|

시장보고서

상품코드

1639508

동남아시아의 플라스틱 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)South-East Asia (SEA) Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

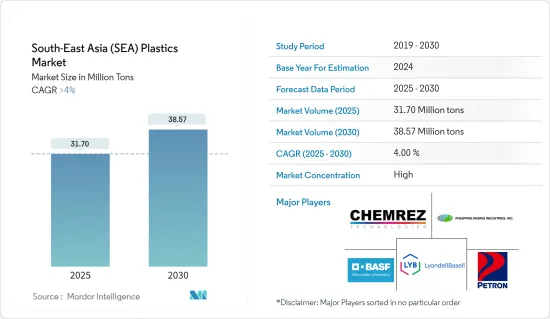

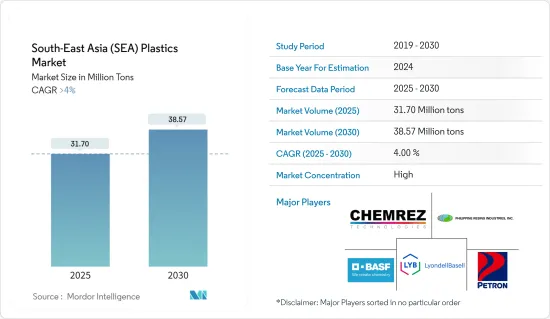

동남아시아 플라스틱 시장 규모는 2025년 3,170만 톤으로 추정되며, 2030년에는 3,857만 톤에 달할 것으로 예상되며, 예측 기간(2025-2030년) 동안 4% 이상의 CAGR을 기록할 것으로 예상됩니다.

COVID-19는 동남아시아 전역의 국가들에 심각한 영향을 미쳤습니다. 팬데믹은 플라스틱 생산과 공급에 영향을 미쳐 시장에 영향을 미쳤습니다. 그러나 팬데믹 기간 동안 온라인 식품 및 소매 E-Commerce 서비스 이용이 증가함에 따라 포장 부문의 수요가 급증했습니다. 그러나 COVID 팬데믹 이후 포장, 전기 및 전자, 건축 및 건설, 자동차, 운송 산업의 수요 증가로 인해 시장은 큰 성장률을 기록했습니다.

주요 하이라이트

- 중기적으로는 식음료 포장에 대한 수요 증가와 다운스트림 처리 능력의 급속한 증가가 시장 성장을 견인할 것으로 예상됩니다.

- 그러나 플라스틱 사용에 대한 정부 규제와 원료 수입에 대한 과도한 의존도가 조사 대상 시장의 성장을 저해하는 주요 요인으로 작용하고 있습니다.

- 항공우주 부문의 잠재적 성장과 생분해성 플라스틱의 사용량 증가는 시장 성장에 다양한 기회를 제공할 것으로 예상됩니다.

동남아시아 플라스틱 시장 동향

사출 성형 기술이 시장을 장악

- 사출 성형 기술은 다양한 산업에서 사용되는 대량의 플라스틱 제품을 제조하는 데 사용됩니다. 플라스틱 사출 성형 기술은 건축 및 건설, 소비재, 포장, 전자, 자동차, 의료 산업 등 다양한 분야에서 사용되고 있습니다.

- 식품 포장과 관련하여 이 지역은 세계 주요 식품 산업 중 하나입니다. USDA Foreign Agriculture Services에 따르면, 포장 식품의 소매 판매액은 2022년 3,297만 달러로 전년도 3,761만 달러에 비해 3,297만 달러에 달할 것으로 예상됩니다. 751만 달러가 될 것으로 예상됩니다. 또한, 인도네시아의 식품 E-Commerce 시장은 2023년까지 63억 2,950만 달러에 달할 것으로 예상됩니다. 따라서 인도네시아 식품 시장의 성장은 인도네시아의 플라스틱 수요를 견인할 것으로 예상됩니다.

- 또한 태국에서는 플라스틱 포장에 대한 수요가 증가하고 있습니다. 태국에는 10,000개 이상의 식음료 가공업체가 있으며, 대부분 중소 규모입니다. 식음료 산업은 태국에서 세 번째로 큰 산업으로 국내총생산(GDP)의 21%를 차지합니다. 이러한 요인들이 이 지역의 식품 포장에 대한 수요를 촉진하고 있습니다.

- 태국은 관광객의 가장 큰 거점 중 하나입니다. 쇼핑몰, 고급 호텔 등의 확장 및 건설에 상당한 투자가 이루어지고 있으며, 파타야 메리어트 마르퀴스 호텔은 태국에서 가장 큰 규모의 프로젝트로 2024년까지 900개 이상의 객실로 운영될 가능성이 있습니다. 이 새로운 Marriott Marquis는 398개의 객실을 갖춘 JW Marriott와 Pattaya Beach Resort & Spa를 포함한 두 개의 부동산 개발의 일부가 될 것이며, Marriott는 2027년까지 태국 방콕과 파타야에 3개의 브랜드로 4개의 호텔을 새로 지을 가능성이 있습니다.

- 베트남은 자동차 산업이 크게 성장하고 있으며, 2022년 11월 현대자동차는 베트남에 10만대 생산능력을 갖춘 자동차 공장을 신설했습니다. 중국의 전기자동차 업체인 BYD는 2023년 1월 베트남에 자동차 부품을 생산하는 공장을 건설할 계획을 밝혔습니다. 이처럼 자동차 산업의 성장은 베트남의 플라스틱 수요를 증가시킬 것으로 예상됩니다.

- 따라서 예측 기간 동안 사출 성형 기술이 동남아시아 플라스틱 시장을 지배할 것으로 예상됩니다.

시장을 독점하는 인도네시아

- 인도네시아는 이 지역에서 플라스틱의 중요한 시장입니다. 플라스틱은 포장, 전기 및 전자, 건축 및 건설, 자동차, 가구 산업 등 다양한 최종사용자 산업에서 사용되고 있습니다. 인도네시아에서는 자동차 산업과 포장 산업이 괄목할 만한 성장률을 기록하며 인도네시아의 플라스틱 수요를 견인하고 있습니다.

- 인도네시아는 동남아시아에서 가장 중요한 자동차 생산 기지이며, 2022년 인도네시아의 자동차 생산량은 147만146대로 전년도 1,129만9,967대 대비 31%의 성장률을 기록할 것으로 예상됩니다. 따라서 자동차 산업의 성장이 인도네시아의 플라스틱 수요를 견인할 것으로 예상됩니다.

- 인도네시아에서 건축 및 건설 활동이 활발해지고 있습니다. 인도네시아에서는 고층 빌딩의 수가 눈에 띄게 증가하고 있습니다. 최근 인도네시아 정부는 보르네오 섬에 3,359만 달러를 투자해 새로운 수도를 건설하고, 건설에 10년이 걸릴 것이라고 밝혔습니다.

- 또한, 정부 투자 증가에 따라 인도네시아의 인프라 건설 활동이 활발해지고 있습니다. 인도네시아 정부는 2024년까지 공공 인프라 개발에 약 4,300억 달러를 투자할 계획이며, 이는 지난 투자금액 3,592억 달러 대비 20% 증가한 수치입니다.

- 마찬가지로 인도네시아에서는 주택 건설도 증가하고 있습니다. 또한, 인도네시아 정부는 인도네시아 전역에 약 1,000만 채의 주택을 건설하는 프로그램을 시작했으며, 이를 위해 약 10억 달러의 예산을 책정했습니다. 이러한 주택 및 인프라 건설 활동의 성장은 인도네시아의 플라스틱 수요를 견인할 것입니다.

- E-Commerce 산업에서 상품 포장의 필요성으로 인해 인도네시아의 플라스틱 사용량이 증가하고 있으며, Wilmar Group, Mayora, Indofood를 포함한 일부 FMCG 기업은 인도네시아에 통합 포장 생산 단위를 설립하고 있으며, ExxonMobil도 인도네시아 플라스틱 산업에 투자하고 있으며, 2022년 11월 PT Indomobil Prima Energi(IPE)와 인도네시아에서 첨단 플라스틱 재활용 기술의 대규모 적용에 관한 양해각서를 체결했습니다.

- 이처럼 자동차 산업과 주택 산업의 성장은 예측 기간 동안 플라스틱 시장을 확대할 것으로 예상됩니다.

동남아시아 플라스틱 산업 개요

동남아시아 플라스틱 시장은 통합된 시장입니다. 이 시장의 주요 기업들(순서에 관계없이)로는 BASF SE, Chemrez Technologies, Inc. Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 식품 및 음료 포장의 수요 증가

- 다운스트림 가공 능력 증강 급증

- 기타 촉진요인

- 성장 억제요인

- 플라스틱 오염에 대한 정부의 엄격한 규제

- 기타 성장 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화(시장 규모(수량 기준))

- 유형

- 전통적 플라스틱

- 엔지니어링 플라스틱

- 바이오플라스틱

- 기술

- 블로우 성형

- 압출 성형

- 사출 성형

- 기타

- 용도

- 포장

- 전기·전자

- 건축·건설

- 자동차와 운송

- 가정용품

- 가구·침구

- 기타

- 지역

- 인도네시아

- 태국

- 말레이시아

- 싱가포르

- 필리핀

- 베트남

- 기타 동남아시아 지역

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요

- Plastic Resin Manufacturers

- AGC Chemicals Vietnam Co., Ltd.

- BASF SE

- Chemrez Technologies, Inc.

- Dow

- DuPont

- JG summit Petrochemical Corporation

- LyondellBasell Industries Holdings B.V.

- Nan Ya Plastics Corporation(Formosa)

- NPC Alliance Corporation

- Petron Corporation

- Philippine Resins Industries, Inc.

- Plastic Product Manufacturers

- Ampac Holdings, LLC

- Bavico Ltd.

- Binh Minh Plastic

- Chan Thuan Thanh Plastic Mechanical & Trading Co. Ltd.

- Cholon Plastic Co. Ltd.

- City Long(Cambodia) Co., Ltd.

- Duy Tan Plastics Corporation

- Plastic Resin Manufacturers

제7장 시장 기회와 향후 동향

- 항공우주 부문의 잠재적 성장?

- 생물 분해성 플라스틱 사용 증가

The South-East Asia Plastics Market size is estimated at 31.70 million tons in 2025, and is expected to reach 38.57 million tons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic severely affected countries across Southeast Asia. The pandemic affected the production and supply of plastics, thereby affecting the market. However, the demand from the packaging segment surged due to the increasing use of online food and retail e-commerce services during the pandemic. However, post-COVID pandemic, the market registered a significant growth rate due to rising demand from packaging, electrical and electronics, building and construction, automotive, and transportation industries.

Key Highlights

- Over the medium term, The rising demand from the food and beverage packaging, and the rapid increase in the downstream processing capacity additions are expected to drive the market's growth.

- However, government regulations on the use of plastics and over-reliance on the imports of raw materials are the major factors hindering the growth of the studied market.

- The potential growth in the aerospace sector and the increasing usage of bio-degradable plastics are expected to offer various opportunities for the growth of the market.

Southeast Asia Plastics Market Trends

Injection Molding Technology to Dominate the Market

- Injection molding technology is used to manufacture high-volume plastic products used in various industries. The plastic injection molding technology is used in various applications, such as building and construction, consumer goods, packaging, electronics, automotive, and healthcare industries.

- In terms of food packaging, the region has one of the major food industries in the world. The growing demand for food in these countries is a major driving factor for the packaging sector, which further increases the demand for packaging in the region. According to USDA Foreign Agriculture Services, the retail sales value of packaged foods registered at USD 37.51 million in 2022, compared to USD 32.97 million registered in the previous year. Furthurmore, the Indonesian Food e-commerce market is predicted to reach USD 6,329.5 million by 2023. Thus, the growth in the country's food market is expected to drive the demand for plastics in the country.

- Further, the demand for plastic packaging is increasing in Thailand. The country has more than 10,000 10,000 F&B processing companies, of which most of them are small-to-medium size. The food and beverage industry is the country's third-largest industry, contributing 21% to the country's Gross Domestic Product (GDP). Such factors are driving the demand for food packaging in the region.

- Thailand is one of the largest hubs for tourists. It has been witnessing considerable investments in the expansion and construction of malls, luxury hotels, etc. The Pattaya Marriott Marquis Hotel is the largest project in Thailand's pipeline, which may be in operation by 2024, with over 900 guest rooms. This new Marriott Marquis will be part of a dual-property development, which will also include the 398-room JW Marriott and the Pattaya Beach Resort & Spa. Marriott may add four new hotels under three of its brands across Bangkok and Pattaya in Thailand by 2027.

- The automotive industry is growing at a significant rate in Vietnam. In November 2022, Hyundai opened a new car factory in the country with a capacity of 100,000 units. Chinese electric vehicle player BYD, in January 2023, revealed its plan to build a plant in Vietnam to produce car parts. Thus, the growth of the automotive industry is expected to increase the demand for plastics in the country.

- Thus, Injection molding technology is expected to dominate the Southeast Asia plastics market during the forecast period.

Indonesia Country to Dominate the Market

- Indonesia is a significant market for plastics in the region. Plastics are used in various end-user industries such as packaging, electrical and electronics, building and construction, automotive, and furniture industries. In Indonesia, the automotive and packaging industries registered a significant growth rate, thereby driving the demand for plastics in the country.

- Indonesia is Southeast Asia's most significant automotive production hub. In 2022, the production volume of automotive vehicles in Indonesia registered at 1,470,146 units as compared to 11,21,967 units manufactured in the previous year, at a growth rate of 31%. Thus, the growth in the automotive industry is expected to drive the demand for plastics in the country.

- The building and construction activities are increasing in Indonesia. The number of high-rise buildings in Indonesia has been growing significantly. Recently, the government of Indonesia revealed that the new capital city would be built on the island of Borneo with an investment of USD 33.59 million, and construction would take ten years.

- Furthermore, infrastructural construction activities are increasing in the country with the rising government investments. The government of Indonesia has planned to invest around USD 430 billion in public infrastructure development by the year 2024, a 20% increase compared to its previous investment of USD 359.2 billion.

- Similarly, residential construction activities are increasing in Indonesia. Moreover, the Indonesian government has started a program to build about 10,00,000 housing units across Indonesia, for which the government has allocated about USD 1 billion in the budget. Thus, the growth in residential and infrastructural construction activities will drive the demand for plastics in the country.

- The usage of plastics in Indonesia is expanding since the e-commerce industry necessitates the packaging of items. Several FMCG companies, including Wilmar Group, Mayora, and Indofood, have established integrated packaging production units in Indonesia. Exxon Mobil is also investing in the Indonesian plastic industry and signed a memorandum of understanding with PT Indomobil Prima Energi (IPE) in November 2022 regarding the application of advanced plastic recycling technology on a large scale in Indonesia.

- Thus, the growth in the automotive and residential industries is expected to increase the market for plastics during the forecast period.

Southeast Asia Plastics Industry Overview

The South-East Asia plastics market is consolidated. Some of the major players in the market (not in any particular order) include BASF SE, Chemrez Technologies, Inc., LyondellBasell Industries Holdings B.V.,Petron Corporation, and Philippine Resins Industries, Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from Food and Beverage Packaging

- 4.1.2 Rapid Increase in the Downstream Processing Capacity Additions

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations against Plastic Pollution

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Traditional Plastics

- 5.1.2 Engineering Plastics

- 5.1.3 Bioplastics

- 5.2 Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Housewares

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Thailand

- 5.4.3 Malaysia

- 5.4.4 Singapore

- 5.4.5 Philippines

- 5.4.6 Vietnam

- 5.4.7 Rest of South-East Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Plastic Resin Manufacturers

- 6.4.1.1 AGC Chemicals Vietnam Co., Ltd.

- 6.4.1.2 BASF SE

- 6.4.1.3 Chemrez Technologies, Inc.

- 6.4.1.4 Dow

- 6.4.1.5 DuPont

- 6.4.1.6 JG summit Petrochemical Corporation

- 6.4.1.7 LyondellBasell Industries Holdings B.V.

- 6.4.1.8 Nan Ya Plastics Corporation (Formosa)

- 6.4.1.9 NPC Alliance Corporation

- 6.4.1.10 Petron Corporation

- 6.4.1.11 Philippine Resins Industries, Inc.

- 6.4.2 Plastic Product Manufacturers

- 6.4.2.1 Ampac Holdings, LLC

- 6.4.2.2 Bavico Ltd.

- 6.4.2.3 Binh Minh Plastic

- 6.4.2.4 Chan Thuan Thanh Plastic Mechanical & Trading Co. Ltd.

- 6.4.2.5 Cholon Plastic Co. Ltd.

- 6.4.2.6 City Long (Cambodia) Co., Ltd.

- 6.4.2.7 Duy Tan Plastics Corporation

- 6.4.1 Plastic Resin Manufacturers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Growth in the Aerospace Sector?

- 7.2 Increasing Usage of Bio-degradable Plastics