|

시장보고서

상품코드

1686522

북미의 혈당 모니터링 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)North America Blood Glucose Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

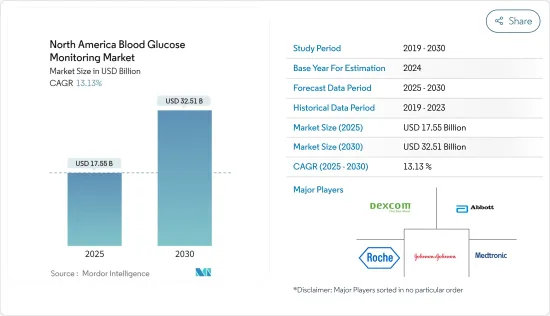

북미의 혈당 모니터링 시장 규모는 2025년에 175억 5,000만 달러, 2030년에는 325억 1,000만 달러에 달할 것으로 예측됩니다. 예측 기간(2025년-2030년) CAGR은 13.13%를 나타낼 전망입니다.

북미에서는 2형 당뇨병 및 기타 당뇨병의 이환율은 COVID-19 환자에서 수치적으로 높습니다. SARS-CoV-2 감염으로부터 회복된 당뇨병력이 없는 사람은 인슐린 저항성과 인슐린 분비 장애가 보고되었습니다. COVID-19 후 증후군의 진단과 치료는 질병 특이적 접근이 아니라 통합적인 접근이 필요하다는 것을 시사합니다.

지난 10년간 세계적으로 당뇨병 인구가 급격히 증가하고 있습니다. 일부 보고서와 조사는 생활양식과 습관 변화에 따른 당뇨병 인구의 급증을 기록하고 있습니다. 당뇨병 인구 증가는 CGM과 같은 혈액 모니터링 장치를 뒷받침합니다. 선진국에서는 1형 당뇨병 환자의 90% 가까이가 글루코미터를 사용하고 있습니다. 예측 기간 동안 2형 당뇨병 환자의 거의 50%가 글루코미터를 사용할 것으로 예상됩니다.

북미는 이 지역에서 당뇨병 유병률이 높고, 좌식 생활 스타일, 신약 발매 등으로 세계 인슐린 치료제 시장을 독점하고 있습니다. 미국은 이 지역에서 비만이 높은 유병률과 당뇨병 치료에 대한 의식이 높아지는 등의 요인으로 인해 예측 기간 동안 현저한 성장이 예상되고 있습니다.

따라서 위의 요인들로부터 예측기간 동안 조사된 시장은 성장을 나타낼 것으로 예상됩니다.

북미의 혈당 모니터링 시장 동향

지속적인 혈당 모니터링은 북미의 혈당 모니터링 시장에서 가장 높은 시장 점유율을 차지합니다.

CGM은 설정된 간격으로 포도당 값을 루틴에 체크하는 종래의 방법보다 혈당의 패턴이나 동향을 보다 상세하게 파악하기 위해서 사용됩니다. 현재 CGM 장치는 데이터를 다운로드하여 혈당 수치의 추세를 후향적으로 표시하거나 수신기 디스플레이를 통해 실시간으로 혈당 수치를 파악할 수 있습니다. 실시간 CGM은 혈당의 적시 관리를 촉진하기 위해 실제 또는 보류중인 혈당 방문 중에 환자, 부모 또는 간병인에게 알릴 수 있습니다. 이러한 사실로 인해 CGM 시장은 예측 기간 동안 안정적인 성장을 보일 것으로 예상됩니다. 손가락을 찔러야 하며 환자는 3-7일마다 피부 아래에 놓인 센서를 교체해야 합니다.

1형 당뇨병 환자의 CGM 사용은 2형 당뇨병 환자에 비해 훨씬 적습니다. G6의 최신 CGM 모델은 많은 기술적 장벽을 극복했습니다. 애봇사가 매월 약 75-150달러(14일간 사용 가능한 센서 2개)의 저가격의 새로운 카테고리 Libre를 발표했습니다.

미국이 북미의 혈당 모니터링 시장을 독점할 것으로 예상됩니다.

미국에서는 지난 20년간 당뇨병의 유병률이 극적으로 증가했지만, 이는 비만 유병률 증가와 라이프스타일 변화로 인한 것입니다.당뇨병은 미국에서 급성장하고 있는 만성 질환 중 하나입니다.

미국에서는 Glooko, OneDrop, Verily, Vacate, Insulet, Noom, Bigfoot Biomedical, Virta Health, Diabeloop, Orgenesis 등 신흥 기업이 혁신을 시장에 투입했습니다. 당뇨병 치료 장비 시장은 운동량 감소, 건강에 해로운 식습관 및 기타 라이프 스타일 요인으로 인한 비만 확산으로 안정적인 성장이 예상되고 있습니다. 염자에게 지속 포도당 모니터링을 사용하는 FDA의 승인을 취득했습니다. 덱스콤은 2020년 4월에 병원에 CGM의 출하를 시작했습니다.

첨단 당뇨병 관리 제품에 대한 사람들의 의식 증가는 향후 북미 당뇨병 관리 장비 시장에 긍정적인 영향을 미칠 수 있습니다.

북미 혈당 모니터링 산업 개요

혈당 모니터링 시장은 매우 세분화되어 있으며 주요 제조업체는 거의 존재하지 않습니다. BGM 장비 시장은 Roche, LifeScan, Arkray, Ascensia 등 보다 일반적인 기업으로 구성되어 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 디바이스

- 자기 혈당 측정 장치

- 글루코미터 기기

- 검사 스트립

- 란셋

- 상용 포도당 모니터링

- 센서

- 내구 소비재

- 자기 혈당 측정 장치

- 최종 사용자

- 병원 및 클리닉

- 가정 및 개인

- 지역

- 미국

- 캐나다

- 기타 북미

제6장 시장 지표

- 1형 당뇨병 인구

- 2형 당뇨병 인구

제7장 경쟁 구도

- 기업 프로파일

- Abbott Diabetes Care

- F. Hoffmann-La Roche AG

- Johnson & Johnson

- Dexcom

- Medtronic

- Arkray

- Ascensia Diabetes Care

- Agamatrix Inc.

- Bionime Corporation

- Acon

- Medisana

- Trivida

- Rossmax

- 기업 점유율 분석

제8장 시장 기회와 앞으로의 동향

SHW 25.04.29The North America Blood Glucose Monitoring Market size is estimated at USD 17.55 billion in 2025, and is expected to reach USD 32.51 billion by 2030, at a CAGR of 13.13% during the forecast period (2025-2030).

In North America, diabetes incidence of Type-2 diabetes and other diabetes forms was numerically higher in individuals with COVID-19. Insulin resistance and impaired insulin secretion have been described in individuals without diabetes history who recovered from SARS-CoV-2 infections. It has been suggested that diagnosis and treatment of post-COVID-19 syndrome require integrated rather than disease-specific approaches.

Over the past decade, there has been a tremendous increase in the diabetic population globally. Several reports and surveys documented a drastic increase in the diabetic population based on the changes in lifestyles and habits. The growing diabetic population drives blood monitoring devices, such as CGM. Nearly 90% of Type-1 diabetic patients in developed countries use a glucometer. Almost 50% of Type-2 patients are expected to use a glucometer during the forecast period.

North America dominates the global insulin therapeutics market due to the high prevalence of diabetes in the region, the sedentary lifestyle, and the launch of new drugs. The United States is expected to grow tremendously during the forecast period, owing to factors such as the high prevalence of obesity and increasing awareness regarding diabetes care in the region.

Therefore, due to the abovementioned factors, the market studied is anticipated to witness growth during the forecast period.

North America Blood Glucose Monitoring Market Trends

Continuous Glucose Monitoring Holds Highest Market Share in the North American Blood Glucose Monitoring Market.

CGMs are used to deliver a more descriptive picture of blood glucose patterns and trends than what may be achieved by traditional routine checking of glucose levels at set intervals. Current CGM devices can either retrospectively display the trends in blood glucose levels by downloading the data or give a real-time picture of glucose levels through receiver displays. Real-time CGMs may alert patients, parents, or caregivers during actual or pending glycemic visits to facilitate the timely management of blood glucose. Due to this factor and the fact that CGM devices are becoming cheaper with the advent of new technologies, like cell phone integration, the CGM market is expected to witness steady growth during the forecast period. Traditional home monitors are not replaced by CGM. To keep the monitor accurate, patients must still check their blood sugar several times per day with a conventional glucose meter. Most monitors still require a finger poke, and every three to seven days, patients should change the sensor placed beneath their skin. Patients who use insulin pumps can connect their CGM system to their insulin pump for continuous monitoring. Patients won't need to manually program the pump, unlike other finger-prick techniques, making it a "sensor-augmented pump."

The use of CGM by Type-1 diabetic patients is much less compared to Type-2 diabetic patients. However, the expenditure incurred by Type-1 diabetic patients on these devices is nearly double that of Type-2 diabetics. The Abbott Freestyle Libre and the Dexcom G6's newest CGM models overcame many technical barriers. However, high costs and uncertainties about their efficacy and necessity kept CGM from being widely used by people with Type-2 diabetes. Moreover, to lower the cost burden of diabetic patients in the United States, Abbott introduced a new, lower-priced category with Libre, at around USD 75 to USD 150 each month (two sensors that last 14 days each). The rise in national awareness of diabetes is anticipated to drive the adoption of SMBGs and CGMs on account of the prognostic and diagnostic treatment of diabetes.

The United States is Expected to Dominate the North American Blood Glucose Monitoring Market.

In the United States, the prevalence of diabetes has increased dramatically in the last two decades, a fact driven by the increased prevalence of obesity and lifestyle changes. Diabetes ranks among the fast-growing chronic diseases in the United States. About 1.75 million US citizens are diagnosed with diabetes every year. The country also has the highest obese population, which is a prominent cause of Type-2 diabetes.

In the United States, innovations by startups like Glooko, OneDrop, Verily, Vacate, Insulet, Noom, Bigfoot Biomedical, Virta Health, Diabeloop, and Orgenesis were launched in the market. The market for diabetes care devices is expected to experience steady growth due to the greater prevalence of obesity, owing to less physical activity, unhealthy food habits, and other lifestyle factors. Abbott and Dexcom received FDA approval to use continuous glucose monitoring in US hospitals for COVID-19-affected people. Dexcom began shipping CGMs to hospitals in April 2020. It aims to make 100,000 sensors for hospitals at low costs. The company plans to donate 10,000 phones and CGM readers to hospitals to scan those sensors.

The growing awareness among people regarding advanced diabetes care products may positively impact the North American diabetes care devices market in the future.

North America Blood Glucose Monitoring Industry Overview

The blood glucose monitoring market is highly fragmented, with few major manufacturers present. The CGM devices market is dominated by a few major players, like Dexcom, Medtronic, Abbott, and Senseonics. The market for BGM devices comprises more generic players like Roche, LifeScan, Arkray, Ascensia, etc. Technological innovations in the recent past have helped companies strengthen their market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Device

- 5.1.1 Self-monitoring Blood Glucose Devices

- 5.1.1.1 Glucometer Devices

- 5.1.1.2 Test Strips

- 5.1.1.3 Lancets

- 5.1.2 Continuous Glucose Monitoring

- 5.1.2.1 Sensors

- 5.1.2.2 Durables

- 5.1.1 Self-monitoring Blood Glucose Devices

- 5.2 End User

- 5.2.1 Hospital/Clinics

- 5.2.2 Home/Personal

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Abbott Diabetes Care

- 7.1.2 F. Hoffmann-La Roche AG

- 7.1.3 Johnson & Johnson

- 7.1.4 Dexcom

- 7.1.5 Medtronic

- 7.1.6 Arkray

- 7.1.7 Ascensia Diabetes Care

- 7.1.8 Agamatrix Inc.

- 7.1.9 Bionime Corporation

- 7.1.10 Acon

- 7.1.11 Medisana

- 7.1.12 Trivida

- 7.1.13 Rossmax

- 7.2 Company Share Analysis