|

시장보고서

상품코드

1683929

유럽의 자동차용 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

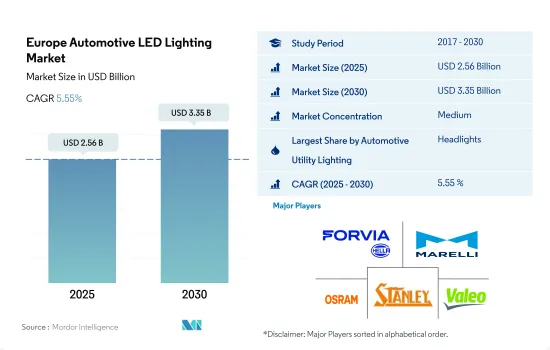

유럽의 자동차용 LED 조명 시장 규모는 2025년 25억 6,000만 달러에 달할 것으로 추정됩니다. 2030년에는 33억 5,000만 달러에 이르고, 예측 기간(2025-2030년)의 CAGR은 5.55%를 나타낼 것으로 예측됩니다.

제조업체는 LED를 통한 차량 외부 조명 인증을 받았으며 자동차 제조업체는 LED 조명 사용을 늘리기 위해 교통 안전, 기술 및 디지털화에 투자할 것으로 예상됩니다.

- 금액 점유율에서는 2023년에는 전조등이 대부분을 차지한 다음 다른 라이트와 방향 표시등이 뒤를 이었습니다. 전조등은 일상적인 사망자와 사고를 줄였습니다. 전년 교통사고 사망자 수는 약 20,600명으로 유행기간 회복에 따라 2021년부터 3% 증가했습니다. 그러나 이는 유행 전 2019년에 비하면 교통사고 사망자 수가 2,000명 감소(10% 감소)한 것입니다. EU와 유엔은 2030년까지 교통사고 사망자 수를 줄이겠다는 목표를 세웠습니다. 따라서 기존 교통사고 사망자 수를 줄이기 위해 자동차에 LED 전조등이 장착될 것으로 기대됩니다.

- 수량 점유율에서 2023년에는 방향 표시등이 대부분을 차지한 다음 전조등 및 기타 조명과 함께 뒤를 이었습니다. 이러한 조명 시장 점유율은 거의 변동하지 않고 변하지 않을 것으로 예상됩니다. 폭스바겐, 다임러, 보쉬, ZF 및 기타 유럽 최고공급업체와 같은 자동차 제조업체는 디지털화, 전기 이동성 및 운전, 수소 기술, 교통 안전에 향후 몇 년동안(1,619억 달러)를 지출합니다. 이는 신호등의 사용을 증가시켜 국내에서 LED 조명의 사용을 증가시킵니다.

- 이 시장의 주요 자동차 제조업체는 전기자동차 시장의 확대에 주력하고 있습니다. 이를 위해 2009년 4월 23일자 유럽 의회와 유럽 이사회는 이사회 규칙(EC) No.443/2009에 따라 소형 상용차로부터의 CO2 배출량을 줄이기 위한 공동체의 통합적 접근의 일환으로 신형 승용차의 배출가스 기준을 설정했습니다. 각 제조업체는 공동으로 내연기관 탑재 차량 및 외부 충전을 필요로 하지 않는 하이브리드 전기자동차용 혁신 기술로서 LED에 의한 효율적인 차외 조명 인가를 신청했습니다. 이것이 국산 LED 조명 시장 점유율을 확대했습니다.

자동차의 CO2 배출량을 줄이기 위한 규제 증가와 EV 수요를 높이기 위한 자기 전기 모터의 개발이 시장 성장을 뒷받침할 것으로 예상됩니다.

- 이 분야에서는 기타 유럽이 2023년 30% 이상 시장 점유율을 차지했으며, 이어 독일이 20% 이상, 스페인이 15% 이상 시장 점유율을 차지했습니다. 이것은 상용차, 이륜차, 승용차 증가 때문입니다. 전기차의 보급 확대도 유럽의 다른 지역에서 시장 성장에 대응할 것으로 예상됩니다.

- 2021년, 폴란드는 매우 오래된 승용차의 비율이 가장 높았고, 승용차의 41.3%가 20년 이상 경과했습니다. 2023년 신흥 국가에서 승용차의 긍정적인 개발은 국가 수준에서도 반영되었습니다. 가장 강력한 성장을 기록한 것은 스페인(51.4%)과 이탈리아(19.0%)였고, 그 후 프랑스(8.8%)는 완만하지만 꾸준한 성장이었습니다. 하이브리드 전기자동차(HEV)도 2021년에 호조로 스타트를 끊었습니다. 판매 대수는 22.1% 증가한 19만 7,982대가 되었습니다. 이 지역의 4대 시장에서 2자리 성장이 견인했습니다 : 스페인(59.3% 증가), 이탈리아(24.7% 증가), 독일(19.0% 증가), 프랑스(12.5% 증가). 그 결과 시장 점유율은 26.0%로 2022년 1월에 비해 2.3포인트 개선되었습니다.

- 자동차의 CO2 배출량 감소를 목표로 한 정부 규정은 유럽 자동차 제조업체의 LED 광원 채택을 더욱 강화할 것으로 보입니다. 자동차 제조업체는 또한 지속가능성에 기여하기 위한 많은 새로운 프로그램을 출시하고 있습니다. 예를 들어, 전기자동차(EV)를 위한 저렴하고 효율적인 고출력 영구자석 전기모터를 개발하기 위한 유럽의 새로운 R&D 프로그램은 2023년에 시작될 예정이었습니다. Mondragon University는 유럽의 8개 파트너로 구성된 컨소시엄을 이끌고 있으며 GKN Automotive도 참여하고 있습니다.

유럽의 자동차용 LED 조명 시장 동향

EV 판매 증가가 유럽 LED 시장을 견인할 전망

- 한국의 자동차 총 생산 대수는 2022년에는 1,767만대, 2023년에는 1,833만대에 달했습니다. 중국 최초의 공장 폐쇄는 유럽 자동차 부문공급망을 혼란시켰습니다. EU 회원국 전체 자동차 공장의 평균 다운타임은 30일로 스웨덴의 다운타임이 가장 짧고(15일) 이탈리아의 다운타임이 가장 길었습니다(41일). EU 자동차 부문은 2020년 상반기에 360만 대의 생산량을 잃어 1,000억 유로(1,079억 달러)의 손실을 기록했습니다. 이 수치는 2020년 9월 말까지 402만 4,036대까지 상승해 EU의 2020년 생산 대수의 22.3%를 차지했습니다. 유럽에서 이러한 생산 감소는 궁극적으로 자동차 부문의 LED 조명에 악영향을 미쳤습니다.

- 폭스바겐 그룹, 스텔란티스, 메르세데스 벤츠, BMW, 포르쉐, Hurtan, GTA 모터스, 아우디, 푸조가이 지역의 주요 자동차 제조 업체입니다. EV의 대두와 자동차에 사용되는 연료 유형의 기술적 진보에 의해 이 지역의 자동차 산업은 큰 변모를 이루고 있습니다. EU에서 배터리 전기자동차의 판매량은 현재도 빠르게 증가하고 있습니다. 예를 들어 2022년 EU 시장에서 판매된 910만대 중 12.1%가 완전 배터리 전기차였던 반면 2019년의 점유율은 불과 1.9%, 2021년은 9.1%였습니다. 판매 대수의 약 22.6%는 하이브리드 전기자동차로, 9.4%는 최근의 친환경 플러그인 하이브리드 차량이었습니다. EV의 보급에 따라 차량 탑재 조명용 반도체와 LED 수요는 효율의 높이에서 높습니다.

EV 등록 대수 증가와 EV 보급을 위한 정부 정책이 LED 시장 성장을 가속

- 유럽 전역에서 EV의 보급이 급속히 진행되고 있습니다. 유럽에 있어서의 전기자동차(BEV, PHEV, EREV, FCEV)의 판매 대수는 259만대로, 2021년 대비 15% 증가, 2020년 대비 92% 증가했습니다. 2022년 유럽의 EV 판매 점유율은 노르웨이(79%), 스웨덴(33%), 네덜란드(23%), 덴마크(21%)가 가장 높았으며 핀란드, 스위스, 독일이 각각 18%로 이어졌습니다. 2022년 시장 점유율에서 배터리 전기자동차(BEV)는 전체의 12.1%를 차지했으며 2021년의 9.1%, 2019년의 1.9%에서 상승했습니다.

- 2016년 영국의 배터리 전기차는 3만 669대였지만 2023년 5월에는 78만 4,968대에 달했습니다. 2022년에는 26만 5,000대 이상의 배터리 전기차가 등록되어 2021년 대비 40% 증가했습니다. 영국 정부는 영국에서 전기자동차 등록 수를 늘리기 위해 EV를 선택하는 사람들을 강력하게 지원합니다. 구매자는 신차 EV에 최대 2,500유로(2,699달러)의 할인을 제공하는 플러그인 보조금의 혜택을 누릴 수 있습니다. 또한 스코틀랜드에서는 EV의 신차·중고차 구입에 무이자 대출을 제공합니다.

- 프랑스는 자동차 산업 재편 전략의 일환으로 2020년 5월에 보조금 인상을 계획했습니다. 주된 이유는 COVID-19의 대유행으로 인한 판매 감소입니다. 이때 보조율 상한은 6,479달러에서 7,558.8달러로 인상되었습니다. 2021년 중반에는 상한이 7,558.8달러에서 6,478.9달러로 인하되었습니다. 2023년 정부는 2023년 1월부터 전기차 보조금을 6,478.9달러에서 5,399달러로 인하했습니다. 또한 2030년까지 연간 200만대의 전기차를 생산한다는 목표도 내걸고 있습니다. 이러한 시장 진보로 이 지역의 자동차 LED 수요는 향후 수년간 증가할 것으로 보입니다.

유럽의 자동차용 LED 조명 산업 개요

유럽의 자동차용 LED 조명 시장은 적당히 통합되어 상위 5개사에서 48.57%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. HELLA GmbH & Co. KGaA, Marelli Holdings, OSRAM GmbH., Stanley Electric and Valeo(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 자동차 생산 대수

- 인구

- 1인당 소득

- 자동차 대출 금리

- 충전소 수

- 자동차 보유 대수

- LED 총 수입량

- 가구수

- 도로 네트워크

- LED 보급률

- 규제 프레임워크

- 프랑스

- 독일

- 스페인

- 영국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 자동차용 유틸리티 조명

- 주간 주행등(DRL)

- 방향지시등

- 전조등

- 후진등

- 정지등

- 후미등

- 기타

- 자동차용 조명

- 이륜차

- 상용차

- 승용차

- 국가

- 프랑스

- 독일

- 스페인

- 영국

- 기타 유럽

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- HELLA GmbH & Co. KGaA

- HYUNDAI MOBIS

- KOITO MANUFACTURING CO., LTD.

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Phoenix Lamps Ltd(Suprajit Engineering Ltd)

- Signify(Philips)

- Stanley Electric Co., Ltd.

- Valeo

- ZKW Group

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Europe Automotive LED Lighting Market size is estimated at 2.56 billion USD in 2025, and is expected to reach 3.35 billion USD by 2030, growing at a CAGR of 5.55% during the forecast period (2025-2030).

Manufacturers are expected to get approval for exterior vehicle lighting with LED and automakers are expected to invest in road safety, technology, and digitization to increase the use of LED lights

- In terms of value share, in 2023, headlights accounted for the majority, followed by other lights and directional signal lights. Headlights have reduced daily fatalities and accidents. About 20,600 people died in road crashes the previous year, up by 3% from 2021 as traffic recovered from the pandemic. However, this represented 2,000 fewer road fatalities (10% less) compared to the pre-pandemic year of 2019. The goal of reducing road fatalities by 2030 was set by the EU and UN. Hence, it is expected that vehicles will be fitted with LED headlights to reduce the existing rate of road fatalities.

- In terms of volume share, in 2023, directional signal lights accounted for the majority, followed by headlights and other lights. The market share of these lights is expected to remain the same with little fluctuation. Automakers such as Volkswagen, Daimler, Bosch, ZF, and other top European suppliers will spend (USD 161.9 billion) over the next few years on digitalization, electromobility and driving, hydrogen technology, and road safety. This will increase the use of signal lights, thus increasing the use of LED lights in the country.

- The major automakers in the market are focusing on expanding the electric vehicle market. To this end, the European Parliament and Council of 23 April 2009 set emissions standards for new passenger cars as part of the community's integrated approach to reducing CO2 emissions from light commercial vehicles under Council Regulation (EC) No. 443/2009. Manufacturers jointly applied for the approval of efficient exterior vehicle lighting with LED as an innovative technology for vehicles with internal combustion engines and hybrid electric vehicles that do not require external charging. This factor increased the market share of domestic LED lighting.

Increasing regulations to reduce vehicle CO2 emissions and the development of magnetic electric motors to boost EV demand are expected to boost the market's growth

- In this segment, the Rest of Europe is expected to occupy a market share of more than 30% in 2023, followed by Germany and Spain, with market shares of more than 20% and 15%, respectively. This is due to an increase in the number of commercial vehicles, two-wheelers, and passenger cars. An increase in electric vehicle adoption is also anticipated to correspond to the market's growth in other parts of Europe.

- In 2021, Poland had the highest proportion of very old passenger cars, with 41.3% of passenger cars being over 20 years old. The positive development of passenger cars in the region in 2023 was reflected at the country level. The strongest growth was recorded in Spain (+51.4%) and Italy (+19.0%), followed by France (+8.8%), which had slow but steady growth. Hybrid electric vehicles (HEVs) also got off to a strong start in 2021. Sales increased by 22.1% to 197,982 units. This was driven by double-digit growth in the region's four largest markets: Spain (+59.3%), Italy (+24.7%), Germany (+19.0%), and France (+12.5%). This resulted in a market share of 26.0%, an improvement of 2.3 points compared to January 2022.

- Government regulations aimed at reducing vehicle CO2 emissions will further encourage the adoption of LED light sources by European automakers. Automakers are also launching a number of new programs to contribute to sustainability. For example, a new European R&D program to develop cheaper, more efficient, and power-dense permanent magnet electric motors for electric vehicles (EVs) was expected to start in 2023. Mondragon University leads the consortium of eight European partners and includes GKN Automotive.

Europe Automotive LED Lighting Market Trends

Increasing EV sales are expected to drive the LED market in Europe

- The total automobile vehicle production in South Korea was 17.67 million units in 2022, and it is expected to reach 18.33 million units in 2023. The first Chinese factory closures disrupted the supply chains of the European automotive sectors. The average downtime for automotive plants throughout EU Member States was 30 days, with Sweden experiencing the most minor downtime (15 days) and Italy experiencing the highest (41 days). The EU automobile sector lost 3.6 million vehicles from production in the first half of 2020, amounting to a loss of EUR 100 billion (USD 107.9 billion). This number climbed to 4,024,036 motor vehicles by the end of September 2020, accounting for 22.3% of the EU's 2020 production. Such production loss in Europe ultimately had a negative impact on LED lights in the automotive sector.

- Volkswagen Group, Stellantis, Mercedes-Benz, BMW, Porsche, Hurtan, GTA Motors, Audi, and Peugeot are the major automotive car manufacturers in the region. With the rise in EVs and technological advancements in the fuel types utilized in vehicles, the region is seeing a significant transformation in its automotive industry. Battery electric vehicle sales in the EU are still rising quickly. For instance, 12.1% of the 9.1 million vehicles sold in EU markets in 2022 were fully battery electric vehicles, as compared to a share of just 1.9% in 2019 and 9.1% in 2021. About 22.6% of sales were made up of hybrid electric cars, and 9.4% of sales were made up of the more recent and eco-friendly plug-in hybrids. With the growing usage of EVs, the demand for semiconductors and LEDs in vehicle lighting is high due to their efficiency.

Increasing EV registrations and government policies for EV adoption may drive the growth of the LED market

- The adoption of EVs across Europe is growing rapidly. In Europe, sales of electric vehicles (BEVs, PHEVs, EREVs, and FCEVs) totaled 2.59 million units, up by 15% from 2021 and by 92% from 2020. Norway (79%), Sweden (33%), the Netherlands (23%), and Denmark (21%) had the highest market shares of EV sales in Europe in 2022, followed by Finland, Switzerland, and Germany, with an 18% share of EV registrations each in Europe in 2022. In 2022, battery electric vehicles (BEVs) accounted for 12.1% of the total market share, up from 9.1% in 2021 and 1.9% in 2019.

- In 2016, the number of battery-electric cars in the United Kingdom was 30,669, and by May 2023, this number reached 784,968. More than 265,000 battery-electric vehicles were registered in 2022, a 40% increase over 2021. The British government strongly supports the people who are choosing EVs to increase the number of registered electric vehicles in the United Kingdom. Buyers can benefit from the Plug-In Grant, which offers a discount of up to EUR 2,500 (USD 2,699) on new EVs. Scotland also offers interest-free loans on purchases of new and used EVs.

- As part of a restructuring strategy for the automotive industry, France planned to raise subsidy rates in May 2020. The main reason was a drop in sales caused by the COVID-19 pandemic. The maximum subsidy rate was increased from USD 6,479 to USD 7,558.8 at the time. In mid-2021, the maximum rate was reduced from USD 7,558.8 to USD 6,478.9. In 2023, the government reduced subsidies for electric cars to USD 5,399 from USD 6,478.9, effective from January 2023. It also set a target of producing two million electric vehicles per year by 2030. These advancements in the market are expected to drive the demand for automotive LEDs in the region in the coming years.

Europe Automotive LED Lighting Industry Overview

The Europe Automotive LED Lighting Market is moderately consolidated, with the top five companies occupying 48.57%. The major players in this market are HELLA GmbH & Co. KGaA, Marelli Holdings Co., Ltd., OSRAM GmbH., Stanley Electric Co., Ltd. and Valeo (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 France

- 4.11.2 Germany

- 4.11.3 Spain

- 4.11.4 United Kingdom

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Spain

- 5.3.4 United Kingdom

- 5.3.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 HELLA GmbH & Co. KGaA

- 6.4.2 HYUNDAI MOBIS

- 6.4.3 KOITO MANUFACTURING CO., LTD.

- 6.4.4 Marelli Holdings Co., Ltd.

- 6.4.5 OSRAM GmbH.

- 6.4.6 Phoenix Lamps Ltd (Suprajit Engineering Ltd)

- 6.4.7 Signify (Philips)

- 6.4.8 Stanley Electric Co., Ltd.

- 6.4.9 Valeo

- 6.4.10 ZKW Group

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms