|

시장보고서

상품코드

1651058

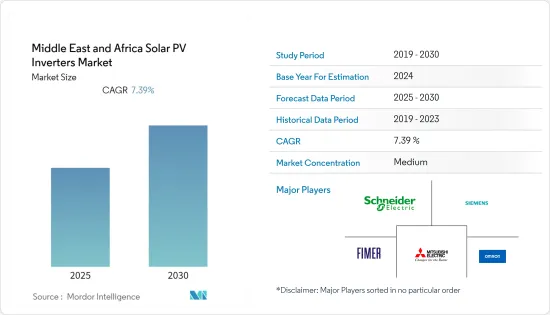

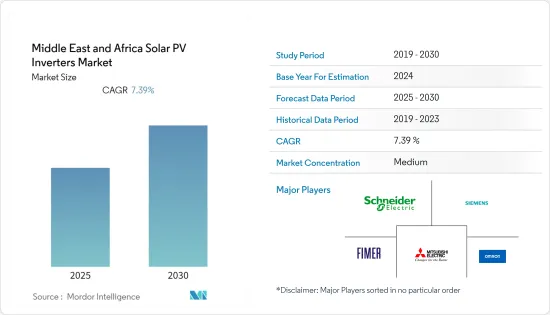

중동 및 아프리카의 태양광발전 인버터 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Middle East and Africa Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

중동 및 아프리카의 태양광발전 인버터 시장은 예측 기간 동안 CAGR 7.39%를 기록할 것으로 예상됩니다.

COVID-19는 2020년 시장에 큰 영향을 미치지 않았습니다. 현재 시장은 전염병 이전 수준에 도달했습니다.

주요 하이라이트

- 장기적으로 태양광발전 인버터 시장은 투자 및 야심찬 태양광 에너지 목표와 함께 태양광발전에 대한 수요 증가로 인해 발전할 것으로 예상됩니다.

- 반면, 스트링 인버터의 확장성 부족과 같은 기술적 단점은 예측 기간 동안 태양광발전 인버터의 성장을 저해할 것으로 예상됩니다.

- 기술 발전과 제품 혁신은 향후 몇 년 동안 시장 성장의 기회를 창출할 것으로 보입니다.

- 아랍에미리트는 태양광 에너지 수요의 대부분을 차지하며, 예측 기간 동안 가장 큰 시장이 될 것으로 예상됩니다.

중동 및 아프리카의 태양광발전 인버터 시장 동향

중앙 인버터 부문이 시장을 장악할 것으로 예상

- 중요한 그리드 피더는 중앙 인버터입니다. 정격 출력이 100kWp를 초과하는 태양광발전 시스템에서 자주 사용됩니다. 태양전지 어레이에서 수집된 직류 전력은 종종 바닥 장착형 또는 지상 장착형 인버터를 사용하여 계통 연결용 교류 전력으로 변환됩니다. 이러한 장치는 실내 또는 실외에서 사용할 수 있으며 용량은 약 50kW에서 1MW까지 다양합니다.

- 또한, 중앙 인버터는 인버터 수가 적고 관리가 용이합니다. 이 인버터는 고집적, 고출력 밀도, 저비용, 완벽한 보호 기능, 높은 발전소 안전성을 갖추고 있습니다.

- 중앙 인버터는 유틸리티 규모의 애플리케이션에 사용되기 때문에 사용되는 전력망의 전압 및 주파수와 동일한 전압 및 주파수를 생성해야 합니다. 전 세계적으로 다양한 전력망 표준이 있기 때문에 제조업체는 이러한 매개 변수를 위상 수라는 특정 요구 사항에 맞게 사용자 정의 할 수 있으며, 생산되는 대부분의 중앙 인버터는 3 상 인버터입니다.

- 예를 들어, 2022년 6월 1.5GW 규모의 태양광발전소인 수데아 태양광발전소는 세계에서 가장 큰 단일 계약 태양광발전 시설 중 하나로 연간 약 290만 톤의 이산화탄소 배출을 줄이면서 18만 5,000가구가 사용할 수 있는 전력을 생산할 것으로 예상되었습니다. 변속기, 인버터, 송전용 변전소도 프로젝트의 일부가 될 것입니다.

- 2021년 중동의 총 태양광발전량은 15.2테라와트시, 연간 성장률은 20.4%에 달할 것입니다. 중앙 인버터는 태양에너지를 사용 가능한 전력으로 변환하는 데 사용되기 때문에 향후 유틸리티 규모의 프로젝트와 태양광발전이 증가함에 따라 중앙 인버터 부문은 예측 기간 동안 시장 성장을 지배할 것으로 예상됩니다.

아랍에미리트가 시장을 독점할 가능성이 높습니다.

- 아랍에미리트는 석유와 가스의 주요 생산국이지만, 지난 몇 년 동안 대규모 재생에너지 프로젝트를 진행해왔습니다. 그 결과, 아랍에미리트는 이 지역의 재생에너지 전환, 특히 태양광 분야에서의 전환을 주도하고 있습니다. 아랍에미리트는 전국적으로 재생에너지 프로젝트를 시행하는 데 있어 선도적인 역할을 하고 있습니다.

- 예를 들어, 아랍에미리트는 아부다비에 세계 최대 규모의 태양광발전소를 건설 중이며, 이를 통해 아부다비의 태양광발전 용량은 약 3.2기가와트까지 증가하게 됩니다. 이 태양광발전소는 지역 전체의 약 16만 가구에 전력을 공급할 예정입니다.

- 또한, 'UAE 에너지 전략 2050'은 2050년까지 전체 에너지 믹스에서 청정에너지의 비중을 50%까지 늘리는 것을 목표로 하고 있으며, 그 결과 전체 에너지 비용의 약 1,900억 달러를 절감할 수 있을 것으로 예상됩니다. 이는 예측 기간 동안 태양광발전 인버터 시장에 큰 비즈니스 기회를 제공합니다.

- 2021년 아랍에미리트의 태양광발전량은 약 5.1테라와트시였습니다. 연간 성장률은 13%, 향후 전략적 계획으로 인해 태양광발전 프로젝트의 성장이 예상되며, 예측 기간 동안 태양광발전 인버터 시장의 견인차 역할을 할 것으로 예상됩니다.

중동 및 아프리카의 태양광발전 인버터 산업 개요

태양광발전 인버터 시장은 상당히 세분화되어 있습니다. 이 시장의 주요 기업으로는 FIMER SpA, Schneider Electric SE, Siemens AG, 미쓰비시 전기, 오므론(Omron) 등이 있습니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2027년까지 시장 규모 및 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 규제와 정책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 인버터 유형별

- 센트럴 인버터

- 스트링 인버터

- 마이크로 인버터

- 용도별

- 주택

- 상업·산업(C&I)

- 유틸리티·스케일

- 지역별

- 아랍에미리트

- 사우디아라비아

- 이스라엘

- 기타 중동 및 아프리카

제6장 경쟁 상황

- 인수합병

- 주요 기업의 전략

- 기업 개요

- Omron Corporation

- Mitsubishi Electric Corporation

- FIMER SpA

- Siemens AG

- Schneider Electric SE

- Delta Energy Systems Inc.

- Huawei Technologies Co. Ltd

- Enphase Energy Inc.

제7장 시장 기회와 향후 동향

ksm 25.02.27The Middle East and Africa Solar PV Inverters Market is expected to register a CAGR of 7.39% during the forecast period.

The COVID-19 pandemic didn't significantly impact the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the market for solar PV inverters is anticipated to develop, along with investments and ambitious solar energy targets, due to the rising demand for solar electricity.

- On the other hand, technological drawback, such as the lack of expandability of string inverters, is expected to hamper the growth of solar PV inverters during the forecast period.

- Technological advancement and product innovation are likely to create opportunities for the market to grow in the upcoming years.

- United Arab Emirates is expected to be the largest market during the forecast period, with the majority of the demand for solar energy.

MEA Solar PV Inverters Market Trends

Central Inverters Segment is Expected to Dominate the Market.

- A significant grid feeder is a central inverter. It is frequently employed in solar photovoltaic systems with rated outputs of more than 100 kWp. DC power gathered from a solar array is often converted into AC power for grid connection using floor or ground-mounted inverters. These gadgets can be employed indoors or outdoors and have capacities ranging from about 50kW to 1MW.

- Moreover, a central inverter has less number of inverters, which is easy to manage. The inverter has high integration, high power density, low cost, complete protection functions, and high power station safety.

- As central inverters are used for utility-scale applications, they should produce the same voltage and frequency as that of the electric grid where they are used. As there are a lot of different electric grid standards worldwide, manufacturers are allowed to customize these parameters to match the specific requirements in terms of the number of phases; most central inverters manufactured are three-phase inverters.

- For instance, In June 2022, the Sudair Solar Power project, a 1.5GW photovoltaic (PV) solar farm, was anticipated to be one of the most extensive single-contracted solar PV facilities in the world, producing enough electricity to run 185,000 homes while reducing annual emissions by around 2.9 million tonnes. Transformers, inverters, and an electrical transmission substation will be part of the project.

- In 2021, the total Middle East solar generation accounted for 15.2 terawatt-hours with an annual growth rate of 20.4%; solar generation is expected to grow in the future. As the central inverters are used to convert solar energy into usable electricity, thus with the upcoming utility-scale projects and increasing solar generation the central inverters segment is expected to dominate the market growth during the forecast period.

United Arab Emirates Likely to Dominate the Market.

- United Arab Emirates is a major oil and gas producer, but it has undertaken several sizable renewable energy projects over the past several years. As a result, the nation is leading the region's transition to renewable energy, especially in the solar sector. It has become one of the leaders in executing renewable energy projects around the nation.

- For instance, United Arab Emirates is building the world's largest solar power plant in Abu Dhabi, which will increase Abu Dhabi's solar power capacity to approximately 3.2 gigawatts. This solar power plant will provide electricity to approximately 160,000 households across the region.

- Moreover, the 'UAE Energy Strategy 2050' targets to increase the contribution of clean energy to the overall national energy mix of the country to 50% by 2050, resulting in savings of approximately USD 190 billion of the overall energy costs. This provides significant opportunities for the solar PV inverters market in the forecast period.

- In 2021, United Arab Emirates' total solar generation was around 5.1 terawatt-hours. With an annual growth rate of 13 % and upcoming strategic plans, solar photovoltaic projects are expected to grow, which, in turn, is expected to drive the PV inverters market in the forecast period.

MEA Solar PV Inverters Industry Overview

The solar PV inverters market is moderately fragmented. Some of the major players in the market (in no particular order) include FIMER SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and Omron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Billion Till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial (C&I)

- 5.2.3 Utility-scale

- 5.3 By Geography

- 5.3.1 UAE

- 5.3.2 Saudi Arabia

- 5.3.3 Israel

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Omron Corporation

- 6.3.2 Mitsubishi Electric Corporation

- 6.3.3 FIMER SpA

- 6.3.4 Siemens AG

- 6.3.5 Schneider Electric SE

- 6.3.6 Delta Energy Systems Inc.

- 6.3.7 Huawei Technologies Co. Ltd

- 6.3.8 Enphase Energy Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록