|

시장보고서

상품코드

1877349

혈당 측정기 시장 : 제품 유형별, 용도별, 측정 부위별, 최종 사용자별 예측(-2030년)Blood Glucose Monitor Market by Product Type, Application, Test site, End User - Global Forecast to 2030 |

||||||

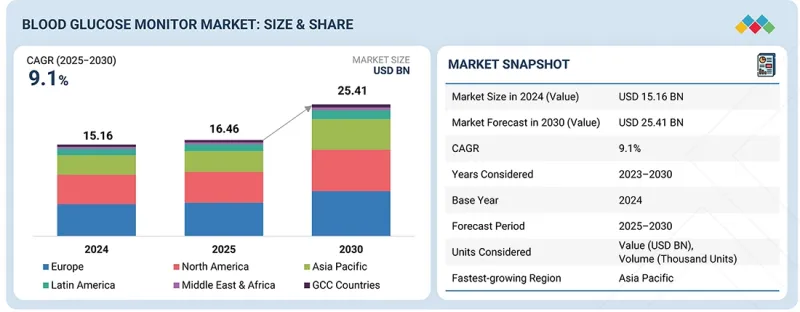

세계의 혈당 측정기 시장 규모는 예측 기간 동안 CAGR 9.1%를 나타내 2025년 165억 달러에서 2030년에는 254억 달러에 이를 것으로 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2023-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제품 유형별, 측정 부위별, 용도별, 최종 사용자별, 지역별 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

혈당 측정기 시장은 인구 역학, 임상적 요인, 기술적 요인에 견인되어 견조한 성장이 예상됩니다. 세계적인 당뇨병 환자 증가, 고령화 사회의 진전, 자기 관리 의식의 고조가 함께 혈당 측정 기기에 대한 수요를 지속적으로 추진하고 있습니다.

연속 혈당 모니터링(CGM), 스마트폰 및 웨어러블 기기와의 연계, AI 기반 데이터 분석 등의 기술적 진보로 정밀도, 편리성, 환자의 관여도가 대폭 향상되어 보급이 가속화되고 있습니다. 게다가 정부의 지원책, 의료 인프라 개선, 재택 모니터링 솔루션에 대한 액세스 확대가 시장 성장에 기여하고 있습니다. 이러한 추세는 앞으로 수년간 선진국과 신흥국 모두에서 견조한 성장을 유지할 것으로 예측됩니다.

제품 유형별로 세계의 혈당 측정기 시장은 주로 4개의 부문으로 분류됩니다(자기 혈당 측정 시스템, 연속 혈당 모니터링 시스템, 전문적인 POC(Point-of-Care) 장치, 비침습적 제품). 이 중 자가혈당 측정(SMBG) 시스템은 특히 집에서 병리학을 관리하는 환자에게 있어서 정확도, 쾌적성, 편리성의 최적의 균형을 실현하고 있기 때문에 가장 높은 보급률을 획득하고 있습니다. 이 장비는 최소한의 불쾌감과 빠르고 안정적인 혈당 측정을 제공하여 지속적인 자체 관리를 촉진합니다. 또한, 마이크로니들 란셋, 소량의 시료 요구, 개선된 테스트 스트립 설계 등의 진보로 사용의 용이성이 향상되었습니다. 스마트폰 앱, 클라우드 기반 데이터 추적 및 원격 의료 통합을 비롯한 커넥티드 헬스 에코시스템과의 호환성은 환자 참여를 더욱 촉진하고 의료 제공업체 모니터링을 개선합니다. 합리적인 가격으로 사용하기 쉬운 모니터링 툴에 대한 환자의 선호의 높아짐과, 적극적인 당뇨병 관리에의 의식 향상이 함께, 선진국·개발도상국 시장을 불문하고, SMBG 부문의 우위성이 계속 강화되고 있습니다.

세계의 혈당 측정기 시장은 용도별로 당뇨병 관리, 건강·웰니스 모니터링, 기타 용도의 3 카테고리로 분류됩니다. 이 중 당뇨병 관리 부문은 1형 및 2형 당뇨병의 유병률 상승과 지속적이고 정밀한 혈당 추적의 필요성 증가를 배경으로 예측 기간 중에 가장 빠른 성장이 예상되고 있습니다. 실시간 인사이트를 제공하는 연속 혈당 모니터링(CGM) 시스템의 채용 확대로 인슐린 복용량 개선, 식단 관리, 생활 습관 최적화가 가능해졌습니다. 모니터링 장비와 디지털 헬스 플랫폼, 모바일 애플리케이션, 클라우드 기반 분석 툴의 통합을 통해 원격 진료, 자동 경보, 의료 전문가와의 원활한 데이터 공유를 실현하여 개별화된 당뇨병 관리를 지원합니다. 게다가 예방의료, 질병의 조기 발견, 지원적인 상환 프로그램에의 중점화가 진행됨으로써, 정기적인 모니터링의 채용이 촉진되고 있습니다. 컴팩트하고 사용하기 쉽고, 연결 기능을 갖춘 가정용 모니터링 기기의 보급으로 환자는 스스로 혈당를 관리할 수 있게 되어 컴플라이언스의 향상과 심각한 합병증 위험을 저감할 수 있습니다. 또한 건강 증진과 대사 기능의 건전성에 대한 소비자의 관심이 높아짐에 따라 혈당 측정기의 이용이 기존의 당뇨병 관리를 넘어 확대되어 시장 성장을 더욱 가속화하고 있습니다.

세계의 혈당 측정기 시장은 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 및 GCC 국가의 6개 주요 지역으로 구분됩니다.

북미는 첨단 의료 인프라, 높은 당뇨병 유병률, 디지털 건강 기술에 대한 강한 도입 의욕에 힘입어 세계의 혈당 측정기 시장에서 가장 큰 점유율을 차지하고 있습니다. 이 지역에서는 지속적인 혈당 모니터링(CGM) 시스템의 광범위한 보급, 유리한 상환 제도, 당뇨병 관리 및 예방 의료에 대한 의식의 향상이 장점이 되고 있습니다. 또한 주요 시장 진출기업의 강력한 존재감, 지속적인 제품 혁신, 의료 제공업체와 기술 기업 간의 전략적 제휴가 북미의 주도적 입장을 더욱 강화하고 있습니다. 의료비 증가, 노인 인구의 확대, 그리고 접속형·AI 탑재형 혈당 측정기 디바이스의 급속한 보급이, 이 지역 전체에서 지속적인 시장 성장을 지지하고 있습니다.

본 보고서에서는 세계의 혈당 측정기 시장에 대해 조사했으며 제품 유형별, 측정 부위별, 용도별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 미충족 수요(Unmet Needs)와 백스페이스

- 연결된 시장과 부문 간 기회

제6장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 주된 회의와 이벤트(2025-2026년)

- 고객의 비즈니스에 영향을 미치는 동향/혁신

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세가 혈당 측정기 시장에 미치는 영향(2025년)

제7장 기술, 특허, 디지털 및 AI 도입으로 파괴적 혁신

- 주요 신기술

- 보완적 기술

- 기술/제품 로드맵

- 특허 분석

- 파이프라인 분석

- AI/생성형 AI가 혈당 측정기 시장에 미치는 영향

- 성공 사례와 실세계에의 응용

제8장 치료와 규제 상황

- 지역 규제 및 규정 준수

- 주요 국가별 당뇨병역학

- 인증, 라벨, 환경 기준

- 치료 및 규제 상황

제9장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 채용 장벽과 내부 과제

- 최종 사용자의 미충족 수요(Unmet Needs)

- 시장 수익성

제10장 혈당 측정기 시장(제품 유형별)

- 서론

- 자기 혈당 측정 시스템

- 연속 혈당 모니터링 시스템

- 전문 POC(Point-of-Care) 기기

- 비침습성 제품

제11장 혈당 측정기 시장(측정 부위별)

- 서론

- 손가락 끝

- 상완부

- 기타

제12장 혈당 측정기 시장(용도별)

- 서론

- 당뇨병 관리

- 건강 및 웰빙 모니터링

- 기타

제13장 혈당 측정기 시장(최종 사용자별)

- 서론

- 셀프 케어/홈 케어

- 병원 및 클리닉

- 기타

제14장 혈당 측정기 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 성장을 가속하기 위한 국제 원조 프로그램과 정부 주도의 비감염성 질환 관리의 대처

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 당뇨병 이환율의 상승이 GCC 국가 시장을 견인

- GCC 국가의 거시경제 전망

제15장 경쟁 구도

- 서론

- 주요 진입기업의 전략/강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업평가와 재무지표

- 브랜드/제품 비교

- 주요 기업의 연구 개발비

- 경쟁 시나리오

제16장 기업 프로파일

- 주요 진출기업

- ABBOTT LABORATORIES

- DEXCOM, INC.

- MEDTRONIC

- SINOCARE

- ROCHE DIABETES CARE

- B. BRAUN SE

- I-SENS, INC.

- SENSEONICS

- ASCENSIA DIABETES CARE HOLDINGS AG

- NIPRO

- NEMAURA MEDICAL INC.

- MEDICAL TECHNOLOGY AND DEVICES SPA

- TERUMO CORPORATION

- LIFESCAN IP HOLDINGS, LLC

- 기타 기업

- ACON LABORATORIES, INC.

- LIFEPLUS

- PRODIGY DIABETES CARE, LLC

- ULTRAHUMAN HEALTHCARE PVT. LTD.

- BEURER GMBH

- OURA HEALTH OY

- SD BIOSENSOR, INC.

- A. MENARINI DIAGNOSTICS SRL

- MEDISANA GMBH

- AGATSA

- ROSSMAX INTERNATIONAL LTD.

제17장 부록

KTH 25.11.28The global blood glucose monitor market is projected to reach 25.4 billion in 2030 from USD 16.5 billion in 2025, at a CAGR of 9.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product type, Application, Test Site, End User, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, the Middle East & Africa, and GCC Countries |

The market for blood glucose monitors is expected to grow strongly, driven by demographic, clinical, and technological factors. The rising global prevalence of diabetes, coupled with an expanding geriatric population and increasing awareness of self-monitoring, continues to fuel demand for blood glucose monitoring devices.

Technological advancements, including continuous glucose monitoring (CGM), integration with smartphones and wearables, and AI-based data analytics, have significantly improved accuracy, convenience, and patient engagement, thereby accelerating adoption. Furthermore, supportive government initiatives, improved healthcare infrastructure, and expanding access to home-based monitoring solutions are contributing to market growth. These trends are expected to sustain robust momentum across both developed and emerging economies in the coming years.

Based on product type, the self-monitoring blood glucose systems segment accounted for the largest share in the blood glucose monitor market in 2024.

Based on product type, the global blood glucose monitor market is divided into four main segments: self-monitoring blood glucose systems, continuous glucose monitoring systems, professional point-of-care devices, and non-invasive products. Among these, self-monitoring blood glucose (SMBG) systems have gained the highest adoption due to their optimal balance between accuracy, comfort, and convenience for patients, particularly those managing their condition at home. These devices offer quick and reliable glucose readings with minimal discomfort, encouraging consistent self-monitoring practices. Additionally, advancements such as micro-needle lancets, smaller sample requirements, and improved test strip designs have enhanced their usability. Their compatibility with connected health ecosystems-including smartphone apps, cloud-based data tracking, and telehealth integration-further drives patient engagement and improves healthcare provider oversight. Growing patient preference for affordable, easy-to-use monitoring tools, combined with rising awareness of proactive diabetes management, continues to reinforce the dominance of the SMBG segment across both developed and developing markets.

Based on application, the diabetes management segment is expected to grow at the highest CAGR during the forecast period in the blood glucose monitor market.

The global blood glucose monitor market is segmented by application into three categories: diabetes management, health & wellness monitoring, and other applications. Among these, the diabetes management segment is projected to witness the fastest growth during the forecast period, driven by the rising prevalence of type 1 and type 2 diabetes and the growing need for continuous and precise glucose tracking. The increasing adoption of continuous glucose monitoring (CGM) systems, which offer real-time insights, has enabled improved insulin dosing, dietary management, and lifestyle optimization. The integration of monitoring devices with digital health platforms, mobile applications, and cloud-based analytics enables remote consultations, automated alerts, and seamless data sharing with healthcare professionals, thereby supporting personalized diabetes care. Moreover, the growing emphasis on preventive healthcare, early disease detection, and supportive reimbursement programs is encouraging the adoption of regular monitoring. The availability of compact, user-friendly, and connected home monitoring devices empowers patients to independently manage their glucose levels, ensuring better compliance and reducing the risk of severe complications. Additionally, the rising consumer focus on health optimization and metabolic wellness is expanding the use of glucose monitors beyond traditional diabetes management, further amplifying market growth.

North America is expected to register the highest share of the blood glucose monitor market during the forecast period.

The global blood glucose monitor market is divided into six main regions: North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries.

North America accounted for the largest share of the global blood glucose monitor market, driven by its advanced healthcare infrastructure, high diabetes prevalence, and strong adoption of digital health technologies. The region benefits from the widespread availability of continuous glucose monitoring (CGM) systems, favorable reimbursement frameworks, and increased awareness of diabetes management and preventive care. Moreover, the strong presence of leading market players, continuous product innovation, and strategic collaborations between healthcare providers and technology companies further reinforce North America's leadership position. Rising healthcare expenditure, growing geriatric population, and the rapid integration of connected and AI-enabled glucose monitoring devices continue to support sustained market growth across the region.

A breakdown of the primary participants (supply side) for the blood glucose monitor market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Directors (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), Middle East & Africa (2%), GCC Countries (3%)

Prominent players in the blood glucose monitor market include Abbott Laboratories (US), Dexcom, Inc. (US), Medtronic (Ireland), B.Braun SE (Germany), F. Hoffmann-La Roche Ltd (Switzerland), Ascensia Diabetes Care Holdings AG (Switzerland), Senseonics (US), Nipro (Japan), Medical Technology and Devices S.p.A. (Italy), Terumo Corporation (Japan), i-SENS, Inc. (South Korea), Sinocare (China), Nemaura Medical Inc. (UK), ACON Laboratories, Inc. (US), LifeScan IP Holdings, LLC (US), Ultrahuman Healthcare Pvt Ltd. (India), LifePlus (US), Prodigy Diabetes Care, LLC (US), A. Menarini Diagnostics S.r.l (Italy), Beurer GmbH (Germany), Oura Health Oy (Finland), SD Biosensor, INC (South Korea), Agatsa (India), Rossmax International Ltd (US), and Medisana Gmbh (Germany).

Research Coverage

The report provides an analysis of the blood glucose monitor market, focusing on estimating the market size and potential for future growth across various segments, including products, applications, test sites, regions, and end users. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product & service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report provides valuable insights for market leaders and new entrants in the blood glucose monitor industry, offering approximate revenue figures for the overall market and its subsegments. It assists stakeholders in understanding the competitive landscape, enabling them to better position their businesses and develop effective go-to-market strategies. Additionally, the report highlights key market drivers, restraints, challenges, and opportunities, enabling stakeholders to assess the current state of the market.

This report provides insights into the following pointers:

- Analysis of key drivers (Increasing prevalence of diabetes, Growing elderly population and increasing life expectancy, Rise in R&D investments and launch of technologically advanced products, wellness & preventive use of CGMs beyond diabetes), restraints (High cost and socioeconomic disparities in access to blood glucose sensors, Short sensor lifespan and frequent replacements), opportunities (Integration with digital health platforms and smart devices, Expansion of coverage and reimbursement policies for CGMs) and challenges (Regulatory compliance challenges for non-invasive glucose monitoring technologies, Data overload & alarm fatigue).

- Market Penetration: It provides detailed information on the product portfolios offered by major players in the global blood glucose monitor market. The report covers various segments, including product type, application, test site, end user, and region.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global blood glucose monitor market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product type, application, test site, end user, and region.

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global blood glucose monitor market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global blood glucose monitor market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Objectives of primary research

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH (BASED ON UTILIZATION RATE AND ADOPTION PATTERN)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH LIMITATIONS

- 2.4.1 SCOPE-RELATED LIMITATIONS

- 2.4.2 METHODOLOGY-RELATED LIMITATIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BLOOD GLUCOSE MONITOR MARKET OVERVIEW

- 4.2 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE AND COUNTRY (2024)

- 4.3 BLOOD GLUCOSE MONITOR MARKET: GEOGRAPHICAL MIX

- 4.4 BLOOD GLUCOSE MONITOR MARKET: REGIONAL MIX (2025-2030)

- 4.5 BLOOD GLUCOSE MONITOR MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of diabetes

- 5.2.1.2 Growing elderly population and increasing life expectancy

- 5.2.1.3 Rise in R&D investments and launch of technologically advanced products

- 5.2.1.4 Wellness & preventive use of CGMs beyond diabetes

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and socioeconomic disparities in access to blood glucose sensors

- 5.2.2.2 Short sensor lifespan and frequent replacements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration with digital health platforms and smart devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory and compliance challenges for non-invasive glucose monitoring technologies

- 5.2.4.2 Data overload & alarm fatigue

- 5.2.4.3 Financial burden and coverage gaps

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS & WHITE SPACES

- 5.3.1 UNMET NEEDS IN BLOOD GLUCOSE MONITOR MARKET

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 INTENSITY OF COMPETITIVE RIVALRY

- 6.1.3 BARGAINING POWER OF BUYERS

- 6.1.4 BARGAINING POWER OF SUPPLIERS

- 6.1.5 THREAT OF SUBSTITUTES

- 6.2 MACROECONOMIC OUTLOOK

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN DIABETES CARE INDUSTRY

- 6.2.4 TRENDS IN GLOBAL INSULIN DELIVERY SYSTEMS INDUSTRY

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.5.1 ROLE IN ECOSYSTEM

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF BLOOD GLUCOSE MONITORS, BY PRODUCT, 2024

- 6.6.2 AVERAGE SELLING PRICE TREND OF SELF-MONITORING BLOOD GLUCOSE SYSTEMS, BY REGION, 2022-2024

- 6.6.3 PRODUCT PURCHASE CYCLE, BY PRODUCT SEGMENT

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT DATA FOR HS CODE 9027, 2020-2024

- 6.7.2 EXPORT DATA FOR HS CODE 9027, 2020-2024

- 6.8 KEY CONFERENCES & EVENTS, 2025-2026

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.10 INVESTMENT & FUNDING SCENARIO

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 CASE STUDY 1: LONG-TERM GLUCOSE MONITORING FOR SENSITIVE SKIN PATIENTS USING SENSEONICS' EVERSENSE E3 IMPLANTABLE SENSOR

- 6.11.2 CASE STUDY 2: ENHANCING PATIENT ADHERENCE AND GLYCEMIC CONTROL USING ABBOTT'S FREESTYLE LIBRE 2 CGM

- 6.11.3 CASE STUDY 3: IMPROVING GLYCEMIC CONTROL WITH DEXCOM G6 CGM SYSTEM

- 6.12 IMPACT OF 2025 US TARIFFS ON BLOOD GLUCOSE MONITOR MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTIONS THROUGH TECHNOLOGY, PATENTS, AND DIGITAL AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 BATTERY AND ENERGY HARVESTING INNOVATIONS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 7.3.2 MID TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 7.3.3 LONG TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 7.4 PATENT ANALYSIS

- 7.4.1 PATENT PUBLICATION TRENDS FOR BLOOD GLUCOSE MONITOR MARKET

- 7.4.2 TOP APPLICANTS (COMPANIES) OF BLOOD GLUCOSE MONITOR PATENTS

- 7.4.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN BLOOD GLUCOSE MONITOR MARKET

- 7.4.4 LIST OF MAJOR PATENTS

- 7.5 PIPELINE ANALYSIS

- 7.6 IMPACT OF AI/GEN AI ON BLOOD GLUCOSE MONITOR MARKET

- 7.6.1 TOP USE CASES AND MARKET POTENTIAL

- 7.6.2 TOP CASE STUDIES OF AI IMPLEMENTATION IN BLOOD GLUCOSE MONITOR MARKET

- 7.6.3 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 7.6.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN BLOOD GLUCOSE MONITOR MARKET

- 7.7 SUCCESS STORIES & REAL-WORLD APPLICATIONS

- 7.7.1 ABBOTT: FREESTYLE LIBRE 3-MINIATURIZED SENSOR WITH REAL-TIME CONNECTIVITY

- 7.7.2 DEXCOM: G7 SENSOR-ADVANCED ALGORITHM FOR ACCURATE AND FAST GLUCOSE READINGS

- 7.7.3 SENSEONICS: EVERSENSE E3-LONG-TERM IMPLANTABLE CGM WITH SMART ALERTS

8 TREATMENT & REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS & COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 REGULATORY STANDARDS

- 8.1.2.1 North America

- 8.1.2.1.1 US

- 8.1.2.1.2 Canada

- 8.1.2.2 Europe

- 8.1.2.3 Asia Pacific

- 8.1.2.3.1 China

- 8.1.2.3.2 Japan

- 8.1.2.3.3 India

- 8.1.2.4 Latin America

- 8.1.2.4.1 Brazil

- 8.1.2.4.2 Mexico

- 8.1.2.5 Middle East

- 8.1.2.6 Africa

- 8.1.2.1 North America

- 8.2 EPIDEMIOLOGY OF DIABETES, BY KEY COUNTRY

- 8.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

- 8.3.1 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN BLOOD GLUCOSE MONITOR MARKET

- 8.4 TREATMENT AND REGULATORY LANDSCAPE

- 8.4.1 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 KEY BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS OF END USERS

- 9.5 MARKET PROFITABILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

10 BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE

- 10.1 INTRODUCTION

- 10.2 SELF-MONITORING BLOOD GLUCOSE SYSTEMS

- 10.2.1 GLUCOMETERS

- 10.2.1.1 Regulatory reinforcement and digital integration to drive advancements in market

- 10.2.2 TESTING STRIPS

- 10.2.2.1 Shift toward non-invasive methods for blood glucose monitoring to restrain market growth

- 10.2.3 LANCETS & LANCING DEVICES

- 10.2.3.1 Rising focus on reducing chances of infection to increase popularity of safety lancets

- 10.2.1 GLUCOMETERS

- 10.3 CONTINUOUS GLUCOSE MONITORING SYSTEMS

- 10.3.1 SENSORS

- 10.3.1.1 Technological advancements and expanding use in diabetes management to boost market growth

- 10.3.2 IMPLANTS

- 10.3.2.1 Rising demand for long-duration sensors offering extended lifespan and reduced replacement frequency to drive growth

- 10.3.3 TRANSMITTERS & RECEIVERS

- 10.3.3.1 Integration with smart monitoring systems and interoperable diabetes management platforms to fuel growth

- 10.3.1 SENSORS

- 10.4 PROFESSIONAL POINT-OF-CARE DEVICES

- 10.4.1 ADVANCING PATIENT CARE THROUGH DECENTRALIZED POINT-OF-CARE GLUCOSE MONITORING TO BOOST MARKET

- 10.5 NON-INVASIVE PRODUCTS

- 10.5.1 RISING PATIENT PREFERENCE FOR PAINLESS TECHNOLOGY TO FOSTER DEVELOPMENT AND ADOPTION IN FUTURE

11 BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE

- 11.1 INTRODUCTION

- 11.2 FINGERTIP

- 11.2.1 HIGH ACCURACY ASSOCIATED WITH FINGERTIP TESTING TO SUPPORT MARKET GROWTH

- 11.3 UPPER ARM

- 11.3.1 RISE OF CONTINUOUS AND MINIMALLY INVASIVE MONITORING TECHNOLOGIES TO BOOST DEMAND FOR UPPER ARM TESTING

- 11.4 OTHER TEST SITES

12 BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 DIABETES MANAGEMENT

- 12.2.1 TYPE 1 DIABETES

- 12.2.1.1 Intensive management needs associated with type 1 diabetes to boost adoption

- 12.2.2 TYPE 2 DIABETES

- 12.2.2.1 High prevalence of type 2 diabetes to drive market demand

- 12.2.1 TYPE 1 DIABETES

- 12.3 HEALTH & WELLNESS MONITORING

- 12.3.1 EMERGING ROLE OF HEALTH & WELLNESS MONITORING FOR BLOOD GLUCOSE MONITORS TO DRIVE MARKET GROWTH

- 12.4 OTHER APPLICATIONS

13 BLOOD GLUCOSE MONITOR MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 SELF/HOME CARE

- 13.2.1 CONVENIENT, COST-EFFECTIVE, AND FREQUENT MONITORING ASSOCIATED WITH HOME CARE SETTINGS TO DRIVE MARKET

- 13.3 HOSPITALS & CLINICS

- 13.3.1 STRATEGIC ADOPTION OF BLOOD GLUCOSE SENSORS IN HOSPITALS & CLINICS TO DRIVE MARKET VALIDATION AND GROWTH

- 13.4 OTHER END USERS

14 BLOOD GLUCOSE MONITOR MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 US to account for largest share of North American blood glucose monitor market

- 14.2.3 CANADA

- 14.2.3.1 Rising government support to boost blood glucose monitor market in Canada

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Germany to dominate European blood glucose monitor market

- 14.3.3 UK

- 14.3.3.1 Government support and research funding to drive blood glucose monitor market growth in UK

- 14.3.4 FRANCE

- 14.3.4.1 High insurance coverage and increasing affordability to support market growth

- 14.3.5 ITALY

- 14.3.5.1 Increasing government spending to drive market growth in Italy

- 14.3.6 SPAIN

- 14.3.6.1 High diabetes prevalence to drive market growth in Spain

- 14.3.7 REST OF EUROPE (ROE)

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 CHINA

- 14.4.2.1 China to dominate Asia Pacific blood glucose monitor market

- 14.4.3 JAPAN

- 14.4.3.1 Rising aging population and high number of diabetes cases to drive market growth in Japan

- 14.4.4 INDIA

- 14.4.4.1 Rising diabetes cases and affordable local manufacturing to fuel insulin device demand in India

- 14.4.5 AUSTRALIA

- 14.4.5.1 Government subsidies to drive market

- 14.4.6 SOUTH KOREA

- 14.4.6.1 Rising diabetes cases across country to boost market

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 LATIN AMERICA

- 14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 14.5.2 BRAZIL

- 14.5.2.1 Brazil to account for largest share of Latin American blood glucose monitor market

- 14.5.3 MEXICO

- 14.5.3.1 Rising diabetes prevalence to drive market growth

- 14.5.4 REST OF LATIN AMERICA

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 INTERNATIONAL AID PROGRAMS AND GOVERNMENT-LED INITIATIVES FOR NON-COMMUNICABLE DISEASE MANAGEMENT TO FOSTER GROWTH

- 14.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 14.7 GCC COUNTRIES

- 14.7.1 RISING DIABETES PREVALENCE TO DRIVE MARKET IN GCC COUNTRIES

- 14.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN BLOOD GLUCOSE MONITOR MARKET

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.5.5.1 Company footprint

- 15.5.5.2 Region footprint

- 15.5.5.3 Product type footprint

- 15.5.5.4 Test site footprint

- 15.5.5.5 Application footprint

- 15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.6.5.1 Detailed list of key startups/SMEs

- 15.6.5.2 Competitive benchmarking of key startups/SMEs

- 15.7 COMPANY VALUATION & FINANCIAL METRICS

- 15.7.1 FINANCIAL METRICS

- 15.7.2 COMPANY VALUATION

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 R&D EXPENDITURE OF KEY PLAYERS

- 15.10 COMPETITIVE SCENARIO

- 15.10.1 PRODUCT LAUNCHES & APPROVALS

- 15.10.2 DEALS

- 15.10.3 EXPANSIONS

- 15.10.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 ABBOTT LABORATORIES

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches & approvals

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.3.4 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses & competitive threats

- 16.1.2 DEXCOM, INC.

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches & approvals

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses & competitive threats

- 16.1.3 MEDTRONIC

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product approvals

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Expansions

- 16.1.3.3.4 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses & competitive threats

- 16.1.4 SINOCARE

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product approvals

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses & competitive threats

- 16.1.5 ROCHE DIABETES CARE

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches & approvals

- 16.1.5.3.2 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses & competitive threats

- 16.1.6 B. BRAUN SE

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.7 I-SENS, INC.

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product approvals

- 16.1.7.3.2 Deals

- 16.1.8 SENSEONICS

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches & approvals

- 16.1.8.3.2 Deals

- 16.1.8.3.3 Other developments

- 16.1.9 ASCENSIA DIABETES CARE HOLDINGS AG

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.3.2 Deals

- 16.1.10 NIPRO

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Expansions

- 16.1.11 NEMAURA MEDICAL INC.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Other developments

- 16.1.12 MEDICAL TECHNOLOGY AND DEVICES S.P.A.

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Deals

- 16.1.13 TERUMO CORPORATION

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Deals

- 16.1.13.3.2 Expansions

- 16.1.13.3.3 Other developments

- 16.1.14 LIFESCAN IP HOLDINGS, LLC

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Deals

- 16.1.1 ABBOTT LABORATORIES

- 16.2 OTHER PLAYERS

- 16.2.1 ACON LABORATORIES, INC.

- 16.2.2 LIFEPLUS

- 16.2.3 PRODIGY DIABETES CARE, LLC

- 16.2.4 ULTRAHUMAN HEALTHCARE PVT. LTD.

- 16.2.5 BEURER GMBH

- 16.2.6 OURA HEALTH OY

- 16.2.7 SD BIOSENSOR, INC.

- 16.2.8 A. MENARINI DIAGNOSTICS S.R.L

- 16.2.9 MEDISANA GMBH

- 16.2.10 AGATSA

- 16.2.11 ROSSMAX INTERNATIONAL LTD.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS