|

시장보고서

상품코드

1639430

OLED 패널 시장 전망 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)OLED Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

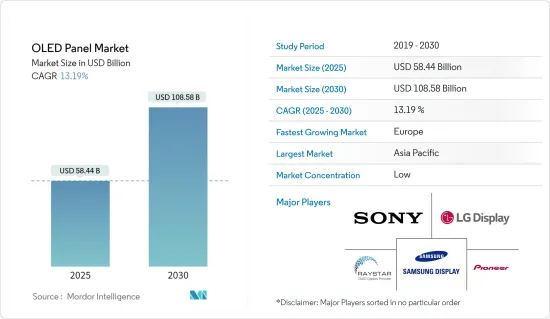

OLED 패널 시장 규모는 2025년에 584억 4,000만 달러로 추정되며, 예측기간(2025-2030년)의 연평균 성장율(CAGR)은 13.19%로, 2030년에는 1,085억 8,000만 달러에 달할 것으로 예측됩니다.

OLED는 더 큰 화면 크기, 향상된 8K(7680 x 4320픽셀) 해상도, 비교적 새로운 폼 팩터를 갖춘 중요한 디스플레이 기술 트렌드입니다. 삼성과 LG 같은 기업들은 꽤 오랫동안 플렉서블 OLED 디스플레이를 실험해 왔습니다. 특히 삼성은 현재 모든 플래그십 기기에 커브드 플렉서블 OLED 패널을 사용하고 있습니다.

주요 하이라이트

- OLED는 각 픽셀이 독립적으로 제어되어 빛을 생성하는 발광 디스플레이를 가능하게 합니다(백라이트 장치에서 빛을 받는 LCD와 달리). OLED 디스플레이는 생생한 색상, 빠른 움직임, 무엇보다도 높은 명암비 등 뛰어난 시각적 품질을 제공합니다. 가장 주목할 만한 점은 “진짜” 블랙(LCD는 조명으로 인해 생성할 수 없는 블랙)입니다. 또한 간단한 OLED 아키텍처 덕분에 유연하고 투명한 패널을 매우 간단하게 제조할 수 있습니다.

- 시야각과 블랙 레벨에 대한 여러 가지 장점으로 인해 OLED TV는 여러 지역에서 수요가 급증하고 있습니다. ICDM에 따르면 TV 해상도를 검증하는 데 있어 명암 변조는 순수한 픽셀 수보다 더 중요하며, OLED TV 디스플레이는 이러한 수요를 충족합니다.

- 시장 확산 모델에 따르면 플렉서블 OLED는 예측 기간 동안 높은 시장 침투율을 보일 것으로 예상됩니다. 중국과 같은 많은 주요 시장에서 스마트폰이 성숙함에 따라 스마트폰 제조업체는 플렉서블 OLED를 통합한 새로운 폴더블폰 모델을 개발하고 있으며 향후 몇 년 동안 엄청난 성장 잠재력을 가지고 있습니다.

- 대량 생산을 통해 기업은 규모의 경제를 달성할 수 있으므로 전체 기기 가격을 낮춰 기기 제조업체에 이익이 됩니다. 현재 OLED는 중급 시장에서 사용하기에는 너무 비싸다는 이유로 소수의 TV 제조업체만 사용하고 있습니다. 많은 피트니스 밴드와 간단한 스마트워치 디바이스가 PMOLED 디스플레이를 채택하고 있습니다.

- 예를 들어 Fitbit의 Charge 밴드는 소형 단색(흰색) PMOLED 디스플레이를 사용합니다. OLED의 두께, 유연성 및 외관은 LCD보다 웨어러블 용도에 유망한 기술임을 보여줍니다. 또한, 단순 결정론적 추정에 따르면 퀀텀닷 기반 OLED 디스플레이 패널의 수요는 예측 기간 동안 기하급수적으로 급증할 것으로 예상됩니다

OLED 패널 시장 동향

높은 성장세를 보일 것으로 예상되는 스마트폰용 AMOLED 디스플레이

- AMOLED는 태블릿, 스마트워치, 게임 콘솔, 디지털 카메라, 휴대용 음악 플레이어 및 음악 제작 장비에 사용되는 OLED 디스플레이 기술입니다. 라인 픽셀 상태는 박막 트랜지스터(TFT)와 저장 커패시터를 사용하여 저장됩니다. AMOLED 패널은 패시브 매트릭스 유기 발광 다이오드(PMOLED)보다 훨씬 빠르며 모든 크기의 디스플레이에 쉽게 맞출 수 있습니다. 또한 이전 디스플레이 기술보다 에너지 효율이 높고, 더 선명한 화질과 더 넓은 시야각을 제공하며, 움직임에 더 빠르게 반응합니다.

- 전 세계적으로 급속한 도시화, 소득 수준 증가, 레저 및 엔터테인먼트 수요 확대는 가전제품 판매에 긍정적인 영향을 미칩니다. 이는 AMOLED 디스플레이 부문의 확장을 촉진하는 가장 중요한 요인 중 하나입니다. 수단, 시리아, 짐바브웨 등 여러 곳에서 인플레이션으로 인해 제조 운영 비용이 상승할 것으로 예상됩니다. 그러나 향상된 화질과 고해상도 디스플레이 등 다른 디스플레이 기술에 비해 AMOLED 디스플레이가 제공하는 여러 가지 이점이 있어 시장 확장을 촉진하고 있습니다.

- 유연한 AMOLED 디스플레이는 다른 디스플레이보다 에너지 소비가 적고 가격이 저렴하기 때문에 휴대폰, 모니터, 웨어러블 기술 제작에 자주 사용됩니다. 수단, 시리아, 인도 등 여러 곳에서 인플레이션으로 인해 제조 운영 비용이 상승할 것으로 예상됩니다.

- 기술 발전과 스마트폰에서 OLED 디스플레이의 사용 증가는 수익성 높은 성장 기회를 제공합니다. 또한 LG, 필립스, 소니와 같은 저명한 전자 회사의 OLED 개발에 대한 투자가 증가하면서 성장 기간 동안 업계의 진화를 주도할 것입니다. 예를 들어, LG디스플레이는 2022년 6월 국내 베이커리 파리바게뜨와 협력하여 디지털 스크린으로 사용하기 위해 투명 OLED 디스플레이 38대를 설치했습니다.

- 또한 OLED 패널은 별도의 백라이트가 필요 없고 발광형이기 때문에 기존에 스마트폰에 사용되던 평면 패널 디스플레이를 가리는 효과가 있습니다. 또한, 얇은 두께와 밝은 출력 등 우수한 특성으로 인해 모바일 제조업체들이 제품에 AMOLED 패널을 점점 더 많이 채택하고 있으며, 이는 시장 성장을 견인할 것으로 보입니다.

- 게다가, OLED 패널 시장의 선두주자 중 하나인 삼성은 대부분의 스마트폰에 AMOLED 및 슈퍼 AMOLED 디스플레이 기술을 통합하고 있습니다.

- 수많은 디스플레이 공장에서 AMOLED 생산 라인을 확장하기 위해 지속적으로 투자하고 있어 시장에서의 AMOLED 보급률이 높아질 것입니다. 또한 스마트폰 보급률 증가로 인해 전 세계적으로 스마트폰 디스플레이에 대한 수요가 증가함에 따라 시장에서 AMOLED 패널에 대한 수요를 촉진할 것으로 예상됩니다.

아시아태평양이 가장 큰 시장 점유율을 차지

- 아시아태평양은 LG와 삼성을 비롯한 대부분의 주요 업체가 이 지역에 제조 시설을 보유하고 있기 때문에 OLED 패널의 가장 큰 시장입니다. 또한 여러 TV 및 사이니지 디스플레이 제조업체와 기타 공급업체가 아시아태평양 지역에 본사를 두고 있습니다.

- 미국과 중국 간의 무역 전쟁으로 인해 중국 정부가 계획한 예산의 상당 부분이 디스플레이 산업에 투입되고 있습니다. 반면 집중적인 투자유치 산업 중 하나인 반도체 산업은 어려움을 예고하고 있습니다.

- 한국은 작은 규모에도 불구하고 OLED 기술에 대한 학술 R&D에 투자하고 있습니다. 한국은 LG와 삼성과 같은 전자 대기업의 막대한 투자를 목격하고 있습니다.

- 중국은 전 세계 OLED 패널 생산 능력의 43%를 점유하며 한국의 라이벌을 위협하고 있습니다. 막대한 국가 보조금을 받은 BOE 테크놀로지 그룹과 TCL 차이나 스타 옵토일렉트로닉스 테크놀로지(TCL CSOT)는 2019년경부터 생산량을 늘린 중국의 두 패널 제조업체입니다.

- 미국의 시장 정보 기관인 디스플레이 서플라이 체인 컨설턴트(DSCC)가 10월에 발표한 전망에 따르면 중국은 2022년 말 생산량 점유율이 55%에 달할 것으로 예상되는 한국을 추월하고 있습니다. 유기발광다이오드를 사용하는 OLED 패널은 액정 디스플레이 패널과 마찬가지로 다양한 방식으로 개발 및 생산되지만 보다 심도 있는 기술 지식을 갖춘 엔지니어가 필요합니다.

- 중국은 제조의 글로벌 허브입니다. 중국은 최대 소비재 수출국 중 하나이자 세계에서 가장 빠르게 성장하는 소비 시장입니다. 또한 세계 최대의 TV 시장 중 하나입니다. LG는 중국 내 유통업체 및 TV 제조업체와 협력해 OLED 패널 사업을 확대할 계획입니다. 이 지역에서 OLED 디스플레이 패널의 판매량은 기하급수적으로 증가할 것으로 예상됩니다.

OLED 패널 산업 개요

OLED 패널 시장은 국내외에 다수의 기업이 존재하기 때문에 단편화되어 경쟁이 심합니다. 또한 각 패널 제조업체는 다양한 기업을 위한 대체 기술에 투자하고 있으며, 기업 간의 치열한 경쟁이 펼쳐지고 있습니다. 시장의 주요 기업은 삼성 디스플레이, LG 디스플레이, 소니 주식 회사입니다.

삼성디스플레이는 2023년 5월 태블릿 컴퓨터나 노트북의 이동성에 혁신을 가져올 롤러블 플렉스와 별도의 모듈을 부착하지 않고 패널에 혈압, 지문 센서를 통합해 활용성을 높인 센서 OLED 디스플레이를 출시할 예정입니다. 삼성은 이 외에도 다양한 OLED 혁신을 통해 새로운 시장 분야를 개척하고 지배하겠다는 의지를 보여주고 있습니다.

2023년 3월, 소니는 최고의 홈 엔터테인먼트 경험을 제공하기 위해 BRAVIA XR TV 라인업을 출시했습니다. BRAVIA XR 라인업에는 X95L 및 X93L 미니 LED, X90L 풀 어레이 LED, A95L QD-OLED, A80L OLED 등 5가지 새로운 모델이 있습니다. 모든 모델에는 몰입형 비디오, 스트리밍 용도, 게임 및 기타 활동을 즐길 수 있는 기능이 탑재되어 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 업계 밸류체인 분석

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 스마트폰에 OLED 채택 증가

- 각국의 OLED 기술 개발에 대한 정부 지원

- 시장의 과제

- 양자점 기술과 마이크로 LED 기술의 진화

제6장 시장 세분화

- 유형별

- 플렉서블

- 경질

- 투명

- 디스플레이 어드레스 방식별

- PMOLED 디스플레이

- AMOLED 디스플레이

- 사이즈별

- 소형 OLED 패널

- 중형 OLED 패널

- 대형 OLED 패널

- 제품별

- 모바일 태블릿

- TV

- 차재

- 웨어러블

- 기타(조명, 헬스케어, 가전)

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 이탈리아

- 프랑스

- 아시아

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 북미

제7장 벤더의 시장 점유율

제8장 경쟁 구도

- 기업 프로파일

- Samsung Display Co. Ltd

- LG Display Co., Ltd

- Sony Corporation

- Pioneer Corporation

- Raystar Optronics Inc.

- Ritek Corporation

- OSRAM OLED GmbH

- WiseChip Semiconductor Inc.

- Winstar Display Co. Ltd

- Visionox Co. Ltd

제9장 투자 분석

제10장 시장의 미래

HBR 25.02.17The OLED Panel Market size is estimated at USD 58.44 billion in 2025, and is expected to reach USD 108.58 billion by 2030, at a CAGR of 13.19% during the forecast period (2025-2030).

OLED is a significant display technology trend, with larger screen sizes, improved 8K (7680 x 4320 pixels) resolution, and relatively new form factors. For quite some time, companies like Samsung and LG have experimented with flexible OLED displays. Samsung, in particular, uses curved flexible OLED panels for all of its flagship devices now.

Key Highlights

- OLEDs make it possible for emissive displays, where each pixel is independently controlled and generates its light (unlike LCDs, which get their light from a backlighting unit). OLED displays provide excellent visual quality, including vivid colors, quick motion, and, most significantly, a high contrast ratio. Most notably, "real" blacks (LCDs can't produce due to the illumination). Additionally, the straightforward OLED architecture makes it very simple to manufacture flexible and transparent panels.

- Due to multiple advantages with viewing angles and black levels, OLED Televisions are surging in demand in several regions. According to the ICDM, contrast modulation in qualifying a TV resolution is more critical than pure pixel count, and OLED TV displays cater to this demand.

- Based on market diffusion models, flexible OLEDs are anticipated to observe a high market penetration in the foreseen period. With the maturity of smartphones in many significant markets, such as China, smartphone manufacturers are developing new, foldable phone models that incorporate flexible OLEDs and further have a massive potential for growth over the next few years.

- Mass production enables companies to reach economies of scale, thereby benefiting the device manufacturers by reducing the overall price of the device. Only a few TV manufacturers currently use OLEDs, as the technology is considered too expensive for the mid-range market. Many fitness bands and simple smartwatch devices adopt PMOLED displays.

- For instance, Fitbit's Charge band uses a small monochrome (white) PMOLED display. The thickness, flexibility, and appearance of OLEDs show make it a promising technology for wearable applications over LCDs. Further, based on simple deterministic extrapolation, the demand for quantum dots-based OLED display panels is anticipated to surge exponentially in the forecast period.

OLED Panel Market Trends

AMOLED Display in Smartphone is Expected to Witness High Growth

- AMOLED is an OLED display technology used in tablets, smartwatches, game consoles, digital cameras, portable music players, and music-making equipment. The line pixel states are stored using a thin-film transistor (TFT) and a storage capacitor. AMOLED panels are far quicker than their passive matrix organic light-emitting diode (PMOLED) and can easily fit into displays of any size. In addition, they are more energy-efficient than previous display technologies, offer more vivid image quality and a broader viewing angle, and respond to motion more quickly.

- Globally, rapid urbanization, growing income levels, and expanding leisure and entertainment demand favorably impact consumer electronics sales. This is one of the most significant factors promoting the expansion of the AMOLED display sector. The operating expenses of manufacturing are anticipated to rise as a result of inflation in several places, including Sudan, Syria, Zimbabwe, etc. However, there are a number of benefits that AMOLED displays offer over other display technologies, including enhanced picture quality and a high-resolution display, both of which are propelling the market's expansion.

- Flexible AMOLED displays are often used in the creation of mobile phones, monitors, and wearable technology because they consume less energy and are more affordable than other displays. The operating expenses of manufacturing are anticipated to rise as a result of inflation in numerous places, including Sudan, Syria, India, and other countries.

- Technological advancements and the increasing use of OLED displays in smartphones provide lucrative growth opportunities. Furthermore, growing investments in OLED development by prominent electronics companies such as LG, Philips, and Sony will drive industry evolution during the growing period. For instance, in June 2022, LG Display collaborated with the Korean bakery Paris Baguette to install 38 transparent OLED displays for use as digital screens.

- Further, the OLED panel requires no additional backlighting, and it is emissive, due to which overshadows the flat panel displays traditionally used in smartphones. Additionally, owing to the superior properties, such as less thickness and bright output, mobile manufacturers have been increasingly incorporating AMOLED panels in their products, which is likely to drive market growth.

- Additionally, Samsung, one of the leaders in the OLED panels market, incorporates AMOLED and Super AMOLED display technologies in most of its smartphones.

- Continuous investment undertaken by numerous display factories to expand AMOLED production lines will boost the AMOLED penetration rate in the market. Moreover, the increasing demand for smartphone displays across the globe, owing to the increasing smartphone penetration rates, is expected to propel the demand for AMOLED panels in the market.

Asia Pacific Occupies the Largest Market Share

- Asia-Pacific is the biggest market for OLED panels as most key players, including LG and Samsung, have manufacturing facilities in the region. Additionally, several TV and signage display manufacturers and other vendors have headquarters in the APAC region.

- Due to the trade war between the United States and China, a large portion of the budget planned by the Chinese government is percolating into the display industry. In contrast, the semiconductor industry, one of the intensive investment promotion industries, foreshadows difficulties.

- Despite its small size, South Korea invests in academic R&D for OLED technology. The country is witnessing huge investments from electronics giants like LG and Samsung.

- China is on track to control 43% of the capacity for manufacturing OLED panels globally, putting it in striking reach of South Korea's rival. With hefty state subsidies, BOE Technology Group and TCL China Star Optoelectronics Technology (TCL CSOT) are two Chinese panel manufacturers that have increased output since around 2019.

- China is overtaking South Korea, whose capacity share, according to a projection made in October by the American market intelligence firm Display Supply Chain Consultants (DSCC), is supposed to reach 55% at the end of 2022. OLED panels, which employ organic light-emitting diodes, are developed and produced in many ways as liquid crystal display panels but need engineers with more in-depth technical knowledge.

- China is the global hub for manufacturing. It is one of the largest exporters of consumer goods and the fastest-growing consumer market in the world. The country boasts one of the world's largest television markets. For instance, LG plans to collaborate with retailers and TV makers in China to expand its OLED panel business. The sales of OLED display panels are expected to grow exponentially in the region.

OLED Panel Industry Overview

The OLED Panel Market is fragmented and competitive because of the presence of many players conducting business on a national and an international scale. Also, panel manufacturers are investing in alternative technologies for various players, which showcases an intense rivalry among the players. The major players in the market are Samsung Display Co. Ltd., LG Display Co. Ltd., and Sony Corporation.

In May 2023, Samsung Display is introducing Rollable Flex, which intends to revolutionize the mobility of tablet computers or laptops, and Sensor OLED display, which offers additional usefulness by incorporating blood pressure and fingerprint sensors in panels without attaching separate modules. With these and other OLED breakthroughs, Samsung is showcasing its desire to establish and dominate new market sectors.

In March 2023, to provide the best possible home entertainment experience, Sony Electronics Inc. introduced its BRAVIA XR TV lineup. The BRAVIA XR lineup has five new models: the X95L and X93L Mini LED, X90L Full Array LED, A95L QD-OLED, and A80L OLED. All models come with features that let customers enjoy immersive video, streaming applications, gaming, and other activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of OLEDs in Smartphones

- 5.1.2 Government Support for the Development of OLED Technology in Various Countries

- 5.2 Market Challenges

- 5.2.1 Evolution of Quantum Dot Technology and Micro LED Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Flexible

- 6.1.2 Rigid

- 6.1.3 Transparent

- 6.2 By Display Address Scheme

- 6.2.1 PMOLED Display

- 6.2.2 AMOLED Display

- 6.3 By Size

- 6.3.1 Small-sized OLED Panel

- 6.3.2 Medium-sized OLED Panel

- 6.3.3 Large-sized OLED Panel

- 6.4 By Product

- 6.4.1 Mobile and Tablet

- 6.4.2 Television

- 6.4.3 Automotive

- 6.4.4 Wearable

- 6.4.5 Other Products (Lighting Products, Healthcare, and Home Appliances)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 Italy

- 6.5.2.4 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 South Korea

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.5.1 Brazil

- 6.5.5.2 Mexico

- 6.5.6 Middle East and Africa

- 6.5.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Samsung Display Co. Ltd

- 8.1.2 LG Display Co., Ltd

- 8.1.3 Sony Corporation

- 8.1.4 Pioneer Corporation

- 8.1.5 Raystar Optronics Inc.

- 8.1.6 Ritek Corporation

- 8.1.7 OSRAM OLED GmbH

- 8.1.8 WiseChip Semiconductor Inc.

- 8.1.9 Winstar Display Co. Ltd

- 8.1.10 Visionox Co. Ltd