|

시장보고서

상품코드

1639446

남미의 페인트 및 코팅 시장 전망 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)South America Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

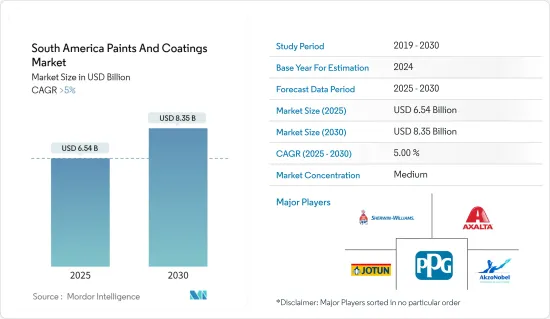

남미의 페인트 및 코팅 시장 규모는 2025년에 65억 4,000만 달러로 추정되어 예측 기간 중(2025-2030년)의 연평균 성장율(CAGR)은 5%를 넘고, 2030년에는 83억 5,000만 달러에 달할 것으로 예측됩니다.

COVID-19 팬데믹은 남미의 페인트 및 코팅 산업에 부정적인 영향을 미쳤습니다. 초기 충격 이후, 업계는 수많은 공장과 건설 현장의 폐쇄로 인해 수요 감소를 경험했습니다. 그 결과 페인트 및 코팅 생산량이 감소하고 공급망에 차질이 생겼습니다. 현재 시장은 팬데믹에서 회복되었습니다. 시장은 2022년에 팬데믹 이전 수준에 도달했으며 향후 몇 년 동안 완만한 속도로 성장할 것으로 예상됩니다.

주요 하이라이트

- 시장을 견인하는 주요 요인은 이 지역의 건설 산업 성장과 자동차 부문 수요 증가입니다.

- VOC가 없는 재료 사용에 대한 엄격한 규제가 시장 성장을 저해할 것으로 예상됩니다.

- 바이오 기반 페인트 및 코팅에 대한 수요 증가와 이 지역에서 항공 우주 부문의 존재감 증가는 시장에서 성장 기회를 제공할 것으로 예상됩니다.

- 남미에서는 건축 분야가 시장의 최종 사용자 분야를 지배하고 있습니다.

남미의 페인트 및 코팅 시장 동향

건축용 페인트 및 코팅이 시장을 독점

- 건축용 페인트 및 코팅은 페인트 및 코팅 산업에서 가장 큰 부문입니다. 건축용 코팅은 표면의 특징을 보호하고 장식하기 위한 것입니다. 건물과 주택을 코팅하는 데 사용됩니다. 대부분은 지붕 코팅, 벽 페인트 또는 데크 마감과 같은 특정 용도로 지정되어 있습니다. 용도에 관계없이 각 건축용 코팅은 특정 장식, 내구성 및 보호 기능을 제공해야 합니다.

- 건축용 코팅은 사무실 건물, 창고, 소매 편의점, 쇼핑몰, 주거용 건물과 같은 상업적 용도로 사용됩니다. 이러한 코팅은 외부 표면과 내부 표면에 적용될 수 있으며 실러 또는 특수 제품을 포함합니다.

- 브라질은 최근 다양한 건설 프로젝트에 대한 투자가 증가하고 있는 남미의 가장 큰 국가 중 하나입니다.

- 2023년 8월, 브라질 정부는 경기부양 프로그램(Novo Programa de Aceleracao do Crescimento, Novo PAC)에 따라 2023년부터 2026년까지 브라질의 다양한 인프라 및 건물 건설에 3450억 달러를 투자할 계획을 세웠습니다.

- 이 지역은 상업용 건설 환경에서 주목할 만한 변화를 목격하고 있습니다. 2023년에 시작된 브라질의 파울리니아 데이터 센터와 포르투 알레그레 데이터 센터 I과 같은 주목할 만한 프로젝트는 이 지역에서 가장 큰 규모에 속합니다.

- 여러 남미 국가에서는 증가하는 인구를 위해 주택을 보다 저렴하게 공급하기 위한 이니셔티브를 추진하고 있습니다. 예를 들어, 2023년 2월 브라질은 저소득층을 대상으로 하는 전국적인 연방 주택 프로그램을 다시 시작했습니다. 2023년 10월, 세계은행은 에콰도르에 1억 달러 규모의 금융 패키지를 승인했는데, 이는 특히 저렴하고 회복력 있는 주택을 강화하는 것을 목표로 합니다.

- 이 지역의 이러한 추세는 예측 기간 동안 건축용 페인트의 성장에 기여할 것으로 보입니다.

시장을 독점하는 브라질

- 브라질은 기존 자동차 및 건설 산업의 존재와 산업 부문에 대한 투자로 인해 예측 기간 동안이 지역에서 우위를 점할 것으로 예상됩니다.

- OICA에 따르면 2022년 브라질의 자동차 생산량은 237만 대에 달하며 전년 대비 약 5%의 성장률을 기록할 것으로 예상됩니다. OICA에 따르면 2022년 브라질의 총 자동차 판매량은 183만 대로 2021년 186만 대에 비해 약 1.9% 감소했습니다.

- 승용차, 경상용차, 대형 상용차는 차량 비용 상승으로 인해 2022년 브라질에서 판매량이 감소했습니다. 그러나 버스와 코치 판매는 2022년 23.4%를 차지하며 자동차 부문에서 가장 높은 성장률을 기록했습니다.

- 하지만 브라질은 남미에서 가장 큰 전기 자동차 시장을 보유하고 있습니다. 지난 1월 중순, 브라질 헌법 및 사법위원회(CCJ)는 2030년 1월부터 브라질에서 휘발유 및 경유 자동차의 신차 판매를 금지하는 법안을 승인했습니다. 2030년까지 브라질에는 약 70만 대의 전기차가 보급될 것으로 예상됩니다.

- 또한, 브라질 건설 산업은 2023년 3월에도 활동과 고용이 5개월째 감소하는 등 여전히 약세를 보였습니다. 그러나 브라질 건설산업회의소(CBIC)의 지원을 받아 전국산업연맹(CNI)이 최근 발표한 데이터에 따르면 활동 감소 폭이 심각하고 광범위하지는 않은 것으로 나타났습니다. 또한, 2023년 2월부터 3월까지의 활동 감소는 2022년 11월에 시작된 일련의 활동 감소 중 가장 경미한 수준입니다.

- 2023년 3월의 건축 활동 지수는 49.5로 5개월 연속 50 미만을 기록했습니다. 그 이전에는 2월 47.6점, 2023년 1월 45.9점이었습니다.

- 브라질 가구 산업은 지난 3년 동안 꾸준히 성장해 왔으며, 최근에는 새로 디자인된 가구에 대한 수요가 높습니다.

- 브라질은 전 세계에서 6번째로 큰 가구 생산국이며, 많은 브라질 가구 회사와 디자이너들이 생산, 배송 및 배송 속도를 높이는 혁신적인 솔루션에 투자하고 있습니다. 이러한 노력 등의 결과로 2020년부터 2021년까지 가구 수출은 50.9% 증가했으며, 특히 브라질 가구 산업 수출의 35%가 미국 매장으로 향하고 있습니다.

- 브라질 가구 제조업체 협회(ABIMOVEL)에 따르면 브라질의 가구 산업은 1만 9,000개의 기업에 의해 형성되어 있으며, 그 중 80%가 상파울루 주를 중심으로 리오그란지두술, 미나스제라이스, 파라나, 산타카타리나 등 남부와 남동부 지역에 집중되어 있습니다.

- IEMI 인텔리젠시아 데 메르카도에 따르면, 브라질은 2022년에 3억 6,700만 대 이상의 가구를 생산하여 2021년 4억 5,000만 대에 비해 가구 생산량이 증가할 것으로 예상됩니다. 그러나 브라질의 가구 생산 가치는 2022년 약 650억 브라질 헤알로 2021년 684억 브라질 헤알에 비해 감소했습니다.

- 따라서 건설, 인프라, 자동차 부문의 성장과 함께 페인트 및 코팅제에 대한 수요는 향후 수년간 성장할 것으로 예상됩니다.

남미의 페인트 및 코팅 산업 개요

남미의 페인트 및 코팅 시장은 부분적으로 통합되어 있습니다. 주요 기업(특정한 순서 없음)으로는 PPG Industries, Inc., Akzo Nobel NV, Jotun, Axalta Coating Systems, The Sherwin William Company 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 지역에서의 건설 산업의 성장

- 자동차 분야에서의 용도와 이용 증가

- 기타 촉진요인

- 억제요인

- VOC 배출에 관한 엄격한 환경 규제

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(금액 기준 시장 규모)

- 수지 유형별

- 아크릴

- 에폭시

- 알키드

- 폴리에스테르

- 폴리우레탄

- 기타 수지(폴리프로필렌 등)

- 기술별

- 수성

- 용제계

- 파우더 코팅

- UV 경화형 코팅

- 최종 사용자 산업별

- 건축

- 자동차

- 목재

- 공업

- 기타 최종 사용자 산업

- 지역별

- 브라질

- 아르헨티나

- 콜롬비아

- 칠레

- 페루

- 기타 남미

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율, 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE

- Hempel

- Jotun

- Lanco Paints

- PPG Industries, Inc.

- Renner Herrmann SA

- The Sherwin William Company

- WEG Coatings

제7장 시장 기회와 앞으로의 동향

- 바이오 기반 및 친환경 페인트 및 코팅 수요 증가

- 항공우주 분야에서의 성장 기회

The South America Paints And Coatings Market size is estimated at USD 6.54 billion in 2025, and is expected to reach USD 8.35 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the South American paints and coatings industry. Following the initial impact, the industry has experienced a decline in demand due to the shutdown of numerous factories and construction sites. Consequently, paint and coating production declined and disrupted the supply chain. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow at a moderate pace in the coming years.

Key Highlights

- Major factors driving the market studied are the growing construction industry in the region and the increasing demand from the automotive sector.

- It is anticipated that stringent regulations on using VOC-free materials are expected to hinder market growth.

- The increasing demand for bio-based paints and coatings and the growing presence of the aerospace sector in the region are expected to provide growth opportunities in the market.

- The architectural sector dominated the end-user segment of the market in South America.

South America Paints and Coatings Market Trends

Architectural Paints and Coatings to Dominate the Market

- Architectural paints and coatings are by far the largest segment in the paints and coatings industry. Architectural coatings are meant to protect and decorate surface features. They are used to coat buildings and homes. Most are designated for specific uses, such as roof coatings, wall paints, or deck finishes. No matter its use, each architectural coating must provide certain decorative, durable, and protective functions.

- Architectural coatings are used in applications for commercial purposes, such as office buildings, warehouses, retail convenience stores, shopping malls, and residential buildings. Such coatings can be applied on outer surfaces and inner surfaces and include sealers or specialty products.

- Brazil is one of the largest countries in the South that has seen a rise in investments for various construction projects in recent times.

- In August 2023, Under the Novo Programa de Aceleracao do Crescimento (Novo PAC), the government planned to invest USD 345 billion between 2023 and 2026 in the construction of various infrastructure and buildings in the country.

- The region is witnessing a notable shift in its commercial construction landscape. Notable projects like the Paulinia Data Center and Porto Alegre Data Center I of Brazil, initiated in 2023, are among the largest in the region.

- Several South American nations are rolling out initiatives to make housing more affordable for their growing populations. For Instance, in February 2023, Brazil relaunched its nationwide federal housing program, targeting low-income individuals. In October 2023, the World Bank approved a USD 100 million financing package for Ecuador, specifically aimed at bolstering affordable and resilient housing.

- Such trends in the region are expected to contribute to the growth of architectural coatings during the forecast period.

Brazil to Dominate the Market

- Brazil is expected to dominate in the region during the forecast period due to the presence of established automotive and construction industries and investments in the industrial sector.

- As per OICA, the production of automobiles in the country amounted to 2.37 million units in 2022, registering a growth of around 5% compared to the previous year. As per OICA, the total sales of vehicles in the country amounted to 1.83 million units in Brazil in 2022, as compared to 1.86 million units in 2021, registering a decline of around 1.9%.

- Passenger cars, light commercial vehicles, and heavy commercial vehicles witnessed a decline in 2022 sales in the country owing to the growing cost of vehicles. However, bus and coach sales registered the highest growth in the automotive segment, accounting for 23.4% in 2022.

- However, Brazil has the largest electric vehicle market in South America. In mid-January, Brazil's Constitution and Justice Commission (CCJ) approved a bill prohibiting the sale of new petrol and diesel-powered cars in the country as of January 2030. Around 700 thousand EVs are expected to be circulating in Brazil by 2030.

- Furthermore, The Brazilian construction industry remained weak in March 2023, with activity and employment falling for the fifth month. However, the most recent data by the National Confederation of Industry (CNI), with the support of the Brazilian Chamber of Construction Industry (CBIC), indicate that the fall in activity was not severe and broad. Furthermore, the reduction in activity from February to March 2023 is the mildest in the series of declines that began in November 2022.

- The reduction in activity is ascribed to high energy and construction material prices and soaring inflationary pressures, as are high-interest rates, decreasing levels of demand, and excessive household debt. In March 2023, the building activity index was 49.5, marking the fifth consecutive month with a score less than 50. This was preceded by February scores of 47.6 and January 2023 scores of 45.9.

- The Brazilian furniture industry has been growing steadily over the past three years, and the demand for newly designed furniture has been high recently.

- Brazil is the sixth largest producer of furniture globally, and many Brazilian furniture companies and designers have invested in innovative solutions that speed up production, shipping, and delivery. As a result of these efforts and more, furniture exports grew 50.9% from 2020 to 2021, with 35% of Brazil's exports in the furniture industry specifically destined for American stores.

- According to the Brazilian Association of Furniture Manufacturers (ABIMOVEL), Brazil's furniture industry is formed by 19,000 companies, 80% of which are concentrated in the country's South and Southeast regions, led by the state of Sao Paulo and followed by the conditions of Rio Grande do Sul, Minas Gerais, Parana, and Santa Catarina.

- According to IEMI Inteligencia de Mercado, the country produced more than 367 million furniture units in 2022 compared to 405 million units in 2021. However, the furniture production value in Brazil amounted to approximately 65 billion Brazilian reals in 2022 compared to 68.04 billion Brazilian reals in 2021.

- Hence, with the growth in the construction, infrastructure, and automotive sectors, the demand for paints and coatings is expected to witness growth over the coming years.

South America Paints and Coatings Industry Overview

The South American paints and coatings market is partially consolidated. The major companies (not in particular order) include PPG Industries, Inc., Akzo Nobel N.V., Jotun, Axalta Coating Systems, and The Sherwin William Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Industry in the Region

- 4.1.2 Increasing Applications and Usage in the Automotive Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Related to VOC-Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylics

- 5.1.2 Epoxy

- 5.1.3 Alkyd

- 5.1.4 Polyester

- 5.1.5 Polyurethane

- 5.1.6 Other Resin Types (Polypropylene, Etc.)

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 End-User Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Colombia

- 5.4.4 Chile

- 5.4.5 Peru

- 5.4.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE

- 6.4.4 Hempel

- 6.4.5 Jotun

- 6.4.6 Lanco Paints

- 6.4.7 PPG Industries, Inc.

- 6.4.8 Renner Herrmann S.A.

- 6.4.9 The Sherwin William Company

- 6.4.10 WEG Coatings

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based and Eco-friendly Paints and Coatings

- 7.2 Growing Opportunities in the Aerospace Sector