|

시장보고서

상품코드

1849995

홈 케어 패키징 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

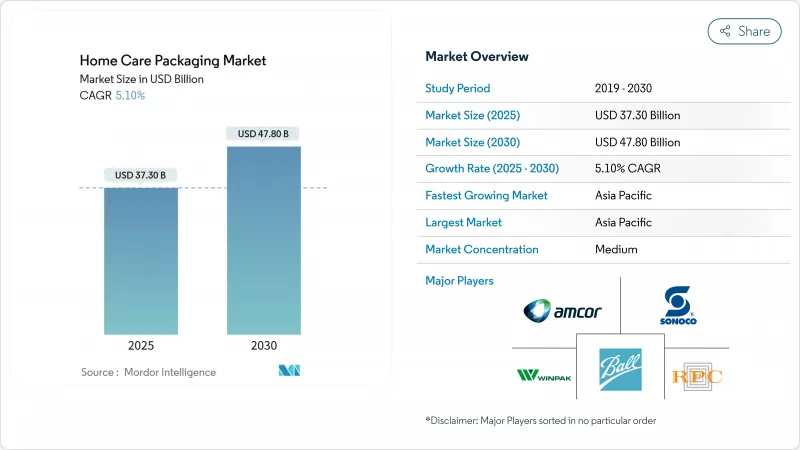

홈케어 패키징 시장은 2025년에 373억 달러로 평가되었고, 2030년에 478억 달러로 확대될 것으로 예측되며, CAGR은 5.10%를 나타낼 전망입니다.

이러한 확장은 위생 제품에 대한 꾸준한 수요, 전자상거래 보급률 확대, 지속 가능한 솔루션에 대한 정책 지원이 반영된 결과입니다. 2025년 2월부터 시행되는 유럽연합의 '포장 및 포장 폐기물 규정'은 2030년까지 모든 포장재의 재활용을 의무화함으로써 성장 동력을 강화하고 있습니다. 특히 폴리에틸렌과 폴리프로필렌을 중심으로 한 원자재 가격 변동은 비용 변동성을 가중시키지만, 경량화와 바이오 기반 혁신을 촉진하고 있습니다. 아시아태평양 지역은 도시화와 가처분 소득 증가로 우위를 유지하는 반면, 중동은 경제 다각화를 배경으로 가장 빠른 지역 성장을 기록하고 있습니다. Amcor의 Berry Global 인수(84억 달러 규모)로 대표되는 기업 통합은 원자재 가격 상승과 다가오는 생산자 책임 확대(EPR) 비용에 대응하기 위한 규모의 경제 추구를 시사합니다.

세계의 홈케어 패키징 시장 동향 및 인사이트

고급화 추세와 브랜드 주도 SKU 확대

고급 세정 제품 수요가 기능적 용기 이상의 포장 혁신을 주도합니다. 브랜드들은 고급 가격대를 정당화하기 위해 첨단 차단 기술, 스마트 캡, 독특한 디자인을 도입합니다. 2024년 출시된 타이드 에보 파이버 타일은 플라스틱 대신 용해성 6중 섬유 구조를 적용해 프리미엄 소비자층을 겨냥합니다. 2027년까지 470억 달러에 달할 것으로 예상되는 중동 지역 뷰티 시장 지출은 홈케어 패키징에 대한 유사한 기대감을 부추깁니다. 실건(Silgan)의 2024년 4분기 매출이 6억 3,940만 달러로 급증한 사례에서 알 수 있듯, 디스펜싱 및 특수 캡 제조업체들이 수혜를 입습니다. 프리미엄화는 동시에 소형화되고 디자인이 풍부한 포맷을 촉진하며 수지 원가 변동에 대한 마진 회복탄력성을 높입니다. 이 트렌드는 선진국과 신흥 시장을 가로지르며 홈케어 패키징 시장의 진열대 경쟁 구도를 재편하고 있습니다.

재활용 가능한 단일 소재 포장재에 대한 순환경제 의무화

규제 기관들은 단순한 재활용이 가능한 디자인으로 생산자들을 유도하고 있습니다. EU의 PPWR(플라스틱 제품 규정)은 2030년까지 100% 재활용 가능성과 일회용 플라스틱 음료 병의 30% 재활용 소재 함량을 규정하여 단일 소재 구조로의 전환을 촉진하고 있습니다. 유니레버의 종이 기반 세제 병은 기업 R&D가 다가오는 할당량과 어떻게 부합하는지 보여줍니다. 현재 63개국이 공식적인 생산자 책임 재활용(EPR) 제도를 운영하며, 폐기물 처리 비용을 지자체에서 생산자로 이전하고 재활용을 고려한 설계 방식을 보상합니다. 단일 소재 필름에 포지셔닝된 변환업체는 가격 결정력을 확보하는 반면, 다층 차단재 공급업체는 설비를 재구축하거나 주문량 감소를 감수해야 합니다. 장기적으로 규정 준수 투자는 홈케어 패키징 시장 전반의 안정적 성장 궤도를 뒷받침할 것으로 전망됩니다.

석유화학 수지 가격 변동성

폴리에틸렌(PE)과 폴리프로필렌(PP) 가격 변동은 가공업체 마진을 압박하고 가격 전략을 복잡하게 만듭니다. PE는 2024-2025년 생산 중단과 원료 가격 급등으로 파운드당 5센트(¢/lb) 수준의 여러 차례 가격 인상이 발생했습니다. 열대성 폭풍 알베르토로 공급이 차질을 빚으면서 PET 가격은 1.1% 급등했습니다. 소규모 변환업체들은 헤징 도구가 부족해 홈케어 패키징 시장에서 원가 전가나 마진 침식을 감수해야 합니다. 가격 변동성은 경량화 및 대체 소재에 대한 관심을 가속화합니다. 생물 기반 또는 재활용 원료로 빠르게 전환할 수 있는 변환업체들은 화석 연료 가격 변동에 대한 완충 역할을 할 수 있습니다.

부문 분석

플라스틱은 2024년 홈케어 패키징 시장 점유율의 63.00%를 차지하며 비용 효율적이고 차단 기능이 우수한 응용 분야에서 확고한 위치를 재확인했습니다. 해당 부문은 성숙한 공급망과 다용도 가공 기술을 지속적으로 활용하고 있습니다. 그러나 바이오플라스틱은 12.10%의 연평균 복합 성장률(CAGR)로 성장하며, 규제 기관과 브랜드가 재생 가능 원료를 우선시함에 따라 디자인 논의에서 점차 주도권을 장악하고 있습니다.

종이와 판지는 높은 재활용률과 낮은 탄소 발자국으로 재조명받고 있으나, 무게와 습기 민감성으로 인해 주류 액체 세제 시장 진입에는 한계가 있습니다. 금속은 가압 에어로졸 분야에서 틈새 시장을 유지하고 있으며, 유리는 전자상거래에서 파손 위험으로 인해 사용이 제한적입니다. 바이오플라스틱의 성장세는 PLA 및 PHA 수지 투자로 이어지고 있으며, 가공업체들은 산소 차단 요구사항을 충족하는 단일 소재 필름을 시험 중입니다. 재활용 함량 의무화가 강화됨에 따라 PCR(소비 후 재생 플라스틱)과 바이오 기반 원료의 호환성 블렌드는 홈케어 패키징 시장의 공급 안정성과 비용 경쟁력을 강화할 수 있습니다.

2024년 홈케어 패키징 시장 규모에서 병 및 경질 용기가 47.00%를 차지했으며, 이는 기존 생산 라인과 소비자의 전통적 포맷에 대한 친숙도를 반영합니다. 경량 HDPE 및 PET 병은 우수한 낙하 충격 저항성과 브랜드 광고 효과로 여전히 널리 사용됩니다. 그러나 9.90%의 연평균 성장률(CAGR)로 확장 중인 리필 파우치와 디스펜싱 시스템은 소재 절감과 순환형 편의성을 통해 가치 제안을 재정의하고 있습니다. 아프타(Aptar)의 피부화장품용 재활용 가능 에어리스 병과 B-CAP의 친환경 도징 캡은 혁신이 기존 포맷조차 현대화하는 방식을 보여줍니다.

파우치는 물류 효율성을 제공하여 화물 중량과 부피를 줄여 전자상거래 수익성에 핵심적입니다. 재사용 가능한 디스펜서와 경량 리필 봉지를 결합하면 수명 주기 배출량을 줄여 EPR(생산자 책임 재활용) 요금 체계와 부합합니다. 한편 금속 캔과 스틱 팩은 특정 전달 방식이 필요한 특수 세정제 분야에서 역할을 유지합니다. 모든 유형에 걸쳐 변환업체들은 재활용 지침을 위한 QR 코드를 통합하여 소비자의 순환 체계 참여를 용이하게 하고, 홈케어 패키징 시장의 미래 성장을 뒷받침하는 준수 지표를 높이는 것을 목표로 합니다.

홈케어 패키징 시장 보고서에서는 업계를 소재(플라스틱, 종이 등), 포장 유형(병 및 경질 용기, 파우치 및 가방 등), 제품 카테고리(식기세척, 살충제 등), 형태(액체, 분말 등), 지역으로 분류하고 있습니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

아시아태평양 지역은 2024년 홈케어 패키징 시장 점유율 38.70%로 우위를 점했으며, 이는 중국, 인도 및 동남아시아의 급속한 도시화, 전자상거래 성장 및 중산층 확장을 반영합니다. 중국의 재활용 식품 접촉용 플라스틱에 대한 향후 규정은 지역적으로 새로운 규정 준수 기준을 설정할 것입니다. 일본의 고령화 사회는 소규모 가구에 적합한 손쉬운 개봉 포장 및 1회용 세제 수요를 촉진합니다. 지역 포장 기계에 대한 투자는 2024년까지 180억 달러를 넘어설 것으로 예상되어 변환업체의 규모 확대를 뒷받침할 것입니다.

중동은 걸프협력회의(GCC) 시장의 프리미엄화로 지원되어 2030년까지 연평균 성장률(CAGR) 7.80%로 가장 빠르게 성장하는 지역입니다. 고급 홈케어 패키징 수요로 이어지는 지역 미용 및 개인 위생 제품 지출은 2027년까지 470억 달러에 달할 전망입니다. 고온 기후는 차단 기능 강화와 자외선 안정성 안료 사용을 요구하며, 이는 공급업체 사양을 형성합니다. 사우디아라비아가 GCC 의약품 판매의 34.6%를 차지하는 점은 위생적 1차 포장재에 대한 병행 기회를 시사합니다.

북미와 유럽은 여전히 핵심 시장이지만 강화되는 규제 그물망에 직면해 있습니다. EU의 PPWR(플라스틱 포장재 규정)만으로도 글로벌 브랜드 소유자들의 재설계 예산을 주도하고 있습니다. 한편 오리건주와 콜로라도주는 2025년 7월까지 EPR(생산자 책임 재활용) 제도를 도입해 생산자 부담 재활용 모델을 확대할 예정입니다. 라틴 아메리카는 신흥 시장으로서의 가능성을 보여주고 있습니다. 원자재 비용 상승으로 2025년 종이 포장재 가격이 상승할 전망이며, 이는 시장 성숙도를 시사합니다. 지역별 규제와 소비자 행동이 복합적으로 작용하며 홈케어 패키징 시장의 성장 경로는 지역별로 미묘한 차이를 보입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고급화 추세와 브랜드 주도 SKU 확대

- 재활용 가능한 단일 소재 포장재에 대한 순환경제 의무화

- 전자상거래 붐으로 인한 파손 방지 포장 수요 증가

- 아시아 도시 가구의 1회용 편의 포장 선호

- IoT 기반 스마트 디스펜서 및 리필 생태계

- 시장 성장 억제요인

- 석유화학수지 가격 변동

- 유럽의 생산자 책임 확대(EPR) 비용

- 브랜드 약속을 위한 식품 등급 PCR 수지 부족

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측(가치 기준)

- 소재별

- 플라스틱

- 종이 및 판지

- 금속

- 유리

- 바이오플라스틱

- 패키징 유형별

- 병 및 경질 용기

- 파우치와 가방

- 판지 및 골판지 상자

- 금속캔 및 에어로졸

- 리필용파우치 및 디스펜싱 시스템

- 스틱팩 및 사쉐

- 제품 카테고리별

- 세탁 케어

- 식기 세척

- 표면 및 화장실 클리너

- 공기 관리

- 살충제

- 광택제 및 특수 클리너

- 형태별

- 액체

- 분말

- 캡슐/탭

- 겔

- 스프레이/폼

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 중동

- 이스라엘

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Amcor plc

- Ball Corporation

- RPC Group(Berry Global)

- Winpak Ltd

- Aptar Group Inc.

- Sonoco Products Company

- Silgan Holdings

- Constantia Flexibles GmbH

- DS Smith plc

- Can-Pack SA

- ProAmpac LLC

- Berry Global Group

- Mondi plc

- Huhtamaki Oyj

- Smurfit Kappa Group

- Sealed Air Corp.

- WestRock Company

- Albea Group

- Gerresheimer AG

- Tetra Pak

제7장 시장 기회와 장래의 전망

HBR 25.11.14The home care packaging market reached USD 37.3 billion in 2025 and is forecast to advance to USD 47.8 billion by 2030, translating into a 5.10% CAGR.

This expansion reflects steady demand for hygiene products, widening e-commerce penetration, and policy support for sustainable solutions. Momentum is reinforced by the European Union's Packaging and Packaging Waste Regulation, effective February 2025, which requires all packs to be recyclable by 2030. Material-price swings, especially in polyethylene and polypropylene, add cost volatility yet stimulate lightweighting and bio-based innovation. Asia-Pacific retains dominance thanks to urbanisation and rising disposable incomes, while the Middle East posts the quickest regional growth on the back of economic diversification. Corporate consolidation-illustrated by Amcor's USD 8.4 billion takeover of Berry Global-signals a push for scale as producers tackle raw-material inflation and looming Extended Producer Responsibility (EPR) fees.

Global Home Care Packaging Market Trends and Insights

Rising Premiumisation and Brand-Led SKU Proliferation

Demand for upscale cleaning products drives packaging innovation beyond functional containment. Brands deploy advanced barriers, smart closures, and distinctive aesthetics to justify higher price points. Tide evo fibre tiles, launched in 2024, replace plastic with a dissolvable six-layer fibre structure and target premium shoppers. Middle East beauty spending, set to hit USD 47 billion by 2027, fuels similar expectations for home-care packs. Manufacturers of dispensing and specialty closures benefit, as evidenced by Silgan's Q4 2024 sales jump to USD 639.4 million. Premiumisation simultaneously promotes smaller, design-rich formats and boosts margin resilience against resin cost swings. The trend cuts across developed and emerging markets, reshaping shelf competition within the home care packaging market.

Circular-Economy Mandates for Recyclable Mono-Material Packs

Regulators push producers toward designs that enable straightforward recycling. The EU's PPWR stipulates 100% recyclability by 2030 and 30% recycled content for single-use plastic beverage bottles, compelling shifts to mono-material structures. Unilever's paper-based detergent bottle underscores how corporate R&D aligns with looming quotas. Sixty-three countries now run formal EPR schemes, moving disposal costs from municipalities to producers and rewarding design-for-recycling approaches. Converters positioned in mono-material films gain pricing power, whereas multi-layer barrier suppliers must retool or face declining order books. Over the long term, compliance investments are expected to stabilise and support the broader home care packaging market trajectory.

Petro-chemical Resin Price Volatility

Fluctuating polyethylene and polypropylene prices compress converter margins and complicate pricing strategy. PE registered several 5 ¢/lb hikes in 2024 - 2025 due to outages and feedstock spikes. PET saw a 1.1% jump after Tropical Storm Alberto disrupted supply. Smaller converters lack hedging tools, forcing cost-pass through or margin erosion in the home care packaging market. Volatility accelerates interest in lightweighting and alternative substrates. Converters able to shift to bio-based or recycled inputs faster can cushion against fossil-fuel price swings.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Boom Accelerating Demand for Shatter-Proof Formats

- Urban Asian Households Favouring Single-Dose Convenience Packs

- Extended-Producer-Responsibility Fees in Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics captured 63.00% of the home care packaging market share in 2024, underlining their entrenched role in cost-effective, barrier-rich applications. The segment continues to leverage mature supply chains and versatile processing techniques. However, bioplastics, propelled by a 12.10% CAGR, increasingly command design conversations as regulators and brands prioritise renewable feedstocks.

Paper and paperboard regain relevance through high recycling rates and lower carbon footprints, yet weight and moisture sensitivity keep them from mainstream liquid detergents. Metal retains niche importance in pressurised aerosols, and glass sees marginal use due to breakage risks in e-commerce. Bioplastics' momentum spurs investment in PLA and PHA resins, with converters trialling mono-material films that still meet oxygen-barrier demands. As recycled-content mandates tighten, compatibilised blends of PCR and bio-based inputs can bolster supply stability and cost competitiveness for the home care packaging market.

Bottles and rigid containers accounted for 47.00% of the home care packaging market size in 2024, reflecting legacy production lines and consumer familiarity with traditional formats. Lightweight HDPE and PET bottles remain prevalent thanks to excellent drop-impact resistance and brand-billboard capability. Yet refill pouches and dispensing systems, expanding at a 9.90% CAGR, are redefining value propositions through material savings and circular-loop convenience. Aptar's recyclable airless bottle for dermocosmetics and B-CAP's eco dosing cap demonstrate how innovation modernises even established formats.

Pouches deliver logistics efficiencies, shaving freight weight and cubic volume, crucial for e-commerce profitability. Reusable dispensers coupled with lightweight refill sachets reduce life-cycle emissions, resonating with EPR fee structures. Meanwhile, metal cans and stick packs maintain roles in specialty cleaners requiring specific delivery modes. Across all types, converters integrate QR codes for recycling instructions, aiming to ease consumer participation in circular schemes and boost compliance metrics that underpin the future growth of the home care packaging market.

Home Care Packaging Market Report Segments the Industry Into Material (Plastic, Paper and More), Packaging Type (Bottles and Rigid Containers, Pouches and Bags and More), Product Category (Dishwashing, Insecticides and More), Form Factor(Liquids, Powders and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 38.70% home care packaging market share in 2024, reflecting rapid urbanisation, e-commerce growth, and middle-class expansion in China, India, and Southeast Asia. China's forthcoming rules for recycled food-contact plastics will set new compliance benchmarks regionally. Japan's ageing society drives demand for easy-open packs and single-dose detergents suited to smaller households. Investment in regional packaging machinery is forecast to surpass USD 18 billion by 2024, underpinning scale-up for converters.

The Middle East is the fastest-growing territory, with a 7.80% CAGR through 2030, supported by premiumisation in Gulf Cooperation Council markets. Regional beauty and personal-care outlays-from which spillover demand for upscale home-care packs emerges-will hit USD 47 billion by 2027. Hot climates necessitate barrier enhancements and UV-stable pigments, shaping supplier specifications. Saudi Arabia's 34.6% share of GCC pharmaceutical sales highlights parallel opportunities for hygienic primary packs.

North America and Europe remain pivotal yet face tightening regulatory nets. The EU PPWR alone drives redesign budgets for global brand owners. Meanwhile, Oregon and Colorado introduce EPR schemes by July 2025, broadening producer-funded recycling models. Latin America shows emerging promise: higher raw-material costs push paper-pack prices up in 2025, signalling market maturation fastmarkets.com. Collectively, region-specific rules and consumer behaviours maintain nuanced growth paths across the home care packaging market.

- Amcor plc

- Ball Corporation

- RPC Group (Berry Global)

- Winpak Ltd

- Aptar Group Inc.

- Sonoco Products Company

- Silgan Holdings

- Constantia Flexibles GmbH

- DS Smith plc

- Can-Pack SA

- ProAmpac LLC

- Berry Global Group

- Mondi plc

- Huhtamaki Oyj

- Smurfit Kappa Group

- Sealed Air Corp.

- WestRock Company

- Albea Group

- Gerresheimer AG

- Tetra Pak

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising premiumisation and brand-led SKU proliferation

- 4.2.2 Circular-economy mandates for recyclable mono-material packs

- 4.2.3 E-commerce boom accelerating demand for shatter-proof formats

- 4.2.4 Urban Asian households favouring single-dose convenience packs

- 4.2.5 IoT-enabled smart dispensers and refill ecosystems

- 4.3 Market Restraints

- 4.3.1 Petro-chemical resin price volatility

- 4.3.2 Extended-producer-responsibility (EPR) fees in Europe

- 4.3.3 Scarcity of food-grade PCR resin for brand pledges

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Paper and Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Bioplastics

- 5.2 By Packaging Type

- 5.2.1 Bottles and Rigid Containers

- 5.2.2 Pouches and Bags

- 5.2.3 Cartons and Corrugated Boxes

- 5.2.4 Metal Cans and Aerosols

- 5.2.5 Refill Pouches and Dispensing Systems

- 5.2.6 Stick Packs and Sachets

- 5.3 By Product Category

- 5.3.1 Laundry Care

- 5.3.2 Dishwashing

- 5.3.3 Surface and Toilet Cleaners

- 5.3.4 Air Care

- 5.3.5 Insecticides

- 5.3.6 Polishes and Specialty Cleaners

- 5.4 By Form Factor

- 5.4.1 Liquids

- 5.4.2 Powders

- 5.4.3 Capsules/Tabs

- 5.4.4 Gels

- 5.4.5 Sprays/Foams

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Nigeria

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Ball Corporation

- 6.4.3 RPC Group (Berry Global)

- 6.4.4 Winpak Ltd

- 6.4.5 Aptar Group Inc.

- 6.4.6 Sonoco Products Company

- 6.4.7 Silgan Holdings

- 6.4.8 Constantia Flexibles GmbH

- 6.4.9 DS Smith plc

- 6.4.10 Can-Pack SA

- 6.4.11 ProAmpac LLC

- 6.4.12 Berry Global Group

- 6.4.13 Mondi plc

- 6.4.14 Huhtamaki Oyj

- 6.4.15 Smurfit Kappa Group

- 6.4.16 Sealed Air Corp.

- 6.4.17 WestRock Company

- 6.4.18 Albea Group

- 6.4.19 Gerresheimer AG

- 6.4.20 Tetra Pak

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment