|

시장보고서

상품코드

1683950

인도의 자동차용 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)India Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

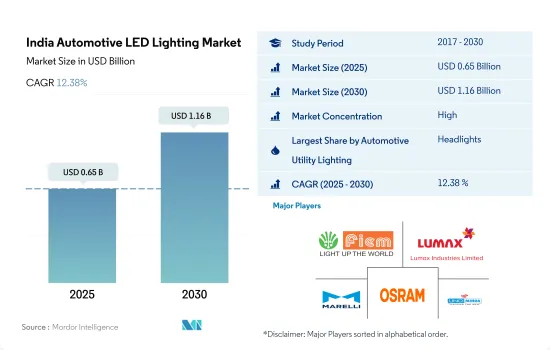

인도의 자동차용 LED 조명 시장 규모는 2025년 6억 5,000만 달러에 달할 것으로 추정됩니다. 2030년에는 11억 6,000만 달러에 이를 것으로 예상되며, 예측 기간(2025-2030년)의 CAGR은 12.38%를 나타낼 것으로 전망됩니다.

시장 매출에서는 전조등이 가장 높은 점유율을 차지할 전망

- 2017년 금액 점유율에서는 전조등이 과반수를 차지하고 방향지시등과 DRL이 뒤를 이었습니다. 예측 기간 동안 전조등와 DRL 시장 점유율은 변하지 않으며 방향지시등은 약간 감소할 것으로 예상됩니다. 인도의 자동차 조명 시장의 가장 큰 동향은 전조등에 프로젝터 조명이 있는 DRL(낮 주행 램프)을 추가하는 것입니다. Tata, Hyundai, Mahindra는 향후 자동차에 LED 프로젝터 조명을 통합하는 몇 가지 인기 있는 예입니다. 안개 LED 램프의 보급률은 사고 동향이 증가함에 따라 상승할 것으로 예상됩니다. 우천, 안개, 우박/진눈깨비 등의 악천후 하에서의 사고는 2021년 교통사고 전체의 16.8%를 차지해 전년 대비 12.6% 증가했습니다.

- 수량 점유율에서 2017년에는 방향지시등이 과반수를 차지하고 전조등, 정지등이 그 뒤를 이었습니다. 이러한 조명 시장 점유율은 변동이 적고 앞으로도 변하지 않을 것으로 예상됩니다. 방향지시등은 모든 차종에서 경미한 사고에서 큰 사고까지 영향을 받을 확률이 높고 교환이 필요한 주요 부품입니다. 2017년에는 총 4,64,910건의 교통사고가 발생하였으나 2021년에는 4,12,432건으로 감소하였습니다. 이는 방향지시등의 수량이 매년 감소하고 있음을 나타냅니다.

- 확장과 혁신 측면에서 2022년 9월 Marelli는 남부 인도의 Bangalore에 새로운 기술 R & D 센터를 출시하여 전자 기계 설계 시뮬레이션에서 회사의 혁신 능력을 향상시키고 자동차 조명 제품을 향해 전진하고 있습니다.

인도의 자동차용 LED 조명 시장 동향

국산 자동차 브랜드가 경제적인 승용차와 상용차를 추진

- 인도의 자동차 생산량은 2022년에는 2,747만대가 되었고, 2023년에는 2,906만대에 달했습니다. COVID-19의 발생은 자동차 산업 전체의 경영에 영향을 미쳤습니다. 2020년 4월, 자동차 산업은 완전히 중단되었고 판매도 기록되지 않았습니다. 판매는 2020년 5월에 시작되었지만 여전히 2019년 같은 시점보다 훨씬 낮았습니다. 인도자동차공업회(SIAM)의 계산에 의하면, 이 조업 정지의 결정에 의해 하루 2,300캐롤 루피(2억7,707만 달러)의 생산 손실이 생겼습니다. 그러나 시장은 2021년에 회복되어 예측기간을 통해 플러스 성장을 이루었습니다.

- TATA Motors, Mahindra & Mahindra, Ashok Leyland Ltd, Maruti Suzuki, Bajaj Auto Ltd 등은 인도 최고의 자동차 제조업체입니다. 인도의 자동차 산업은 확대되고 있으며 대체 연료를 중시하고 친환경 연료로 차량 경제성을 향상시키고 있습니다. 예를 들어 타타 모터스는 스마트 시티의 현재와 미래의 여객 수송 요구를 충족시키기 위해 대체 연료로 구동되는 승용차 스타 버스 전기 버스를 발표했습니다. LED 조명의 에너지 절약 성능과 높은 루멘 출력으로 차량에 채용이 진행되고 있습니다.

- 자동차 조명은 여전히 중요한 요소입니다. 조명은 차량의 내외장의 미관을 높이는 동시에 차량의 안전성에도 기여합니다. 예를 들어 2021년 9월 인도에서는 50개 이상의 기업이 LED 등 생산 연동형 장려금 신청서를 제출했고 6,000캐롤 루피(7억 2,200만 달러)의 투자액이 제안되었습니다. 기업과 정부의 이러한 투자는 인도에서 LED 조명의 전반적인 보급을 촉진할 것으로 예상됩니다.

정부 정책이 충전소 네트워크 확대에 기여

- 현재 인도는 발전 단계에 있습니다. 2023년 3월까지 국내에서 운영되는 공공 충전소(PCS)은 6,586곳이었습니다. 인도 정부는 전기자동차를 위한 이니셔티브를 일관되게 도입함으로써 인도를 EV 산업의 중요한 선수 중 하나에 확립하는 약속을 제시합니다.

- 인도가 발전함에 따라 전기자동차 산업도 급성장하고 있으며 100% 직접 투자, 새로운 제조 공장, 충전 인프라 정비 추진이 가능해지고 있습니다. 정부는 FAME-II, PLI SCHEME, 배터리 교환 정책, 전기 이동성 특구, EV 감세 등 자본 보조금을 제공함으로써 EV 충전소의 설치를 촉진하고 있습니다. 2019년 4월에는 50만대의 E-3륜차, 7,000대의 E-버스, 5만 5,000대의 E-승용차, 100만대의 E-이륜차를 지원하기 위해 12억 465만 달러의 예산으로 FAME II 계획이 도입되었습니다. 그 목적은 인도에서 전기자동차의 보급을 촉진하는 것이 었습니다. 이 계획은 2022년에 종료될 예정이었습니다. 2021년 9월, 전기 및 수소 연료 전지 차량의 생산을 늘리기 위해 자동차 부문을 위한 생산 연계 인센티브 제도(PLI 제도)가 내각의 승인을 받았습니다.

- 게다가 PLI 방식의 부가가치로서 LED 조명 시장에 대한 투자는 40%에서 75% 정도가 될 것으로 예상됩니다. 이로 인해 원래 인도에서 제조되지 않은 부품 및 하위 어셈블리의 제조도 수행됩니다. 정부에 의한 이러한 투자는 자동차용 LED를 포함한 인도의 LED 조명 시장 전체를 견인할 것으로 예상됩니다. 또한 인도에서의 EV 수요의 추가 확대는 EV 충전 인프라 수요를 끌어올려 예측 기간 동안 자동차 LED의 요구를 만들 것으로 예상됩니다.

인도의 자동차용 LED 조명 산업 개요

인도의 자동차용 LED 조명 시장은 상당히 통합되어 상위 5개사에서 80.99%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. 자동차용 LED 조명 Fiem Industries Ltd., Lumax Industries, Marelli Holdings, OSRAM GmbH. and Uno Minda Limited(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 자동차 생산 대수

- 인구

- 1인당 소득

- 자동차 대출 금리

- 충전소 수

- 자동차 보유 대수

- LED 총 수입량

- 가구수

- 도로 네트워크

- 보급률

- 규제 프레임워크

- 인도

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 자동차용 유틸리티 조명

- 주간 주행등(DRL)

- 방향지시등

- 전조등

- 후진등

- 정지등

- 후미등

- 기타

- 자동차용 조명

- 이륜차

- 상용차

- 승용차

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- Fiem Industries Ltd.

- HELLA GmbH & Co. KGaA

- HYUNDAI MOBIS

- Lumax Industries

- Marelli Holdings Co., Ltd.

- Neolite ZKW Lightings Pvt. Ltd

- OSRAM GmbH.

- Uno Minda Limited

- Valeo

- Varroc Group

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The India Automotive LED Lighting Market size is estimated at 0.65 billion USD in 2025, and is expected to reach 1.16 billion USD by 2030, growing at a CAGR of 12.38% during the forecast period (2025-2030).

Headlights are expected to hold the highest share by market value

- In terms of value share, in 2017, headlights accounted for the majority, followed by directional signal lights and DRL. The market share is expected to remain the same for headlights and DRL during the forecast period, with a small reduction in directional signal lights. The biggest trend in India's automotive lighting market is the addition of DRLs (daytime running lamps) with projector lights in frontal lighting. Tata, Hyundai, and Mahindra are among the few popular examples of integrating LED projector lights in upcoming vehicles. The fog LED lamp penetration rate is expected to increase with increasing accident trends. Accidents under adverse weather conditions such as rainy, foggy, and hail/sleet accounted for 16.8% of total road accidents in 2021, an increase of 12.6% from the prior year.

- In terms of volume share, in 2017, directional signal lights accounted for the majority, followed by headlights and stoplights. The market share is expected to remain the same with less fluctuation for these lights. Directional signal lights are the prime part with a high probability of getting affected in minor to major accidents in all types of vehicles and require replacement. In 2017, a total of 4,64,910 road accidents occurred, while in 2021, it decreased to 4,12,432. This also indicated the decrease in the volume of directional signal light every year.

- In terms of expansion and innovations, in September 2022, Marelli inaugurated its new Technical R&D Center in Bangalore, South India, boosting the company's innovation capability in Mechanical Design Simulations for Electronics and moving forward for automotive lighting products.

India Automotive LED Lighting Market Trends

Homegrown automotive brands are promoting economical passenger and commercial vehicles

- The total automobile vehicle production in India stood at 27.47 million units in 2022, and it was expected to reach 29.06 million units in 2023. The COVID-19 outbreak impacted the auto industry's entire operations. In April 2020, the auto industry was completely shut down, and no sales were recorded. Sales started in May 2020, but even then, they were far lower than they had been at the same point in 2019. According to a calculation by the Society of Indian Automobile Manufacturers (SIAM), the shutdown decision caused a daily output loss of INR 2,300 crore (USD 277.07 million). However, the market rebounded in 2021, and it is projected to witness positive growth throughout the forecast period.

- TATA Motors, Mahindra & Mahindra, Ashok Leyland Ltd, Maruti Suzuki, and Bajaj Auto Ltd, among others, are the country's top automakers. India's automotive industry is expanding, with businesses emphasizing alternative fuels and improving the vehicle economy with eco-friendly fuels. For instance, Tata Motors introduced the Starbus Electric Bus, a passenger vehicle driven by alternative fuels, to satisfy the present and future passenger transportation needs in smart cities. Due to the energy-saving capabilities and high-lumen output of LED lights, they are being increasingly adopted in vehicles.

- Vehicle lighting is still a crucial component. Lighting enhances the aesthetic appeal of a vehicle's interior and exterior while contributing to vehicle safety. For instance, in September 2021, more than 50 companies in India submitted applications for production-linked incentives for LEDs and other products, with a proposed investment of INR 6,000 crores (USD 722 million). Such investments by companies and the government are expected to drive the overall adoption of LED lighting in India.

Government policies are helping extend the network of charging stations

- Currently, India is in its developing phase. By March 2023, there were 6,586 public charging stations (PCS) operational in the country. The Government of India consistently demonstrates its commitment to establishing India as one of the significant players in the EV industry by introducing initiatives for electric vehicles.

- As India is developing, the electric vehicle industry is also picking pace, with the possibility of 100% FDI, new manufacturing plants, and an increased push to improve charging infrastructure. The government is promoting the installation of EV charging stations by providing capital subsidies, including FAME-II, PLI SCHEME, Battery Switching Policy, Special Electric Mobility Zone, and tax reduction on EVs. In April 2019, the FAME II plan was introduced with an USD 1204.65 million budget to support 500,000 e-three-wheelers, 7,000 e-buses, 55,000 e-passenger vehicles, and a million e-two-wheelers. The purpose was to encourage electric vehicle adoption in India. The plan was supposed to end in 2022. In September 2021, a PLI Scheme, or Production-Linked Incentive Scheme, for the automotive sector was approved by the Cabinet to increase the manufacturing of electric and hydrogen fuel cell vehicles.

- Additionally, as a value addition under the PLI scheme, investments in the LED lighting market are expected to be around 40% to 75%. This would also result in the manufacturing of components or sub-assemblies that were originally not manufactured in India. Such investments by the government are expected to drive the overall LED lighting market in India, including automotive LEDs. Further growing demand for EVs in India is expected to boost the demand for EV charging infrastructure, which would also create the need for automotive LEDs during the forecast period.

India Automotive LED Lighting Industry Overview

The India Automotive LED Lighting Market is fairly consolidated, with the top five companies occupying 80.99%. The major players in this market are Fiem Industries Ltd., Lumax Industries, Marelli Holdings Co., Ltd., OSRAM GmbH. and Uno Minda Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 India

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Fiem Industries Ltd.

- 6.4.2 HELLA GmbH & Co. KGaA

- 6.4.3 HYUNDAI MOBIS

- 6.4.4 Lumax Industries

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 Neolite ZKW Lightings Pvt. Ltd

- 6.4.7 OSRAM GmbH.

- 6.4.8 Uno Minda Limited

- 6.4.9 Valeo

- 6.4.10 Varroc Group

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms