|

시장보고서

상품코드

1683879

일본의 EV 배터리 팩 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2029년)Japan EV Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

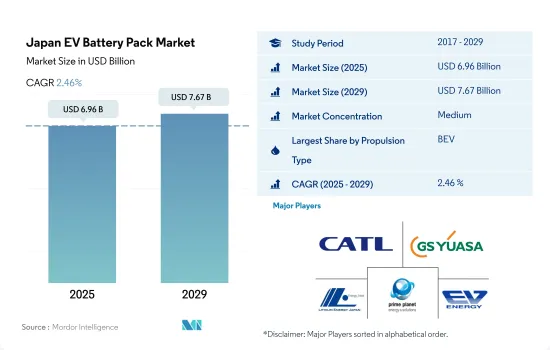

일본의 EV 배터리 팩 시장 규모는 2025년에 69억 6,000만 달러로 추정되며, 2029년에는 76억 7,000만 달러에 이를 것으로 예측되고, 예측 기간 중(2025-2029년) CAGR은 2.46%를 보일 것으로 전망됩니다.

정부 지원과 기술 발전이 BEV 채택을 촉진

- 지난 몇 년 동안 일본에서 차량의 전기화가 인기를 얻고 있습니다. 환경에 대한 관심 증가, 전기자동차 관련 규범 시행, 화석 연료 차량에 비해 전기자동차의 장점, 정부의 리베이트 및 보조금 지원(2021년부터 배터리 전기자동차에 7,200달러의 보조금 지급 등) 등의 요인으로 인해 일본 내 BEV 및 PHEV 등 전기자동차의 수요가 증가했습니다. 이로 인해 일본 내 전기자동차와 플러그인 하이브리드 전기자동차용 리튬이온 배터리의 수요가 크게 증가했습니다.

- 플러그인 하이브리드 전기자동차에 대한 수요는 배터리 전기자동차보다 높습니다. 그러나 전체 전기자동차 판매량의 약 90% 이상, 즉 시장의 대부분은 하이브리드 차량이 차지하고 있습니다. 플러그인 하이브리드 차량은 연료 또는 배터리로 전환할 수 있는 옵션이 있습니다. 하지만 충전 인프라의 발전으로 배터리 전기자동차에 대한 투자도 점차 증가하고 있습니다.

- 배터리 전기자동차에 대한 수요가 증가함에 따라 리튬이온 배터리에 대한 요구 사항도 증가하고 있습니다. 순수 전기자동차에 사용되는 배터리는 2023년 전체 전기자동차 판매량에서 88.1%의 점유율을 차지했습니다. 하지만 다양한 기업들이 플러그인 하이브리드 카테고리에서 새로운 제품을 출시하고 있습니다. 2023년 3월, 도요타는 약 105km의 배터리 주행거리를 제공하는 새로운 플러그인 하이브리드 전기자동차인 프리우스를 공개하고 예약을 시작했습니다. 이러한 신제품 출시는 예측 기간 동안 일본의 전기자동차 및 배터리 산업을 강화할 것으로 예상됩니다.

일본의 EV 배터리 팩 시장 동향

도요타 그룹이 시장을 장악하고 닛산, 혼다, 미쓰비시, BMW가 그 뒤를 이어 지속 가능한 모빌리티로의 전환을 주도

- 일본 전기자동차 시장은 점진적으로 성장하고 있습니다. 이 시장은 고도로 통합되어 있으며, 2022년 시장의 90% 이상을 차지한 5개 주요 기업이 주도하고 있습니다. 이러한 기업에는 도요타 그룹, 닛산, 혼다, 미쓰비시, BMW가 포함됩니다. 도요타 그룹은 일본 내 전기자동차 판매량의 약 57%를 차지하는 최대 판매 업체입니다. 국내 제조업체로서 소비자들의 신뢰를 받고 있습니다. 이 회사는 광범위한 제품 포트폴리오와 전국에 걸친 거대한 판매 및 서비스 네트워크를 제공하고 있습니다.

- 닛산은 약 21%의 시장 점유율을 차지하며 일본 내 전기자동차 판매량 2위를 기록하고 있습니다. 이 회사는 강력한 브랜드 이미지를 가지고 있으며 혁신과 기술에 대한 연구에 광범위하게 참여하고 있습니다. 이 회사는 다양한 제품 포트폴리오를 제공하며 재무 상태도 탄탄합니다. 혼다는 전기자동차 판매에서 세 번째로 높은 시장 점유율인 17%를 기록했습니다. 이 회사는 강력한 R&D 역량을 보유하고 있으며 개발 분야에 집중하고 있습니다.

- 미쓰비시는 2.8%의 시장 점유율로 일본 전체 전기자동차 판매량 4위를 차지했습니다. 이 회사는 고객 중심적이며 주로 고객의 요구 사항에 초점을 맞추고 있으며, 국내 브랜드이기 때문에 신뢰할 수 있고 충성도가 높은 고객을 보유하고 있습니다. 일본 전기자동차 시장에서 5번째로 큰 업체는 BMW로, 약 0.33%의 시장 점유율을 유지하고 있습니다. 일본에서 전기자동차를 판매하는 다른 업체로는 메르세데스-벤츠, 르노, 푸조, 볼보 등이 있습니다.

2022년, 닛산과 도요타가 일본에서 가장 많은 전기자동차를 판매하며 배터리 팩 수요를 견인

- 일본 전기자동차 시장은 지난 몇 년 동안 점진적으로 성장하고 있습니다. 일본에서는 전기자동차에 대한 수요가 증가하고 있습니다. 일본 소비자들은 주차가 용이하고 경제적인 소형차를 찾고 있습니다. 일본의 다양한 브랜드에서 초소형 전기 해치백을 위한 좋은 옵션을 제공하고 있습니다. 그 결과, SUV가 다른 모델에 비해 다양한 도로 조건에서 편안한 승차감을 제공하기 때문에 일본에서는 전기 해치백과 소형 SUV에 대한 수요가 증가하고 있습니다.

- 교통 체증을 피하고 주차하기 쉽도록 작은 차를 선택하는 사람들이 늘어나면서 해치백은 전국적으로 판매 호조를 보이고 있습니다. 토요타 아쿠아 프리우스 C는 연비가 좋은 합리적인 가격의 하이브리드 해치백으로 소비자들에게 인기를 끌면서 2022년에 큰 판매 성장을 보였습니다. 일본 사람들은 2022년에 좋은 판매량을 기록한 도요타의 소형 SUV인 야리스 크로스 등 다양한 세그먼트에 관심을 보이고 있습니다. 신뢰도 높은 브랜드 이미지 덕분에 일본에서는 베스트셀러 브랜드입니다.

- 코롤라 크로스 역시 하이브리드 파워트레인을 탑재해 높은 연비와 넓은 좌석 공간으로 소비자들에게 인기를 끌며 2022년 일본 전기자동차 시장에서 토요타의 베스트셀러 중 하나로 꼽혔습니다. 일본 전기자동차 시장에는 다양한 브랜드의 다양한 전기 SUV와 세단도 있습니다. 대표적인 차량 중 하나는 혼다 베젤로, 2022년에 좋은 판매량을 보였습니다. 일본 전기자동차 시장에서 경쟁하고 있는 다른 차량으로는 도요타 시엔타와 도요타 라제 하이브리드가 있습니다.

일본의 EV 배터리 팩 산업 개요

일본의 EV용 배터리팩 시장은 적당히 통합되어 상위 5개사에서 43.72%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Contemporary Amperex Technology(CATL), GS Yuasa International Ltd., Lithium Energy Japan Inc., Prime Planet Energy & Solutions Inc. and Primearth EV Energy(sorted alphabetically).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 전기자동차 판매 대수

- OEM별 전기자동차 판매 대수

- 베스트셀러 전기자동차 모델

- 선호되는 배터리 화학을 가진 OEM

- 배터리 팩 가격

- 배터리 재료 비용

- 다양한 배터리 화학의 가격 차트

- 누가 누구에게 공급하는지

- EV 배터리 용량 및 효율성

- 출시 된 EV 모델 수

- 규제 프레임워크

- 일본

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 차체 유형

- 버스

- LCV

- M & HDT

- 승용차

- 추진 유형

- BEV

- PHEV

- 배터리 화학

- LFP

- NCM

- NMC

- 기타

- 용량

- 15-40kWh

- 40-80kWh

- 80kWh 이상

- 15kWh 미만

- 배터리 형태

- 원통형

- 파우치형

- 프리즘형

- 방식

- 레이저

- 와이어

- 구성요소

- 양극

- 음극

- 전해질

- 분리기

- 재료 유형

- 코발트

- 리튬

- 망간

- 천연 흑연

- 니켈

- 기타 재료

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Blue Energy Co. Ltd.

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Envision AESC Japan Co. Ltd.

- GS Yuasa International Ltd.

- Lithium Energy Japan Inc.

- Maxell Ltd.

- Panasonic Holdings Corporation

- Prime Planet Energy & Solutions Inc.

- Primearth EV Energy Co. Ltd.

- TOSHIBA Corp.

- Vehicle Energy Japan Inc.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Japan EV Battery Pack Market size is estimated at 6.96 billion USD in 2025, and is expected to reach 7.67 billion USD by 2029, growing at a CAGR of 2.46% during the forecast period (2025-2029).

Government support and technological advancements drive the adoption of BEVs

- Electrification of vehicles has been gaining popularity in Japan over the past few years. Factors such as growing environmental concern, enforcing norms related to electric vehicles, advantages of electric vehicles over fossil fuel vehicles, and government help in terms of rebates and subsidies (such as since 2021, a subsidy of USD 7,200 has been offered on battery electric vehicles) have increased the demand of electric vehicles such BEVs and PHEVs in the country. This led to a significant growth in the demand for lithium-ion batteries for electric vehicles and plug-in hybrid electric vehicles in Japan.

- The demand for plug-in hybrid electric vehicles is higher than the battery electric vehicles. However, the majority of the market, i.e., around more than 90% of the sales of overall electric vehicles, is dominated by hybrid vehicles. Plug-in hybrid vehicles have the option of switching to fuel or battery. However, development in the charging infrastructure is encouraging people to invest in battery electric vehicles gradually.

- The requirement for lithium-ion batteries is increasing with the increased demand for battery electric vehicles. Batteries used in pure electric cars acquired a share of 88.1% in the overall sales of EVs in 2023. However, various companies are launching new products in the plug-in hybrid category. In March 2023, Toyota unveiled its new plug-in hybrid electric car, Prius, which provides a battery range of around 105 km, and bookings of the vehicle started. The introduction of new products is anticipated to strengthen Japan's electric car and battery industries during the forecast period.

Japan EV Battery Pack Market Trends

TOYOTA GROUP DOMINATES THE MARKET, FOLLOWED BY NISSAN, HONDA, MITSUBISHI, AND BMW, DRIVING THE SHIFT TOWARD SUSTAINABLE MOBILITY

- The Japanese electric vehicle market is growing gradually. The market is highly consolidated and is largely driven by five major companies, which held more than 90% of the market in 2022. These companies include Toyota Group, Nissan, Honda, Mitsubishi, and BMW. Toyota Group is the largest seller of electric vehicles in Japan, accounting for around 57% of the share in EV sales. Being a domestic manufacturer, the company has the trust of consumers. The company is offering a wide product portfolio and a huge sales and service network across the country.

- Nissan holds a market share of around 21%, making it the second-largest seller of electric vehicles across Japan. The company has a strong brand image and is extensively involved with work on innovation and technology. The company offers a wide product portfolio and has a strong financial condition. The third highest market share, 17%, for electric vehicle sales was recorded by Honda. The company has strong R&D capabilities and focuses on the areas of development.

- Mitsubishi has secured fourth place in EV sales across Japan with 2.8% of the market share. The company is customer-centric and primarily focuses on customer requirements, and being a domestic brand, the company has reliable and loyal customers. The 5th largest player operating in the Japanese EV market is BMW, maintaining its market share at around 0.33%. Other players selling EVs in Japan include Mercedes-Benz, Renault, Peugeot, and Volvo.

In 2022, Nissan and Toyota sold the most EVs in Japan, driving battery pack demand

- The Japanese electric vehicle market has been growing gradually over the past few years. The country has witnessed a growing demand for electric cars. Consumers in Japan are looking for economical and small cars that can be parked easily. Various brands in Japan are offering good options for electric sub-compact hatchbacks. As a result, the demand for electric hatchbacks and compact SUVs is growing in the country as SUVs offer comfortable rides in various road conditions compared to other models.

- Since more people choose tiny cars to avoid traffic and for easier parking, the hatchback has seen strong sales across the country. Toyota Aqua Prius C saw significant sales growth in 2022, as it is among the very affordable hybrid hatchbacks with good fuel efficiency, attracting consumers. People in Japan are showing interest in various segments, such as Toyota's Yaris Cross, a compact SUV that witnessed good sales units in 2022. Owing to its highly reliable brand image, the company is a bestselling brand in Japan.

- Corolla Cross was also one of the bestsellers from Toyota in the Japanese EV market in 2022 due to its hybrid powertrain, attracting consumers due to its high fuel efficiency and large seating capacity. The Japanese EV market also features a variety of electric SUVs and sedans from various brands. One of the common cars is the Honda Vezel, which saw good sales in 2022. Other cars in the Japanese EV market that are in the competition include Toyota Sienta and Toyota Raize Hybrid.

Japan EV Battery Pack Industry Overview

The Japan EV Battery Pack Market is moderately consolidated, with the top five companies occupying 43.72%. The major players in this market are Contemporary Amperex Technology Co. Ltd. (CATL), GS Yuasa International Ltd., Lithium Energy Japan Inc., Prime Planet Energy & Solutions Inc. and Primearth EV Energy Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 Japan

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCM

- 5.3.3 NMC

- 5.3.4 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Blue Energy Co. Ltd.

- 6.4.2 BYD Company Ltd.

- 6.4.3 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.4 Envision AESC Japan Co. Ltd.

- 6.4.5 GS Yuasa International Ltd.

- 6.4.6 Lithium Energy Japan Inc.

- 6.4.7 Maxell Ltd.

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Prime Planet Energy & Solutions Inc.

- 6.4.10 Primearth EV Energy Co. Ltd.

- 6.4.11 TOSHIBA Corp.

- 6.4.12 Vehicle Energy Japan Inc.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms