|

시장보고서

상품코드

1683797

남미의 전기자전거 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2029년)South America E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

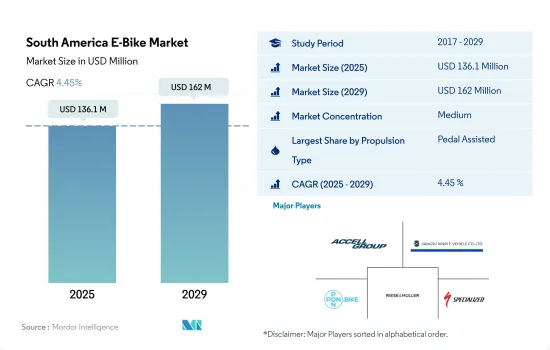

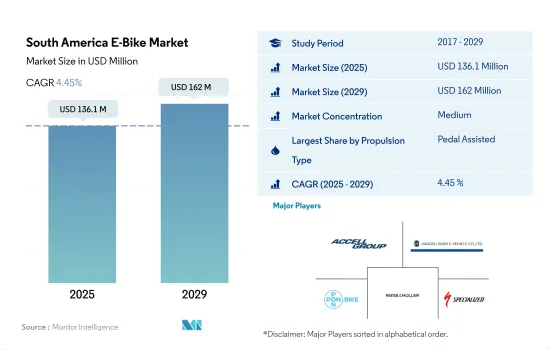

남미의 전기자전거 시장 규모는 2025년 1억 3,610만 달러로 예측되며, 2029년에는 1억 6,200만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2029년) CAGR 4.45%로 성장할 것으로 예측됩니다.

추진 부문 시장 개요

- 남미의 전기자전거 시장은 다양한 추진 유형에 의해 특징지어져 현저한 성장과 변모를 이루고 있습니다. 다양한 추진 유형 중 페달 어시스트형과 스로틀 온 디맨드형의 전기자전거가 가장 보급되고 있습니다. 페달 어시스트식 전기자전거는 그 효율성과 보다 전통적인 사이클링 체험을 제공하는 능력으로부터 지지되고 있어 건강 지향으로 환경 의식이 높은 소비자층과 잘 어울립니다. 스로틀 온 디맨드형 전기자전거는 편의성과 사용 편의성을 요구하는 소비자, 특히 빠르고 편안한 통근이 우선되는 도시 환경에 적합합니다.

- 그러나 주요 시장지역의 일부에서는 경제위기가 발생하고 있으며 세계가 COVID-19 팬데믹에 빠지기 전부터 아르헨티나는 2020년 3년째 불황에 직면해 있었습니다. 지금 유행의 경제적 충격으로 인해 이 위기 상황에 있는 국가에서는 기록적인 축소가 예상되고 있습니다. 그러나 가까운 미래에, 정부는 경제를 다시 성장 궤도에 태우는 데 필요한 조치를 취하고 시장은 더욱 성장할 것으로 예상됩니다.

- 정부가 전기자전거를 강화하는 가운데 많은 자전거 공유 플랫폼이 아르헨티나에 진입하여 창출된 비즈니스 기회를 활용하고 있습니다. 정부와 민간 투자자들은 전기자전거의 보급과 환경 오염을 억제하기 위해 여러 자전거 공유 프로그램을 시작하고 있습니다. 예를 들어, 2019년 11월 캐나다 자전거 쉐어링 기업인 PBSC Urban Solutions는 아르헨티나의 수도인 부에노스아이레스에서 성공적으로 배포되었으며, 수도에 4,000대의 ICONIC 자전거를 도입하여 시내에서 사용할 수 있는 공유 자전거를 두 배로 늘렸다고 발표했습니다.

남미의 국가별 시장 개요

- 라틴아메리카의 전동 이동성 시장은 아직 시작되었지만, 적어도 이 지역 중 45%의 국가가 전동 이동성의 성장에 유리한 조치를 이미 채택하고 있습니다. 또한 지역 기업과 세계 기업 중 일부는 GHG 감소 목표에 적응하고 비용을 줄이기 위해 기존 차량을 지역별로 부분적으로 교체하기로 결정했습니다. 라틴아메리카는 많은 수력 발전과 시장의 다른 재생 가능 에너지 원의 진보적 진화로 인해 GHG 배출량이 적은 발전 매트릭스 중 하나를 가지고 있다는 점을 감안할 때 전기 이동성으로의 가속 전환으로 특히 혜택을 누릴 수 있습니다. 남미경제권에서는 공공정책도 전동차 시장을 뒷받침하고 있습니다.

- 남미의 전기 자전거 시장은 매우 세분화되어 있으며 제품의 제조와 판매를 독점하는 소수의 대기업에 의해 지배되는 것은 아닙니다. 대신 시장 경쟁은 치열하고 지배적인 기업은 존재하지 않습니다. 매출이 높은 것은 Giant Bicycles, Merida, Trek Bikes, Riese & Muller 등입니다.

- 휘발유 비용이 상승함에 따라 정부와 일반 시민들이 전기자동차를 선택하는 경향이 커지고 있습니다. 페달 어시스트식 전기자전거는 단거리 이동에 적합하기 때문에 스피드 페데렉이 전기자전거 중에서 가장 실용적인 선택이 되는 날도 가깝다고 생각됩니다. 앞으로 몇 년동안 힘과 속도가 향상됨에 따라 사람들은 속도 페드렉에 끌릴 것으로 예상됩니다. 남미에서는 스로틀 어시스트식 전기자전거는 법으로 금지되어 있지만, 페달 어시스트식 전기자전거에 비하면 훨씬 적습니다.

남미 전기자전거 시장 동향

아르헨티나와 브라질은 완만한 성장을 보여주며 앞으로 크게 확대될 수 있는 신흥 시장임을 보여줍니다.

- 남미의 전기자전거 시장은 현재 발전 전 단계에 있으며, 주목할만한 전기자전거 판매량을 목격하고 있는 국가는 많지 않지만, 이는 세계 전기자전거 판매 대수에 차지하는 비율은 비교적 작습니다. 그 주된 이유는 전기자전거의 가격이 높고 전기자전거가 고급 이륜차로 인식되고 있기 때문입니다.

- 이 지역에서는 공유 카테고리의 전기 자전거 시장이 높은 성장을 보이고 있습니다. 아르헨티나와 브라질에 존재하는 자전거 공유 사업자의 대부분은 자전거 공유 서비스에 전기자전거를 통합하거나 보유 대수를 늘리고 있습니다.

- 시장은 세분화되어 있으며 Giant Bicycles, EDG, Trek Bicycle Corporation 등 수많은 신흥기업과 기업이 참가하고 있습니다. 대조적으로, 주요 전기자전거 대여 회사는 시장 범위를 확대하고 보유하는 전기자전거를 늘리고 있습니다.

남미에서는 통근 습관이 점차 변화하고 있음을 반영하여 매일 5-15km의 거리를 통근하는 인구가 전반적으로 증가하고 있습니다.

- 이 지역에는 브라질과 아르헨티나를 포함한 다양한 자전거 유망국이 있습니다. 남미 지역에는 브라질과 아르헨티나를 포함한 다양한 자전거 유망국이 있습니다. 남미인들은 근거리(-15km)용 자전거를 서서히 선택하게 되어 있습니다. 브라질은 5-15km의 범위에서 매일 통근하는 사람의 비율이 남미에서 가장 높습니다.

- COVID-19가 발생한 후, 사람들은 자전거가 가장 효율적이고 효과적인 통근 수단임을 깨달았습니다. 게다가 유행기간 동안 사람들은 자전거와 주말 레크리에이션 활동으로써 운동하기로 했기 때문에 2021년에는 하루 이동 거리가 5-15km인 통근자 수가 지역 전체에서 2020년보다 증가했습니다. 또한 고급 기능을 갖추고 항속 거리가 40-45km로 긴 전기자전거의 도입은 소비자가 매일 통근에 자전거를 선택하는 것을 뒷받침하고 있습니다.

- 남미 전역에서 COVID-19 규제가 철폐되어 사무실과 사업이 재개된 것도 자전거 이용자 증가에 기여했습니다. 많은 사람들이 정기적으로 자전거 통근을 시작합니다. 브라질 등에서는 카본 프리 교통수단, 높은 연비, 교통 시간의 절약 등, 다양한 장점으로부터 자전거 통근이 보급되고 있습니다. 이러한 요인에 의해 예측기간 중 남미 전역에서 이동거리가 5-15km인 통근자가 가속될 것으로 예상됩니다.

남미의 전기자전거 산업 개요

남미의 전기자전거 시장은 적당히 통합되어 상위 5개사에서 45.18%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Accell Group, Jiangsu Xinri E-Vehicle Co. Ltd., Pon Bicycle Holding BV, Riese & Muller, Specialized Bicycle Components(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 자전거 판매 대수

- 1인당 GDP

- 인플레이션율

- 전기자전거의 보급률

- 1일 이동 거리가 5-15킬로인 인구/통근자의 비율

- 렌터사이클

- 전기자전거 배터리 가격

- 배터리 화학의 가격표

- 슈퍼 로컬 배송

- 자전거 전용 레인

- 트레커 수

- 배터리 충전 능력

- 교통 정체 지수

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 추진 유형

- 페달 어시스트

- 스피드 페데렉

- 스로틀 어시스트

- 용도 유형

- 시티/어반

- 트레킹

- 배터리 유형

- 납 배터리

- 리튬 이온 배터리

- 기타

- 국가

- 아르헨티나

- 브라질

- 기타 남미

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Accell Group

- Giant Manufacturing Co. Ltd.

- Jiangsu Xinri E-Vehicle Co. Ltd.

- Merida Industry Co. Ltd.

- Pedego LLC

- Pon Bicycle Holding BV

- Riese & Muller

- Specialized Bicycle Components

- Trek Bicycle Corporation

- Yadea Group Holdings Ltd.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The South America E-Bike Market size is estimated at 136.1 million USD in 2025, and is expected to reach 162 million USD by 2029, growing at a CAGR of 4.45% during the forecast period (2025-2029).

Propulsion Segment Market Overview

- The South American e-bike market, characterized by its diverse range of propulsion types, is experiencing significant growth and transformation. Among the various propulsion types, pedal-assisted and throttle-on-demand e-bikes are the most prevalent. Pedal-assisted e-bikes are favored for their efficiency and the ability to offer a more traditional cycling experience, aligning well with the health-conscious and environmentally aware consumer base. Throttle-on-demand e-bikes cater to those seeking convenience and ease of use, particularly in urban settings where quick and effortless commuting is a priority.

- However, because of the economic crisis in some of the major market regions, which was there even before the world was hit by the COVID-19 pandemic and Argentina was facing a third year of recession in 2020. Now, with the pandemic's economic shock, it is expected that a record contraction in the crisis-prone country. Yet, it is expected that in the near future, the government of the country will take the necessary steps to bring the economy back to the growth trajectory, and the market will grow even at a high rate.

- With the government ramping up the country's e-bikes, many bike-sharing platforms have entered Argentina to leverage the business opportunities created. The government and private investors are launching several bike-sharing programs in the country to promote e-bikes and control environmental pollution. For instance, in November 2019, Canadian bike-sharing company, PBSC Urban Solutions, announced a successful rollout in Buenos Aires, the capital of Argentina, introducing 4,000 ICONIC bikes to the capital city, doubling the shared bikes available in the city.

SOUTH AMERICA COUNTRY LEVEL MARKET OVERVIEW

- Although the Latin American market for electric mobility is nascent, at least 45% of the countries in the region have already adopted measures that favor its growth. Some local and global companies have also decided to make partial replacements of their existing fleets regionally to adapt to GHG reduction targets and reduce their costs. The Latin American region can particularly benefit from the accelerated transition to electric mobility, considering that it has one of the electricity generation matrices with lower GHG emissions due to the high hydroelectricity generation and the progressive evolution of other renewable energy sources in the market. In the South American economies, public policies are also helping drive the market for electric vehicles.

- The South American electric bicycle market is highly fragmented and not dominated by a few major players with a monopoly over manufacturing and sales of the product. Instead, the market is highly competitive without any dominant players. The companies recording the highest sales include Giant Bicycles, Merida, Trek Bikes, and Riese & Muller.

- In line with rising gasoline costs, governments and the general public are increasingly expected to choose electric vehicles. The speed pedelec will soon be the most practical choice among e-bikes because the pedal-assisted e-bike is better suited for shorter trips. Over the coming years, people are expected to gravitate toward speed pedelecs as their power and speed capabilities advance. Although throttle-assisted e-bikes are prohibited by law in South America, they are far less common than pedal-assisted e-bikes.

South America E-Bike Market Trends

Argentina and Brazil show gradual growth, signaling emerging markets with potential for significant expansion.

- The South American e-bike market is currently in the pre-emerging stage, with a few countries witnessing notable unit sales of electric bikes, which is a relatively small fraction of global electric bike sales. The major reason for this is the high price of e-bikes and the perception of e-bikes as premium two-wheelers.

- In the region, the e-bike market in the shared category is witnessing higher growth. The majority of bike-sharing operators present in Argentina and Brazil are either integrating or increasing the fleet of e-bikes in their bike-sharing services.

- The market is fragmented with a number of startups and companies, such as Giant Bicycles, EDG, Trek Bicycle Corporation, and others. In contrast, major e-bike rental companies are expanding their market reach and adding more e-bikes to their fleet.

South America shows a general increase in the population commuting 5-15 km daily, reflecting a gradual change in commuting habits across the continent.

- The region has various bicycle potential countries, such as Brazil and Argentina. The countries falling under the South America region is witnessing a decent demand for bicycles over the past few years. People in South America are gradually opting for bicycles for short distances (up to 15 km). Brazil has the highest percentage of daily commuters in the range of 5 to 15 km in South America.

- People found bicycles as the most efficient and effective way of commuting after the COVID-19 outbreak. Moreover, people opted to exercise during the pandemic by bicycling or going on weekend recreational activities, which increased the number of commuters with a daily travel distance of 5 to 15 km in 2021 over 2020 across the region. Additionally, the introduction of e-bikes with advanced features and a higher range of 40 to 45 km is encouraging consumers to opt for bicycles for daily commuting.

- Removal of the COVID-19 restrictions and resumption of offices and business operations across South America contributed to the growth of bicycle users. Many people have regularly started to commute by bicycle to their places of employment. Bicycle commuting is becoming popular due to its various benefits, such as carbon-free rides, fuel efficiency, and time-saving in traffic in countries such as Brazil. Such factors are expected to accelerate commuters with journey distances of 5 to 15 km across South America during the forecast period.

South America E-Bike Industry Overview

The South America E-Bike Market is moderately consolidated, with the top five companies occupying 45.18%. The major players in this market are Accell Group, Jiangsu Xinri E-Vehicle Co. Ltd., Pon Bicycle Holding BV, Riese & Muller and Specialized Bicycle Components (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 City/Urban

- 5.2.2 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

- 5.4 Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Rest-of-South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Accell Group

- 6.4.2 Giant Manufacturing Co. Ltd.

- 6.4.3 Jiangsu Xinri E-Vehicle Co. Ltd.

- 6.4.4 Merida Industry Co. Ltd.

- 6.4.5 Pedego LLC

- 6.4.6 Pon Bicycle Holding BV

- 6.4.7 Riese & Muller

- 6.4.8 Specialized Bicycle Components

- 6.4.9 Trek Bicycle Corporation

- 6.4.10 Yadea Group Holdings Ltd.

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms