|

시장보고서

상품코드

1637757

아시아태평양의 화장품 포장 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Asia Pacific Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

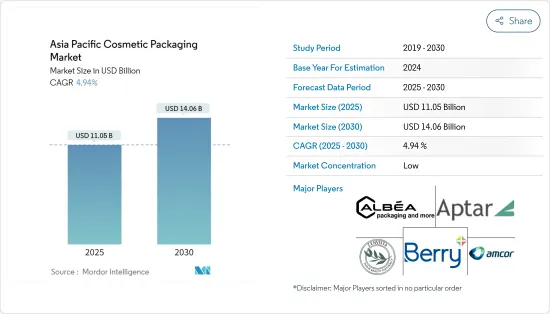

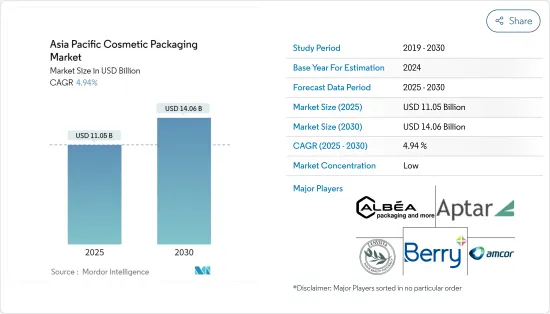

아시아태평양의 화장품 포장 시장 규모는 2025년에 110억 5,000만 달러로 추정되며, 예측기간 중(2025-2030년) CAGR은 4.94%로, 2030년에는 140억 6,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 아시아태평양의 화장품 포장 시장은 주로 중국, 인도, 일본, 인도네시아 등 주요 국가에서 고객 기반의 확대로 큰 성장을 이루고 있습니다. 이 성장에는 몇 가지 중요한 요소가 있습니다. 이 지역에서 소비자의 미의식 고조에 의해 몸단장이나 미용 동향에 대한 인식이 높아져, 화장품 수요가 높아지고 있습니다.

- 합리적인 가격의 화장품을 사용할 수 있게 되면서 이러한 제품은 보다 폭넓은 소비자층에게 친숙해지고 시장은 다양한 가격대에서 폭넓은 선택을 제공합니다. 전자상거래 성장도 중요한 역할을 합니다. 온라인 소매 플랫폼의 출현으로 소비자는 화장품을 구입하기 쉬워졌고 소비 확대에 기여하고 있습니다.

- 많은 아시아 국가에서 급속한 도시화는 라이프스타일 변화와 가처분소득 증가로 이어져 화장품 수요를 더욱 밀어올리고 있습니다. 게다가 아시아의 피부 유형과 기호에 맞춘 새로운 개량형 화장품의 개발 등 끊임없는 제품 혁신이 시장을 크게 확대하고 있습니다.

- 많은 국제 브랜드가 이 지역에서 새로운 화장품 라인을 출시하고 있으며, 다수의 국내 및 세계 포장 제조업체에게 기회를 제공합니다. 예를 들어, 2024년 4월 Kylie Jenner의 Kylie Cosmetics가 House of Beauty와의 제휴를 통해 인도로 진출했습니다. 이 주요 미용 전문 기업은 국제적인 미용 브랜드를 Sephora India에 발표합니다. 이번 제휴는 이 브랜드가 House of Beauty와 같은 인도의 옴니채널 전문기업과 처음으로 협업한 것을 의미합니다. Kylie Cosmetics는 현재 전국 25곳의 Sephora India 매장과 온라인 상점에서 독점 판매되고 있습니다.

- 지속가능성에 대한 우려가 증가하고 플라스틱이 환경과 건강에 미치는 부정적인 영향에 대한 소비자 의식 증가는 시장 성장을 방해할 수 있습니다. 그러나, 많은 화장품 회사는 다재다능성 및 비용 효율성에서 플라스틱 포장을 사용합니다. 화장품 산업에서는 용기, 연질 파우치, 캡, 클로저, 노즐 등의 주요 포장 재료로 플라스틱이 사용됩니다. 이러한 플라스틱에 대한 지속적인 의존은 시장 성장을 지원할 것으로 예상됩니다.

- 동시에 아시아태평양에서는 종이 기반 화장품 포장이 인기를 끌고 있습니다. 아시아와 세계 브랜드는 지속 가능한 선택을 요구하는 소비자 수요 증가에 부응하기 위해 종이 포장 제품을 도입했습니다. 이러한 종이 기반 포장으로의 전환은 보다 친환경 솔루션에 대한 더 넓은 산업 동향을 반영합니다. 소비자의 환경 의식이 높아짐에 따라 화장품 회사는 이러한 선호도에 맞게 포장 전략을 조정하여 향후 수년간 시장 상황을 재구성할 수 있습니다.

아시아태평양 화장품 포장 시장 동향

플라스틱 병과 용기 부문이 시장 성장을 이끌 것으로 예측

- 플라스틱 병과 용기는 화장품 포장에 가장 일반적으로 사용되며 선호되는 재료 중 하나입니다. 많은 화장품이 플라스틱 병과 용기에 들어있는 것은이 재료의 성형 용이성, 구조화, 디자인 능력 및 보호 특성 때문입니다. 플라스틱의 다용도성을 통해 제조업체는 다양한 화장품 제품의 요구에 맞게 다양한 모양과 크기를 만들 수 있습니다.

- 또한 플라스틱 포장은 경량 구조, 내구성, 비용 효과를 설명합니다. 이러한 특성으로 인해 플라스틱 병과 용기는 화장품 산업의 제조업체와 소비자에게 매력적인 선택이 되었습니다. 제품의 무결성을 유지하고 보존 기간을 연장하는 재료의 능력은 화장품 포장 솔루션에서 인기를 끌고 있습니다.

- 게다가 지속가능성에 대한 관심이 높아지면서 많은 기업들이 재활용 재료를 사용한 퍼스널케어와 화장품 포장을 혁신하고 있습니다. 2024년 7월, Berry Global Group Inc.는 많은 폴리프로필렌(PP) 제품에 Berry의 CleanStream 재생 플라스틱을 채택한 미용 및 개인 관리 제품을 위한 B Circular 포장 시리즈를 출시했습니다.

- 지속 가능한 포장으로의 전환은 친환경 제품을 요구하는 소비자 요구 증가에 대한 산업의 대응을 반영합니다. 기업은 R&D에 투자하고 제품의 품질과 안전성을 유지하면서 환경에 미치는 영향을 줄이는 포장 솔루션을 만들고 있습니다. 포장에 재활용 재료를 사용하는 것은 폐기물을 최소화하고 자원을 한 번 사용한 것만으로 폐기하는 것이 아니라 재사용·재활용하는 순환형 경제에 기여합니다.

- 2024년 1월과 2월의 중국 플라스틱 제품 생산량은 약 1,189만 톤으로 2023년 11월 670만 톤에서 증가했습니다. 이 플라스틱 생산의 상당한 성장은 플라스틱 병 및 용기 제조의 현저한 확대로 이어졌습니다. 그 결과, 이 부문은 화장품 산업에서 점점 더 중요해지고 있습니다. 플라스틱 용기 생산 증가는 아시아 화장품 포장 시장에 직접적인 영향을 미치며 성장과 시장 개척을 추진하고 있습니다. 플라스틱 포장의 선택이 늘어나면서 화장품 회사는 제품 수요 증가에 대응할 수 있게 되어, 이 지역에서 시장 확대를 더욱 자극하고 있습니다.

현저한 성장이 기대되는 인도

- 인도의 화장품 시장은 소비자의 관심이 높아지면서 최근 급성장하고 있습니다. 이러한 소비자의 관심 증가는 시장 확대에 크게 기여하고 있습니다. 가처분 소득 증가, 몸짓에 대한 의식의 높아짐, 소셜 미디어의 영향력 등의 요인이 이 성장에 중요한 역할을 하고 있습니다.

- 또한, 다양한 소매 채널에서 국내외 화장품 브랜드를 이용할 수 있게 되는 것도 시장 개척을 더욱 자극하고 있습니다. 또한, 보다 건강하고 지속 가능한 선택을 요구하는 소비자의 기호의 변화를 반영하여 천연 재료와 유기농의 화장품에 대한 수요가 높아지고 있는 것도 시장의이점이 되고 있습니다.

- 인도 소비자의 화장품에 대한 지출은 증가의 길을 따라가며, 가공되고 포장된 고급품으로의 동향을 뒷받침하고 있습니다. 이 성장의 배경은 가처분 소득 증가, 라이프 스타일의 변화, 몸단장에 대한 인식 증가가 있습니다. 스킨 케어 및 장식용 화장품 부문은 꾸준한 성장을 이루고 있으며, 페이셜 케어 및 의료 스킨 케어 제품에 대한 수요가 견조합니다. 피부 건강에 대한 관심 증가와 아름다움 기준에 대한 소셜 미디어의 영향이 이러한 동향을 뒷받침하고 있습니다.

- 프랑스의 미용·화장품 소매업체인 L'Oreal India는 2023 회계 연도의 총 이익을 약 6억 480만 달러로 보고해 전년 3억 4,512만 달러에서 대폭 증가했습니다. 이 큰 성장은 인도에서 화장품 시장의 전반적인 확대와 국제 브랜드에 대한 선호도 증가를 반영합니다. 이 회사의 성공은 다양한 제품군, 효과적인 마케팅 전략, 다양한 소비자층에 대응하는 능력에 기인합니다.

- 이러한 소비 확대는 포장 제조업체에게 수많은 기회를 제공합니다. 화장품에 대한 수요가 증가함에 따라 혁신적이고 매력적이고 기능적인 포장 솔루션에 대한 요구도 커지고 있습니다. 포장 제조업체는 환경 친화적인 옵션, 사용자 친화적인 디자인 및 제품의 보존성을 높이는 포장을 개발하는 것이 어려워지고 있습니다. 이 추세는 포장 산업의 혁신을 촉진하고 화장품 부문에 특화된 새로운 재료, 디자인 및 기술 개발로 이어질 것으로 예상됩니다.

- 인도에서는 화장품에 대한 소비 지출이 늘어나고 있으며, 가공되어 포장된 고급품으로의 동향이 촉진되고 있습니다. 스킨 케어 화장품과 장식용 화장품은 꾸준한 성장을 이루고 있으며, 페이셜 케어 및 메디컬 스킨 케어 제품에 대한 수요가 높습니다. 안티 에이징 제품과 환경 오염 방지 제품도 큰 성장 가능성을 가지고 있습니다. 이 시장은 포장용 플라스틱 재료의 풍부한 산지라는 장점이 있으며, 화장품 포장 재료의 가용성을 높이고 비용을 절감할 수 있어, 지역의 제조업체에게 유리합니다.

아시아태평양 화장품 포장 산업 개요

아시아태평양의 화장품 포장 시장은 Albea Group, Berry Global Inc., AptarGroup Inc.와 같은 국제적, 지역적, 현지 진출 기업이 다수 존재하기 때문에 부문화된 채로 남아 있습니다. 혁신을 통한 지속 가능한 경쟁 우위, 시장 침투, 경쟁 전략의 광고 광고비가 시장에 영향을 미치는 주요 요소입니다.

- 2024년 6월, 지속가능한 포장의 세계 기업인 Berry Global Group Inc.은 미용, 가정 및 개인 관리 시장을 위한 맞춤형 직사각형 Domino 병을 발표했습니다. 이 250ml 병은 100% 재활용(PCR) 플라스틱을 사용하여 제조됩니다. Domino 병은 75밀리미터 폭의 전면과 커스터마이즈 가능한 측면 패널이 특징으로, 4면에 모두 인쇄가 가능합니다. 이 디자인은 브랜드가 선반에 큰 영향을 주는 개성적인 포장을 만들 수 있습니다. 사이드 패널은 텍스처 엠보싱 및 디보스 가공을 할 수 있어 소비자에게 촉감을 제공할 수 있습니다.

- 2024년 5월, 책임있는 포장 솔루션의 개발과 제조로 세계를 선도하는 Amcor와 135년의 역사를 가진 화장품, 스킨케어, 퍼스널케어 기업의 AVON은 AVON의 대표적인 샤워 젤 「Little Black Dress」용 리필 파우치 「AmPrima Plus」를 중국에서 발매한다고 발표했습니다. 이 재활용 가능한 포장은 재활용 시 이산화탄소 배출량을 83%, 물 소비량을 88%, 재생가능 에너지 사용량을 79% 절감합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 화장품 수요 증가가 이 지역 시장 성장을 견인

- 혁신과 포장이 시장 성장과 소비자의 관심을 높인다.

- 시장 성장 억제요인

- 화장품 포장에 있어서의 플라스틱 사용에 관한 환경 문제의 고조

제6장 시장 세분화

- 재료 유형별

- 플라스틱

- 유리

- 금속

- 종이

- 제품 유형별

- 플라스틱 병과 용기

- 유리병 및 용기

- 금속 용기

- 접이식 판지

- 골판지 상자

- 튜브 및 스틱

- 캡과 마개

- 펌프와 디스펜서

- 스포이드

- 앰풀

- 연질 플라스틱 포장

- 화장품 유형별

- 컬러 화장품

- 스킨케어

- 맨즈 그루밍

- 탈취제

- 기타 화장품 유형(향기, 탈모제, 유아&아기 케어, 선케어)

- 국가별

- 중국

- 일본

- 인도

- 인도네시아

- 호주 및 뉴질랜드

제7장 경쟁 구도

- 기업 프로파일

- Albea Group

- HCP Packaging UK Ltd

- Berry Global Inc.

- DS Smith PLC

- Zenvista Packagings

- AptarGroup Inc.

- Amcor Group

- Takemoto Yohki Co. Ltd

- QUADPACK Group

- Gerresheimer AG

제8장 투자 분석

제9장 시장의 미래

JHS 25.02.06The Asia Pacific Cosmetic Packaging Market size is estimated at USD 11.05 billion in 2025, and is expected to reach USD 14.06 billion by 2030, at a CAGR of 4.94% during the forecast period (2025-2030).

Key Highlights

- The Asia-Pacific cosmetic packaging market is experiencing significant growth, primarily driven by expanding customer bases in major economies such as China, India, Japan, and Indonesia. Several vital factors fuel this growth. Rising beauty consciousness among consumers in the region has led to increased awareness of personal grooming and beauty trends, resulting in higher demand for cosmetic products.

- The availability of affordable cosmetics has made these products accessible to a broader consumer base, with the market offering a wide range of options at various price points. The growth of e-commerce has played a crucial role, as the rise of online retail platforms has made it easier for consumers to purchase cosmetic products, contributing to increased consumption.

- Rapid urbanization in many Asian countries has led to changing lifestyles and increased disposable income, further driving the demand for cosmetic products. Additionally, continuous product innovation, including developing new and improved cosmetic formulations tailored to Asian skin types and preferences, has expanded the market significantly.

- Many international brands are launching new cosmetic lines in the region, providing opportunities for numerous domestic and global packaging manufacturers. For instance, in April 2024, Kylie Cosmetics by Kylie Jenner expanded into India through a partnership with House of Beauty. This leading beauty specialty company introduces international beauty brands to India and Sephora. This partnership marks the first time the brand has collaborated with an Indian omnichannel specialist like House of Beauty. Kylie Cosmetics is now available exclusively in 25 Sephora India stores nationwide and online.

- Growing sustainability concerns and increasing consumer awareness regarding the adverse effects of plastic on the environment and health may hinder market growth. However, many cosmetic companies use plastic packaging for its versatility and cost-effectiveness. Plastic remains a primary packaging material in the cosmetics industry for containers, flexible pouches, caps, closures, and nozzles. This ongoing reliance on plastic is expected to support market growth.

- Simultaneously, paper-based cosmetics packaging has gained traction in Asia-Pacific. Both Asian and global brands are introducing products in paper packaging to meet the rising consumer demand for sustainable options. This shift toward paper-based packaging reflects a broader industry trend toward more environmentally friendly solutions. As consumers become more environmentally conscious, cosmetic companies adjust their packaging strategies to align with these preferences, potentially reshaping the market landscape in the coming years.

Asia Pacific Cosmetic Packaging Market Trends

The Plastic Bottles and Containers Segment is Expected to Drive the Market Growth

- Plastic bottles and containers are among the most commonly used and preferred materials for cosmetic packaging. Many cosmetic products come in plastic bottles and containers due to the material's ease of molding, structuring, design capability, and protective properties. Plastic's versatility enables manufacturers to create various shapes and sizes to meet different cosmetic product needs.

- Also, plastic packaging provides lightweight construction, durability, and cost-effectiveness. These attributes make plastic bottles and containers an attractive choice for manufacturers and consumers in the cosmetics industry. The material's ability to preserve product integrity and extend shelf life further contributes to its popularity in cosmetic packaging solutions.

- Further, due to increasing sustainability concerns, many companies are innovating personal care and cosmetic packaging with recycled materials. In July 2024, Berry Global Group Inc. launched its B Circular packaging range for beauty and personal care products, featuring Berry's CleanStream recycled plastic for many polypropylene (PP) products.

- This shift to sustainable packaging reflects the industry's response to growing consumer demand for eco-friendly products. Companies invest in research and development to create packaging solutions that reduce environmental impact while maintaining product quality and safety. Using recycled materials in packaging helps minimize waste and contributes to the circular economy, where resources are reused and recycled rather than discarded after a single use.

- In January and February 2024, China produced approximately 11.89 million metric tons of plastic products, an increase from 6.70 million metric tons in November 2023. This significant growth in plastic production has led to a notable expansion in manufacturing plastic jars and containers. As a result, this segment has become increasingly important within the cosmetics industry. The rise in plastic container production has directly impacted the cosmetic packaging market in Asia, driving its growth and development. The increased availability of plastic packaging options has enabled cosmetic companies to meet the rising demand for their products, further stimulating the market's expansion in the region.

India is Expected to Register Significant Growth

- The Indian cosmetics market has experienced rapid growth in recent years, driven by increasing consumer engagement. This heightened consumer interest has significantly contributed to the market's expansion. Factors such as rising disposable incomes, growing awareness of personal grooming, and the influence of social media have played crucial roles in fueling this growth.

- Additionally, the increasing availability of both domestic and international cosmetic brands across various retail channels has further stimulated market development. The market has also benefited from the growing demand for natural and organic cosmetic products, reflecting changing consumer preferences toward healthier and more sustainable options.

- Consumer spending on cosmetics in India continues to rise, driving a trend toward processed, packaged, and premium products. This growth is attributed to increasing disposable incomes, changing lifestyles, and growing awareness of personal grooming. The skincare and decorative cosmetics segments are experiencing steady growth, with facial care and medical skincare products seeing robust demand. A growing focus on skin health and the influence of social media on beauty standards fuels this trend.

- L'Oreal India, the French beauty and cosmetic retailer, reported a total income of approximately USD 604.80 million for the financial year 2023, a significant increase from USD 345.12 million in the previous year. This substantial growth reflects the overall expansion of the cosmetics market in India and the increasing preference for international brands. The company's success can be attributed to its diverse product range, effective marketing strategies, and ability to cater to various consumer segments.

- This growing consumption creates numerous opportunities for packaging manufacturers. As the demand for cosmetics increases, so does the need for innovative, attractive, and functional packaging solutions. Packaging manufacturers are challenged to develop eco-friendly options, user-friendly designs, and packaging that enhances product shelf life. This trend is expected to drive innovation in the packaging industry, leading to the development of new materials, designs, and technologies specifically for the cosmetics segment.

- Consumer spending on cosmetics continues to grow in India, driving a trend toward processed, packaged, and premium products. Skincare and decorative cosmetics are experiencing steady growth, with facial care and medical skincare products seeing strong demand. Anti-aging products and those designed to protect against environmental pollution also offer significant growth potential. The market benefits from local and abundant sources of plastic materials for packaging, potentially increasing availability and reducing costs for cosmetic packaging materials, advantaging regional manufacturers.

Asia Pacific Cosmetic Packaging Industry Overview

The Asia-Pacific cosmetic packaging market remains fragmented due to numerous international, regional, and local players, such as Albea Group, Berry Global Inc., and AptarGroup Inc. Sustainable competitive advantages via innovation, market penetration levels, and the advertising expense power of competitive strategy are the main elements influencing the market.

- June 2024: Berry Global Group Inc., a global player in sustainable packaging, introduced a customizable, rectangular Domino bottle for the beauty, home, and personal care markets. The 250 ml bottle is manufactured using up to 100% post-consumer recycled (PCR) plastic. The Domino bottle features a 75-millimeter-wide front face and customizable side panels, allowing printing on all four sides. This design maximizes opportunities for brands to create distinctive packaging with significant shelf impact. The side panels can be further enhanced with textured embossing or debossing, offering a tactile experience for consumers.

- May 2024: Amcor, a global leader in developing and producing responsible packaging solutions, and AVON, a cosmetics, skincare, and personal care company with a 135-year history, announced the launch of the AmPrima Plus refill pouch for AVON's Little Black Dress classic shower gels in China. When recycled, the recyclable packaging will result in an 83% reduction in carbon footprint, 88% reduction in water consumption, and 79% reduction in renewable energy use.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Cosmetic Products Drives Market Growth in the Region

- 5.1.2 Innovation and Packaging Drive Market Growth and Consumer Engagement

- 5.2 Market Restraints

- 5.2.1 Rising Environmental Concerns Regarding Plastic Usage in Cosmetic Packaging

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Product Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tubes and Sticks

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Droppers

- 6.2.10 Ampoules

- 6.2.11 Flexible Plastic Packaging

- 6.3 By Cosmetic Type

- 6.3.1 Color Cosmetics

- 6.3.2 Skin Care

- 6.3.3 Men's Grooming

- 6.3.4 Deodrants

- 6.3.5 Other Cosmetic Types (Fragrances, Depilatories, Baby and Child Care, and Sun Care)

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 Indonesia

- 6.4.5 Australia and New Zealand

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Albea Group

- 7.1.2 HCP Packaging UK Ltd

- 7.1.3 Berry Global Inc.

- 7.1.4 DS Smith PLC

- 7.1.5 Zenvista Packagings

- 7.1.6 AptarGroup Inc.

- 7.1.7 Amcor Group

- 7.1.8 Takemoto Yohki Co. Ltd

- 7.1.9 QUADPACK Group

- 7.1.10 Gerresheimer AG