|

시장보고서

상품코드

1906920

선형 알킬벤젠(LAB) : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Linear Alkyl Benzene (LAB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

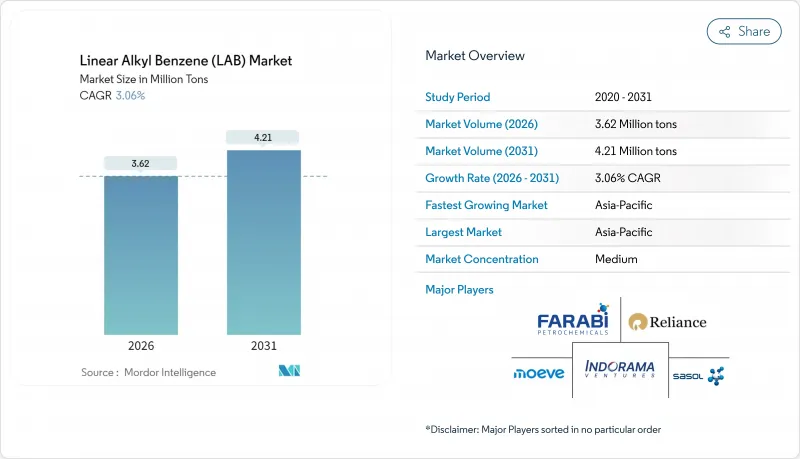

선형 알킬벤젠(LAB) 시장은 2025년 351만 톤으로 평가되었으며, 2026년 362만 톤에서 2031년까지 421만 톤에 이를 것으로 예상됩니다.

예측 기간(2026-2031년)의 CAGR은 3.06%를 나타낼 전망입니다.

선형 알킬벤젠 술폰산염의 주요 전구체로서 선형 알킬벤젠의 안정적인 수요가 이 성장을 지원합니다. 소비자나 규제 당국이 종래의 분기쇄계 세제보다 생분해성 음이온계 계면활성제를 선호하는 경향이 강해지고 있기 때문입니다. 인구가 많은 신흥 경제국에서의 세제 보급률의 상승, 유행 후 가정·시설 위생에의 지속적인 주목, 그리고 데탈 장치의 업그레이드에의 지속적인 투자가 함께, 선형 알킬벤젠(LAB) 시장의 기회를 확대하고 있습니다. 벤젠과 파라핀을 확실하게 통합한 생산자는 비용 우위성을 강화하고, 진행 중인 데탈 설비의 개수는 탄소 배출량의 저감과 공정 안전성의 향상이라는 이중의 이점을 가져옵니다. 한편, 냉각제 첨가제와 같은 부가가치가 높은 틈새 용도의 추구는 생산량의 점증을 촉진하고 비교적 성숙한 세제 밸류체인에 대한 의존도를 감소시킵니다.

세계의 선형 알킬벤젠(LAB) 시장 동향과 인사이트

신흥 경제국에서 세제 보급률 상승

신흥경제국에서는 세제 소비량이 선진지역과의 차이를 계속 줄이고 있으며 매년 수백만 명의 신규 세탁 이용자를 창출하고 있습니다. 가정용 세제 업데이트 사이클에서는 기존의 비누보다 포장된 합성 세제가 선호됩니다. 이는 농촌과 도시 주변 지역에 많은 경수 환경에서 LAS(선형 알킬벤젠) 기반의 배합이 뛰어난 성능을 발휘하기 때문입니다. 포장 세제는 또한 저소득층의 구매 습관에 맞는 소용량의 향신료 형식을 활용하고 있으며, 선형 알킬벤젠(LAB) 시장에 있어서 안정적인 수요 창출 요인이 되고 있습니다. 인도에서는 정부의 위생 캠페인과 소매망의 확대로 농촌지역 전체에서 세제의 보급률이 상승하고 있습니다. 사하라 이남 아프리카와 일부 중동 경제권에서도 비슷한 움직임을 볼 수 있으며 잠재 고객 기반이 더욱 확대되고 있습니다. 이러한 동향이 결합되어 중기적으로는 선형 알킬벤젠(LAB) 시장의 확대를 지지하는 구조적인 성장 기반이 형성되고 있습니다.

생분해성 LAS 계면활성제에 대한 규제 추진

환경 규제 당국은 세제의 분해성 기준을 강화하여 선형 알킬벤젠 유래 LAS로의 전환을 가속화하고 있습니다. 유럽연합의 REACH 규제 프레임워크에서는 분기형 LAS에 비해 직쇄형 LAS의 분해 속도가 우수한 점이 강조되고, 선형 알킬벤젠은 규제 대응에 적합한 원료가 되고 있습니다. 물 스트레스 지역에서는 폐수 처리 비용이 증가함에 따라 유사한 배출 기준이 채택되었습니다. 브랜드 소유자는 세탁세제와 식기세제에 '생분해성'을 표시함으로써 컴플라이언스 대응을 마케팅상의 부가가치로 변환하여 평균 판매가격 상승을 지원하고 있습니다. 인증기관은 계면활성제 선정을 검토할 때 ISO 14852 및 ASTM D-2667 시험방법을 참조하여 선형 알킬벤젠 수요 우위를 더욱 강화하고 있습니다. 각국이 파리 협정에 따른 화학 전략에 정합하는 가운데, 바이오 유래를 중시한 계면활성제는 다국적 기업에 있어서 불가결해져, 장기적인 수요 전망을 확고한 것으로 하고 있습니다.

원료 가격 변동이 이익률 압박

선형 알킬벤젠 생산자는 벤젠과 파라핀에 의존하고 있으며, 그 가격 동향은 세계 원유 가격 변동에 연동하고 있습니다. 분기별 가격 변동은 비통합 제조업체의 전환 스프레드를 압박하는 경향이 있습니다. 재고 보유 전략은 영향을 완화하지만 특히 선물 곡선이 역전되면 위험을 완전히 제거할 수 없습니다. 통합 정제업체는 더 유리한 입장에 있지만, 헤지 비용과 정유소의 정기 점검과 관련된 공급 중단 위험에 여전히 직면하고 있습니다. 신흥 아시아 기업은 원료 수입 결제 시 달러에 대한 환율 변동이라는 추가적인 과제를 안고 있습니다. 지속적인 원료가격의 난고하는 계획의 가시성을 훼손하고, 임의의 설비투자 의욕을 깎고, 단기적인 선형 알킬벤젠(LAB) 시장의 성장세에 브레이크를 가하는 요인이 됩니다.

부문 분석

2025년 생산량의 96.78%를 차지한 계면활성제 용도는 일상적인 세정제의 필수 구성 요소로서 선형 알킬벤젠(LAB) 시장의 입지를 강화하고 있습니다. 이 압도적 인 점유율은 특히 광범위한 소비 지역에서 일반적인 경수 조건 하에서 분말 세제와 액체 세제의 제형에서 LAS의 입증 된 성능을 지원합니다. 다른 용도는 배합 엔지니어가 냉각제 첨가제 패키지 및 특정 산업용 세제를 모색하는 동안 시장 전체를 능가하는 4.48%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다. 수익성의 관점에서 계면활성제 수요는 높은 설비 가동률을 보장하지만, 특수 용도로의 다각화는 이익률의 향상을 가져오고 생산자를 세제 시장의 주기적인 변동으로부터 보호합니다.

제조 공정 사양에서는 C10-C13의 사슬 길이 분포가 엄격하게 규정되어 있으며, 프리미엄 LAS 요구를 충족시키기 위해 원료 정제에 대한 투자가 촉진되고 있습니다. 최근의 연구는 황산 세척 처리가 올레핀계 불순물을 감소시키고, 세제의 백도 점수 향상 및 배합 안정제 부하량의 감소에 기여하는 것으로 나타났습니다. 자동차용 냉각액 블렌드를 공급하는 제조업체는 높은 산화 안정성을 중시해, 종래는 양판 주도였던 시장에 새로운 기술적 요소를 도입하고 있습니다. 이러한 성능 기준의 진화에 의해 종래의 HF제법보다 순도가 높은 제품을 안정적으로 공급하는 데탈 플랜트의 라이프 사이클이 연장되고 있습니다. 이러한 추세는 종합적으로 계면활성제의 중요성을 재확인하는 동시에 틈새 시장에서 꾸준한 성장 경로를 키우고 선형 알킬벤젠(LAB) 시장의 균형 잡힌 확장을 보장합니다.

선형 알킬벤젠 보고서는 용도별(계면활성제 및 기타 용도), 최종 사용자 산업별(세탁 세제, 경부하 식기용 세제, 산업용 세제, 가정용 세제, 기타 최종 사용자 산업), 지역별(아시아태평양, 북미, 유럽, 남미, 중동, 아프리카)으로 분류됩니다. 시장 예측은 수량(톤) 단위로 제공됩니다.

지역별 분석

아시아태평양은 2025년에 53.72%의 점유율로 선두를 차지했으며, 2031년까지 연평균 복합 성장률(CAGR) 4.12%를 나타낼 전망입니다. 소비자층의 특성과 도시화가 함께 포장세제의 사용이 확대되는 한편, 중국, 인도, 중동의 통합 방향족 복합시설이 경쟁력 있는 비용으로 벤젠의 안정공급을 확보하고 있습니다. 최근 파라핀 탈수소화 프로젝트는 지역의 자급 자족을 더욱 강화하고 수입 의존도와 수송 위험을 줄여줍니다. 중국 연안의 산업 클러스터는 원재료와 완제품의 최종 마일 물류 비용을 절감하고 현지 가솔린 범위 올레핀을 고순도 선형 알킬벤젠으로 신속하게 전환합니다.

유럽에서는 생산량의 성장은 완만하지만 환경 기준의 모범 사례 설정에서 매우 중요한 역할을 담당하고 있습니다. 유럽위원회의 「대량생산 유기화학물질」참조 문서는 배수·배출 가이드라인을 강화하여 기존 플랜트에서의 데탈(Detal) 방식으로의 개수를 가속시키고 있습니다. 스페인과 벨기에의 생산자들은 이미 생산 능력의 업그레이드를 완료하고 고순도 수율을 향상시키는 동시에 에너지 강도를 삭감하고 있습니다. 이 지역에 본사를 둔 소비자 브랜드는 「제조 전 단계까지를 포함한 라이프 사이클 평가」를 채용해, 데탈 방식으로 제조된 계면활성제의 조달 우선도를 확고한 것으로 하고 있습니다.

북미에서는 셰일 유래의 풍부한 원료 공급원으로 벤젠과 파라핀의 비용이 구조적으로 저수준으로 안정되어 있습니다. 그러나 HF 규제 대응 비용의 상승에 따라 경쟁 압력이 강해지고, 데탈 라인에의 자본 재배분에 관한 논의가 활발해지고 있습니다. 미국 걸프 지역의 생산자는 중간 단계에서 가격 변동 위험을 줄이고 부가가치 창출을 목적으로 다운스트림 공정의 LAS 통합의 이점을 검토 중입니다. 미국 인플레이션 억제법에 의한 규제의 가시화는 에너지 절약 개수의 탄소배출권 환금을 가능하게 해, 이러한 요인이 합쳐, 선형 알킬벤젠(LAB) 시장에 대해, 꾸준하고 전략적으로 중요한 공헌을 가져오고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 지원(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 신흥 경제국에서의 세제 보급률의 상승

- 생분해성 LAS 계면활성제에 대한 규제 추진

- 포스트 코로나 시대의 위생 관리와 청소의 철저도

- Detal-2 개조에 의한 LAB의 탄소발자국 삭감

- EV 냉각제 첨가제 패키지에서 LAB 사용

- 시장 성장 억제요인

- 원료(벤젠 및 파라핀) 가격의 변동성

- HF 루트의 환경 규제 대응 비용

- ASEAN의 팜유 유래 MES 세제로의 이행

- 밸류체인 분석

- 가격 개요

- 무역 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 용도별

- 계면활성제

- 기타 용도

- 최종 사용자 업계별

- 세탁 세제

- 경량 식기 세척액

- 산업용 세정제

- 가정용 세정제

- 기타 최종 사용자 산업

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/순위 분석

- 기업 프로파일

- CNPC(Fushun Petrochemical)

- Egyptian Petrochemicals Holding Company(ECHEM)

- Farabi Petrochemicals Company

- Formosan Union Chemical Corp.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited

- ISU Chemical

- JINTUNG Petrochemical Co., Ltd

- Kinef

- Moeve

- NIRMA

- PT Unggul Indah Cahaya Tbk

- QatarEnergy

- Reliance industries Limited

- SBK HOLDING

- Sasol

- Tamilnadu Petroproducts Limited

- Thai Oil Public Company Limited

제7장 시장 기회와 향후 전망

KTH 26.01.20The Linear Alkyl Benzene Market was valued at 3.51 Million tons in 2025 and estimated to grow from 3.62 Million tons in 2026 to reach 4.21 Million tons by 2031, at a CAGR of 3.06% during the forecast period (2026-2031).

Steady demand for linear alkyl benzene as the key precursor to linear alkyl benzene sulfonate underpins this growth as consumers and regulators favor biodegradable anionic surfactants over legacy branched-chain detergents. Rising detergent penetration across populous emerging economies, a sustained post-pandemic focus on household and institutional hygiene, and continued investments in upgraded Detal units collectively widen the linear alkyl benzene market opportunity set. Producers with secure benzene and paraffin integration deepen cost leadership, while ongoing Detal retrofits provide dual benefits of lower carbon intensity and improved process safety. Meanwhile, the pursuit of value-added niche applications such as coolant additives augments incremental volume growth and reduces reliance on the relatively mature detergent value chain.

Global Linear Alkyl Benzene (LAB) Market Trends and Insights

Rising Detergent Penetration in Emerging Economies

Emerging economies continue to close the detergent consumption gap with industrialized regions, adding millions of new wash-day users each year. Household upgrade cycles favor packaged synthetic detergents over traditional soap bars because LAS-based formulations excel in hard-water conditions that prevail in rural and peri-urban zones. Packaged detergents also leverage smaller sachet formats that align with low-income purchasing habits, creating a stable volume pull for the linear alkyl benzene market. In India, government sanitation campaigns and expanded retail access raise detergent adoption rates across rural districts. Similar dynamics in sub-Saharan Africa and selected Middle Eastern economies further enlarge the prospective customer base. Together these trends embed a structural growth floor that supports linear alkyl benzene market expansion over the medium term.

Regulatory Push for Biodegradable LAS Surfactants

Environmental regulators tighten degradability benchmarks for cleaning agents, accelerating the shift toward LAS derived from linear alkyl benzene. The European Union's REACH framework highlights faster breakdown of straight-chain LAS compared with branched analogs, making linear alkyl benzene a compliance-friendly feedstock. Water-stressed regions adopt similar discharge norms as wastewater treatment costs climb. Brand owners translate compliance into marketing premiums by labeling laundry and dishwashing detergents as biodegradable, supporting higher average selling prices. Certification bodies reference ISO 14852 and ASTM D-2667 methods when vetting surfactant choices, reinforcing the demand advantage enjoyed by linear alkyl benzene. As countries align with Paris-aligned chemical strategies, bio-favored surfactants become indispensable for multinationals, cementing the long-term demand outlook.

Feedstock Price Volatility Pressures Margins

Linear alkyl benzene producers rely on benzene and paraffin, whose price trajectories remain tethered to global crude oil swings. Quarter-to-quarter price variability tends to compress conversion spreads for non-integrated manufacturers. Inventory holding strategies mitigate but do not eliminate exposure, especially when forward curves invert. Integrated refiners fare better, yet they still confront hedging costs and occasional supply disruptions linked to refinery turnarounds. Emerging Asian players bear the additional challenge of currency fluctuations against the U.S. dollar when settling feedstock imports. Persistent input turbulence undermines planning visibility, discourages discretionary capital spending, and introduces a drag on short-term linear alkyl benzene market growth momentum.

Other drivers and restraints analyzed in the detailed report include:

- Post-COVID Hygiene and Cleaning Intensity

- Detal-2 Retrofits Cutting LAB Carbon Footprint

- HF-Route Environmental Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surfactant production accounted for 96.78% of the 2025 volume, reinforcing the linear alkyl benzene market position as an essential building block for everyday cleaning agents. This overwhelming share is anchored in the proven performance of LAS in powder and liquid detergent formulations, particularly under hard-water conditions that prevail across vast consumption territories. Other Applications outpace the headline market at 4.48% CAGR as formulators explore coolant additive packages and select industrial cleaners. From a profitability standpoint, surfactant demand ensures high asset utilization; however, diversification into specialty uses offers margin accretion and shields producers from cyclical detergent swings.

Process specifications dictate narrow C10-C13 chain-length distributions, encouraging producers to invest in feedstock purification to meet premium LAS requirements. Recent studies show that sulfuric acid wash treatments cut olefinic contaminants, thereby raising detergent brightness scores and reducing formulation stabilizer loadings. Producers supplying automotive coolant blends emphasize high oxidative stability, injecting new technical parameters into what was once a volume-driven market. These evolving performance criteria extend the life cycle of Detal plants that consistently deliver purer cuts than their HF predecessors. Taken together, these trends reinforce the primacy of surfactants while simultaneously cultivating a measured growth path for niche outlets, ensuring balanced expansion for the linear alkyl benzene market.

The Linear Alkyl Benzene Report is Segmented by Application (Surfactant and Other Applications), End-User Industry (Laundry Detergents, Light-Duty Dishwashing Liquids, Industrial Cleaners, Household Cleaners, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominates with a 53.72% share in 2025 and is set to grow at a 4.12% CAGR through 2031. Consumer demographics combine with urbanization to expand packaged detergent usage, while integrated aromatics complexes in China, India, and the Middle East ensure secure benzene supply at competitive cost. Recent paraffin dehydrogenation projects further reinforce regional self-sufficiency, lowering import dependence and freight exposure. Industry clusters in coastal China reduce last-mile logistics costs for both raw materials and finished goods, rapidly converting local gasoline-range olefins into high-purity linear alkyl benzene.

Europe registers modest volume growth but plays a pivotal role in setting best-practice environmental norms. The European Commission's Large Volume Organic Chemicals reference document strengthens effluent and emissions guidelines, accelerating Detal retrofits across legacy plants. Producers in Spain and Belgium have already completed capacity upgrades that boost high-purity yields while trimming energy intensity. Consumer brands headquartered in the region adopt cradle-to-gate life-cycle assessments, solidifying procurement preferences for Detal-produced surfactants.

North America benefits from ample shale-derived feedstock streams that offer structurally low benzene and paraffin costs. Competitive pressure nevertheless mounts as HF compliance costs climb, prompting debate over capital redeployment toward Detal lines. Gulf Coast producers weigh the merits of downstream LAS integration to capture additional value and mitigate volatility at the intermediate stage. Regulatory visibility provided by the U.S. Inflation Reduction Act paves the way for carbon-credit monetization of energy-efficient retrofits. Collectively, these factors produce a steady but strategically significant contribution to the linear alkyl benzene market.

- CNPC (Fushun Petrochemical)

- Egyptian Petrochemicals Holding Company (ECHEM)

- Farabi Petrochemicals Company

- Formosan Union Chemical Corp.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited

- ISU Chemical

- JINTUNG Petrochemical Co., Ltd

- Kinef

- Moeve

- NIRMA

- PT Unggul Indah Cahaya Tbk

- QatarEnergy

- Reliance industries Limited

- S.B.K HOLDING

- Sasol

- Tamilnadu Petroproducts Limited

- Thai Oil Public Company Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising detergent penetration in emerging economies

- 4.2.2 Regulatory push for biodegradable LAS surfactants

- 4.2.3 Post-COVID hygiene and cleaning intensity

- 4.2.4 Detal-2 retrofits cutting LAB carbon footprint

- 4.2.5 LAB use in EV coolant additive packages

- 4.3 Market Restraints

- 4.3.1 Feedstock (benzene and paraffin) price volatility

- 4.3.2 HF-route environmental compliance costs

- 4.3.3 ASEAN shift to palm-based MES detergents

- 4.4 Value Chain Analysis

- 4.5 Price Overview

- 4.6 Trade Analysis

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Surfactant

- 5.1.2 Other Applications

- 5.2 By End-User Industry

- 5.2.1 Laundry Detergents

- 5.2.2 Light-Duty Dishwashing Liquids

- 5.2.3 Industrial Cleaners

- 5.2.4 Household Cleaners

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CNPC (Fushun Petrochemical)

- 6.4.2 Egyptian Petrochemicals Holding Company (ECHEM)

- 6.4.3 Farabi Petrochemicals Company

- 6.4.4 Formosan Union Chemical Corp.

- 6.4.5 Indian Oil Corporation Ltd

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 ISU Chemical

- 6.4.8 JINTUNG Petrochemical Co., Ltd

- 6.4.9 Kinef

- 6.4.10 Moeve

- 6.4.11 NIRMA

- 6.4.12 PT Unggul Indah Cahaya Tbk

- 6.4.13 QatarEnergy

- 6.4.14 Reliance industries Limited

- 6.4.15 S.B.K HOLDING

- 6.4.16 Sasol

- 6.4.17 Tamilnadu Petroproducts Limited

- 6.4.18 Thai Oil Public Company Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment