|

시장보고서

상품코드

1686582

살균제 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

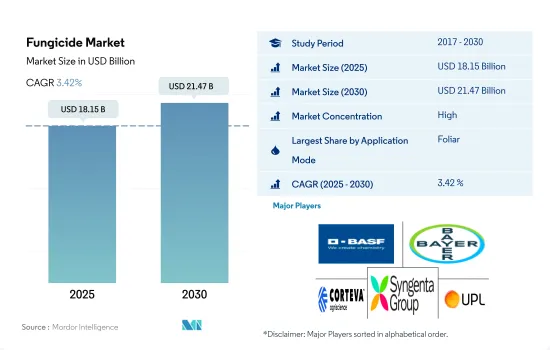

살균제 시장 규모는 2025년에 181억 5,000만 달러로 추정되고, 2030년에는 214억 7,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년) 중 CAGR 3.42%로 성장할 전망입니다.

진균 병해 증가는 다양한 살포 방법에 의한 살균제 수요를 견인하고 있습니다.

- 살균제는 특정 요건과 질병에 따라 다양한 방식으로 살포됩니다. 다양한 살포 방법은 다양한 농업 조건 하에서 살균제를 효과적으로 살포하는데 중요한 역할을 합니다.

- 2022년에는 엽면살포가 살균제 부문에서 60.1%의 최대 시장 점유율을 차지했습니다. 이 방법은 잎에 있는 병원균을 직접 표적으로 함으로써 엽면진균병에 대한 효율적인 보호를 제공하기 때문에 매우 선호됩니다. 엽면살포는 살균제의 식물 조직에 대한 신속한 침투 및 흡수를 촉진하고, 진균 병원체에 대한 효과적인 작용을 보증합니다.

- 살균제 종자 처리는 식물 성장 초기에 곰팡이 감염에 대한 대응에 중요한 역할을 합니다. 이러한 처리는 씨앗 주위에 보호 차폐를 만들어 씨앗 부패, 묘종 고갈, 습해, 뿌리 썩음 등 다양한 병해를 효과적으로 예방합니다. 특히 세계의 살균제 시장에서 살균제 종자 처리제는 2022년에 14.1%라는 큰 시장 점유율을 차지했습니다. 이것은 식물의 건강을 보호하고 작물 정착을 촉진하는 데 살균제가 크게 기여하고 있음을 보여줍니다.

- 살포 방법의 선택은 대상으로 하는 특정 병해, 작물의 유형, 병해의 발생 단계, 설비 유무 등 여러 요인에 영향을 받습니다. 살균제 시장은 확대될 것으로 예측되며 2023-2029년 예측 기간 중 CAGR 3.8%로 성장할 전망입니다. 이 성장은 식물 병해와 싸워 농업 생산성을 향상시키는 전략의 진화를 반영하고 있습니다.

진균 병원체에 의한 작물 만연 증가가 살균제의 채용을 높이고 있습니다.

- 균류 병해에 의한 작물 손실 증가 및 세계의 식량 안보에 대한 우려의 고조가 살균제와 같은 작물 보호 화학제품의 채용을 높이고 있습니다. 세계적인 수준에서 농가는 작물의 10-23%를 진균병으로 잃고 있습니다. 집약적인 농업 관행의 채택, 단일 농법, 가뭄과 열파와 같은 기후 조건의 변화는 농업 생산에서 살균제의 높은 이용을 가져온 다양한 진균병의 증가로 이어집니다. 세계 살균제 시장은 2022년에 163억 7,000만 달러, 190만 톤의 소비량으로 전 세계 작물 보호 화학제품 시장 전체의 18.1%의 시장 점유율을 차지했습니다.

- 남미의 살균제 시장 가치는 30.3%를 차지했고, 시장 가치는 49억 6,000만 달러였습니다. 시장 점유율이 높은 것은 농작물 가뭄과 열파의 영향으로 진균병이 만연해 농작물 손실이 발생했기 때문이며, 그 결과 이 지역에서는 살균제 이용률이 높아졌습니다. 같은 해 브라질은 남미 살균제 시장의 59.4%를 차지했는데, 주요 작물인 쌀, 밀, 콩이 진균병에 매우 걸리기 쉽기 때문입니다.

- 유럽의 살균제 시장 매출은 2022년 세계 살균제 시장 매출의 28.4%를 차지했습니다. 포도 늦마름병, 포도 조기 역병, 우동병, 베토병, 후자리움 마름병, 셉토리아 병, 세균성 역병은 이 지역에서 재배되는 주요 작물을 공격하는 일반적인 병해입니다. 스페인, 러시아, 프랑스, 이탈리아가 주요 살균제 소비국으로 각각 18.1%, 15.0%, 14.3%, 12.5% 시장 점유율을 차지하고 있습니다. 유럽에서는 기온의 상승이 다양한 진균 병원균의 증식에 유리해지고 있습니다.

세계의 살균제 시장 동향

연간 평균 경제 손실이 증가함에 따라 농부는 더 많은 살균제를 사용하게 되었습니다.

- 진귬병은 작물 생산에 큰 위협을 가져오고 곡물, 과일, 야채, 관엽 식물 등 다양한 작물에 영향을 미칩니다. 2017년에는 1헥타르당 1.4kg이었던 평균 살균제 소비량이 2022년에는 1.6kg으로 해마다 증가하고 있는 것은 병해를 효과적으로 관리 및 방제하고, 작물에 대한 피해를 최소화하고 최적의 수율을 확보할 필요성이 배경에 있습니다.

- 조사 대상 지역 중 2022년에 화학 살균제의 헥타르당 연간 살포량이 가장 많았던 것은 유럽으로 농지 1헥타르당 2.5kg이었습니다. 이는 고부가가치 작물을 중심으로 한 집약농법과 단일재배에 의한 것입니다. 집약적인 농업은 보통 한 땅에 작물을 밀집시켜 더 많은 병원균을 끌어들여 토양 양분을 고갈시키고 식물을 병원균에 감염시키기 쉽습니다. 따라서 작물을 보호하고 수확량을 유지하기 위해 화학 살균제를 많이 사용하게 됩니다.

- 살균제 사용량은 유럽에 이어 남미가 많았고, 2022년 1헥타르당 평균 살포량은 1.7kg이었습니다. 2022년 살균제 사용량은 칠레가 4.1kg/헥타르로 이 지역에서 가장 많아졌습니다. 이 높은 사용량은 칠레의 특정 지역이 고습도, 강우량, 기온의 변동으로 인해 진균병해 발생을 조장하는 기후조건을 가지고 있기 때문입니다. 아시아태평양, 북미, 중동과 같은 다른 지역도 살균제 사용량이 많습니다.

- 식량농업기관이 제공한 데이터에 따르면 살균제가 대량으로 사용되고 있음에도 불구하고, 진균병은 평균적으로 약 2,200억 달러의 경제손실을 가져오고 있습니다. 기후 조건의 변화나 병해의 빈발이라고 하는 상황이 상황을 악화시켜 살포량을 증가시킬 가능성마저 있습니다.

Mancozeb는 다른 살균제에 비해 광범위한 활성 스펙트럼을 가지고 있습니다.

- 테부코나졸은 트라이아졸계의 살균제입니다.다양한 작물의 진균병 방제에 널리 사용되고 있습니다. 테부코나졸은 진균 세포막의 중요한 성분인 에르고스테롤의 생합성을 저해함으로써 효과를 발휘합니다. 2022년 가격은 8,700달러였습니다.

- Mancozeb는 디티오카르바민산염의 화학 등급에 속하는 살균제입니다. 감자, 토마토, 포도, 바나나 등의 작물로 늦마름병, 우동병, 초기역병, 탄저병 등의 진균성 병해 방제에 많이 사용됩니다. Mancozeb은 기타 살균제에 비해 폭넓은 활성 스펙트럼을 가지며 진균 세포 내 여러 부위에 작용하기 때문에 더욱 효과적입니다. Mancozeb의 2022년 가격은 7,800달러였습니다.

- 아조시스트로빈은 스트로빌린계의 살균제로 가격은 톤당 4,600달러입니다. 아조시스트로빈은 다양한 작물의 진균성 병해를 방제하기 위해 널리 사용되고 있습니다. 아조시스트로빈은 진균세포의 미토콘드리아 호흡을 저해함으로써 진균의 성장과 번식을 저해하고 최종적으로 사멸시킵니다.

- 메탈락실은 늦마름병, 곰팡이병, 근부병 등의 진균병해의 방제에 널리 사용되고 있으며, 가격은 톤당 4,400달러입니다. 메탈락실은 진균 세포의 RNA 형성을 저해함으로써 효과를 발휘합니다. 이 저해로 인해 필수 단백질의 합성이 방해받고 진균의 성장과 번식이 저해됩니다.

- 프로피네브와 질람은 디티오카르바민산염에 속합니다. 2022년 가격은 각각 톤당 3,500달러, 3,300달러였습니다. 지난 기간 동안 가격이 소폭 상승한 것은 이러한 제품에 대한 수요의 증가 및 생산에 사용되는 원재료의 급등에 의한 것입니다.

살균제 산업 개요

살균제 시장은 상당히 통합되어 있으며 상위 5개 기업에서 81.72%를 차지하고 있습니다. 이 시장의 주요 기업은 BASF SE、Bayer AG、Corteva Agriscience、Syngenta Group、UPL Limited입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 오퍼

제3장 서문

- 조사의 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 1헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 아르헨티나

- 호주

- 브라질

- 캐나다

- 칠레

- 중국

- 프랑스

- 독일

- 인도

- 인도네시아

- 이탈리아

- 일본

- 멕시코

- 미얀마

- 네덜란드

- 파키스탄

- 필리핀

- 러시아

- 남아프리카

- 스페인

- 태국

- 우크라이나

- 영국

- 미국

- 베트남

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 용도별

- 화학 관개

- 잎면 살포

- 훈증

- 종자 처리

- 토양처리

- 작물 유형별

- 상업 작물

- 과일 및 야채

- 곡물

- 콩류 및 지방종자

- 잔디 및 관상용 식물

- 지역별

- 아프리카

- 국가별

- 남아프리카

- 기타 아프리카

- 아시아태평양

- 국가별

- 호주

- 중국

- 인도

- 인도네시아

- 일본

- 미얀마

- 파키스탄

- 필리핀

- 태국

- 베트남

- 기타 아시아태평양

- 유럽

- 국가별

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 우크라이나

- 영국

- 기타 유럽

- 북미

- 국가별

- 캐나다

- 멕시코

- 미국

- 기타 북미

- 남미

- 국가별

- 아르헨티나

- 브라질

- 칠레

- 기타 남미 국가

- 아프리카

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Fungicide Market size is estimated at 18.15 billion USD in 2025, and is expected to reach 21.47 billion USD by 2030, growing at a CAGR of 3.42% during the forecast period (2025-2030).

Rising fungal diseases are driving the demand for fungicides in various application methods

- Fungicides may be applied using a variety of methods, depending on the specific requirements and diseases. Diverse application methods play a crucial role in effectively applying fungicides across various agricultural conditions.

- In 2022, foliar application dominated the fungicide segment, holding the largest market share of 60.1%. This method is highly preferred as it provides efficient protection against foliar fungal diseases by directly targeting the pathogens on the leaves. The foliar application facilitates swift penetration and absorption of fungicides into the plant tissues, ensuring their effective action against fungal pathogens.

- Fungicide seed treatments play a crucial role in addressing fungal infections during the initial phases of plant growth. These treatments create a protective shield around seeds, effectively preventing various diseases like seed rots, seedling blights, damping off, and root rots. Notably, within the global fungicide market, fungicide seed treatments accounted for a significant market share of 14.1% in 2022. This highlights their substantial contribution to safeguarding plant health and promoting successful crop establishment.

- The selection of the application mode is influenced by multiple factors, encompassing the particular disease being targeted, the type of crop, the stage of disease development, and the availability of equipment. The fungicide market is anticipated to expand, projecting an estimated CAGR of 3.8% during the forecast period spanning from 2023 to 2029. This growth reflects the ongoing evolution of strategies to combat plant diseases and enhance agricultural productivity.

Growth in the crop infestations by the fungal pathogens raise the fungicides adoption

- Increasing crop losses due to fungal diseases and growing concerns over global food security raise the adoption of crop protection chemicals like fungicides. At the Global level, the farmers are losing 10-23% of their crops to fungal diseases. Adoption of intensive agricultural practices, monocultural practices, and changing climatic conditions like drought and heatwaves lead to the growth of various fungal diseases, which resulted in higher utilization of fungicides in agricultural production. The Global fungicide market accounted for 18.1% market share in the overall Global crop protection chemical market value with USD 16.37 billion in 2022 with a consumption volume of 1.9 million metric tons.

- South American fungicide market value accounted for 30.3%, with a market value of USD 4.96 billion. The higher market share is attributed to the drought and heatwave effect on the crops, which led to the proliferation of fungal diseases and crop losses, resulting in higher utilization of fungicides in the region. In the same year, Brazil accounted for 59.4% of the South American fungicide market, with rice, wheat, and soybeans being the major crops grown and are highly susceptible to fungal diseases.

- Europe's fungicide market value accounted for 28.4% of the Global fungicide market value in 2022. Grape late blight, early blight, powdery mildew, downy mildew, Fusarium wilting, Septoria, and bacterial blight are the common diseases attacking the major crops grown in the region. Spain, Russia, France, and Italy are the major fungicide-consuming countries with a market value share of 18.1%, 15.0%, 14.3%, and 12.5%, respectively. In Europe, temperature increases favor the various fungal pathogens' growth.

Global Fungicide Market Trends

Increasing average annual economic losses are driving farmers to use a higher amount of fungicides

- Fungal diseases pose a significant threat to crop production, affecting a wide range of crops, including cereals, fruits, vegetables, and ornamentals. The rise in the average per-hectare fungicide consumption over the years from 1.4 kg per ha in 2017 to 1.6 kg per ha in 2022 was driven by the need to manage and control diseases effectively, minimizing crop damage and ensuring optimum yields.

- Among the regions studied, in 2022, Europe had the highest per-hectare application of chemical fungicides annually, with 2.5 kg per ha of agricultural land. This was due to its intensified farming practices and monocultures with a focus on high-value crops. Intensive farming usually attracts more pathogens due to overcrowding of crops on a piece of land, depleting soil nutrients and making the plants more susceptible to pathogens. This leads to the overuse of chemical fungicides to protect crops and maintain crop yields.

- Europe is followed by South America in fungicide usage, with an average per-hectare application of 1.7 kg/ha in 2022. Chile had the highest per-hectare consumption of fungicides at 4.1 kg/ha in the region in 2022. This high usage was due to certain regions in Chile having climatic conditions that are conducive to fungal disease development due to high humidity, rainfall, and temperature fluctuations. Other regions like Asia-Pacific, North America, and the Middle East also have a significant amount of fungicidal application.

- According to the data provided by the Food and Agriculture Organization, fungal diseases cause an average economic loss of around USD 220.0 billion despite abundant usage of fungicides. Circumstances like changing climatic conditions and frequent disease outbreaks may even worsen the situation, increasing the application rates.

Mancozeb has a broad spectrum of activity compared to other fungicides

- Tebuconazole is a fungicide belonging to the chemical class of triazoles. It is widely used to control fungal diseases in various crops. Tebuconazole works by inhibiting the biosynthesis of ergosterol, a critical component of fungal cell membranes. This was priced at USD 8.7 thousand in 2022.

- Mancozeb is a fungicide belonging to the chemical class of dithiocarbamates. It is commonly used to control fungal diseases like late blight, downy mildew, early blight, and anthracnose in crops like potatoes, tomatoes, grapes, and bananas. Mancozeb has a broad spectrum of activity compared to other fungicides and acts on multiple sites within the fungal cell, making it more effective. Mancozeb was priced at USD 7.8 thousand in 2022.

- Azoxystrobin is a fungicide belonging to the chemical class of strobilurins and was priced at USD 4.6 thousand per metric ton. It is widely used to control fungal diseases in various crops. Azoxystrobin works by inhibiting the mitochondrial respiration in fungal cells, resulting in their inability to grow and reproduce and eventually causing their death.

- Metalaxyl is widely used to control fungal diseases such as late blight, downy mildew, and root rot and was priced at USD 4.4 thousand per metric ton. Metalaxyl works by inhibiting the formation of RNA in fungal cells. This disruption prevents the synthesis of essential proteins, leading to the inhibition of fungal growth and reproduction.

- Propineb and Ziram belong to the chemical class of dithiocarbamates. They were priced at USD 3.5 thousand and 3.3 thousand per metric ton, respectively, in 2022. These slight increases in the prices during the historical period were due to the growing demand for these products and the escalating costs of raw materials used in their production.

Fungicide Industry Overview

The Fungicide Market is fairly consolidated, with the top five companies occupying 81.72%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 Chile

- 4.3.6 China

- 4.3.7 France

- 4.3.8 Germany

- 4.3.9 India

- 4.3.10 Indonesia

- 4.3.11 Italy

- 4.3.12 Japan

- 4.3.13 Mexico

- 4.3.14 Myanmar

- 4.3.15 Netherlands

- 4.3.16 Pakistan

- 4.3.17 Philippines

- 4.3.18 Russia

- 4.3.19 South Africa

- 4.3.20 Spain

- 4.3.21 Thailand

- 4.3.22 Ukraine

- 4.3.23 United Kingdom

- 4.3.24 United States

- 4.3.25 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Myanmar

- 5.3.2.1.7 Pakistan

- 5.3.2.1.8 Philippines

- 5.3.2.1.9 Thailand

- 5.3.2.1.10 Vietnam

- 5.3.2.1.11 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Ukraine

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.4.1.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Chile

- 5.3.5.1.4 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.7 Nufarm Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록