|

시장보고서

상품코드

1683200

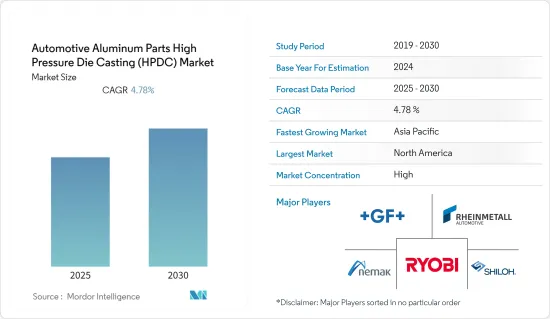

자동차 알루미늄 부품 고압 다이캐스트(HPDC) 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Automotive Aluminum Parts High Pressure Die Casting (HPDC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

자동차 알루미늄 부품 고압 다이캐스트 시장은 예측 기간 동안 CAGR 4.78%를 기록할 전망입니다.

COVID-19 팬데믹은 2020년 상반기 제조시설의 운영 정지 및 봉쇄로 인해 세계적으로 자동차 생산이 감소하여 시장에 부정적인 영향을 미쳤습니다. 그러나 2021년에는 규제가 서서히 개방되어 자동차 생산이 회복되었고, 더욱 안정적인 EV 판매가 시장 성장 회복에 기여했습니다.

승용차 및 상용차의 생산량 증가는 고압 알루미늄 다이캐스트에 의해 개발된 자동차 부품의 장점을 활용하여 시장을 견인할 것으로 예상됩니다. 시장 성장을 가속하는 주요 요인으로는 엄격한 배기 가스 규제와 기업 평균 연비(CAFE) 기준의 제정, 상용차 수요 증가와 유럽에서의 판매, 자동차 산업의 성장 등을 들 수 있습니다. 소비되는 알루미늄의 약 75.0%는 재사용이 가능하고, 재생 알루미늄은 무기한으로 재활용할 수 있기 때문에 자동차 부품 고압 다이캐스트 재료로서 가장 인기가 있습니다.

정부는 미국, 독일, 영국, 인도, 중국 등 주요 국가에서 보조금을 지급함으로써 자동차 제조업체를 뒷받침하고 고객에게 전기자동차 채용을 장려하고 있습니다. 이러한 전기 모빌리티의 확대 동향은 시장에서 사업을 전개하는 진출기업이 배터리 하우징, 변속기 부품 등 다양한 전기자동차 부품을 생산하도록 장려하고 있습니다.

또한 자동차 및 자동차 부문에서 철강의 알루미늄 대체 성장과 이러한 부문에서 자금 조달 증가는 예측 기간 동안 고압 알루미늄 다이캐스트 시장의 성장에 유리한 기회를 창출할 것으로 예상됩니다.

자동차 알루미늄 부품 고압 다이캐스트 시장 동향

알루미늄 가격 상승이 시장을 방해

2021년 세계 자동차 판매 대수는 약 6,670만 대, 2020년은 약 6,380만 대였습니다. 세계의 팬데믹은 자동차 판매를 포함한 세계 경제 활동에 영향을 미치고 바이러스의 확산을 억제하기 위해 여러 국가에서 엄격한 봉쇄가 실시되었습니다. 이 때문에 2020년 자동차 판매량은 2019년에 비해 14.8% 감소했습니다. 그러나 삶이 정상으로 돌아왔을 때 자동차 판매량은 세계적으로 증가하고 자동차 알루미늄 부품 고압 다이캐스트 시장이 예측 기간 동안 성장하는 데 도움이 되었습니다.

승용차 수요 증가와 전동 이동성에 대한 의식이 높아짐에 따라 주요 기업은 현재 보유 차량의 전동화에 기대하고 있습니다. 예를 들면 다음과 같습니다.

- 2022년 8월 일본 자동차 제조업체인 스즈키 모터는 구자라트 주 한살풀에 전기자동차 배터리 공장을 설립하기 위해 730억 루피에 상당한 전략적 투자를 할 것이라고 발표했습니다. 이 공장은 인도에서 향후 개발되는 전기자동차 기술에 대응하는 선진 화학 전지의 제조를 시야에 넣고 있습니다. 이것은 Suzuki가 Toshiba Corporation, Denso와 공동으로 구자라트 주에 설립한 TDS 리튬 이온 배터리 구자라트(TDSG)에 이어 인도에서 두 번째 전기자동차 배터리에 대한 노력입니다.

- 2022년 3월 Ford Motors는 2024년 말까지 유럽에서 3차종 전기차를 도입할 것이라고 발표했으며, 2026년까지 유럽에서 연간 60만대 이상의 전기차를 판매할 목표를 세웠습니다.

- 2022년 1월, 제너럴 모터스는 전기자동차 생산 능력을 강화하기 위해 미시간의 두 공장에 40억 달러 이상을 투자할 것을 고려하고 있다고 발표했습니다. GM과 LG Energy Solution은 랜싱에 25억 달러의 배터리 시설을 건설할 것을 제안합니다.

승용차의 판매량이 증가함에 따라 HPDC 수요는 유망한 성장을 보여줍니다. 현재 승용차는 경량이고 높은 인장 강도를 가진 HPDC를 다양한 자동차 부품에 요구하고 있습니다. 알루미늄 압출 성형 회사는 판매 바의 상승을 보여주기 위해 많은 투자를 하고 있습니다. 예를 들어, 2022년 8월, 라틴아메리카 최대의 알루미늄 압출업체인 Cuprum은 자동차 부문에 고압 다이캐스트 기술을 제공하기 위해 누에보 레온에 알루미늄 압출을 위한 새로운 공장을 건설하기 위해 1억 달러를 투자할 것이라고 발표했습니다.

이러한 요인과 앞서 언급한 개발을 고려하면, 승용차 부문은 자동차 알루미늄 HPDC 수요에 동등한 기세를 줄 것으로 예상됩니다.

더 빠른 속도로 성장하는 북미

세계의 많은 다이캐스트 부품 제조업체들이 자동차 산업용 알루미늄 고압 다이캐스트 생산 공정 확대에 크게 투자하고 있습니다. 2020년부터 2021년까지, 북미는 미국과 멕시코를 중심으로 Nemak, Bocar, George Fischer와 같은 선도적인 제조업체에 의한 신규 생산 공장에 대한 투자와 확대의 수가 많아 주요 지역 중 하나로 인식되고 있습니다.

이 지역의 CO2 배출량 증가와 이에 따른 까다로운 CAFE와 EPA 규제로 자동차 제조업체는 제조 공정에서 알루미늄 고압 다이캐스트(HPDC) 부품을 보다 광범위하게 채용할 수밖에 없었으며, 이는 이 나라에서 시장 성장의 추진력이 되고 있습니다.

멕시코는 세계 7위의 자동차 제조업체이며 독일, 일본, 한국에 이은 4위의 자동차 수출국이기 때문에 멕시코의 자동차용 다이캐스트 시장은 대두되고 있습니다.

Toyota, Mercedes-Benz(Nissan과의 합작), Audi, BMW와 같은 주요 자동차 제조업체가 멕시코에 새로운 공장을 설립했습니다. General Motors, Fiat-Chrysler, Hyundai, Honda와 같은 다른 자동차 제조업체들은 기존 공장 확대에 주력하고 있습니다. 또한 중국에서 미국으로의 자동차 부품 수입 관세 인상이 최근 발표되었기 때문에 중국 자동차 제조업체가 멕시코에서 생산 기지 확대를 계획하고 있습니다.

멕시코 자동차 산업의 성장으로 Tier 1, Tier 2, Tier 3 공급업체의 존재감이 크게 증가하고 있습니다. 가볍고 견고한 자동차 부품의 동향이 증가함에 따라 예측 기간 동안 위공급업체는 HPDC를 통해 제조된 알루미늄 부품을 채택할 가능성이 높습니다.

자동차 알루미늄 부품 고압 다이캐스트 산업 개요

자동차 알루미늄 부품 고압 다이캐스트 시장은 Rheinmetall Automotive, Endurance Group, Shiloh Industries, GF Casting Solutions, Ryobi Die Casting Inc., Nemak 등 주요 기업에 의해 세분화되고 있습니다.

사업부분과 제조공장 확대, 주요 지역의 현지 제조업체와의 합작사업, M&A는 시장 경쟁을 유지 및 향상하기 위해 진입기업이 채용하는 주요 전략입니다. 예를 들면

- 2022년 8월, Minda Corporation Limited는 알루미늄 HPDC 부품을 포함한 고압 다이캐스트 부품의 사업 개발을 위해 미국, 아프리카, 유럽 내연 기관 및 전기자동차 부문의 여러 Tier1 및 OEM 인수를 시작했다고 발표했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 산업의 매력-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 용도 유형별

- 바디 인 화이트

- 도어 프레임

- 배터리 하우징

- 기둥

- 지붕

- 기타(프론트 엔드 캐리어, 리포스먼트, 크로스 빔, 인파네 서포트)

- 섀시

- 변속기

- 기타(서스펜션, 스티어링)

- 바디 인 화이트

- 차종별

- 승용차

- 상용차

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 기타

- 브라질

- 남아프리카

- 기타 국가

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Georg Fischer AG

- Rheinmetall Automotive AG(KSPG AG(KS Kolbenschmidt GmbH))

- Ryobi Die Casting Inc.

- Nemak

- Endurance Technologies

- Shiloh Industries Inc.

- Pace Industries

- Brabant Alucast*

제7장 시장 기회 및 향후 동향

AJY 25.03.31The Automotive Aluminum Parts High Pressure Die Casting Market is expected to register a CAGR of 4.78% during the forecast period.

The COVID-19 pandemic had a negative impact on the market as the shutdown of manufacturing facilities and lockdowns in the first half of 2020 resulted in a decline in vehicle production across the world. However, with the gradual opening of restrictions in 2021 vehicle production picked up and further stable EV sales help the market regain its growth.

An increase in the production of passenger cars and commercial vehicles is expected to drive the market for the automotive parts developed through high-pressure aluminum die casting owing to their advantages. Some of the major factors driving the growth of the market are the enactment of stringent emission regulations and Corporate Average Fuel Economy (CAFE) standards, an increase in the demand for commercial vehicles and sales in the European region, and the growth of the automotive industry. Approximately 75.0% of the aluminum consumed can be reused, and reclaimed aluminum can be recycled indefinitely, making it the most popular material for automotive parts high pressure die casting.

Government pushing automobile manufacturers and encouraging customers to adopt electric vehicles by providing subsidies across key major countries like the United States, Germany, United Kingdom, India, China, etc. This trend of growing electric mobility encourages players operating in the market to produce various electric vehicle components like battery housings, transmission parts, etc.

Furthermore, growth in the substitution of aluminum for iron and steel in the automotive and automobile sectors, as well as increased funding in these sectors, would create lucrative opportunities for the growth of the high-pressure aluminum die casting market during the forecast period.

Automotive Aluminum Parts High Pressure Die Casting Market Trends

Rising Aluminum Prices Hindering the Market

In 2021, the global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower than compared in 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive aluminium parts high-pressure die casting market to grow in the forecast period.

Owing to the increase in the demand for passenger cars and the growing awareness of electric mobility, major players are looking forward to electrifying their present fleet. For instance:

- In August 2022, Japanese carmaker Suzuki Motor announced its strategic investment worth INR 7,300 crore to set up the electric vehicle battery plant at Hansalpurin Gujarat. The plant will look forward for manufacturing advanced-chemistry cell batteries for upcoming electric vehicle technology in India. This will be Suzuki's second EV battery initiative in India after TDS Lithium-Ion Battery Gujarat (TDSG), which it set up in Gujarat in collaboration with Toshiba and Denso.

- In March 2022, Ford Motors announced to include three all-electric passenger vehicles in Europe by the end of 2024 and set a target to sell more than 600,000 electric vehicles annually by 2026 in the Europe region.

- In January 2022, General Motors announced considering investing more than USD 4 billion in two Michigan factories to increase its electric car manufacturing capacity. GM and LG Energy Solution have proposed constructing a USD 2.5 billion battery facility in Lansing.

With rising sales of the passenger car segment, demand for HPDC is witnessing promising growth. Nowadays, passenger car demanding HPDC in their different car components owing to their lightweight features and higher tensile strength. Aluminium extrusion companies are investing heavily to witness elevate sales bars. For instance, in August 2022, Cuprum who is the Latin America's largest aluminium extruder announced the investment of USD 100 million to build a new plant in Nuevo Leon for extrusion of aluminium to offer high pressure die casting technology in the automotive sector.

Considering these factors and aforementioned developments, passenger car segmented is expected to provide equivalent momentum to the demand for automotive aluminium HPDC.

North America Growing at a Faster Pace

Many die casting parts manufacturers across the world have significantly invested in the expansion of the aluminum high-pressure die-casting production process for the automotive industry. During 202-2021, North America has been recognized as one of the major regions with a larger number of investments and expansions of new production plants by major manufacturers like Nemak, Bocar, and George Fischer, mainly in the United States and Mexico.

Increased CO2 emissions and subsequent stringent CAFE and EPA regulations in the region are forcing automakers to employ high-pressure die casting (HPDC) parts of aluminum more extensively in their manufacturing processes, acting as a propellant for the market's growth in the country.

The Mexican automotive die casting market is emerging, as the country is one of the largest vehicle manufacturers and seventh-largest car manufacturers in the world, as well as is the fourth-largest car exporter, behind Germany, Japan, and South Korea.

Key automakers, like Toyota, Mercedes-Benz (with Nissan), Audi, and BMW established new factories in Mexico. Other automakers, like General Motors, Fiat-Chrysler, Hyundai, and Honda are focusing on expanding their existing factories. Additionally, Chinese automobile manufacturers are planning to expand their production bases in Mexico, owing to the recent announcement of an increase in import tariff on auto parts from China to the United States.

Owing to the growing Mexican automotive industry, the presence of tier 1, tier 2, and tier 3 suppliers have been significantly increasing. With the rising trend of lightweight and robust automotive parts, the above suppliers are likely to adopt aluminum parts manufactured through HPDC, during the forecast period.

Automotive Aluminum Parts High Pressure Die Casting Industry Overview

The automotive aluminum parts high pressure die casting market is fragmented, as major players, like Rheinmetall Automotive, Endurance Group, Shiloh Industries, GF Casting Solutions, Ryobi Die Casting Inc., and Nemak.

Expansion of business segments and manufacturing plants, joint ventures with local manufacturers in key geographies, and mergers and acquisitions are the key strategies adopted by the players to maintain and improve their competitive position in the market. For instance,

- In August 2022, Minda Corporation Limited has announced that it has initiated acquisition of several Tier1 and OEMs in the internal combustion engine and electric vehicles space in United States, Africa, and Europe for developing business for high pressure die cast parts which includes aluminium HPDC parts as well.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application Type

- 5.1.1 Body-in-white

- 5.1.1.1 Door Frames

- 5.1.1.2 Battery Housing

- 5.1.1.3 Pillar

- 5.1.1.4 Roof Components

- 5.1.1.5 Others (Front-end Carriers, Reinforcement, Cross Beams, and Instrument Panel Support)

- 5.1.2 Chassis

- 5.1.3 Transmission

- 5.1.4 Other Components (Suspension and Steering)

- 5.1.1 Body-in-white

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Georg Fischer AG

- 6.2.2 Rheinmetall Automotive AG (KSPG AG (KS Kolbenschmidt GmbH))

- 6.2.3 Ryobi Die Casting Inc.

- 6.2.4 Nemak

- 6.2.5 Endurance Technologies

- 6.2.6 Shiloh Industries Inc.

- 6.2.7 Pace Industries

- 6.2.8 Brabant Alucast*