|

시장보고서

상품코드

1684055

미국의 적층 세라믹 커패시터(MLCC) 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)United States MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

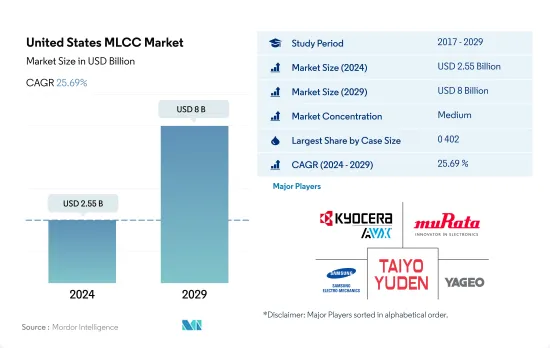

미국의 MLCC 시장 규모는 2024년에 25억 5,000만 달러로 평가되었고, 2029년에는 80억 달러에 이를 것으로 예측되며, 예측 기간인 2024-2029년 CAGR 25.69%로 성장할 전망입니다.

0 201형 MLCC의 주요 성장 요인 중 하나는 신기술 출현에 대한 소비자의 의식 증가입니다.

- 케이스 사이즈 0 201 부문이 톱 러너에 부상하였고, 2022년의 수량 기준으로 22.29%의 최대 시장 점유율을 획득하였으며, 0 402가 22.22%, 0 603이 21.94%이 뒤를 이었습니다.

- 현재 진행되고 있는 소형화 동향은 부품 고밀도화의 필요성과 함께, 이러한 부품 수요를 견인하고 있습니다. 휴대기기 및 커넥티드 디바이스의 인기가 높아지고 있는 것도, 0 201 MLCC 부품 수요를 높이고 있습니다. 미국에는 이 시장에서 큰 존재감을 보여주는 유명한 노트북 제조업체와 다국적 기업이 몇 개 있습니다. 화상 회의, 가상 협업 도구 및 온라인 교육에 대한 요구가 커짐에 따라 노트북 판매가 가속화되고 있습니다.

- 0 1005 MLCC의 용도는 다양하며, 특히 스마트폰, 웨어러블 기기, IoT 기기 등 소형 전자 기기에서는 제조업체가 성능을 저하시키지 않고도 스마트하고 컴팩트한 설계를 실현할 수 있게 되었습니다. 미국에서는 5G 네트워크의 급속한 보급으로 스마트폰 수요가 높아지고 있습니다.

- 0 402 케이스 유형은 표면 실장 세라믹 커패시터의 폼 팩터로서 널리 채용되고 있습니다. 자동차 산업은 엔진 제어 유닛, 인포테인먼트 시스템, ADAS 등 다양한 용도에서 0 402 MLCC에 의존합니다. 이 커패시터는 가혹한 자동차 환경에서 안정적인 성능을 발휘합니다. 북미에서는 자동차의 안전성을 중시하고 자동차의 쾌적 기능에 대한 수요가 높아지며 사고 시 휴먼 에러를 줄이고자 하는 자동차 소유자의 소망이 높아짐에 따라 자율주행차에 대한 수요가 높아지고 있습니다.

미국의 MLCC 시장 동향

제3자 물류업체 개발이 소형 상용차 수요를 촉진할 가능성

- 소형 상용차(LCV) 시장은 주로 전자상거래와 물류 산업이 견인하고 있습니다. 더 많은 사람들이 인터넷과 스마트폰에 액세스할 수 있게 되었기 때문에 온라인 소매 판매 및 전자상거래가 증가하고 있습니다. LCV의 구매는 증가할 것으로 예상되며, 이는 고객에게 상품의 신속한 배송을 촉진합니다. 2019년 동국의 생산 대수는 803만 대였습니다.

- COVID-19 팬데믹 및 러시아와 우크라이나 전쟁에 의해 전례가 없는 수준과 유형의 이동 및 수송 제한이 발생하여 생산 대수는 전년대비 17.17% 감소했습니다. 봉쇄 및 기타 규정은 상용차 업계공급망에 전대 미문의 문제를 일으켰습니다. 배기가스 규제 강화, 자동차 안전성 향상, 자동차 운전 지원 시스템, 소매 및 전자상거래 분야에서 물류의 폭발적인 성장은 모두 새롭고 혁신적인 상용차에 대한 수요를 부추겼습니다.

- FedEx, UPS, DHL과 같은 제3자 물류업체는 다양한 LCV를 사용하여 제품을 가장 가까운 제품 배송 스테이션으로 운송합니다. 소형 LCV는 도시를 통근할 때 대형 상용차보다 연료 소비량이 적기 때문에 이들 기업들은 LCV의 보유 대수를 늘리고 있습니다. 기후 변화와 도시공해에 대항하기 위해 대형 물류사업자는 보유한 내연기관을 전기자동차나 저배출 가스차로 대체하기 시작했습니다. 예를 들어, 페덱스는 2021년 12월 새로 구입하는 차량의 50%를 2025년까지 전기자동차로 만들고 2030년까지 100%로 만드는 세계 목표를 발표했습니다. 페덱스는 중요한 투자 분야로서 2040년까지 집배 차량의 전동화를 통해 세계적인 탄소 중립의 달성을 목표로 하고 있습니다.

미국 고객은 더 높은 안전을 요구하고 있으며, 이는 승용차 수요를 촉진하고 있습니다.

- 미국은 세계 최대급의 자동차 시장을 갖고 있으며, 승용차 생산 대수로는 8위를 차지하며, 2019년에는 250만 대를 생산했습니다.

- COVID-19 발생 후 생산 대수는 대폭 감소하여 전년 대비 24% 감소를 기록했습니다. 승용차의 정비 활동도 대폭 감소했습니다. 봉쇄 조치가 완화되면서 마이커의 사용이 급증하고 승용차 소비 회복을 견인 할 수 있었습니다.

- 미국의 승용차 생산 대수는 172만 대에 달했는데, 이는 여러 OEM이 전기차 수요 증가에 대응하기 위해 생산능력 증강에 관심을 보였기 때문입니다. 정부 내연기관차 금지 정책도 전기차 판매를 뒷받침했습니다. 또한 세계 여러 가지 이유로 가솔린과 디젤 가격 상승이 전기자동차 제조업체들에게 판매량 증가를 촉진했습니다. 세 번째 시장인 미국의 전기차 판매량은 2022년 55% 증가했으며 판매 점유율은 8%에 달했습니다.

- ICE 모델의 판매는 꾸준히 감소하고 있습니다. 사용 가능한 ICE 옵션의 수는 미국에서 2022년에는 2016년보다 3%-4% 감소했습니다. 미국의 전기자동차 판매 증가에는 몇 가지 요인이 있습니다. OEM이 제공하는 것 이외의 사용 가능한 모델이 증가하면 공급 갭을 채우는 데 도움이 됩니다.

- 미국은 두 번째로 FCEV 재고가 많으며 15,000대 이상의 FCEV를 보유하고 있습니다. 대부분은 연료전지 차량입니다. 2022년에는 미국 FCEV 스톡이 20% 이상 증가했습니다. 이러한 주요 요소는 승용차 생산 수요에 연료를 공급하고 있으며 앞으로도 증가할 것으로 예상됩니다.

미국의 MLCC 산업 개요

미국의 MLCC 시장은 적당히 통합되어 상위 5개사에서 41.51%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Kyocera AVX Components Corporation(Kyocera Corporation), Murata Manufacturing, Samsung Electro-Mechanics, Taiyo Yuden 및 Yageo Corporation.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 가격 동향

- 구리 가격 동향

- 니켈 가격 동향

- 석유 가격 동향

- 아연 가격 동향

- 가전 판매 대수

- 에어컨 판매 대수

- 데스크톱 PC 판매 대수

- 게임기 판매 대수

- 노트북 판매 대수

- 냉장고 판매 대수

- 스마트폰 판매 대수

- 수납 기기 판매 대수

- 태블릿 판매 대수

- TV 판매 대수

- 자동차 생산

- 대형 트럭 생산

- 소형 상용차 생산

- 승용차 생산

- 자동차 생산 대수

- 전기자동차 생산

- BEV(배터리 전기자동차) 생산

- PHEV(플러그인 하이브리드차) 생산 대수

- 산업용 자동화 판매

- 산업용 로봇 판매

- 서비스 로봇 판매

- 규제 프레임워크

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 유전체 유형별

- 클래스 1

- 클래스 2

- 케이스 사이즈별

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 기타

- 전압별

- 500V-1000V

- 500V 미만

- 1000V 이상

- 정전 용량별

- 100uF-1,000uF

- 100uF 미만

- 1,000uF 이상

- MLCC 실장 유형별

- 금속 캡

- 레이디얼 리드

- 표면 실장

- 최종 사용자별

- 항공우주 및 방위

- 자동차

- 소비자용 전자 기기

- 산업 기기

- 의료 기기

- 전력 및 유틸리티

- 통신 기기

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The United States MLCC Market size is estimated at 2.55 billion USD in 2024, and is expected to reach 8 billion USD by 2029, growing at a CAGR of 25.69% during the forecast period (2024-2029).

Increasing awareness among consumers about the emergence of novel technologies among the primary growth drivers of 0201 MLCCs

- The case size 0201 segment emerged as the frontrunner, capturing the largest market share of 22.29%, followed by 0402, with 22.22%, and 0603, with 21.94%, in terms of volume in 2022.

- The ongoing trend of miniaturization, coupled with the need for higher component density, drives the demand for these components. The increasing popularity of portable and connected devices further contributes to the demand for 0201 MLCC components, enabling manufacturers to achieve compact designs without compromising performance. The United States is home to several prominent laptop manufacturers and multinational companies with a significant presence in the market. The increased need for video conferencing, virtual collaboration tools, and online education has accelerated laptop sales.

- The usage of 01005 MLCCs spans diverse applications, particularly in compact electronic devices such as smartphones, wearables, and IoT devices, enabling manufacturers to achieve sleek and compact designs without compromising performance. Smartphones are in high demand in the United States due to the rapid adoption of the 5G network.

- The 0402 case type is widely adopted as a form factor for surface-mount ceramic capacitors. The automotive industry relies on 0402 MLCCs for various applications, including engine control units, infotainment systems, and ADAS. These capacitors provide reliable performance in harsh automotive environments. The demand for autonomous vehicles is rising in North America due to the increased focus on automotive safety, the rise in demand for comfort features in a vehicle, and a growing desire of vehicle owners to reduce the amount of human error in case of accidents.

United States MLCC Market Trends

The development of third-party logistic providers may propel the demand for light commercial vehicles

- The market for light commercial vehicles (LCVs) is primarily driven by the e-commerce and logistics industries. As more people have access to the Internet and smartphones, online retail sales and e-commerce have been increasing. Purchases of LCVs are anticipated to increase, thereby facilitating quick delivery of items to customers. The country produced 8.03 million units in 2019.

- The COVID-19 pandemic and the Russia-Ukraine War resulted in unprecedented levels and types of mobility and transportation restrictions, resulting in a 17.17% Y-o-Y drop in production. Lockdowns and other restrictions caused previously unheard-of problems in the commercial vehicle industry's supply chain. Tightening emissions regulations, vehicle safety improvements, driver-assist systems in cars, and the explosive growth of logistics in the retail and e-commerce sectors have all fueled demand for new and innovative commercial vehicles.

- Third-party logistic providers, such as FedEx, UPS, and DHL, use a variety of LCVs to transport products to the nearest product delivery station. These businesses have a larger fleet of LCVs because smaller LCVs use less fuel than heavy commercial vehicles when commuting within a city. To combat climate change and city pollution, big logistics operators have started replacing their fleets of combustion engines with electric or low-emission vehicles. For instance, in December 2021, FedEx announced a global target to make 50% of all newly purchased vehicles electric by 2025, rising to 100% for the new fleet by 2030. By 2040, FedEx wants to achieve global carbon neutrality through the electrification of pickups and delivery vehicles as a significant investment area.

Customers in the United States are demanding higher safety, which is propelling the demand for passenger vehicles

- The United States has one of the largest automotive markets in the world and ranks 8th in the production of passenger cars, producing 2.5 million units in 2019.

- Post the COVID-19 outbreak, there has been a major decline in production, registering a Y-o-Y drop of 24%, along with a decline in the usage of personal vehicles for commuting. Maintenance activities of passenger vehicles have significantly declined. With the ease of lockdown measures, there has been a surge in the usage of personal vehicles, which may drive the recovery of passenger vehicle consumption.

- The production of passenger vehicles in the United States reached 1.72 million units as several OEMs became interested in increasing their production capacity to meet the growing demand for electric vehicles. The government policy of banning ICE engines helped boost the sales of electric vehicles. The increase in the price of gasoline and diesel due to various global reasons has also made it easy for EV companies to boost their sales. Electric car sales in the United States, the third largest market, increased by 55% in 2022, reaching a sales share of 8%.

- Sales of ICE models have been steadily decreasing. The number of available ICE options was 3% to 4% lower in the United States in 2022 than in 2016. Several factors help increase sales of electric cars in the United States. More available models beyond those offered by OEMs help close the supply gap.

- The United States holds the second largest FCEV stock, with over 15,000 FCEVs. Most of these are fuel-cell cars. In 2022, the stock of FCEVs in the United States increased by more than 20%. These key elements fuel production demand for passenger vehicles and are expected to increase in the future.

United States MLCC Industry Overview

The United States MLCC Market is moderately consolidated, with the top five companies occupying 41.51%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Oil Price Trend

- 4.1.4 Zinc Price Trend

- 4.2 Consumer Electronics Sales

- 4.2.1 Air Conditioner Sales

- 4.2.2 Desktop PC's Sales

- 4.2.3 Gaming Console Sales

- 4.2.4 Laptops Sales

- 4.2.5 Refrigerator Sales

- 4.2.6 Smartphones Sales

- 4.2.7 Storage Unit Sales

- 4.2.8 Tablets Sales

- 4.2.9 Television Sales

- 4.3 Automotive Production

- 4.3.1 Heavy Trucks Production

- 4.3.2 Light Commercial Vehicles Production

- 4.3.3 Passenger Vehicles Production

- 4.3.4 Total Motor Production

- 4.4 Ev Production

- 4.4.1 BEV (Battery Electric Vehicle) Production

- 4.4.2 PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5 Industrial Automation Sales

- 4.5.1 Industrial Robots Sales

- 4.5.2 Service Robots Sales

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms