|

시장보고서

상품코드

1683809

전력 전자 장치용 커패시터 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Capacitor For Power Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

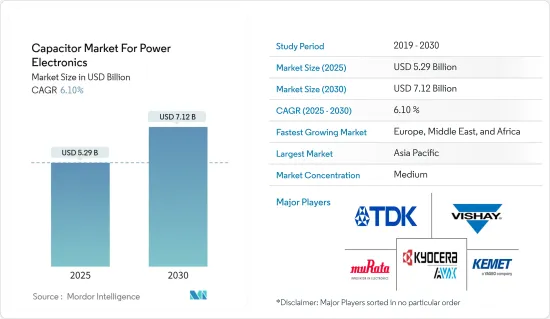

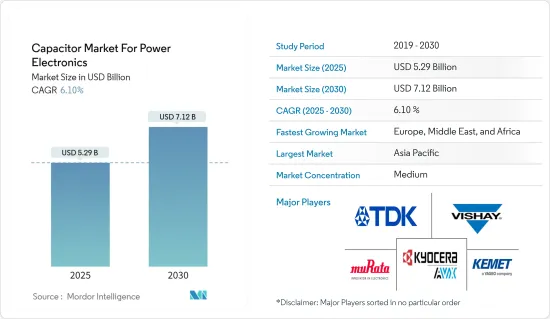

전력 전자 장치용 커패시터 시장은 2025년 52억 9,000만 달러에서 2030년에는 71억 2,000만 달러로 성장할것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 6.1%를 나타낼 것으로 전망됩니다.

전기 회로에서 커패시터는 직류(DC)를 차단하고 교류는 흐르게 하는 데 자주 사용됩니다.

주요 하이라이트

- 2022년 커패시터 비용은 전력 컨버터 전체 비용의 약 10%를 차지했습니다. 필름 커패시터는 커패시터 중 가장 비용이 많이 드는 형태이며 고전력 레벨에 자주 사용됩니다. 따라서 시스템의 전력 레벨이 높아짐에 따라 더 많은 커패시터가 필요하므로 전력 컨버터의 커패시터 비용도 상승합니다.

- 전기자동차는 매일 사용되는 버스, 기차, 트램, 산업용 트럭 및 장비와 같은 수많은 상업용 및 공공용 전기자동차 외에도 상당한 시장 수요에 기여하고 있습니다. 또한 치솟는 유가에 대응하여 사람들이 보다 친환경적인 개인용 교통수단을 찾으면서 하이브리드 자동차가 도로를 달리고 있습니다. DC 링크 전력 커패시터는 이처럼 다양한 전기자동차를 제작할 수 있게 해준 전기 시스템과 부품이 모두 큰 변화를 겪은 한 가지 예일 뿐입니다.

- 커패시터는 전기자동차에서 DC 버스 전압의 변화를 완화하고 리플 전류가 전원으로 되돌아가는 것을 막기 위해 사용됩니다. 또한 커패시터는 기존 사이리스터 대신 IGBT와 같은 반도체를 보호하는 데 사용됩니다.

- 예측 기간이 끝날 때까지 전기차에 사용되는 전력 전자 장치용 커패시터의 시장 점유율은 29%에서 44%로 증가할 것으로 예상됩니다. 그 결과, 많은 커패시터 기업들이 자동차 부문의 현재와 미래의 요구 사항에 집중하고 성장하기를 열망하고 있습니다.

- 가장 일반적인 전기 모터는 신뢰성, 경제성 및 내구성으로 인해 유도 모터입니다. 산업 및 광업 분야에서 사용되는 대부분의 장비는 3상 AC 유도 모터를 주 전원으로 사용합니다. 이 모터는 전 세계적으로 사용되는 모든 전력의 70-80%를 사용합니다. 유도 모터는 부하가 없을 때 역률이 상대적으로 낮습니다. 무부하에서 최대 부하로 전환할 때 더 좋아집니다. 역률 보정은 시동기, 배전반 또는 배전반에서 구현할 수 있으며 관련 모터 회로에 커패시터를 병렬로 추가하여 수행합니다.

커패시터 시장 동향

상당한 성장을 기록할 슈퍼 커패시터/EDLC 부문

- 에너지 위기와 환경 파괴로 인해 청정 및 재생 에너지 저장 기술이 개발되고 있습니다. 흔히 슈퍼 커패시터로 알려진 전기 이중층 커패시터(EDLC)는 컴팩트한 형태로 매우 높은 커패시턴스를 제공합니다. 화학 공정과 관련된 마모를 거치지 않기 때문에 두 개의 전도성 판 사이에 전기장을 형성하여 전기 에너지를 저장하고 배터리보다 수십만 회 더 많은 충방전 사이클을 수행할 수 있습니다. 이러한 특성으로 인해 전기 드라이브, UPS, 액티브 필터, 트랙션 및 자동차 산업에서 그 적용이 증가하고 있으며, 그 특성에 대해 자세히 알아보고자 하는 관심이 높아지고 있습니다.

- 슈퍼 커패시터의 뛰어난 저장 용량 덕분에 SSD, LED 램프, 전기 드라이브, UPS, 트랙션, 전기자동차 등 다양한 용도에서 널리 사용되고 있습니다. 슈퍼 커패시터는 상하이 시내 버스의 유일한 동력원으로, 회생 제동 에너지를 사용하여 3정거장마다 1-2분 만에 재충전됩니다. 중국은 이 기술이 광범위하게 사용될 수 있다는 것을 전 세계에 보여주었습니다. 그러나 슈퍼 커패시터와 배터리를 결합한 기술은 버스에 더 유리합니다.

- IEA에 따르면 2022년에는 중국에서 5만 4,000대, 유럽에서 5,000대의 전기 버스 등록이 완료되었습니다. 대기오염을 막기 위해 석유가격이 급등하고 있기 때문에 이 동향은 점차 높아지고 있습니다. 이러한 추세는 대기 오염 방지를 위해 유가가 상승함에 따라 점차 증가하고 있습니다. 이러한 전기차 보급 증가는 예측 기간 동안 전력 전자 장치용 커패시터 시장 성장을 촉진할 것입니다.

- 슈퍼 커패시터는 라디오 튜너, 휴대폰, 노트북 메모리 및 기타 전자 장비에 사용됩니다. LED 플래시 장치와 같이 짧은 전력 서지가 필요한 상황에서 사용됩니다.

아시아태평양이 큰 시장 점유율을 차지

- 아시아태평양은 전력 전자 장치용 커패시터에 있어 가장 중요한 시장 중 하나입니다. 전기자동차의 인기가 높아지고 있으며, 중국은 전기자동차를 가장 많이 채택하는 국가 중 하나로 꼽힙니다. 중국의 13차 5개년 계획은 중국 교통 부문의 발전을 위해 하이브리드 및 전기차와 같은 친환경 교통 솔루션의 개발을 장려하고 있습니다.

- 중국의 전기자동차는 수십 개의 경쟁업체가 새로운 모델을 출시하여 새로운 구매자를 유치하고 소유주들이 전기자동차로 전환하도록 장려한 덕분에 중국 정부의 2025년 예측보다 훨씬 앞선 2022년에 전국적으로 20% 보급 목표를 달성할 것으로 예상됩니다.

- 전력 전자 장치용 커패시터는 인도 전역에 배전망을 확대하는 정부의 관심이 높아짐에 따라 큰 혜택을 받을 것으로 예상됩니다. e-2W 사용을 장려하기 위해 FAME-II 계획 수요 장려금은 INR10,000(USD 119.67)/KWh에서 INR15,000(USD 179.51)/KWh로 인상되었으며, 상한은 차량 비용의 20%에서 40%로 늘어났습니다. 게다가 2022년 3월 31일 이후 FAME-India 체계의 2단계가 2년 더 연장되었습니다. 이 전략은 보다 경제적이고 친환경적인 운송 수단을 제공하고, 국가 연료 안보를 강화하며, 인도의 자동차 부문이 글로벌 제조업을 선도할 수 있도록 지원하기 위해 개발되었습니다.

- 이 지역은 시장 투자 증가를 목격하고 있습니다. 예를 들어, 예를 들어, 2024년 2월 인도 우주연구기구와 파트너십을 맺은 켈트론은 칸누르에 최첨단 슈퍼 커패시터 제조 공장을 개장했습니다. 이러한 움직임은 에너지 저장 기술의 획기적인 발전을 의미합니다. 42칼로르 루피가 투자된 이 시설은 뛰어난 에너지 저장 능력을 자랑할 뿐만 아니라 인도를 최첨단 커패시터 기술의 최전선으로 이끌고 있습니다.

전력 전자 장치용 커패시터 산업 개요

전력 전자 장치용 커패시터 시장은 단편화되어 경쟁이 치열합니다. 주요 기업으로는 TDK Corporation, Vishay Intertechnology Inc., 무라타 제작소, AVX Corporation(교세라 그룹), Kemet Corporation(야게오 컴퍼니) 등을 들 수 있습니다.경쟁이 치열한 시장에서 입지를 유지하기 위해 이 업체들은 지속적으로 신제품을 혁신하고 다양한 비즈니스 개발 전략을 추진하고 있습니다.

- 2023년 4월 : Vishay Intertechnology Inc.가 개발한 Vishay BC components 172 RLX 시리즈는 저임피던스 차량용 등급 소형 알루미늄 전해 커패시터의 새로운 라인업입니다. 10mm×12mm에서 18mm×40mm까지의 14유형의 케이스 사이즈가 있어, 105℃까지의 온도에서 동작합니다. 자동차, 통신, 산업, 오디오 비디오, 전자 데이터 처리(EDP) 용도을 위한 스위치 모드 전원 공급 장치, DC/DC 컨버터, 모터 드라이브 및 제어 유닛은 Vishay BC components 172 RLX 시리즈의 비고체 전해액이 포함된 극성 알루미늄 전해 커패시터의 평활, 필터링, 버퍼링 기능이 유효합니다.

- 2022년 12월 : TDK 주식회사는 DC 링크 용도을 위해 매우 높은 스위칭 주파수에서 동작할 수 있는 모듈형 커패시터 아이디어인 ModCap HF를 제공합니다. 새롭게 개발된 B25647A* 시리즈의 6개의 전력커패시터의 정격 전압은 900-1600 볼트, 정전 용량 범위는 640-1850 볼트입니다. 최대 허용 핫스팟 온도는 90℃, 정격 전류는 유형에 따라 160-210A입니다. ModCap HF는 단지 8nH의 초저 ESL 값과 고주파에서도 손실을 최소화할 수 있는 평탄한 ESR 대 주파수 특성으로 인해 고속 스위칭 SiC 기반 인버터에 특히 적합합니다.전력 반도체는 매우 낮은 자체 유도 전류로 인해 전류가 꺼질 때 전압 오버슈팅이 발생하지 않습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 구매자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 업계 밸류체인 분석

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 여러 산업에서 유도 모터에 대한 수요 증가

- 전기자동차의 혁신적인 시스템에 대한 수요 증가

- 시장 성장 억제요인

- 전기 부품의 전류 누설 사례

제6장 시장 세분화

- 유형

- 세라믹

- 탄탈륨

- 알루미늄 전해 커패시터

- 종이 및 플라스틱 필름 커패시터

- 슈퍼 커패시터/EDLC

- 지역

- 아메리카

- 유럽, 중동 및 아프리카

- 아시아(일본, 한국 제외)

- 일본 및 한국

- 호주 및 뉴질랜드

제7장 경쟁 구도

- 기업 프로파일

- TDK Corporation

- Vishay Intertechnology Inc.

- Murata Manufacturing Co. Ltd

- AVX Corporation(Kyocera Group)

- Kemet Corporation(Yageo Company)

- Cornell Dubilier Electronics Inc.

- Eaton Corporation PLC

- Hongfa Technology Co.

- NIPPON CHEMI-CON CORPORATION

- Yageo Corporation

제8장 투자 분석

제9장 시장의 미래

HBR 25.04.11The Capacitor Market For Power Electronics Industry is expected to grow from USD 5.29 billion in 2025 to USD 7.12 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

In electrical circuits, capacitors are frequently employed to block direct current (DC) while allowing alternating current to flow.

Key Highlights

- In 2022, the cost of the capacitor made up around 10% of the entire cost of the power converter. Film capacitors are the costliest form of capacitors and are frequently employed for high power levels. Consequently, as more capacitors are required due to the system's increasing power level, the cost of capacitors in a power converter rises.

- Electric automobiles contribute to significant market demand, in addition to the numerous commercial and public electric vehicles, such as buses, trains, trams, and industrial trucks and equipment, that are used daily. Besides, hybrid cars are now on the roads as people search for more environment-friendly forms of personal transportation in response to the skyrocketing price of oil. The DC link power capacitor is only one example of how the electrical systems and parts that have made it possible to build such a wide range of electric cars have all undergone significant change.

- Capacitors are used in electric cars to smooth out changes in DC bus voltage and stop ripple currents from returning to the power source. Additionally, capacitors are utilized for safeguarding semiconductors like IGBTs rather than the original thyristors.

- It is expected that by the end of the forecast period, the market share of capacitors for power electronics used in EVs will rise from 29% to 44%. As a result, many capacitor businesses are eager to grow and concentrate on the present and future requirements of the automobile sector.

- The most common electrical motors are induction motors because of their dependability, affordability, and durability. Most pieces of equipment used in industrial and mining applications use three-phase AC induction motors as their main power source. These motors use 70-80% of all the power used worldwide. Induction motors have relatively low power factors when there is no load. It becomes better at going from zero load to full load. Power factor correction can be implemented at the starter, switchboard, or distribution panel and is accomplished by adding capacitors in parallel with the related motor circuits.

Capacitor Market Trends

Supercapacitor/EDLC Segment to Register Significant Growth

- Clean and renewable energy storage technologies have been developed due to the energy crisis and environmental damage. The Electrical Double Layer Capacitor (EDLC), often known as a supercapacitor, offers a very high capacitance in a compact form. Because it does not undergo the wear and tear associated with the chemical process, it may store electric energy as an electric field between two conducting plates and perform hundreds of thousands more charge-discharge cycles than batteries. Because of this and its growing application in electric drives, UPS, active filters, traction, and automotive industries have drawn interest to learn more about their peculiarities.

- The exceptional storage capacity of supercapacitors has led to their widespread usage in various applications, including SSDs, LED lamps, electric drives, UPS, traction, and electric cars. Supercapacitors are the sole power source for buses in Shanghai, and they are recharged every third stop in one to two minutes using regenerative braking energy. China has shown the rest of the world that this technology can be used extensively. However, the technology that combines a supercapacitor and battery is more favorable for buses.

- According to IEA, in 2022, 54 thousand electric bus registrations were completed in China and five thousand in Europe. This trend is gradually increasing as oil prices are hiking to prevent air pollution. This growing adoption of EVs will boost the growth of the market for capacitors in power electronics during the forecast period.

- Supercapacitors are utilized in radio tuners, mobile phones, laptop memory, and other electronic equipment. They are used in situations like LED flash units when a brief power surge is necessary.

Asia-Pacific to Hold a Significant Market Share

- The Asia-Pacific region is one of the most important markets for capacitors in power electronics applications. The popularity of EVs is growing, and China is regarded as one of the most dominant adopters of electric vehicles. The country's 13th Five-Year Plan promotes the development of green transportation solutions, such as hybrid and electric cars, for advancements in the country's transportation sector.

- China's electric cars are reached the 20% nationwide penetration goal in 2022, well ahead of the Chinese government's 2025 forecast, due to new models by dozens of competitors attracting new buyers and encouraging owners to switch to electric vehicles.

- Capacitors in power electronics applications are expected to benefit significantly from the government's growing interest in expanding electric distribution networks throughout India. To encourage the use of e-2W, the demand incentive under the FAME-II plan was raised from INR 10,000 (USD 119.67)/KWh to INR 15,000 (USD 179.51)/KWh with a ceiling increase from 20% to 40% of vehicle cost. Additionally, after March 31, 2022, phase II of the FAME-India Scheme was extended for an additional two years. This strategy was developed to provide more economical, environment-friendly transportation, strengthen national fuel security, and help India's car sector take the lead in global manufacturing.

- The region is witnessing an increase in market investments. For instance, in February 2024, Keltron, partnered with the Indian Space Research Organisation, has inaugurated a state-of-the-art supercapacitor manufacturing plant in Kannur. This move signifies a major advancement in energy storage technology. The facility, backed by a INR 42 crore investment, not only boasts exceptional energy storage capabilities but also propels India to the forefront of cutting-edge capacitor technology.

Capacitor Industry Overview

The capacitors market for power electronics is fragmented and highly competitive, as several international and domestic players are operating in the market. Some key players include TDK Corporation, Vishay Intertechnology Inc., Murata Manufacturing Co. Ltd, AVX Corporation (Kyocera Group), and Kemet Corporation (Yageo Company), among others. To maintain their position in a highly competitive market, the players are continuously innovating new products and undertaking various other business development strategies.

- April 2023: The Vishay BC components 172 RLX series, developed by Vishay Intertechnology Inc., is a new line of low-impedance automotive-grade miniature aluminum electrolytic capacitors. It features 14 case sizes with dimensions ranging from 10mm by 12mm to 18mm by 40mm, and it can operate at temperatures up to +105 °C. The switch mode power supplies, DC/DC converters, motor drives, and control units for automotive, telecommunications, industrial, audio-video, and electronic data processing (EDP) applications can benefit from the smoothing, filtering, and buffering capabilities of the Vishay BC components 172 RLX series of polarised aluminum electrolytic capacitors with non-solid electrolyte.

- December 2022: TDK Corporation offers ModCap HF, a modular capacitor idea that can operate at extremely high switching frequencies for DC link applications. The six newly created power capacitors in the B25647A* series are rated for voltages between 900 and 1600 volts and have capacitance ranges between 640 and 1850 volts. The highest allowable hot spot temperature is 90 °C, and the rated currents range from 160 A to 210 A depending on the kind. ModCap HF is especially well suited for fast-switching SiC-based inverters because of its ultra-low ESL value of just 8 nH and flat ESR vs. Freq evolution that allows minimizing losses even at high frequency. The power semiconductors don't experience voltage overshooting when the current is turned off due to the extremely low self-inductance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Induction Motors Across Several Industries

- 5.1.2 Increasing Demand for Innovative Systems in Electric Vehicles

- 5.2 Market Restraints

- 5.2.1 Instances of Current Leakage in Electrical Components

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Ceramic

- 6.1.2 Tantalum

- 6.1.3 Aluminium Electrolytic Capacitors

- 6.1.4 Paper and Plastic Film Capacitor

- 6.1.5 Supercapacitors/EDLC

- 6.2 Geography

- 6.2.1 Americas

- 6.2.2 Europe, Middle East and Africa

- 6.2.3 Asia (excluding Japan and Korea)

- 6.2.4 Japan and South Korea

- 6.2.5 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TDK Corporation

- 7.1.2 Vishay Intertechnology Inc.

- 7.1.3 Murata Manufacturing Co. Ltd

- 7.1.4 AVX Corporation (Kyocera Group)

- 7.1.5 Kemet Corporation (Yageo Company)

- 7.1.6 Cornell Dubilier Electronics Inc.

- 7.1.7 Eaton Corporation PLC

- 7.1.8 Hongfa Technology Co.

- 7.1.9 NIPPON CHEMI-CON CORPORATION

- 7.1.10 Yageo Corporation