|

시장보고서

상품코드

1639376

스페인의 재생에너지 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Spain Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

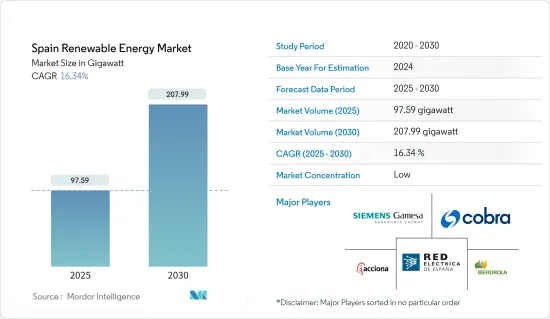

스페인의 재생에너지 시장 규모는 2025년에 97.59기가와트로 추정됩니다. 예측기간(2025-2030년)의 CAGR은 16.34%로, 2030년에는 207.99기가와트에 달할 것으로 예측됩니다.

시장은 지역 운영 중단과 공급망 혼란으로 인해 프로젝트 지연으로 이어지는 COVID-19의 발생으로 부정적인 영향을 받았습니다. 현재 시장은 팬데믹 전 수준에 도달하고 있습니다.

주요 하이라이트

- 스페인의 재생에너지 시장은 앞으로 수년간 강력한 성장이 예상됩니다. 이 성장의 주요 요인은 좋은 기상 조건과 국가와 지역 포럼이 조달한 많은 자금을 사용할 수 있다는 것입니다.

- 그러나 재생에너지는 다른 전통적인 연료와 같이 단기적인 유연성을 제공하지 않고 장기적인 백업 계획을 필요로 하기 때문에 시장은 송전 유연성 문제로 인한 병목 현상에 직면할 수 있습니다.

- 이 나라는 2035년까지 원자력발전과 석탄화력발전의 완전한 단계적 폐지를 계획하고 있습니다. 국가의 에너지 계획에서 이산화탄소 배출량 감소 목표는 에너지 믹스에서 원자력을 제거하도록 촉구하고 있습니다. 7기의 원자력발전소 중 이미 4기가 2030년까지 폐쇄될 예정이며, 2020년에는 22%였던 원자력의 비율은 2030년에는 7% 정도가 됩니다. 이 이니셔티브는 재생에너지를 기반으로 하는 에너지 시장에 충분한 기회를 제공할 것으로 예상됩니다.

스페인의 재생에너지 시장 동향

풍력기술이 시장을 독점할 전망

- 스페인에서는 최근 몇 년 동안 국제 포럼과 민간 기업의 풍력 기술에 대한 대규모 투자가 진행되어 풍력 발전 점유율이 급속히 확대되었습니다. 이 나라의 재생에너지발전에 차지하는 풍력발전의 비율은 2022년 시점에서 약 43%를 나타낼 전망입니다.

- 2021년에 발표된 스페인 정부의 국가 통합 에너지·기후 계획에 따르면 풍력 터빈의 설비 용량은 2030년까지 2배 이상이 될 것으로 예상되고 있습니다. 스페인의 풍력 발전을 가속시키기 위해 많은 해상 및 육상 프로젝트가 열을 이루고 있습니다.

- Red Electrica에 따르면 2022년 스페인의 풍력발전 누적 용량은 2만 9,729MW로 연간 성장률은 약 4%입니다. 새로운 풍력발전 프로젝트가 증가함에 따라 풍력에너지에 대한 수요가 증가할 것으로 예상되며, 이는 예측기간 시장을 견인하게 됩니다.

- 2023년 2월, Repsol은 스페인의 카스티야 일레온에 있는 회사 최초의 재생에너지 발전 프로젝트인 PI에서 청정 에너지의 발전을 시작했습니다. PI 프로젝트에는 총 설비 용량 175MW의 풍력 발전소 7개가 포함됩니다.

- 이러한 개발로 인해 풍력 발전은 스페인의 재생에너지 발전 시장을 독점할 것으로 예상됩니다.

정부의 규제와 시책이 시장을 견인할 가능성

- 스페인 정부는 발전 부문에서 재생에너지의 성장을 가속하기 위해 몇 가지 계획과 조치를 발표하고 있습니다. 이러한 이니셔티브와 프로젝트 투자를 통해 2021년 시점에서 총 발전량에서 차지하는 재생에너지의 비율은 약 42%입니다.

- 국제재생에너지기구(International Renewable Energy Agency)에 따르면 2022년 스페인의 재생에너지의 총 설비 용량은 6만 7,909MW로 2021년 대비 9.05% 증가했습니다. 재생에너지에 대한 정부의 지원 시책으로 재생에너지의 설비 용량은 앞으로도 증가할 것으로 예상됩니다.

- 예를 들어 EU 규정을 준수하고 국가의 온실가스 배출량(GHG) 감축 목표를 달성하기 위해 스페인 정부는 2021-2030년의 통합 국가에너지·기후계획(PNACC)을 채택했습니다. 이 10개년 계획에서는 전력, 운수, 산업 부문으로부터의 온실가스 총 배출량을 삭감함으로써 탄소중립의 달성을 목표로 하고 있습니다.

- 2021년 12월, 스페인 정부는 재생에너지 프로젝트를 지원하는 민간 자금 대책을 승인하고 녹색 에너지 전환의 조기 달성을 기대했습니다. 이 계획 하에 정부는 혁신적인 녹색 에너지 기술을 위해 77억 7,000만 달러 이상의 공적 자금을 할당했습니다.

- 2022년 7월, REER, 스페인 생태적 이행·인구학적 과제부(MITECO)는 제3회와 제4회의 재생에너지 입찰을 발표했습니다. 스페인 전력의 74%를 재생에너지 발전으로 충분하지 않은 현재 배출되고 있는 온실가스의 3톤에 1톤을 삭감하기 위해 스페인국가통합에너지·기후계획(PNIEC)은 60GW의 재생에너지를 개발할 예정입니다. MITECO에 따르면 REER 경매는 2030년까지 이러한 목표를 달성하기 위한 계획의 중요한 요소입니다.

- 이러한 정부의 이니셔티브는 앞으로 수년간 시장 성장을 뒷받침할 것으로 기대되고 있습니다.

스페인의 재생에너지 산업 개요

스페인의 재생에너지 시장은 적당히 세분화되어 있습니다. 주요 기업으로는 Siemens Gamesa Renewable Energy SA, Acciona SA, Iberdrola SA, Cobra Group, Red Electrica Corporation SA 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 재생에너지 믹스(2022년)

- 2028년까지의 재생에너지 설비 용량과 예측(단위:GW)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 태양에너지와 풍력에너지 도입 증가

- 정부 정책 및 규제

- 억제요인

- 주요 전력망에 재생에너지 통합

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

제5장 기술별 시장 세분화

- 수력

- 풍력

- 태양광

- 기타

제6장 경쟁 구도

- 인수합병, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Siemens Gamesa Renewable Energy SA

- Acciona SA

- Iberdrola SA

- Cobra Group

- Red Electrica Corporacion SA

- Saclima Solar Fotovoltaica SL

- Tudela Solar SL

- IM2 Systems SLU

- JinkoSolar Holding Co. Ltd

- Solaria Energia y Medio Ambiente SA

제7장 시장 기회와 앞으로의 동향

- 석탄 화력 및 원자력 발전소의 단계적 폐지를 통한 재생 에너지 부문의 기회 창출

The Spain Renewable Energy Market size is estimated at 97.59 gigawatt in 2025, and is expected to reach 207.99 gigawatt by 2030, at a CAGR of 16.34% during the forecast period (2025-2030).

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns and supply chain disruptions leading to delays in projects. Currently, the market reached pre-pandemic levels.

Key Highlights

- The renewable energy market in Spain is expected to have robust growth in the coming years. The growth can be attributed to two main factors, favorable weather conditions and the availability of substantial funds raised by national and regional forums.

- However, the market can also face bottlenecks due to dispatch-flexibility issues, as renewables do not provide short-term flexibility as other traditional fuels; instead, they need long-term backup plans.

- The country has planned the complete phase-out of nuclear and coal-fired power by 2035. The targets to reduce carbon emissions in the national energy plans have prompted the country to eliminate nuclear power from the energy mix. Out of seven nuclear power plants, four are already scheduled to be closed by 2030, making the share of nuclear power from 22% in 2020 to around 7% in 2030. The initiative is likely to create ample opportunities for the renewables-based energy market.

Spanish Renewable Energy Market Trends

Wind Technology is Expected to Dominate the Market

- The country witnessed huge investments in wind technology by international forums and private players in recent years, which resulted in rapid growth in wind-generated power share. The share of wind power generation in the country's renewable energy mix was around 43% as of 2022.

- The installed capacity of wind turbines is anticipated to more than double by 2030, according to the Spanish government's National Integrated Energy and Climate Plan, published in 2021. Many offshore and onshore projects are queued up to accelerate wind power generation in the country.

- According to Red Electrica, in 2022, Spain's total cumulative wind power capacity accounted for 29,729 MW, with an annual growth rate of approximately 4%. With the increase in new wind projects, demand for wind energy is expected to increase, which, in turn, will drive the market in the forecast period.

- In February 2023, Repsol began generating clean energy at PI, its first renewable project in Castilla y Leon, Spain. The PI project includes seven wind farms with a total installed capacity of 175 MW.

- On account of such developments, wind energy generation is expected to dominate Spain's renewable energy market.

Government Policies and Regulations May Drive the Market

- The Spanish government has released several plans and policies to promote the growth of renewable energy in the power generation sector. These initiatives and project investments have resulted in around 42% of renewables share in the total power production as of 2021.

- According to International Renewable Energy Agency, in 2022, the total installed renewable energy in Spain was 67,909 MW, with an increase of 9.05% compared to 2021. With the supportive government policies for renewable energy, the renewable installed capacity is expected to increase in the future.

- For instance, to comply with EU regulations and reach the nation's greenhouse gas emission (GHG) reduction goals, the Spanish government adopted the integrated National Energy and Climate Plan (PNACC) for 2021-2030. The ten-year plan seeks to achieve carbon neutrality by reducing the gross total GHG emissions from the power, transportation, and industrial sectors.

- In December 2021, the Spanish government approved the public-private funding measure to support renewable energy projects with the hope that it will help in achieving the green energy transition as soon as possible. Under the plan, the government allocated over USD 7.77 billion in public funds for innovative green energy technologies.

- In July 2022, REER, the Spanish Ministry for Ecological Transition and the Demographic Challenge (MITECO) announced the third and fourth renewable energy auctions. To generate 74% of Spain's electricity from renewable sources and save one out of every three tonnes of greenhouse gas emissions now emitted, the Spanish National Integrated Energy and Climate Plan (PNIEC) intend to develop 60 GW of renewable energy sources. According to MITECO, REER auctions are a key component of the plan to reach these objectives by 2030.

- Such government initiatives are expected to bolster market growth in the coming years.

Spanish Renewable Energy Industry Overview

Spain's renewable energy market is moderately fragmented. Some of the major companies include (in no particular order) Siemens Gamesa Renewable Energy SA, Acciona SA, Iberdrola SA, Cobra Group, and Red Electrica Corporation SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2022

- 4.3 Renewable Energy Installed Capacity and Forecast, in GW, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Adoption Of Solar And Wind Energy

- 4.6.1.2 Supportive Government Policies And Ambitious Targets

- 4.6.2 Restraints

- 4.6.2.1 Integrating Renewables into the Main Electricity Grid

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION BY TECHNOLOGY

- 5.1 Hydro

- 5.2 Wind

- 5.3 Solar

- 5.4 Other Technologies

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Gamesa Renewable Energy SA

- 6.3.2 Acciona SA

- 6.3.3 Iberdrola SA

- 6.3.4 Cobra Group

- 6.3.5 Red Electrica Corporacion SA

- 6.3.6 Saclima Solar Fotovoltaica SL

- 6.3.7 Tudela Solar SL

- 6.3.8 IM2 Systems SLU

- 6.3.9 JinkoSolar Holding Co. Ltd

- 6.3.10 Solaria Energia y Medio Ambiente SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Phasing Out Of Coal-fired and Nuclear Power Plants To Create Opportunities For Renewable Sector