|

시장보고서

상품코드

1642177

데이터센터 상호 연결 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Data Center Interconnect - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

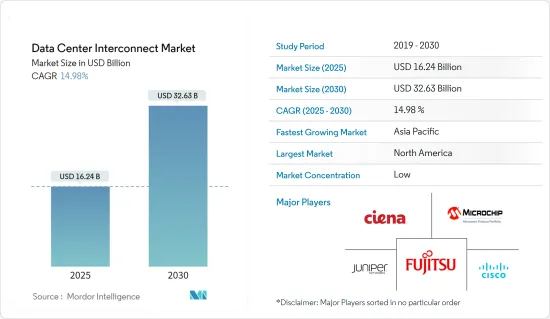

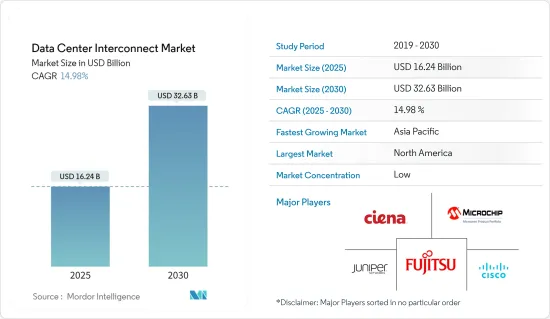

데이터센터 상호 연결 시장 규모는 2025년 162억 4,000만 달러, 2030년 326억 3,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR은 14.98%에 이를 것으로 예측됩니다.

데이터가 급증하고 AI 및 고성능 컴퓨팅(HPC)과 같은 기술이 확대됨에 따라 데이터센터 자산을 신속하고 안정적이고 비용 효율적으로 연결할 필요성이 현저하게 증가하고 있습니다.

주요 하이라이트

- 처리량, 대기 시간, 운영 및 유지 관리 간소화, 인텔리전스 및 보안과 같은 요소는 데이터센터 공급업체에게 중요한 우선순위가 되고 있습니다. 이것이 데이터센터 상호연결(DCI) 기술의 채택을 촉진하는 주요 요인 중 하나입니다. 이는 데이터센터 간의 대역폭을 늘리고 지연을 줄이고 패킷 손실을 방지할 수 있기 때문입니다.

- 또한 5G 서비스의 상용화가 진행됨에 따라 상호 연결 데이터센터 솔루션의 범위가 더욱 확대될 수 있습니다. 자율주행 차량, 스마트 시티, 디지털 트윈, 가상현실, AI 가상 어시스턴트, 비디오 모니터링 및 모니터링, 게임 등이 시장 수요를 촉진할 수 있습니다.

- 데이터센터 상호연결 시장이 성장하고 있는 이유는 접근이 용이하고 편의성이 높고 데이터가 고도로 암호화되고 다른 데이터 부문와 연결될 수 있는 등 많은 이점이 있음을 인식하는 사람들이 늘고 있기 때문입니다.

- 2020년 세계 봉쇄 시나리오에 필수적인 에지 컴퓨팅 동향은 조사 대상 시장 범위를 더욱 확대합니다. 데이터의 약 10-15%는 집중형 데이터센터나 클라우드 밖에서 작성 및 처리되고 있지만, 2025년에는 60-70%에 이를 것으로 예상되고 있습니다. Amazon, Google, Equinix, DRT와 같은 하이퍼스케일 데이터센터는 상호 연결되어 있으며 네트워크를 통해 데이터와 용도를 최종 사용자에게 전달합니다. 에지 클라우드는 개방적이고 상호 연결된 데이터센터로 구성된 고유한 생태계일 수 있습니다.

- 특히 중소기업의 주요 과제는 데이터센터 연결 서비스 비용입니다. 새로운 데이터센터는 건설과 유지 보수의 양면에서 많은 투자가 필요합니다. 또한 데이터센터 간의 거리는 데이터센터의 효율을 저하시킬 수 있기 때문에 중요하며 데이터센터 상호연결 산업의 성장을 제한하고 있습니다.

COVID-19의 발생은 세계 클라우드 컴퓨팅 수요의 급증에 불을 붙였습니다. 또한 데이터센터 시장의 범위도 확대되었습니다. 데이터센터 건설 프로젝트에서는 노동력 부족으로 인한 공급망의 혼란이 보였으나 일부 프로젝트의 완성이 지연될 것으로 예상되지 않았습니다. 이것은 초기 단계에서만 볼 수 있습니다. 비디오 스트리밍과 회의 이용은 특히 전국적인 봉쇄 기간 동안 예상보다 급증하여 세계 네트워크의 대역폭 수요를 끌어올렸습니다. 유행 후, 급속한 디지털화와 5G 서비스 증가로 현재 시장이 확대되고 있습니다.

데이터센터 상호 연결 시장 동향

데이터센터 수 증가로 시장 성장 견인

- 미국에 본사를 둔 시장 공급업체인 Ciena Corporation에 따르면 최근 몇 년간 데이터센터 수가 증가하고 있으며 현재는 전 세계적으로 7,500개가 넘고 세계 상위 20개 도시에서도 2,600개가 집적되고 있습니다. Huawei에 따르면 2025년에는 전 세계 연간 데이터 생산량이 180ZB에 달할 수 있다고 합니다. 또한 비구조화된 데이터(원래 음성, 비디오, 이미지 데이터 등)의 비율도 증가의 길을 따라 곧 95% 이상에 달할 수 있어 세계 데이터센터의 성장을 뒷받침합니다.

- 데이터 통신 네트워크(DCN) 및 데이터센터 상호연결(DCI) 솔루션은 패킷 손실 0, 저지연, 고처리량 무손실 네트워크를 확보하고 신속한 서비스 개발 요구 사항을 충족하기 위해 DCN 및 DCI 대역폭을 신속하게 확장하는 것이 점차 중요해지고 있습니다. 데이터센터를 연결하는 DCI 네트워크는 10 Tbit/s 파장 분할 다중화(WDM) 상호 연결 네트워크로 진화하고 있습니다.

- 또한 데이터센터 서비스 제공업체는 공동 위치 및 클라우드 기능 확장에 투자하고 있습니다. 최종 사용자 기업(전기통신 및 금융 등)은 자사 데이터센터 건설을 선택하고 주로 데이터센터 상호 연결 시장을 세계 투자 핫스팟으로 만들고 있습니다. 주로 OTT, ISP, 금융 부문, 공공 부문 등의 개발 산업은 데이터센터의 성장과 분산, 섬유 이용률 향상, 저비용 플러그인 모듈을 통해 DCI 네트워크 이용 사례를 개발하고 있습니다.

- 데이터센터 증가도 DCI 증가를 뒷받침하고 있으며, 기업은 자체 데이터센터, 클라우드 제공업체 및 기타 데이터센터 사업자를 연결하여 보다 단순한 데이터와 리소스 공유를 가능하게 합니다. CloudScene에 따르면 인도의 인터넷 사용자 수는 인구 100명당 29명이며, 연결 생태계는 122개의 코로케이션 데이터센터, 348개의 클라우드 서비스 제공업체, 8개의 네트워크 패브릭으로 구성되어 있습니다.

가상화와 클라우드 컴퓨팅 성장, 모바일 데이터 확대, 비디오 소비, 온디맨드 서비스 등 많은 요인들이 인도와 세계에서 DCI의 필요성을 높이고 있습니다. 기타 주요 홍보 요인으로는 데이터 및 디지털 지능형 디바이스(Amazon Alexa 및 Google Home 등)의 상당한 증가, 정부의 야심찬 디지털 인디아 개념 등이 있습니다.

유럽이 큰 시장 점유율을 차지

- 데이터센터 수 증가, 클라우드 기술 투자 증가, 최종 사용자 시장 확대는 유럽 데이터센터 상호 연결 시장 투자를 촉진하는 주요 요인의 일부입니다. GDPR(EU 개인정보보호규정) 및 개인 데이터 보호 이니셔티브(Gaia-X)와 같은 엄격한 지역법은 이 지역의 데이터센터 건설 및 개발을 더욱 강화하고 있습니다.

- 독일, 영국, 네덜란드, 프랑스는 조사 대상 시장에서 주요 투자국과 채용 국가입니다. 이 지역의 데이터센터 부문에 대한 투자와 성장이 증가하고 있습니다. 이는 주로 클라우드 기술 채택률이 높기 때문입니다. 예를 들어 Microsoft는 최근 유럽의 데이터센터용량을 두 배로 늘렸습니다.

- 데이터 트래픽 증가는 시장 성장에 크게 기여할 것으로 예상됩니다. 예를 들어, Equinix에 따르면 런던은 향후 유럽에서 가장 중요한 데이터 시장으로 계속 될 것으로 예상됩니다. 게다가 유럽의 데이터 컴플라이언스 규제 증가가 촉매가 되어, 연간 48%의 성장이 전망되어 세계의 상호 접속 대역폭의 23%를 차지한다고 합니다.

- 이 솔루션을 통해 DCspine은 더 많은 클라우드와 상호 연결 서비스를 제공하여 네트워크 확장을 용이하게 하며 네트워크 운영을 자동화할 수 있습니다.

- 이 건물은 Equinix HH1 International Business Exchange(IBX) 데이터센터로 개명됩니다. 이를 통해 Equinix의 세계 상호 연결 플랫폼 'Platform Equinix'에 독일에서 네 번째 시장이 추가되어 유럽 전역에서 확대되는 디지털 인프라 연결 수요에 대응할 수 있습니다.

데이터센터 상호 연결 산업 개요

데이터센터 상호연결 시장은 세계 진출 기업과 중소기업 모두가 존재하기 때문에 세분화되어 있습니다. 최근에는 데이터센터를 제공하는 공급업체도 데이터센터 상호 연결 솔루션을 결합했습니다. 시장 진출기업은 제품 혁신, 합병, 인수, 제휴 등의 전략을 채택하고 있습니다.

2022년 11월, Nokia는 7250 IXR(상호연결 라우터) 시스템을 위한 400기가비트 지원 인터페이스를 상호 연결된 캐리어 중립 및 클라우드 중립 데이터센터 시설을 제공하는 아프리카 대륙 최대 공급업체인 Africa Data Centers에 제공할 것이라고 발표했습니다. 범 아프리카 기술 기업인 Cassava Technologies 산하의 아프리카 데이터센터(Africa Data Centres)는 많은 아프리카 국가의 고객에게 저비용으로 대용량의 상호 접속 서비스를 제공할 수 있게 됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 데이터센터 수 증가(엣지와 하이퍼스케일)

- AI나 HPC등의 용도에 의한 초광대역, 간소화, 지능적인 DCI 네트워크 요구의 고조

- 시장의 과제

- 시장 기회

- 5G 상용화 증가

- 자율주행차, 스마트시티 등 시장의 성장

제6장 COVID-19의 산업에 미치는 영향 평가

제7장 기술 스냅샷

제8장 시장 세분화

- 용도별

- 재해 복구와 사업 계속

- 공유 데이터 및 리소스

- 데이터(스토리지) 이동성

- 기타

- 최종 사용자 산업별

- 통신 서비스 제공업체(CSP)

- 인터넷 컨텐츠 및 커리어 뉴트럴 프로바이더(ICPs/CNPs)

- 정부/연구 및 교육기관(Government/R&E)

- 기타 최종 사용자 산업별

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

제9장 경쟁 구도

- 기업 프로파일

- Ciena Corp.

- Cisco Systems Inc.

- Juniper Networks Inc.

- Fujitsu Ltd.

- Microsemi Corp.

- Pluribus Networks Inc.

- Huawei Technologies Co. Ltd.

- ADVA Optical Networking SE

- Infinera Corp.

- Nokia Oyj

제10장 투자 분석

제11장 시장의 미래

JHS 25.02.20The Data Center Interconnect Market size is estimated at USD 16.24 billion in 2025, and is expected to reach USD 32.63 billion by 2030, at a CAGR of 14.98% during the forecast period (2025-2030).

With the proliferation of data and expansion of technologies like AI and High-Performance Computing (HPC), the need to connect data center assets quickly, reliably, and cost-effectively is growing significantly.

Key Highlights

- Factors such as throughput, latency, simplified operations and maintenance, intelligence, and security are becoming significant priorities for data center vendors. This is one of the major factors driving the adoption of Data Center Interconnect (DCI) technology. This is because they can increase bandwidth between data centers, cut down on latency, and stop packet loss.

- The market being studied is getting bigger because of the growing cloud computing industry and the recent rise in OTT service use due to a nationwide lockdown.Moreover, the increasing commercialization of 5G services may further expand the scope of interconnected data center solutions. Autonomous vehicles, smart cities, digital twins, virtual reality, AI virtual assistants, video surveillance and monitoring, and gaming can drive the market's demand.

- The data center interconnection market is growing because more and more people are becoming aware of its many benefits, such as easy access, more convenience, highly encrypted data, connecting with other data segments, and so on.

- The edge computing trend, essential in the 2020 nationwide lockdown scenario, further expands the studied market scope. About 10-15 percent of data is created and processed outside a centralized data center or cloud, but it is expected to reach 60-70 percent by 2025. The hyperscale data centers of Amazon, Google, Equinix, and DRT, are interconnected and stream data and applications over the network to end users. The edge cloud may be a unique ecosystem of open and interconnected data centers.

- The major challenge, especially for small and medium-sized businesses, is the cost of data center connectivity services. A new data center necessitates a significant investment in both construction and maintenance. Furthermore, the distance between data centers is important since it might reduce a data center's efficiency, limiting the growth of the data center interconnect industry.

The COVID-19 outbreak sparked a surge in demand for cloud computing globally. It also expanded the scope of the data center market. Although the data center construction projects witnessed a supply chain disruption due to the labor shortage, it was not expected to delay the completion of several projects. This was only seen in the initial phases. Video streaming and conferencing usage surged beyond expectations, particularly during the nationwide lockdown period, driving up bandwidth demands for networks globally. After the pandemic, the market is currently growing due to rapid digitization and increased 5G services.

Data Center Interconnect Market Trends

Increasing Number of Data Centers to Drive the Market Growth

- According to the US-based market vendor, Ciena Corporation, the number of data centers has increased in recent years, as there are now more than 7,500 around the globe, with 2,600 packed into the top 20 global cities alone. According to Huawei, global data produced annually may reach 180 ZB in 2025. The proportion of unstructured data (such as raw voice, video, and image data) may also continue to increase, reaching more than 95% shortly, boosting the growth of data centers globally.

- Data Communication Network (DCN) and Data Center Interconnect (DCI) solutions are increasingly concerned with quickly increasing DCN and DCI bandwidth to ensure zero packet loss, low latency, and high throughput of lossless networks, meeting the requirements of rapid service development. The DCI network connecting data centers has evolved into a 10 Tbit/s Wavelength Division Multiplexing (WDM) interconnection network.

- Further, data center service providers are investing in expanding their colocation and cloud capabilities. End-user enterprises (like telecom and financial organizations) opting to build their own data centers are mainly making the interconnected market for data centers a global investment hotspot. Industries, mainly OTT, ISPs, the financial sector, and the public sector, are developing their use cases for DCI networks due to data center growth and distribution, improved fiber utilization, and low-cost pluggable modules.

- The growth of data centers is also driving an increase in DCI, which allows enterprises to connect their data centers, cloud providers, and other data center operators to enable simpler data and resource sharing. According to CloudScene, India has 29 internet users for every 100 people, and its connectivity ecosystem is made up of 122 colocation data centers, 348 cloud service providers, and eight network fabrics.

Numerous factors, including the growth of virtualization and cloud computing, mobile data expansion, video consumption, and on-demand services, are driving a greater need for DCI in India and globally. Other key drivers include a significant increase in data and digital intelligent devices (such as Amazon's Alexa and Google Home) and the government's ambitious Digital India initiative.

Europe to Hold Significant Market Share

- The growing number of data centers, increasing investment in cloud technologies, and the expansion of end-user markets are some of the major factors driving the European data center's investment in the interconnect market. The stringent regional laws, like GDPR and the Personal Data Protection Initiative (Gaia-X), further boost the region's local data center construction and development.

- Germany, the United Kingdom, the Netherlands, and France are some of the major investors and adopters in the market studied. Investment and growth in the data center sector in the region have been increasing. This is mainly due to the high rate of adoption of cloud technologies. For instance, Microsoft alone has doubled its European data center capacity recently.

- Data traffic growth is expected to contribute to the market's growth significantly. For instance, according to Equinix, London is expected to remain the most important European market for data. Furthermore, an increasing number of European data compliance regulations serve as a catalyst, which is expected to grow 48% per year, accounting for 23% of global interconnection bandwidth.

- Furthermore, Nokia announced the availability of its 7220 IXR data center hardware platforms running SR Linux to DCspine, a subsidiary of Eurofiber Cloud Infra that provides digital infrastructure and connectivity services across European data centers, in November of this year.With this solution, DCspine will be able to offer more cloud and interconnection services, make the network easier to scale, and automate network operations.

- The building would be renamed the Equinix HH1 International Business Exchange (IBX) data center. It would add a fourth market in Germany to the company's global interconnection platform, Platform Equinix, and help meet the growing demand for connecting digital infrastructure across Europe.

Data Center Interconnect Industry Overview

The Data Center Interconnect Market is fragmented due to the presence of both global players and small and medium-sized enterprises. Lately, the vendors offering data centers are also combining data center interconnect solutions. Market players are adopting strategies such as product innovation, mergers, acquisitions, and partnerships.

In November 2022, Nokia announced that it will provide 400-gigabit-enabled interfaces for its 7250 IXR (interconnect router) systems to Africa Data Centers, the continent's largest provider of interconnected, carrier- and cloud-neutral data center facilities. Africa Data Centres, a business of Cassava Technologies, a pan-African technology company, would be able to offer its clients in many African countries low-cost, high-capacity interconnection services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Centers (Edge and Hyperscale)

- 5.1.2 Increasing Need for Ultra- broadband, Simplified, and Intelligent DCI Networks due to Applications, like AI and HPC

- 5.2 Market Challenges

- 5.3 Market Opportunities

- 5.3.1 Rising Commercialization of 5G

- 5.3.2 Growth in Markets, Such as Autonomous Vehicle, Smart City

6 ASSESSMENT OF COVID-19 IMPACT ON THE INDUSTRY

7 TECHNOLOGY SNAPSHOT

8 MARKET SEGMENTATION

- 8.1 By Application

- 8.1.1 Disaster Recovery and Business Continuity

- 8.1.2 Shared Data and Resources

- 8.1.3 Data (Storage) Mobility

- 8.1.4 Other Applications

- 8.2 By End-user Industry

- 8.2.1 Communications Service Providers (CSPs)

- 8.2.2 Internet Content and Carrier- neutral Providers (ICPs/CNPs)

- 8.2.3 Government/Research and Education (Government/R&E)

- 8.2.4 Other End-user Verticals

- 8.3 By Geography

- 8.3.1 North America

- 8.3.2 Europe

- 8.3.3 Asia Pacific

- 8.3.4 Rest of the World

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Ciena Corp.

- 9.1.2 Cisco Systems Inc.

- 9.1.3 Juniper Networks Inc.

- 9.1.4 Fujitsu Ltd.

- 9.1.5 Microsemi Corp.

- 9.1.6 Pluribus Networks Inc.

- 9.1.7 Huawei Technologies Co. Ltd.

- 9.1.8 ADVA Optical Networking SE

- 9.1.9 Infinera Corp.

- 9.1.10 Nokia Oyj