|

시장보고서

상품코드

1849873

밀리미터파 기술 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2031년)Millimeter Wave Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

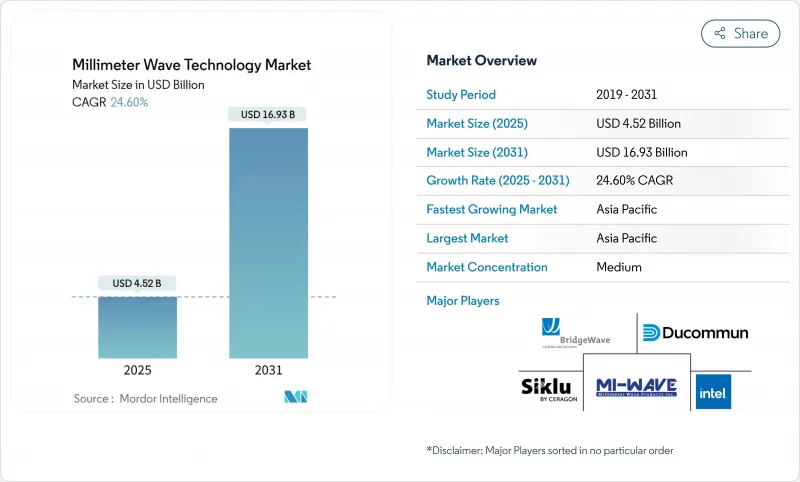

밀리미터파 기술 시장 규모는 2025년에 45억 2,000만 달러, 2031년에는 169억 3,000만 달러에 이를 것으로 추정되며, 예측기간(2025-2031년)의 CAGR은 24.60%를 나타낼 전망입니다.

네트워크 사업자는 용량 완화를 위해 24GHz 이상의 주파수로 눈을 돌리고 있으며, 방어 기관은 고해상도 타겟팅을 위해 레이더 시스템을 94GHz로 업그레이드하고 있습니다. 5G의 고밀도 전개와 6G의 조기시험으로 인한 이중 수요가 설비투자를 지원하는 한편, 디바이스 비용의 저하가 의료 화상, 산업 자동화, 자동차 ADAS에서의 채용을 뒷받침하고 있습니다. 아시아태평양은 수백만 사이트의 5G 전개에 의해 지역 최대의 지위를 차지하지만, 북미는 주파수 자유화와 CHIPS-Act에 뒷받침된 반도체 자금에 의해 기술 혁신을 추진합니다. 구성 요소 공급업체는 특허로 보호된 RF 프론트엔드로부터 혜택을 받지만 질화 갈륨 웨이퍼에 대한 공급망 노출은 전략적 위험을 초래합니다.

세계의 밀리미터파 기술 시장 동향과 인사이트

5G 네트워크의 고밀도화와 스몰셀 백홀 수요

통신 사업자는 스몰셀 밀도가 도시 지역의 구역화 한계를 초과하면 섬유가 경제적이지 않다는 것을 즉시 발견합니다. 중국, 미국, 인도의 실제 시험에서 몇 기가비트의 처리량을 얻었고, 밀리미터파 백홀이 고비용 홈 파기 작업을 대체하는 것으로 확인되었습니다. 장비 공급업체는 현재 소프트웨어 정의 빔 스티어링을 통합하여 정렬 시간을 단축하고 도시 당국은 옥상 허가를 간소화하여 사이트 활성화를 가속화하고 있습니다. 자본 효율과 시장 투입까지의 시간 단축에 의해 무선 백홀은 밀리미터파 기술 시장의 요점이 되고 있습니다.

24-100GHz 대역에서 모바일 및 고정 무선 데이터 트래픽 증가

고정 무선 가입자는 모바일 가입자의 최대 5배의 데이터를 소모하기 때문에 통신 사업자는 주거용 게이트웨이에 연속적인 28GHz 블록을 할당해야 합니다. 규제기관은 70/80/90GHz의 규칙을 조화시켜 보다 넓은 채널을 가능하게 함으로써 대응하고, 칩셋 제조업체는 링크 최적화를 위한 AI를 통합한 2세대 CPE 플랫폼을 발표했습니다. 이러한 발전은 지역 광대역 프로그램을 지원하고 밀리미터파 기술 시장 전체 수요를 자극합니다.

100GHz 이상의 RF 프론트엔드의 열 관리 한계

주파수가 높아짐에 따라 열 집중이 불균형으로 상승하여 질화 갈륨 디바이스를 신뢰성을 저하시키는 접합 온도로 밀어 올립니다. 다이아몬드 기판과 마이크로플루이딕스 냉각을 이용한 첨단 패키징이 평가되고 있지만, 이러한 접근법은 재료 비용을 증가시키고 인증 사이클을 길게 합니다. 확장 가능한 열 솔루션이 등장하기 전까지는 단기 도입이 100GHz 이하로 집중되어 밀리미터파 기술 시장의 어퍼 밴드 성장이 억제됩니다.

부문 분석

2030년까지 연평균 복합 성장률(CAGR)이 가장 빠른 이유는 이미징 센서로, 테라헤르츠 이미징이 종양학 및 화상 평가에서 라벨이 없는 조직 진단을 가능하게 하기 때문입니다. 이와는 대조적으로, 안테나와 트랜시버는 모바일 기지국을 위한 무선 프론트엔드를 제공함으로써 2024년에 38%의 최대 점유율을 유지했습니다. 이미징 센서의 밀리미터파 기술 시장 규모는 병원이 비전리 진단 도구를 채택함으로써 2030년까지 30억 달러 이상에 달할 것으로 예상됩니다. 통신 네트워크 IC는 매크로셀의 고밀도화에 의해 보완적으로 성장하고, 인터페이스 제어 IC는 레이더 온 칩 통합의 동향을 탄다.

NTT의 300GHz에서 280Gbps 신호 생성과 같은 R&D의 획기적인 연결은 링크 예산을 개선하고 주파수 애자일 신디사이저 수요를 자극합니다. 한편, 통합자가 더 높은 전력 밀도를 요구함에 따라, 첨단 기판 및 열 인터페이스 재료를 중심으로 하는 다른 부품의 존재감이 증가하고 있습니다. 그 결과 밀리미터파 기술 시장을 지원하는 구성 요소 스택이 확대되고 있습니다.

완전 또는 부분적으로 라이선싱된 주파수 대역은 2024년 매출의 78%를 차지하며, 이는 통신의 매크로셀 및 방어 네트워크에서 간섭 없는 운영에 프리미엄이 붙어 있음을 반영했습니다. 그러나 규제 당국이 최소한의 사무처리로 끝나는 산업용 프레즌스 센싱 룰을 책정했기 때문에 95GHz 이상의 면허 불필요한 할당이 CAGR 26.43%를 나타낼 전망입니다. 중소기업은 이 간소화된 제도를 이용하여 로봇공학 및 품질검사용 공장 바닥 레이더를 도입하여 밀리미터파 기술 시장에 새로운 수익원을 더하고 있습니다.

공급업체는 현재 규제 환경을 자동 감지하고 EIRP 설정을 실시간으로 조정하는 듀얼 모드 칩셋을 도입하여 주요 채택 장벽을 제거하고 있습니다. 라이선스 스펙트럼은 미션 크리티컬 링크에 필수적인 것은 아니지만, 언라이선스 스펙트럼이 급증함에 따라 어드레싱 가능한 전체 베이스가 확산되고 있습니다.

밀리미터파 기술 시장 보고서는 구성 요소(안테나 및 트랜시버, 통신 및 네트워킹 IC, 인터페이스 및 제어 IC, 주파수 생성 및 필터 등), 라이선스 모델(전체/파트 라이선스 및 언라이선싱), 주파수 대역(24-57GHz, 57-95GHz, 95-300GHz), 용도(통신 인프라, 모바일 및 소비자 장비, 고정 무선 액세스 등)

지역 분석

아시아태평양은 2024년 수익의 42%를 차지하며 2030년까지 28.02%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다. 이는 중국의 440만대 5G 기지국과 인도의 급속한 FWA 보급이 뒷받침되고 있습니다. 지방정부는 5G-Advanced 연구에 공적 자금을 할당하고 수탁 제조업자는 질화갈륨 웨이퍼 라인에 투자하여 공급을 현지화합니다. 일본의 민간 5G 모델에서는 용지 취득의 복잡성으로부터 mmWave의 보급이 늦어지고 있지만, 기업의 캠퍼스에서는 AR 트레이닝용으로 60GHz의 실내 네트워크가 시험적으로 도입되고 있습니다.

북미에서는 주파수 정책이 산업혁신과 정합해 37GHz대와 70/80/90GHz대가 해방되는 한편, CHIPS-Act의 인센티브가 국내 공장으로 향하게 됩니다. 국방 레이더 업그레이드 및 고정 무선 배포가 탄력적인 고객 기반을 지원하고 Nokia-T-Mobile과 같은 파트너십이 여러 해의 장비 파이프라인을 확보합니다. 캐나다는 지역에서 광대역 시험 운영을 위해 밀리미터파를 채택하여 밀리미터파 기술 시장을 더욱 확대합니다.

유럽은 스스로를 기술연구소로 자리잡고 있습니다. 독일은 6G 테스트 베드와 마이크로 일렉트로닉스 클러스터를 지원하고 규제 당국은 제조 혁신을 선호하는 42GHz 경매 조건을 수립합니다. 독일 OEM 제조업체의 자동차 레이더 수요는 전문 칩 제조업체와의 협력 관계를 촉진하고 영국은 60GHz 운송 인프라 링크를 찾고 있습니다. 중동은 스마트 시티의 실증 실험에 투자하고 남아프리카공화국은 28GHz FWA를 시험적으로 도입했으며 브라질은 mmWave CPE의 조립을 목표로 세금 우대를 도입했습니다. 이러한 신흥 시장으로부터의 수익공헌은 1자리대에 머무르는 것, 성장률은 성숙지역을 상회하고 시장 역학에 역동성을 부여하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 5G 네트워크의 고밀도화와 스몰셀 백홀 수요

- 24-100GHz대에서의 모바일 및 고정 무선 데이터 트래픽 증가

- 40GHz 이상의 주파수대의 자유화와 새로운 경매

- 저지연 타겟팅을 위해 방어 레이더를 94GHz로 업그레이드

- 마지막 50미터의 광섬유 대체를 위한 실내 밀리미터파 FWA

- 122GHz 산업용 프레즌스 센싱 규제의 출현

- 시장 성장 억제요인

- 100GHz를 초과하는 RF 프론트 엔드의 열 관리 한계

- 대량 생산에 있어서의 고비용의 페이즈드 어레이 교정

- 밀집지에 있어서의 지자체의 「가로 가구」존닝의 장해

- 질화 갈륨 웨이퍼 공급망의 집중 위험

- 밸류체인/공급망 분석

- 규제 상황

- 기술 전망

- 밀리미터파 용도에서의 GaN의 중요성

- mmWave 기판의 상황 : LCP, PI, PTFE가 5G HW에 미치는 영향

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 경쟁 기업 간 경쟁 관계

- 대체품의 위협

- COVID-19의 영향 평가

제5장 시장 규모와 성장 예측

- 구성 요소별

- 안테나 및 송수신기

- 통신 및 네트워킹 IC

- 인터페이스 및 제어 IC

- 주파수 발생 및 필터

- 이미징 센서

- 기타 구성 요소

- 라이선싱 모델별

- 완전/부분 라이선스

- 비라이선스

- 주파수 대역별

- 24-57GHz

- 57-95GHz

- 95-300GHz

- 용도별

- 통신 인프라(RAN 및 백홀)

- 모바일 및 소비자 기기

- 고정 무선 액세스(FWA)

- 레이더 및 보안 영상

- 자동차 ADAS 및 V2X

- 산업 자동화 및 IIoT

- 의료 및 생명과학 영상

- 항공우주 및 방위통신

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 나이지리아

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Anokiwave Inc.

- Aviat Networks

- Broadcom Inc.

- BridgeWave Communications(REMEC)

- Ducommun Incorporated

- Eravant(SAGE Millimeter)

- Farran Technology

- Huawei Technologies

- Intel Corporation

- Keysight Technologies

- L3Harris Technologies

- Millimeter Wave Products Inc.

- NEC Corporation

- Nokia Corporation

- NXP Semiconductors

- Qualcomm Technologies

- Samsung Electronics

- Sivers Semiconductors

- Siklu Communication(Ceragon)

- Smiths Interconnect

- Vubiq Networks

제7장 시장 기회와 향후 전망

KTH 25.11.03The Millimeter Wave Technology Market size is estimated at USD 4.52 billion in 2025, and is expected to reach USD 16.93 billion by 2031, at a CAGR of 24.60% during the forecast period (2025-2031).

Network operators are turning to frequencies above 24 GHz for capacity relief, and defense agencies are upgrading radar systems to 94 GHz for higher-resolution targeting. Dual demand arising from dense 5G rollouts and early 6G trials sustains capital spending, while falling device costs encourage adoption in medical imaging, industrial automation, and automotive ADAS. Asia Pacific commands the largest regional position thanks to multi-million-site 5G deployments, whereas North America drives innovation through spectrum liberalization and CHIPS-Act-backed semiconductor funding. Component suppliers benefit from patent-protected RF front-ends, yet supply-chain exposure to gallium-nitride wafers introduces strategic risk.

Global Millimeter Wave Technology Market Trends and Insights

5G network densification and small-cell backhaul demand

Operators quickly discover that fiber becomes uneconomical when small-cell density exceeds urban zoning caps, so 60 GHz and E-band radio links are adopted to connect sites within weeks instead of months. Field trials in China, the United States, and India deliver multi-gigabit throughput, confirming that millimeter-wave backhaul can substitute for high-cost trenching activities. Equipment vendors now integrate software-defined beam steering to reduce alignment time, while urban authorities streamline rooftop permitting to accelerate site activation. Capital efficiency and time-to-market gains make wireless backhaul a cornerstone of the millimeter wave technology market.

Rising mobile and fixed-wireless data traffic in 24-100 GHz bands

Fixed-wireless customers consume up to five times the data of mobile subscribers, forcing operators to allocate contiguous 28 GHz blocks to residential gateways. Regulatory agencies respond by harmonizing 70/80/90 GHz rules to enable wider channels, and chipset makers have announced second-generation CPE platforms with integrated AI for link optimization. These advances support rural broadband programs and stimulate demand across the millimeter wave technology market.

RF front-end thermal management limits above 100 GHz

Heat concentration rises disproportionately as frequency increases, pushing gallium-nitride devices toward junction temperatures that degrade reliability. Advanced packaging using diamond substrates and micro-fluidic cooling is under evaluation, yet these approaches add material cost and prolong qualification cycles. Until scalable thermal solutions emerge, near-term deployments will cluster below 100 GHz, tempering the millimeter wave technology market's upper-band growth.

Other drivers and restraints analyzed in the detailed report include:

- Spectrum liberalization and new auctions above 40 GHz

- Defense radar upgrades to 94 GHz

- High-cost phased-array calibration in volume production

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Imaging Sensors deliver the fastest 25.32% CAGR through 2030, as terahertz imaging enables label-free tissue diagnosis in oncology and burn assessment. In contrast, Antennas and Transceivers preserve the largest 38% share in 2024 by supplying radio front-ends for mobile base stations. The millimeter wave technology market size for Imaging Sensors is expected to cross USD 3 billion by 2030 as hospitals adopt non-ionizing diagnostic tools. Complementary growth in Communication and Networking ICs arises from densified macro-cell deployments, while Interface and Control ICs ride the trend toward radar-on-chip integration.

R&D breakthroughs such as NTT's 280 Gbps signal generation at 300 GHz improve link budgets and stimulate demand for frequency-agile synthesizers. Meanwhile, Other Components, chiefly advanced substrates and thermal interface materials, gain visibility as integrators seek higher power density. The result is a broadening component stack that anchors the millimeter wave technology market.

Fully or Partly Licensed spectrum delivered 78% of 2024 revenue, reflecting the premium attached to interference-free operations in telecom macro cells and defense networks. However, unlicensed allocations above 95 GHz advance at 26.43% CAGR as regulators create industrial presence-sensing rules that require minimal paperwork. SMEs leverage the simplified regime to deploy factory-floor radar for robotics and quality inspection, adding fresh revenue streams to the millimeter wave technology market.

Vendors now introduce dual-mode chipsets that auto-detect regulatory environments and adjust EIRP settings in real time, removing a key adoption barrier. Licensed spectrum will remain critical for mission-critical links, yet the unlicensed surge broadens the overall addressable base.

The Millimeter Wave Technology Market Report is Segmented by Component (Antennas and Transceivers, Communications and Networking ICs, Interface and Control ICs, Frequency Generation and Filters, and More), Licensing Model (Fully/Partly Licensed and Unlicensed), Frequency Band (24-57 GHz, 57-95 GHz, and 95-300 GHz), Application (Telecom Infrastructure, Mobile and Consumer Devices, Fixed Wireless Access, and More), and Geography.

Geography Analysis

Asia Pacific commands 42% of 2024 revenue and is forecast to grow at 28.02% CAGR through 2030, propelled by China's 4.4 million 5G base stations and India's rapid FWA penetration. Regional governments allocate public funds to 5G-Advanced research, and contract manufacturers invest in gallium-nitride wafer lines to localize supply. Japan's private 5G model shows slower mmWave uptake due to site-acquisition complexity, but corporate campuses are piloting 60 GHz indoor networks for AR training.

North America aligns spectrum policy with industrial innovation, releasing 37 GHz and 70/80/90 GHz bands while channeling CHIPS-Act incentives toward domestic fabs. Defense radar upgrades and fixed-wireless deployments underpin a resilient customer base, and partnerships such as Nokia-T-Mobile secure multi-year equipment pipelines. Canada adopts mmWave for rural broadband pilots, further expanding the millimeter wave technology market.

Europe positions itself as a technology laboratory. Germany supports 6G testbeds and micro-electronics clusters, and regulators craft 42 GHz auction terms that prioritize manufacturing innovation. Automotive radar demand from German OEMs drives collaboration with specialist chipmakers, while the UK explores 60 GHz transport-infrastructure links. The Middle East invests in smart-city proof-of-concepts, South Africa pilots 28 GHz FWA, and Brazil introduces targeted tax breaks for mmWave CPE assembly. Although revenue contributions from these emerging markets remain single-digit, growth rates surpass mature regions, adding dynamism to the millimeter wave technology market.

- Anokiwave Inc.

- Aviat Networks

- Broadcom Inc.

- BridgeWave Communications (REMEC)

- Ducommun Incorporated

- Eravant (SAGE Millimeter)

- Farran Technology

- Huawei Technologies

- Intel Corporation

- Keysight Technologies

- L3Harris Technologies

- Millimeter Wave Products Inc.

- NEC Corporation

- Nokia Corporation

- NXP Semiconductors

- Qualcomm Technologies

- Samsung Electronics

- Sivers Semiconductors

- Siklu Communication (Ceragon)

- Smiths Interconnect

- Vubiq Networks

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G network densification and small-cell backhaul demand

- 4.2.2 Rising mobile and fixed-wireless data traffic in 24-100 GHz bands

- 4.2.3 Spectrum liberalisation and new auctions above 40 GHz

- 4.2.4 Defense radar upgrades to 94 GHz for low-latency targeting

- 4.2.5 Indoor millimetre-wave FWA for last-50-metre fibre substitution

- 4.2.6 Emerging 122 GHz industrial presence-sensing regulations

- 4.3 Market Restraints

- 4.3.1 RF front-end thermal management limits above 100 GHz

- 4.3.2 High-cost phased-array calibration in volume production

- 4.3.3 Municipal "street-furniture" zoning hurdles for dense sites

- 4.3.4 Gallium-nitride wafer supply chain concentration risk

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Significance of GaN across mmWave applications

- 4.6.2 mmWave substrate landscape: LCP, PI, PTFE impact on 5G HW

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 COVID-19 Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Antennas and Transceivers

- 5.1.2 Communication and Networking ICs

- 5.1.3 Interface and Control ICs

- 5.1.4 Frequency Generation and Filters

- 5.1.5 Imaging Sensors

- 5.1.6 Other Components

- 5.2 By Licensing Model

- 5.2.1 Fully/Partly Licensed

- 5.2.2 Unlicensed

- 5.3 By Frequency Band

- 5.3.1 24-57 GHz

- 5.3.2 57-95 GHz

- 5.3.3 95-300 GHz

- 5.4 By Application

- 5.4.1 Telecom Infrastructure (RAN and backhaul)

- 5.4.2 Mobile and Consumer Devices

- 5.4.3 Fixed Wireless Access (FWA)

- 5.4.4 Radar and Security Imaging

- 5.4.5 Automotive ADAS and V2X

- 5.4.6 Industrial Automation and IIoT

- 5.4.7 Medical and Life-Sciences Imaging

- 5.4.8 Aerospace and Defense Communications

- 5.4.9 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Anokiwave Inc.

- 6.4.2 Aviat Networks

- 6.4.3 Broadcom Inc.

- 6.4.4 BridgeWave Communications (REMEC)

- 6.4.5 Ducommun Incorporated

- 6.4.6 Eravant (SAGE Millimeter)

- 6.4.7 Farran Technology

- 6.4.8 Huawei Technologies

- 6.4.9 Intel Corporation

- 6.4.10 Keysight Technologies

- 6.4.11 L3Harris Technologies

- 6.4.12 Millimeter Wave Products Inc.

- 6.4.13 NEC Corporation

- 6.4.14 Nokia Corporation

- 6.4.15 NXP Semiconductors

- 6.4.16 Qualcomm Technologies

- 6.4.17 Samsung Electronics

- 6.4.18 Sivers Semiconductors

- 6.4.19 Siklu Communication (Ceragon)

- 6.4.20 Smiths Interconnect

- 6.4.21 Vubiq Networks

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment