|

시장보고서

상품코드

1686221

농업 테스트 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Agricultural Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

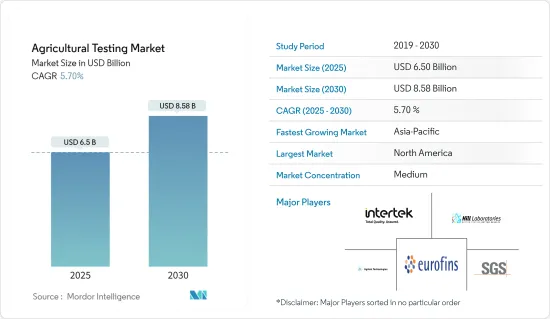

농업 테스트 시장 규모는 2025년에 65억 달러로 추정되고, 2030년에는 85억 8,000만 달러에 달할 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 5.7%를 나타낼 전망입니다.

주요 하이라이트

- 농업 테스트에는 물, 토양, 종자 등의 샘플을 테스트하여 품질과 오염 물질의 수준을 평가하는 작업이 포함됩니다. 이 산업은 특히 전 세계의 선진 지역과 상업화된 지역에서 상당한 성장을 경험하고 있습니다. 환경 안전을 보장하고 농업 생산성을 향상시키기 위한 규제와 법률이 시장의 확장을 주도하고 있습니다.

- 향후 몇 년 동안 농업 테스트 시장은 농산물에 대한 수요 증가로 인한 생산량 증가와 정기적인 토양 테스트의 필요성에 힘입어 강하게 반등할 것으로 예상됩니다. 또한 소비자 선호도가 식품 안전과 품질, 특히 잔류 화학물질에 대한 높은 기준으로 변화하고 있습니다. 이로 인해 고품질 생산을 위해 토양의 특성을 유지해야 할 필요성이 커지고 있으며, 이는 시장 성장에 힘을 실어주고 있습니다.

- 세계화로 인해 곡물과 유지 종자의 무역을 촉진하기 위해 표준화된 평가 기술이 필요해졌습니다. 이에 따라 수출업체와 수입업체는 글로벌 품질 및 안전 표준 준수를 입증하기 위해 분석 인증서를 요청하고 있습니다. 이로 인해 특히 농산물 수출이 많은 지역에서 농업 생산물과 관련된 시험 서비스에 대한 수요가 증가했습니다. 예를 들어 중국의 현미 수출액은 2020년 1억 6,886만 7,000달러에서 2022년 2억 1,184만 7,000달러로 크게 증가했습니다. 그러나 수출업체들은 곡물의 높은 수분 함량으로 인한 곰팡이 발생으로 인해 어려움을 겪고 있습니다. 곰팡이 성장의 높은 독성으로 인해 허용 독성 수준에 대한 엄격한 규제로 인해 세계 시장에서 현미에 대한 거부감이 커지고 있습니다.

- 농업 테스트시장은 북미가 주도하고 있습니다. 이는 식품 안전, 환경, 농업, 영양 성분, 화학 물질 및 라벨링과 관련된 이 지역의 엄격한 규제에 기인합니다. 이 지역에 수많은 농업 테스트 서비스 제공업체가 존재한다는 점도 시장 성장에 기여하고 있습니다.

농업 테스트시장 동향

농업 테스트 및 환경 안전 관련 규정 및 법률

농업 테스트 및 환경 안전에 관한 규제와 법률은 시장 성장의 주요 동력이었습니다. 농업 및 식품 안전 문제를 해결하기 위한 정부의 이니셔티브가 시장 확대를 촉진했습니다. 예를 들어, 미국 식품의약국(FDA)은 최근 관개수의 유해 오염 물질이 식중독을 유발하는 것을 방지하여 식품 안전을 강화하기 위해 FDA 식품 안전 현대화법(FSMA) 농산물 안전 규칙의 개정을 제안했습니다. 제안된 가이드라인에 따라 해당 농장은 최소 1년에 한 번, 그리고 변경 사항이 발생할 때마다 수확 전 농업용수 평가를 의무적으로 실시하여 오염 위험을 줄여야 합니다. 이러한 규정 변경은 농부에게 더 큰 유연성을 제공하는 동시에 소비자에게는 제품 안전을 보장하는 것을 목표로 합니다.

샘플 테스트는 농산물의 수출 성장을 지속하기 위해 농업 선진국에서 인기를 얻고 있습니다. 종자 및 토양 테스트 역시 국제종자검정협회(ISTA)가 절차를 표준화하고 종자 거래를 현대화하는 데 중요한 역할을 하면서 채택이 증가하고 있습니다.

2022년 4월, 캐나다 정부는 캐나다 수출에 대한 식물 위생 인증을 지원하기 위해 기업이 종자, 곡물 및 곡물 제품 배치에서 샘플을 수집하여 제공할 수 있는 캐나다 곡물 샘플링 프로그램(CGSP)을 시작했습니다. 이 정책은 캐나다 식품테스트청(CFIA)이 CGSP에 참여하는 기업을 승인하는 데 사용하는 지침을 명시합니다. 또한 이 정책에는 샘플을 수집하고 CFIA에 제출하기 위해 수행해야 하는 단계가 자세히 설명되어 있습니다.

또한 2024년 영국 정부는 공인 무역 테스트관(ATI)의 곡물 샘플링 및 테스트 절차를 포함하여 잉글랜드와 웨일즈에서 인증이 필요한 비EU로 벌크 곡물을 수출하기 위한 식물 위생 인증서 발급을 위한 곡물 표준 운영 프로토콜(GSOP)을 업데이트했습니다. 글로벌 공급망 전반에 걸쳐 안전과 품질을 보장하기 위한 테스트 프로토콜을 시행하는 정부의 의무로 인해 농산물 테스트 시장은 큰 변화를 겪고 있습니다. 이러한 지침은 오염을 방지하기 위해 모든 단계에서 세심한 절차를 요구하기 때문에 전 세계적으로 농산물 테스트에 대한 수요가 증가하고 있습니다.

북미가 시장을 독점할 전망

북미는 전 세계에서 가장 큰 농업 테스트 시장이며, 미국은 종자 테스트에 대한 지속적인 수요로 인해 매력적인 시장입니다. 이러한 수요는 미국에서 종자 인증에 대한 필요성에 의해 주도되고 있습니다. 종자 규제 및 테스트 부서(SRTD)는 농업 종자를 테스트하고, 종자의 효율적이고 질서 있는 마케팅을 보장하며, 시장의 성장을 지원하는 데 중요한 역할을 하고 있습니다. 또한 식품 안전 이니셔티브에 중점을 두고 있습니다. 예를 들어, 미국 질병통제예방센터(CDC)는 매년 4,800만 명의 사람들이 식중독으로 인해 병에 걸리는 것으로 추정하고 있습니다. 이를 해결하기 위해 연방곡물테스트국에서는 '더 스마트한 식품 안전 청사진' 계획의 일환으로 테스트 방법론을 표준화하고, 테스트 및 실험실 서비스를 평가하며, 최종 사용 품질 속성을 향상시키기 위한 새로운 테스트 및 분석 방법을 개발하고 있습니다.다.

캐나다의 농업 부문은 기술 발전, 정책 변화, 소비자 선호도 변화로 인해 상당한 변화를 겪고 있으며, 고품질, 안전, 영양적으로 일관된 농산물에 대한 수요 증가를 충족하기 위해 농산물 마케팅에 대한 투자가 증가하고 있습니다. 이러한 수요 증가로 인해 엄격한 테스트 프로토콜이 필요해졌고, 국내 테스트 시장이 더욱 성장했습니다. 또한 영국의 워버턴스(Warburtons)와 같은 기업이 캐나다 밀 생산업체와 계약을 체결하여 맞춤형 사양의 필요성을 강조하는 등 농업 분야의 특정 요구사항에 대한 추세가 두드러지고 있습니다. 2023년 수확 샘플 프로그램에는 2022년의 256개 샘플에 비해 379개의 유지종자형 대두 샘플이 접수되어 테스트에 대한 중요성이 점점 더 강조되고 있음을 알 수 있습니다.

이러한 개선된 테스트 표준은 북미의 농업 부문의 명성을 높이고 수출 증대를 위한 기반을 마련하여 국제 품질 및 안전 표준을 충족하는 테스트 서비스에 대한 필요성이 더욱 커지고 있습니다.

농업 테스트 산업 개요

세계의 농업 테스트시장은 단편화되고 있으며, 수많은 정부 운영 실험실에서 전 세계 농부들에게 다양한 농업 테스트 서비스를 제공하고 있습니다. Eurofins Scientific, RJ Hill Laboratories Ltd, Agilent Technologies Inc., SGS SA, Intertek 등이 선도 기업입니다. 기업들은 장비 품질과 홍보를 기반으로 농업 테스트 시장에서 경쟁하고 있으며, 시장에서 더 큰 점유율을 차지하기 위한 전략적 움직임에 집중하고 있습니다. 새로운 서비스, 파트너십, 인수는 시장을 선도하는 기업들이 채택한 주요 전략입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력도 - Porter's Five Forces 분석

- 구매자, 소비자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 샘플

- 수질 테스트

- 토양 테스트

- 종자 테스트

- 바이오 솔리드 테스트

- 분뇨 테스트

- 기타 샘플

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 호주

- 일본

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- Eurofins Scientific

- Intertek

- SGS SA

- Bureau Veritas SA

- Merieux NutriSciences Corporation

- Temasek Holdings(Element Materials Technology)

- TUV Nord Group

- Agilent Technologies Inc.

- EMD Millipore Corporation

- BioMerieux SA

- RJ Hill Laboratories Limited

제7장 시장 기회와 앞으로의 동향

HBR 25.04.04The Agricultural Testing Market size is estimated at USD 6.50 billion in 2025, and is expected to reach USD 8.58 billion by 2030, at a CAGR of 5.7% during the forecast period (2025-2030).

Key Highlights

- Agricultural testing involves the examination of samples such as water, soil, and seeds to assess their quality and levels of contaminants. This industry is experiencing significant growth, particularly in developed areas and commercialized regions across the world. Regulations and laws largely drive the market's expansion to ensure environmental safety and improve agricultural productivity.

- Over the next few years, the agricultural testing market is anticipated to rebound strongly, driven by increased demand for farm products, leading to higher production and the need for regular soil testing. Additionally, there is a shift in consumer preferences toward higher standards of food safety and quality, particularly about chemical residues. This is creating a greater need to maintain soil properties for quality production, thus bolstering the market's growth.

- Globalization has necessitated standardized assessment techniques to facilitate the trade of grains and oilseeds. Consequently, exporters and importers are requesting analysis certificates to demonstrate compliance with global quality and safety standards. This has led to an increased demand for testing services related to agricultural outputs, particularly in regions with high agricultural exports. For instance, China saw a significant increase in the value of its brown rice exports from USD 168,867 thousand in 2020 to USD 211,847 thousand in 2022. However, exporters are facing challenges due to mold growth caused by high moisture levels in the grains. The high toxicity of the fungal growth has led to the rejection of brown rice in global markets due to stringent regulations on permissible toxicity levels.

- The agricultural testing market is currently dominated by North America. This is attributed to the region's stringent regulations related to food safety, environment, agriculture, nutritional content, chemicals, and labeling. The presence of numerous agricultural testing service providers in the region is contributing to the market's growth.

Agricultural Testing Market Trends

Regulations and Legislations Pertaining to Agriculture Testing and Environmental Safety

Regulations and legislation concerning agricultural testing and environmental safety have been key drivers for the market's growth. Government initiatives to address agricultural and food safety have propelled market expansion. For instance, the Food and Drug Administration (FDA) recently proposed revisions to the FDA Food Safety Modernization Act (FSMA) Produce Safety Rule to enhance food safety by preventing harmful contaminants in irrigation water from causing foodborne illnesses. Under the proposed guidelines, covered farms would be mandated to conduct pre-harvest agricultural water assessments at least once annually and whenever changes occur, thereby reducing the risk of contamination. These regulatory changes aim to provide farmers with greater flexibility while ensuring product safety for consumers.

Sample testing has gained popularity in commercialized agriculture countries to sustain the export growth of agricultural commodities. Seed and soil testing have also seen increased adoption, with the International Seed Testing Association (ISTA) playing a crucial role in standardizing procedures and modernizing the seed trade.

In April 2022, the Canadian government initiated the Canadian Grain Sampling Program (CGSP), allowing companies to gather and deliver samples from batches of seed, grain, and grain products to assist with phytosanitary certification for exports from Canada. This policy sets out the guidelines that the Canadian Food Inspection Agency (CFIA) uses to approve companies participating in the CGSP. Furthermore, this policy details the steps that need to be taken for the collection and submission of samples to the CFIA.

Moreover, in 2024, the UK government updated the grain standard operating protocol (GSOP) for the issue of phytosanitary certificates for the export of bulk grain from England and Wales to non-EU requiring certification, including the procedures for sampling and inspection of grain by authorized trade inspectors (ATI). The agricultural testing market is experiencing a major shift as government mandates enforce testing protocols to ensure safety and quality throughout the global supply chain. These guidelines necessitate meticulous procedures at every stage to prevent contamination, thereby driving the demand for agricultural testing across the world.

North America is Expected to Dominate the Market

North America is the largest market for agricultural testing globally, with the United States being an attractive market due to the ongoing demand for seed testing. This demand is driven by the need for certifications for seeds in the United States. The Seed Regulatory and Testing Division (SRTD) plays a crucial role in testing agricultural seeds, ensuring the efficient and orderly marketing of seeds, and supporting the growth of the market. Furthermore, there is a significant emphasis on food safety initiatives. For instance, the United States Centers for Disease Control and Prevention (CDC) estimated that 48 million people get sick every year from a foodborne illness. To address this, the Federal Grain Inspection Service is standardizing testing methodologies, evaluating testing and laboratory services, and developing new testing and analytical methods to enhance end-use quality attributes as part of the Smarter Food Safety Blueprint plan.

In Canada, the agriculture sector has been undergoing significant changes due to technological advancements, policy changes, and evolving consumer preferences, with increased investments in the marketing of agriculture products to meet the increasing demand for high-quality, safe, and nutritionally consistent output. This increased demand has necessitated rigorous testing protocols, further driving the market for testing in the country. Additionally, the trend toward specific requirements in the agriculture sector is exemplified by companies such as Warburtons in the United Kingdom establishing contracts with Canadian wheat producers, emphasizing the growing need for tailored specifications. In 2023, the Harvest Sample Program received 379 samples of oilseed-type soybean, compared to 256 samples in 2022, highlighting the growing emphasis on testing.

These improved testing standards enhance the reputation of the North American agriculture sector and pave the way for increased exports, leading to a greater need for testing services to meet international quality and safety standards.

Agriculture Testing Industry Overview

The global agricultural testing market is fragmented, with numerous government-operated laboratories providing various agricultural testing services to farmers worldwide. Eurofins Scientific, R J Hill Laboratories Ltd, Agilent Technologies Inc., SGS SA, and Intertek are some of the major players. Companies compete in the agricultural testing market based on equipment quality and promotion and focus on strategic moves to hold larger shares in the market. New services, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sample

- 5.1.1 Water Testing

- 5.1.2 Soil Testing

- 5.1.3 Seed Testing

- 5.1.4 Bio-solids Testing

- 5.1.5 Manure Testing

- 5.1.6 Other Samples

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Eurofins Scientific

- 6.3.2 Intertek

- 6.3.3 SGS SA

- 6.3.4 Bureau Veritas SA

- 6.3.5 Merieux NutriSciences Corporation

- 6.3.6 Temasek Holdings (Element Materials Technology)

- 6.3.7 TUV Nord Group

- 6.3.8 Agilent Technologies Inc.

- 6.3.9 EMD Millipore Corporation

- 6.3.10 BioMerieux SA

- 6.3.11 R J Hill Laboratories Limited