플레이 사용 증가, 플렉서블 디스플레이 패널 수요 증가, 새로운 OLED 및 LCD 패널 제조 시설 건설에 대한 투자가 증가하고 있습니다.

- 재택 근무 및 온라인 교육과 같은 동향은 다른 기기와 함께 스마트폰 수요를 증가시키고 있습니다. 에릭슨의 모바일 데이터 트래픽 아웃룩에 따르면 스마트폰 1대당 데이터 사용량은 2021년 말까지 11.4GB에 달할 것으로 예상됩니다. 이 보고서에 따르면 동영상 트래픽은 현재 모든 모바일 데이터 트래픽의 69%를 차지하고 있으며 그 비율은 2027년까지 79%로 상승할 것으로 예상됩니다. 온라인 시청과 함께 모바일 게임은 스마트폰 사용률을 높이고 스마트폰 수요도 증가하고 있습니다. 따라서 스마트폰 디스플레이 패널 판매에 직접적인 영향을 미치고 있습니다.

- 재택근무의 규범이 받아들여지고 있는 것, COVID-19 위기 동안, 디스플레이 시장을 부양시키기 위한 재정 정책의 설계에 지역 금융기관이 힘을 들이게 되고 있는 것과 베트남, 한국, 멕시코, 그 밖의 동남아시아 국가 등, 영향이 적은 지역에 제조 부문이 시프트하고 있는 것 등이 포스트 코로나19 디스플레이 패널 시장의 성장을 이끄는 요인입니다.

- 원자재의 중국에 대한 과도한 의존을 피하기 위해, 약 200개의 미국 기업들이 제조 기지를 중국에서 인도 및 기타 아시아 국가로 옮기는 데 주력하고 있습니다. 예를 들어 Apple은 지속적인 생산을 보장하기 위해 제조 공장의 일부를 중국에서 인도로 이전하는 것을 목표로 합니다. 대만 기업인 위스트론은 인도뿐만 아니라 베트남과 멕시코도 진출하고 있습니다. 인도네시아에 신공장을 설립한 후 또 다른 아이폰 조립 업체인 페그트론은 2021년까지 베트남에서 제조를 시작할 야심을 밝혔습니다. 공급망의 탄력성을 높임으로써 이 기술은 성능을 향상시키고 공급망의 위험을 최소화합니다.

- 폴더블 스크린 등 기타 스마트폰도 동향이 되고 있습니다. 2021년 8월 출시 후 2개월 만에 Galaxy Z Fold3와 Flip3은 전 세계적으로 200만 대 이상 판매되었습니다. 중국 스마트폰 제조업체인 OPPO는 2021년 12월 첫 접이식 플래그쉽 스마트폰 'OPPO Find N'을 발표해 거의 호평을 받았습니다. 세계의 스마트폰 제조업체는 향후 몇 년동안 더 많은 플래그쉽 폴더블 스마트폰을 출시할 것으로 예상됩니다. 게다가 폴더블 기술의 도입은 스마트폰 사업에 큰 영향을 미칠 것으로 예측되고 있으며, 삼성 디스플레이에 따르면 세계의 폴더블 휴대전화 시장은 2021년부터 2027년 사이에 21.3%의 비율로 증가할 것으로 예상되고 있습니다.

스마트폰 디스플레이 패널 시장 동향

AMOLED LTPO 유연성이 시장 견인

- LTPO는 저온 다결정 산화물의 약자. LTPO는 AMOLED의 백플레인 기술로 최고의 스크린 기술을 통해 디스플레이를 동적으로 새로 고치는 새로운 기능을 제공합니다. 이를 통해 기업은 배터리 수명을 희생하지 않고 높은 리프레시 속도의 스크린을 사용할 수 있습니다. 그러나 이러한 패널은 비용이 많이 듭니다.

- LTPO 패널의 가장 큰 장점은 리프레시 속도로 인한 가변성입니다. 높은 리프레시 레이트는 게임과 같은 액티비티에는 도움이 되지만, 배터리 수명에 부담을 줍니다. 높은 새로 고침 속도가 계속되면 휴대폰의 배터리가 순식간에 소모됩니다. 따라서 최신 스마트폰의 LTPO 패널은 새로 고침 속도를 변경해야 합니다. 예를 들어 OnePlus 9 Pro는 120Hz를 지원합니다. 6.7인치 AMOLED 패널은 1Hz에서 120Hz의 속도로 새로 고칩니다. 게임과 같은 액티브한 동작을 할 때는 120Hz로 동작하지만, 동영상을 볼 때는 24Hz로 바뀝니다. 사용자가 사진을 보거나 텍스트를 읽을 때 디스플레이는 새로 고침 속도를 1Hz로 떨어뜨립니다. 그 결과 배터리 수명이 향상되었습니다.

- 플래그십 기계에서는 LTPO 기술이 표준입니다. 이 기술을 채택한 최초의 스마트폰에는 OnePlus 9 Pro와 삼성 Galaxy S21 Ultra가 있습니다. 2022년에도 LTPO AMOLED 패널은 프리미엄 스마트폰 시장에서 볼 수 있을 것으로 보입니다. 그러나 다른 신기술과 마찬가지로 어느 쪽도 다른 시장에도 침투해 나갈 것으로 보입니다. 그러나 LTPO는 스마트폰에 국한되지 않습니다. Apple Watch Series 5 이상에도 탑재되어 있습니다.

- Visionox는 LTPO 연구개발 프로젝트를 완료하고 2021년 말까지 LTPO OLED 패널 생산을 시작할 준비가 되었습니다. 그러나 2022년 2월, 이 회사는 최초의 LTPO AMOLED 디스플레이를 발표해, 1Hz-120Hz의 다이나믹 리프레시 레이트를 실현했습니다. Visionox에 따르면 이러한 획기적인 디스플레이를 탑재한 최초의 휴대폰은 곧 출시될 예정이라고 합니다. Visionox의 허페이 6세대 유연한 AMOLED 공장은 최신 LTPO AMOLED 스크린을 생산합니다.

- 2022년 2월-Qoo 9 Pro, iQOO 9, iQOO 9 SE로 구성된 iQOO 9 시리즈가 인도에서 출시되어 iQOO의 제품 라인업이 확충되었습니다. 플래그쉽의 Snapdragon 8 Gen 1 프로세서, Gimbal 카메라 기술, 120Hz 리프레시 레이트의 AMOLED 디스플레이, 트리플 리어 카메라 구성 등이 특징입니다. iQOO 9 Pro 디스플레이는 LTPO 2.0 기술을 채택한 6.78인치 E5 AMOLED입니다.

중국이 시장에서 큰 점유율을 차지

- 국가기관의 최신 데이터에 따르면 중국 스마트폰 시장은 2020년 유행에 의한 우울에서 작년 회복했지만 총 판매량은 아직 2019년 수준에 도달하지 못했다고 합니다. 2021년 세계 최대 스마트폰 시장인 중국은 국내 사용자를 대상으로 3억 4,280만 대의 기기를 출하해 2020년부터 15.9% 증가했습니다. 중국 정보통신연구원(CAICT)에 따르면 지난해 증가는 출하대수가 전년 대비 20% 감소한 2억 9,570만 대가 된 2020년 동 분야 부진과는 대조적이었습니다. 그러나 2019년 스마트폰 공급 대수는 3억 7,200만 대로, 2021년 출하 대수는 팬데믹 전 수준을 밑도는 것으로 보입니다.

- 중국의 스마트폰 디스플레이 부문이 등장하는 이유 중 하나는 중국 정부가 하이테크 기업과 전기 기업을 크게 지원하고 있다는 것입니다. 중국 기업은 대규모 국내 시장과 많은 양의 정부 보조금으로부터 이익을 얻고 있습니다. 중국 정부는 또한 수많은 인프라와 재정적 이익을 인정하고 있습니다. 예를 들어 중국 디스플레이 제조업체는 토지, 건물, 물, 전력을 무료로 제공하며 법인세율도 법인세(공식명칭은 기업소득세(EIT))의 25%보다 상대적으로 낮습니다. 또, 타국으로부터 수입하는 설비나 소모품의 관세도 제로입니다. 그 결과 중국의 디스플레이 제조업체는 한국의 디스플레이 제조업체보다 제조 비용이 낮습니다.

- BOE Technology Group 및 Visionox Technology Inc와 같은 국내 디스플레이 패널 제조업체는 유연한 액티브 매트릭스 유기 LED, 즉 AMOLED(보다 유연한 OLED의 일종)에 크게 베팅하고 있습니다. BOE는 세계 최초의 독특한 플렉서블 디스플레이 패널을 다수 발표하고 있으며, 오너의 Magic 3 시리즈와 Vivo의 iQOO 8 등 프리미엄 플래그쉽 스마트폰 단말기에 채용되고 있습니다.

- 2017년 BOE Technology가 중국 허페이시에 최초의 10.5세대 LCD 공장을 건설했을 때, 이 회사는 프로젝트에 투자된 460억 위안(70억 달러) 전체의 6.5%밖에 기여하지 않았습니다. 나머지는 허페이시 정부계 기업과 정부보증에 뒷받침된 은행대출에 의한 것입니다. 한국 DB그룹 산하의 대형증권회사에서 투자은행의 DB Financial Investments에 따르면 BOE Technology는 2010년부터 10년간 2조 위안(17억 달러) 이상의 간접적인 정부 보조금을 받았으며 지난 10년간 회사의 순이익의 59%를 차지하고 있습니다.

- BOE는 Samsung Electronics의 A13과 A23의 저렴한 스마트폰 시리즈용 패널을 다루고 있는 것 같습니다. 또한 삼성은 BOE에 차세대 플래그십 단말의 디스플레이 패널 제조를 제안할 것으로 보입니다. Samsung Electronics는 삼성의 플래그십 기계가 최첨단 LTPO 기술 OLED 스크린을 채택하고 있기 때문에 BOE에 우선 자사의 기술을 검증할 것을 요구하고 있습니다.

스마트폰 디스플레이 패널 산업 개요

스마트폰 디스플레이 패널 시장은 삼성디스플레이, BOE, LG디스플레이 등 소수의 기업들이 시장의 대부분을 차지하고 있어 매우 집중하고 있습니다. 높은 기술력, 연구 개발, 건설 및 기계의 초기 개발 비용이 높기 때문에 다른 공급업체가 시장에 진입하기가 어렵습니다.

- 2021년 12월-Tianma Microelectronics는 무한 천마G6산업기지에서 샤오미와의 제휴를 발표했습니다. 양사의 새로운 제휴는 모바일 기기를 위한 혁신적인 디스플레이 기술의 연구 개발에 중점을 둡니다. 양사는 모든 디스플레이 기술 연구가 수행되는 공동 연구소를 설립하기로 합의했습니다.

- 2021년 12월-Visionox는 LTPO 연구개발 프로젝트를 완료하고 LTPO OLED 디스플레이를 생산하기 시작했습니다. 이를 통해 이 회사는 하이엔드 스마트폰 디스플레이 범주에서 삼성 및 기타 선도적인 OLED 제조업체와 경쟁할 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 기술 동향

- 업계 밸류체인 및 공급체인 분석

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 시장의 과제

제6장 시장 세분화

- 기술별

- TFT LCD LTPS 리지드

- TFT LCD a-Si 리지드

- AMOLED LTPS 리지드

- AMOLED LTPS 플렉서블

- AMOLED LTPO 플렉서블

- TFT LCD Oxide 리지드

- 지역별

- 미국

- 중국

- 일본

- 한국

제7장 경쟁 구도

- 기업 프로파일

- Samsung Display

- BOE Technology Group Co. Ltd

- Tianma Group

- Japan Display Inc.

- TCL China Star

- Innolux

- AUO

- Sharp Corporation

- Century

- IVO

- LG Display

제8장 투자 분석

제9장 시장의 미래

AJY 25.02.12The Global Smartphone Display Panel Market is expected to register a CAGR of less than 5.37% during the forecast period.

Key Highlights

- With the availability of UHD content, increasing demand for 4K and 8K displays, increasing use of OLED displays in smartphones, rising demand for flexible display panels, and increasing investments in the construction of new OLED and LCD panel manufacturing facilities.

- The trends such as Work from home and online education have increased the demand for smartphones along with other devices. According to Ericsson Mobile data traffic outlook, the data usage per smartphone was expected to reach 11.4 GB by the end of 2021. Video traffic currently accounts for 69% of all mobile data traffic, with that percentage expected to rise to 79% by 2027, according to the same report. Alongside online viewing, mobile gaming has also increased the usage of smartphones and the demand for smartphones. Therefore a direct impact on the sales of smartphone display panels.

- The growing acceptance of the work-from-home norm, the increasing focus of regional financial institutions on designing fiscal policies to keep the display market afloat during the COVID-19 crisis, and the shifting of manufacturing units to less affected regions such as Vietnam, Korea, Mexico, and other Southeast Asian countries are all factors driving the growth of the post-COVID-19 display panel market.

- To avoid overdependence on China for raw materials, some 200 US corporations are focusing on relocating their manufacturing base from China to India and other Asian countries. Apple, for example, aims to relocate some of its manufacturing plants from China to India to ensure continued production. Wistron, a Taiwanese company, is eyeing India, as well as Vietnam and Mexico. After establishing a new plant in Indonesia, another iPhone assembler, Pegtron, has revealed ambitions to begin manufacturing operations in Vietnam by 2021. By making supply chains more resilient, this technique improves performance and minimizes supply chain risks.

- Other smartphones, such as foldable screens, are also coming into trend. In just two months after its launch in August 2021, the Galaxy Z Fold3 and Flip3 sold over 2 million units around the world. OPPO, a Chinese smartphone manufacturer, released its first foldable flagship smartphone, the OPPO Find N, in December 2021, to mostly excellent reviews. Global smartphone manufacturers are expected to release more flagship foldable phones in the coming years. Furthermore, the introduction of foldable technology is predicted to have a significant impact on the smartphone business, with the worldwide foldable phone market expected to increase at a rate of 21.3% between 2021 and 2027, according to Samsung Display.

Smartphone Display Panel Market Trends

AMOLED LTPO Flexible to drive the market

- LTPO stands for low-temperature polycrystalline oxide. LTPO is an AMOLED backplane technology that allows the best screen technology to unlock a new capability of dynamically refreshing the display. This allows companies to use high refresh rate screens without sacrificing battery life. However, such panels are costlier.

- The biggest advantage of LTPO panels is their variability with refresh rates. Higher refresh rates, though helpful in activities like Gaming, put a toll on the battery life. A continuously high refresh rate will drain the phone battery in no time; therefore, LTPO panels in modern smartphones have to change refresh rates. For instance, The OnePlus 9 Pro supports 120Hz. The 6.7-inch AMOLED panel refreshes at a rate of 1Hz to 120Hz. When performing active stuff like Gaming, it runs at full 120Hz; however, when viewing videos, it switches to 24Hz. The display decreases the refresh rate to 1Hz when the user is viewing a photo or reading text. As a result, the battery life is improved.

- For flagship phones, LTPO technology has become the standard. Some of the first smartphones that used this technology were the OnePlus 9 Pro and Samsung Galaxy S21 Ultra. In 2022, LTPO AMOLED panels will still be found in the premium smartphone market. However, like with all newer technologies, it will eventually filter down to the rest of the market. However, LTPO is not limited to smartphones. Apple Watch Series 5 and later have it.

- Visionox has completed its LTPO R&D project and is ready to begin producing LTPO OLED panels by the end of 2021. In February 2022, however, the company unveiled its first LTPO AMOLED display, which can deliver a dynamic refresh rate of 1Hz to 120Hz. The first phones with these revolutionary displays are expected to be introduced soon, according to Visionox. Visionox's Hefei 6-Gen flexible AMOLED plant produces the latest LTPO AMOLED screens.

- In February 2022 - The iQOO 9 series, which comprises the Qoo 9 Pro, iQOO 9, and iQOO 9 SE, was launched in India, expanding iQOO's offering. Highlights include the flagship Snapdragon 8 Gen 1 processor, Gimbal camera technology, 120Hz refresh rate AMOLED display, and triple rear camera configuration. The display on the iQOO 9 Pro is a 6.78-inch E5 AMOLED with LTPO 2.0 technology.

China to hold a significant share in the market

- According to the newest data from a state agency, China's smartphone market recovered last year following a pandemic-induced dip in 2020, albeit total sales have yet to reach 2019 levels. In 2021, China, the world's largest smartphone market, shipped 342.8 million devices to domestic users, up 15.9% from 2020. According to the China Academy of Information and Communications (CAICT), last year's rise contrasted with the sector's poor performance in 2020, when shipments fell 20% year on year to 295.7 million. However, with 372 million smartphones supplied in 2019, shipments in 2021 will fall short of pre-pandemic levels.

- One of the reasons for the rise of the Chinese smartphone display sector is the Chinese government's significant backing of its tech and electrical companies. Chinese enterprises benefit from their large local market as well as hefty government subsidies. The Chinese government has also granted numerous infrastructure and financial benefits. For example, Chinese display producers receive free land, buildings, water, and electricity, and their corporate tax rate is also relatively lower than its set corporate tax or officially known as the Enterprise Income Tax (EIT), which is 25%. They also have zero tariffs on the equipment and supplies they import from other countries. As a result, Chinese display makers have lower production costs than their South Korean counterparts.

- Domestic display panel makers like BOE Technology Group Co Ltd and Visionox Technology Inc are betting big on flexible active-matrix organic LED, or AMOLED, a sort of more flexible OLED. BOE has introduced a variety of world-first and unique flexible display panels, which have been used in premium flagship smartphone devices like Honor's Magic 3 series and Vivo's iQOO 8.

- When BOE Technology built its first 10.5-generation LCD factory in Hefei, China, in 2017, the company contributed only 6.5% of the overall CNY 46 billion (USD 7 billion) invested in the project. The rest came from Hefei city government-owned firms and bank loans backed by government guarantees. According to DB Financial Investments, a major securities firm and investment bank under the DB Group in South Korea, BOE Technology received over CNY 2 trillion (USD 1.7 billion) indirect government subsidies for ten years starting in 2010, accounting for 59% of the company's net income for the decade.

- BOE is apparently working on panels for Samsung Electronics' A13 and A23 cheap smartphone series. Furthermore, Samsung is expected to propose that BOE manufacture the display panels for its next-generation flagship handsets. Samsung Electronics has demanded that BOE validate their technology first because the Samsung flagships employ cutting-edge LTPO technology OLED screens.

Smartphone Display Panel Industry Overview

The smartphone display panel market is highly concentrated, with a few players like Samsung Display, BOE, and LG Display dominating a major portion of the market. The high technology, Research & development, and high initial development cost in construction and machinery make the market difficult for other vendors to penetrate.

- In December 2021 - Tianma Microelectronics announced a partnership with Xiaomi Corporation at the Wuhan Tianma G6 Industrial Base. The two companies' new alliance will focus on researching and developing innovative display technologies for mobile devices. Both firms have agreed to establish a collaborative laboratory where all display technology research would be conducted.

- In December 2021 - Visionox completed its LTPO research and development project and started producing LTPO OLED displays. This will allow the company to compete in the high-end smartphone display category against Samsung and other major OLED manufacturers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technological Trends

- 4.4 Industry Value Chain/Supply Chain Analysis

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Challenges

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 TFT LCD LTPS Rigid

- 6.1.2 TFT LCD a-Si Rigid

- 6.1.3 AMOLED LTPS Rigid

- 6.1.4 AMOLED LTPS Flexible

- 6.1.5 AMOLED LTPO Flexible

- 6.1.6 TFT LCD Oxide Rigid

- 6.2 By Geography

- 6.2.1 United States

- 6.2.2 China

- 6.2.3 Japan

- 6.2.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Display

- 7.1.2 BOE Technology Group Co. Ltd

- 7.1.3 Tianma Group

- 7.1.4 Japan Display Inc.

- 7.1.5 TCL China Star

- 7.1.6 Innolux

- 7.1.7 AUO

- 7.1.8 Sharp Corporation

- 7.1.9 Century

- 7.1.10 IVO

- 7.1.11 LG Display

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

샘플 요청 목록