|

시장보고서

상품코드

1683796

이탈리아의 전기자전거 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2029년)Italy E-bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

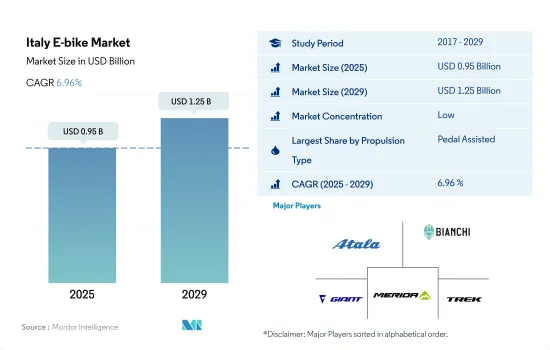

이탈리아의 전기자전거 시장 규모는 2025년 9억 5,000만 달러로 예측되고, 2029년에는 12억 5,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2029년) CAGR 6.96%로 성장할 것으로 예측됩니다.

추진 부문 시장 개요

- 이탈리아는 유럽 전기자전거 시장의 주요 지역 중 하나입니다. 이탈리아 전기자전거 시장의 판매를 견인하는 주요 요인은 혁신적인 제품 기능, 배터리 및 구동 장치의 완전 통합, 매력적인 디자인, 고품질 소재 등입니다.

- VW와 Gazelle 같은 기업은 이탈리아 하노버에서 개최된 2018년 IAA(Internationale Automobil-Ausstellung) 상용차 전시회에서 물류 업계 수요에 대응하는 새로운 전기 화물자전거를 발표했습니다. 폰바이크 그룹의 한 회사인 Gazelle은 Aluca 및 DOCKR(MaaS(mobility as a services) 스타트업)과 협력하여 Gazell D10 cargo 전기자전거를 제조했습니다. 이 새로운 화물용 전기자전거는 경량 전기화물 운송기(LEFT)로 알려져 있으며, 100킬로그램의 용량을 가지며 유로 팔레트 치수(1,200*800*1,100mm)의 기존 캐리지 박스 2개까지 운반할 수 있습니다.

- 또, 개인의 자동차 이용을 줄이고, 무배출 차로 전환, 화물 산업과 대중교통의 탈탄소화 등의 대책을 강구할 필요성에 대한 인식이 높아지고 있는 것도, 시장을 견인하고 있습니다. 가솔린 가격이 상승하고 사람들의 환경 의식이 높아짐에 따라 이탈리아 정부와 시민들은 전기자동차로 전환할 것으로 예상됩니다. 스피드 페데렉은 단거리 이동에 최적이라 하더라도 가장 실용적인 교통 수단으로 가까이에 페달 어시스트 자전거를 몰아넣을 것으로 보입니다. 스피드 페데렉은 파워와 스피드의 성능이 향상될수록 인기가 높아질 것으로 보입니다. 이러한 요인으로 인해 이탈리아의 전기 자전거 시장은 예측 기간 동안 성장할 것으로 예상됩니다.

이탈리아 전기자전거 시장 동향

이탈리아의 전기자전거 보급률은 일관되고 견조한 성장을 나타내며 시장과 소비자 기반의 확대를 보여줍니다.

- 이상적인 운동수단으로서의 자전거에 대한 관심이 높아지고, 이탈리아의 도로에 있어서의 피크시의 교통 정체의 많음, 환경 문제에 대한 우려로부터 전기자전거를 추진하는 정부의 대처가 증가하고 있는 것이, 동국에 있어서의 전기자전거의 보급을 향상시키고 있습니다. 연료비와 유지보수 비용이 적기 때문에 2019년 전기자전거 보급률은 1.70% 증가했습니다.

- 2020년 COVID-19 감염 증가는 이탈리아 전기자전거 시장에 긍정적인 영향을 미쳤습니다. 사람들은 바이러스 감염의 우려로 대중 교통 및 대여 서비스를 이용하는 것을 두려워했으며, 전기자전거와 같은 개인 소유 차량 수요가 증가했습니다. 이탈리아 사람들 사이에서 전기자전거 판매가 증가함에 따라 전기자전거의 보급률은 2020년에 약 2.40%까지 더욱 가속화되었습니다.

- COVID-19의 건수가 감소함에 따라 규제와 봉쇄가 완화되어 업무와 사무실이 재개됨에 따라 2021년 말 전기자전거 보급률은 2020년 13.90%에서 14.90%로 증가했습니다. 긴 배터리 항속 거리, 좋은 속도 제한, 빠른 충전 기능과 같은 고급 기능을 갖춘 새로운 전기 자전거의 도입은 소비자의 전기 자전거에 대한 투자를 크게 뒷받침했습니다. 그 결과, 이 나라에서는 예측 기간 중에 전기자전거의 보급률이 30% 이상 증가할 것으로 예상됩니다.

이탈리아에서는 매일 5-15km의 거리를 통근하는 인구가 서서히 증가하고 있어 이동거리의 변화는 완만하지만 일관됩니다.

- 이탈리아에서는 자전거 이동을 선택하는 개인이 증가하고 있기 때문에 자전거 수요가 해마다 커지고 있습니다. 자전거 수요 증가는 하루에 5-15km의 거리를 이동하는 통근자의 수도 증가하고 있습니다. 이탈리아 전역의 다양한 도시에서 자전거 이용자의 약 18% 이상이 매일 통근 등의 근거리 이동을 하고 있습니다.

- 봉쇄로 인해 교통이 멈추고 스포츠 체육관도 폐쇄되었기 때문에 사람들은 자전거를 이용하게 되었고 2020-2021년 자전거 수요는 증가했습니다. 자전거 타는 습관을 가진 사람들은 이탈리아 국내 사무실과 기업 및 기타 인근 장소에 대한 일상적인 통근 수단으로 자전거를 선택했습니다. 자전거의 동향으로 5-15km의 거리를 이동하는 통근자의 수는 2020년보다 2021년에 0.4% 증가했습니다.

- COVID-19의 규제 완화에 의해 많은 사람들이 5-15km권내의 직장, 회사, 인근 시장에 자전거로 이동하게 되었습니다. 2022년에는 노동 인구의 약 16%가 자전거 통근을 했습니다. 자전거 인프라 개발과 자전거 전용 도로 증가도 통근에 자전거를 선택하는 사람을 늘렸기 때문에 2022년 자전거 이용자 점유율은 2021년보다 0.4% 증가했습니다.

이탈리아 전기자전거 산업 개요

이탈리아의 전기자전거 시장은 세분화되어 주요 5개사에서 26.58%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Atala SpA, Fabbrica Italiana Velocipedi Edoardo Bianchi SpA (Bianchi), Giant Manufacturing Co. Ltd., Merida Industry Co. Ltd., Trek Bicycle Corporation(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 자전거 판매 대수

- 1인당 GDP

- 인플레이션율

- 전기자전거의 보급률

- 1일 이동 거리가 5-15킬로인 인구/통근자의 비율

- 렌터사이클

- 전기자전거 배터리 가격

- 배터리 화학의 가격표

- 슈퍼 로컬 배송

- 자전거 전용 레인

- 트레커 수

- 배터리 충전 능력

- 교통 정체 지수

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 추진 유형

- 페달 어시스트

- 스피드 페데렉

- 스로틀 어시스트

- 용도 유형

- 화물/유틸리티

- 시티/어반

- 트레킹

- 배터리 유형

- 납축전지

- 리튬 이온 배터리

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Askoll EVA SpA

- Atala SpA

- BOTTECCHIA CICLI SRL

- Campagnolo Srl

- CICLI LOMBARDO SpA

- Colnago Ernesto & C SRL

- Fabbrica Italiana Velocipedi Edoardo Bianchi SpA(Bianchi)

- Giant Manufacturing Co. Ltd.

- Merida Industry Co. Ltd.

- Trek Bicycle Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Italy E-bike Market size is estimated at 0.95 billion USD in 2025, and is expected to reach 1.25 billion USD by 2029, growing at a CAGR of 6.96% during the forecast period (2025-2029).

PROPULSION SEGMENT MARKET OVERVIEW

- Italy is one of the leading regions of the European e-bike market. Some major factors driving sales in the Italian e-bike market are innovative product features, fully integrated batteries and drives, appealing designs, and high-quality materials.

- Players like VW and Gazelle unveiled new e-cargo bikes at the 2018 IAA (Internationale Automobil-Ausstellung) Commercial Vehicles exhibition in Hannover, Italy, to address the demand from the logistics industry. One of Pon Bike Group's companies, Gazelle, collaborated with Aluca and DOCKR (mobility as a services (MaaS) start-up) to produce the Gazell D10 cargo e-bike. The new cargo e-bike, known as the light electrical freight transporter (LEFT), has a capacity of 100 kilograms and can carry up to two conventional carriage boxes with Euro Pallet dimensions (1,200*800*1,100 millimeters).

- The market is also being driven by the growing awareness of the need to take action to cut back on personal vehicle usage, switch to zero-emission cars, and decarbonize the freight industry and public transportation. Italy's government and citizens are expected to switch to electric vehicles as gasoline prices increase and people become more environmentally conscious. The speed pedelec will soon overtake the pedal-assisted bicycle as the most practical mode of transportation, even if it is best for shorter trips. Speed pedelecs will likely become more popular as power and speed capabilities advance. Owing to these factors, the Italian e-bike market is expected to grow over the forecast period.

Italy E-bike Market Trends

Italy demonstrates a consistent and robust growth in E-Bike adoption rates, indicating an expanding market and consumer base.

- The increase in interest in bicycles as an ideal mode of exercise, high traffic congestion on the roads of Italy during peak hours, and increasing government practices to promote e-bicycles due to environmental concerns are improving the adoption of e-bicycles in the country. Fewer fuel and maintenance costs increased the e-bicycle adoption rate by 1.70% in 2019.

- The growth in COVID-19 cases in 2020 positively impacted the Italian e-bike market. People feared taking public transport and rental services due to the fear of contracting the virus, which hiked the demand for personal vehicles such as e-bicycles. An increase in the sales of e-bikes among the people of Italy further accelerated the adoption rate of e-bikes by around 2.40% in 2020.

- Declining COVID-19 cases led to the relaxation of restrictions and lockdowns and the resumption of business operations and offices, which increased the adoption of e-bikes at the end of 2021, by 14.90%, compared to 13.90% in 2020. The introduction of new e-bikes with advanced features such as a long battery range, good speed limits, and fast charging features have highly encouraged consumers to invest in e-bikes. As a result, the country is expected to witness a growth in the adoption rate of e-bikes, by more than 30%, during the forecast period.

Italy shows a gradual increase in the population commuting 5-15 km daily, reflecting a slow but consistent change in travel distances.

- Italy is witnessing a significant demand for bicycles every year as more individuals opt to travel by bicycle. The increase in the demand for bicycles is also increasing the number of commuters who travel 5-15 km per day. Approximately more than 18% of bicycle users commute daily for work and other places at shorter distances in various cities across Italy.

- Due to the lockdown, transportation systems were halted, and gyms were closed, which led people to take up cycling and increased the demand for bicycles in 2020 and 2021. People with the habit of cycling opted for bicycles as the daily mode of commuting to offices, businesses, and other nearby places in Italy. The trend of cycling has increased the number of commuters traveling 5-15 km by 0.4% in 2021 over 2020.

- The relaxation of COVID-19 restrictions encouraged many people to travel by bicycle to workplaces, businesses, and nearby markets within a range of 5-15 km. Around 16% of the working population commuted by bicycle in 2022. Developments in the bicycle infrastructure and growth in bicycle lanes have also encouraged more people to opt for bicycles for commute, thus increasing the share of bicycle users by 0.4% in 2022 over 2021.

Italy E-bike Industry Overview

The Italy E-bike Market is fragmented, with the top five companies occupying 26.58%. The major players in this market are Atala SpA, Fabbrica Italiana Velocipedi Edoardo Bianchi SpA (Bianchi), Giant Manufacturing Co. Ltd., Merida Industry Co. Ltd. and Trek Bicycle Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 Cargo/Utility

- 5.2.2 City/Urban

- 5.2.3 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Askoll EVA SpA

- 6.4.2 Atala SpA

- 6.4.3 BOTTECCHIA CICLI SRL

- 6.4.4 Campagnolo S.r.l.

- 6.4.5 CICLI LOMBARDO SpA

- 6.4.6 Colnago Ernesto & C SRL

- 6.4.7 Fabbrica Italiana Velocipedi Edoardo Bianchi SpA (Bianchi)

- 6.4.8 Giant Manufacturing Co. Ltd.

- 6.4.9 Merida Industry Co. Ltd.

- 6.4.10 Trek Bicycle Corporation

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms