|

시장보고서

상품코드

1683100

풍력 터빈 정비, 수리 및 점검(MRO) 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Wind Turbine Maintenance, Repair and Overhaul (MRO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

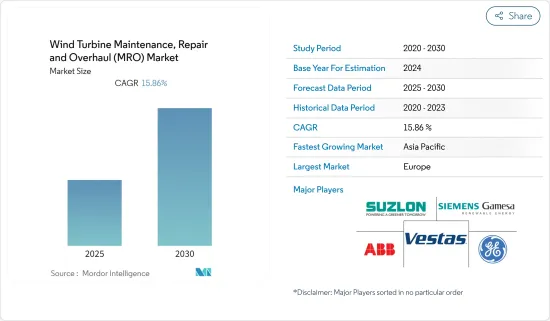

풍력 터빈 정비, 수리 및 점검(MRO) 시장은 예측 기간 동안 CAGR 15.86%를 기록할 전망

주요 하이라이트

- 풍력 터빈의 해양 배치 증가는 세계 풍력 터빈 정비, 수리 및 점검(MRO) 시장을 견인하고 예측 기간 동안 가장 빠르게 성장하는 부문이 될 가능성이 높습니다.

- 또한 발전용 풍력 발전의 채용이 크게 증가하고 있습니다. 다양한 국가들이 풍력 발전 시장에 투자하고 있으며 정비의 필요성이 높아질 가능성이 높습니다. 중동 및 아프리카는 풍력 발전소의 현저한 성장을 목격하고 있으며, 이것이 세계의 풍력 터빈 정비, 수리 및 점검(MRO) 시장 성장에 기회를 제공할 것으로 예상됩니다.

- 아시아태평양은 2020년에 풍력 발전 설비 용량이 가장 빠르고 빠르게 증가하기 때문에 가장 급성장하는 지역으로 예상됩니다.

풍력 터빈 MRO 시장 동향

해상 풍력 발전 설비가 큰 성장을 이룰 전망

- 에너지 수요가 높아지는 가운데, 깨끗한 에너지를 공급할 수 있는 신재생 에너지의 도입에 주요국이나 기업이 방향타를 끊고 있습니다. 선진기술을 구사한 해상 풍력 발전의 도입은 국가나 기업의 고액투자를 끌고 있습니다.

- 도입 장소별로는 비용의 저하와 기술의 향상에 의해 예측 기간 중에도 해상 산업이 세계의 풍력 터빈 산업 투자의 견인역인 계속할 것으로 예상됩니다.

- 세계의 해양 시장은 2020년에도 안정적으로 추이해, 신규 증설량은 2019년과 거의 같은 606만kW가 되었습니다. 오프쇼어의 누적 설치 용량은 3,530만 kW에 달하고, 전년대비 21.7% 증가했습니다.

- 해상 풍력 산업은 2020년에 대규모 설치를 나타냈습니다. 예를 들어 중국은 단년도에 3GW의 해상풍력을 설치했으며, 네덜란드(설치량 150만kW), 벨기에(설치량 706만kW), 영국(설치량 483만kW), 독일(설치량 237만kW)이 이에 이어졌습니다. 그러나 영국에서의 신규 도입량 증가의 둔화는 주로 차금결제계약(CfD) 1라운드와 CfD2 라운드의 프로젝트 실행의 어긋남에 의한 것이었습니다. 게다가 독일에서는 신규 설치의 둔화는 주로, 불리한 조건과 단기 해상 풍력 발전 프로젝트 파이프라인의 수준 저하에 의한 것이었습니다.

- 보다 근해와 같이 복잡하고 어려운 환경에서 풍력 터빈의 도입 증가가 예상되고, 풍력 터빈의 능력 증대와 함께 풍력 터빈의 작동 부품에 추가 압력이 가해지고 있습니다. 그 결과, 기어 박스 등의 부품의 조기 고장이 발생해, 풍력 발전소의 대폭적인 침체를 초래할 가능성이 높습니다. 또한 MRO 서비스를 제공하는 비용은 육상 사이트보다 훨씬 높습니다. 재료와 서비스 증가, 접근하기 어려운 지형 등의 요인이 육상 시설에 비해 성장을 억제하고 있습니다.

- 따라서 위의 관점에서 해상 풍력 발전의 도입은 예측기간 동안 풍력 터빈 정비, 수리 및 점검 시장에서 큰 성장을 보일 것으로 예상됩니다.

아시아태평양이 급성장 시장이 될 전망

- 아시아태평양은 중국의 공헌으로 세계에서 가장 빠르게 성장하는 풍력 에너지 시장입니다. 이 지역의 누적 설비 용량은 346.70GW이며, 그 중 육상 풍력 발전의 설비 용량은 336.29GW, 해상 풍력 발전의 설비 용량은 10.41GW입니다.

- 2020년 현재 중국은 아시아태평양에서 가장 큰 풍력 발전 설비 용량, 약 278.32GW를 보유하고 있습니다. 또, 육상 풍력 발전 세계 시장에서도 톱 클래스입니다. 2020년 중국은 새롭게 5,893만 kW의 풍력발전을 추가했으며, 그 내역은 육상설비가 4,894만 kW, 해상설비가 999만 kW이었습니다. 이러한 점은 중국이 아시아태평양에서 정비, 수리 및 점검(MRO) 서비스의 최대 시장이 될 것으로 예상을 보여줍니다.

- 한편, 풍력 발전 설비 용량으로 아시아태평양 2위인도는 2020년 시점에서 3,862만5,000kW에 그쳤습니다. 그러나 인구 13억 5,000만 명의 인도에서는 향후 10년간 전력 수요가 두배로 될 것으로 전망되고 있습니다. 그래서 인도 정부는 2022년까지 신재생 에너지 발전 용량을 175GW, 그 중 풍력 발전을 60GW, 2030년까지 450GW, 그 중 풍력 발전을 140GW로 하는 목표를 내걸었습니다. 한국은 120m의 허브 높이에서 695GW라는 방대한 기술적 잠재력을 자랑합니다.

- 한국은 또한 2030년까지 6,380만 kW의 신재생 에너지 용량을 가지는 것을 목표로 하고 있으며, 그 중 약 1,800만 kW가 풍력발전에 의한 것입니다. Orsted와 같은 국제 기업들은 한국이 풍력 발전, 특히 지리적 특성을 고려한 해안 지역에서 풍력 발전에 성공할 수 있다고 말합니다.

- 이것은 예측 기간 동안 세계의 풍력 터빈 정비, 수리 및 점검 사업에 종사하는 진출 기업에게 아시아태평양이 뛰어난 비즈니스 대상이 될 것으로 예상됩니다.

풍력 터빈 MRO 산업 개요

세계의 풍력터빈 정비, 수리 및 점검(MRO) 시장은 적당히 분할되어 있습니다. 이 시장의 주요 기업으로는 Siemens Gamesa Renewable Energy SA, General Electric Company, Suzlon Energy Ltd, ABB Ltd, Vestas Wind Systems A/S 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 서문

- 세계의 신재생 에너지 믹스(2020년)

- 풍력 발전 설비 용량(GW) 및 예측(-2027년)

- 시장 규모 및 수요 예측(단위 : 10억 달러, -2027년)

- 세계의 풍력 터빈의 평균 규모(MW)(2018-2027년)

- 최근 동향 및 개발

- 정부의 규제 및 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 전개 장소별

- 온쇼어

- 해외

- 서비스 유형별

- 정비

- 수리

- 점검

- 컴포넌트

- 기어박스

- 발전기

- 로터 블레이드

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 남미

- 중동 및 아프리카

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 주요 기업의 전략

- 기업 프로파일

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Stork(a Fluor Company)

- Moventas Gears Oy

- ZF Friedrichshafen AG

- Vestas Wind Systems A/S

- Suzlon Energy Ltd

- ABB Ltd

- Dana SAC UK Ltd

- Nordex SE

- Mistras Group

- Integrated Power Services LLC

제7장 시장 기회 및 향후 동향

AJY 25.03.31The Wind Turbine Maintenance, Repair and Overhaul Market is expected to register a CAGR of 15.86% during the forecast period.

Key Highlights

- Increasing, offshore deployment of wind turbine is likely to drive the global wind turbine maintenance, repair, and overhaul (MRO) market, thus making it fastest growing segment during the forecast period.

- Moreover, the adoption of wind power for power generation is increasing significantly. Various countries are investing in the wind energy market which likely to increase the requirement for maintenance. Middle-East and Africa region witnessing significant growth in wind power plant which is likely to provide the opportunity to the growth of global wind turbine maintenance, repair & overhaul market.

- Asia-Pacific is expected to be the fastest growing region, owing to the largest and fastest increase in wind power installed capacity in 2020.

Wind Turbine MRO Market Trends

Offshore Wind Installations Expected to Witness Signifcant Growth

- As demand for energy is rising, major countries and companies are turning towards the adoption of renewable energy as it has the ability to provide clean energy. The adoption of offshore wind energy with advance technology attracted the countries and companies for high investment.

- By location of deployment, the offshore industry is expected to remain the driver of the global wind turbine industry investments during the forecast period, owing to declining costs and improved technology.

- The global offshore market remained stable in 2020, with 6.06 GW of new additions, almost the same as in 2019. The total cumulative offshore installations have reached 35.3 GW, representing a 21.7% increase in cumulative offshore wind installed capacity over the previous year.

- The offshore wind industry witnessed major installations in 2020. For instance, China installed a 3 GW offshore wind in a single year, followed by the Netherlands (installed 1.5 GW), Belgium (installed 706 MW), the United Kingdom (installed 483 MW), and Germany (237 MW). However, the slowdown of growth in terms of new installation in the United Kingdom was mainly due to the gap between the execution of projects in the Contracts for Difference (CfD) 1 and CfD 2 rounds. Furthermore, in Germany, the slowdown in new installations was primarily caused by unfavorable conditions and a lower level of the short-term offshore wind project pipeline.

- The expected increase in the deployment of wind turbines in more complex and challenging environments, such as farther offshore, coupled with the growing capacity of the wind turbine capacity, has put additional pressure on the operating components of the wind turbine. This results in premature failure of the components, such as gearbox and other components, and is likely to cause a significant downturn in wind farms. Additionally, the costs involved in providing MRO services are much higher than onshore sites. Factors, such as increased material, service, and hard-to-access terrains, are restraining growth compared to onshore facilities.

- Therefore, owing to the above points, offshore wind deployments are expected to witness significant growth in wind turbine maintenance, repair & overhaul market during the forecast period.

Asia-Pacific Expected to be the Fastest Growing Market

- Asia-Pacific is the fastest growing wind energy market in the world, owing to the contribution of China. The region has a cumulative installed capacity of 346.70 GW, of which onshore wind power installed capacity is 336.29 GW and offshore wind power installed capacity is 10.41 GW.

- As of 2020, China had the largest wind power installed capacity in Asia-Pacific, around 278.32 GW. The country is also considered among the top markets in the onshore wind power industry globally. In 2020, China added up to 58.93 GW of new wind power, with 48.94 GW onshore installations and 9.99 GW offshore installations. All of this indicates that China is expected to be the largest market for maintenance, repair, and overhaul services in the Asia-Pacific region.

- On the other hand, India, the second-largest country in the Asia-Pacific region in terms of wind energy installed capacity, sat only with a capacity of 38.625 GW as of 2020. However, over the next ten years, the electricity demand is expected to double in the country of 1.35 billion people. Accordingly, the Indian government has set a target of 175 GW of renewable energy capacity by 2022, of which 60 GW is expected to come from wind energy, and a target of 450 GW by 2030, of which 140 GW is expected to be wind-based generation. The country boasts a technical potential at a 120-meter hub height of a vast 695 GW.

- South Korea also aims to have a total renewable energy capacity of 63.8 GW by 2030, with approximately 18 GW coming from wind power. The international players, such as Orsted, have stated that South Korea may thrive from wind power generation, particularly in offshore areas considering its geographical characteristics.

- This, in turn, is expected to present Asia-Pacific as an excellent business destination for players involved in the global wind turbine maintenance, repair & overhaul business during the forecast period.

Wind Turbine MRO Industry Overview

The global wind turbine maintenance, repair, and overhaul market is moderately fragmented. Some of the key players in this market include Siemens Gamesa Renewable Energy SA, General Electric Company, Suzlon Energy Ltd, ABB Ltd, and Vestas Wind Systems A/S among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Global Renewable Energy Mix, 2020

- 4.3 Wind Power Installed Capacity and Forecast in GW, till 2027

- 4.4 Market Size and Demand Forecast in USD billion, till 2027

- 4.5 Global Average Size of Wind Turbine in MW, 2018-2027

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.2 Restraints

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitutes Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Service Type

- 5.2.1 Maintenance

- 5.2.2 Repair

- 5.2.3 Overhaul

- 5.3 Component

- 5.3.1 Gearbox

- 5.3.2 Generators

- 5.3.3 Rotor Blades

- 5.3.4 Other Components

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Gamesa Renewable Energy SA

- 6.3.2 General Electric Company

- 6.3.3 Stork (a Fluor Company)

- 6.3.4 Moventas Gears Oy

- 6.3.5 ZF Friedrichshafen AG

- 6.3.6 Vestas Wind Systems A/S

- 6.3.7 Suzlon Energy Ltd

- 6.3.8 ABB Ltd

- 6.3.9 Dana SAC UK Ltd

- 6.3.10 Nordex SE

- 6.3.11 Mistras Group

- 6.3.12 Integrated Power Services LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록