|

시장보고서

상품코드

1849841

POS 단말기 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

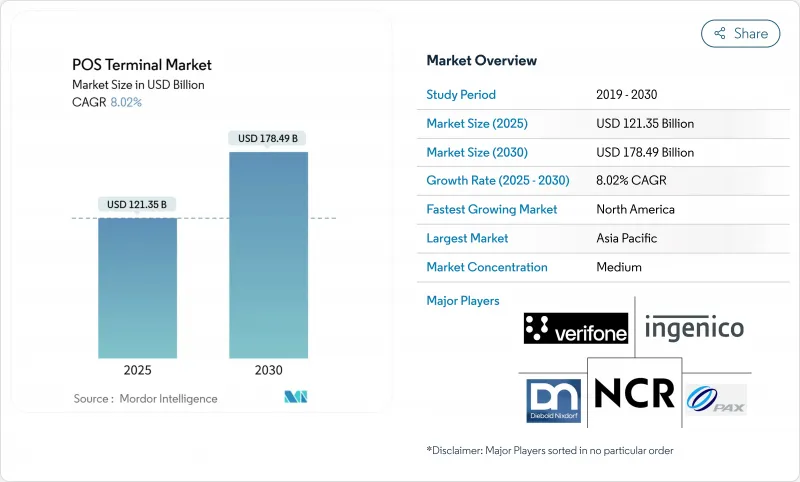

세계의 POS 단말기 시장 규모는 2025년에 1,213억 5,000만 달러로 평가되었고, 2030년에 1,784억 9,000만 달러에 이를 것으로 예측되며, CAGR은 8.02%를 나타낼 전망입니다.

성장은 상인들이 기존 현금 등록기를 클라우드 기반의 분석 중심 시스템으로 교체하면서 비롯됩니다. 이 시스템은 결제 수락 기능과 재고, 고객, 규정 준수 관리를 통합합니다. 비접촉 결제 기능, 생체 인증, 인공지능은 POS 단말기 시장을 단순 거래 처리에서 실시간 비즈니스 인텔리전스로 진화시키고 있습니다. 반도체 부품에 대한 공급망 압박은 하드웨어 생산량을 계속 제약하고 있지만, 소프트웨어 구독 및 하이브리드 배포 모델은 하드웨어 병목 현상에도 불구하고 도입률을 높이고 있습니다. 옴니채널 결제, 규제 준수, 낮은 총소유비용(TCO)을 결합할 수 있는 벤더들이 소매, 숙박, 의료, 운송 분야 전반에 걸친 증가하는 수요를 선점할 수 있는 최적의 위치에 있습니다.

세계의 POS 단말기 시장 동향 및 인사이트

소매 업계 채택 확대

소매업체들은 이제 매장 내 및 온라인 거래를 연결하는 통합 커머스 플랫폼을 도입하여 15-20%의 효율성 향상과 40%의 대기 시간 단축을 달성하고 있습니다. POS 단말기 시장에 연계된 재고 관리는 실시간 재고 가시성을 제공하여 품절을 30%, 과잉 재고 비용을 25% 절감합니다. 소규모 상점들은 기존 레지스터를 건너뛰고 엔터프라이즈급 클라우드 시스템을 도입하는 추세이며, 이는 아시아태평양 지역에서 가장 두드러지게 나타나고 있습니다. 해당 지역의 소매 POS 도입 속도는 글로벌 평균보다 1.5배 빠릅니다. 이러한 추세는 결제, 프로모션, 주문 처리 기능을 통합한 단말기에 대한 수요를 강화합니다. 소매업체에 맞춤형 가격 정책과 지원을 제공하는 공급업체들은 오프라인 매장이 옴니채널 모델로 전환함에 따라 시장 점유율을 확대하고 있습니다.

클라우드 기반 POS 플랫폼 채택 증가

2025년 신규 설치의 73%를 차지하는 클라우드 솔루션은 자본 지출을 운영 지출로 전환하는 중소기업 사이에서 급증하고 있습니다. 지속적인 소프트웨어 업데이트는 기존 시스템 대비 단말 수명을 최대 60% 연장하며 변화하는 세법 규정을 신속히 반영할 수 있게 합니다. 호텔·레스토랑 업계는 클라우드 POS를 활용한 실시간 메뉴·테이블 관리가 평균 주문 금액을 12-18% 끌어올린다는 점을 강조합니다. 다중 관할권 소매업체는 하드웨어 교체 없이 단일 업데이트로 새 세법을 적용할 수 있는 기능을 높이 평가합니다. 이 추세는 항상 연결된 클라우드 환경을 지원하는 광대역 품질이 구현된 POS 단말기 시장 침투를 가속화합니다.

데이터 보안 및 사이버 사기 우려

2024년 사기 시도 37% 증가로 POS 환경에 대한 감시가 강화됩니다. 모바일 POS는 무선 연결을 통해 공격 표면을 확대하여, 규정 준수 및 모니터링을 위해 가맹점당 연간 18,000-25,000달러의 보안 비용 지출을 유발합니다. 하드웨어 교체 주기가 진화하는 위협에 뒤처져 소프트웨어 패치가 필요한 취약점이 발생하며, 이는 성능 저하를 초래할 수 있습니다. 생체 인식은 인증을 강화하지만 지역별로 상이한 개인정보 문제를 야기하여 POS 단말기 시장 내 글로벌 확산을 복잡하게 만듭니다.

부문 분석

2024년 POS 단말기 시장 점유율은 접촉 디바이스가 71%를 차지했지만 비접촉 솔루션은 2030년까지 14.9%의 연평균 복합 성장률(CAGR)를 나타낼 전망입니다. 비접촉형 하드웨어의 POS 단말기 시장 규모는 2025년 배포의 78%가 NFC를 포함하기 때문에 급속히 확대됩니다. 소비자의 선호도는 분명하며, 특히 25달러 이하의 쇼핑에서는 51% 이상이 탭앤고 카드와 월렛을 정기적으로 선택합니다. 칩 앤 PIN과 콘택트리스 모두를 처리하는 하이브리드 단말기는 보안 지향 구매자를 멀리하지 않고 가맹점이 마이그레이션을 관리하는 데 도움이 됩니다.

웨어러블 기기, 모바일 기기 및 생체 인식 탭은 인증 옵션을 확장하고 교통, 숙박, 의료 분야에서 마찰 없는 여정을 가능하게 합니다. 지문 보안 비접촉 결제는 표준 NFC 대비 사기 발생률을 60% 감소시킵니다. 이러한 기능은 공급업체가 토큰화된 신원 데이터와 연계된 분석 구독 서비스를 교차 판매할 수 있는 기반을 마련합니다. 강력한 고객 인증 관련 규제가 강화됨에 따라 생체 인식 검증을 내장한 비접촉 솔루션이 POS 단말기 시장에서 일반 NFC를 능가할 것으로 예상됩니다.

2024년 POS 단말기 시장 규모에서 고정형 단말기가 여전히 54%를 차지하지만, 모바일 시스템은 연평균 12.8% 성장률을 보이고 있습니다. 휴대용 단말기를 도입한 소매 체인점은 대기열이 28% 단축되고 직원 생산성이 15-20% 향상되었다고 보고합니다. 통합 SIM 카드로 작동하는 셀룰러 지원 단말기는 Wi-Fi가 불안정한 환경에서도 연결성을 보장합니다.

의료 분야에서는 병상 결제 기기가 청구 지연을 최대 35% 단축하고 수금률을 25% 향상시킵니다. 이동성은 커브사이드 픽업 및 이벤트 기반 상거래의 기반이 됩니다. 보안은 여전히 문제점으로, 상인의 43%가 모바일 플랫폼 평가 시 데이터 보호를 최대 장애물로 지적하지만, 암호화 통신 및 기기 관리 기술의 발전으로 점차 격차가 좁혀지고 있습니다. 정부 등급 보안 프로토콜을 확보한 공급업체는 POS 단말기 시장의 추가 성장을 이끌 수 있습니다.

POS 단말기 시장은 결제 수단(접촉형, 비접촉형), POS 유형(고정 POS 시스템, 모바일/휴대용 POS 시스템), 컴포넌트(하드웨어, 소프트웨어, 서비스), 전개 형태(클라우드 기반, 온프레미스), 최종 사용자 산업(소매, 접객, 헬스케어 등), 지역별로 구분됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역 분석

아시아태평양 지역은 무현금 경제를 위한 정부 캠페인과 모바일 중심 소비자 문화에 힘입어 POS 단말기 시장을 주도하고 있습니다. 중국, 일본, 한국은 높은 거래량을 기록하는 반면, 인도와 싱가포르는 각각 ‘디지털 인도’ 및 ‘스마트 네이션’ 이니셔티브 아래 급속히 성장하고 있습니다. 지역 카드 결제 규모는 2025년 24조 7,000억 달러에 달할 전망입니다. 생체 인증 도입이 증가하며 인구 밀집 도시에서 신원 확인이 원활해지고 있습니다. 그러나 농촌 지역의 연결성 격차와 이질적인 규제로 인해 오프라인 처리를 지원하는 유연한 아키텍처가 필요합니다.

남미는 2030년까지 연평균 10.4% 성장률로 가장 빠르게 성장하는 지역입니다. 브라질은 Stone, Pagseguro 등 단말기 제조사와 디지털 인수업체 간 협력을 통해 성장 동력을 확보하고 있습니다. 여러 국가에서 성인 인구의 70%가 여전히 은행 계좌를 보유하지 않은 상태인 만큼, 금융 포용 프로그램은 대체 결제 수단을 관리하는 기기에 대한 수요를 창출합니다. 멕시코, 코스타리카 등지에서 시행되는 전자 세금계산서 법안은 하드웨어 또는 소프트웨어의 신속한 업그레이드를 촉진하고 있습니다.

북미는 비접촉 결제 및 AI 기반 분석 기술의 조기 도입을 통해 규모를 유지하고 있습니다. 2025년 기준 미국 단독으로 291억 1,000만 달러 규모의 POS 시장을 형성했습니다. 유럽은 의무적 전자세금계산서 제도로 발전 중이며, 스페인의 Verifactu 도입이 교체 수요의 주요 촉매제입니다. 중동 및 아프리카는 스마트폰 보급률과 도시화가 교차하는 고성장 지역을 제공하지만, 인프라 한계로 인해 농촌 지역 보급은 여전히 더딘 상황입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 소매 업계에서의 채택 확대

- 클라우드 기반 POS 플랫폼 채택 증가

- 비접촉형 결제와 모바일 결제 수요 가속

- POS 데이터와 고급 분석 및 CRM의 통합

- 재정화 및 전자 청구서 의무화에 대한 규제 추진

- 자본 지출을 낮추는 “서비스형 POS(POS-as-a-Service)” 구독 모델

- 시장 성장 억제요인

- 데이터 보안과 사이버 사기 우려

- 하드웨어 신뢰성과 유지보수 비용 문제

- 지역별 결제 표준의 분산화

- 반도체 공급망의 불안정성

- 밸류체인 분석

- 규제 상황

- 기술 전망(IoT, AI, 엣지 프로세싱)

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장의 거시 경제 동향 평가

제5장 시장 규모와 성장 예측(가치)

- 결제 방법별

- 접촉형

- 비접촉형

- POS 유형별

- 고정 POS 시스템

- 모바일/휴대용 POS 시스템

- 컴포넌트별

- 하드웨어

- 소프트웨어

- 서비스

- 전개 모드별

- 클라우드 기반

- 온프레미스

- 최종 사용자 업계별

- 소매

- 접객

- 헬스케어

- 운송 및 물류

- 기타 최종 사용자 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 동남아시아

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 중동

- GCC

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(MandA, 파트너십, 자금 조달)

- 시장 점유율 분석

- 기업 프로파일

- Ingenico SA(Worldline)

- VeriFone Systems Inc.

- PAX Technology Ltd.

- NCR Corporation

- Diebold Nixdorf Inc.

- Toshiba Global Commerce Solutions

- HP Inc.

- Panasonic Corporation

- Fujitsu Ltd.

- Samsung Electronics Co. Ltd.

- Newland Payment Technology

- BBPOS Ltd.

- Square Inc.(Block)

- Fiserv Inc.(Clover)

- Lightspeed Commerce Inc.

- Shopify Inc.(Shopify POS)

- Toast Inc.

- Revel Systems Inc.

- Oracle Corporation(MICROS)

- Agilysys Inc.

- Aptos Inc.

- GK Software SE

- NEC Corporation

- NEXGO(Shenzhen Xinguodu Technology)

- Qashier Pte Ltd.

- Cegid Group

- Cow Hills Retail BV

- PCMS Group Ltd.

제7장 시장 기회와 장래의 전망

HBR 25.11.12The global POS terminal market is valued at USD 121.35 billion in 2025 and is forecast to reach USD 178.49 billion by 2030, advancing at an 8.02% CAGR.

Growth stems from merchants replacing legacy cash registers with cloud-enabled, analytics-driven systems that blend payment acceptance with inventory, customer, and compliance management. Contactless capability, biometric authentication, and artificial intelligence are moving the POS terminal market beyond transaction handling toward real-time business intelligence. Supply-chain pressure on semiconductor components continues to constrain hardware output, but software subscriptions and hybrid deployment models are lifting adoption despite hardware bottlenecks. Vendors that can combine omnichannel payments, regulatory compliance, and low total cost of ownership are best placed to capture incremental demand across retail, hospitality, healthcare, and transportation.

Global POS Terminal Market Trends and Insights

Growing Adoption in the Retail Sector

Retailers now deploy unified commerce platforms that connect in-store and online transactions, generating 15-20% efficiency gains and cutting queues by 40%. Inventory linked to the POS terminal market enables real-time stock visibility, which trims stockouts by 30% and excess inventory costs by 25%. Small merchants are bypassing legacy registers and embracing enterprise-grade cloud systems, a pattern most visible across Asia-Pacific where retail POS roll-outs outpace global averages by 1.5 times. The momentum reinforces demand for terminals that merge payment, promotion and fulfilment functions. Suppliers that tailor pricing and support to smaller retailers gain share as brick-and-mortar stores pivot toward omnichannel models.

Rising Adoption of Cloud-Based POS Platforms

Cloud solutions account for 73% of new installations in 2025, up sharply among small and mid-sized enterprises that convert capital expense to operating outflow. Continuous software updates extend terminal life by as much as 60% compared with traditional systems and allow rapid alignment with changing fiscal rules. Hospitality operators highlight the advantage; real-time menu and table management using cloud POS typically lifts average ticket values by 12-18%. Multi-jurisdiction retailers value the ability to roll out new tax rules through a single update rather than hardware swaps. The trend accelerates penetration of the POS terminal market, where broadband quality supports always-on cloud connectivity.

Data-Security and Cyber-Fraud Concerns

A 37% rise in fraud attempts during 2024 heightens scrutiny of POS environments. Mobile POS broadens attack surfaces through wireless links, prompting annual security outlays of USD 18,000-25,000 per merchant for compliance and monitoring. Hardware refresh cycles lag evolving threats, creating gaps that require software patches, which may erode performance. Biometrics harden authentication yet introduce privacy issues that differ across regions, complicating global roll-outs within the POS terminal market.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Demand for Contactless & Mobile Payments

- Integration of POS Data with Advanced Analytics and CRM

- Hardware Reliability and Maintenance-Cost Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Contact-based devices retained 71% of the POS terminal market share in 2024, but contactless solutions are scaling at a 14.9% CAGR through 2030. The POS terminal market size for contactless-enabled hardware is set to widen rapidly as 78% of 2025 deployments include NFC. Consumer preference is clear: more than 51% regularly choose tap-and-go cards or wallets, especially for purchases below USD 25. Hybrid terminals that process both chip-and-PIN and contactless help merchants manage the transition without alienating security-minded shoppers.

Wearables, mobile devices and biometric taps expand authentication options and open the door to frictionless journeys in transit, hospitality and healthcare. Fingerprint-secured contactless payments cut fraud by 60% versus standard NFC. Such capability positions vendors to cross-sell analytics subscriptions tied to tokenised identity data. As regulations tighten around strong customer authentication, contactless solutions that embed biometric checks are expected to outperform generic NFC in the POS terminal market.

Fixed units still account for 54% of the POS terminal market size in 2024, yet mobile systems are accelerating at 12.8% CAGR. Retail chains deploying handheld devices report 28% shorter queues and 15-20% higher associate productivity. Cellular-enabled terminals operating with integrated SIM cards guarantee connectivity even where Wi-Fi falters.

In healthcare, bedside payment devices cut billing delays by up to 35% and improve collection rates by 25%. Mobility also underpins curbside pickup and event-based commerce. Security remains an issue, with 43% of merchants flagging data protection as the top hurdle when evaluating mobile platforms, but progress in encrypted communication and device management is gradually closing the gap. Providers that lock in government-grade security protocols can unlock further growth in the POS terminal market.

Point of Sale Terminal Market is Segmented by Mode of Payment Acceptance (Contact-Based, Contactless), POS Type (Fixed Point-Of-Sale Systems, Mobile / Portable Point-Of-Sale Systems), Component (Hardware, Software, Services), Deployment Mode (Cloud-Based, On-Premise), End-User Industry (Retail, Hospitality, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the POS terminal market, propelled by government campaigns for cashless economies and a mobile-first consumer culture. China, Japan, and South Korea supply high transaction volumes, while India and Singapore climb rapidly under Digital India and Smart Nation initiatives, respectively. Regional card payments are expected to reach USD 24.7 trillion in 2025. Biometric verification adoption is rising, smoothing identity checks across densely populated cities. Yet, rural connectivity gaps and heterogeneous regulations require flexible architectures that support offline processing.

South America represents the fastest-growing region with a 10.4% CAGR forecast to 2030. Brazil drives momentum through partnerships between terminal makers and digital acquirers such as Stone and Pagseguro. Financial inclusion programmes create demand for devices that manage alternative payments, as 70% of adults remain unbanked in several countries. Fiscal e-invoicing laws across Mexico, Costa Rica, and others compel rapid hardware or software upgrades.

North America maintains scale through early adoption of contactless and AI-driven analytics. The United States alone accounted for a USD 29.11 billion POS segment in 2025. Europe progresses under mandatory fiscalisation; Spain's Verifactu rollout is a prominent trigger for replacements. The Middle East and Africa offer pockets of high growth where smartphone penetration and urbanisation intersect, though infrastructure limitations continue to slow rural uptake.

- Ingenico SA (Worldline)

- VeriFone Systems Inc.

- PAX Technology Ltd.

- NCR Corporation

- Diebold Nixdorf Inc.

- Toshiba Global Commerce Solutions

- HP Inc.

- Panasonic Corporation

- Fujitsu Ltd.

- Samsung Electronics Co. Ltd.

- Newland Payment Technology

- BBPOS Ltd.

- Square Inc. (Block)

- Fiserv Inc. (Clover)

- Lightspeed Commerce Inc.

- Shopify Inc. (Shopify POS)

- Toast Inc.

- Revel Systems Inc.

- Oracle Corporation (MICROS)

- Agilysys Inc.

- Aptos Inc.

- GK Software SE

- NEC Corporation

- NEXGO (Shenzhen Xinguodu Technology)

- Qashier Pte Ltd.

- Cegid Group

- Cow Hills Retail BV

- PCMS Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption in the retail sector

- 4.2.2 Rising adoption of cloud-based POS platforms

- 4.2.3 Accelerating demand for contactless and mobile payments

- 4.2.4 Integration of POS data with advanced analytics and CRM

- 4.2.5 Regulatory push for fiscalisation and e-invoicing mandates

- 4.2.6 "POS-as-a-Service" subscription models lowering cap-ex

- 4.3 Market Restraints

- 4.3.1 Data-security and cyber-fraud concerns

- 4.3.2 Hardware reliability and maintenance-cost issues

- 4.3.3 Fragmentation of regional payment standards

- 4.3.4 Semiconductor supply-chain volatility

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (IoT, AI, Edge-processing)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Mode of Payment Acceptance

- 5.1.1 Contact-based

- 5.1.2 Contactless

- 5.2 By POS Type

- 5.2.1 Fixed Point-of-Sale Systems

- 5.2.2 Mobile / Portable Point-of-Sale Systems

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Deployment Mode

- 5.4.1 Cloud-based

- 5.4.2 On-Premise

- 5.5 By End-User Industry

- 5.5.1 Retail

- 5.5.2 Hospitality

- 5.5.3 Healthcare

- 5.5.4 Transportation and Logistics

- 5.5.5 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Italy

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Southeast Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, Partnerships, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ingenico SA (Worldline)

- 6.4.2 VeriFone Systems Inc.

- 6.4.3 PAX Technology Ltd.

- 6.4.4 NCR Corporation

- 6.4.5 Diebold Nixdorf Inc.

- 6.4.6 Toshiba Global Commerce Solutions

- 6.4.7 HP Inc.

- 6.4.8 Panasonic Corporation

- 6.4.9 Fujitsu Ltd.

- 6.4.10 Samsung Electronics Co. Ltd.

- 6.4.11 Newland Payment Technology

- 6.4.12 BBPOS Ltd.

- 6.4.13 Square Inc. (Block)

- 6.4.14 Fiserv Inc. (Clover)

- 6.4.15 Lightspeed Commerce Inc.

- 6.4.16 Shopify Inc. (Shopify POS)

- 6.4.17 Toast Inc.

- 6.4.18 Revel Systems Inc.

- 6.4.19 Oracle Corporation (MICROS)

- 6.4.20 Agilysys Inc.

- 6.4.21 Aptos Inc.

- 6.4.22 GK Software SE

- 6.4.23 NEC Corporation

- 6.4.24 NEXGO (Shenzhen Xinguodu Technology)

- 6.4.25 Qashier Pte Ltd.

- 6.4.26 Cegid Group

- 6.4.27 Cow Hills Retail BV

- 6.4.28 PCMS Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment