|

시장보고서

상품코드

1640589

인도네시아의 종이 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Indonesia Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

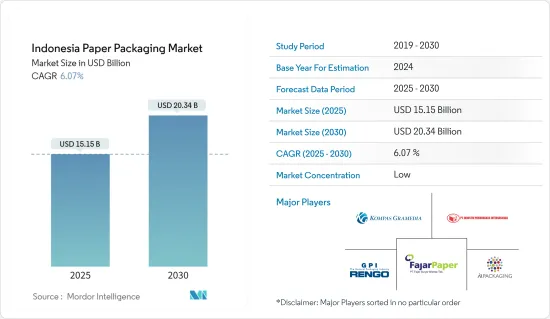

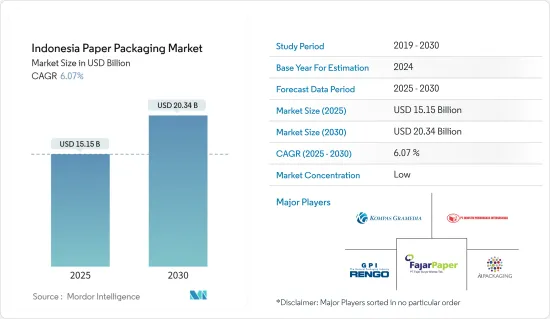

인도네시아의 종이 포장 시장 규모는 2025년에 151억 5,000만 달러로 추정됩니다. 예측 기간(2025-2030년)의 CAGR은 6.07%로, 2030년에는 203억 4,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 인도네시아에는 수많은 제지 공장이 존재하기 때문에 종이 포장 자재의 입수성과 편의성이 강화되어 다양한 산업에서 수요가 높아지고 있습니다. 예를 들어, 2023년 11월 Paper Desk에 따르면 인도네시아의 종이 펄프 산업은 112개사로 구성되어 총 생산 능력은 펄프 1,145만 톤, 종이 2,065만 톤으로 일본 경제에 크게 공헌하고 있습니다.

- 전자상거래와 식품택배 서비스 등 국내산업은 앞으로도 계속 성장해 펄프 및 종이제품의 소비량도 증가할 것으로 보입니다. 이것은 국내 전역에 큰 시장 진입·투자 기회를 가져옵니다.

- 인도네시아의 종이 포장 산업 증가는 소매업 및 전자상거래 산업의 확대, 그리고 이 나라의 전자상거래 솔루션에 대한 수요 증가가 원동력이 되고 있습니다. 트레이딩 이코노믹스사에 따르면 인도네시아의 소매 매출액은 2024년 2월에 전년 동월 대비 6.4% 증가하여 전월의 1.1% 증가로부터 급회복했습니다.

- 소비자에게 직접 배달의 물류 체인이 복잡해지기 때문에 저렴한 골판지 2차 포장의 요구가 높아지고 있습니다. 전자상거래화물은 일반 물류에서 20회 이상 처리될 것으로 예상됩니다.

- 온라인 소매업체의 판매가 증가하고 있기 때문에 당연히 더 많은 포장 및 배송 용품이 필요합니다. 이것이 골판지 시장의 현재 및 미래 성장 이유 중 하나입니다. 골판지 상자는 지속가능성에 대한 요구가 증가함에 따라 온라인 기반 배송 채널에서 선호되는 소재가되고 있습니다.

- 종이 포장은 또한 환경적으로 지속 가능하고 소비자에게 편리하기 때문에 식품 포장에도 광범위하게 적용됩니다. 접이식 판지와 골판지 상자와 같은 종이 포장 제품은 식품 포장, 특히 유분이 없는 제품의 포장에 이상적입니다. 이 상자는 견고한 구조로 알려져 있으며 기업은 식품을 확실하게 운송할 수 있습니다. 골판지 상자는 음식을 깨끗한 밀폐 용기에 보관하여 부패의 위험을 최소화합니다.

인도네시아의 종이 포장 시장 동향

대폭적인 보급이 예상되는 골판지 상자

- 도시 인구 증가, 환경 의식 증가, 지속 가능한 포장 솔루션에 대한 국민 수요 증가, 편리한 포장 수요 증가, 전자상거래 활동 확대 등의 요인이 인도네시아 골판지 포장 시장의 성장을 가속화하고 있습니다.

- FMCG와 브랜드 내구 소비재에 대한 큰 수요로 인해 포장용 골판지의 사용량이 증가하고 있습니다. 골판지는 빵, 스낵 과자, 조리된 식품(RTE), 고기 제품, 과일, 내구 소비재, 식음료 등의 가공 식품을 포장하기 위해 식품 및 음료 업계에서 널리 사용되고 있습니다.

- 예를 들어, 외식 산업은 피자 포장에 골판지 상자를 사용합니다. 고품질의 포장 서비스에 대한 수요는 소비자의 라이프 스타일 변화와 편의점에 대한 욕구 증가에 의해 견인되어 전국적인 골판지 업계의 확대에 박차를 가하고 있습니다.

- 골판지 포장은 운송 중 제품에 견고한 보호를 제공하여 포장 변조로 인한 배송 반품을 줄이고 전자상거래에서 중요한 역할을 수행합니다. 국제무역국이 2024년 1월 발표한 보고서에 따르면 인도네시아의 전자상거래 시장 규모는 2023년 529억 3,000만 달러로, 2028년에는 868억 1,000만 달러에 달할 것으로 예상됩니다. 온라인 쇼핑 증가 추세에 따라 포장 자재에 대한 수요도 향후 수년간 평행 증가할 것으로 예상됩니다.

가장 높은 시장 성장을 보일 것으로 예상되는 식음료 산업

- 종이 포장은 식품 분야에서 널리 사용됩니다. 환경 친화적이고 소비자에게도 편리합니다. 그 결과, 식품 및 식품 업계에서는 소비자에게 고품질의 제품을 제공하는 기업간에 큰 경쟁이 일어나고 있습니다. 골판지와 골판지 상자 등 다양한 포장 자재가 있으며 여러 포장 요구를 충족시킬 수 있습니다.

- 인도네시아의 식품 산업에서는 전자상거래 플랫폼이 주목을 받고 있습니다. 다양한 식품을 제공하고 적절한 포장으로 제 시간에 배달되도록 보장하기 때문입니다. 전자상거래가 확대됨에 따라 식품 포장 수요도 증가할 것으로 예상됩니다. 혁신적인 포장은 제품의 품질을 유지하고 유통 기한을 연장합니다.

- 국내에서는 주로 밀레니얼 세대의 고객이 유연한 종이 포장 솔루션 수요를 견인하고 있으며, 그들은 혼자서 운반할 수 있는 식품과 음식을 선호하고 있습니다. 유연한 종이 포장은 휴대가 가능하고 튼튼하고 가볍기 때문에 이러한 제품을 포장하는 일반적인 옵션이되었습니다. 국내 식음료 산업의 연포장에 대한 요구는 신선한 식품과 가공 식품 모두에서 가장 빠르게 성장하는 스낵 과자 카테고리에 지배될 가능성이 높습니다.

- 1인당 소득 상승, 도시화 진전, 높은 젊은 인구가 이 나라의 포장 식품·식음료 산업의 진흥을 뒷받침할 것으로 예상됩니다. 이것은 식품 소매업과 외식 산업에서 종이 포장 증가에 박차를 가할 것으로 보입니다. 종이 포장은 플라스틱 포장의 지속가능성에 대한 우려가 증가함에 따라 혜택을 받을 것으로 보입니다.

- 경제협력개발기구(OECD)에 따르면 2031년 인도네시아에서의 신선한 유제품 소비량은 1인당 약 5.01킬로그램이 된다고 합니다. 이 메커니즘의 조사에 따르면 인도네시아에서는 신선한 유제품이 일상적인 주식이 아니지만 신선한 우유, 치즈, 요구르트 등 유제품이 중소득층 사이에서 인기를 얻고 있습니다. 인도네시아에서의 유제품 소비 증가는 지속 가능한 포장 솔루션을 요구하는 소비자의 선호도와 일치하며 신선도, 보존성 및 환경 친화적 특성으로 종이 포장 채택을 추진할 예정입니다.

인도네시아 종이 포장 산업 개요

인도네시아의 종이 포장 시장은 일부 유력한 시장 기업이 대부분의 점유율을 차지하기 때문에 단편화되었습니다. SIG Group AG, PT Industri Pembungkus Internasional, PT Fajar Surya Wisesa Tbk, PT Metaform(Kompas Gramedia), AR Packaging Group AB, Rengo 등 시장 기업은 시장 점유율을 확대하기 위해 전략적 파트너십과 제휴를 고려하고 있습니다.

- 2024년 1월 아시아태평양 리소시즈 인터내셔널 리미티드(APRIL 그룹)의 자회사인 리아우 안다란 페이퍼보드 인터내셔널(PT Riau Andalan Paperboard International)은 23억 달러를 투자한 새로운 판지 제조 공장의 시운전을 시작했습니다. 이에 따라 이 공장은 올해 후반에 예정된 본격적인 상업생산에 접근했습니다. 새로운 판지 공장은 고부가가치 제품으로 다운스트림에서 다각화하고 지속 가능한 사업 성장을 목표로 APRIL 그룹의 전략을 강조합니다. 이 전략은 섬유 기반의 소비자 제품의 종합 제조업체로서 당사의 강점을 활용한 것입니다.

- 2024년 5월 - 국제 규모의 전시회 주최자인 크리스타 이그제큐션은 ALLPack Indonesia 2024가 AllPrint Indonesia Expo 2024와 함께 개최된다고 발표했습니다. 이 이벤트는 10월 자카르타 케마요란에 있는 자카르타 국제 엑스포(JIExpo) 센터에서 개최될 예정입니다. 제23회째가 되는 ALLPack Indonesia 2024는 식품, 음식, 비스킷, 과자류, 의약품, 전통적인 허브 음료, 화장품, 퍼스널케어, 미용, 농업, 일렉트로닉스, 쿨러 등 다양한 산업에 대응하는 가공·포장 기술에 초점을 맞춥니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 친환경 포장에 대한 수요 증가

- 다양한 산업에서 접이식 상자 도입 증가

- 시장의 과제

- 원재료 가격 변동

제6장 현재의 무역 시나리오 - 수출입 분석

- 골판지

- 재생용지

제7장 인도네시아 국가별 분석

- 주요 거시경제지표 분석

- 규제 상황과 법 제도

- 경제 성장에 기여하는 주요산업

- 외국 기업이 인도네시아에 진출하기 위한 중요한 과제

제8장 인도네시아 포장 산업의 전망

제9장 시장 세분화

- 유형별

- 접이식 상자

- 골판지 상자

- 기타 유형

- 최종 사용자 산업별

- 음식

- 헬스케어

- 퍼스널케어

- 공업

- 기타 최종 사용자 산업

제10장 경쟁 구도

- 기업 프로파일

- PT Industri Pembungkus Internasional

- PT Fajar Surya Wisesa TBK

- PT Metaform(Kompas Gramedia)

- AR Packaging Group AB

- Rengo Co. Ltd

- APP(Asia Pulp & Paper)

- PT Pabrik Kertas Indonesia(PT Pakerin)

- International Paper Company

- SIG Group AG

- Teguh Group

- PT Pura Barutama

제11장 투자 분석

제12장 시장 기회와 앞으로의 동향

KTH 25.02.19The Indonesia Paper Packaging Market size is estimated at USD 15.15 billion in 2025, and is expected to reach USD 20.34 billion by 2030, at a CAGR of 6.07% during the forecast period (2025-2030).

Key Highlights

- The presence of numerous paper mills in Indonesia bolsters the availability and affordability of paper packaging materials, driving demand across diverse industries. For instance, as per Paper Desk in November 2023, Indonesia's pulp and paper industry consisted of 112 companies with a total capacity of 11.45 million tons of pulp and 20.65 million tons of paper, contributing significantly to the country's economy.

- Domestic industries like e-commerce and food delivery services, among others, will continue to grow over the coming years, and so will the consumption of pulp and paper products. This presents significant market entry and investment opportunities across the country.

- The increase in the paper packaging industry in Indonesia is driven by the expansion of the retail and e-commerce industries and the growing demand for eco-conscious packaging solutions in the country. According to Trading Economics, retail sales in Indonesia increased by 6.4% Y-o-Y in February 2024, sharply picking up from the 1.1% growth registered in the previous month.

- There is a growing need for affordable secondary corrugated board packaging since the logistics chain for direct-to-consumer delivery is getting more complicated. E-commerce shipments are anticipated to be handled up to 20 times or more during ordinary distribution.

- With online retailers' growing sales, they naturally need more packing and shipping supplies. This is one of the reasons for the current and future growth of the corrugated boxes market. Corrugated boxes are becoming the material of preference for online-based delivery channels due to the rising need for sustainability.

- Paper packaging also finds extensive application in food packaging as it is environmentally sustainable and convenient for consumers. Paper packaging products such as folding cartons and corrugated boxes are ideal for food packaging, specifically for non-greasy items. These boxes are known for their sturdy structures, allowing businesses to transport food products reliably. A corrugated box stores food in a clean and sealed container to minimize spoilage risk.

Indonesia Paper Packaging Market Trends

Corrugated Boxes Expected to Register Significant Adoption

- Factors such as rising urban populations, growing environmental consciousness, the nation's increasing demand for sustainable packaging solutions, the rise in demand for convenient packaging, and the expansion of e-commerce activities are accelerating the growth of the corrugated packaging market in Indonesia.

- The usage of corrugated boards for packaging is increasing due to the significant demand for fast-moving consumer goods (FMCG) and branded consumer durables. Corrugated boards are widely used in the food and beverage industry to package processed foods, including bread, snacks, ready-to-eat (RTE) meals, meat products, fruits, durable foods, and beverages.

- Foodservice establishments, for instance, use corrugated boxes to package pizza. The demand for high-quality packaging services has been driven by a shift in consumer lifestyles and the increased desire for convenience food, fueling the expansion of the corrugated board industry across the country.

- Corrugated packaging plays a crucial role in e-commerce by providing robust protection to products during transit, thus reducing shipment returns due to tampered packaging. According to the International Trade Administration's report published in January 2024, Indonesia's e-commerce market size was USD 52.93 billion in 2023 and is expected to reach USD 86.81 billion by 2028. With the rising trend of online shopping, a parallel increase in the demand for packaging materials is also expected over the coming years.

The Food and Beverage Industry is Expected to Exhibit the Highest Market Growth

- Paper packaging is being extensively used in the food segment. It is both environmentally beneficial and convenient for consumers. As a result, there is tremendous competition in the food and beverage industry among companies that provide high-quality products to consumers. Various packaging materials, such as cardboard and corrugated boxes, are available to satisfy multiple packaging needs.

- E-commerce platforms have gained much attention in the Indonesian food industry. This is because they offer various food products and ensure those are delivered on time and in proper packaging. With the expansion of e-commerce, the demand for food packaging is expected to rise. Innovative packaging preserves a product's quality and extends its shelf-life.

- Millennial customers in the country primarily drive the demand for flexible paper packaging solutions, as they favor single-serving and on-the-go food and beverage products. Flexible paper packaging is a common alternative for packing these products because it is meant to be portable, sturdy, and lightweight. The need for flexible packaging from the food and beverage industry in the country is likely to be governed by the fastest-growing categories of snack foods, both fresh and processed foods.

- The rising per capita income, increasing urbanization, and a high youth population are expected to boost the country's packaged food and beverage industry's rise. This will help fuel the increase in folding carton packaging in the food retail and restaurant industries. Paper packaging will benefit from growing concerns about the sustainability of plastic packaging.

- According to the Organization for Economic Co-operation and Development, the human consumption of fresh dairy products in Indonesia in 2031 will be around 5.01 kilograms per capita. The organization's study outlines that despite fresh dairy products not being a regular staple in the Indonesian daily diet, dairy products like fresh milk, cheese, and yogurt have gained traction among middle-income families. The rising consumption of dairy products in Indonesia intends to propel the adoption of paper packaging due to its freshness, preservation, and eco-friendly attributes, aligning with consumer preferences for sustainable packaging solutions.

Indonesia Paper Packaging Industry Overview

The Indonesian paper packaging market is fragmented due to several prominent market players holding the majority share. The market players, such as SIG Group AG, PT Industri Pembungkus Internasional, PT Fajar Surya Wisesa Tbk, PT Metaform (Kompas Gramedia), AR Packaging Group AB, and Rengo Co. Ltd, are considering strategic partnerships and collaborations to expand their market share.

- January 2024: PT Riau Andalan Paperboard International, a subsidiary of Asia Pacific Resources International Limited (APRIL Group), began commissioning its new USD 2.3 billion paperboard manufacturing plant. This move brings the facility closer to its anticipated full-scale commercial production, set for later this year. The new paperboard facility underscores APRIL Group's strategy of diversifying downstream into high-value-added products, aiming for sustainable business growth. This strategy capitalizes on the company's strength as a fully integrated producer of fiber-based consumer products.

- May 2024 - Krista Exhibitions, an international-scale exhibition organizer, announced that ALLPack Indonesia 2024 will take place alongside the AllPrint Indonesia Expo 2024. The event is scheduled for October at the Jakarta International Expo (JIExpo) center in Kemayoran, Jakarta. The 23rd edition of ALLPack Indonesia 2024 will highlight processing and packaging technologies catering to a diverse range of industries, including food, beverages, biscuits, confectionery, pharmaceuticals, traditional herbal drinks, cosmetics, personal care, beauty, agriculture, electronics, and coolers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-friendly Packaging

- 5.1.2 Increase in Adoption of Folding Carton by Different Industries

- 5.2 Market Challenges

- 5.2.1 Fluctuations in the Prices of Raw Materials

6 CURRENT TRADE SCENARIO - EXPORT/IMPORT ANALYSIS

- 6.1 Cartonboard

- 6.2 Recovered Paper

7 INDONESIA COUNTRY ANALYSIS

- 7.1 Analysis of Key Macroeconomic Indicators

- 7.2 Regulatory and Legal Landscape

- 7.3 Major Industries Contributing to Economic Growth

- 7.4 Key Imperatives for Foreign Companies to Establish a Presence in Indonesia

8 INDONESIA PACKAGING INDUSTRY OUTLOOK

9 MARKET SEGMENTATION

- 9.1 By Type

- 9.1.1 Folding Cartons

- 9.1.2 Corrugated Boxes

- 9.1.3 Other Types

- 9.2 By End-user Industry

- 9.2.1 Food and Beverage

- 9.2.2 Healthcare

- 9.2.3 Personal Care and Household Care

- 9.2.4 Industrial

- 9.2.5 Others End-user Industries

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 PT Industri Pembungkus Internasional

- 10.1.2 PT Fajar Surya Wisesa TBK

- 10.1.3 PT Metaform (Kompas Gramedia)

- 10.1.4 AR Packaging Group AB

- 10.1.5 Rengo Co. Ltd

- 10.1.6 APP (Asia Pulp & Paper)

- 10.1.7 PT Pabrik Kertas Indonesia (PT Pakerin)

- 10.1.8 International Paper Company

- 10.1.9 SIG Group AG

- 10.1.10 Teguh Group

- 10.1.11 PT Pura Barutama