|

시장보고서

상품코드

1764336

자동차용 LED 시장(2025년) - 조명과 디스플레이 제품 동향2025 Global Automotive LED Market- Lighting and Display Product Trend |

||||||

세계의 자동차용 LED 시장(2025년) - 조명과 디스플레이 제품 동향에 따르면, 경제 전반의 불확실성이 지속됨에 따라 2025년에는 가격 하락 압력이 강화될 것으로 예상됩니다. 그러나 TrendForce의 자동차용 LED 제조업체의 주문량 분석에 따르면, 자동차 생산량은 25년 하반기에 다시 회복될 것으로 예상됩니다. 또한 2026년 자동차 모델에는 첨단 기술이 계속 탑재될 것으로 예상되며, 2025년 자동차 LED 및 자동차 조명 시장 규모는 34억 5,100만 달러에서 357억 2,900만 달러로 성장할 것으로 전망됩니다.

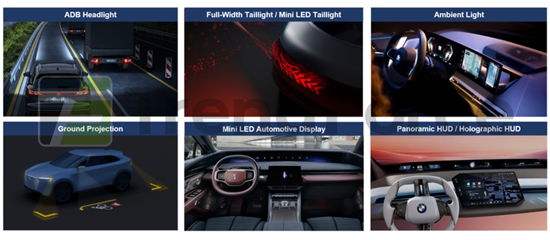

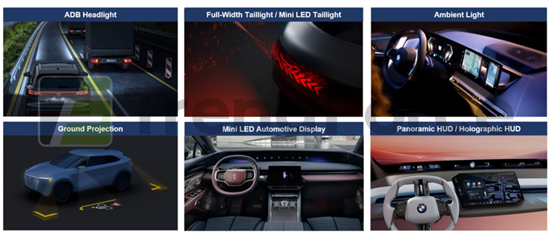

차량용 조명은 향후 개인화, 커뮤니케이션 디스플레이, 운전 지원, 안전 향상에 집중할 것

자동차 조명 및 디스플레이 시장 동향

1. 헤드라이트

ADB 헤드라이트는 고성능 LED를 독립적으로 제어하여 운전자의 야간 시야를 넓히고 장애물을 발견했을 때 반응할 수 있는 시간을 늘려 더 나은 도로 조명을 제공합니다. 눈부심이 없는 하이빔은 앞차와 마주 오는 차량 운전자의 불편함을 줄이고 보행자가 헤드라이트에 의해 눈부심을 느끼지 않도록 합니다. TrendForce의 분석에 따르면 세계 경제의 불확실성이 높아지면서 ADB 헤드라이트 시장의 보급률 성장이 둔화되고 있지만, 2029년에는 21.6%에 달할 수 있다고 합니다.

ADB 헤드라이트에 Micro/Mini LED 픽셀화 모듈이 점점 더 많이 사용되고 있으며, 픽셀의 독립적인 디지털 제어를 통해 조사 면적을 조정하여 운전의 안전성을 높일 수 있습니다. 삼성의 PixCell LED(COB 기술)를 활용한 미니 LED 픽셀 모듈은 Tesla Model 3/Y와 NIO ES6에 탑재되어 성공을 거둔 바 있습니다. 또한 Volkswagen, Porsche, SAICVolkswagen, NIO, Opel, Audi는 2025년 Micro LED 헤드라이트 솔루션을 채택하는 자동차 제조업체를 선도하고 있습니다.

ADB 헤드라이트는 소형 발광면(LES), 고휘도, 고명암비를 중시하는 시대적 트렌드이며, TrendForce에 따르면 자동차 제조사들은 Micro LED ADB 헤드라이트에 평균 2백만 화소를 요구하고 있습니다. 향후 마이크로 LED 픽셀 어레이의 제품 트렌드는 3,000-4,000 픽셀을 사용하는 저화소 제품과 7만-10만 픽셀을 사용하는 프리미엄 제품의 두 가지 방향으로 발전할 가능성이 있으며, OEM은 헤드라이트 당 10만 픽셀을 목표로 하고 있습니다. 따라서 ams 오스람과 Nichia는 자동차 제조업체의 요구와 목표에 부응하기 위해 Micro LED 픽셀 어레이의 픽셀 수를 지속적으로 늘릴 계획입니다.

2. 미등

자동차 조명의 개인화, 커뮤니케이션 디스플레이, 운전자 보조, 안전 향상 추세는 Mini LED 미등(후면)과 RGB Mini LED 커뮤니케이션 디스플레이(전면)를 만들어 냈습니다. 이들 제품은 IM Motors, GWM(SAR Mecha Dragon), Changan(NEVO CD07)의 차량에 탑재되어 있으며, TrendForce의 분석에 따르면, 현재 주류 설계는 주로 P3-P4 디스플레이를 탑재하고, 비용과 소비전력을 고려하여 100W 사양을 채택하고 있습니다.

ams OSRAM은 ALIYOS 기술을 혁신적으로 개발하여 슬림하고 유연한 투명 호일 위에 배치된 눈에 잘 띄지 않는 금속 와이어로 Mini LED를 연결하여 Mini LED 어레이를 배치할 수 있는 유연성을 제공합니다. 또한, 개별적으로 주소 지정이 가능한 유닛으로 모든 형상을 형성할 수 있으며, 블록 기반 조명 제어를 통해 스타일링, 메시지, 경고 등을 위해 기호, 단어, 이미지, 추상적인 그림을 동적으로 표시할 수 있습니다. ams OSRAM은 전 세계 주요 자동차 부품 제조업체 및 OEM과 협력하여 자동차 내/외장 조명의 새로운 가능성을 추구하고 있습니다.

3. 장식 조명

TrendForce의 분석에 따르면, 장식 조명에는 앰비언트 라이트, 그릴 램프, 풀 와이드 프론트 스트립, ADS 마커 램프 등이 포함됩니다. 장식 조명 시장 규모는 2024년부터 2029년까지 28%의 CAGR로 2029년까지 3억 1,100만 달러에 달할 것으로 보입니다. 특히 지능형 앰비언트 LED 시장의 2024-2029년 CAGR은 무려 69%에 달할 것으로 예상됩니다.

인텔리전트 앰비언트 라이트는 내장된 드라이버 IC로 구동되는 RGB LED를 탑재하고 있습니다. ISELED 얼라이언스 인증을 받은 지능형 앰비언트 라이트 외에도 ams OSRAM과 Dominant가 오픈 시스템 프로토콜(OSP)을 탑재한 지능형 앰비언트 라이트를 잇달아 출시하고 있습니다. ams OSRAM의 지능형 앰비언트 라이트는 ZEEKR MIX(2024) 모델에 탑재되어 유럽 및 미국 자동차 제조업체에 적용될 예정입니다.

자동차 업체들은 RGB LED 솔루션 외에도 독서등, 루프 라이트, 화장 거울, 풋룸 조명에 높은 연색성(CRI 95 이상), 색온도 조절 가능(2,700-6,500K)을 특징으로 하는 백색 LED 솔루션을 채택할 계획입니다. SunLike 기술을 적용한 서울반도체의 주변 백색 LED 제품은 업계를 선도하고 있습니다. 이 제품은 볼보 Polestar 3/EX90에 성공적으로 탑재되었다. 1W 주변 백색 LED는 최대 100lm의 밝기(CRI 95 이상)를 달성했습니다.

4. 소형 LED 차량용 디스플레이

HDR, 로컬 디밍, 광색역, 곡면 스크린 디자인 트렌드에 따라 자동차 제조업체들은 2024년 NIO, General Motors, Li Auto, BYD, Ford, Geely, Stellantis를 포함한 차량용 미니 LED 디스플레이를 채택하기 시작했습니다. Xiaomi, BMW, Mercedes-Benz, HKMC, BAIC, GWM, Sony는 2025-2029년 사이에 미니 LED 디스플레이를 장착한 자동차를 출시할 것으로 예상됩니다. 또한, 파노라마 HUD와 홀로그램 HUD는 명암비를 높이기 위해 Mini LED 기술을 채택하기 시작하여 차량용 디스플레이 시장의 성장 모멘텀을 촉진할 것으로 예상됩니다.

자동차 조명 시장 규모와 자동차 램프 제조업체의 수익 실적

TrendForce에 따르면 NEV에 힘입어 2024년 세계 자동차 판매량은 8,855만 대에 달했으며, NEV 보급률은 25%에 달했습니다. 그러나 자동차 조명 제조업체가 가격 압력, 재고 고갈, 환율 변동 등의 영향을 받아 자동차 조명 시장 규모는 346억 5,800만 달러로 소폭 감소했습니다. 2024년 자동차 조명 상위 10개 업체는 Koito, Valeo, Forvia Hella, Marelli, Stanley, SL Corporation, Xingyu, HASCO Vision, ZKW, OPmobility 순으로 나타났습니다.

자동차용 LED 제조업체의 수익 실적

2024년 상위 5개 자동차 LED 제조업체는 ams OSRAM, Nichia, Lumileds, Seoul Semiconductor, Dominant입니다. ams OSRAM은 제품의 안정적인 품질, 뛰어난 발광 효율 및 경제성을 바탕으로 전 세계 고급 자동차 및 NEV 제조업체들이 선택한 공급업체로 자리매김하고 있습니다. Seoul Semiconductor의 판매 실적은 주로 한국과 중국에서의 수주 증가에 따른 것입니다. 또한, 중국, 유럽, 한국에서의 수요 증가로 에버라이트는 2024년 차량용 LED 매출이 40% 이상 급증했습니다. Brightek은 자동차 시장 용도에 특화되어 있으며, 커뮤니케이션과 몰입형 경험을 위한 광센싱을 타깃으로 고객에게 통합적인 부가가치 서비스를 제공하는 것을 목표로 하고 있습니다.

TrendForce는 자동차 LED 시장 개척을 7가지 관점에서 분석하고 있습니다:

- (1) 차량용 조명 및 디스플레이 제품 동향

- (2) 차량용 조명 시장 규모 및 용도

- (3) 차량용 조명 제조업체의 수익 및 제품 전략

- (4) 자동차 램프 가격

- (5) 차량용 LED 시장 수요(제품 용도 및 지역별 시장 가치)

- (6) 자동차용 LED 진출 기업의 수익 실적 및 제품 전략

- (7) 자동차용 드라이버 IC 시장 규모 및 제품 동향

이를 통해 독자들에게 차량용 LED 시장의 마케팅 역학에 대한 전체적인 그림을 제공합니다.

목차

제1장 자동차 조명 제품 동향

- 자동차 조명 제품 트렌드

- 헤드라이트 제품 트렌드

- 헤드라이트 제품 트렌드 - ADB 헤드라이트 대 소구경 헤드라이트

- LED 헤드라이트/ADB 헤드라이트 보급률 분석, 2025-2029년

- ADB 헤드라이트 - 장점 및 규제 분석

- ADB 헤드라이트 - 매트릭스 LED/DLP/마이크로 LED 기술 개요

- ADB 헤드라이트 - 매트릭스 LED/DLP/마이크로 LED 기술 분석

- ADB 헤드라이트 - 매트릭스 LED/DLP/마이크로 LED 기술 동향, 2025-2029년

- ADB 헤드라이트 LED 시장 - LED 대 마이크로/미니 LED 모듈(2025-2029년)

- ADB 헤드라이트 - 삼성 PixCell LED 기술 분석

- ADB 헤드라이트 - 100 픽셀 미니 LED 모듈 가격 및 비용 예측

- ADB 헤드라이트 - 테슬라/헬라 SSL 100 헤드라이트 가격 및 비용 예측

- ADB 헤드라이트 - 마이크로 LED 픽셀 어레이 사양 분석

- ADB 헤드라이트 - 마이크로 LED 픽셀 어레이 기술 분석

- ADB 헤드라이트 - 물질 이동 장치 분석

- ADB 헤드라이트 - 마이크로 LED 픽셀 어레이 가격 및 비용 예측

- ADB 헤드라이트 - 마이크로 LED 헤드라이트 가격 및 비용 예측

- ADB 헤드라이트 - 마이크로 LED 헤드라이트 시장 애플리케이션 분석

- 마이크로 LED ADB 헤드라이트 - Volkswagen/Porsche, 2023-2024년

- 마이크로 LED ADB 헤드라이트 사례 연구 개요 및 공급망 개요

- 마이크로 LED ADB 헤드라이트의 기능 분석

- LED 헤드라이트 가격 분석, 2025년

- 레이저 헤드라이트 - 제품 설계 및 공급망

- LED 미등 제품 트렌드

- 전폭 미등 가격 및 비용 예측 - 0.2W SMD LED

- 전폭 미등 가격 및 비용 예측 -1515 LED

- 미니 LED 미등-ALIYOS

- 미니 LED 미등 가격의 적정 가격 및 비용 예측

- OLED 유사 LED 테일램프 제품 트렌드

- 앰비언트 조명 제품 트렌드 - 다이나믹 비주얼 조명

- (지능형) 앰비언트 라이트 - 장점과 단점 분석

- (지능형) 앰비언트 라이트 - 디자인 아키텍처 개요

- (지능형) 앰비언트 라이트 - 디자인 아키텍처 솔루션

- 지능형 앰비언트 라이트 - 개방형 시스템 프로토콜(OSP) vs.

- 지능형 앰비언트 라이트 - 사례 연구 분석

- 앰비언트 라이트 화이트 제품 트렌드

- 앰비언트 라이트 - 시장 상황 분석

- 그릴 램프/전면 전폭 스트라이프 제품 트렌드

- 그릴 램프/전면 전폭 스트라이프 제품 디자인

- 자율주행시스템 마커램프 제품 동향

- 지상 투영 제품 트렌드

- (지능형) 주변 조명 LED/장식 조명 LED 시장(2025-2029)

제2장 차량용 디스플레이 제품 동향

- 스마트 조종석 트렌드

- 스마트 콕핏 - 오늘부터 미래까지

- 차량용 디스플레이 기술 개요

- 차량용 디스플레이 패널 출하량 및 보급률(2025-2029년)

- 자동차 백라이트 LED 시장 가치 분석(2025-2029)

- LCD(엣지형/직하형)와 OLED 차량용 디스플레이 사양 비교

- 미니 LED 차량용 디스플레이 - 사양 및 공급망,2022년

- 미니 LED 차량용 디스플레이 - 사양 및 공급망, 2023년

- 미니 LED 차량용 디스플레이 - 사양 및 공급망, 2024년

- COB/COG/POG 기술 분석

- 미니 LED 차량용 디스플레이 일정 및 사양, 2022-2029년

- NIO ET7/ET5/ES7 차량용 디스플레이 - 사양 및 비용 분석

- 캐딜락 LYRIQ 차량용 디스플레이 - 사양 및 비용 분석

- 뷰익 일렉트라 E5 차량용 디스플레이 - 사양 및 비용 분석

- 캐딜락 셀레스틱 오토모티브 디스플레이 - 사양 및 비용 분석

- Zeekr 7X 차량용 디스플레이 - 사양 및 비용 분석

- Zeekr 009 차량용 디스플레이 - 사양 및 비용 분석

- HKMC 자동차 디스플레이 - 사양 및 비용 분석, 2026년

- 차량용 디스플레이 비용 분석 - 엣지형/직하형,2025년

- 미니 LED 차량용 디스플레이 - 다이렉트/스캔 드라이버 IC의 장점과 단점 분석

- OLED 차량용 디스플레이의 일정 및 사양, 2022-2025년

- 차량용 백라이트 디스플레이 시장 상황 분석

- HUD 시장 출하량 - 제품 및 지역별 시장 분석, 2025-2029년

- HUD 진입기업 출하량/시장 점유율 분석, 2024년

- HUD 제품 사양 분석

- AR-HUD 기술 분석

- AR-HUD OEM 공급망 및 제품 사양 분석

- HUD 제품 가격 분석, 2025년

- 파노라마 HUD 및 홀로그램 HUD

- HUD 시장 상황 분석

- 마이크로 LED 투명 디스플레이

- 마이크로 LED 차량용 디스플레이 애플리케이션 개요

- 마이크로 LED 차량용 투명 디스플레이의 비용 분석, 2025년

- 마이크로 LED 차량용 디스플레이 시장 상황 분석

제3장 자동차 조명 시장 규모와 진입 기업의 수익 실적

- 자동차 조명 시장 상황 분석

- 자동차 조명 시장 규모 - 용도 분석, 2025-2029년

- 자동차 조명 제조업체의 시장 점유율 분석, 2022-2024년

- 자동차 조명 제조업체 매출 순위 상위 15개사, 2022-2024년

- 자동차 조명 산업 M&A 분석

- 15개 자동차 램프 제조업체의 수익과 제품 전략

- 중국 자동차 램프/모듈 공장

제4장 자동차용 LED 기업의 수익과 전략

- 세계 자동차 LED 진출 기업 목록

- 2023-2024년 차량용 LED 시장 점유율 분석, 2023-2024년

- 2022-2024년 자동차용 LED 시장 진입 기업 매출 상위 10위권 순위, 2022-2024년

- 2023-2024년 자동차용 LED 진입 기업 매출 상위 10위 - 조명 및 백라이트, 2023-2024년

- 18개 자동차용 LED 제조업체의 수익 - 조명 및 백라이트, 2024년

- 상위 6대 자동차 LED 조명 제조업체의 수익 예측 - 조명 제품 분석, 2024년

- 2023년 세계 5대 전조등 LED 기업 수익 분석, 2023년

- 2024년 세계 5대 헤드라이트 LED 기업 수익 분석, 2024년

- 자동차 조명용 LED 진입 기업 순위 - 중국/아시아/EMEA/아메리카, 2023년

- 자동차 조명용 LED 진입 기업 순위 - 중국/아시아/EMEA/아메리카, 2024년

- 18개 자동차용 LED 제조업체의 수익과 제품 전략

제5장 차량용 LED 드라이버 IC 시장 및 제품 분석

- 자동차 LED 드라이버 IC 시장 가치 분석(2025-2029)

- Texas Instruments

- Macroblock

- Chipone

- Xm-Plus

- 차량용 LED 드라이버 IC의 사양 및 가격 분석

[엑셀]

- 1. 자동차 시장 출하 - 지역 시장 분석

- 2. 2025-2029년 자동차용 LED 시장 가치, 수량, 보급률 - 제품 분석

- 3. 2024-2025년 자동차용 LED 시장 가치, 수량, 보급률 - 제품/지역별 시장 분석

- 4. 자동차용 조명/자동차용 LED 진입기업 수익 실적

- 5. 자동차용 램프/자동차용 LED 시장 가격 분석

According to TrendForce "2025 Global Automotive LED Market- Lighting and Display Product Trend, towards 2025", due to the ongoing uncertainty in the overall economy, greater downward pricing pressure is anticipated in 2025. However, according to TrendForce's analysis on automotive LED manufacturers' orders on hand, car production is expected to recover again in 2H25. Additionally, with advanced technologies continuing to be incorporated into car models of 2026, the automotive LED and automotive lighting market value is forecasted to grow to USD 3.451 billion and USD 35.729 billion in 2025.

Automotive Lighting Will Concentrate on Personalization, Communication Display,

Driver Assistance, and Safety Upgrading in the Future

Automotive Lighting and Display Market Trend

1. Headlights

Through independent control of high-performance LEDs, the ADB headlights help expand drivers' nighttime field of view, giving them more time to react when seeing an obstacle and achieving better road lighting. Glare-free high beams help reduce discomfort for drivers of vehicles ahead, those of opposing vehicles, and prevent pedestrians from being dazzled by headlights. As TrendForce analyzes, increasing global economic uncertainty has slowed the growth of the ADB headlight market penetration rate, but still has the potential to reach 21.6% by 2029.

As Micro/Mini LED pixelated module is increasingly used for ADB headlights, the area of illumination can be adjusted for better driving safety through independent digital control of pixels. Mini LED pixelated modules utilized by Samsung's PixCell LED (COB technology) have been successfully implemented in the Tesla Model 3 / Y and the NIO ES6. In addition, Volkswagen, Porsche, SAIC Volkswagen, NIO, Opel, and Audi have been leading car makers in adopting Micro LED headlight solutions in 2025.

ADB headlights are the trend of the times, with an emphasis on a small light emitting surface (LES), high brightness, and high contrast. According to TrendForce, automakers require an average pixel count of 20,000 for Micro LED ADB headlights. The future product trend of Micro LED pixel arrays will have the opportunity to develop towards two polarizations: one is low-pixel products, using 3,000-4,000-pixels; the other is premium products, using 70,000-100,000-pixels. OEMs have set a target of 100,000 pixels per headlight. Therefore, ams OSRAM and Nichia plan to continually increase the pixel count of its Micro LED pixel array to meet automaker demands and goals.

2. Taillights

The increasing trend towards personalization, communication display, driver assistance, and safety upgrading for automotive lighting has given rise to Mini LED taillights (rear) and RGB Mini LED communication displays (front). These products have been installed in the vehicles of IM Motors, GWM (SAR Mecha Dragon), and Changan (NEVO CD07). According to TrendForce's analysis, current mainstream designs mainly incorporate P3-P4 displays and a 100W specification for cost and power consumption concerns.

ams OSRAM has innovatively developed its ALIYOS technology, connecting Mini LEDs with unnoticeable metal wires that are arranged on a slim, flexible, and transparent foil. ALIYOS offers great flexibility for the arrangement of Mini LED arrays. It can also form any shape as individually addressable units, achieving block-based light control, hence the ability to display symbols, words, images, and abstract pictures dynamically for styling, messaging, and warning. ams OSRAM is working with leading Tier 1 automotive suppliers and OEMs worldwide to explore new possibilities in both interior and exterior automotive lighting.

3. Decorative Lighting

As TrendForce analyzes, decorative lights include ambient lights, grill lamps, full-width front strips, and ADS marker lamps. The decorative light market scale is likely to jump to USD 311 million by 2029, with a 28% CAGR from 2024 to 2029. Specifically, the 2024-2029 CAGR for the intelligent ambient LED market will be a whopping 69%.

Intelligent ambient lights are equipped with RGB LEDs powered by built-in driver ICs. Beyond the intelligent ambient lights certified by the ISELED Alliance, ams OSRAM and Dominant have successively launched intelligent ambient lights with the Open System Protocol (OSP). The microcontroller can send commands to lighting units individually and obtain their status, enabling high-precision color calibration and temperature compensation. ams OSRAM's intelligent ambient lights are installed on the ZEEKR MIX (2024) model and is expected to be adopted by European and American automakers.

In addition to RGB LED solutions, automakers intend to adopt white LED solutions featuring high color rendering (CRI greater than or equal to 95), and adjustable color temperature (2,700-6,500K) for reading lights, roof lights, make-up mirrors, and foot room illumination. Seoul Semiconductor's ambient white LED product featuring SunLike technology leads the industry. The product has been successfully integrated into Volvo Polestar 3 / EX90. Its 1W ambient white LED achieves a brightness of up to 100 lm (CRI greater than or equal to 95).

4. Mini LED Automotive Displays

Following the trend towards HDR, local dimming, wide color gamut, and curved screen design, car manufacturers began adopting automotive Mini LED displays in 2024, including NIO, General Motors, Li Auto, BYD, Ford, Geely, and Stellantis. Xiaomi, BMW, Mercedes-Benz, HKMC, BAIC, GWM, and Sony are expected to release vehicles equipped with Mini LED displays between 2025 and 2029. Additionally, panoramic HUDs and holographic HUDs will start adopting Mini LED technology to enhance contrast ratio, which is expected to drive growth momentum for the automotive display market.

Automotive Lighting Market Scale and Automotive Lamp Player Revenue Performance

According to TrendForce, driven by NEVs, global car sales in 2024 hit 88.55 million units, with the NEV penetration rate reaching 25%. However, as automotive lighting manufacturers were affected by pricing pressure, inventory depletion, and exchange rate fluctuations, the automotive lighting market value slightly dropped to USD 34.658 billion. In 2024, the top ten automotive lighting players were Koito, Valeo, Forvia Hella, Marelli, Stanley, SL Corporation, Xingyu, HASCO Vision, ZKW, and OPmobility.

Automotive LED Player Revenue Performance

The top five automotive LED manufacturers in 2024 include ams OSRAM, Nichia, Lumileds, Seoul Semiconductor, and Dominant. Thanks to the stable quality, exceptional luminous efficacy, and good value of its products, ams OSRAM has become the preferred supplier for premium vehicle and NEV manufacturers worldwide. Seoul Semiconductor's sales performance was mainly benefited from order increases in Korea and China. In addition, thanks to the rising demand in China, Europe, and South Korea, Everlight saw its automotive LED revenue surge more than 40% in 2024. Brightek specializes in automotive market applications and has regarded light sensing for communication and immersive experiences as its target, aiming to offer integrated value-added services for its customers.

TrendForce has analyzed developments in the automotive LED market from seven perspectives:

- 1) automotive lighting and display product trends,

- 2) automotive lighting market scale and applications,

- 3) automotive lighting player revenue and product strategies,

- 4) automotive lamp prices,

- 5) automotive LED market demand (product applications and regional market value), and

- 6) automotive LED player revenue performance and product strategies.

- 7) automotive driver IC market scale and product trend.

In this way, we provide readers with a comprehensive picture of marketing dynamics in the automotive LED market.

Table of Contents

Chapter 1. Automotive Lighting Product Trend

- Automotive Lighting Product Trend

- Headlight Product Trend

- Headlight Product Trend- ADB Headlight vs. Small Aperture

- 2025-2029 LED Headlight / ADB Headlight- Penetration Rate Analysis

- ADB Headlight- Advantage and Regulation Analysis

- ADB Headlight- Matrix LED / DLP / Micro LED Technology Overview

- ADB Headlight- Matrix LED / DLP / Micro LED Technology Analysis

- 2025-2029 ADB Headlight- Matrix LED / DLP / Micro LED Technology Trend

- 2025-2029 ADB Headlight LED Market- LED vs. Micro/Mini LED Module

- ADB Headlight- Samsung PixCell LED Technology Analysis

- ADB Headlight- 100-Pixel Mini LED Module Price and Cost Estimates

- ADB Headlight- Tesla / Hella SSL 100 Headlight Price and Cost Estimates

- ADB Headlight- Micro LED Pixel Array Specification Analysis

- ADB Headlight- Micro LED Pixel Array Technology Analysis

- ADB Headlight- Mass Transfer Equipment Analysis

- ADB Headlight- Micro LED Pixel Array Price and Cost Estimates

- ADB Headlight- Micro LED Headlight Price and Cost Estimates

- ADB Headlight- Micro LED Headlight Market Application Analysis

- 2023-2024 Micro LED ADB Headlight- Volkswagen / Porsche

- Micro LED ADB Headlight Case Study Overview and Supply Chain

- Micro LED ADB Headlight Function Analysis

- 2025 LED Headlight Price Analysis

- Laser Headlight- Product Design and Supply Chain

- LED Taillight Product Trend

- Full-Width Taillight Price and Cost Estimates- 0.2W SMD LED

- Full-Width Taillight Price and Cost Estimates- 1515 LED

- Mini LED Taillight- ALIYOS

- Mini LED Taillight Price Sweet Spot and Cost Estimates

- OLED-Like LED Taillight Product Trend

- Ambient Light Product Trend- Dynamic Visual Lighting

- (Intelligent) Ambient Light- Pros-Cons Analysis

- (Intelligent) Ambient Light- Design Architecture Overview

- (Intelligent) Ambient Light- Design Architecture Solutions

- Intelligent Ambient Light- Open System Protocol (OSP) vs. ISELED

- Intelligent Ambient Light- Case Study Analysis

- Ambient Light White Product Trend

- Ambient Light- Market Landscape Analysis

- Grille Lamp / Full-Width Front Stripe Product Trend

- Grille Lamp / Full-Width Front Stripe Product Design

- Autonomous Driving System Marker Lamp Product Trend

- Ground Projection Product Trend

- 2025-2029 (Intelligent) Ambient Light LED / Decorative Light LED Markets

Chapter 2. Automotive Display Product Trend

- Smart Cockpit Trend

- Smart Cockpit- From Today to the Future

- Automotive Display Technology Overview

- 2025-2029 Automotive Display Panel Shipment and Penetration Rate

- 2025-2029 Automotive Backlight LED Market Value Analysis

- LCD (Edge / Direct-Type) vs. OLED Automotive Display Specification

- 2022 Mini LED Automotive Display- Specification vs. Supply Chain

- 2023 Mini LED Automotive Display- Specification vs. Supply Chain

- 2024 Mini LED Automotive Display- Specification vs. Supply Chain

- COB / COG / POG Technology Analysis

- 2022-2029 Mini LED Automotive Display Schedule and Specification

- NIO ET7 / ET5 / ES7 Automotive Display- Specification and Cost Analysis

- Cadillac LYRIQ Automotive Display- Specification and Cost Analysis

- Buick Electra E5 Automotive Display- Specification and Cost Analysis

- Cadillac Celestiq Automotive Display- Specification and Cost Analysis

- Zeekr 7X Automotive Display- Specification and Cost Analysis

- Zeekr 009 Automotive Display- Specification and Cost Analysis

- 2026 HKMC Automotive Display- Specification and Cost Analysis

- 2025 Automotive Display Cost Analysis- Edge / Direct-Type

- Mini LED Automotive Display- Direct / Scan Driver IC Pros-Cons Analysis

- 2022-2025 OLED Automotive Display Schedule and Specification

- Automotive Backlight Display Market Landscape Analysis

- 2025-2029 HUD Market Shipment- Product vs. Regional Market Analysis

- 2024 HUD Player Shipment / Market Share Analysis

- HUD Product Specification Analysis

- AR-HUD Technology Analysis

- AR-HUD OEM Supply Chain and Product Specification Analysis

- 2025 HUD Product Price Analysis

- Panoramic HUD vs. Holographic HUD

- HUD Market Landscape Analysis

- Micro LED Transparent Display

- Micro LED Automotive Display Application Overview

- 2025 Micro LED Automotive Transparent Display Cost Analysis

- Micro LED Automotive Display Market Landscape Analysis

Chapter 3. Automotive Lighting Market Scale and Player Revenue Performance

- Automotive Lighting Market Landscape Analysis

- 2025-2029 Automotive Lighting Market Scale- Application Analysis

- 2022-2024 Automotive Lighting Player Market Share Analysis

- 2022-2024 Top 15 Automotive Lighting Player Revenue Ranking

- Automotive Lighting Industry M&A Analysis

- 15 Automotive Lamp Manufacturers Revenue and Product Strategies

- Automotive Lamp / Module Factories in China

Chapter 4. Automotive LED Player Revenue and Strategies

- Global Automotive LED Player List

- 2023-2024 Automotive LED Player Market Share Analysis

- 2022-2024 Top 10 Automotive LED Player Revenue Ranking

- 2023-2024 Top 10 Automotive LED Player Revenue- Lighting vs. Backlight

- 2024 18 Automotive LED Players' Revenue- Lighting vs. Backlight

- 2024 Top 6 Automotive LED Player Revenue- Lighting Product Analysis

- 2023 Global Top 5 Headlight LED Player Revenue Analysis

- 2024 Global Top 5 Headlight LED Player Revenue Analysis

- 2023 Auto Lighting LED Player Ranking- China / Asia / EMEA / Americas

- 2024 Auto Lighting LED Player Ranking- China / Asia / EMEA / Americas

- 18 Automotive LED Manufacturers Revenue and Product Strategies

Chapter 5. Automotive LED Driver IC Market and Product Analysis

- 2025-2029 Automotive LED Driver IC Market Value Analysis

- Texas Instruments

- Macroblock

- Chipone

- Xm-Plus

- Automotive LED Driver IC Specification and Price Analysis

[EXCEL]

- 1. Car Market Shipment- Regional Market Analysis

- 2. 2025-2029 Automotive LED Market Value, Volume and Penetration- Product Analysis

- 3. 2024-2025 Automotive LED Market Value, Volume and Penetration- Product / Regional Market Analysis

- 4. Automotive Lighting / Automotive LED Player Revenue Performance

- 5. Automotive Lamp / Automotive LED Market Price Analysis