|

시장보고서

상품코드

1683943

프랑스의 LED 조명 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)France LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

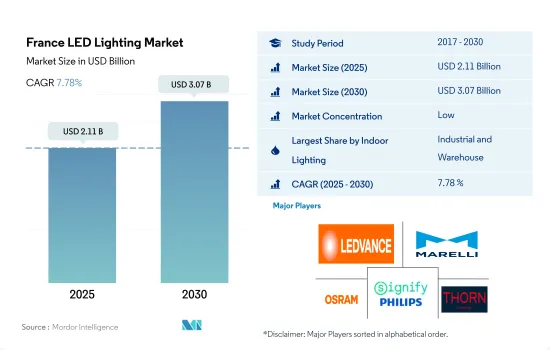

프랑스의 LED 조명 시장 규모는 2025년에 21억 1,000만 달러로 추정되고, 2030년에는 30억 7,000만 달러에 이를 것으로 예측되며, 예측 기간 2025년부터 2030년까지 CAGR 7.78%로 성장할 전망입니다.

산업 및 주택 분야의 발전과 상업 오피스 분야로의 FDI 유입이 시장 성장을 견인

- 금액 점유율에서는 2023년 산업용과 창고가 실내 조명 부문 중 대부분의 점유율을 차지했습니다. COVID-19의 대유행은 프랑스가 산업 생산 능력을 국내로 되돌리는 노력을 가속시켰습니다. 프랑스의 광산업 생산은 2022년 11월의 2% 증가에 이어 12월에는 1개월에 1.1% 증가했습니다. 제조업 생산고는 2022년 11월의 2.4% 증가 후 2022년 12월에는 전월 대비 0.3% 증가했습니다. 이 부문 시장은 LED 수요와 관련하여 포화 상태에 있지만 창고 수가 증가함에 따라 부문 성장이 수요를 계속 밀어올렸습니다.

- 수량 기준으로 2023년에는 주택이 가장 높은 점유율을 차지했습니다. 주택 건설 활동은 최근 몇 년동안 다양한 결과를 보여줍니다. 2022년 1-11월 프랑스(마요트 제외)의 신축 허가 호수는 전년 동기 대비 5.6% 증가한 44만 8,416호로, 2021년 동 18.5% 증가에 이어졌습니다. 2023년 프랑스의 주택가격은 다소 안정적이었고(아마도 성장률은 5% 미만) 연간 부동산 판매 건수는 100만 건을 약간 넘는 정도에 머물렀습니다. COVID-19 팬데믹에 의한 봉쇄 이래, 프랑스에서는 많은 사람들이 대도시에서 지방으로 옮겨 살고 있습니다. 주거용 실내 조명 시장은 향후 몇 년동안 더 안정될 것으로 예상됩니다.

- 오피스 분야는 팬데믹시 WFH 상황이나 개발 및 판매 침체로 인해 감소한 후 2023년부터 점유율이 상승하는 경향이었습니다. COVID-19의 대유행에 의해 감소한 프랑스로의 FDI 플로우는 2021년에는 회복했지만(191.4% 증가), 여전히 금융위기 전의 수준을 밑돌고 있습니다. 2022년 프랑스에 대한 FDI 프로젝트는 3% 증가했습니다(1,259건). 사무실 분야에서의 판매 회복으로 LED 수요 증가가 기대됩니다.

프랑스의 LED 조명 시장 동향

승용차와 배터리 전기 자가용차 및 유틸리티 차량 등록 대수 증가가 LED 시장 성장 견인

- 프랑스의 총 인구는 해마다 증가하고 있으며, 2021년에는 6,764만 명에 달했습니다. 프랑스 출생률은 여성 1명당 1.83명입니다. 프랑스의 평균 수명은 2021년 82.32세가 된 것으로 평가되었습니다. 지난 몇 년동안 프랑스의 평균 수명은 안정적이었습니다. 프랑스 사망률은 2020년에 비해 2021년 인구 1,000명당 0.2명 감소했습니다(-2.02%). 전체적으로 사망률은 감소했고, 2021년에는 인구 1,000명당 9.7명이 되었습니다. 이 데이터에 따르면 인구가 늘어나는 것은 그만큼 거주 공간이 필요하다는 것이며, 시장의 확대로 이어집니다.

- 프랑스에서는 2021년에는 약 3,100만 가구가 되었습니다. 프랑스에서는 2018년 당시 1세대 평균 2.19명이 살았습니다. 프랑스에서는 2021년 4분기 시점에 29,712호 이상 판매 또는 판매 예약된 신축 주택이 있었습니다. 2020년 4분기에는 약 27,918호의 주택 판매가 완료되거나 예정되어 있었습니다. 판매 호수 증가로 LED를 더 많이 사용할 수 있습니다.

- 2022년 1월 당시 프랑스 승용차 보유 대수는 3,870만 대를 넘어 2011년의 3,580만 대 이상에서 증가했습니다. 2022년까지 승용차의 보유 대수는 증가일로를 걷습니다. 게다가 프랑스 자동차 시장에 전기차 등록이 등장한 이래로 그 수는 급격히 증가하고 있습니다. 2022년 프랑스에서 새롭게 등록된 배터리 구동 전기 자가용차와 전기 유틸리티 차량는 21만 9,800대 가까이였습니다. 이는 전년보다 26.1% 가까이 증가했습니다. 프랑스에서의 LED 판매는 자동차 판매량 증가로 혜택을 누릴 것으로 보입니다.

높은 1인당 소득 및 에너지 절약 제도가 LED 조명 사용 촉진

- 2022년 프랑스의 평균 가구 인원은 2.2명이었습니다. 프랑스의 현재 인구는 2023년 6월 6,570만 명으로 매년 0.2% 전후의 느린 속도로 증가하고 있습니다. 인구의 81.5%는 도시 인구입니다(2020년에는 5,320만 명). 따라서 인구 증가로 LED 보급이 진행되고 국내 조명 요구가 높아질 것으로 예상됩니다.

- 2017년부터 2020년까지 독일의 주택 소유율은 약간 감소했습니다. 2021년에는 인구의 약 64.7%가 주택에 살았고, 2022년에는 63.4%에 달했습니다. 이로 인해 프랑스는 주택 소유주율이 가장 높은 국가 중 하나가 되었지만 앞으로 몇 년간은 완만하게 감소하고, 이 나라에서는 가장 낮은 임대주택 부동산 시장이 더욱 성장할 것으로 예상됩니다. 이러한 사례로부터 LED의 보급은 진행되고 있지만, 주택 부문에서는 이전에 비해 보급이 진행되지 않았음을 알 수 있습니다.

- 프랑스에서는 가처분 소득이 높아 개인의 소비력이 높아져 새로운 주택 공간에 더 많은 자금을 투자할 수 있습니다. 프랑스의 1인당 소득은 2021년 12월 27,184.2달러에 비해 2022년 12월 25,337.71달러에 달했습니다. 일부 선진국에 비해 프랑스의 구매력은 높습니다. 예를 들어, 브라질은 2021년 시점에서 7732.4달러였고 이탈리아는 2017년 시점에서 15321.9달러였으며 그보다 낮았습니다.

- 2017년 6월 프랑스 정부는 에너지 절약 증명서 제도를 발표하여 가구주의 소득에 따라 LED 전구 가격의 최대 100%를 커버할 수 있는 보조금을 얻을 수 있게 되었습니다. 이와 같은 사례로 인해 이 나라의 LED 조명 수요가 더욱 급증할 것으로 예상됩니다.

프랑스의 LED 조명 산업 개요

프랑스의 LED 조명 시장은 세분화되어 상위 5개사에서 27.85%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. LEDVANCE GmbH(MLS), Marelli Holdings, OSRAM GmbH., Signify(Philips) 및 Thorn Lighting Ltd.(Zumtobel Group)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 자동차 생산 대수

- 인구

- 1인당 소득

- 자동차 대출 금리

- 충전소 수

- 자동차 주행 대수

- LED 총 수입량

- 조명 소비 전력

- #가구수

- 도로망

- LED 보급률

- #경기장수

- 원예 면적

- 규제 프레임워크

- 실내 조명

- 프랑스

- 옥외 조명

- 프랑스

- 자동차용 조명

- 프랑스

- 실내 조명

- 밸류체인 및 유통경로 분석

제5장 시장 세분화

- 실내 조명별

- 농업용 조명

- 상업용 조명

- 사무실

- 소매

- 기타

- 산업 및 창고

- 주택 조명

- 옥외 조명별

- 공공시설

- 도로

- 기타

- 자동차용 유틸리티 조명별

- 데이터임 러닝 라이트(DRL)

- 방향 지시기

- 헤드라이트

- 리버스 라이트

- 스톱라이트

- 테일 라이트

- 기타

- 자동차용 조명별

- 이륜차

- 상용차

- 승용차

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA

- LEDVANCE GmbH(MLS Co Ltd)

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Signify(Philips)

- Thorn Lighting Ltd.(Zumtobel Group)

- TRILUX GmbH & Co. KG

- Valeo

- VIGNAL GROUP

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The France LED Lighting Market size is estimated at 2.11 billion USD in 2025, and is expected to reach 3.07 billion USD by 2030, growing at a CAGR of 7.78% during the forecast period (2025-2030).

Increasing developments in the industrial and residential segments, along with FDI flows in the commercial office segment, driving the market's growth

- In terms of value share, in 2023, industrial and warehouse accounted for the majority share among indoor lighting segments. The COVID-19 pandemic seems to have accelerated France's efforts to return industrial production capacities to the country. French industrial production increased by 1.1% over one month in December 2022, after +2% in November 2022. Manufacturing output rose by 0.3% M-o-M in December 2022, after +2.4% in November 2022. While the market in this segment is saturating in terms of LED demand, the growth in the segment with an increasing number of warehouses is expected to continue boosting the demand.

- In terms of volume, in 2023, residential accounted for the highest share. Residential construction activity has been showing mixed results in recent years. In the first 11 months of 2022, new dwellings authorized in France, excluding Mayotte, rose by 5.6% Y-o-Y to 448,416 units, following an 18.5% Y-o-Y increase in 2021. During 2023, house prices in France were expected to stabilize a bit (perhaps growth would drop below 5%), and the number of property sales would remain just above 1 million during the year. Since the COVID-19 pandemic-induced confinements, many people have moved from the major cities to the provinces in France. The market in the residential indoor lighting segment is expected to get more stable over the coming years.

- The office segment's share was expected to increase from 2023 after declining during the pandemic due to WFH conditions and low development and sales. After dropping due to the COVID-19 pandemic, FDI flows to France rebounded in 2021 (+191.4%) but remained below pre-crisis levels. In 2022, FDI projects increased by 3% (1,259 projects) in France. Rebound sales in the office segment are expected to increase demand for LEDs.

France LED Lighting Market Trends

Increasing passenger car and battery electric private and utility car registrations to drive the growth of the LED market

- France's total population has been growing for years, which reached 67.64 million in 2021. The fertility rate in France looks to be 1.83 children for every woman. The overall life expectancy at birth in France was expected to be 82.32 years in 2021. Over the years, the nation's rate has remained consistent. The death rate in France fell by 0.2 per 1,000 people (-2.02%) in 2021 compared to 2020. Overall, the death rate decreased, falling to 9.7 deaths per 1,000 people in 2021. According to the data, there are more people, which means that they will need more space to live in, which will help the market to expand.

- In France, there will be about 31 million households in 2021. In France, there are 2.19 individuals in each family on average as of 2018. In France, as of the fourth quarter of 2021, there were over 29,712 new dwelling units that had been sold or reserved for sale. There were around 27,918 completed or scheduled house sales in the fourth quarter of 2020. More LED usage will be made possible by the rise in the number of homes sold.

- As of January 2022, there will be more than 38.7 million passenger vehicles in the French fleet, up from over 35.8 million in 2011. Up to 2022, the number of passenger vehicles on the road increased continuously. Additionally, since electric passenger car registrations first appeared on the French automobile market, they have dramatically increased. Nearly 219,800 new battery-powered electric private and utility cars were registered in France in 2022. This was an increase of almost 26.1% from the previous year. The sale of LEDs in France will benefit from the rise in automotive vehicle sales.

High per capita income and energy saving scheme to promote the use of LED lights

- The average household size is 2.2 people per household in France in 2022. The current population of France is 65.7 million as of June 2023, increasing at a slow pace of around 0.2% yearly. 81.5 % of the population is urban (53.2 million people in 2020). Thus, the increase in population is expected to create more LED penetration and increase the need for illumination in the country.

- Between 2017 and 2020, the homeownership rate in Germany decreased slightly. In 2021, about 64.7% of the population lived in an owner-occupied dwelling, and in 2022, it reached 63.4%. This makes France one of the countries with the highest homeownership rate, but in coming years, it is expected to decline slowly, and the lowest rental residential real estate market is expected to grow further in the country. These instances suggest that LED penetration is there, but the penetration is less compared to previous years in the residential segment.

- In France, disposable income is high, which results in the rising spending power of individuals and affording more money on new residential spaces. France's per Capita income reached USD 25,337.71 in December 2022, compared to USD 27,184.2 in December 2021. Compared to some developed nations, it has high purchasing power. For instance, Brazil had USD 7732.4 as of 2021, and Italy had USD 15,321.9 as of 2017, which is lower.

- In June 2017, the French government announced the Energy Savings Certificate scheme, which allows people to get subsidies that can cover up to 100% of the price of LED bulbs based on the householder's income. Such instances are further expected to surge the demand for LED lighting in the country.

France LED Lighting Industry Overview

The France LED Lighting Market is fragmented, with the top five companies occupying 27.85%. The major players in this market are LEDVANCE GmbH (MLS Co Ltd), Marelli Holdings Co., Ltd., OSRAM GmbH., Signify (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 France

- 4.14.2 Outdoor Lighting

- 4.14.2.1 France

- 4.14.3 Automotive Lighting

- 4.14.3.1 France

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.2 HELLA GmbH & Co. KGaA

- 6.4.3 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.4 Marelli Holdings Co., Ltd.

- 6.4.5 OSRAM GmbH.

- 6.4.6 Signify (Philips)

- 6.4.7 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.8 TRILUX GmbH & Co. KG

- 6.4.9 Valeo

- 6.4.10 VIGNAL GROUP

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms