|

시장보고서

상품코드

1685674

미국의 발포 폴리스티렌(EPS) 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)US Expandable Polystyrene (EPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

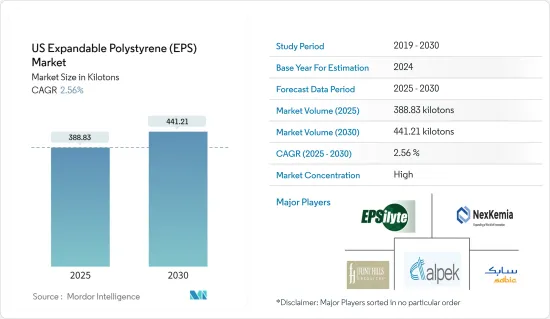

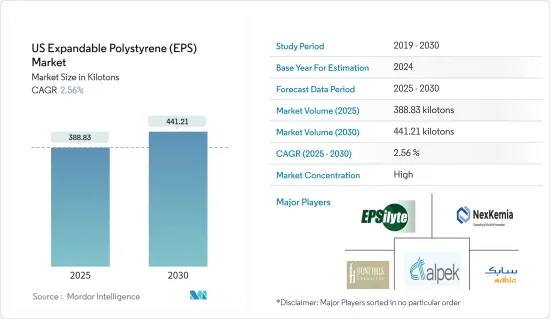

미국의 발포 폴리스티렌 시장 규모는 2025년에 388.83킬로톤으로 추정되고, 예측 기간인 2025-2030년 CAGR 2.56%로 성장할 전망이며, 2030년에는 441.21킬로톤에 이를 것으로 예측됩니다.

미국의 발포 폴리스티렌(EPS) 시장은 COVID-19에 의한 좌절에 직면했습니다. 세계의 봉쇄 및 엄격한 정부 규정으로 인해 생산 기지가 광범위하게 폐쇄되었습니다. 그러나 시장은 2021년에 회복되어 향후 수년간 크게 성장할 것으로 예측됩니다.

주요 하이라이트

- 단기적으로는 국내 건설 활동 증가 및 포장 산업 수요 증가가 조사 대상 시장 수요를 견인하는 주요 요인입니다.

- 그러나 친환경 대체품을 사용할 수 있다는 것은 시장 성장을 방해할 것으로 예상됩니다.

- 그럼에도 불구하고 발포 폴리스티렌(EPS) 산업의 재활용은 이 시장에 새로운 기회를 가져올 것으로 기대됩니다.

- 건축 및 건설 분야는 예측 기간 동안 급성장을 기록하면서 조사 시장 최대의 최종 사용자 산업을 차지할 것으로 예상됩니다.

미국의 발포 폴리스티렌(EPS) 시장 동향

회색과 은색 EPS 부문이 시장을 독점

- 회색과 은색 EPS는 발포체 제조, 특히 단열재에서 매우 중요합니다. 그것의 독특한 색조는 중합체 매트릭스에 내장된 미량의 탄소 또는 흑연으로부터 유래합니다.

- 열성능이 강화된 회색과 은색의 EPS는 단열 용도가 뛰어나 내구성과 열화에 대한 내성에 있어서 종래의 EPS 재료보다 우수합니다.

- 이러한 재료는 발포 보드 및 패널과 같은 단열재를 제조하는 데 필수적입니다.

- 회색 EPS는 혁신적인 개량형이며, 흑연(흑연)을 짜넣어 굴절 및 반사 특성을 높여 단열성을 높이고 있습니다. 흑연이 적외선의 굴절을 미묘하게 증폭하여 열을 직접 놓치기 어렵게 합니다. 회색에서 흑색으로 변하는 독특한 그늘, 견고한 기계적 특성, 높은 내수성, 향상된 내화성으로 인해 회색 EPS는 기존 EPS와 동일한 장비로 가공할 수 있습니다.

- 회색 EPS는 독특한 특성으로 인해 열전도도를 20% 줄이고 성능을 저하시키지 않고 보드 두께를 20% 얇게 할 수 있습니다. 그 용도는 외벽, 지붕 시스템, 기초, 바닥 단열, 열 음향 단열, 단열 거푸집의 제조, 경량 건축 블록의 제조 등 다양합니다.

- EPS의 사용은 오래된 건물과 새로운 건물 모두에서 단열성을 높여 전력 비용 절감에 기여합니다. 회색 EPS는 백색 EPS의 밀도와 비슷하지만 단열 성능은 20% 뛰어납니다.

- 이러한 성능 향상으로 주택 개축이 진행되고 유지 보수 비용 절감이 중시되는 경향이 있는 미국에서는 회색 EPS의 매력이 특히 높아지고 있습니다.

- 건축 분야에서 회색과 실버 EPS는 건물 단열재, 지붕재 및 바닥재에 사용됩니다.

- 건축 이외에서는 보호 포장 및 완충재 등, 패키징에도 빠뜨릴 수 없습니다.

- 인터내셔널 페이퍼의 데이터에 따르면 미국은 2023년에 3,910억 평방 피트의 골판지 포장을 수출하고, 2024년에는 4,060억 평방 피트까지 증가할 것으로 예측했습니다.

- 연포장은 음료 및 제품 낭비를 크게 줄여 온라인 브랜드가 우수한 전자상거래 경험을 위해 포장을 새롭게 할 수 있습니다.

- 미국 상무부에 따르면 전자상거래 매출은 2022년 1조 400억 달러에서 2023년 약 1조 1,190억 달러로 급증하여 연률 7.6%의 성장을 기록했습니다.

- 2024년 전자상거래 매출은 1조 2,500억 달러에 이르렀고, 추정 성장률은 10.5%를 나타낼 것으로 예측됩니다. 이것은 미국 EPS 시장에 좋은 징후입니다.

- 이러한 동태를 근거로 회색과 은색의 EPS 수요는 예측기간 동안 영향을 받을 것으로 보입니다.

시장을 독점하는 건축 및 건설 부문

- 건축 및 건설 업계에서는 발포 폴리스티렌(EPS)이 매우 중요하며 구조물의 에너지 효율, 지속가능성 및 저렴한 가격을 향상시키고 있습니다.

- 세계 최대의 경제대국으로 알려진 미국은 중공업부터 소규모 산업까지 다양한 업계 정세를 자랑하며 활기찬 상업활동으로 유명합니다.

- 미국은 건축 및 건설 업계에 있어서도 거대한 시장입니다. 미국 인구조사국의 데이터에 따르면 2023년 미국 건설액은 1조 9,787억 달러로 2022년 1조 8,487억 달러를 7% 웃돌았습니다. 그러나 2023년 주택 건설은 8,649억 달러에 그쳤습니다.

- 2023년에는 추정 146만 9,800호의 주택 건설이 허가되었으며, 2022년 166만 5,100호를 11.7% 밑돌았습니다. 또한 미국 인구조사국의 데이터에 따르면 2023년 착공된 주택 호수는 추정 141만 3,100호로 2022년 수치 155만 2,600호를 9.0%(+2.5%) 밑돌았습니다.

- 2024년 8월 건설 지출은 계절 조정된 연율 2조 1,319억 달러로 예측되었으며, 7월 2조 1,339억 달러에서 0.1%(1.2%)의 감소로 나타났습니다. 하지만 지난 8월 숫자는 2023년 8월 2조 474억 달러에서 4.1%(1.6%) 증가를 보였습니다. 미국 인구조사국의 데이터에 따르면 2024년 1-8월 건설 지출은 1조 4,285억 달러로 2023년 동시기 1조 3,270억 달러에서 7.6%(1.2%) 증가했습니다.

- 건설 부문의 이러한 추세를 감안할 때, 미국의 EPS 수요는 예측 기간 동안 증가할 것으로 보입니다.

미국의 발포 폴리스티렌(EPS) 산업 개요

미국의 발포 폴리스티렌(EPS) 시장은 그 특성상 고도로 통합되어 있습니다. 주요 기업으로는 Epsilyte LLC, NexKemia Petrochemicals Inc., Flint Hills Resources, Alpek SAB de CV(Styropek), SABIC 등이 있습니다.(순부동)

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 국내에서의 건설 활동 증가

- 포장 업계로부터 수요 증가

- 기타 촉진요인

- 성장 억제요인

- 녹색 대체품의 가용성

- 기타 억제요인

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 유형별

- 화이트

- 회색과 은색

- 최종 사용자별

- 건축 및 건설

- 포장

- 기타 최종 사용자

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 점유율(%)** 및 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Alpek SAB de CV(Styropek)

- Dart Container Corporation

- Epsilyte LLC

- Flint Hills Resources

- Foam Holdings, Inc.

- Harbor Foam

- NexKemia Petrochemicals Inc.

- NOVA Chemicals Corporate

- Ravago

- SABIC

- Styrotech, Inc.

- TotalEnergies

제7장 시장 기회 및 향후 동향

- 발포 폴리스티렌(EPS) 산업에서의 재활용

- 기타 기회

The US Expandable Polystyrene Market size is estimated at 388.83 kilotons in 2025, and is expected to reach 441.21 kilotons by 2030, at a CAGR of 2.56% during the forecast period (2025-2030).

The United States Expandable Polystyrene (EPS) market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to grow significantly in the upcoming years.

Key Highlights

- Over the short term, increasing construction activities in the country and increasing demand from the packaging industry are the major factors driving the demand for the market studied.

- However, the availability of green alternatives is expected to hinder the market's growth.

- Nevertheless, recycling in the expandable polystyrene (EPS) industry is expected to create new opportunities for the market studied.

- The building and construction segment is expected to account for the largest end-user industry in the market studied while registering rapid growth over the forecast period.

United States Expandable Polystyrene (EPS) Market Trends

Grey and Silver EPS Segment to Dominate the Market

- Grey and Silver EPS are pivotal in foam production, especially for insulation materials. Their unique coloration stems from a trace amount of carbon or graphite embedded in the polymer matrix.

- With enhanced thermal performance, Grey and Silver EPS excel in insulation applications and outlast traditional EPS materials in durability and resistance to degradation.

- These materials are integral to producing insulation solutions like foam boards and panels.

- Grey EPS, an innovative variant, incorporates graphite to boost its refractive and reflective properties, enhancing thermal insulation. The graphite subtly amplifies IR light refraction, making heat escape less direct. With its distinctive gray-to-black hue, robust mechanical properties, high water resistance, and enhanced fire resistance, grey EPS can be processed using the same equipment as conventional EPS.

- Owing to its unique attributes, grey EPS achieves a 20% reduction in thermal conductivity, allowing a 20% decrease in board thickness without compromising performance. Its applications span insulating external walls, roof systems, foundations, and floors, as well as thermo-acoustic insulation, manufacturing insulated formwork, and creating lightweight building blocks.

- EPS usage boosts insulation in both old and new buildings, aiding in power cost reductions. While it matches the density of white EPS, its isolation capability is 20% superior.

- This enhanced performance has made grey EPS especially appealing in the United States, where there's a growing trend towards housing renovations and a focus on lower maintenance costs.

- In construction, grey and silver EPS find applications in building insulation, roofing, and flooring.

- Beyond construction, they're vital in packaging, serving roles in protective packaging and cushioning materials.

- According to data from International Paper, the United States exported 391 billion square feet of corrugated packaging in 2023, with projections indicating an increase to 406 billion square feet in 2024.

- Flexible packaging significantly curtails waste in beverages and products, enabling online brands to refresh their packaging for a superior e-commerce experience.

- The US Department of Commerce notes that e-commerce sales jumped from USD 1.040 trillion in 2022 to approximately USD 1.119 trillion in 2023, marking a 7.6% annual growth.

- Looking ahead, this upward trajectory is set to persist into 2024, with e-commerce sales projected to hit USD 1.25 trillion, reflecting an estimated growth rate of 10.5%. This bodes well for the EPS market in the United States.

- Given these dynamics, the demand for grey and silver EPS is poised to be influenced during the forecast period.

Building and Construction Segment to Dominate the Market

- In the building and construction industry, expandable polystyrene (EPS) is pivotal, enhancing energy efficiency, sustainability, and affordability in structures.

- The United States, recognized as the world's largest economy, boasts a diverse industrial landscape, from heavy to small-scale industries, and is renowned for its vibrant commercial activities.

- The United States is also a huge market for the building and construction industry. As per the data from the US Census Bureau, the value of construction in the United States in 2023 was USD 1,978.7 billion, 7% higher than the USD 1,848.7 billion spent in 2022. However, the residential construction in 2023 was only USD 864.9 billion.

- In 2023, an estimated 1,469,800 housing units were authorized by building permits, 11.7 percent below the 2022 figure of 1,665,100. Moreover, an estimated 1,413,100 housing units were started in 2023, 9.0 percent (+-2.5 percent) below the 2022 figure of 1,552,600, as per the data from the US Census Bureau.

- In August 2024, construction spending was projected at a seasonally adjusted annual rate of USD 2,131.9 billion, slightly down by 0.1% (+-1.2%) from July's USD 2,133.9 billion. This August figure, however, shows a 4.1% (+-1.6%) increase from August 2023's USD 2,047.4 billion. For the first eight months of 2024, construction spending totaled USD 1,428.5 billion, marking a 7.6% (+-1.2%) rise from the USD 1,327.0 billion during the same timeframe in 2023, as per the data from the US Census Bureau.

- Given these trends in the construction sector, the demand for EPS in the United States is poised to rise during the forecast period.

United States Expandable Polystyrene (EPS) Industry Overview

The United States expandable polystyrene (EPS) market is highly consolidated in nature. The major players (not in any particular order) include Epsilyte LLC, NexKemia Petrochemicals Inc., Flint Hills Resources, Alpek S.A.B. de C.V. (Styropek), and SABIC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in the Country

- 4.1.2 Increasing Demand from Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Green Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 White

- 5.1.2 Grey and Silver

- 5.2 End User

- 5.2.1 Building and Construction

- 5.2.2 Packaging

- 5.2.3 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alpek S.A.B. de C.V. (Styropek)

- 6.4.2 Dart Container Corporation

- 6.4.3 Epsilyte LLC

- 6.4.4 Flint Hills Resources

- 6.4.5 Foam Holdings, Inc.

- 6.4.6 Harbor Foam

- 6.4.7 NexKemia Petrochemicals Inc.

- 6.4.8 NOVA Chemicals Corporate

- 6.4.9 Ravago

- 6.4.10 SABIC

- 6.4.11 Styrotech, Inc.

- 6.4.12 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recycling in the Expandable Polystyrene (EPS) Industry

- 7.2 Other Opportunities