|

시장보고서

상품코드

1683520

유럽의 무인 시스템 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Europe Unmanned Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

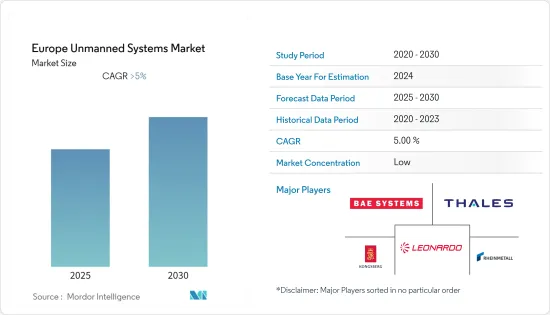

유럽의 무인 시스템 시장은 예측 기간 동안 CAGR 5% 이상을 나타낼 것으로 예상됩니다.

2020년과 2021년 유럽 무인 시스템 시장의 군사 분야에는 COVID-19 팬데믹에 의한 큰 영향은 없었습니다. 그러나 2020년에 민간 및 상업 최종 사용자 수요는 COVID-19 팬데믹 때문에 감소했습니다. 그러나 상황이 개선되고 상업 및 연구활동이 재개되면서 2021년에는 수요가 개선되었습니다.

소규모이면서도 유능한 부대를 배치하기 위해 여러 군대에 집중하는 것에 중점을 둔 군사 분야에서 무인 시스템의 개발과 조달을 촉진하고 있습니다. 주요 군사 대국의 국방비 성장도 선진적인 군용 무인 시스템의 연구 개발을 뒷받침하고 있습니다. 민간 및 법 집행 분야에서는 농업, 채굴, 조사, 화물 수송 등 다양한 용도의 무인 시스템에 대한 수요 증가가 시장의 성장을 뒷받침하고 있습니다.

인공지능과 머신러닝과 같은 첨단 기술의 통합은 보다 우수한 재료와 전력 시스템의 사용과 함께 무인 시스템의 신뢰성을 높여 향후 몇 년동안 효과적일 것으로 예상됩니다.

유럽 무인 시스템 시장 동향

군사 부문이 예측 기간 동안 현저한 성장을 보임

유럽 각국은 러시아에 의한 이 지역의 군사화 증가에 따라 지난 몇 년간 군용 무인기와 UGV의 조달에 대한 투자를 늘리고 있습니다. 우크라이나와 러시아 간의 긴장이 계속되고 있기 때문에 유럽 국가의 국방 지출은 향후 몇 년동안 더 증가할 것으로 예상됩니다. 또한 전쟁의 성격이 변화하고, 이 지역의 나라들의 국방비가 증가하고 있기 때문에 각 국은 병사를 지키기 위해 무인 시스템에 상당액의 투자를 실시했습니다. 반자율형 수상함선과 잠수함, 차세대 소형 무인 항공기, 다양한 크기와 능력을 갖춘 선진 UGV에 관한 몇 가지 프로젝트가 이 지역의 국가 파트너십을 통해 개발되고 있습니다.

예를 들어, 트윈 터보프롭 MALEUAV 인 유럽 중 고도의 장시간 내구 원격 조종 항공기 시스템(MALE RPAS) 또는 Eurodrone은 독일, 프랑스, 이탈리아, 스페인을 위해 에어 버스, 다쏘 에비에이션, 레오나르도에 의해 개발되었으며 2027년중반까지 첫 비행이 예정되어 있습니다. 2022년 1월, 스페인은 무인 항공기 개발, 생산 및 서비스 분담금으로 총 35억 달러의 예산을 승인했습니다. 이 지역의 국가들은 무인 시스템을 대량으로 조달하고 있습니다.

게다가 2022년 6월 독일은 팩봇 제조업체인 테레다인 플리어(Teledyne FLIR)와 독일 육군과의 4년에 걸친 대화를 거쳐 동국 육군이 120대 이상의 팩봇 525 폭발물 처리(EOD) 로봇을 수령한다고 발표했습니다. 이러한 개발은 예측 기간 동안 이 분야의 성장을 가속할 것으로 예상됩니다.

영국이 2021년 최대 시장 점유율을 차지

2021년 유럽의 무인 시스템 시장은 영국이 가장 많았습니다. 영국 정부는 민간 항공국(CAA)과 협력하여 개인의 요구를 충족시키기 위해 무인 항공기의 사용을 지원합니다. 정부는 UAV 패스파인더 프로그램을 시작하여 민간 기업이 농업, 건설, 리모트 센싱 등 다양한 용도의 육안 무인기를 제조할 수 있도록 하고 있습니다. 2021년 4월, 민간 항공국(CAA)은 무인 항공기의 육안 비행(BVLOS)을 승인했습니다. 현지 신흥 기업인 sees.ai는 일상적인 육안 비행(BVLOS) 명령 및 제어 솔루션의 개념을 견인하기 위해 영국 민간 항공국(CAA)의 인가를 취득한 최초의 기업입니다.

또한 군사 분야에서는 영국 국방부(MoD)의 국방, 과학 및 기술 연구소(Dstl)도 영국 육군을 위한 미래 UGV에 관한 연구를 시작했습니다. Line Metal BAE Systems Land(RBSL)가 이끄는 컨소시엄은 보다 광범위한 구현 전투 시스템 연구 프로젝트의 일환으로 UGV에 대한 새로운 접근법을 찾고 있습니다. 이 나라는 또한 새로운 UGV를 조달하고 있습니다. 2022년 1월, 국방부(MoD)는 라인 메탈에 7대의 미션 마스터 자율 무인 지상 차량(A-UGV)을 주문했습니다. 7대 중 4대는 ISTAR 구성으로 조달되고, 3대는 영국 로봇 소대 차량(RPV) 실험 프로그램의 나선형 3용 화물 차량으로 사용되며 2022년 8월 말까지 납품됩니다.

또한 영국 해군은 은밀한 임무를 수행하기 위해 무인 수중 시스템도 도입하고 있습니다. 영국 국방부는 영국 해군을 위해 최대 3000 해리의 거리에서 임무를 수행하는 초대형 무인 수중기(XLUUV)의 개발 옵션을 모색하고 있습니다. 이러한 신흥 국가의 개발은 예측 기간 동안 이 나라 시장 전망을 강화할 것으로 예상됩니다.

유럽 무인 시스템 산업 개요

유럽의 무인 시스템 시장은 군사, 법 집행 및 상업 용도에 무인 시스템을 제공하는 여러 기업이 존재하기 때문에 매우 단편화되었습니다. Rheinmetall AG, Thales Group, Leonardo SpA, Kongsberg Gruppen, BAE Systems plc 등이 이 시장의 유력 기업입니다. 일부 기업은 고객을 유치하기 위해 고급 무인 시스템의 연구 개발에 투자하고 있습니다. 또한 기업과 정부와 협력하여 새로운 첨단 무인 시스템을 개발하고 있습니다.

예를 들어, 2022년 6월, 룩셈부르크 국방부, 레오나르도, 미국과 스페인의 항공우주 신흥 기업인 스카이드웰러 에어로(Skydweller Aero)는 주로 ISR 기회를 평가하는 데 중점을 둔 태양전지 UAV를 개발하기 위한 제휴를 발표했습니다. 이러한 파트너십은 예측 기간 동안 시장 기업에게 성장 기회를 제공할 것으로 기대됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자, 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 무인 항공기

- 무인 지상 차량

- 무인 해상 시스템

- 용도별

- 민간 및 법 집행

- 군사

- 국가별

- 영국

- 프랑스

- 독일

- 스페인

- 이탈리아

- 러시아

- 기타 유럽

제6장 경쟁 구도

- 기업 프로파일

- Milrem Robotics

- QinetiQ

- Nexter Group

- Rheinmetall AG

- Thales Group

- Leonardo SpA

- Kongsberg Gruppen

- BAE Systems plc

- Saab AB

- UAS Europe AB

- Flyability SA

- Parrot Drone SAS

- DJI

- Maritime Robotics AS

- Telerob Gesellschaft fr Fernhantierungstechnik mbH

제7장 시장 기회와 앞으로의 동향

SHW 25.03.28The Europe Unmanned Systems Market is expected to register a CAGR of greater than 5% during the forecast period.

There is no considerable impact of the COVID-19 pandemic on the military segment of the Europe unmanned systems market in 2020 and 2021. However, the demand from the civil and commercial end-users has reduced, majorly in 2020 due to the COVID-19 pandemic. Nevertheless, as the situation improved and commercial and research activities resumed, the demand improved in 2021.

The focus on several militaries to field small but capable forces is driving the development and procurement of unmanned systems in the military segment. The growth in the defense expenditures of major military powerhouses is also driving the R&D of advanced military unmanned systems. In the civil and law enforcement sector, the growing demand for unmanned systems for various applications like agriculture, mining, research, and cargo delivery, among others is driving the market growth.

The integration of advanced technologies like artificial intelligence and machine learning, along with the use of better materials and power systems, is expected to make the unammed systems more reliable, and effective in the years to come.

Europe Unmanned Systems Market Trends

Military Segment Will Showcase Remarkable Growth During the Forecast Period

Countries in Europe have increased their investments in the procurement of military drones and UGVs in the past few years due to the growing militarization of the region by Russia. Due to the ongoing tension between Ukraine and Russia, it is expected that the defense spending by the European countries will further increase in the coming years. Also, the changing nature of warfare and the growing defense spending of the countries in the region is resulting in countries investing significantly in unmanned systems to protect their soldiers. Several projects on semi-autonomous surface ships and submarines, next-generation small drones, and advanced UGVs of various sizes and capabilities are being developed through partnerships among the countries in the region.

For instance, the European Medium Altitude Long Endurance Remotely Piloted Aircraft System (MALE RPAS), or Eurodrone, a twin-turboprop MALE UAV, is being developed by Airbus, Dassault Aviation, and Leonardo for the countries Germany, France, Italy, and Spain, with a first flight expected by mid-2027. In January 2022, Spain approved a total budget of USD 3.5 billion for its share of the development, production, and service of drones. Countries in the region are also procuring unmanned systems in huge quantities.

Furthermore, in June 2022, Germany announced that its Army will receive more than 120 PackBot 525 explosive ordnance disposal (EOD) robots, following a four-year dialogue between PackBot manufacturer Teledyne FLIR and the German Army. Such developments are expected to drive the growth of the segment during the forecast period.

United Kingdom Held the Largest Market Share in 2021

The United Kingdom was the largest market for unmanned systems in Europe in 2021. The United Kingdom government, in collaboration with the Civil Aviation Authority (CAA), is supporting the use of unmanned aerial vehicles to meet personal needs. The government has launched the UAV pathfinder program to enable private players to manufacture beyond the visual line of sight drones for various applications, such as agriculture, construction, and remote sensing. In April 2021, the Civil Aviation Authority (CAA) approved the Beyond-visual-line-of-sight Flights (BVLOS) operations of drones. The local startup sees.ai is the first company to obtain the United Kingdom's Civil Aviation Authority (CAA) authorization for trailing a concept for a routine beyond-visual-line-of-sight (BVLOS) command and control solution.

Furthermore, in the military sector, the United Kingdom's Ministry of Defense (MoD's) Defense, Science, and Technology Laboratory (Dstl) has also initiated a study on future UGVs for the British Army. The consortium led by Rheinmetall BAE Systems Land (RBSL) is exploring new approaches to UGVs as part of its wider Mounted Combat Systems research project. The country is also procuring several new UGVs. In January 2022, the Ministry of Defense (MoD) ordered seven Mission Master autonomous unmanned ground vehicles (A-UGVs) from Rheinmetall. Out of the seven, four UGVs will be procured in ISTAR configuration while three will be used as cargo vehicles for the Spiral 3 of the UK's Robotic Platoon Vehicle (RPV) experimentation programme, to be delivered by the end of August 2022.

Also, the United Kingdom Royal Navy is also incorporating unmanned underwater systems to conduct covert missions. Britain's Ministry of Defense is exploring options for the development of an Extra Large Unmanned Underwater Vehicle (XLUUV) to conduct missions at distances of up to ranges of 3,000 nautical miles for the Royal Navy. Such developments are expected to bolster the market prospects in the country during the forecast period.

Europe Unmanned Systems Industry Overview

The Europe unmanned systems market is highly fragmented, due to the presence of several players that provide several unmanned systems for military, law enforcement, and commercial applications. Rheinmetall AG, Thales Group, Leonardo SpA, Kongsberg Gruppen, and BAE Systems plc are some of the prominent players in the market. Several companies are investing in the R&D of advanced unmanned systems to attract customers. Companies are also collaborating with each other and with governments to develop new and advanced unmanned systems.

For instance, in June 2022, the Luxembourg Directorate of Defence, Leonardo and Skydweller Aero, the United States-Spanish aerospace startup, announced their partnership to develop a solar-powered UAV that will mainly focus on assessing ISR opportunities. Such partnerships are expected to provide growth opportunities for the market players during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Unmanned Aerial Vehicles

- 5.1.2 Unmanned Ground Vehicles

- 5.1.3 Unmanned Sea Systems

- 5.2 Application

- 5.2.1 Civil and Law Enforcement

- 5.2.2 Military

- 5.3 Country

- 5.3.1 United Kingdom

- 5.3.2 France

- 5.3.3 Germany

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Russia

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Milrem Robotics

- 6.1.2 QinetiQ

- 6.1.3 Nexter Group

- 6.1.4 Rheinmetall AG

- 6.1.5 Thales Group

- 6.1.6 Leonardo SpA

- 6.1.7 Kongsberg Gruppen

- 6.1.8 BAE Systems plc

- 6.1.9 Saab AB

- 6.1.10 UAS Europe AB

- 6.1.11 Flyability SA

- 6.1.12 Parrot Drone SAS

- 6.1.13 DJI

- 6.1.14 Maritime Robotics AS

- 6.1.15 Telerob Gesellschaft fr Fernhantierungstechnik mbH