|

시장보고서

상품코드

1851271

의료기기 포장 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Medical Devices Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

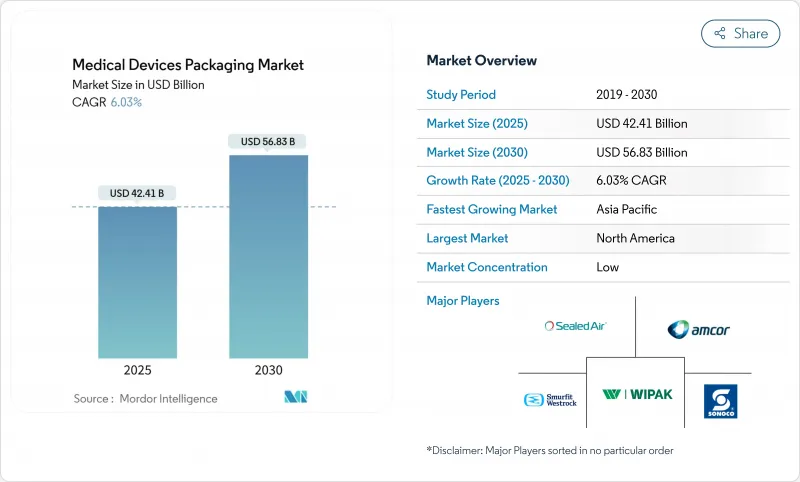

의료기기 포장 시장 규모는 2025년에 424억 1,000만 달러로 추정되고, 2030년에는 568억 3,000만 달러에 이를 전망이며, CAGR 6.03%로 선진할 것으로 예측되고 있습니다.

이 기세를 뒷받침하는 것은 무균 기준의 엄격화, 스마트 라벨 기술의 급속한 채용, 고성능 배리어 형식을 필요로 하는 저침습성 기기나 웨어러블 기기의 꾸준한 파이프라인입니다. 고리형 올레핀 공중합체 및 액정 중합체와 같은 중합체는 고온 멸균을 견디는 반면, RFID의 통합을 가능하게 하기 때문에 재료의 혁신은 여전히 핵심 성장 레버입니다. 위탁 멸균 네트워크는 계속 확대되고 있으며 여러 시설에서 일관된 성능을 발휘하는 표준화된 1차 팩에 대한 수요가 증가하고 있습니다. 동시에 원료 비용 변동 및 산화 에틸렌 생산 능력의 한계로 인해 컨버터는 대체 멸균 방법에 대응하는 팩을 재설계해야 하며 비용 압력과 혁신의 창구가 모두 형성되었습니다. 지역적으로는 북미가 시장의 주도권을 유지하고 있지만, 중국과 인도의 병원 건설과 정책적 지원을 통한 현지 생산으로 아시아태평양이 가장 빠르게 매출을 늘리고 있습니다.

세계의 의료기기 포장 시장 동향 및 인사이트

긴 수명 형식에 대한 수요 증가

헬스케어 제공자는 팬데믹에 대한 대비나 지방에 대한 지원 활동으로 보충 사이클이 늘어나기 때문에, 5-7년간 사용 가능한 기기를 요구하고 있습니다. 에틸렌 비닐 알코올과 메탈라이즈드 폴리에스테르를 사용한 배리어 필름은 현재 이러한 긴 수명을 실현하고 있으며, 듀폰이 2025년 코스타리카에서 실시하는 확장 공사(무균 타이벡 팩 전용으로 16,000피트 2를 추가)는 뛰어난 배리어에 대한 세계적인 뒷받침을 지원합니다. 가속 에이징과 실시간 안정성 프로토콜은 일상적이 되고 있어 구입 가격은 상승하는 반면, 재료의 선택은 프리미엄 폴리머로 시프트 하고 있습니다.

저침습성 및 웨어러블 기기의 성장

새로운 복강경 수술 기구 및 커넥티드 웨어러블은 복잡한 형상과 섬세한 전자 기기를 탑재하고 있기 때문에 부드럽고 무균적인 봉쇄가 요구됩니다. 소형 수술 세트에는 맞춤형 캐비티를 가진 열 성형 트레이가 주류이며, 가정에서 사용되는 스마트 패치에는 감온성 잉크를 포함한 유연한 파우치가 적합합니다. 스킨 포장의 과학자들은 웨어러블 센서의 피부 안전을 보장하기 위해 접착제의 전환을 완화하기 위해 노력하고 있습니다.

규제 준수 비용 부담

EU의 MDR에서는 각 팩 구성이 생체 적합성, 가속 노화, 유통 시뮬레이션 배터리를 통과해야 하므로 검증 비용이 25-30% 증가하고 있습니다. 소규모 컨버터는 테스트 반복을 억제하기 위해 플랫폼을 통합하지만, 이는 용도 적합성을 손상시킬 수 있습니다. 이 복잡성은 비용이 많이 드는 비용으로 문서 작성을 안내하는 틈새 컨설팅 분야를 만듭니다.

부문 분석

2024년에는 플라스틱이 의료기기 포장 시장의 55.23%를 차지하였고, 2030년까지 CAGR 8.22%로 이 부문이 성장을 선도할 전망입니다. 고리형 올레핀 공중합체와 같은 고급 폴리머는 휘어짐 없이 증기 멸균 및 플라즈마 멸균을 가능하게 하며, 액정 폴리머는 스마트 회로의 매립을 지원합니다. 그 결과, 의료기기 포장 시장은 기존의 유리나 금속의 1차 포장으로부터 꾸준히 이행하고 있습니다. 판지는 비용 효율성이 장벽 성능에 우선하는 2차적인 역할을 담당합니다. 바이오 베이스 플라스틱은 판매량의 5% 미만이지만, 병원의 지속가능성 스코어카드와 아시아태평양의 바이오폴리머 거점으로서의 대두에 의해 2자리의 신장을 기록하고 있습니다.

감마선 멸균과 전자선 멸균에 견디는 다층 필름에 대한 수요가 높아져 미국과 말레이시아의 공압출 라인에 대한 설비 투자가 활발해지고 있습니다. 폴리머 공급업체는 수직 통합을 활용하여 의료 등급 수지 순도를 보장하고 효과적인 장벽 시스템의 확실한 파트너로서의 지위를 확립합니다. 이러한 역학은 예측 기간 동안 의료기기 포장 시장에서 플라스틱의 압도적인 점유율을 유지할 것으로 예측됩니다.

파우치와 가방은 1회 사용 일회용 기구와 전자 카테터에 범용성이 있기 때문에 2024년 매출의 36.32%를 차지했습니다. 그러나 정형외과와 심장혈관의 개입에 있어서의 키트의 복잡성은 단단한 상자나 카톤 수요를 높여, 이 포맷이 CAGR 9.32%의 페이스로 추이하는 원인이 되고 있습니다. 그 결과, 타이벡으로 뒷받침된 다층 판지가 외부의 강성과 내부의 무균성을 공존시켜야 하는 장소에서 점유율을 확대하고 있습니다. 트레이는 섬세한 범위에 필수적이며 열 성형 물집은 진단 스트립과 같은 소품을 보호합니다.

제3자 멸균업체는 수술실에서 프레젠테이션을 가속화하기 위해 최적화된 박리성을 갖춘 플랫 파우치에 대한 요구가 증가하고 있습니다. 이와 병행하여, 판지 공급자는 임상의가 봉인하지 않고 기구 세트를 확인할 수 있도록 투명한 개구부를 통합합니다. 이러한 편리한 개선은 의료기기 포장 시장에서 제품 유형의 다양화를 촉진합니다.

지역 분석

2024년의 점유율은 북미가 35.43%로 톱이었으며, 미국의 견고한 기기 혁신 기반과 FDA의 명확한 검증 패스웨이가 뒷받침하고 있습니다. 캐나다 병원 현대화 프로그램은 비용 효율적인 팩 수요를 끌어올리고, 멕시코의 마키라도라 클러스터는 FDA와 COFEPRIS 기준을 모두 충족하는 국경을 넘는 포장 라인을 통합합니다. 재료 순환의 목표는 미국의 여러 병원 시스템에서 재활용 가능한 고밀도 폴리에틸렌 필름의 시험을 시작하고 Amcor의 폐쇄 루프 프로젝트 확대가 이러한 노력을 뒷받침하고 있습니다.

아시아태평양은 중국, 일본, 인도를 중심으로 CAGR 10.83%로 전진하고 있습니다. 중국은 2,100억 달러의 장치 시장이 예측되고 라벨의 현지화 투자 및 UDI 준수 인쇄를 촉구하고 컨버터를 소주 등의 지방 거점으로 끌어들이고 있습니다. 일본에서는 고령화가 진행되어 긴 수명 파우치가 들어간 가정용 키트의 요구가 높아지고 있습니다.

유럽은 성숙하면서도 기술 혁신 주도형입니다. EU의 MDR은 다국어 디스플레이와 재활용 가능성을 증명할 것을 의무화하고 있으며 독일의 정형외과 클러스터는 포장 연구소와 제휴하여 단일 소재 무균 시스템을 시작하고 있습니다. EU 이탈 후에는 EU와 영국 시장을 타겟으로 하는 수출업체에게 이중 인증이 의무화됩니다. 중동 및 아프리카는 걸프 국가들이 새로운 병원에 위탁하고 있는 것으로 꾸준한 성장을 기록하고 있으며, 남미의 성장은 브라질 국내의 페이스메이커 라인이 현지 컨버터로부터 타이벡 트레이를 조달하고 있는 것에 기인하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 유통기한 연장 포맷에 대한 수요 증가

- 저침습 및 웨어러블 디바이스의 성장

- 세계 무균규제 강화(ISO 11607, EU MDR, FDA)

- RFID/UDI 스마트 라벨 및 추적성 통합

- 탄소발자국의 개시가 모노 머티리얼 촉진

- 외부 위탁 멸균 네트워크의 확대

- 시장 성장 억제요인

- 규제 대응 비용 부담

- 불안정한 의료용 폴리머 가격

- 바이오 베이스 수지 및 PCR 수지의 희소성

- 콜드체인 전자상거래의 씰 불량 리콜

- 공급망 분석

- 규제 상황

- 기술의 전망

- 지속가능성 동향 및 LCA의 영향

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 재료별

- 플라스틱

- 종이 및 판지

- 금속 및 박

- 유리

- 바이오 베이스 플라스틱

- 제품 유형별

- 파우치 및 가방

- 트레이

- 상자 및 판지

- 블리스터 팩

- 기타 제품 유형

- 용도별

- 무균 포장

- 비무균 포장

- 액티브 및 스마트 패키징

- 최종 사용자별

- 병원 및 클리닉

- 화상 진단센터

- 재택 헬스케어

- 수탁 제조 및 멸균 기관

- 포장 레벨별

- 1차

- 2차

- 3차

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주, 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Amcor plc

- DuPont de Nemours Inc.

- Smurfit WestRock

- Mitsubishi Chemical Group

- Sonoco Products Company

- Technipaq Inc.

- SteriPack Group

- Riverside Medical Packaging

- Wipak Group

- 3M Company

- Sealed Air Corporation

- Constantia Flexibles

- Klockner Pentaplast Group

- Placon Corporation

- West Pharmaceutical Services

- Nelipak Healthcare Packaging

- Oliver Healthcare Packaging

- Tekni-Plex

- Multivac Group

제7장 시장 기회 및 향후 전망

AJY 25.11.21The medical device packaging market size is USD 42.41 billion in 2025 and is forecast to reach USD 56.83 billion by 2030, advancing at a 6.03% CAGR.

This momentum is underpinned by tighter sterility standards, rapid adoption of smart-label technologies, and a steady pipeline of minimally invasive and wearable devices that demand high-performance barrier formats. Material innovation remains a core growth lever because polymers such as cyclic olefin copolymers and liquid-crystal polymers withstand high-temperature sterilization while enabling RFID integration. Contract sterilization networks continue to expand, which raises demand for standardized primary packs that perform consistently across multiple facilities. At the same time, raw-material cost volatility and limited ethylene oxide capacity are forcing converters to redesign packs for alternative sterilization methods, creating both cost pressures and innovation windows. Geographically, North America preserves market leadership yet Asia-Pacific delivers the fastest incremental revenue, thanks to hospital build-outs in China and India and policy-backed local manufacturing.

Global Medical Devices Packaging Market Trends and Insights

Rising Demand for Extended-Shelf-Life Formats

Healthcare providers want devices that remain usable for five to seven years because pandemic preparedness and rural outreach stretch replenishment cycles. Barrier films incorporating ethylene vinyl alcohol and metallized polyester now deliver that longevity, and DuPont's 2025 Costa Rica expansion-adding 16,000 ft2 solely for sterile Tyvek packs-underscores the global push for superior barriers. Accelerated-aging and real-time stability protocols are becoming routine, shifting material choice toward premium polymers despite higher purchase prices.

Growth in Minimally-Invasive and Wearable Devices

New laparoscopic tools and connected wearables feature complex geometries and sensitive electronics that require gentle yet sterile containment. Thermoformed trays with custom cavities dominate for small surgical sets, whereas flexible pouches embedded with temperature-sensitive inks suit smart patches destined for home use. Packaging scientists are also mitigating adhesive migration to ensure skin safety for wearable sensors, a challenge cited by device integrators interviewed across APAC clinics.

Regulatory Compliance Cost Burden

Validation outlays have risen 25-30% under the EU MDR because each pack configuration must pass biocompatibility, accelerated-aging, and distribution-simulation batteries. Smaller converters are consolidating platforms to curb test repetition, yet this can compromise application fit. The complexity fuels a niche consulting segment that guides dossier compilation at premium fees.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Global Sterility Regulations

- Integration of RFID/UDI Smart-Label Traceability

- Volatile Medical-Grade Polymer Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics retained 55.23% of the medical device packaging market in 2024, and the segment leads growth with an 8.22% CAGR through 2030. Advanced polymers such as cyclic olefin copolymers enable steam and plasma sterilization without warping, whereas liquid-crystal polymers support smart circuitry embedment. As a result, the medical device packaging market records steady migration away from legacy glass and metal for primary packs. Paperboard continues in secondary roles where cost efficiency trumps barrier performance. Bio-based plastics, though under 5% of volume, post double-digit expansion riding on hospital sustainability scorecards and Asia-Pacific's emergence as a biopolymer hub.

Rising demand for multi-layer films that withstand gamma and e-beam sterilization fuels capital investment in co-extrusion lines across the United States and Malaysia. Polymer suppliers leverage vertical integration to guarantee medical-grade resin purity, positioning themselves as assured partners for validated barrier systems. These dynamics are expected to uphold plastics' commanding share of the medical device packaging market through the forecast horizon.

Pouches and bags delivered 36.32% of 2024 revenues owing to their versatility across single-use disposables and electronic catheters. However, kit complexity in orthopedic and cardiovascular interventions lifts demand for rigid boxes and cartons, causing this format to pace at a 9.32% CAGR. Consequently, multilayer cartons lined with Tyvek are gaining share where outer rigidity and inner sterility must coexist. Trays remain indispensable for delicate scopes, while thermoformed blisters secure small items such as diagnostic strips.

Third-party sterilizers increasingly request flat pouches equipped with optimized peelability that speeds operating-room presentation. In parallel, carton suppliers integrate transparent apertures so clinicians can verify instrument sets without breaking seals. These usability tweaks reinforce product-type diversification within the medical device packaging market.

The Medical Device Packaging Market Report is Segmented by Material (Plastics, Paper and Paperboard, and More), Product Type (Pouches and Bags, and More), Application (Sterile Packaging, Non-Sterile Packaging, Active/Smart Packaging), End User (Hospitals and Clinics, Diagnostic and Imaging Centers, and More ), Packaging Level (Primary, Secondary, Tertiary), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35.43% share in 2024, propelled by the United States' robust device innovation base and FDA's clear validation pathways. Canadian hospital-modernization programs boost demand for cost-effective packs, while Mexico's maquiladora clusters integrate cross-border packaging lines that meet both FDA and COFEPRIS standards. Material circularity targets drive trial runs of recyclable high-density polyethylene film across several US hospital systems, initiatives supported by Amcor's expanded closed-loop projects.

Asia-Pacific advances at a 10.83% CAGR, anchored by China, Japan, and India. China's forecast USD 210 billion device market prompts label-localization investments and UDI-compliant printing, drawing converters into provincial hubs such as Suzhou. Japan's ageing demographic multiplies the need for home-use kits preserved in long-life pouches, while India's Make-in-India incentives attract joint ventures that erect extrusion and die-cutting capacity near Ahmedabad.

Europe remains mature yet innovation-driven. The EU MDR compels multi-language labeling and proof of recyclability, and Germany's orthopedic cluster partners with packaging labs to prototype mono-material sterility systems. Post-Brexit divergence obliges dual certification for exporters targeting both EU and UK markets. The Middle East and Africa record steady gains as Gulf states commission new hospitals, whereas South America's growth stems from Brazil's domestic pacemaker lines that now source Tyvek trays from local converters.

- Amcor plc

- DuPont de Nemours Inc.

- Smurfit WestRock

- Mitsubishi Chemical Group

- Sonoco Products Company

- Technipaq Inc.

- SteriPack Group

- Riverside Medical Packaging

- Wipak Group

- 3M Company

- Sealed Air Corporation

- Constantia Flexibles

- Klockner Pentaplast Group

- Placon Corporation

- West Pharmaceutical Services

- Nelipak Healthcare Packaging

- Oliver Healthcare Packaging

- Tekni-Plex

- Multivac Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for extended-shelf-life formats

- 4.2.2 Growth in minimally-invasive and wearable devices

- 4.2.3 Stricter global sterility regulations (ISO 11607, EU MDR, FDA)

- 4.2.4 Integration of RFID/UDI smart-label traceability

- 4.2.5 Carbon-footprint disclosure pushing mono-materials

- 4.2.6 Expansion of outsourced contract sterilization networks

- 4.3 Market Restraints

- 4.3.1 Regulatory compliance cost burden

- 4.3.2 Volatile medical-grade polymer prices

- 4.3.3 Scarcity of bio-based and PCR resins

- 4.3.4 Cold-chain e-commerce seal-failure recalls

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Sustainability Trends and LCA Impact

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Paper and Paperboard

- 5.1.3 Metals and Foils

- 5.1.4 Glass

- 5.1.5 Bio-based Plastics

- 5.2 By Product Type

- 5.2.1 Pouches and Bags

- 5.2.2 Trays

- 5.2.3 Boxes and Cartons

- 5.2.4 Blister Packs

- 5.2.5 Other Product Types

- 5.3 By Application

- 5.3.1 Sterile Packaging

- 5.3.2 Non-sterile Packaging

- 5.3.3 Active / Smart Packaging

- 5.4 By End User

- 5.4.1 Hospitals and Clinics

- 5.4.2 Diagnostic and Imaging Centers

- 5.4.3 Home Healthcare

- 5.4.4 Contract Manufacturing and Sterilization Orgs

- 5.5 By Packaging Level

- 5.5.1 Primary

- 5.5.2 Secondary

- 5.5.3 Tertiary

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 DuPont de Nemours Inc.

- 6.4.3 Smurfit WestRock

- 6.4.4 Mitsubishi Chemical Group

- 6.4.5 Sonoco Products Company

- 6.4.6 Technipaq Inc.

- 6.4.7 SteriPack Group

- 6.4.8 Riverside Medical Packaging

- 6.4.9 Wipak Group

- 6.4.10 3M Company

- 6.4.11 Sealed Air Corporation

- 6.4.12 Constantia Flexibles

- 6.4.13 Klockner Pentaplast Group

- 6.4.14 Placon Corporation

- 6.4.15 West Pharmaceutical Services

- 6.4.16 Nelipak Healthcare Packaging

- 6.4.17 Oliver Healthcare Packaging

- 6.4.18 Tekni-Plex

- 6.4.19 Multivac Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment