|

시장보고서

상품코드

1640593

중남미의 유정관 용품(OCTG) 시장 전망 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)South and Central America Oil Country Tubular Goods (OCTG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

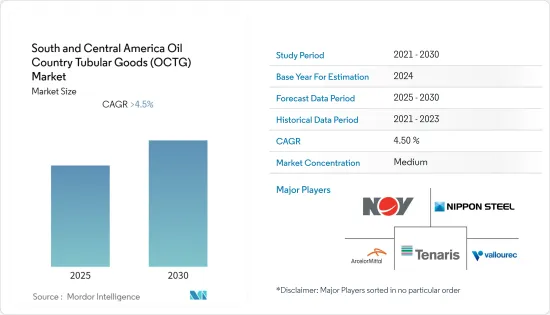

중남미의 유정관 용품 시장은 예측 기간 동안 4.5% 이상의 연평균 성장율(CAGR)로 추이할 전망입니다.

조사 대상 시장은 2020년에 코로나19로 인해 부정적인 영향을 받았습니다. 그 이후 시장은 회복세를 보이며 현재 팬데믹 이전 수준에 도달했습니다.

시장의 성장을 이끄는 주요 요인으로는 수요 및 공급 격차 감소, 기술 발전으로 인한 낮은 석유 손익분기점 가격, 석유 서비스 비용 감소, 방향성 시추 증가 등이 있습니다. 그러나 변동성이 큰 원유 가격과 경기 순환과 관련된 리스크는 OCTG 시장의 성장을 제약할 것으로 예상됩니다. 중남미 주요 국가들의 석유 및 가스 산업 자유화는 외국인 투자를 증가시켜 석유 및 가스 산업의 성장에 도움이 될 것으로 예상되며, 이는 역내 OCTG 시장의 성장을 촉진할 것으로 전망됩니다.

석유 및 가스 탐사 활동이 증가함에 따라 브라질은 예측 기간 동안 중남미에서 큰 수요를 목격할 것으로 예상됩니다.

중남미의 유정관 용품 시장 동향

프리미엄 등급 부문이 상당한 수요를 예상

프리미엄급 OCTG 시장은 업스트림 석유 및 가스 활동의 수요 증가로 인해 성장하고 있습니다. 프리미엄급 용도는 가스정, 수평 유정, 고압(5,000PSI 이상) 및 고온(250F 이상) 유정에서 널리 사용되고 있습니다. 프리미엄급 OCTG는 보다 복잡한 용도와 기밀 밀봉이 필요한 연결부에 적용됩니다.

천연가스의 탐광은 셰일층 매장량의 급증에 따라 큰 추진력이 되고 있습니다. 수평 방향 시추로 셰일 매장지에서 천연가스 생산이 가능해지면서 프리미엄급 OCTG 시장의 성장이 촉진되고 있습니다.

2022년 11월 기준 남미 해양 시추선의 총 공급량은 39대이며, 이 중 판매 및 계약된 시추선의 수는 35대입니다. 열악한 환경의 외딴 지역에서 심해 탐사가 증가함에 따라 프리미엄급 시추 장비의 사용이 증가하여 시장이 성장하고 있습니다. 주요 해양 심해 매장지 중 하나인 멕시코만은 예측 기간 동안 생산량이 급증할 것으로 예상됩니다.

2022년 10월, ExxonMobil은 가이아나 해안의 스탤브로엑 블록의 Sailfin-1 우물과 Yarrow-1 유정에서 두 가지 발견을 발표하고 개발 기회의 풍부한 포트폴리오에 합류했습니다. 석유 및 가스의 발견 증가에 따라 드릴 파이프, 케이스, 튜브 등 고급 유정관 용품 제품이 필요합니다.

따라서, 상기 요인들로부터 프리미엄 등급 부문은 예측 기간 동안 중남미에서 성장세를 유지할 것으로 예상됩니다.

상당한 수요 증가가 예상되는 브라질

브라질은 세계 최대급의 석유 및 가스 생산국이며, 남미 최대의 생산국이며, 세계 제7위의 석유 제품 소비국입니다. 브라질에서 생산되는 석유 및 가스의 거의 80-90%는 연안에서 생산됩니다.

브라질 산토스 분지의 리브라 유전은 초심해 유역으로 브라질에서 가장 큰 유전이며 현재 개발 단계에 있으며 2022년 말까지 완공될 예정입니다. 이 개발에는 방향성 시추, 유정 개입 및 유정 완성을 위해 여러 대의 OCTG가 사용될 것으로 예상됩니다.

대규모 해상 전염유 매장지의 발견으로 브라질은 세계 10대 석유 액체 연료 생산국으로 부상했습니다. 2022년 11월, 중국석유공사와 페트로브라스는 브라질 산토스 분지에 있는 심해 유전의 첫 석유 탐사 테스트를 완료했습니다. 산토스 분지에 있는 대형 유전인 구라-1 유정은 CNPC의 해외 심해 석유 및 가스 탐사에서 중요한 성과를 거둔 유정입니다.

투자자 친화적인 규제 개혁을 고려할 때 브라질에서 외국 석유 및 가스 회사의 전망은 밝습니다. 석유 및 가스 탐사 활동의 증가는 이 지역에서 OCTG 시장의 성장을 견인할 것으로 예상됩니다.

2022년 10월 노르웨이의 석유 메이저인 에퀴노르는 브라질 캄포스 분지 연안의 페레그리노 중유전 2단계에서 생산을 시작했습니다. 페레그리노 유전은 수심 120m에 설치된 새로운 유정 플랫폼과 시추 장비인 페레그리노 C를 통해 생산되고 있으며, 이러한 프로젝트는 브라질 전역의 OCTG 시장 성장을 촉진할 것으로 예상됩니다.

따라서 위의 요인들로 인해 브라질은 예측 기간 동안 중남미에서 유정관 용품 시장 성장을 가속할 것으로 예상됩니다.

중남미의 유정관 용품 산업 개요

중남미의 유정관 용품 시장은 적당히 통합되어 있습니다. 주요 진출기업(특정한 순서 없음)에는 National-Oilwell Varco Inc., Nippon Steel Corporation, Tenaris SA, ArcelorMittal SA, Vallourec SA 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2027년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 제조 공정별

- 원활한

- 전기 저항 용접

- 등급별

- 프리미엄 등급

- API 등급

- 지역별

- 브라질

- 아르헨티나

- 베네수엘라

- 기타 중남미

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- ArcelorMittal SA

- National-Oilwell Varco Inc.

- Nippon Steel Corporation

- Tenaris SA

- Vallourec SA

- TPCO Enterprise Inc.

제7장 시장 기회와 앞으로의 동향

HBR 25.02.13The South and Central America Oil Country Tubular Goods Market is expected to register a CAGR of greater than 4.5% during the forecast period.

The market studied was negatively impacted by COVID-19 in 2020. Since then, the market has been recovering and has now reached pre-pandemic levels.

Major factors driving the growth of the market studied are reducing the supply-demand gap, low oil breakeven prices due to technological advancement, reduced oil services cost, and increased directional drilling. However, volatile crude oil prices and the risk associated with the cyclic nature of the tube are expected to restrain the OCTG market's growth. Liberalization of the oil and gas industry by major countries in South and Central America is expected to increase foreign investment, thereby helping the oil and gas industry to grow, and is anticipated to boost the OCTG market's growth in the region.

Due to the increase in oil and gas exploration activities, Brazil is expected to witness significant demand in South and Central America during the forecast period.

South and Central America Oil Country Tubular Goods Market Trends

Premium Grade Segment is Expected to Witness Significant Demand

The premium-grade OCTG market is growing due to the increasing demand from upstream oil and gas activities. The premium-grade applications are widespread in gas wells, horizontal wells, high-pressure (above 5,000 PSI), and high-temperature (above 250 F) wells. The premium-grade OCTG is applied to connections with more complex applications and where gas-tight sealing is required.

The exploration of natural gas is receiving huge impetus with the surge in the development of shale reserves. Horizontal directional drilling has promulgated natural gas production from shale reserves, which boosts the premium-grade OCTG market's growth.

As of November 2022, the total supply of offshore rigs in South America was 39 units, of which the amount of marketed and contracted rigs was 35. The increase in deepwater exploration in remote areas with harsh environments has resulted in the rise in the use of premium quality drilling equipment, which has resulted in the growth of the market. The Gulf of Mexico, one of the major offshore deepwater reserves, is expected to witness an upsurge in production during the forecast period.

In October 2022, ExxonMobil announced two discoveries at the Sailfin-1 and Yarrow-1 wells in the Stabroek block offshore Guyana, adding to its extensive portfolio of development opportunities. The growing oil and gas discoveries will require premium-grade OCTG products such as drill pipes, casings, and tubings.

Therefore, based on the above-mentioned factors, the premium grade segment is expected to maintain its growth momentum in South and Central America during the forecast period.

Brazil is Expected to Witness Significant Demand

Brazil is one of the largest producers of oil and gas across the world, the largest producer in South America, and the seventh largest oil product consumer in the world. Almost 80-90% of oil and gas produced in Brazil are from offshore.

Libra oil field in Santos Basin in Brazil is an ultra-deep-water basin, is the largest oil field in Brazil, is under the development phase, and is expected to complete by the end of 2022. The development is expected to use several units of OCTG for directional drilling, well intervention, and well completion.

The discoveries of large, offshore, pre-salt oil deposits have transformed Brazil into a top-10 petroleum liquid fuels producer. In November 2022, China National Petroleum Corp and Petrobras completed their first oil exploration test of a deepwater field in Brazil's Santos basin. Well Gura-1, a large oil field in the Santos basin, represents a significant accomplishment in CNPC's foreign deepwater oil and gas exploration.

The outlook for foreign oil and gas companies in Brazil is bright, considering the significant investor-friendly regulatory reforms. The increase in oil and gas exploration activities is expected to drive the OCTG market's growth in the region.

In October 2022, Norway's oil major Equinor started production from Phase 2 of the Peregrino heavy oil field offshore the Campos basin in Brazil. The Peregrino field is being produced through a new wellhead platform and drilling rig called Peregrino C. The new platform is installed at a water depth of 120 m. Such projects are expected to boost the growth of the OCTG market across the country.

Therefore, based on the above-mentioned factors, Brazil is expected to boost the OCTG market's growth in South and Central America during the forecast period.

South and Central America Oil Country Tubular Goods Industry Overview

The South and Central America oil country tubular goods (OCTG) market is moderately consolidated. Some major players (in no particular order) include National-Oilwell Varco Inc., Nippon Steel Corporation, Tenaris SA, ArcelorMittal SA, and Vallourec SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Manufacturing Process

- 5.1.1 Seamless

- 5.1.2 Electric Resistance Welded

- 5.2 By Grade

- 5.2.1 Premium Grade

- 5.2.2 API Grade

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Venezuela

- 5.3.4 Rest of South and Central America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ArcelorMittal SA

- 6.3.2 National-Oilwell Varco Inc.

- 6.3.3 Nippon Steel Corporation

- 6.3.4 Tenaris SA

- 6.3.5 Vallourec SA

- 6.3.6 TPCO Enterprise Inc.