|

시장보고서

상품코드

1683989

유럽의 살선충제 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Europe Nematicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

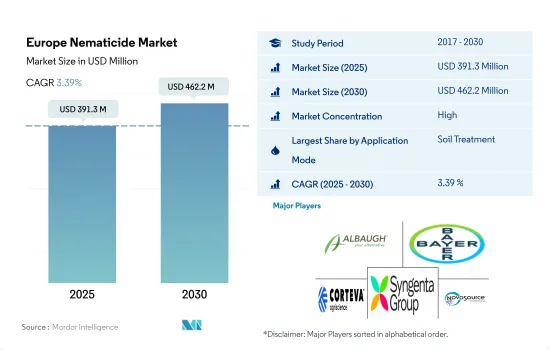

유럽의 살선충제 시장 규모는 2025년에는 3억 9,130만 달러로 추정되고, 2030년에는 4억 6,220만 달러에 이를 것으로 예측되며, 예측 기간 2025년부터 2030년까지 CAGR 3.39%로 성장할 전망입니다.

토양 적용은 유익한 곤충과 꽃가루 매개자를 보호하는 이점이 있기 때문에 비표적 생물에 노출되는 시장을 독점하고 있습니다.

- 식물의 일부를 먹는 선충을 식물 기생 선충(PPN)이라고 합니다. 유럽에서는 가장 큰 피해를 입히는 식물 기생 선충은 시스트 선충, 뿌리 곡물 벌레, 뿌리 딱정벌레 선충(RKN), 줄기 및 구근 선충, 감귤류 선충 및 바이러스 매개 선충입니다. 이 선충의 감염과 관련된 증상은 뿌리 성장과 기능 장애로 인한 증상과 유사합니다. 따라서 가뭄이나 영양 부족과 같은 생물학적 스트레스와 줄기와 뿌리 부패와 같은 생물학적 요인과 유사할 수 있습니다. 선충에 의한 일반적인 증상으로는 황화, 발육 저해, 위음 등이 있어 수율의 저하를 수반합니다.

- 엽면 살포와 같은 다른 살포 방법에 비해 선충의 토양 살포는 일반적으로 유익한 곤충과 수분 매개자를 포함한 비표적 생물에 노출될 위험이 적습니다. 이것은 선충제가 주로 토양에 머물고 표적 선충이 서식하기 때문입니다. 이 때문에 토양 시용이 2022년에는 68.5%의 점유율을 차지하였고, 시장을 독점했습니다.

- 엽면 살포는 2022년에 유럽 살선충제 시장의 11.6%를 차지했습니다. 엽면 살포의 목적은 밀과 같은 곡류에 존재하는 종병의 원인 선충으로도 알려진 Anguina tritici와 같은 선충에 의한 화서와 잎의 침입을 방제하는 것입니다. 엽면 살포는 메틸 브로마이드, 옥사밀, 팔라티온과 같은 활성 성분의 사용에 의해 선충에 대해 효과적이었습니다.

- 선충의 침입으로 인한 농작물의 손실은 해마다 증가하고 있으며, 농민들에게 큰 우려가 되어 농작물을 보호하기 위해 살선충제를 사용하도록 격려하고 있습니다. 이 시장은 예측 기간 동안 CAGR 3.3%를 나타낼 것으로 예상됩니다.

농업의 확대와 선충에 의한 농작물 피해에 대한 의식의 고조가 이 분야의 성장을 가속

- 유럽은 살선충제 시장의 모든 국가에서 성장을 경험하고 있습니다. 프랑스는 다양한 작물 생산을 수행하는 중요한 농업 부문을 보유하고 있습니다. 이 나라에서는 곡물, 지방종자, 과일, 야채 등 다양한 작물이 재배되고 있습니다. 선충 방제를 포함한 농작물 보호의 중요성은 프랑스 농업 부문에서 잘 알려져 있습니다. 그 결과 프랑스는 유럽에서 살선충제의 주요 소비국이 되고 있으며, 이 시장에서 큰 점유율에 기여하고 있습니다.

- 러시아에서는 선충에 의한 작물 피해에 대한 의식이 높아짐에 따라 농업 확대가 선충제 시장의 성장을 견인하고 있습니다. 이 나라의 농가들이 보다 효과적인 선충제 제거 대책을 채택함에 따라 선충제 치료제 수요가 증가하고 있으며, 그 결과 러시아는 상당한 시장 점유율을 획득하고 있으며, 2023년부터 2029년까지 CAGR은 2.5%를 나타낼 것으로 예측되고 있습니다.

- 스페인은 예측 기간(2023-2029년)에 CAGR 3.0%를 기록할 전망이며, 기타 국가에 비해 살선충제 시장에서 가장 빠른 성장이 예상되고 있습니다. 스페인은 농업 부문이 강하고 과일, 야채, 관엽 식물 등의 고가치 작물에 중점을 둡니다. 이 작물은 특히 선충의 피해를 입기 쉽습니다. 스페인에서 고가치 작물의 재배가 확대됨에 따라 선충을 효과적으로 방제하기 위한 살선충제 수요가 높아져 시장의 성장으로 이어질 것으로 예상됩니다.

- 고가치 작물 재배 확대, 선충에 의한 작물 피해에 대한 의식 증가, 선진적인 농업 관행의 도입에 대한 주목 증가 등의 요인을 고려하면 선충 방제의 효과적인 솔루션으로서 살선충제에 대한 수요는 유럽 농업에서 증가할 것으로 예상됩니다.

유럽의 살선충제 시장 동향

선충 방제의 중요성에 대한 농부의 의식 증가로 산포율 상승

- 유럽에서는 선충의 피해로부터 작물을 보호하고 잠재적인 수율 손실을 줄이기 위해 농업, 원예, 골프 코스, 스포츠 터프 등 다양한 작물 유형에서 살선충제가 널리 사용됩니다. 이 살선충제는 심기 또는 파종 전에 토양에 살포하여 사용할 수 있습니다. 이 지역에서 2022년 살선충제의 평균 사용량은 농지 1헥타르당 700.7kg이었습니다.

- 유럽에서 살선충제의 사용량은 국가와 농법에 따라 다릅니다. 이탈리아는 헥타르 당 최대 살선충제 소비국으로 2022년 평균 소비량은 농지 헥타르당 195.8g이었습니다.

- 2022년 헥타르당 살선충제 사용량으로 2위는 네덜란드이며 1헥타르당 119.7g을 사용했습니다. 기타 유럽, 독일, 프랑스가 이어져 각각 헥타르당 109, 78.3, 69g의 살선충제를 사용합니다. 이 숫자는 작물에 영향을 미치는 다양한 유형의 선충 해충(뿌리 벌레 선충, 시스트 선충, 병반 선충, 신장 선충, 피열 선충, 줄기 선충 등)을 치료하기 위해 살포된 선충제의 양을 나타냅니다.

- 2022년, 유럽에서 살선충제의 사용은 금액 점유율로 전년 대비 10.8%의 성장을 보였습니다. 이 증가는 선충의 피해를 받기 쉬운 야채, 과일, 관엽 식물 등 고가치 작물의 재배가 확대되고 있기 때문입니다. 단작이나 연작 등의 집약적인 농법은 선충의 개체군이 토양에서 번식하기 쉬운 조건을 만들어 선충 문제 증가에 기여하고 있습니다. 그 결과, 이러한 만연을 효과적으로 관리 및 방제하기 위해 살선충제의 사용이 필요합니다.

플루엔술폰의 가격은 가장 높으며 2022년에는 톤당 1만 9,100달러가 되었습니다. 살선충제에 대한 수요 증가가 살선충제 성분의 가격을 높일 것으로 예상됩니다.

- 살선충제는 식물 기생성 선충과 싸우는 병충해 종합 관리 시스템에서 중요한 역할을 합니다. 다양한 살포 방법 중에서도, 종자 살포형 살선충제는 유럽에서 인기를 얻고 있으며, 연작 작물 농업에서 가장 빈번하게 이용되는 기술의 하나가 되고 있습니다.

- 플루엔술폰은 플루오로알킬계의 비훈증성 살선충제로, 우리과나 과채류의 뿌리 벌레 선충, 시스트 선충, 병반선충, 대거 선충 등의 식물 기생성 선충을 효과적으로 방제합니다. 그 작용기전은 선충의 신경계를 파괴하고 마비와 그 후의 죽음으로 이어집니다. 플루엔술폰은 선충을 표적으로 하여 선충의 개체수를 줄이고 작물에 대한 잠재적인 피해를 줄입니다. 2022년 플루엔술폰의 가격은 톤당 1만 9,100달러였습니다.

- 활성 성분인 아바멕틴의 2022년 가격은 톤당 12.3달러였습니다. 아바멕틴은 아베르멕틴의 화학 클래스에 속하며, 뿌리류선충(Pratylenchus penetrans), 신상선충(Rotylenchus reniformis), 뿌리 뭉치 선충(Meloidogyne incognita), 시스트 선충(Heterodera chacht) 등의 선충에 대해 높은 고유 활성을 나타냅니다. 강력한 살선충 효과가 있는 것으로 알려져 있습니다. 아바멕틴은 낮은 농도에서도 선충 감염을 효과적으로 억제합니다.

- 옥사밀은 토양 선충 방제에 널리 사용되는 계통 살선충제로서의 유효 성분입니다. 특히, 아래쪽으로 이동하는 전신활성을 나타내기 때문에 등록된 엽면 살선충제에 적합합니다. 2022년 옥사밀 가격은 톤당 8,900달러였습니다.

유럽의 살선충제 산업 개요

유럽의 살선충제 시장은 상당히 통합되어 상위 5개사에서 86.40%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Albaugh LLC, Bayer AG, Corteva Agriscience, Syngenta Group 및 Tessenderlo Kerley Inc.(Novasource)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 1헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 우크라이나

- 영국

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 적용 모드별

- 화학 관개

- 엽면 살포

- 훈증

- 종자 처리

- 토양치료

- 작물 유형별

- 상업 작물

- 과일 및 야채

- 곡물

- 콩류 및 지방종자

- 잔디 및 관상용

- 국가별

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 우크라이나

- 영국

- 기타 유럽

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- Albaugh LLC

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- Tessenderlo Kerley Inc.(Novasource)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Europe Nematicide Market size is estimated at 391.3 million USD in 2025, and is expected to reach 462.2 million USD by 2030, growing at a CAGR of 3.39% during the forecast period (2025-2030).

Soil application dominated the market exposing non-target organisms due to its benefits like protecting beneficial insects and pollinators

- Nematodes that feed on plant parts are called plant parasitic nematodes (PPNs). In Europe, the most damaging plant parasitic nematodes are cyst nematodes, root-lesion nematodes, root-knot nematodes (RKNs), stem and bulb nematodes, citrus nematodes, and virus vector nematodes. Symptoms associated with this nematode infection are similar to those caused by impaired root growth and function. Therefore, they may resemble abiotic stress like drought and nutritional deficiencies, as well as biotic factors like stem and root rots. General symptoms from nematodes include yellowing, stunting, and wilting, accompanied by a yield decline.

- Compared to other application methods, such as foliar application, soil application of nematodes generally poses fewer risks of exposing non-target organisms, including beneficial insects and pollinators. This is because the nematicide remains primarily in the soil, where the target nematodes reside. Owing to this, soil application dominated the market with a share of 68.5% in 2022.

- Foliar applications accounted for 11.6% of the European nematicide market in 2022. The purpose of the foliar application is to control the infestation of inflorescence and leaves by nematodes such as Anguina tritici, also known as seed gall disease-causing nematodes, which are present in cereals such as wheat. The foliar application was effective against the nematodes due to the use of active ingredients like methyl bromide, oxamyl, and parathion.

- The increase in crop losses due to nematode infestation is increasing every year and acting as a major concern for farmers, thus encouraging them to use nematicides to protect crops. The market is anticipated to record a CAGR of 3.3% during the forecast period.

The expansion of agriculture and the increasing awareness of nematode-related crop damage are driving the growth of the segment

- Europe is experiencing growth across all the countries in the nematicide market. France has a significant agricultural sector with diverse crop production. The country cultivates a wide range of crops, including grains, oilseeds, fruits, and vegetables. The importance of crop protection, including nematode control, is well-recognized in the French agricultural sector. As a result, France has been a major consumer of nematicides in Europe, contributing to its significant share in the market.

- In Russia, the expansion of agriculture, along with the increasing awareness of nematode-related crop damage, has driven the growth of the nematicide market. As farmers in the country adopt more effective nematode control measures, the demand for nematicides is increasing, resulting in Russia gaining a substantial market share, which is anticipated to record a CAGR of 2.5% during 2023-2029.

- Spain is expected to witness the fastest growth in the nematicide market compared to other countries, recording a CAGR of 3.0% during the forecast period (2023-2029). Spain has a strong agricultural sector, with a focus on high-value crops, such as fruits, vegetables, and ornamentals. These crops are particularly susceptible to nematode damage. As the cultivation of high-value crops expands in Spain, the demand for nematicides for effective nematode control is expected to rise, leading to growth in the market.

- Considering factors such as the expansion of high-value crop cultivation, rising awareness of nematode-related crop damage, and the rising focus on the adoption of advanced agricultural practices, the demand for nematicides as an effective solution for nematode control is expected to increase in European agriculture.

Europe Nematicide Market Trends

Growing awareness among the farmers about the importance of nematode control is increasing their application rate

- In Europe, nematicides are widely used in various crop types, including agriculture, horticulture, golf courses, and sports turfs, to safeguard crops from nematode damage and mitigate potential yield losses. These nematicides can be used by soil application during planting or prior to sowing. The average consumption of nematicides in the region was 700.7 kg per hectare of agricultural land in 2022.

- Nematicide usage in Europe varies across countries and agricultural practices. Italy is the largest consumer of nematicides per hectare, with an average consumption of 195.8 g per hectare of agricultural land in 2022.

- In 2022, the Netherlands ranked second in terms of nematicide consumption per hectare, using 119.7 g per hectare. The Rest of Europe, Germany, and France followed with nematicide consumption rates of 109, 78.3, and 69 grams per hectare, respectively. These figures indicate the quantities of nematicides applied to control various types of nematode pests that affect crops, including root-knot nematodes, cyst nematodes, lesion nematodes, reniform nematodes, lance nematodes, and stem and bulb nematodes.

- In 2022, the use of nematicides in Europe witnessed a growth of 10.8% in terms of value share compared to the previous year. This increase can be attributed to the expanding cultivation of high-value crops, including vegetables, fruits, and ornamentals, which tend to be more susceptible to nematode damage. Intensive agricultural practices like monoculture and continuous cropping contribute to the increase of nematode issues by creating favorable conditions for nematode populations to thrive in the soil. As a result, the use of nematicides becomes necessary to effectively manage and control these infestations.

Fluensulfone was priced the highest at USD 19.1 thousand per metric ton in 2022. The growing demand for Nematicides is expected to fuel the prices of acitve ingredients.

- Nematicides play a crucial role in integrated pest management systems to combat plant-parasitic nematodes. Among various application methods, seed-applied nematicides have gained popularity in Europe and become one of the most frequently utilized techniques in row crop agriculture.

- Fluensulfone, a non-fumigant nematicide falling under the fluoroalkyl chemical class, effectively controls plant-parasitic nematodes like root-knot nematodes, cyst nematodes, lesion nematodes, and dagger nematodes in cucurbits and fruiting vegetables. Its mode of action disrupts nematode nervous systems, leading to paralysis and subsequent death. By targeting nematodes, fluensulfone helps reduce their populations, mitigating potential crop damage. In 2022, fluensulfone was priced at USD 19.1 thousand per metric ton.

- Abamectin, an active ingredient, was valued at USD 12.3 per thousand per metric ton in 2022. It belongs to the avermectin chemical class and demonstrates high intrinsic activity against nematodes like the root lesion nematode (Pratylenchus penetrans), reniform nematode (Rotylenchus reniformis), root-knot nematode (Meloidogyne incognita), and cyst nematodes (Heterodera chacht). It is known for its potent nematicidal properties. Even at low concentrations, abamectin inhibits nematode infections effectively.

- Oxamyl is an active ingredient used as a systematic nematicide widely employed for soil nematode control. Particularly, it exhibits downward-moving systemic activity, rendering it suitable for registered foliar nematicidal applications. In 2022, oxamyl was priced at USD 8.9 thousand per metric ton.

Europe Nematicide Industry Overview

The Europe Nematicide Market is fairly consolidated, with the top five companies occupying 86.40%. The major players in this market are Albaugh LLC, Bayer AG, Corteva Agriscience, Syngenta Group and Tessenderlo Kerley Inc. (Novasource) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Albaugh LLC

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 Syngenta Group

- 6.4.5 Tessenderlo Kerley Inc. (Novasource)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms