|

시장보고서

상품코드

1637739

전자 포장 시장 전망 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Electronic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

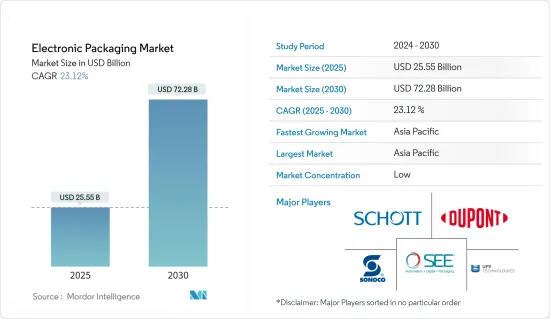

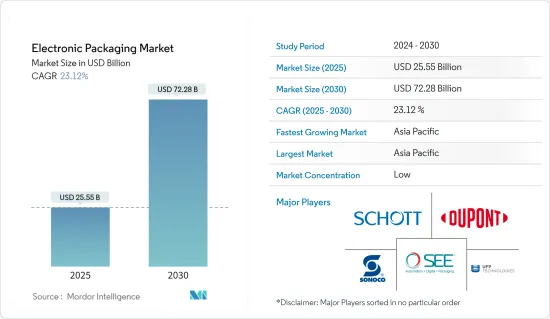

전자 포장 시장 규모는 2025년에 255억 5,000만 달러로 추정되며, 예측 기간(2025-2030년)의 연평균 성장율(CAGR)은 23.12%로, 2030년에는 722억 8,000만 달러에 이를 것으로 예측됩니다.

주요 하이라이트

- TV, 셋톱박스, MP3 플레이어, 디지털 카메라 등 수요가 급증하는 가운데, 전자 포장은 대량 생산에 점점 더 선호되고 있습니다. 복잡한 전자제품의 확산과 함께 IoT 및 AI의 부상으로 소비자 가전 및 자동차 산업 내 하이엔드 애플리케이션 부문이 성장하고 있습니다. 따라서 이러한 급증하는 수요를 충족하기 위해 전자제품 패키징을 위한 첨단 기술이 빠르게 도입되고 있습니다.

- 전자제품을 판매하는 기업들은 소비자 선택에 있어 지속가능성이 중추적인 역할을 한다는 점을 인식하고 포장 디자인에 지속가능성을 꾸준히 반영하고 있습니다. 예를 들어, 거대 기술 기업인 삼성은 2025년까지 전체 제품 라인에 친환경 소재를 통합하기로 약속했습니다. 이러한 야심찬 움직임에는 기존 플라스틱 포장에서 생분해성 또는 재활용 대체재로 전환하는 것이 포함됩니다. 이러한 이니셔티브는 환경을 생각하는 소비자들의 공감을 이끌어낼 뿐만 아니라 환경 문제에 점점 더 민감해지는 시장에서 책임감 있는 선두주자로서의 입지를 다질 수 있습니다.

- 디지털 시대가 패키징 디자인을 재편하고 있습니다. 최신 가전제품 패키징은 이제 QR코드, 증강 현실(AR) 인터페이스, NFC(근거리 무선 통신) 태그와 같은 기능을 자랑합니다. 이러한 혁신은 패키징과 소비자의 상호작용을 혁신적으로 변화시키고 있습니다.

- 물리적 포장을 디지털 경험과 융합함으로써 이러한 기술은 사용자 참여를 증폭시킵니다. 예를 들어, 포장의 QR 코드를 스캔하면 소비자는 상세한 제품 사양, 사용자 리뷰 또는 몰입형 가상현실 데모를 발표하는 웹사이트로 연결될 수 있습니다. 이러한 기능은 소비자용 가전 포장 시장에서 이러한 기술의 중요성이 높아지고 있음을 뒷받침합니다.

- 특히 전기 및 하이브리드 차량으로 빠르게 전환하고 있는 자동차 산업은 시장 지형에서 지배적인 역할을 하고 있습니다. 이러한 차량에 메모리 장치, 프로세서, 아날로그 회로 및 센서가 광범위하게 사용됨에 따라 전자 패키징에 대한 수요가 크게 증가할 것으로 예상됩니다.

- IBEF의 예측에 따르면 인도 전기자동차(EV) 시장은 2025년까지 5,000억 루피(70억 9,000만 달러)에 이를 수 있습니다. 또한 CEEW Centre for Energy Finance의 조사에 따르면 2030년까지 인도의 EV 시장 규모는 2,060억 달러에 달한다고 합니다. 이러한 낙관적인 전망은 전자 패키징 시장에 더욱 활기를 불어넣을 것으로 보입니다.

- COVID-19 팬데믹은 많은 산업에 그림자가 드리워졌지만 전자제품 패키징 솔루션과 가전제품 패키징은 회복세를 보였습니다. 휴대폰과 컴퓨터 산업은 주로 소비자 가전 패키징에 대한 수요를 주도합니다. 생산 중단, 원자재 부족, 공급망 중단과 같은 어려움에도 불구하고 이들 산업의 생산량은 비교적 큰 타격을 입지 않았습니다.

전자 포장 시장 동향

항공우주 및 방위부문은 일렉트로닉스 포장의 도입이 증가할 전망

- 미국, 프랑스, 영국을 비롯한 선진국과 러시아, 인도, 중국과 같은 개발도상국 모두에서 국방 예산이 증가하고 있습니다. 이들 국가 중 상당수는 무기 수출에도 열을 올리고 있습니다. 따라서 항공우주 및 방위 시장에 대한 R&D 투자가 지속적으로 추진되고 있습니다.

- 오늘날과 같은 역동적인 지정학적 환경에서 집단 방어의 중요성은 아무리 강조해도 지나치지 않습니다. 무기와 유도 시스템부터 무장 차량과 동력원에 이르기까지 모든 것을 포괄하는 군대와 방위력은 외부 위협으로부터 국가를 보호하는 데 중추적인 역할을 합니다. 강력한 군사 시스템을 유지하려면 감시와 군사력 모두 최고의 효율성과 효과성으로 작동해야 합니다.

- 인도 국방생산부(Department of Defense Production)의 보고에 따르면, 2022-23 회계연도(FY)의 국방 생산은 2021-22 회계연도의 95,000크로레(약 114억 5천만 달러)에서 처음으로 1라크크로레(약 120억 5천만 달러)를 돌파하며 역사적인 이정표를 달성했습니다. 또한 인도의 방위용 배터리 수요는 2022년 4기가와트시에서 2030년에는 10기가와트시로 두 배로 증가할 것으로 예상됩니다. 이러한 지속적인 국방 생산량 증가와 국방 배터리 채택 증가는 향후 몇 년간 시장 성장을 견인할 것으로 보입니다.

- 해군 군함, 선상 위성 통신 채널, 무기 제어 시스템, 해안 경비대는 모두 첨단 전자 제품에 의존합니다. 이러한 부품은 특히 습기와 열악한 환경으로 인해 발생하는 문제를 고려할 때 군용 등급 패키징이 필요합니다. 이러한 요구는 고품질 제품의 필요성을 강조할 뿐만 아니라 R&D에 대한 투자를 촉진합니다.

아시아태평양이 상당한 시장 성장을 달성

- 예측 기간 동안 아시아태평양 지역은 자동차 인프라 확대와 전기 자동차 판매 급증에 힘입어 시장을 지배할 것으로 예상됩니다. 중산층의 소득이 증가하고 젊은 층 인구가 크게 증가함에 따라 자동차 산업의 수요가 증가할 것으로 예상됩니다. 인도 자동차 제조업체 협회(SIAM)는 2023년 인도의 승용차 생산량이 454만 대로 2022년의 365만 대보다 크게 증가하여 향후 강력한 시장 성장을 예고하고 있다고 보고했습니다.

- 전 세계적으로 전자제품 허브로 인정받는 중국은 전기 부품 및 전자 제품 대량 생산에 탁월하며, 최고 수준의 품질, 성능 및 납기 기준을 준수합니다. 이러한 능력은 전자 패키징 시장의 막대한 성장 잠재력을 보여줍니다

- 중국의 산업 성장은 급증하는 내수 수요, 기술 혁신, 프리미엄 제품 생산에 대한 노력에 힘입어 이루어지고 있습니다. 중국의 광범위한 종이 및 판지 생산은 전자 패키징 판매의 번창 환경을 조성하고 있습니다.

- 인도 전자 제조 산업은 강력한 정책 지원, 상당한 투자, 전자 제품에 대한 수요 증가에 힘입어 2025년까지 2,200억 달러에 달할 것으로 예상되며, 인도 투자 촉진 및 촉진 기관(NIPFA)의 보고에 따르면 2025년에는 2,200억 달러에 달할 것으로 예상됩니다.

전자 포장 산업 개요

전자 포장 시장은 세분화되어 있습니다. 마이크로 시스템은 거의 모든 산업 부문에서 사용되며 소비자 전자 제품, 의료기기, 항공우주 및 방위, 통신 등이 주요 부문입니다. 주요 시장 진출기업으로는 UFP Technologies, Schott AG, Sealed Air Corporation, DuPont de Nemours Inc., Sonoco Products Company 등이 있습니다.

- 2023년 9월 Sealed Air는 3D 자동 포장 솔루션의 주요 공급업체인 Sparck Technologies와 제휴했습니다. 쉴드 에어는 호주, 한국, 일본, 한국에서 Sparck Technologies의 3D CVP 자동 포장 솔루션을 독점적으로 판매할 예정입니다. 제휴의 일환으로 Sealed Air 고객은 산업 최첨단 자동 포장 솔루션에 대한 액세스로 혜택을 누리고 프로세스를 간소화하고 안전한 작업 환경을 만들 수 있습니다.

- 2023년 11월, Mondi는 골판지 포장을 완전히 재활용 가능하고 퇴비화할 수 있는 옵션으로 추진함으로써 지속 가능한 대안을 선도할 것이라고 발표했습니다. 재생 섬유를 원료로 하는 이 회사의 골판지는 유럽에서 주목되는 종이 포장의 재활용률 82.5% 달성에 매우 중요한 역할을 하고 있습니다. 백색 소비자용 전자기기 및 전자기기의 순환 포장에 종사하는 Mondi 소재 및 설계 전문가들은 EPS 소재를 대체할 수 있는 고급 골판지 솔루션을 구축하고 있습니다.

- 2023년 9월, Schott AG는 항공우주 산업을 위한 새로운 마이크로 전자 포장을 발표했습니다. 이 포장은 코발 철 니켈 합금으로 만들어진 기존의 전자기기 포장에 비해 중량을 최대 75% 줄이면서 항공 전자기기 보호의 수명을 연장하는 것을 목표로 합니다. 또한 이 제품은 무선 주파수 설계, 직류 및 직류 컨버터, 저장 장치, 센서 부품 등의 고감도 전자 기기를 보호한다고 합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 분석

- 시장 성장 촉진요인

- 세계의 전기자동차 판매의 가속

- 기술 진보에 의한 제품의 품질 향상

- 시장 성장 억제요인

- 전자 포장의 고비용과 숙련된 전문가의 부족이 시장 성장의 과제

- 기술 스냅샷

제5장 시장 세분화

- 재료별

- 플라스틱

- 금속

- 유리

- 최종 사용자 산업별

- 소비자, 가전

- 항공우주 및 방위

- 자동차

- 의료

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 기업 프로파일

- SCHOTT AG

- DuPont de Nemours Inc.

- Sealed Air Corporation

- GY Packaging

- UFP Technologies Inc.

- Sonoco Products Company

- Smurfit Kappa Group PLC

- Dunapack Packaging Group

- WestRock Company

- Mondi Group

- Dordan Manufacturing Company

제7장 투자 분석

제8장 시장의 미래

HBR 25.02.06The Electronic Packaging Market size is estimated at USD 25.55 billion in 2025, and is expected to reach USD 72.28 billion by 2030, at a CAGR of 23.12% during the forecast period (2025-2030).

Key Highlights

- As demand surges for TVs, set-top boxes, MP3 players, and digital cameras, electronics packaging is increasingly favored for mass production. The rise of IoT and AI, coupled with the proliferation of intricate electronics, propels the high-end application segment within the consumer electronics and automotive industries. Consequently, to meet this burgeoning demand, advanced technologies for electronics packaging have been swiftly adopted.

- Companies selling electronics are steadily weaving sustainability into their packaging designs, recognizing its pivotal role in shaping consumer choices. For example, tech giant Samsung has committed to integrating eco-friendly materials across its entire product line by 2025. This ambitious move encompasses a shift from conventional plastic packaging to biodegradable or recycled alternatives. Such initiatives not only resonate with eco-conscious consumers but also position the brand as a responsible frontrunner in a market increasingly attuned to environmental issues.

- The digital age is reshaping packaging design. Modern consumer electronics packaging now boasts features like QR codes, augmented reality (AR) interfaces, and NFC (near-field communication) tags. These innovations are revolutionizing consumer interactions with packaging.

- By blending physical packaging with digital experiences, these technologies amplify user engagement. For example, scanning a QR code on a package might lead consumers to a website showcasing detailed product specs, user reviews, or even immersive virtual reality demonstrations. Such capabilities underscore the growing importance of these technologies in the consumer electronics packaging market.

- The automotive industry, particularly with its swift pivot toward electric and hybrid vehicles, plays a dominant role in the market landscape. Given the extensive use of memory devices, processors, analog circuits, and sensors in these vehicles, the demand for electronics packaging is poised for a significant uptick.

- Forecasts from IBEF suggest that the Indian electric vehicles (EV) market could touch INR 50,000 crores (USD 7.09 billion) by 2025. Additionally, insights from a CEEW Centre for Energy Finance study indicate a whopping USD 206 billion opportunity for EVs in India by 2030. Such bullish projections are set to further fuel the electronics packaging market.

- While the COVID-19 pandemic cast a shadow on many industries, electronics packaging solutions and consumer electronics packaging showed resilience. The mobile phone and computer industries primarily drive the demand for consumer electronics packaging. Despite challenges like production halts, raw material shortages, and supply chain disruptions, these industries' output remained relatively unscathed.

Electronic Packaging Market Trends

Aerospace and Defense Segment Expected to Increasingly Adopt Electronics Packaging

- Defense budgets are on the rise in both developed nations, including the United States, France, and the United Kingdom, and in developing nations like Russia, India, and China. Many of these countries are also keen on weapon exports. Consequently, there has been a sustained push for R&D investments in the aerospace and defense market.

- In today's dynamic geopolitical climate, the significance of collective defense cannot be overstated. Military and defense forces, encompassing everything from weapons and guidance systems to armed vehicles and their power sources, play a pivotal role in safeguarding a nation from external threats. To uphold a robust military system, both surveillance and armed forces must function with utmost efficiency and effectiveness.

- As reported by the Department of Defence Production (India), defense production in the Financial Year (FY) 2022-23 achieved a historic milestone, surpassing INR 1 lakh crore (~USD 12.05 billion) for the first time, up from INR 95,000 crore (~USD 11.45 billion) in FY 2021-22. Additionally, India's demand for defense batteries is projected to double, rising from 4 gigawatt hours in 2022 to 10 gigawatt hours by 2030. This consistent uptick in defense production, alongside the growing adoption of defense batteries, is poised to drive market growth over the coming years.

- Naval warships, onboard satellite communication channels, weapon control systems, and coastguards all rely on advanced electronic products. These components necessitate military-grade packaging, especially given the challenges posed by humidity and harsh environments. Such demands not only underscore the need for high-quality products but also fuel investments in R&D.

Asia-Pacific to Experience Significant Market Growth

- During the forecast period, Asia-Pacific is poised to dominate the market, driven by expanding automotive infrastructure and a surge in electric vehicle sales. With rising incomes among the middle-income group and a substantial youth demographic, demand in the automotive industry is set to escalate. The Society of Indian Automobile Manufacturers (SIAM) reported that in 2023, India produced 4.54 million passenger vehicles, a notable rise from 3.65 million units in 2022, signaling robust future market growth.

- China, recognized globally as the electronics hub, excels in mass-producing electrical components and electronic products, adhering to top-notch quality, performance, and delivery benchmarks. This prowess underscores the vast growth potential of the electronics packaging market.

- China's industry growth is fueled by surging domestic demand, technological innovations, and a commitment to producing premium products. Such extensive production of paper and paperboard in China fosters a thriving environment for electronics packaging sales.

- The Indian electronic manufacturing industry, buoyed by strong policy backing, substantial investments, and a rising demand for electronic products, is projected to hit USD 220 billion by 2025, as reported by the National Investment Promotion & Facilitation Agency (NIPFA).

Electronic Packaging Industry Overview

The electronics packaging market is fragmented. Microsystems are used in almost every industry vertical, with some significant sections being consumer electronics, healthcare equipment, aerospace and defense, and communications. The major market players include UFP Technologies, Schott AG, Sealed Air Corporation, DuPont de Nemours Inc., and Sonoco Products Company.

- September 2023: Sealed Air collaborated with Sparck Technologies, a key 3D automated packaging solutions provider. Sealed Air is expected to exclusively distribute Sparck Technologies' 3D CVP automated packaging solutions in Australia, South Korea, Japan, and South Korea. As part of the alliance, Sealed Air's customers will benefit from access to the industry's most advanced automated packaging solutions, allowing them to streamline processes and create a more secure work environment.

- November 2023: Mondi announced that it was leading the charge for sustainable alternatives by promoting corrugated packaging as a fully recyclable and compostable option. The company's corrugated boxes, made from recycled fibers, play a pivotal role in achieving Europe's notable 82.5% recycling rate for paper-based packaging. Committed to circular packaging for white goods and electronics, Mondi's experts in materials and designs are crafting advanced corrugated solutions as substitutes for EPS materials.

- September 2023: Schott AG unveiled new microelectronic packages for the aerospace industry. The packages aim to extend the life of avionics protection while reducing the weight by up to 75% compared to conventional electronics packaging made from Kovar iron-nickel alloy. The products are also said to protect sensitive electronics, such as radio frequency designs, direct current/direct current converters (DC/DC), electrical storage devices, and sensor components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Accelerated Sales of Electrical Automotive Worldwide

- 4.4.2 Technological Advancements Driving Product Quality

- 4.5 Market Restraints

- 4.5.1 High Costs of Electronic Packaging and Lack of Skilled Professionals to Challenge Market Growth

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.2 By End-user Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive

- 5.2.4 Healthcare

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SCHOTT AG

- 6.1.2 DuPont de Nemours Inc.

- 6.1.3 Sealed Air Corporation

- 6.1.4 GY Packaging

- 6.1.5 UFP Technologies Inc.

- 6.1.6 Sonoco Products Company

- 6.1.7 Smurfit Kappa Group PLC

- 6.1.8 Dunapack Packaging Group

- 6.1.9 WestRock Company

- 6.1.10 Mondi Group

- 6.1.11 Dordan Manufacturing Company